Antiviral Drugs Market - Snapshot

Antiviral drugs refer to those prescription medicines that are capable of fighting against flu viruses in one’s body. Antiviral drugs could include intravenous solutions, an inhaled powder, liquid, or pills. However, antiviral drugs cannot be purchased just over-the-counter, one would need a prescription for obtaining such drugs. The global antiviral drugs market is likely to observe considerable growth due to the rising incidences of viral infections.

As coronavirus spreads at an exponential rate and the number of deaths crosses 74,000 worldwide, efforts are being made to lessen transmission through standard public health interventions. These interventions are based on tracing of contacts and isolation of cases. So far, there is no drug or vaccine to contain the spread of the pandemic worldwide. However, researchers and doctors have observed that antiviral drugs administered shortly after the onset of symptoms can diminish the infectiousness to others through diminished viral shredding in the patient’s respiratory secretions. The global antiviral drugs market is predicted to observe immense opportunity in the exponential spread of coronavirus. Besides, novel antiviral drugs, Tilorone and Remdesivir, have already come up as two of the most promising drugs for COVID-19 treatment, according to the researchers.

Rise in the Prevalence of Chronic Diseases to Support Demand of these Drugs

Rise in the research and development activities for development of newer and more advanced formulations is likely to further drive the demand for antiviral drugs in the near future. Many serious diseases could cause viral infections as their side effects. Such viral infection causing diseases are

As such, increased prevalence of these diseases are likely to increase the prevalence of viral infections thereby driving the demand for antiviral drugs. Apart from that, presence of sound healthcare infrastructure in several parts of the world is predicted to foster growth of the global antiviral drugs market in the years to come.

Global Antiviral Drugs Market – Overview

In recent years, there has been a considerable demand for antiviral drugs all across the globe. A large number of people are relying on these drugs to treat several diseases. A few years ago, the same population base relied on home remedies to cure basic diseases and infections. This kept these antiviral drugs market developing at a sluggish rate. However, in the past few years, technological advancements as well as advancements in the medical sciences have created a huge availability of these drugs. Previously, antiviral drugs were some sort of luxury. But with these developments, the production rate doubled up and these medicines became easily accessible to common masses. Naturally, the reliance over home remedies and cure dwindled as there came the availability of medically proven, more effective drugs. Furthermore, with the mass production or availability of these antiviral drugs, they also become cost effective. This only added to their popularity. Thus, the global antiviral drugs market has experienced a tremendous growth in recent years.

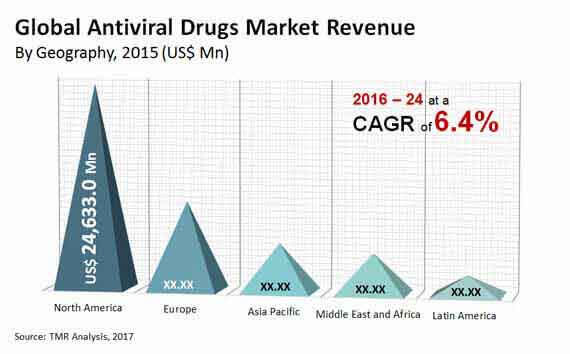

A new research report by Transparency Market Research on the global antiviral drugs market provide all the necessary insights and information required for formulation precise marketing strategies. According to the research report, the global market for antiviral drugs will exhibit a healthy CAGR of 6.40% over the course of the given forecast period of 2016 to 2024. The market is projected to reach a valuation worth US$82.9 bn by the end of the forecast period in 2024.

Targeted Efforts towards Better Global Healthcare to Drive Market Growth

There are various reasons behind getting infected by a viral infections. At times, the infection may also be a side effect of some other medical treatment. Viral infections are common side effect of the treatment for diseases such as respiratory disorders, HIV, diabetes, and cancer among others. Because of the growing prevalence of these major diseases, there has been a growing demand for antiviral drugs. Naturally, this has helped in pushing the growth of the global antiviral drugs market to newer heights. In addition to this, with economical, sociological, and technological advancements, considerable efforts have been made towards achieving a strong and robust healthcare infrastructure across the globe. Though we are far from perfection, we can take solace in the fact that these consolidated and targeted efforts are only expected to grow in the future. This has had a profound impact on the development of the global antiviral drugs market. With targeted efforts from organizations such as Red Cross and World Health Organization, the spread and reach of antiviral drugs has grown exponentially and has thus helped in the overall growth of the global market.

Early Availability of New Drugs is Pushing Growth of North America Market

In terms of geographical segmentation, the global market for antiviral drugs is divided into five key regions viz. Asia Pacific, Middle East and Africa, North America, Europe, and Latin America. Of these, the growth of the market is maximum in North America. The presence of strong healthcare infrastructure and early access to latest medications and medical technology are some of the key factors for the growth of the antiviral drugs market in North America. Moreover, several new drugs are already in the production pipeline that will further strengthen the growth of the regional market.

Asia Pacific and Africa regions are showing great promise for the development of their respective antiviral drugs market. Growing prevalence of viral diseases such as malaria, dengue, chikungunya, and other deadly viral diseases is prompting an ever increasing demand for these antiviral drugs from these regions.

Some of the key players in the global antiviral drugs market include names such as Merck & Co. Inc., Johnson and Johnson, Schering-Plough Corporation, AbbVie Inc., and AstraZeneca Plc. among others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Antiviral Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Disease Indication Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Key Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Global Antiviral Drugs Market Analysis and Forecasts, 2014–2024

4.5.1. Market Revenue Projections (US$ Mn)

4.6. Porter’s Five Force Analysis

4.7. Market Outlook

4.8. Antiviral Drugs: FDA Approvals and Patent Expiries by each drug class

4.9. Global relative prevalence rate of each hepatitis genotype infection

4.10. Global relative prevalence rate of HIV infection

4.11. Pipeline Analysis: Major Market Players

5. Global Antiviral Drugs Market Analysis and Forecasts, By Disease Indication

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value Forecast by Disease Indication, 2014–2024

5.4.1. Hepatitis Virus Infection

5.4.2. HIV Infection

5.4.3. Respiratory Virus Infection

5.4.4. Others

5.5. Market Attractiveness by Disease Indication

6. Global Antiviral Drugs Market Analysis and Forecasts, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Value Forecast by Product Type, 2014–2024

6.4.1. Branded Drugs

6.4.2. Generic Drugs

6.5. Market Attractiveness by Product Type

7. Global Antiviral Drugs Market Analysis and Forecasts, by Distribution Channels

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Value Forecast by Distribution Channels, 2014–2024

7.4.1. Hospital Pharmacy Store

7.4.2. Retail Pharmacy Store

7.4.3. Online Pharmacy

7.5. Market Attractiveness by Distribution Channels

8. Global Antiviral Drugs Market Analysis and Forecasts, by Region

8.1. Key Findings

8.2. Policies and Regulations

8.3. Market Value Forecast by Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia Pacific

8.3.4. Latin America

8.3.5. Middle East and Africa

8.4. Market Attractiveness by Country/Region

9. North America Antiviral Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Policies and Regulations

9.1.3. Key Trends

9.2. Market Value Forecast by Disease Indication, 2014–2024

9.2.1. Hepatitis Virus Infection

9.2.2. HIV Infection

9.2.3. Respiratory Virus Infection

9.2.4. Others

9.3. Market Value Forecast by Product Type, 2014–2024

9.3.1. Branded Drugs

9.3.2. Generic Drugs

9.4. Market Value Forecast by Distribution Channels, 2014–2024

9.4.1. Hospital Pharmacy Store

9.4.2. Retail Pharmacy Store

9.4.3. Online Pharmacy

9.5. Market Value Forecast by Country, 2014–2024

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

9.6.1. By Disease Indication

9.6.2. By Product Type

9.6.3. By Distribution Channels

9.6.4. By Country

10. Europe Antiviral Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.1.2. Policies and Regulations

10.1.3. Key Trends

10.2. Market Value Forecast by Disease Indication, 2014–2024

10.2.1. Hepatitis Virus Infection

10.2.2. HIV Infection

10.2.3. Respiratory Virus Infection

10.2.4. Others

10.3. Market Value Forecast by Product Type, 2014–2024

10.3.1. Branded Drugs

10.3.2. Generic Drugs

10.4. Market Value Forecast by Distribution Channels, 2014–2024

10.4.1. Hospital Pharmacy Store

10.4.2. Retail Pharmacy Store

10.4.3. Online Pharmacy

10.5. Market Value Forecast by Country, 2014–2024

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Italy

10.5.5. Spain

10.5.6. Russia

10.5.7. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Disease Indication

10.6.2. By Product Type

10.6.3. By Distribution Channels

10.6.4. By Country

11. Asia Pacific Antiviral Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Policies and Regulations

11.1.3. Key Trends

11.2. Market Value Forecast by Disease Indication, 2014–2024

11.2.1. Hepatitis Virus Infection

11.2.2. HIV Infection

11.2.3. Respiratory Virus Infection

11.2.4. Others

11.3. Market Value Forecast by Product Type, 2014–2024

11.3.1. Branded Drugs

11.3.2. Generic Drugs

11.4. Market Value Forecast by Distribution Channels, 2014–2024

11.4.1. Hospital Pharmacy Store

11.4.2. Retail Pharmacy Store

11.4.3. Online Pharmacy

11.5. Market Value Forecast by Country, 2014–2024

11.5.1. India

11.5.2. China

11.5.3. Japan

11.5.4. Australia & New Zealand

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Disease Indication

11.6.2. By Product Type

11.6.3. By Distribution Channels

11.6.4. By Country

12. Latin America Antiviral Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.1.2. Policies and Regulations

12.1.3. Key Trends

12.2. Market Value Forecast by Disease Indication, 2014–2024

12.2.1. Hepatitis Virus Infection

12.2.2. HIV Infection

12.2.3. Respiratory Virus Infection

12.2.4. Others

12.3. Market Value Forecast by Product Type, 2014–2024

12.3.1. Branded Drugs

12.3.2. Generic Drugs

12.4. Market Value Forecast by Distribution Channels, 2014–2024

12.4.1. Hospital Pharmacy Store

12.4.2. Retail Pharmacy Store

12.4.3. Online Pharmacy

12.5. Market Value Forecast by Country, 2014–2024

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

12.6.1. By Disease Indication

12.6.2. By Product Type

12.6.3. By Distribution Channels

12.6.4. By Country

13. Middle East and Africa Antiviral Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.1.2. Policies and Regulations

13.1.3. Key Trends

13.2. Market Value Forecast by Disease Indication, 2014–2024

13.2.1. Hepatitis Virus Infection

13.2.2. HIV Infection

13.2.3. Respiratory Virus Infection

13.2.4. Others

13.3. Market Value Forecast by Product Type, 2014–2024

13.3.1. Branded Drugs

13.3.2. Generic Drugs

13.4. Market Value Forecast by Distribution Channels, 2014–2024

13.4.1. Hospital Pharmacy Store

13.4.2. Retail Pharmacy Store

13.4.3. Online Pharmacy

13.5. Market Value Forecast by Country, 2014–2024

13.5.1. South Africa

13.5.2. GCC Countries

13.5.3. Rest of Middle East and Africa

13.6. Market Attractiveness Analysis

13.6.1. By Disease Indication

13.6.2. By Product Type

13.6.3. By Distribution Channels

13.6.4. By Country

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis by Company – 2016 (Estimated)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1. AbbVie, Inc.

14.3.1.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.1.2 Financial Overview

14.3.1.3 Product Portfolio

14.3.1.4 SWOT Analysis

14.3.1.5 Strategic Overview

14.3.2. Bristol-Myers Squibb Company

14.3.2.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.2.2 Financial Overview

14.3.2.3 Product Portfolio

14.3.2.4 SWOT Analysis

14.3.2.5 Strategic Overview

14.3.3. Cipla, Inc.

14.3.3.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.3.2 Financial Overview

14.3.3.3 Product Portfolio

14.3.3.4 SWOT Analysis

14.3.3.5 Strategic Overview

14.3.4. F. Hoffmann-La Roche Ltd.

14.3.4.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.4.2 Financial Overview

14.3.4.3 Product Portfolio

14.3.4.4 SWOT Analysis

14.3.4.5 Strategic Overview

14.3.5. Gilead Sciences, Inc.

14.3.5.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.5.2 Financial Overview

14.3.5.3 Product Portfolio

14.3.5.4 SWOT Analysis

14.3.5.5 Strategic Overview

14.3.6. GlaxoSmithKline plc.

14.3.6.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.6.2 Financial Overview

14.3.6.3 Product Portfolio

14.3.6.4 SWOT Analysis

14.3.6.5 Strategic Overview

14.3.7. Johnson & Johnson

14.3.7.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.7.2 Financial Overview

14.3.7.3 Product Portfolio

14.3.7.4 SWOT Analysis

14.3.7.5 Strategic Overview

14.3.8. Merck & Co., Inc.

14.3.8.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.8.2 Financial Overview

14.3.8.3 Product Portfolio

14.3.8.4 SWOT Analysis

14.3.8.5 Strategic Overview

14.3.9. Mylan N.V.

14.3.9.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.9.2 Financial Overview

14.3.9.3 Product Portfolio

14.3.9.4 SWOT Analysis

14.3.9.5 Strategic Overview

14.3.10. Teva Pharmaceutical Industries Ltd.

14.3.10.1 Company Overview (HQ, Business Segments, Employee Strengths)

14.3.10.2 Financial Overview

14.3.10.3 Product Portfolio

14.3.10.4 SWOT Analysis

14.3.10.5 Strategic Overview

14.3.11. Others

List of Tables

Table 01: Global Antiviral Drugs Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 02: Global Antiviral Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 03: Global Antiviral Drugs Market Size (US$ Mn) Forecast, by Distribution Channels, 2014–2024

Table 04: Global Antiviral Drugs Market Size (US$ Mn) Forecast, by Region, 2014–2024

Table 05: North America Antiviral Drugs Market Size (US$ Mn) Forecast, by Country, 2014–2024

Table 06: North America Antiviral Drugs Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 07: North America Antiviral Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 08: North America Antiviral Drugs Market Size (US$ Mn) Forecast, by Distribution Channels, 2014–2024

Table 09: Europe Antiviral Drugs Market Size (US$ Mn) Forecast, by Country/Region, 2014–2024

Table 10: Europe Antiviral Drugs Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 11: Europe Antiviral Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 12: Europe Antiviral Drugs Market Size (US$ Mn) Forecast, by Distribution Channels, 2014–2024

Table 13: Asia Pacific Antiviral Drugs Market Size (US$ Mn) Forecast, by Country/ Region, 2014–2024

Table 14: Asia Pacific Antiviral Drugs Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 15: Asia Pacific Antiviral Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 16: Asia Pacific Antiviral Drugs Market Size (US$ Mn) Forecast, by Distribution Channels, 2014–2024

Table 17: Latin America Antiviral Drugs Market Size (US$ Mn) Forecast, by Country/Region, 2014–2024

Table 18: Latin America Antiviral Drugs Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 19: Latin America Antiviral Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 20: Latin America Antiviral Drugs Market Size (US$ Mn) Forecast, by Distribution Channels, 2014–2024

Table 21: MEA Antiviral Drugs Market Size (US$ Mn) Forecast, by Country/ Region, 2014–2024

Table 22: Middle East & Africa Antiviral Drugs Market Size (US$ Mn) Forecast, by Disease Indication, 2014–2024

Table 23: Middle East & Africa Antiviral Drugs Market Size (US$ Mn) Forecast, by Product, 2014–2024

Table 24: Middle East & Africa Antiviral Drugs Market Size (US$ Mn) Forecast, by Distribution Channels, 2014–2024

List of Figures

Figure 01: Global Antiviral Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 02: FDA Approvals

Figure 03: FDA Approvals

Figure 04: FDA Approvals

Figure 05: FDA Approvals

Figure 06: FDA Approvals

Figure 07: FDA Approvals

Figure 08: FDA Approvals

Figure 09: FDA Approvals

Figure 10: HIV Prevalence

Figure 11: Hepatitis c virus prevalence

Figure 12: Pipeline Analysis

Figure 13: Global Antiviral Drugs Market Value Share Analysis, Disease Indication, 2016 and 2024

Figure 14: Global Hepatitis Virus Infection Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 15: Global HIV Infection Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 16: Global Respiratory Virus Infection Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 17: Global Other Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 18: Antiviral Drugs Market Attractiveness Analysis, Disease Indication, 2016–2024

Figure 19: Global Antiviral Drugs Market Value Share Analysis, by Product, 2016 and 2024

Figure 20: Global Branded Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 21: Global Generic Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 22: Antiviral Drugs Market Attractiveness Analysis, by Product, 2016–2024

Figure 23: Global Antiviral Drugs Market Value Share Analysis, by distribution Channels, 2016 and 2024

Figure 24: Global Hospital Pharmacy Store Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 25: Global Retail Pharmacy Store Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 26: Global Online Pharmacy Antiviral Drugs Market Revenue (US$ Mn), 2014–2024

Figure 27: Antiviral Drugs Market Attractiveness Analysis, by Distribution Channels, 2016–2024

Figure 28: Global Antiviral Drugs Market Value Share Analysis, by Region, 2016 and 2024

Figure 29: Antiviral Drugs Market Attractiveness Analysis, by Region, 2016–2024

Figure 30: North America Antiviral Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 31: North America Market Attractiveness Analysis, by Country, 2016–2024

Figure 32: North America Market Value Share Analysis, by Country, 2016 and 2024

Figure 33: North America Antiviral Drugs Market Value Share Analysis, Disease Indication, 2016 and 2024

Figure 34: North America Antiviral Drugs Market Value Share Analysis, by Product, 2016 and 2024

Figure 35: North America Antiviral Drugs Market Value Share Analysis, by distribution Channels, 2016 and 2024

Figure 36: North America Market Attractiveness Analysis, by Disease Indication, 2016-2024

Figure 37: North America Market Attractiveness Analysis, by Product, 2016-2024

Figure 38: North America Market Attractiveness Analysis, by Distribution Channels, 2016-2024

Figure 39: Europe Antiviral Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 40: Europe Market Attractiveness Analysis, by Country/ Region, 2016–2024

Figure 41: Europe Market Value Share Analysis, by Country/Region, 2016 and 2024

Figure 42: Europe Antiviral Drugs Market Value Share Analysis, Disease Indication, 2016 and 2024

Figure 43: Europe Antiviral Drugs Market Value Share Analysis, by Product, 2016 and 2024

Figure 44: Europe Antiviral Drugs Market Value Share Analysis, by distribution Channels, 2016 and 2024

Figure 45: Europe Market Attractiveness Analysis, by Disease Indication, 2016-2024

Figure 46: Europe Market Attractiveness Analysis, by Product, 2016-2024

Figure 47: Europe Market Attractiveness Analysis, by Distribution Channels, 2016-2024

Figure 48: Asia Pacific Antiviral Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 49: Asia Pacific Market Attractiveness Analysis, by Country/Region, 2016–2024

Figure 50: Asia Pacific Market Value Share Analysis, by Country/ Region, 2016 and 2024

Figure 51: Asia Pacific Antiviral Drugs Market Value Share Analysis, Disease Indication, 2016 and 2024

Figure 52: Asia Pacific Antiviral Drugs Market Value Share Analysis, by Product, 2016 and 2024

Figure 53: Asia Pacific Antiviral Drugs Market Value Share Analysis, by distribution Channels, 2016 and 2024

Figure 54: Asia Pacific Market Attractiveness Analysis, by Disease Indication, 2016-2024

Figure 55: Asia Pacific Market Attractiveness Analysis, by Product, 2016-2024

Figure 56: Asia Pacific Market Attractiveness Analysis, by Distribution Channels, 2016-2024

Figure 57: Latin America Antiviral Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 58: Latin America Market Attractiveness Analysis, by Country/Region, 2016–2024

Figure 59: Latin America Antiviral Drugs Market Value Share Analysis, by Country/Region, 2016 and 2024

Figure 60: Latin America Antiviral Drugs Market Value Share Analysis, Disease Indication, 2016 and 2024

Figure 61: Latin America Antiviral Drugs Market Value Share Analysis, by Product, 2016 and 2024

Figure 62: Latin America Antiviral Drugs Market Value Share Analysis, by distribution Channels, 2016 and 2024

Figure 63: Latin America Market Attractiveness Analysis, by Disease Indication, 2016-2024

Figure 64: Latin America Market Attractiveness Analysis, by Product, 2016-2024

Figure 65: Latin America Market Attractiveness Analysis, by Distribution Channels, 2016-2024

Figure 66: MEA Antiviral Drugs Market Size (US$ Mn) Forecast, 2014–2024

Figure 67: MEA Market Attractiveness Analysis, by Country/ Region, 2016-2024

Figure 68: MEA Antiviral Drugs Market Value Share Analysis, by Country/Region, 2016 and 2024

Figure 69: Middle East & Africa Antiviral Drugs Market Value Share Analysis, Disease Indication, 2016 and 2024

Figure 70: Middle East & Africa Antiviral Drugs Market Value Share Analysis, by Product, 2016 and 2024

Figure 71: Middle East & Africa Antiviral Drugs Market Value Share Analysis, by distribution Channels, 2016 and 2024

Figure 72: Middle East & Africa Market Attractiveness Analysis, by Disease Indication, 2016-2024

Figure 73: Middle East & Africa Market Attractiveness Analysis, by Product, 2016-2024

Figure 74: Middle East & Africa Market Attractiveness Analysis, by Distribution Channels, 2016-2024

Figure 75: Global Antiviral Drugs Market Share Analysis, by Company, (2015)