Analysts’ Viewpoint

Increase in demand is expected to drive the global antihyperlipidemic drugs market during the forecast period. These drugs are primary treatment for antihyperlipidemic. Demand for new and improved medications among patients to lower lipid levels and reduce the risk of cardiovascular diseases is expected to propel market expansion in the next few years.

Surge in awareness about the importance of cardiovascular health is likely to offer lucrative opportunities to market players. Companies are investing significantly in research & development of new and improved antihyperlipidemic drugs & other cardiovascular medications and medical devices. However, the industry is highly competitive, with the presence of large number of major players. Competition among companies is projected to drive innovation and improve the quality of drugs available; however, it could also lead to pricing pressures and challenges in maintaining market share.

Antihyperlipidemic drugs are medications used to treat high level of lipids (such as cholesterol and triglycerides) in the blood. Hyperlipidemia is a major risk factor for cardiovascular diseases, and these drugs are used to lower lipid levels and reduce the risk of cardiovascular events such as heart attack and stroke. Companies are investing in research & development to develop new and improved drugs and expanding distribution network to increase market share. Increase in patient population, rise in awareness about cardiovascular health, and advancements in drug development & distribution are expected bolster market development in the next few years.

Hyperlipidemia, or high level of lipids (such as cholesterol and triglycerides) in the blood, is a major risk factor for cardiovascular disease. Prevalence of hyperlipidemia has increased in the past few years, driven by changes in diet, sedentary lifestyles, and aging population.

According to the World Health Organization (WHO), hyperlipidemia is one of the most common metabolic disorders across the world, affecting around one-third of adults globally. Prevalence of hyperlipidemia is estimated to be around 39% in the U.S., according to data from the National Health and Nutrition Examination Survey (NHANES). Hyperlipidemia is more common in developed countries, where diets tend to be high in saturated fats and cholesterol. However, the condition is becoming more prevalent in developing countries, as diets and lifestyles become more westernized. Therefore, rise in prevalence of hyperlipidemia is a major driver of the global antihyperlipidemic drugs market.

Increase in awareness about the importance of cardiovascular health is propelling the global antihyperlipidemic drugs market. Public health campaigns, media coverage, and rise in availability of health information on the Internet are increasing awareness about cardiovascular health. Patients are taking an active role in managing their health, and many are seeking out information on how to lower cholesterol levels and reduce the risk of cardiovascular disease. This is driving demand for antihyperlipidemic drugs, which are one of the primary treatment options for hyperlipidemia.

Increase in awareness about cardiovascular health is also driving demand for cardiovascular medications and medical devices, such as blood pressure medications and cardiac stents. This presents significant opportunities for companies operating in the cardiovascular health segment.

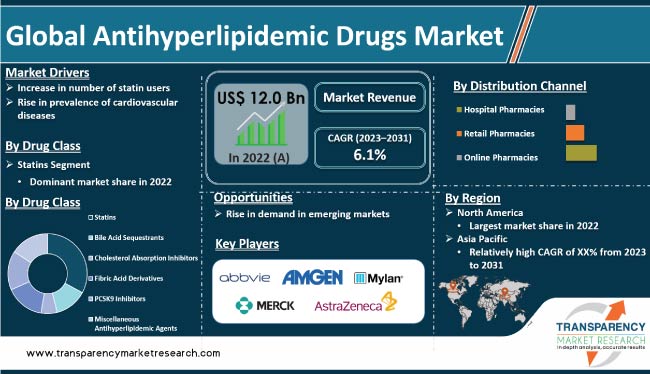

In terms drug class, the statins segment dominated the global antihyperlipidemic drugs market in 2022. Statins work by inhibiting the enzyme HMG-CoA reductase, which is involved in cholesterol synthesis. These drugs are highly effective in reducing low-density lipoprotein (LDL) cholesterol levels and are the first-line treatment for hyperlipidemia.

Fibric acid derivatives, which include drugs, such as gemfibrozil and fenofibrate, are also commonly used in the treatment of hyperlipidemia. These drugs work by activating peroxisome proliferator-activated receptor alpha (PPARα), which leads to reduction in triglycerides and increase in high-density lipoprotein (HDL) cholesterol levels.

Bile acid sequestrants, such as cholestyramine and colestipol, work by binding to bile acids in the intestine, which prevents their reabsorption and leads to a reduction in LDL cholesterol levels.

PCSK9 inhibitors, such as alirocumab and evolocumab, are a newer class of antihyperlipidemic drugs that work by blocking the PCSK9 protein, which increases the number of LDL receptors on the liver and leads to a reduction in LDL cholesterol levels.

Statins is currently the leading drug class in the global market. However, other drug classes such as fibric acid derivatives, bile acid sequestrants, and PCSK9 inhibitors are also important in the treatment of hyperlipidemia.

Based on distribution channel, the retail pharmacies segment accounted for the largest global antihyperlipidemic drugs market share in 2022. Retail pharmacies, including chain drug stores and independent pharmacies, are easily accessible and are often located in convenient locations such as shopping centers and supermarkets. This makes it easier for patients to fill their prescriptions and adhere to their medication regimen.

The hospital pharmacies segment is an important distribution channel for antihyperlipidemic drugs, particularly for patients who are hospitalized and require immediate treatment for hyperlipidemia. These pharmacies also serve as a resource for healthcare providers to obtain specialized medications and dosage forms.

Online pharmacies are a growing distribution channel for antihyperlipidemic drugs, offering convenience and accessibility to patients who may not have access to traditional retail pharmacies. However, the online pharmacies segment is relatively small compared to the retail and hospital pharmacies segments.

As per antihyperlipidemic drugs market trends, North America dominated the global market in 2022. Large patient population with hyperlipidemia and cardiovascular diseases; high level of awareness about cardiovascular health; and favorable reimbursement scenario are fueling the market in the region. The U.S. was the largest market for antihyperlipidemic drugs in North America in 2022. The trend is expected to continue in the next few years. High prevalence of hyperlipidemia and increase in the geriatric population are driving demand for these drugs in the country.

Canada is another significant market for these drugs in North America. The market in the country is propelled by increase in patient population and favorable reimbursement scenario. The Government of Canada has implemented various initiatives to improve access to healthcare, which is expected to boost the market in the country.

The market in Europe and Asia Pacific are expected to experience significant growth in the next few years, driven by factors such as increase in patient population and rise in awareness about cardiovascular health.

The global antihyperlipidemic drugs market is fragmented, with the presence of large number of prominent players. Leading players have adopted strategies such as product portfolio expansion and merger & acquisition to increase market share. AbbVie, Inc., Amgen, Inc., AstraZeneca plc, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Limited, Dr. Reddy’s Laboratories Ltd., Merck & Co., Inc., Mylan N.V, Pfizer, Inc., Novartis, Sanofi S.A., Esperion Therapeutics, and CJ Healthcare are the prominent players in the global market.

Each of these players has been profiled in the market report based on parameters such as company overview, financial overview, product portfolio, business strategies, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 12.0 Bn |

|

Forecast (Value) in 2031 |

More than US$ 20.1 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis consist of drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 12.0 Bn in 2022.

It is projected to reach more than US$ 20.1 Bn by 2031.

The CAGR is anticipated to be 6.1% from 2023 to 2031.

Increase in number of statin users, rise in prevalence of cardiovascular diseases, surge in prevalence of hyperlipidemia, and increase in awareness about cardiovascular health are driving the global market.

North America is expected to account for leading share of the global market during the forecast period.

AbbVie, Inc., Amgen, Inc., AstraZeneca plc, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Limited, Dr. Reddy’s Laboratories Ltd., Merck & Co., Inc., Mylan N.V, Pfizer, Inc., Sanofi S.A., Esperion Therapeutics, CJ Healthcare, and Novartis are the prominent players in the global market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Antihyperlipidemic Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Class Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Antihyperlipidemic Drugs Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Industry Events

5.3. Regulatory Scenario by Region/Globally

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Antihyperlipidemic Drugs Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Class, 2017–2031

6.3.1. Statins

6.3.2. Bile Acid Sequestrants

6.3.3. Cholesterol Absorption Inhibitors

6.3.4. Fibric Acid Derivatives

6.3.5. PCSK9 Inhibitors

6.3.6. Miscellaneous Antihyperlipidemic Agents

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Antihyperlipidemic Drugs Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospital Pharmacies

7.3.2. Retail Pharmacies

7.3.3. Online Pharmacies

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Global Antihyperlipidemic Drugs Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Antihyperlipidemic Drugs Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Drug Class, 2017–2031

9.2.1. Statins

9.2.2. Bile Acid Sequestrants

9.2.3. Cholesterol Absorption Inhibitors

9.2.4. Fibric Acid Derivatives

9.2.5. PCSK9 Inhibitors

9.2.6. Miscellaneous Antihyperlipidemic Agents

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Drug Class

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Antihyperlipidemic Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017–2031

10.2.1. Statins

10.2.2. Bile Acid Sequestrants

10.2.3. Cholesterol Absorption Inhibitors

10.2.4. Fibric Acid Derivatives

10.2.5. PCSK9 Inhibitors

10.2.6. Miscellaneous Antihyperlipidemic Agents

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospital Pharmacies

10.3.2. Retail Pharmacies

10.3.3. Online Pharmacies

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Drug Class

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Antihyperlipidemic Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017–2031

11.2.1. Statins

11.2.2. Bile Acid Sequestrants

11.2.3. Cholesterol Absorption Inhibitors

11.2.4. Fibric Acid Derivatives

11.2.5. PCSK9 Inhibitors

11.2.6. Miscellaneous Antihyperlipidemic Agents

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Hospital Pharmacies

11.3.2. Retail Pharmacies

11.3.3. Online Pharmacies

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Drug Class

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Antihyperlipidemic Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017–2031

12.2.1. Statins

12.2.2. Bile Acid Sequestrants

12.2.3. Cholesterol Absorption Inhibitors

12.2.4. Fibric Acid Derivatives

12.2.5. PCSK9 Inhibitors

12.2.6. Miscellaneous Antihyperlipidemic Agents

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Hospital Pharmacies

12.3.2. Retail Pharmacies

12.3.3. Online Pharmacies

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Drug Class

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Antihyperlipidemic Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017–2031

13.2.1. Statins

13.2.2. Bile Acid Sequestrants

13.2.3. Cholesterol Absorption Inhibitors

13.2.4. Fibric Acid Derivatives

13.2.5. PCSK9 Inhibitors

13.2.6. Miscellaneous Antihyperlipidemic Agents

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Hospital Pharmacies

13.3.2. Retail Pharmacies

13.3.3. Online Pharmacies

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Drug Class

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. AbbVie, Inc.

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Amgen, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. AstraZeneca plc

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Bristol-Myers Squibb Company

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Daiichi Sankyo Company Limited

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Dr. Reddy’s Laboratories Ltd.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Merck & Co., Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Mylan N.V

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Pfizer, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Sanofi S.A.

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Esperion Therapeutics

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. CJ Healthcare

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Novartis

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

List of Tables

Table 01: Global Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 02: Global Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 03: Global Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 05: North America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 06: North America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 08: Europe Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 11: Asia Pacific Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: Asia Pacific Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 14: Latin America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Latin America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 17: Middle East & Africa Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 18: Middle East & Africa Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Antihyperlipidemic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 03: Global Antihyperlipidemic Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 04: Global Antihyperlipidemic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 05: Global Antihyperlipidemic Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 06: Global Antihyperlipidemic Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Antihyperlipidemic Drugs Market Attractiveness Analysis, by Region, 2022–2031

Figure 08: North America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Antihyperlipidemic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 10: North America Antihyperlipidemic Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 11: North America Antihyperlipidemic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 12: North America Antihyperlipidemic Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 13: North America Antihyperlipidemic Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Antihyperlipidemic Drugs Market Attractiveness Analysis, by Country, 2022–2031

Figure 15: Europe Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Antihyperlipidemic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 17: Europe Antihyperlipidemic Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 18: Europe Antihyperlipidemic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 19: Europe Antihyperlipidemic Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 20: Europe Antihyperlipidemic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Antihyperlipidemic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 22: Asia Pacific Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Antihyperlipidemic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 24: Asia Pacific Antihyperlipidemic Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 25: Asia Pacific Antihyperlipidemic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 26: Asia Pacific Antihyperlipidemic Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 27: Asia Pacific Antihyperlipidemic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Antihyperlipidemic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 29: Latin America Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Antihyperlipidemic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 31: Latin America Antihyperlipidemic Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 32: Latin America Antihyperlipidemic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 33: Latin America Antihyperlipidemic Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 34: Latin America Antihyperlipidemic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Antihyperlipidemic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Middle East & Africa Antihyperlipidemic Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Antihyperlipidemic Drugs Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 38: Middle East & Africa Antihyperlipidemic Drugs Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 39: Middle East & Africa Antihyperlipidemic Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 40: Middle East & Africa Antihyperlipidemic Drugs Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 41: Middle East & Africa Antihyperlipidemic Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Antihyperlipidemic Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Global Antihyperlipidemic Drugs Market Share Analysis, by Company, 2022