Analysts’ Viewpoint on Anticoagulants Market Scenario

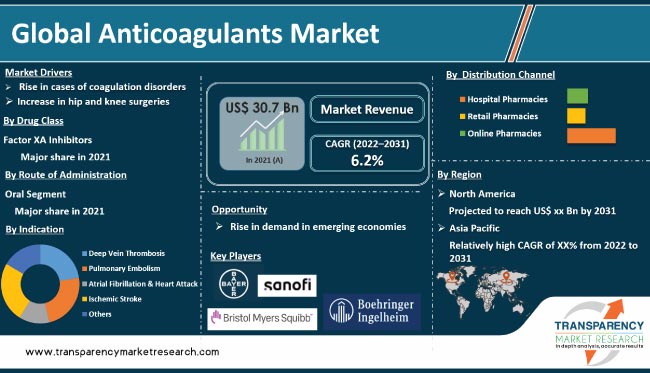

Increase in cases of coagulation disorders across the globe is driving the global anticoagulants market. Surge in thrombotic complications in patients affected by COVID-19 is also augmenting the global anticoagulants market. Strategic alliances among leading companies is expected to increase product penetration, which in turn is likely to drive the global anticoagulants market growth in the next few years. Surge in geriatric population, rise in prevalence of obesity, and increase in hip & knee surgeries are also projected to fuel the global anticoagulants market during the forecast period. Governments and private players are focusing on commercializing anticoagulant products. Furthermore, manufacturers of anticoagulants are focusing on expanding their presence in developing countries such as India, China, South Africa, Brazil, and Mexico in order to increase business operations and explore new markets.

Medicines called anticoagulants stop the blood from clotting. Blood thinners are also referred to as anticoagulants. These medicines are used in order to treat and prevent blood clots that could form in blood vessels. An artery or a vein could be obstructed by blood clots. A blocked artery prevents oxygen and blood from reaching a specific area of the body such as heart, brain, or lungs. Oral anticoagulants and injectable anticoagulants are the two major forms of anticoagulants. The coagulation pathway in the blood is different for each type. Anticoagulants can be used to treat blood clots or lower the risk in situations where they are more likely to occur. People with atrial fibrillation, deep vein thrombosis, hip or knee replacement, ischemic stroke, myocardial infraction (heart attack), and pulmonary embolism can benefit from the usage of anticoagulants.

Different types of anticoagulants available in the market are Coumadin & indandiones (also called vitamin K antagonist), factor XA inhibitors, direct thrombin inhibitors, and heparin. Warfarin, sold under brand name Coumadin, is available in the U.S. only for human use. Indandiones are primarily used for pest control, especially mice and rabbit. Heparins, such as Lipo-Hepin, are injectable anticoagulants that activate antithrombin III. In the normal coagulation system, liquemin acts at multiple locations. Antithrombin III, a heparin cofactor, and heparin can prevent thrombosis by inactivating activated factor X and preventing the conversion of prothrombin to thrombin. By inhibiting the activation of the fibrin stabilizing factor, liquemin also prevents the formation of a stable fibrin clot.

Coagulation disorders cause the body to form too many or too few blood clots. These are usually formed due to a genetic mutation and are often treatable with medications. Coagulation disorders can cause excessive bleeding if the body is unable to form blood clots properly. In other cases, these disorders could cause the body to produce blood clots too readily and increase the risk of blocked blood vessels. Bleeding disorders such as hemophilia and von Willebrand disease are genetic disorders.

According to the Centers of Disease Control and Prevention, the rate of occurrence of von Willebrand disease (VWD) is equal in men and women, affecting up to 1% of the general population. Between 2012 and 2016, more than 14,600 men, women, and children were seen at hemophilia treatment centers for the treatment of von Willebrand disease (VWD); of these, about 2/3 were women and girls. Thus, rise in cases of coagulation disorders is expected to drive the global market during the forecast period.

Increase in number of knee and hip replacement surgeries raises the risk of developing deep vein thrombosis (DVT). Surgeries often result in prolonged immobility, which increases the risk of deep vein thrombosis (DVT) due to decreased blood flow in the body. According to the WHO 2016 report, the number of surgical procedures performed among the elderly population has increased. Rise in number of surgeries is expected to increase the likelihood of developing thromboembolic events after surgery, thereby boosting patient demand for anticoagulant treatment.

In terms of drug class, the global anticoagulants market has been classified into factor XA inhibitors (NOAC/DOAC), heparins, direct thrombin inhibitors, and vitamin K antagonists. The factor XA inhibitors segment accounted for major share of the global market in 2021. Factor XA inhibitor drugs include 90% of direct factor XA. Factor XA inhibitors prevent the formation of thrombin, thereby inhibiting the formation of clots. Factor XA inhibitors have predictable anticoagulant effects and do not require routine monitoring, unlike some other blood thinners.

Based on indication, the global anticoagulants market has been segregated into deep vein thrombosis (DVT), pulmonary embolism (PE), atrial fibrillation & heart attack, ischemic stroke, and others. The atrial fibrillation & heart attack segment dominated the global market in terms of share in 2021. Atrial fibrillation can cause conditions such as blood clots, stroke, heart failure, overactive thyroid gland or other metabolic imbalance, and other issues, which lead to thromboembolism. Anticoagulants are used to treat these conditions.

In terms of route of administration, the global anticoagulants market has been bifurcated into oral and injectable. The oral segment accounted for the largest share of the global anticoagulants market in 2021. A number of direct oral anticoagulants (DOACs) have been approved by the U.S. Food & Drug Administration (FDA) since 2010. Oral anticoagulants directly inhibit the blood’s ability to form clots. Implementation of different technologies for oral drug delivery is changing the market scenario.

Based on distribution channel, the global anticoagulants market has been divided into hospital pharmacies, online pharmacies, and retail pharmacies. The hospital pharmacies segment dominated the global market in 2021. Surge in adoption of minimally invasive procedures for spine surgeries in hospitals & clinics is expected to drive the segment during the forecast period.

As per the global anticoagulants market analysis, North America accounted for major share of the market in 2021. The market in the region is likely to grow at a high CAGR from 2022 to 2031, due to high incidence of orthotic conditions among people over the age of 60 in the region. This is driving the demand for anticoagulant drugs among the geriatric population. Cardiovascular and kidney diseases are the most common conditions that affect the elderly. Cardiovascular complications account for 50% to 55% of hospital admissions for AFIB and heart attack. Thus, the anticoagulants market demand in the U.S. and Canada is likely to rise in the near future.

The market in Asia Pacific is projected to advance at a high CAGR from 2022 to 2031. China and Japan are expected to dominate the anticoagulants market in the region in the next few years. The patient pool in Asia Pacific is expected to rise in the near future due to the increase in awareness about and improvement in healthcare infrastructure. Health care organizations in Asia Pacific are implementing guidelines to support the usage of specific drugs for the prevention and treatment of anticoagulant disorders.

The global anticoagulants market is fragmented, with the presence of large number of local as well as international players. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players in the market. Prominent players in the global anticoagulants market are Bayer AG, Boehringer Ingelheim International GmbH, Bristol Myers Squibb, Daiichi Sankyo Company, Sanofi, Johnson & Johnson, and Pfizer, Inc.

Key players have been profiled in the anticoagulants market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 30.7 Bn |

|

Market Forecast Value in 2031 |

More than US$ 56.6 Bn |

|

Growth Rate (CAGR) |

6.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global anticoagulants market was valued at US$ 30.7 Bn in 2021.

The global anticoagulants market is projected to reach more than US$ 56.6 Bn by 2031.

The global anticoagulants market advanced at a CAGR of 10.9% from 2017 to 2021.

The global anticoagulants market is anticipated to grow at a CAGR of 6.2% from 2022 to 2031.

Rise in cases of coagulation disorders and increase in hip & knee surgeries.

North America is expected to account for the largest share of the global market during the forecast period.

Bayer AG, Boehringer Ingelheim International GmbH, Bristol Myers Squibb, Daiichi Sankyo Company, Sanofi, Johnson & Johnson, and Pfizer, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Anticoagulants Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Anticoagulants Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key industry events (mergers & acquisitions, product launches, partnerships, etc.)

5.2. Overview on the Novel Oral Anticoagulants (NOACs)

5.3. Epidemiology of the Key Diseases

5.4. Covid-19 Pandemic Impact on the Industry

6. Global Anticoagulants Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017–2031

6.3.1. Factor XA Inhibitors (NOAC/DOAC)

6.3.2. Heparins

6.3.3. Direct Thrombin Inhibitors

6.3.4. Vitamin K Antagonists

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Anticoagulants Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Route of Administration, 2017–2031

7.3.1. Oral

7.3.2. Injectable

7.4. Market Attractiveness Analysis, by Route of Administration

8. Global Anticoagulants Market Analysis and Forecast, by Indication

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Indication, 2017–2031

8.3.1. Deep Vein Thrombosis

8.3.2. Pulmonary Embolism

8.3.3. Atrial Fibrillation & Heart Attack

8.3.4. Ischemic Stroke

8.3.5. Others

8.4. Market Attractiveness Analysis, by Indication

9. Global Anticoagulants Market Analysis and Forecast, by Distribution Channel

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospital Pharmacies

9.3.2. Retail Pharmacies

9.3.3. Online Pharmacies

9.4. Market Attractiveness Analysis, by Distribution Channel

10. Global Anticoagulants Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Anticoagulants Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017–2031

11.2.1. Factor XA Inhibitors (NOAC/DOAC)

11.2.2. Heparins

11.2.3. Direct Thrombin Inhibitors

11.2.4. Vitamin K Antagonists

11.3. Market Value Forecast, by Route of Administration, 2017–2031

11.3.1. Oral

11.3.2. Injectable

11.4. Market Value Forecast, by Indication, 2017–2031

11.4.1. Deep Vein Thrombosis

11.4.2. Pulmonary Embolism

11.4.3. Atrial Fibrillation & Heart Attack

11.4.4. Ischemic Stroke

11.4.5. Others

11.5. Market Value Forecast, by Distribution Channel, 2017–2031

11.5.1. Hospital Pharmacies

11.5.2. Retail Pharmacies

11.5.3. Online Pharmacies

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Drug Class

11.7.2. By Route of Administration

11.7.3. By Indication

11.7.4. By Distribution Channel

11.7.5. By Country

12. Europe Anticoagulants Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017–2031

12.2.1. Factor XA Inhibitors (NOAC/DOAC)

12.2.2. Heparins

12.2.3. Direct Thrombin Inhibitors

12.2.4. Vitamin K Antagonists

12.3. Market Value Forecast, by Route of Administration, 2017–2031

12.3.1. Oral

12.3.2. Injectable

12.4. Market Value Forecast, by Indication, 2017–2031

12.4.1. Deep Vein Thrombosis

12.4.2. Pulmonary Embolism

12.4.3. Atrial Fibrillation & Heart Attack

12.4.4. Ischemic Stroke

12.4.5. Others

12.5. Market Value Forecast, by Distribution Channel, 2017–2031

12.5.1. Hospital Pharmacies

12.5.2. Retail Pharmacies

12.5.3. Online Pharmacies

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Drug Class

12.7.2. By Route of Administration

12.7.3. By Indication

12.7.4. By Distribution Channel

12.7.5. By Country/Sub-region

13. Asia Pacific Anticoagulants Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017–2031

13.2.1. Factor XA Inhibitors (NOAC/DOAC)

13.2.2. Heparins

13.2.3. Direct Thrombin Inhibitors

13.2.4. Vitamin K Antagonists

13.3. Market Value Forecast, by Route of Administration, 2017–2031

13.3.1. Oral

13.3.2. Injectable

13.4. Market Value Forecast, by Indication, 2017–2031

13.4.1. Deep Vein Thrombosis

13.4.2. Pulmonary Embolism

13.4.3. Atrial Fibrillation & Heart Attack

13.4.4. Ischemic Stroke

13.4.5. Others

13.5. Market Value Forecast, by Distribution Channel, 2017–2031

13.5.1. Hospital Pharmacies

13.5.2. Retail Pharmacies

13.5.3. Online Pharmacies

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Drug Class

13.7.2. By Route of Administration

13.7.3. By Indication

13.7.4. By Distribution Channel

13.7.5. By Country/Sub-region

14. Latin America Anticoagulants Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017–2031

14.2.1. Factor XA Inhibitors (NOAC/DOAC)

14.2.2. Heparins

14.2.3. Direct Thrombin Inhibitors

14.2.4. Vitamin K Antagonists

14.3. Market Value Forecast, by Route of Administration, 2017–2031

14.3.1. Oral

14.3.2. Injectable

14.4. Market Value Forecast, by Indication, 2017–2031

14.4.1. Deep Vein Thrombosis

14.4.2. Pulmonary Embolism

14.4.3. Atrial Fibrillation & Heart Attack

14.4.4. Ischemic Stroke

14.4.5. Others

14.5. Market Value Forecast, by Distribution Channel, 2017–2031

14.5.1. Hospital Pharmacies

14.5.2. Retail Pharmacies

14.5.3. Online Pharmacies

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Drug Class

14.7.2. By Route of Administration

14.7.3. By Indication

14.7.4. By Distribution Channel

14.7.5. By Country/Sub-region

15. Middle East & Africa Anticoagulants Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Drug Class, 2017–2031

15.2.1. Factor XA Inhibitors (NOAC/DOAC)

15.2.2. Heparins

15.2.3. Direct Thrombin Inhibitors

15.2.4. Vitamin K Antagonists

15.3. Market Value Forecast, by Route of Administration, 2017–2031

15.3.1. Oral

15.3.2. Injectable

15.4. Market Value Forecast, by Indication, 2017–2031

15.4.1. Deep Vein Thrombosis

15.4.2. Pulmonary Embolism

15.4.3. Atrial Fibrillation & Heart Attack

15.4.4. Ischemic Stroke

15.4.5. Others

15.5. Market Value Forecast, by Distribution Channel, 2017–2031

15.5.1. Hospital Pharmacies

15.5.2. Retail Pharmacies

15.5.3. Online Pharmacies

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Drug Class

15.7.2. By Route of Administration

15.7.3. By Indication

15.7.4. By Distribution Channel

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share/Ranking Analysis, by Company, 2021

16.3. Company Profiles

16.3.1. Bayer AG

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. SWOT Analysis

16.3.1.4. Strategic Overview

16.3.2. Boehringer Ingelheim International GmbH

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. SWOT Analysis

16.3.2.4. Strategic Overview

16.3.3. Bristol Myers Squibb

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. SWOT Analysis

16.3.3.4. Strategic Overview

16.3.4. Daiichi Sankyo Company

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. SWOT Analysis

16.3.4.4. Strategic Overview

16.3.5. Sanofi

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. SWOT Analysis

16.3.5.4. Strategic Overview

16.3.6. Johnson & Johnson

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. SWOT Analysis

16.3.6.4. Strategic Overview

16.3.7. Pfizer, Inc.

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. SWOT Analysis

16.3.7.4. Strategic Overview

List of Tables

Table 01: Global Anticoagulants Market Value (US$ Bn) Forecast, by Route of Administration, 2017-2031

Table 02: Global Anticoagulants Market Value (US$ Bn) Forecast, by Drug Class, 2017-2031

Table 03: Global Anticoagulants Market Value (US$ Bn) Forecast, by Indication, 2017-2031

Table 04: Global Anticoagulants Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 05: Global Anticoagulants Market Size (US$ Bn) and Volume (Units) Forecast, by Region, 2017-2031

Table 06: North America Anticoagulants Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 07: North America Anticoagulants Market Value (US$ Bn) Forecast, by Route of Administration, 2017-2031

Table 08: North America Anticoagulants Market Value (US$ Bn) Forecast, by Drug Class, 2017-2031

Table 09: North America Anticoagulants Market Value (US$ Bn) Forecast, by Indication, 2017-2031

Table 10: North America Anticoagulants Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 11: Europe Anticoagulants Size Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Europe Anticoagulants Market Value (US$ Bn) Forecast, by Route of Administration, 2017-2031

Table 13: Europe Anticoagulants Market Value (US$ Bn) Forecast, by Drug Class, 2017-2031

Table 14: Europe Anticoagulants Market Value (US$ Bn) Forecast, by Indication, 2017-2031

Table 15: Europe Anticoagulants Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 16: Asia Pacific Anticoagulants Size Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Asia Pacific Anticoagulants Market Value (US$ Bn) Forecast, by Route of Administration, 2017-2031

Table 18: Asia Pacific Anticoagulants Market Value (US$ Bn) Forecast, by Drug Class, 2017-2031

Table 19: Asia Pacific Anticoagulants Market Value (US$ Bn) Forecast, by Indication, 2017-2031

Table 20: Asia Pacific Anticoagulants Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 21: Latin America Anticoagulants Size Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Anticoagulants Market Value (US$ Bn) Forecast, by Route of Administration, 2017-2031

Table 23: Latin America Anticoagulants Market Value (US$ Bn) Forecast, by Drug Class, 2017-2031

Table 24: Latin America Anticoagulants Market Value (US$ Bn) Forecast, by Indication, 2017-2031

Table 25: Latin America Anticoagulants Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 26: Middle East & Africa Anticoagulants Size Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 27: Middle East & Africa Anticoagulants Market Value (US$ Bn) Forecast, by Route of Administration, 2017-2031

Table 28: Middle East & Africa Anticoagulants Market Value (US$ Bn) Forecast, by Drug Class, 2017-2031

Table 29: Middle East & Africa Anticoagulants Market Value (US$ Bn) Forecast, by Indication, 2017-2031

Table 30: Middle East & Africa Anticoagulants Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: Global Anticoagulants Market Snapshot

Figure 02: Global Anticoagulants Market Segments With Leading Market Share (%), 2021

Figure 03: Key Industry Developments (Anticoagulants Market)

Figure 04: Global Anticoagulants Market Value (US$ Bn) Forecast, 2017‒2027

Figure 05: Global Anticoagulants Market Value Share Analysis (%), by Drug Class, 2021

Figure 06: Global Anticoagulants Market Value Share Analysis (%), by Route of Administration, 2021

Figure 07: Global Anticoagulants Market Value Share Analysis (%), by Indication, 2021

Figure 08: Global Anticoagulants Market Value Share Analysis (%), by Distribution Channel, 2021

Figure 09: Global Anticoagulants Market Value Share Analysis (%), by Region, 2021

Figure 10: Global Anticoagulants Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 11: Global Anticoagulants Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 12: Global Anticoagulants Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 13: Global Anticoagulants Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 14: Global Anticoagulants Market Value Share Analysis, by Indication, 2021 and 2031

Figure 15: Global Anticoagulants Market Attractiveness Analysis, by Indication, 2022–2031

Figure 16: Global Anticoagulants Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 17: Global Anticoagulants Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 18: Global Anticoagulants Market Value Share Analysis, by Region, 2021 and 2031

Figure 19: Global Anticoagulants Market Attractiveness Analysis, by Region, 2017-2031

Figure 20: North America Anticoagulants Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 21: North America Anticoagulants Market Value Share Analysis (%), by Drug Class, 2021 and 2031

Figure 22: North America Anticoagulants Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 23: North America Anticoagulants Market Value Share Analysis (%), by Route of Administration, 2021 and 2031

Figure 24: North America Anticoagulants Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 25: North America Anticoagulants Market Value Share Analysis (%), by Indication, 2021 and 2031

Figure 26: North America Anticoagulants Market Attractiveness Analysis, by Indication, 2022–2031

Figure 27: North America Anticoagulants Market Value Share Analysis (%), by Distribution Channel, 2021 and 2031

Figure 28: North America Anticoagulants Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 29: North America Anticoagulants Market Value Share Analysis (%), by Country, 2021 and 2031

Figure 30: North America Anticoagulants Market Attractiveness Analysis, by Country, 2021 and 2031

Figure 31: Europe Anticoagulants Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 32: Europe Anticoagulants Market Value Share Analysis (%), by Drug Class, 2021 and 2031

Figure 33: Europe Anticoagulants Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 34: Europe Anticoagulants Market Value Share Analysis (%), by Route of Administration, 2021 and 2031

Figure 35: Europe Anticoagulants Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 36: Europe Anticoagulants Market Value Share Analysis (%), by Indication, 2021 and 2031

Figure 37: Europe Anticoagulants Market Attractiveness Analysis, by Indication, 2022–2031

Figure 38: Europe Anticoagulants Market Value Share Analysis (%), by Distribution Channel, 2021 and 2031

Figure 39: Europe Anticoagulants Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 40: Europe Anticoagulants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 41: Europe Anticoagulants Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 42: Asia Pacific Anticoagulants Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 43: Asia Pacific Anticoagulants Market Value Share Analysis (%), by Drug Class, 2021 and 2031

Figure 44: Asia Pacific Anticoagulants Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 45: Asia Pacific Anticoagulants Market Value Share Analysis (%), by Route of Administration, 2021 and 2031

Figure 46: Asia Pacific Anticoagulants Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 47: Asia Pacific Anticoagulants Market Value Share Analysis (%), by Indication, 2021 and 2031

Figure 48: Asia Pacific Anticoagulants Market Attractiveness Analysis, by Indication, 2022–2031

Figure 49: Asia Pacific Anticoagulants Value Share Analysis (%), by Distribution Channel, 2021 and 2031

Figure 50: Asia Pacific Anticoagulants Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 51: Asia Pacific Anticoagulants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 52: Asia Pacific Anticoagulants Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 53: Latin America Anticoagulants Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 54: Latin America Anticoagulants Market Value Share Analysis (%), by Drug Class, 2021 and 2031

Figure 55: Latin America Anticoagulants Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 56: Latin America Anticoagulants Market Value Share Analysis (%), by Route of Administration, 2021 and 2031

Figure 57: Latin America Anticoagulants Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 58: Latin America Anticoagulants Market Value Share Analysis (%), by Indication, 2021 and 2031

Figure 59: Latin America Anticoagulants Market Attractiveness Analysis, by Indication, 2022–2031

Figure 60: Latin America Anticoagulants Value Share Analysis (%), by Distribution Channel, 2021 and 2031

Figure 61: Latin America Anticoagulants Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 62: Latin America Anticoagulants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 63: Latin America Anticoagulants Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 64: Middle East & Africa Anticoagulants Market Value (US$ Bn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 65: Middle East & Africa Anticoagulants Market Value Share Analysis (%), by Drug Class, 2021 and 2031

Figure 66: Middle East & Africa Anticoagulants Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 67: Middle East & Africa Anticoagulants Market Value Share Analysis (%), by Route of Administration, 2021 and 2031

Figure 68: Middle East & Africa Anticoagulants Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 69: Middle East & Africa Anticoagulants Market Value Share Analysis (%), by Indication, 2021 and 2031

Figure 70: Middle East & Africa Anticoagulants Value Share Analysis (%), by Distribution Channel, 2021 and 2031

Figure 71: Middle East & Africa Anticoagulants Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 72: Middle East & Africa Anticoagulants Market Value Share Analysis (%), by Country/Sub-region, 2021 and 2031

Figure 73: Middle East & Africa Anticoagulants Market Attractiveness Analysis, by Country/Sub-region, 2022–2031