Analysts’ Viewpoint on Market Scenario

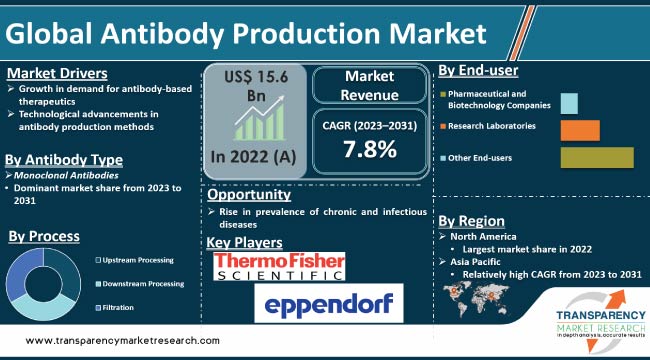

The global antibody production market size is expected to grow at a steady pace during the forecast period due to rise in demand for antibody-based therapeutics. Surge in prevalence of chronic and infectious diseases is also projected to augment market expansion in the next few years.

Growth in investment in research and development activities and technological advancements in antibody production methods are likely to create lucrative opportunities for vendors in the antibody production industry. Vendors are focusing on custom antibody production for biomedical applications. The sector is also benefiting from the surge in demand for personalized medicine and targeted therapies.

Antibody production refers to the process of generating antibodies, which are proteins produced by the immune system to identify and neutralize foreign substances such as bacteria, viruses, and cancer cells. Antibodies have become essential tools in medical research, diagnostics, and therapeutics, with applications in a wide range of fields including cancer treatment, infectious disease diagnosis, and vaccine development.

Antibody production can be achieved through various methods, including hybridoma technology, phage display, and recombinant DNA technology. Increase in demand for personalized medicine, targeted therapies, and biologics is anticipated to spur the antibody production market growth in the near future.

Emergence of the COVID-19 pandemic has led to surge in demand for antibodies for research, diagnosis, and treatment purposes. Numerous biotech and pharmaceutical companies are developing monoclonal antibodies for the treatment of COVID-19.

Increase in prevalence of chronic and infectious diseases and growth in awareness and affordability of personalized medicine and targeted therapies are boosting the demand for antibody-based therapeutics, especially in emerging economies.

Monoclonal antibodies (mAbs) have become the predominant treatment for various diseases in the last 25 years. Technological advances have made the discovery and development of mAb therapies quicker and more efficient. According to the U.S. FDA, as of 2017, there were 61 mAbs in clinical use, globally, with 48 new ones approved since 2008. In 2018 and 2019, 18 new antibodies were approved by the FDA. Thus, rise in adoption of therapeutic mAbs is fueling the antibody production market revenue.

According to an article published in Springer Nature, over 570 monoclonal antibodies (mAbs) are under clinical trials, with most of them in early-stage studies to assess safety and efficacy in cancer treatment. 29 novel mAbs are in late-stage clinical trials for non-cancer indications, with 40% of them intended for immune-mediated disorders. In 2019, five mAbs for cancer treatment were submitted to the FDA for license applications. These developments highlight the continued significance of mAbs as a treatment modality for various diseases, including cancer and immune-mediated disorders.

Technological advancements in antibody production methods have revolutionized the way antibodies are produced, leading to increased efficiency, speed, and precision. These advancements have played a vital role in driving the antibody production market development.

Hybridoma technology has revolutionized various fields, including cell biology, immunology, biotechnology, toxicology, pharmaceutical research, and medical research. It has enabled the production of highly specific and sensitive monoclonal antibodies in large quantities, which have been extensively used in diagnostics and cancer therapy. Prior to hybridoma technology, crude sera from immunized laboratory animals were employed, leading to allergic and hypersensitive reactions in patients.

Moreover, the development of the phage display method and western blotting represents an important milestone in the production of human monoclonal antibodies. This technique enables researchers to identify recombinant monoclonal antibodies against antigens more quickly and without the need for animal immunization. The phage display method allows for the in vitro selection of monoclonal antibodies by genetically engineering bacteriophages and using repeated antigen-guided selection and phage propagation.

Furthermore, the development of high-throughput screening techniques and automation has enabled the rapid screening of several antibodies, allowing researchers to identify potential therapeutic candidates more efficiently.

Monoclonal antibodies was the largest antibody type segment with 40.0% share in 2022. Monoclonal antibodies are being increasingly used in the diagnosis and treatment of various diseases, including cancer, autoimmune disorders, and infectious diseases.

Growth of the monoclonal antibodies segment can be ascribed to the strategic initiatives adopted by pharmaceutical and biotech companies. These include increase in investment in research and development, resulting in product approvals and launches, and growth in collaborations to develop advanced monoclonal antibodies. In May 2021, Cipla launched Roche’s antibody cocktail for the treatment of mild to moderate COVID-19 in India.

Moreover, global pharmaceutical companies are heavily investing in the R&D of cancer biologics drugs, which include monoclonal antibodies, due to their high efficiency and lower toxicity in the diagnosis and treatment of various types of cancer as compared to chemotherapy and other cancer treatment methods. These factors are expected to drive the monoclonal antibodies segment during the forecast period.

According to the latest antibody production market trends, the downstream processing segment is anticipated to dominate the industry during the forecast period. Downstream processing involves the purification and isolation of antibodies from a complex mixture of biological materials, such as fermentation broth or cell culture supernatants. This process is critical to ensure the quality, purity, and potency of the final antibody product. Surge in demand for high-quality and pure antibodies for various research and therapeutic applications is augmenting the downstream processing segment.

Recent advancements in antibody processing have resulted in the development of new technologies that enhance the efficiency, cost-effectiveness, and quality of antibody production. These include single-use sensors, membrane chromatography technology, remote monitoring, and data analytics. Single-use sensors enable real-time monitoring of bioprocess parameters, improving process control and reducing the risk of contamination. Membrane chromatography technology offers a more cost-effective and flexible alternative to traditional resin-based chromatography, thereby reducing the overall manufacturing cost and increasing productivity.

In March 2019, GE Healthcare partnered with Amgen to establish a digital data exchange collaboration program to understand the advances in the bio-manufacturing process on various raw material variability. This collaborative effort aimed to leverage data analytics to improve the efficiency and quality of antibody production, with the ultimate goal of reducing the cost of biologics. Growth in adoption of such advanced processing technologies is estimated to boost the segment in the next few years.

According to the latest antibody production market analysis, the pharmaceutical and biotechnology companies end-user segment is anticipated to dominate the industry during the forecast period. This can be ascribed to increase in demand for biologics and growth in prevalence of chronic diseases such as cancer, autoimmune disorders, and infectious diseases.

Pharmaceutical and biotechnology companies are major consumers of monoclonal antibodies, which are extensively utilized in drug discovery, development, and commercialization.

Moreover, these companies invest heavily in research and development to introduce new and advanced monoclonal antibodies, which can be used for various therapeutic applications. Surge in adoption of personalized and precision medicine approaches is propelling the segment, as monoclonal antibodies are ideal for targeted therapy and precision medicine.

According to the latest antibody production market forecast, North America is expected to hold largest share from 2023 to 2031. Rise in investment in drug discovery and advancements in research and healthcare infrastructure are fueling market dynamics in the region.

North America is home to a robust ecosystem for drug discovery and development, with a large pool of skilled workforce and advanced research facilities. This is prompting the development of several novel and advanced antibody-based products, thereby driving market statistics in the region.

Increase in adoption of biopharmaceuticals is also boosting the production of antibodies in North America. Biopharmaceuticals offer several advantages over traditional small-molecule drugs, including greater specificity, efficacy, and safety, which make them ideal for the treatment of various diseases. Additionally, the adoption of advanced technologies, such as AI technology, is expected to accelerate the drug development process and reduce the cost of discovering new drugs. This is expected to further fuel growth of the antibody production industry in North America in the next few years.

The business in Asia Pacific is projected to grow at a steady pace during the forecast period due to increase in investment in the R&D of new and advanced monoclonal antibodies, polyclonal antibodies, and other antibody-based products. Rise in adoption of antibody-based products for the treatment of various diseases is also fueling market progress in Asia Pacific.

Danaher Corporation, Merck KGaA, Sartorius, Thermo Fisher Scientific Inc., Eppendorf AG, INTEGRA Biosciences AG, Genetix Biotech Asia Pvt Ltd., Solaris Biotech, Grifols, F. Hoffmann-La Roche AG, and FiberCell Systems Inc. are key entities operating in the market.

Vendors are offering high-quality antibody production services for research companies and investing significantly in the R&D of new products to increase their antibody production market share. These vendors have been profiled in the antibody production market report based on parameters such as product portfolio, financial overview, latest developments, business strategies, business segments, and company overview.

| Attribute | Detail |

|---|---|

|

Market Size in 2022 |

US 15.6 Bn |

|

Market Forecast (Value) in 2031 |

US$ 30.7 Bn |

|

Growth Rate (CAGR) |

7.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 15.6 Bn in 2022

It is projected to reach US$ 30.7 Bn by the end of 2031

It is projected to be 7.8% from 2023 to 2031

Growth in demand for antibody-based therapeutics and technological advancements in antibody production methods

Monoclonal antibodies was the largest antibody type segment with 40.0% share in 2022

North America is anticipated to record the highest demand from 2023 to 2031

Danaher Corporation, Merck KGaA, Sartorius, Thermo Fisher Scientific Inc., Eppendorf AG, INTEGRA Biosciences AG, Genetix Biotech Asia Pvt Ltd., Solaris Biotech, Grifols, F. Hoffmann-La Roche AG, and FiberCell Systems Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Antibody Production Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Antibody Production Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. Key Mergers & Acquisitions

5.3. Key Product/Brand Analysis

5.4. Top 3 Players Operating in Market Space

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long-term Impact)

6. Global Antibody Production Market Analysis and Forecast, by Antibody Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Antibody Type, 2017-2031

6.3.1. Monoclonal Antibodies

6.3.2. Polyclonal Antibodies

6.3.3. Other Antibody Types

6.4. Market Attractiveness Analysis, by Antibody Type

7. Global Antibody Production Market Analysis and Forecast, by Process

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Process, 2017-2031

7.3.1. Upstream Processing

7.3.1.1. Bioreactors

7.3.1.1.1. Large-scale Bioreactors

7.3.1.1.2. Single-use Bioreactors

7.3.1.2. Consumables

7.3.2. Downstream Processing

7.3.2.1. Chromatography Systems

7.3.2.2. Chromatography Resins

7.3.3. Filtration

7.3.3.1. Filtration Systems

7.3.3.2. Filtration Consumables & Accessories

7.4. Market Attractiveness Analysis, by Process

8. Global Antibody Production Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Pharmaceutical and Biotechnology Companies

8.3.2. Research Laboratories

8.3.3. Other End-users

8.4. Market Attractiveness Analysis, by End-user

9. Global Antibody Production Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Antibody Production Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Antibody Type, 2017-2031

10.2.1. Monoclonal Antibodies

10.2.2. Polyclonal Antibodies

10.2.3. Other Antibody Types

10.3. Market Value Forecast, by Process, 2017-2031

10.3.1. Upstream Processing

10.3.1.1. Bioreactors

10.3.1.1.1. Large-scale Bioreactors

10.3.1.1.2. Single-use Bioreactors

10.3.1.2. Consumables

10.3.2. Downstream Processing

10.3.2.1. Chromatography Systems

10.3.2.2. Chromatography Resins

10.3.3. Filtration

10.3.3.1. Filtration Systems

10.3.3.2. Filtration Consumables & Accessories

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Pharmaceutical and Biotechnology Companies

10.4.2. Research Laboratories

10.4.3. Other End-users

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Antibody Type

10.6.2. By Process

10.6.3. By End-user

10.6.4. By Country

11. Europe Antibody Production Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Antibody Type, 2017-2031

11.2.1. Monoclonal Antibodies

11.2.2. Polyclonal Antibodies

11.2.3. Other Antibody Types

11.3. Market Value Forecast, by Process, 2017-2031

11.3.1. Upstream Processing

11.3.1.1. Bioreactors

11.3.1.1.1. Large-scale Bioreactors

11.3.1.1.2. Single-use Bioreactors

11.3.1.2. Consumables

11.3.2. Downstream Processing

11.3.2.1. Chromatography Systems

11.3.2.2. Chromatography Resins

11.3.3. Filtration

11.3.3.1. Filtration Systems

11.3.3.2. Filtration Consumables & Accessories

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Pharmaceutical and Biotechnology Companies

11.4.2. Research Laboratories

11.4.3. Other End-users

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Antibody Type

11.6.2. By Process

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Antibody Production Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Antibody Type, 2017-2031

12.2.1. Monoclonal Antibodies

12.2.2. Polyclonal Antibodies

12.2.3. Other Antibody Types

12.3. Market Value Forecast, by Process, 2017-2031

12.3.1. Upstream Processing

12.3.1.1. Bioreactors

12.3.1.1.1. Large-scale Bioreactors

12.3.1.1.2. Single-use Bioreactors

12.3.1.2. Consumables

12.3.2. Downstream Processing

12.3.2.1. Chromatography Systems

12.3.2.2. Chromatography Resins

12.3.3. Filtration

12.3.3.1. Filtration Systems

12.3.3.2. Filtration Consumables & Accessories

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Pharmaceutical and Biotechnology Companies

12.4.2. Research Laboratories

12.4.3. Other End-users

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Antibody Type

12.6.2. By Process

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Antibody Production Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Antibody Type, 2017-2031

13.2.1. Monoclonal Antibodies

13.2.2. Polyclonal Antibodies

13.2.3. Other Antibody Types

13.3. Market Value Forecast, by Process, 2017-2031

13.3.1. Upstream Processing

13.3.1.1. Bioreactors

13.3.1.1.1. Large-scale Bioreactors

13.3.1.1.2. Single-use Bioreactors

13.3.1.2. Consumables

13.3.2. Downstream Processing

13.3.2.1. Chromatography Systems

13.3.2.2. Chromatography Resins

13.3.3. Filtration

13.3.3.1. Filtration Systems

13.3.3.2. Filtration Consumables & Accessories

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Pharmaceutical and Biotechnology Companies

13.4.2. Research Laboratories

13.4.3. Other End-users

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Antibody Type

13.6.2. By Process

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Antibody Production Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Antibody Type, 2017-2031

14.2.1. Monoclonal Antibodies

14.2.2. Polyclonal Antibodies

14.2.3. Other Antibody Types

14.3. Market Value Forecast, by Process, 2017-2031

14.3.1. Upstream Processing

14.3.1.1. Bioreactors

14.3.1.1.1. Large-scale Bioreactors

14.3.1.1.2. Single-use Bioreactors

14.3.1.2. Consumables

14.3.2. Downstream Processing

14.3.2.1. Chromatography Systems

14.3.2.2. Chromatography Resins

14.3.3. Filtration

14.3.3.1. Filtration Systems

14.3.3.2. Filtration Consumables & Accessories

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Pharmaceutical and Biotechnology Companies

14.4.2. Research Laboratories

14.4.3. Other End-users

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Antibody Type

14.6.2. By Process

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Danaher Corporation

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Merck KGaA

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Sartorius

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Thermo Fisher Scientific Inc.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Eppendorf AG

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. INTEGRA Biosciences AG

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Genetix Biotech Asia Pvt Ltd

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Solaris Biotech

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Grifols

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. F. Hoffmann-La Roche AG

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. FiberCell Systems Inc.

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

List of Tables

Table 01: Global Antibody Production Market Value (US$ Bn) Forecast, by Antibody Type, 2017-2031

Table 02: Global Antibody Production Market Value (US$ Bn) Forecast, by Process, 2017-2031

Table 03: Global Antibody Production Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 04: Global Antibody Production Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 05: North America Antibody Production Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 06: North America Antibody Production Market Value (US$ Bn) Forecast, by Antibody Type, 2017-2031

Table 07: North America Antibody Production Market Value (US$ Bn) Forecast, by Process, 2017-2031

Table 08: North America Antibody Production Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 09: Europe Antibody Production Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Europe Antibody Production Market Value (US$ Bn) Forecast, by Antibody Type, 2017-2031

Table 11: Europe Antibody Production Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 12: Europe Antibody Production Market Value (US$ Bn) Forecast, by Process, 2017-2031

Table 13: Asia Pacific Antibody Production Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Asia Pacific Antibody Production Market Value (US$ Bn) Forecast, by Antibody Type, 2017-2031

Table 15: Asia Pacific Antibody Production Market Value (US$ Bn) Forecast, by Process, 2017-2031

Table 16: Asia Pacific Antibody Production Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 17: Latin America Antibody Production Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Antibody Production Market Value (US$ Bn) Forecast, by Antibody Type, 2017-2031

Table 19: Latin America Antibody Production Market Value (US$ Bn) Forecast, by Process, 2017-2031

Table 20: Latin America Antibody Production Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 21: Middle East & Africa Antibody Production Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Antibody Production Market Value (US$ Bn) Forecast, by Antibody Type, 2017-2031

Table 23: Middle East & Africa Antibody Production Market Value (US$ Bn) Forecast, by Process, 2017-2031

Table 24: Middle East & Africa Antibody Production Market Value (US$ Bn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Antibody Production Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Global Antibody Production Market Value Share, by Antibody Type, 2022

Figure 03: Global Antibody Production Market Value Share, by End-user, 2022

Figure 04: Global Antibody Production Market Value Share, by Region, 2022

Figure 05: Global Antibody Production Market Value Share Analysis, by Antibody Type, 2022 and 2031

Figure 06: Global Antibody Production Market Attractiveness Analysis, by Antibody Type, 2023-2031

Figure 07: Global Antibody Production Market Revenue (US$ Bn), by Monoclonal Antibodies, 2017-2031

Figure 08: Global Antibody Production Market Revenue (US$ Bn), by Polyclonal Antibodies 2017-2031

Figure 09: Global Antibody Production Market Revenue (US$ Bn), by Other Antibody Types, 2017-2031

Figure 10: Global Antibody Production Market Revenue (US$ Bn), by Process, 2017-2031

Figure 11: Global Antibody Production Market Revenue (US$ Bn), by Upstream Processing 2017-2031

Figure 12: Global Antibody Production Market Revenue (US$ Bn), by Downstream Processing, 2017-2031

Figure 13: Global Antibody Production Market Revenue (US$ Bn), by Filtration, 2017-2031

Figure 14: Global Antibody Production Market Value Share Analysis, by Filtration Systems, 2022 and 2031

Figure 15: Global Antibody Production Market Attractiveness Analysis, by Filtration Consumables & Accessories, 2023-2031

Figure 16: Global Antibody Production Market Revenue (US$ Bn), by End-user, 2017-2031

Figure 17: Global Antibody Production Market Revenue (US$ Bn), Pharmaceutical and Biotechnology Companies, 2017-2031

Figure 18: Global Antibody Production Market Revenue (US$ Bn), by Research Laboratories, 2017-2031

Figure 19: Global Antibody Production Market Revenue (US$ Bn), by Other End-users, 2017-2031

Figure 20: Global Antibody Production Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Antibody Production Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: North America Antibody Production Market Value (US$ Bn) Forecast, 2017-2031

Figure 23: North America Antibody Production Market Value Share Analysis, by Country, 2022 and 2031

Figure 24: North America Antibody Production Market Attractiveness Analysis, by Country, 2023-2031

Figure 25: North America Antibody Production Market Value Share Analysis, by Antibody Type, 2022 and 2031

Figure 26: North America Antibody Production Market Attractiveness Analysis, by Antibody Type, 2023-2031

Figure 27: North America Antibody Production Market Value Share Analysis (US$ Bn), by End-user, 2017-2031

Figure 28: North America Antibody Production Market Attractiveness Analysis, by End-user, 2023-2031

Figure 31: Europe Antibody Production Market Value (US$ Bn) Forecast, 2017-2031

Figure 32: Europe Antibody Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Europe Antibody Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 34: Europe Antibody Production Market Value Share Analysis, by Antibody Type, 2022 and 2031

Figure 35: Europe Antibody Production Market Attractiveness Analysis, by Antibody Type, 2023-2031

Figure 36: Europe Antibody Production Market Value Share Analysis, by End-user, 2017-2031

Figure 37: Europe Antibody Production Market Attractiveness Analysis, by End-user, 2023-2031

Figure 40: Asia Pacific Antibody Production Market Value (US$ Bn) Forecast, 2017-2031

Figure 41: Asia Pacific Antibody Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Asia Pacific Antibody Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 43: Asia Pacific Antibody Production Market Value Share Analysis, by Antibody Type, 2022 and 2031

Figure 44: Asia Pacific Antibody Production Market Attractiveness Analysis, by Antibody Type, 2023-2031

Figure 45: Asia Pacific Antibody Production Market Value Share Analysis, by End-user, 2017-2031

Figure 46: Asia Pacific Antibody Production Market Attractiveness Analysis, by End-user, 2023-2031

Figure 49: Latin America Antibody Production Market Value (US$ Bn) Forecast, 2017-2031

Figure 50: Latin America Antibody Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 51: Latin America Antibody Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 52: Latin America Antibody Production Market Value Share Analysis, by Antibody Type, 2022 and 2031

Figure 53: Latin America Antibody Production Market Attractiveness Analysis, by Antibody Type, 2023-2031

Figure 54: Latin America Antibody Production Market Value Share Analysis, by End-user, 2017-2031

Figure 55: Latin America Antibody Production Market Attractiveness Analysis, by End-user, 2023-2031

Figure 58: Middle East & Africa Antibody Production Market Value (US$ Bn) Forecast, 2017-2031

Figure 59: Middle East & Africa Antibody Production Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 60: Middle East & Africa Antibody Production Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 61: Middle East & Africa Antibody Production Market Value Share Analysis, by Antibody Type, 2022 and 2031

Figure 62: Middle East & Africa Antibody Production Market Attractiveness Analysis, by Antibody Type, 2023-2031

Figure 63: Middle East & Africa Antibody Production Market Value Share Analysis, by End-user, 2017-2031

Figure 64: Middle East & Africa Antibody Production Market Attractiveness Analysis, by End-user, 2023-2031