Advances in chemical profiling of flavonoids have led the development of antioxidant protective agents against several chronic ailments in recent years. Anthocyanin has been one of the leading emphasized category of flavonoids, where efforts of food researchers have led progress in the epidemiology of anthocyanin, in terms of metabolism and biosynthesis, phytochemical investigations and prevalence in plants. As the demand for natural colorants and additives over synthetic variants continues to spur, anthocyanin has gained widespread acceptance in the global food & beverage industry, post-approval as an effective and healthy additive by international regulatory bodies.

An analytical research study by TMR finds that in 2018, the anthocyanin market was valued at over US$ 500 million, and is estimated to record a Y-o-Y of over 4% in 2019. The anthocyanin market continues to witness growth in line with the continual spending on research and development activities to evaluate the capabilities of anthocyanin. The continually emerging trends in the end-use industries including the food and beverage sector are expected to transform the anthocyanin market.

The increasing transition towards natural food flavonoids and colorants has directed the efforts of food scientists into understanding the efficacy of anthocyanin as a health promoter and in the treatment of diseases. Studies indicate nearly 84 million people in America alone to suffer from cardiovascular diseases - accounting for 1 in 3 deaths. Data from clinical trials have attested the benefits of anthocyanin on the heart and circulatory health, where subjects with the highest anthocyanin intake were 9% less likely to suffer from coronary heart disease.

Key regulations on synthetic food colorants imposed by governing bodies are directing attention of food producers towards natural solutions such as anthocyanin -conventional, natural food colorant. The effective of anthocyanin pigments in terms of its health benefits and the proven anti-oxidant properties, anti-cancer nature, neuro-protective profile, is expected to translate in a healthy demand for the anthocyanin pigments in the near future. With such beneficial attributes, anthocyanin is gaining diverse applicability, not only in the food and beverage sector, but also in the healthcare and pharmaceutical industries.

Food manufacturers are shifting their focus towards additives, ingredients, and colorants such as anthocyanin that promote the health profile of food products, in an attempt to cope up with the changing consumer preferences. One such trend observed across the end-use industry is the blue wine trend. Blue is not approved as a wine color in Spain, which resulted in the initial ban of the blue wine. After striding through a number of regulations and red tape, it was passed through, being added into the category of ‘other alcoholic beverages’. Made from grapes, having anthocyanin, the high blue pigment in its skin, the wine gets a natural blue color. Progressing its way into the French market, the blue wine trend is likely to push the growth of the anthocyanin market.

Purple foods are emerging as a popular choice among consumers for both the color and the associated health benefits. The purple food revolution cited across various parts of the world is expected to push the expansion of the anthocyanin market in terms of extraction. Research has revealed that the highest content of antioxidant activity and anthocyanin in tropical purple fruits were java plum followed by sweet potato, tomi-tomi, and Bali grape. As researchers have linked anthocyanin to increased longevity, the purple foods penetration is directly linked to the anthocyanin market growth.

Use of smart packaging systems for food products has grown in the recent times. Key developments in the smart packaging technology are further widening the scope of applications for the anthocyanin pigments. Food researchers are working on developing new indicator based smart packaging technologies that make use of natural dyes. As the indicators of natural dyes such as anthocyanin prompt the shelf life and quality of perishable foods, the anthocyanin is emerging as a natural dye. As the use of anthocyanin as a natural dye for indicators is likely to aid in accelerating the commercial adoption, this trend would open new opportunities for anthocyanin market players.

The companies operating in the anthocyanin market are focusing on improving the foothold in the food additives industry. Geographical expansions are among the key strategies implemented by the anthocyanin market players in an attempt to achieve business expansion. The production of anthocyanin by the commercial development of plant cell culture is likely to pick pace over the coming years. Primary studies and trials on the regulation of anthocyanin biosynthesis on the enzyme and gene levels are revised, presenting the feasilibility for cloning genes, thereby improving yields of anthocyanin. With no commercial trials for anthocyanin production by the plant cell culture, the intelligent integration of existing strategies could provide a technology for industrial application viable to the current production processes.

MedPalett developed a patented, manufacturing process, together with the University of Bergen, that ensures minimum quantity of 80 mg anthocyanin per MEDOX capsule which is a berry extract developed from New Zealand’s wild Scandinavian bilberries and black currants.

Various efforts have been carried out to develop new analytical techniques for the process of identification and quantification of anthocyanin in plant materials, along with their effects in vivo and in vitro. A number of mass spectrometry (MS) instruments and advances in nuclear magnetic resonance (NMR) have provided an impetus to anthocyanin analysis. These developments are likely to boost the overall growth of the anthocyanin market.

At VitaFoods Europe, Naturex showcased Sweoat Brans, an oat beta glucan-based product that provides a range of health benefits which are EFSA-approved. Along with this, the company has showcased the Aronox aronia berry extract that is known to improve certain biomarkers for cardiovascular well-being which include endothelial function and is vital for blood circulation. The event also included a discussion on the benefits of Aronox, in a session that explored the effect of anthocyanin-rich foods on vascular functions, which was a part of the Vitafoods Education Programme.

Among the key players operating in the anthocyanin market Sensient Technologies Corp, Symrise A.G., Archer Daniels Midlands Co., and CHR Hansen A/S held 50% share of the global anthocyanin market in 2018, in turn reflecting their market dominance.

The companies operating in the anthocyanin market are continually extending their capabilities in the key end-use sectors, strengthening their market foothold. Acquisition strategy has emerged as one of the most vital approaches implemented by the anthocyanin market players.

Analyst Viewpoint

Companies that focus on research and development activities to explore the application scope of anthocyanin will see promising growth prospects. Leading players are focusing on innovative product developments to meet customer requirements, even as putting more efforts in marketing and advertisement activities for increasing their penetration in niche segments. Social media platforms remain potent for increasing the customer base, when used on a large scale.

1. Global Anthocyanin Market - Executive Summary

1.1. Global Anthocyanin Market Country Analysis

1.2. Vertical Specific Market Penetration

1.3. Application – Product Mapping

1.4. Technology Time Line Mapping

1.5. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Introduction

2.2. Market Definition

2.3. Market Taxonomy

3. Market Dynamics

3.1. Macro-economic Factors

3.1.1. Rise in Consumption of Feed Products Across Globe

3.1.2. Business Environment Outlook

3.1.3. Regional Production Vs. Consumption Outlook

3.1.4. Global Modern Trade Penetration by Key Countries

3.1.5. Global Retail Dynamics

3.1.6. Global Trade Scenario

3.2. Drivers

3.2.1. More Brands Are Shifting Towards Natural Colors

3.2.2. Development of Shelf-Stable Natural Color Solution

3.2.3. Increasing Demand for Clean Label Food Products for Children

3.2.4. Growing Number of Government Approvals for Natural Colorants

3.3. Market Restraints

3.3.1. High Production and Controlling Cost

3.3.2. Lengthy Validation Process

3.3.3. Exposure to Light, Extreme Temperature, and Adverse pH Affects Functionality

3.4. Market Trends

3.4.1. Increasing Awareness for Anthocyanin

3.4.2. Walmart & Aldi Leading the Move to Natural Colors

3.4.3. Growing Application in Beverages Industry

3.5. Trend Analysis- Impact on Time Line (2018-2026)

3.6. Forecast Factors – Relevance and Impact

3.7. Key Regulations and Claims

3.7.1. Food Packaging Claims

3.7.2. Labeling and Claims

3.7.3. Import/Export Regulations

3.7.4. Natural Food Color Regulations

3.8. Trade Analysis of Natural Food Colors

3.8.1. Top 10 Country, Import Value & Volume

3.8.2. Top 10 Country, Export Value & Volume

3.9. Social Media Analysis

3.9.1. Social Media Analysis for Natural Color Containing:

Confectionary and Bakery Products

Functional Food Products

3.9.2. Consumer Perception for Natural Color Products

3.9.3. Social Media Analysis for Key Brands using Natural Colors

3.9.4. Shift from Synthetic to Natural Food Colours

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.1.1. Market Size and Forecast

4.1.2. Market Size and Y-o-Y Growth

4.1.3. Absolute $ Opportunity

5. Supply Chain Analysis

5.1. Profitability and Gross Margin Analysis by Competition

5.2. List of Active Participants- by Region

5.2.1. Raw Material Suppliers

5.2.2. Key Manufacturers

5.2.3. Key Distributor/Retailers

6. Global Anthocyanin Market Pricing Analysis

6.1. Price Point Assessment by Type

6.2. Regional Average Pricing Analysis

6.2.1. North America

6.2.2. Latin America

6.2.3. Europe

6.2.4. Asia Pacific Ex. Japan (APEJ)

6.2.5. Japan

6.2.6. Oceania

6.2.7. Middle East and Africa

6.3. Price Forecast till 2027

6.4. Factors Influencing Pricing

7. Global Anthocyanin Market Analysis and Forecast

7.1. Market Size Analysis (2013-2017) and Forecast (2018-2026)

7.1.1. Market Value (US$ Mn) and Volume (Tons) and Y-o-Y Growth

7.1.2. Absolute $ Opportunity

7.2. Global Anthocyanin Market Scenario Forecast (Optimistic, Likely and Conservative Market Conditions)

7.2.1. Forecast Factors and Relevance of Impact

7.2.2. Regional Anthocyanin Market Business Performance Summary

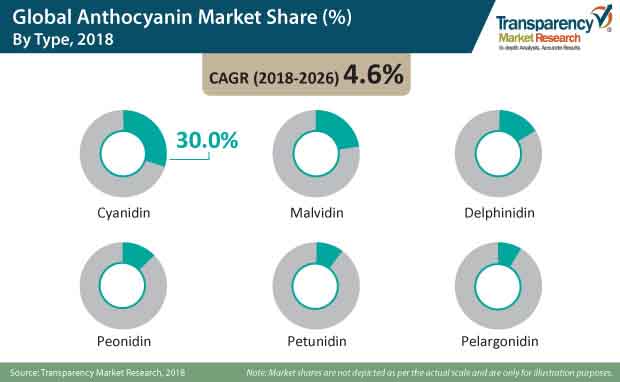

8. Global Anthocyanin Market Analysis by Type

8.1. Introduction

8.1.1. Y-o-Y Growth Comparison by Type

8.1.2. Basis Point Share (BPS) Analysis by Type

8.2. Anthocyanin Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2026) by Type

8.2.1. Cyanidin

8.2.2. Delphinidin

8.2.3. Pelargonidin

8.2.4. Peonidin

8.2.5. Petunidin

8.2.6. Malvidin

8.3. Market Attractiveness Analysis by Type

9. Global Anthocyanin Market Analysis by End Use

9.1. Introduction

9.1.1. Y-o-Y Growth Comparison by End Use

9.1.2. Basis Point Share (BPS) Analysis by End Use

9.2. Anthocyanin Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2026) by End Use

9.2.1. Food & Beverage Industry

9.2.1.1. Bakery & Confectionary

9.2.1.2. Dairy Products

9.2.1.3. Beverages

9.2.1.4. Soup, Sauces & Spreads

9.2.1.5. Others

9.2.2. Nutraceutical Industry

9.2.3. Pharmaceutical Industry

9.2.4. Personal Care and Cosmetic Industry

9.2.5. Animal Feed

9.3. Market Attractiveness Analysis by End Use

10. Global Anthocyanin Market Analysis by Source

10.1. Introduction

10.1.1. Y-o-Y Growth Comparison by Source

10.1.2. Basis Point Share (BPS) Analysis by Source

10.2. Anthocyanin Market Size (US$ Mn) and Volume (MT) Analysis (2013-2017) & Forecast (2018-2026) by Source

10.2.1. Fruits

10.2.2. Vegetables

10.2.3. Flowers

10.2.4. Legume & Cereals

10.3. Market Attractiveness Analysis by Source

11. Global Anthocyanin Market Analysis and Forecast, by Region

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis by Region

11.1.2. Y-o-Y Growth Projections by Region

11.2. Anthocyanin Market Size (US$ Mn) and Volume (MT) & Forecast (2018-2026) Analysis by Region

11.2.1. North America

11.2.2. Europe

11.2.3. APEJ

11.2.4. Japan

11.2.5. Oceania

11.2.6. Latin America

11.2.7. Middle East and Africa

11.3. Market Attractiveness Analysis by Region

12. North America Anthocyanin Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis by Country

12.1.2. Y-o-Y Growth Projections by Country

12.2. Anthocyanin Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

12.2.1. Market Attractiveness by Country

12.2.1.1. U.S.

12.2.1.2. Canada

12.2.2. by Type

12.2.3. by End Use

12.2.4. by Source

12.3. Market Attractiveness Analysis

12.3.1. by Country

12.3.2. by Type

12.3.3. by End Use

12.3.4. by Source

12.4. Drivers and Restraints: Impact Analysis

13. Latin America Anthocyanin Market Analysis and Forecast

13.1. Introduction

13.1.1. Basis Point Share (BPS) Analysis by Country

13.1.2. Y-o-Y Growth Projections by Country

13.1.3. Key Regulations

13.2. Anthocyanin Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

13.2.1. by Country

13.2.1.1. Brazil

13.2.1.2. Mexico

13.2.1.3. Chile

13.2.1.4. Peru

13.2.1.5. Argentina

13.2.1.6. Rest of Latin America

13.2.2. by Type

13.2.3. by End Use

13.2.4. by Source

13.3. Market Attractiveness Analysis

13.3.1. by Country

13.3.2. by Type

13.3.3. by End Use

13.3.4. by Source

13.4. Drivers and Restraints: Impact Analysis

14. Europe Anthocyanin Market Analysis and Forecast

14.1. Introduction

14.1.1. Basis Point Share (BPS) Analysis by Country

14.1.2. Y-o-Y Growth Projections by Country

14.1.3. Key Regulations

14.2. Anthocyanin Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

14.2.1. by Country

14.2.1.1. EU-4 (Germany, France, Italy, Spain)

14.2.1.2. U.K.

14.2.1.3. BENELUX

14.2.1.4. Nordic

14.2.1.5. Russia

14.2.1.6. Poland

14.2.1.7. Rest of Europe

14.2.2. by Type

14.2.3. by End Use

14.2.4. by Source

14.3. Market Attractiveness Analysis

14.3.1. by Country

14.3.2. by Type

14.3.3. by End Use

14.3.4. by Source

14.4. Drivers and Restraints: Impact Analysis

15. APEJ Anthocyanin Market Analysis and Forecast

15.1. Introduction

15.1.1. Basis Point Share (BPS) Analysis by Country

15.1.2. Y-o-Y Growth Projections by Country

15.1.3. Key Regulations

15.2. Anthocyanin Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

15.2.1. by Country

15.2.1.1. China

15.2.1.2. India

15.2.1.3. South Korea

15.2.1.4. ASEAN

15.2.2. by Type

15.2.3. by End Use

15.2.4. by Source

15.3. Market Attractiveness Analysis

15.3.1. by Country

15.3.2. by Type

15.3.3. by End Use

15.3.4. by Source

15.4. Drivers and Restraints: Impact Analysis

16. Japan Anthocyanin Market Analysis and Forecast

16.1. Introduction

16.1.1. Basis Point Share (BPS) Analysis by Country

16.1.2. Y-o-Y Growth Projections by Country

16.1.3. Key Regulations

16.2. Anthocyanin Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

16.2.1. by Type

16.2.2. by End Use

16.2.3. by Source

16.3. Market Attractiveness Analysis

16.3.1. by Type

16.3.2. by End Use

16.3.3. by Source

16.4. Drivers and Restraints: Impact Analysis

17. Oceania Anthocyanin Market Analysis and Forecast

17.1. Introduction

17.1.1. Basis Point Share (BPS) Analysis by Country

17.1.2. Y-o-Y Growth Projections by Country

17.1.3. Key Regulations

17.2. Anthocyanin Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

17.2.1. by Type

17.2.2. by End Use

17.2.3. by Source

17.3. Market Attractiveness Analysis

17.3.1. by Type

17.3.2. by End Use

17.3.3. by Source

17.4. Drivers and Restraints: Impact Analysis

18. Middle East and Africa (MEA) Anthocyanin Market Analysis and Forecast

18.1. Introduction

18.1.1. Basis Point Share (BPS) Analysis by Country

18.1.2. Y-o-Y Growth Projections by Country

18.1.3. Key Regulations

18.2. Anthocyanin Market Size (Value (US$) and Volume (MT) Analysis (2013-2018) and Forecast (2018-2026)

18.2.1. by Country

18.2.1.1. GCC Countries

18.2.1.2. South Africa

18.2.1.3. North Africa

18.2.1.4. Rest of MEA

18.2.2. by Type

18.2.3. by End Use

18.2.4. by Source

18.3. Market Attractiveness Analysis

18.3.1. by Country

18.3.2. by Type

18.3.3. by End Use

18.3.4. by Source

18.4. Drivers and Restraints: Impact Analysis

19. Competition Assessment

19.1. Global Anthocyanin Market Competition - a Dashboard View

19.2. Global Anthocyanin Market Structure Analysis

19.3. Global Anthocyanin Market Company Share Analysis

19.3.1. For Tier 1 Market Players, 2017

19.3.2. Company Market Share Analysis of Top 10 Players, by Region

19.4. Key Participants Market Presence (Intensity Mapping) by Region

20. Brand Assessment

20.1. Brand Identity (Brand as Product, Brand as Organization, Brand as Person, Brand as Symbol)

20.2. Anthocyanin Audience and Positioning (Demographic Segmentation, Geographic Segmentation, Psychographic Segmentation, Situational Segmentation)

20.3. Brand Strategy

21. Competition Deep-dive (Manufacturers/Suppliers)

21.1. Archer Daniels Midland Company

21.1.1. Overview

21.1.2. Product Portfolio

21.1.3. Sales Footprint

21.1.4. Channel Footprint

21.1.4.1. Distributors List

21.1.4.2. Sales Channel (Clients)

21.1.5. Strategy Overview

21.1.5.1. Marketing Strategy

21.1.5.2. Culture Strategy

21.1.5.3. Channel Strategy

21.1.6. SWOT Analysis

21.1.7. Financial Analysis

21.1.8. Revenue Share

21.1.8.1. by Product Type

21.1.8.2. by Region

21.2. Naturex S.A.

21.3. Symrise A.G.

21.4. CHR Hansen A/S

21.5. Sensient Technologies Corp.

21.6. Kalsec Inc.

21.7. FMC Corporation

21.8. Synthite Industries Ltd

21.9. GNT Group

21.10. D.D. Williamson and Co. Inc.

21.11. Vinayak Ingredients India Pvt Ltd

21.12. RFI Ingredients

21.13. California Natural Products Inc.

21.14. Tokiwa phytochemical co. ltd.

21.15. Penta Manufacturing Company

21.16. Hangzhou Skyherb Technologies Co., Ltd.

21.17. Blue Pacific Flavors, Inc.

21.18. Organic Herb Inc.

21.19. Cayman Chemical

21.20. Others (On Request)

22. Recommendation- Critical Success Factors

23. Research Methodology

24. Assumptions & Acronyms Used

LIST OF TABLES

Table 1: Global Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Region, 2018-2026

Table 2: Global Anthocyanin Market Volume (MT) Analysis and Forecast by Region, 2018-2026

Table 3: Global Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 4: Global Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 5: Global Anthocyanin Market Value (US$ Mn) Analysis and Forecast by End Use, 2018-2026

Table 6: Global Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 7: Global Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source 2018-2026

Table 8: Global Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

Table 9: North America Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 10: North America Anthocyanin Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 11: North America Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 12: North America Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 13: North America Anthocyanin Market Value (US$) Analysis and Forecast by End Use, 2018-2026

Table 14: North America Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 15: North America Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source, 2018-2026

Table 16: North America Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

Table 17: Latin America Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 18: Latin America Anthocyanin Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 19: Latin America Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 20: Latin America Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 21: Latin America Anthocyanin Market Value (US$) Analysis and Forecast by End Use, 2018-2026

Table 22: Latin America Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 23: Latin America Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source, 2018-2026

Table 24: Latin America Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

Table 25: Europe Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 26: Europe Anthocyanin Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 27: Europe Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 28: Europe Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 29: Europe Anthocyanin Market Value (US$) Analysis and Forecast by End Use, 2018-2026

Table 30: Europe Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 31: Europe Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source, 2018-2026

Table 32: Europe Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

Table 33: APEJ Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 34: APEJ Anthocyanin Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 35: APEJ Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 36: APEJ Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 37: APEJ Anthocyanin Market Value (US$) Analysis and Forecast by End Use, 2018-2026

Table 38: APEJ Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 39: APEJ Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source, 2018-2026

Table 40: APEJ Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

Table 41: MEA Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Country, 2018-2026

Table 42: MEA Anthocyanin Market Volume (MT) Analysis and Forecast by Country, 2018-2026

Table 43: MEA Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 44: MEA Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 45: MEA Anthocyanin Market Value (US$) Analysis and Forecast by End Use, 2018-2026

Table 46: MEA Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 47: MEA Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source, 2018-2026

Table 48: MEA Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

Table 49: Oceania Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 50: Oceania Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 51: Oceania Anthocyanin Market Value (US$) Analysis and Forecast by End Use, 2018-2026

Table 52: Oceania Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 53: Oceania Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source, 2018-2026

Table 54: Oceania Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

Table 55: Japan Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Type, 2018-2026

Table 56: Japan Anthocyanin Market Volume (MT) Analysis and Forecast by Type, 2018-2026

Table 57: Japan Anthocyanin Market Value (US$) Analysis and Forecast by End Use, 2018-2026

Table 58: Japan Anthocyanin Market Volume (MT) Analysis and Forecast by End Use, 2018-2026

Table 59: Japan Anthocyanin Market Value (US$ Mn) Analysis and Forecast by Source, 2018-2026

Table 60: Japan Anthocyanin Market Volume (MT) Analysis and Forecast by Source, 2018-2026

LIST OF FIGURES

Figure 1: Global Anthocyanin Market Value (US$ Mn) and Volume (MT) Forecast, 2018–2026

Figure 2: Global Anthocyanin Market Absolute $ Opportunity (US$ Mn), 2018–2026

Figure 3: Global Anthocyanin Market Share (%) & BPS Analysis by Region, 2018 & 2026

Figure 4: Global Anthocyanin Market Y-o-Y Growth Rate (%) by Region, 2018–2026

Figure 5: Global Anthocyanin Market Value (US$ Mn) Analysis & Forecast by Region, 2018–2026

Figure 6: Global Anthocyanin Market Attractiveness Index by Region, 2018–2026

Figure 7: Global Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 8: Global Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 9: Global Anthocyanin Market Value (US$ Mn) Analysis & Forecast by Type, 2018–2026

Figure 10: Global Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 11: Global Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 12: Global Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 13: Global Anthocyanin Market Value (US$ Mn) Analysis & Forecast by End Use, 2018–2026

Figure 14: Global Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 15: Global Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 16: Global Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 17: Global Anthocyanin Market Value (US$ Mn) Analysis & Forecast by Source, 2018–2026

Figure 18: Global Anthocyanin Market Attractiveness Index by Source, 2018–2026

Figure 19: North America Anthocyanin Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 20: North America Anthocyanin Market Y-o-Y Growth Rate (%) by Country, 2018–2026

Figure 21: North America Anthocyanin Market Attractiveness Index by Country, 2018–2026

Figure 22: North America Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 23: North America Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 24: North America Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 25: North America Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 26: North America Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 27: North America Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 28: North America Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 29: North America Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 30: North America Anthocyanin Market Attractiveness Index by Source, 2018–2026

Figure 31: Latin America Anthocyanin Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 32: Latin America Anthocyanin Market Y-o-Y Growth Rate (%) by Country, 2018–2026

Figure 33: Latin America Anthocyanin Market Attractiveness Index by Country, 2018–2026

Figure 34: Latin America Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 35: Latin America Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 36: Latin America Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 37: Latin America Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 38: Latin America Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 39: Latin America Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 40: Latin America Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 41: Latin America Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 42: Latin America Anthocyanin Market Attractiveness Index by Source, 2018–2026

Figure 43: Europe Anthocyanin Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 44: Europe Anthocyanin Market Y-o-Y Growth Rate (%) by Country, 2018–2026

Figure 45: Europe Anthocyanin Market Attractiveness Index by Country, 2018–2026

Figure 46: Europe Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 47: Europe Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 48: Europe Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 49: Europe Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 50: Europe Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 51: Europe Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 52: Europe Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 53: Europe Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 54: Europe Anthocyanin Market Attractiveness Index by Source, 2018–2026

Figure 55: APEJ Anthocyanin Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 56: APEJ Anthocyanin Market Y-o-Y Growth Rate (%) by Country, 2018–2026

Figure 57: APEJ Anthocyanin Market Attractiveness Index by Country, 2018–2026

Figure 58: APEJ Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 59: APEJ Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 60: APEJ Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 61: APEJ Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 62: APEJ Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 63: APEJ Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 64: APEJ Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 65: APEJ Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 66: APEJ Anthocyanin Market Attractiveness Index by Source, 2018–2026

Figure 67: MEA Anthocyanin Market Share (%) & BPS Analysis by Country, 2018 & 2026

Figure 68: MEA Anthocyanin Market Y-o-Y Growth Rate (%) by Country, 2018–2026

Figure 69: MEA Anthocyanin Market Attractiveness Index by Country, 2018–2026

Figure 70: MEA Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 71: MEA Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 72: MEA Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 73: MEA Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 74: MEA Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 75: MEA Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 76: MEA Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 77: MEA Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 78: MEA Anthocyanin Market Attractiveness Index by Source, 2018–2026

Figure 79: Oceania Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 80: Oceania Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 81: Oceania Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 82: Oceania Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 83: Oceania Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 84: Oceania Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 85: Oceania Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 86: Oceania Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 87: Oceania Anthocyanin Market Attractiveness Index by Source, 2018–2026

Figure 88: Japan Anthocyanin Market Share (%) & BPS Analysis by Type, 2018 & 2026

Figure 89: Japan Anthocyanin Market Y-o-Y Growth Rate (%) by Type, 2018–2026

Figure 90: Japan Anthocyanin Market Attractiveness Index by Type, 2018–2026

Figure 91: Japan Anthocyanin Market Share (%) & BPS Analysis by End Use, 2018 & 2026

Figure 92: Japan Anthocyanin Market Y-o-Y Growth Rate (%) by End Use, 2018–2026

Figure 93: Japan Anthocyanin Market Attractiveness Index by End Use, 2018–2026

Figure 94: Japan Anthocyanin Market Share (%) & BPS Analysis by Source, 2018 & 2026

Figure 95: Japan Anthocyanin Market Y-o-Y Growth Rate (%) by Source, 2018–2026

Figure 96: Japan Anthocyanin Market Attractiveness Index by Source, 2018–2026