Analysts’ Viewpoint on Animal Drug Compounding Market Scenario

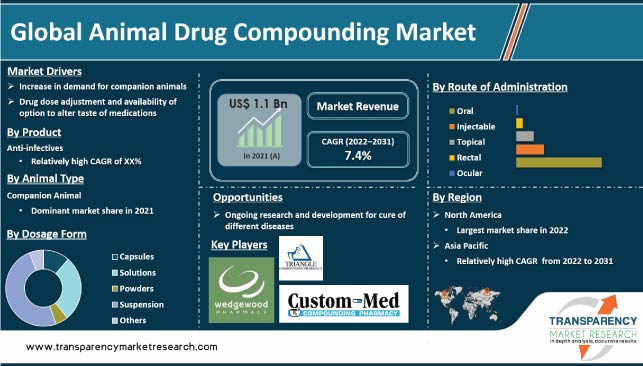

Animal medicine compounding stakeholders have benefited significantly owing to rapid advancements in production techniques and growth in the pharmaceutical & biotechnology industry. People have become more conscious of the importance of improving animal health, which has increased the demand for veterinary medicine compounding. Officially approved drugs are not always available; hence, compounded medication is a better option for treating a wide range of illnesses. Chewable tablets, for example, are commercially approved products in specific dosage forms and are recommended for usage in specific animal species. The animal drug compounding market has matured due to the increase in owner approval of the practice in the past few years. Key players operating in the market are focusing on partnerships and collaborations to expand their global footprint.

Animal drug compounding is the method of combining, blending, or modifying ingredients to produce a medicine tailored to the needs of a single or small group of animals. These drugs can be used in veterinary medicine. These drugs are typically prepared by pharmacists or veterinarians. Compounded animal drug companies are working harder to maintain a steady supply of chemical compounds and materials to support veterinary compounding. Letco Medical, a provider of pharmaceutical ingredients, is now able to support a formula database that assists in choosing the ideal combination for any animal. Suppliers of APIs, bases, flavors, and formula for veterinary compounding collaborate closely with businesses that produce animal drugs.

Increase in number of people who own pets has led to the growth of the pharmacy practice of veterinary pharmacists who compound medications or assist pharmacists in producing compounded pet medications. Compounded medications are used to avoid allergens found in animals such as lactose, gluten, dyes, preservatives, and sugars. A veterinarian with knowledge of compounded medications could help in cases where discontinued medications are urgently needed. Governments of several countries are funding programs, fellowships, and grants to help pharmacists develop the necessary skills for medication compounding. For instance, Brazil has 7,211 compounding pharmacies and 16,000 compounding pharmacists.

The EAHP encourages health authorities in Europe to facilitate the transfer of drug store preparations among hospitals and invest in compounding services, as only healthcare facilities are able to respond to patients’ needs and extraordinary situations such as shortage of essential medicines. This is expected to create new opportunities in the market in the next few years.

The global companion animal population has increased in the past few years. The American Veterinary Medical Association (2017-2018 - U.S. Pet Ownership & Demographics Sourcebook) reported that 38.4% of households have dogs and 25.4% have cats. According to FEDIAF, 85 million households in the country own at least one pet animal, with pet-related services and products totaling EUR 19.7 Bn. Similarly, demand for companion animals is high in Brazil, India, China, and Singapore.

Rise in demand for exotic companion animals is driving the need for compounded medication in order to meet their personalized medical care needs. Animals cannot always be treated with the same medications as humans. Compounded medications are used for specific animals, as these can be tailored to the needs of each individual animal. Making medications more palatable by adding flavors and colors is a service that is especially beneficial for pets. Farmers and ranchers use medicines to ensure the health of their livestock, protect public health, and safeguard the food supply.

In terms of product, the anti-infectives segment is expected to grow at a rapid pace during the forecast period. Anti-infectives, which include antibacterial, antiviral, antifungal, and antiphrastic medications, work to prevent or treat infections. These drugs treat minor infections, and in most cases, cure serious infectious diseases such as pneumonia or tuberculosis. Routine procedures and complex surgeries pose a serious infection risk. Compounding allows to prescribe accurate doses when treating animal patients in need. This is anticipated to propel the anti-infectives segment during the forecast period.

Based on animal type, the companion animal segment dominated the global market in 2021. Dogs and cats are highly common companion animals. More than 60% of households have cats or dogs as companion animals. As per market trends, market players are striving to diversify their product portfolio through R&D, product launches, and other strategic initiatives. For instance, IDEXX Laboratories, a pet healthcare, veterinary diagnostics, and veterinary practice software company, provides a diverse range of tests, devices, and services for companion animal specialty drugs.

In terms of dosage form, the powders segment dominated the global market in 2021. Powders have better chemical stability than liquids and dissolve faster than tablets or capsules. This is a key factor driving the segment. Powder dosage forms have greater physicochemical stability and longer shelf life than liquid dosage forms. Oral powders containing water-soluble drugs dissolve faster than tablets or capsules, which require the disintegration of the tablet or capsule shell prior to dissolution.

Based on route of administration, the oral segment is projected to dominate the global market in 2021. The oral route of administration is commonly used for companion and food animals. Tablets, capsules, solutions, and suspensions are common oral medications for dogs and cats; pastes are also applied to cats' forelimbs, where they are licked and consumed.

North America accounted for around 40.0% share of the global market in 2021. Well-established healthcare infrastructure and rapid adoption of newer therapeutic strategies are expected to propel the market in the region in the near future. The U.S. is anticipated to account for major share of the market in North America due to presence of large chain pharmacies. The U.S. market is anticipated to be driven by technological advancements in highly efficient, precise, and automatic integrated compounding machines during the forecast period. Rise in cost of drugs and preference for customized drug preparation are expected to propel the market in North America in the near future.

The animal drug compounding market in Asia Pacific is expected to grow at a rapid pace during the forecast period. Rise in acceptance of compounded veterinary planning and preparation is the key factor that is anticipated to increase the market size for animal drug compounding in the region. Moreover, surge in pet ownership is likely to drive the market size in Asia Pacific during the forecast period.

The global market is consolidated, with the presence of a small number of dominant players. Strategic alliances are being formed by key players in order to increase revenue and market share. Product line expansion and acquisitions & mergers are the other strategies used by players to expand their business footprint. Prominent players operating in the global animal drug compounding market are Custom Med Compounding Pharmacy, Triangle Compounding Pharmacy, Wellness Pharmacy of Cary, Wedgewood Pharmacy, Central Compounding Center South, Millers Pharmacy, Davis Islands Pharmacy, Smith's Pharmacy, Caringbah Compounding Pharmacy, Specialist Compounding Pharmacy Pte Ltd., and Tache Pharmacy.

Key players have been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 1.1 Bn |

|

Market Forecast Value in 2031 |

More than US$ 2.4 Bn |

|

Growth Rate (CAGR) for 2022-2031 |

7.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global animal drug compounding market was valued at US$ 1.1 Bn in 2021

The global animal drug compounding market is projected to reach more than US$ 2.4 Bn by 2031

The global animal drug compounding market is anticipated to grow at a CAGR of 7.4% from 2022 to 2031.

Increase in demand for companion animals and focus of manufacturers on drug dose adjustment & taste altering

The CNS agents product segment held more than 40.0% share of the global market in 2021

Wedgewood Pharmacy, Triangle Compounding Pharmacy, Davis Islands Pharmacy, Custom Med Compounding Pharmacy, Central Compounding Center South, Wellness Pharmacy of Cary, Caringbah Compounding Pharmacy, Millers Pharmacy, Smith's Pharmacy, Specialist Compounding Pharmacy Pte Ltd., and Tache Pharmacy

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Animal Drug Compounding Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Animal Drug Compounding Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario by Region/globally

5.3. Key Industry Events (mergers, acquisitions, partnerships, collaborations, etc.)

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Animal Drug Compounding Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Anti-invectives

6.3.1.1. Metranidazole

6.3.1.2. Ketaconazole

6.3.1.3. Other Anti invectives

6.3.2. Anti-inflammatory

6.3.2.1. Prednisolone

6.3.2.2. Tramadol

6.3.2.3. Others

6.3.3. CNS Agents

6.3.3.1. Potassium bromide

6.3.3.2. Gabapentin

6.3.3.3. Other CNS agents

6.3.4. GI Drugs

6.3.4.1. Apomorphine

6.3.4.2. Ursodiol

6.3.4.3. Cisapride

6.3.4.4. Other GI Drugs

6.3.5. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Animal Drug Compounding Market Analysis and Forecast, by Animal Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Animal Type, 2017–2031

7.3.1. Companion Animal

7.3.1.1. Dogs

7.3.1.2. Cats

7.3.1.3. Others

7.3.2. Live Stock

7.4. Market Attractiveness Analysis, by Animal Type

8. Global Animal Drug Compounding Market Analysis and Forecast, by Dosage Form

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Dosage Form, 2017–2031

8.3.1. Capsules

8.3.2. Solutions

8.3.3. Powders

8.3.4. Suspension

8.3.5. Others

8.4. Market Attractiveness Analysis, by Dosage Form

9. Global Animal Drug Compounding Market Analysis and Forecast, by Route of Administration

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by Route of Administration, 2017–2031

9.3.1. Oral

9.3.2. Injectable

9.3.3. Topical

9.3.4. Rectal

9.3.5. Ocular

9.4. Market Attractiveness Analysis, by Route of Administration

10. Global Animal Drug Compounding Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Animal Drug Compounding Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Anti-infectives

11.2.1.1. Metranidazole

11.2.1.2. Ketaconazole

11.2.1.3. Other Anti-infectives

11.2.2. Anti-inflammatory

11.2.2.1. Prednisolone

11.2.2.2. Tramadol

11.2.2.3. Others

11.2.3. CNS Agents

11.2.3.1. Potassium bromide

11.2.3.2. Gabapentin

11.2.3.3. Other CNS agents

11.2.4. GI Drugs

11.2.4.1. Apomorphine

11.2.4.2. Ursodiol

11.2.4.3. Cisapride

11.2.4.4. Other GI Drugs

11.2.5. Others

11.3. Market Value Forecast, by Animal Type, 2017–2031

11.3.1. Companion Animal

11.3.1.1. Dogs

11.3.1.2. Cats

11.3.1.3. Others

11.3.2. Live Stock

11.4. Market Value Forecast, by Dosage Form, 2017–2031

11.4.1. Capsules

11.4.2. Solutions

11.4.3. Powders

11.4.4. Suspension

11.4.5. Others

11.5. Market Value Forecast, by Route of Administration, 2017–2031

11.5.1. Oral

11.5.2. Injectable

11.5.3. Topical

11.5.4. Rectal

11.5.5. Ocular

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Animal Type

11.7.3. By Dosage Form

11.7.4. By Route of Administration

11.7.5. By Country

12. Europe Animal Drug Compounding Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Anti-infectives

12.2.1.1. Metranidazole

12.2.1.2. Ketaconazole

12.2.1.3. Other Anti-infectives

12.2.2. Anti-inflammatory

12.2.2.1. Prednisolone

12.2.2.2. Tramadol

12.2.2.3. Others

12.2.3. CNS Agents

12.2.3.1. Potassium bromide

12.2.3.2. Gabapentin

12.2.3.3. Other CNS agents

12.2.4. GI Drugs

12.2.4.1. Apomorphine

12.2.4.2. Ursodiol

12.2.4.3. Cisapride

12.2.4.4. Other GI Drugs

12.2.5. Others

12.3. Market Value Forecast, by Animal Type, 2017–2031

12.3.1. Companion Animal

12.3.1.1. Dogs

12.3.1.2. Cats

12.3.1.3. Others

12.3.2. Live Stock

12.4. Market Value Forecast, by Dosage Form, 2017–2031

12.4.1. Capsules

12.4.2. Solutions

12.4.3. Powders

12.4.4. Suspension

12.4.5. Others

12.5. Market Value Forecast, by Route of Administration, 2017–2031

12.5.1. Oral

12.5.2. Injectable

12.5.3. Topical

12.5.4. Rectal

12.5.5. Ocular

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Animal Type

12.7.3. By Dosage Form

12.7.4. By Route of Administration

12.7.5. By Country/Sub-region

13. Asia Pacific Animal Drug Compounding Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Anti-infectives

13.2.1.1. Metranidazole

13.2.1.2. Ketaconazole

13.2.1.3. Other Anti-infectives

13.2.2. Anti-inflammatory

13.2.2.1. Prednisolone

13.2.2.2. Tramadol

13.2.2.3. Others

13.2.3. CNS Agents

13.2.3.1. Potassium bromide

13.2.3.2. Gabapentin

13.2.3.3. Other CNS agents

13.2.4. GI Drugs

13.2.4.1. Apomorphine

13.2.4.2. Ursodiol

13.2.4.3. Cisapride

13.2.4.4. Other GI Drugs

13.2.5. Others

13.3. Market Value Forecast, by Animal Type, 2017–2031

13.3.1. Companion Animal

13.3.1.1. Dogs

13.3.1.2. Cats

13.3.1.3. Others

13.3.2. Live Stock

13.4. Market Value Forecast, by Dosage Form, 2017–2031

13.4.1. Capsules

13.4.2. Solutions

13.4.3. Powders

13.4.4. Suspension

13.4.5. Others

13.5. Market Value Forecast, by Route of Administration, 2017–2031

13.5.1. Oral

13.5.2. Injectable

13.5.3. Topical

13.5.4. Rectal

13.5.5. Ocular

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Animal Type

13.7.3. By Dosage Form

13.7.4. By Route of Administration

13.7.5. By Country/Sub-region

14. Latin America Animal Drug Compounding Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2017–2031

14.2.1. Anti-infectives

14.2.1.1. Metranidazole

14.2.1.2. Ketaconazole

14.2.1.3. Other Anti-infectives

14.2.2. Anti-inflammatory

14.2.2.1. Prednisolone

14.2.2.2. Tramadol

14.2.2.3. Other Anti-inflammatory

14.2.3. CNS Agents

14.2.3.1. Potassium bromide

14.2.3.2. Gabapentin

14.2.3.3. Other CNS agents

14.2.4. GI Drugs

14.2.4.1. Apomorphine

14.2.4.2. Ursodiol

14.2.4.3. Cisapride

14.2.4.4. Other GI Drugs

14.2.5. Others

14.3. Market Value Forecast, by Animal Type, 2017–2031

14.3.1. Companion Animal

14.3.1.1. Dogs

14.3.1.2. Cats

14.3.1.3. Others

14.3.2. Live Stock

14.4. Market Value Forecast, by Dosage Form, 2017–2031

14.4.1. Capsules

14.4.2. Solutions

14.4.3. Powders

14.4.4. Suspension

14.4.5. Others

14.5. Market Value Forecast, by Route of Administration, 2017–2031

14.5.1. Oral

14.5.2. Injectable

14.5.3. Topical

14.5.4. Rectal

14.5.5. Ocular

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Animal Type

14.7.3. By Dosage Form

14.7.4. By Route of Administration

14.7.5. By Country/Sub-region

15. Middle East & Africa Animal Drug Compounding Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product, 2017–2031

15.2.1. Anti-infectives

15.2.1.1. Metranidazole

15.2.1.2. Ketaconazole

15.2.1.3. Other Anti-infectives

15.2.2. Anti-inflammatory

15.2.2.1. Prednisolone

15.2.2.2. Tramadol

15.2.2.3. Other Anti-inflammatory

15.2.3. CNS Agents

15.2.3.1. Potassium bromide

15.2.3.2. Gabapentin

15.2.3.3. Other CNS agents

15.2.4. GI Drugs

15.2.4.1. Apomorphine

15.2.4.2. Ursodiol

15.2.4.3. Cisapride

15.2.4.4. Other GI Drugs

15.2.5. Others

15.3. Market Value Forecast, by Animal Type, 2017–2031

15.3.1. Companion Animal

15.3.1.1. Dogs

15.3.1.2. Cats

15.3.1.3. Others

15.3.2. Live Stock

15.4. Market Value Forecast, by Dosage Form, 2017–2031

15.4.1. Capsules

15.4.2. Solutions

15.4.3. Powders

15.4.4. Suspension

15.4.5. Others

15.5. Market Value Forecast, by Route of Administration, 2017–2031

15.5.1. Oral

15.5.2. Injectable

15.5.3. Topical

15.5.4. Rectal

15.5.5. Ocular

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Country

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Animal Type

15.7.3. By Dosage Form

15.7.4. By Route of Administration

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Company, 2021

16.3. Company Profiles

16.3.1. Wedgewood Pharmacy

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Company Financials

16.3.1.3. Growth Strategies

16.3.1.4. SWOT Analysis

16.3.2. Triangle Compounding Pharmacy

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Company Financials

16.3.2.3. Growth Strategies

16.3.2.4. SWOT Analysis

16.3.3. Davis Islands Pharmacy

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Company Financials

16.3.3.3. Growth Strategies

16.3.3.4. SWOT Analysis

16.3.4. Custom Med Compounding Pharmacy

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Company Financials

16.3.4.3. Growth Strategies

16.3.4.4. SWOT Analysis

16.3.5. Central Compounding Center South

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Company Financials

16.3.5.3. Growth Strategies

16.3.5.4. SWOT Analysis

16.3.6. Wellness Pharmacy of Cary

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Company Financials

16.3.6.3. Growth Strategies

16.3.6.4. SWOT Analysis

16.3.7. Caringbah Compounding Pharmacy

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Company Financials

16.3.7.3. Growth Strategies

16.3.7.4. SWOT Analysis

16.3.8. Millers Pharmacy

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Company Financials

16.3.8.3. Growth Strategies

16.3.8.4. SWOT Analysis

16.3.9. Smith's Pharmacy

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Company Financials

16.3.9.3. Growth Strategies

16.3.9.4. SWOT Analysis

16.3.10. Specialist Compounding Pharmacy Pte Ltd.

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Company Financials

16.3.10.3. Growth Strategies

16.3.10.4. SWOT Analysis

16.3.11. Tache Pharmacy

16.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.11.2. Company Financials

16.3.11.3. Growth Strategies

16.3.11.4. SWOT Analysis

List of Tables

Table 01: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-infectives, 2017–2031

Table 03: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-inflammatory, 2017–2031

Table 04: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by CNS Agents, 2017–2031

Table 05: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by GI Drugs, 2017–2031

Table 06: Global Animal Drug Compounding Market Value (US$ My) Forecast, by Others, 2017–2031

Table 07: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Animal Type, 2017–2031

Table 08: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-infectives, 2017–2031

Table 09: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 10: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 11: Global Animal Drug Compounding Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 12: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 13: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-infectives, 2017–2031

Table 15: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-inflammatory, 2017–2031

Table 16: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by CNS Agents, 2017–2031

Table 17: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by GI Drugs, 2017–2031

Table 18: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 19: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Animal Type, 2017–2031

Table 20: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Companion Animal, 2017–2031

Table 21: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 22: North America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 23: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 24: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 25: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-infectives, 2017–2031

Table 26: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-inflammatory, 2017–2031

Table 27: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by CNS Agents, 2017–2031

Table 28: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by GI Drugs, 2017–2031

Table 29: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 30: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Animal Type, 2017–2031

Table 31: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Companion Animal, 2017–2031

Table 32: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 33: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 34: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 35: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 36: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-infectives, 2017–2031

Table 37: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-inflammatory, 2017–2031

Table 38: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by CNS Agents, 2017–2031

Table 39: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by GI Drugs, 2017–2031

Table 40: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 41: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Animal Type, 2017–2031

Table 42: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Companion Animal, 2017–2031

Table 43: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 44: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 45: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 46: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 47: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-infectives, 2017–2031

Table 48: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-inflammatory, 2017–2031

Table 49: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by CNS Agents, 2017–2031

Table 50: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by GI Drugs, 2017–2031

Table 51: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 52: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Animal Type, 2017–2031

Table 53: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Companion Animal, 2017–2031

Table 54: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 55: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 56: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 57: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 58: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-infectives, 2017–2031

Table 59: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Anti-inflammatory, 2017–2031

Table 60: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by CNS Agents, 2017–2031

Table 61: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by GI Drugs, 2017–2031

Table 62: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Others, 2017–2031

Table 63: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Animal Type, 2017–2031

Table 64: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Companion Animal, 2017–2031

Table 65: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Dosage Form, 2017–2031

Table 66: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

List of Figures

Figure 01: Global Animal Drug Compounding Market, by Product, 2021 and 2031

Figure 02: Global Animal Drug Compounding Market Attractiveness Analysis, Product, 2022–2031

Figure 03: Global Animal Drug Compounding Market (US$ Mn), by Anti-infectives, 2017–2031

Figure 04: Global Animal Drug Compounding Market (US$ Mn), by Anti-inflammatory, 2017–2031

Figure 05: Global Animal Drug Compounding Market (US$ Mn), by CNS Agents, 2017–2031

Figure 06: Global Animal Drug Compounding Market (US$ Mn), by GI Drugs, 2017–2031

Figure 07: Global Animal Drug Compounding Market (US$ Mn), by Others, 2017–2031

Figure 08: Global Animal Drug Compounding Market, by Animal Type, 2021 and 2031

Figure 09: Global Animal Drug Compounding Market Attractiveness Analysis, Animal Type, 2022–2031

Figure 10: Global Animal Drug Compounding Market (US$ Mn), by Companion Animal, 2017–2031

Figure 11: Global Animal Drug Compounding Market (US$ Mn), by Livestock Animal, 2017–2031

Figure 12: Global Animal Drug Compounding Market, by Dosage Form, 2021 and 2031

Figure 13: Global Animal Drug Compounding Market Attractiveness Analysis, Dosage Form, 2022–2031

Figure 14: Global Animal Drug Compounding Market (US$ Mn), by Capsules, 2017–2031

Figure 15: Global Animal Drug Compounding Market (US$ Mn), by Solutions, 2017–2031

Figure 16: Global Animal Drug Compounding Market (US$ Mn), by Powders, 2017–2031

Figure 17: Global Animal Drug Compounding Market (US$ Mn), by Suspension, 2017–2031

Figure 18: Global Animal Drug Compounding Market (US$ Mn), by Others, 2017–2031

Figure 19: Global Animal Drug Compounding Market, by Route of Administration, 2021 and 2031

Figure 20: Global Animal Drug Compounding Market Attractiveness Analysis, Route of Administration, 2022–2031

Figure 21: Global Animal Drug Compounding Market (US$ Mn), by Oral, 2017–2031

Figure 22: Global Animal Drug Compounding Market (US$ Mn), by Injectable, 2017–2031

Figure 23: Global Animal Drug Compounding Market (US$ Mn), by Topical, 2017–2031

Figure 24: Global Animal Drug Compounding Market (US$ Mn), by Rectal, 2017–2031

Figure 25: Global Animal Drug Compounding Market (US$ Mn), by Ocular, 2017–2031

Figure 26: Global Animal Drug Compounding Market Value Share Analysis, by Region, 2021 and 2031

Figure 27: Global Animal Drug Compounding Market Attractiveness Analysis, by Region, 2022–2031

Figure 28: North America Animal Drug Compounding Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 29: North America Animal Drug Compounding Market Value Share Analysis, by Country, 2021 and 2031

Figure 30: North America Animal Drug Compounding Market Attractiveness Analysis, by Country, 2022–2031

Figure 31: North America Animal Drug Compounding Market Value Share Analysis, by Product, 2021 and 2031

Figure 32: North America Animal Drug Compounding Market Attractiveness Analysis, by Product, 2022–2031

Figure 33: North America Animal Drug Compounding Market Value Share Analysis, by Animal Type, 2021 and 2031

Figure 34: North America Animal Drug Compounding Market Attractiveness Analysis, by Animal Type, 2022–2031

Figure 35: North America Animal Drug Compounding Market Value Share Analysis, by Dosage Form, 2021 and 2031

Figure 36: North America Animal Drug Compounding Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 37: North America Animal Drug Compounding Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 38: North America Animal Drug Compounding Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 39: Europe Animal Drug Compounding Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 40: Europe Animal Drug Compounding Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 41: Europe Animal Drug Compounding Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 42: Europe Animal Drug Compounding Market Value Share Analysis, by Product, 2021 and 2031

Figure 43: Europe Animal Drug Compounding Market Attractiveness Analysis, by Product, 2022–2031

Figure 44: Europe Animal Drug Compounding Market Value Share Analysis, by Animal Type, 2021 and 2031

Figure 45: Europe Animal Drug Compounding Market Attractiveness Analysis, by Animal Type, 2022–2031

Figure 46: Europe Animal Drug Compounding Market Value Share Analysis, by Dosage Form, 2021 and 2031

Figure 47: Europe Animal Drug Compounding Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 48: Europe Animal Drug Compounding Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 49: Europe Animal Drug Compounding Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 50: Asia Pacific Animal Drug Compounding Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 51: Asia Pacific Animal Drug Compounding Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 52: Asia Pacific Animal Drug Compounding Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 53: Asia Pacific Animal Drug Compounding Market Value Share Analysis, by Product, 2021 and 2031

Figure 54: Asia Pacific Animal Drug Compounding Market Attractiveness Analysis, by Product, 2022–2031

Figure 55: Asia Pacific Animal Drug Compounding Market Value Share Analysis, by Animal Type, 2021 and 2031

Figure 56: Asia Pacific Animal Drug Compounding Market Attractiveness Analysis, by Animal Type, 2022–2031

Figure 57: Asia Pacific Animal Drug Compounding Market Value Share Analysis, by Dosage Form, 2021 and 2031

Figure 58: Asia Pacific Animal Drug Compounding Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 59: Asia Pacific Animal Drug Compounding Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 60: Asia Pacific Animal Drug Compounding Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 61: Latin America Animal Drug Compounding Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 62: Latin America Animal Drug Compounding Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 63: Latin America Animal Drug Compounding Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 64: Latin America Animal Drug Compounding Market Value Share Analysis, by Product, 2021 and 2031

Figure 65: Latin America Animal Drug Compounding Market Attractiveness Analysis, by Product, 2022–2031

Figure 66: Latin America Animal Drug Compounding Market Value Share Analysis, by Animal Type, 2021 and 2031

Figure 67: Latin America Animal Drug Compounding Market Attractiveness Analysis, by Animal Type, 2022–2031

Figure 68: Latin America Animal Drug Compounding Market Value Share Analysis, by Dosage Form, 2021 and 2031

Figure 69: Latin America Animal Drug Compounding Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 70: Latin America Animal Drug Compounding Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 71: Latin America Animal Drug Compounding Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 72: Middle East & Africa Animal Drug Compounding Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 73: Middle East & Africa Animal Drug Compounding Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 74: Middle East and Africa Animal Drug Compounding Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 75: Middle East & Africa Animal Drug Compounding Market Value Share Analysis, by Product, 2021 and 2031

Figure 76: Middle East & Africa Animal Drug Compounding Market Attractiveness Analysis, by Product, 2022–2031

Figure 77: Middle East & Africa Animal Drug Compounding Market Value Share Analysis, by Animal Type, 2021 and 2031

Figure 78: Middle East & Africa Animal Drug Compounding Market Attractiveness Analysis, by Animal Type, 2022–2031

Figure 79: Middle East & Africa Animal Drug Compounding Market Value Share Analysis, by Dosage Form, 2021 and 2031

Figure 80: Middle East & Africa Animal Drug Compounding Market Attractiveness Analysis, by Dosage Form, 2022–2031

Figure 81: Middle East & Africa Animal Drug Compounding Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 82: Middle East & Africa Animal Drug Compounding Market Attractiveness Analysis, by Route of Administration, 2022–2031