Strides made in anesthesiology underpin the evolution of demand in the anesthesia gas blender market. Inhalation anesthesia is a promising segment for both pediatrics and non-pediatrics. Over the past few years, electronic blenders are preferred over manual, and the segment is fast gaining popularity. However, limitations exist in both the case, with failure in electric power hindering the adoption of electronic anesthesia gas blenders.Growing adoption of the system in hospitals has propelled the growth opportunities in the overall anesthesia gas blender market. Over the past few years, ambulatory surgical centers (ASC) have gained wide popularity. The expansion of opportunities in this segment is rapid. Growing number of outpatient surgeries has spurred the demand for anesthesia gas blenders.

Automation in the system has opened a new avenue in the anesthesia gas blender market. Rise in adoption of automated medical devices is a key trend boosting the growth prospects in the market. Especially in developing economies, trend of automation is driven by burgeoning medical tourism especially in some Asian nations. Growing number of multispecialty hospitals and surgical centers is fueling the prospects in the anesthesia gas blender market. In these healthcare providers, growing use of these among patients with prolonged surgeries is fueling the prospects in the anesthesia gas blender market. Regulatory norms pertaining to anesthesia gas machines are key aspect to the expansion of technological avenues. North America has been a substantially lucrative regional market due to the presence of advanced healthcare infrastructures. Asia Pacific is emerging as a market with substantial revenue streams. Over the past few months, the use of these as ventilators is spurring new growth avenues for manufacturers in the anesthesia gas blender market.

Global Anesthesia Gas Blender Market: Snapshot

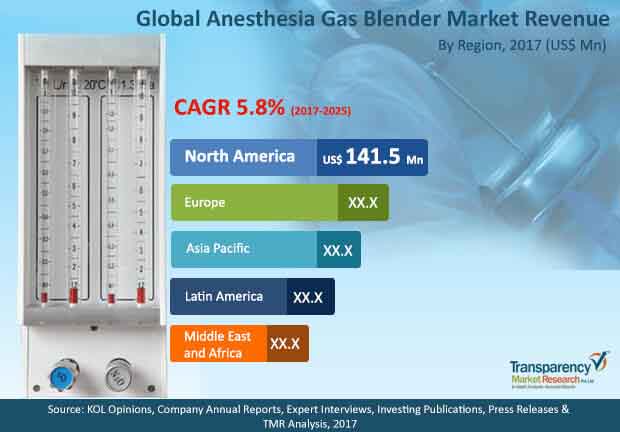

Anesthesia gas blender is a main component of anesthesia delivery machine. The prime function of the anesthesia gas blender is for mixing two or more gases to provide controlled anesthesia during surgery. The anesthesia gas blenders comes with knob for manual handling or it can be electronic for automated handling, to control the flow of gases. Gases such as air/oxygen are mixed with nitrous oxide and other anesthesia gases in order to deliver a blend of gases in a measured amount to the patient undergoing prolonged surgery. According to the research report, the global anesthesia gas blender market was valued at US$400.3 mn in 2016 and is expected to be worth US$663.3 mn by 2025. During the forecast years of 2017 and 2025 the overall market is projected to expand at a CAGR of 5.8%.

Accuracy of Dual Tube Flow Meter Makes it Top-selling Technology

Based on technology, the global anesthesia gas blender market has been further segmented into tube flow meter and dual tube flow meter. Dual tube flow meter segment dominated the global market in 2016 due to their advantages over tube flow meters such as efficiency, accuracy and less energy consumption. Tube flow meter is expected to witness stagnant growth due to market saturation in developed markets like North America & Europe and introduction of advanced technologies in the anesthesia gas blender market.

Global anesthesia gas blender market is further segmented on the basis of the system type. System type include electronic and manual system being used for anesthesia gas delivery. The manual system segment accounted for the largest market share in 2016. However, rise in adoption of electronic blenders over manual in order to deliver accurate results is likely to hamper the growth of the segment.

Hospitals to be Key End Users of Anesthesia Gas Blenders

Out of all the end users, the hospital segment contributed for the major share on a global scale. Rising prevalence of chronic conditions and increase in number of surgeries performed every year is expected to drive this segment. The second most preferred segment under end-user category is the ambulatory surgical centers (ASC). Despite of the fact that it held less market share in 2016 as compared to hospitals, it is expected to expand at the highest CAGR during the forecast period. Patient preference for lesser hospital stay, increase in number of successful outpatient surgeries taking place across the globe are the major drivers behind the growth of ambulatory surgical centers.

North America to Remain Dominant as Ambulatory Surgical Centers Show a Rise in the Region

Geographically, the anesthesia gas blender market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The North America holds largest market share for anesthesia gas blender market in 2016 due to rise in demand from ambulatory surgical centers and hospitals. But change in legislations and new tax reforms may cause a sudden rise in the prices of medical devices, thus the region is expected to witness a decline in market share by 2025. Europe is the second leading market after North America and is expected to witness a steady growth during the forecast period. Asia Pacific is projected to expand rapidly at a highest CAGR during the forecast period due to rise in anesthesia awareness, growing number of surgeries taking place every year, growing medical tourism and technological advancement. Middle East and Africa is also expected to move with the high growth rate due to rise in awareness about anesthesia care among patients and professionals and increase in the number of well-equipped multispecialty hospitals and surgical centers.

The key players operating in the anesthesia gas blender market are medin Medical Innovations GmbH, HEYER Medical AG, Farstar (Wuxi) Medical Equipment, EKU Electronics, Armstrong Medical, Becton, Dickinson and Company, Dameca, Heyer Aerotech GmbH, flow-meter S.p.A., and Smiths Medical.

Chapter 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Chapter 2. Assumptions and Research Methodology

Chapter 3. Executive Summary : Global Anesthesia Gas Blender Market (Value & Volume)

Chapter 4. Market Overview

4.1. Introduction

4.1.1. Product Overview

4.1.2. Industry Evolution / Developments

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Key Trends

4.4. Opportunity Analysis

4.5. Key Industrial Development

Chapter 5. Global Anesthesia Gas Blender Market Analysis and Forecasts, By Technology

5.1. Key Findings / Developments

5.2. Introduction & Definition

5.3. Market Value (US$) and Volume (Units) Forecast, By Technology, 2017–2025

5.3.1. Tube Flow Meter

5.3.2. Dual Tube Flow Meter

5.4. Key Trends

5.5. Market Attractiveness, By Technology

Chapter 6. Global Anesthesia Gas Blender Market Analysis and Forecasts, System Type

6.1. Key Findings / Developments

6.2. Introduction & Definition

6.3. Market Value (US$) and Volume (Units), By System Type, 2017–2025

6.3.1. Electronic

6.3.2. Manual

6.4. Key Trends

6.5. Market Attractiveness, By System Type

Chapter 7. Global Anesthesia Gas Blender Market Analysis and Forecasts, By End-user

7.1. Key Findings / Developments

7.2. Introduction & Definition

7.3. Market Value (US$) and Volume (Units) Forecast, By End-user, 2017–2025

7.3.1. Hospitals

7.3.2. Ambulatory Surgical Centers (ASC)

7.3.3. Others

7.4. Key Trends

7.5. Market Attractiveness, By End-user

Chapter 8. Global Anesthesia Gas Blender Market Analysis and Forecasts, By Geography/Region

8.1. Geographical Representation

8.2. Market Value (US$) and Volume (Units) Forecast By Region, 2017-2025

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, By Region

Chapter 9. North America Anesthesia Gas Blender Market Analysis and Forecast

9.1. Market Value Forecast By Country , 2017–2025

9.1.1. U.S.

9.1.2. Canada

9.2. Market Value Forecast By Technology, 2017–2025

9.3. Market Value Forecast By System Type, 2017–2025

9.4. Market Value Forecast By End-user, 2017–2025

9.5. Market Attractiveness Analysis

9.5.1. By Country

9.5.2. By Technology

9.5.3. By System Type

9.5.4. By End-user

Chapter 10. Europe Anesthesia Gas Blender Market Analysis and Forecast

10.1. Market Value Forecast By Country , 2017–2025

10.1.1. Germany

10.1.2. France

10.1.3. U.K.

10.1.4. Italy

10.1.5. Spain

10.1.6. Russia

10.1.7. Rest of Europe

10.2. Market Value Forecast By Technology, 2017–2025

10.3. Market Value Forecast By System Type, 2017–2025

10.4. Market Value Forecast By End-user, 2017–2025

10.5. Market Attractiveness Analysis

10.5.1. By Country

10.5.2. By Technology

10.5.3. By System Type

10.5.4. By End-user

Chapter 11. Asia Pacific Anesthesia Gas Blender Market Analysis and Forecast

11.1. Market Value Forecast By Country , 2017–2025

11.1.1. China

11.1.2. Japan

11.1.3. India

11.1.4. Rest of APAC

11.2. Market Value Forecast By Technology, 2017–2025

11.3. Market Value Forecast By System Type, 2017–2025

11.4. Market Value Forecast By End-user, 2017–2025

11.5. Market Attractiveness Analysis

11.5.1. By Country

11.5.2. By Technology

11.5.3. By System Type

11.5.4. By End-user

Chapter 12. Latin America Anesthesia Gas Blender Market Analysis and Forecast

12.1. Market Value Forecast By Country, 2017–2025

12.1.1. Brazil

12.1.2. Mexico

12.1.3. Rest of LATAM

12.2. Market Value Forecast By Technology, 2017–2025

12.3. Market Value Forecast By System Type, 2017–2025

12.4. Market Value Forecast By End-user, 2017–2025

12.5. Market Attractiveness Analysis

12.5.1. By Country

12.5.2. By Technology

12.5.3. By System Type

12.5.4. By End-user

Chapter 13. Middle East & Africa Anesthesia Gas Blender Market Analysis and Forecast

13.1. Market Value Forecast By Country , 2017–2025

13.1.1. GCC

13.1.2. South Africa

13.1.3. Rest of MEA

13.2. Market Value Forecast By Technology, 2017–2025

13.3. Market Value Forecast By System Type, 2017–2025

13.4. Market Value Forecast By End-user, 2017–2025

13.5. Market Attractiveness Analysis

13.5.1. By Country

13.5.2. By Technology

13.5.3. By System Type

Chapter 14. Competition Landscape

14.1. Heat Map Analysis By Company

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.2.1. medin Medical Innovations GmbH

14.2.1.1. Company Details

14.2.1.2. Company Description

14.2.1.3. Business Overview

14.2.1.4. SWOT Analysis

14.2.1.5. Financial Analysis

14.2.1.6. Strategic Overview

14.2.2. HEYER Medical AG

14.2.2.1. Company Details

14.2.2.2. Company Description

14.2.2.3. Business Overview

14.2.2.4. SWOT Analysis

14.2.2.5. Strategic Overview

14.2.3. Farstar (Wuxi) Medical Equipment co., Ltd.

14.2.3.1. Company Details

14.2.3.2. Company Description

14.2.3.3. Business Overview

14.2.3.4. SWOT Analysis

14.2.3.5. Strategic Overview

14.2.4. EKU Electronics GmbH

14.2.4.1. Company Details

14.2.4.2. Company Description

14.2.4.3. Business Overview

14.2.4.4. SWOT Analysis

14.2.4.5. Strategic Overview

14.2.5. Armstrong Medical

14.2.5.1. Company Details

14.2.5.2. Company Description

14.2.5.3. Business Overview

14.2.5.4. SWOT Analysis

14.2.5.5. Financial Analysis

14.2.5.6. Strategic Overview

14.2.6. Becton, Dickinson and comapny

14.2.6.1. Company Details

14.2.6.2. Company Description

14.2.6.3. Business Overview

14.2.6.4. SWOT Analysis

14.2.6.5. Financial Analysis

14.2.6.6. Strategic Overview

14.2.7. Dameca A/S

14.2.7.1. Company Details

14.2.7.2. Company Description

14.2.7.3. Business Overview

14.2.7.4. SWOT Analysis

14.2.7.5. Financial Analysis

14.2.7.6. Strategic Overview

14.2.8. Heyer Aerotech GmbH

14.2.8.1. Company Details

14.2.8.2. Company Description

14.2.8.3. Business Overview

14.2.8.4. SWOT Analysis

14.2.8.5. Financial Analysis

14.2.8.6. Strategic Overview

14.2.9. flow-meter S.p.A

14.2.9.1. Company Details

14.2.9.2. Company Description

14.2.9.3. Business Overview

14.2.9.4. SWOT Analysis

14.2.9.5. Strategic Overview

14.2.10. Smith Medical

14.2.10.1. Company Details

14.2.10.2. Company Description

14.2.10.3. Business Overview

14.2.10.4. SWOT Analysis

14.2.10.5. Strategic Overview

List of Tables

Table 01: Global Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Technology, 2017–2025

Table 02: Global Anesthesia Gas Blender Market Volume (No. of Unit) Forecast, by Technology, 2017–2025

Table 03: Global Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by System Type, 2017–2025

Table 04: Global Anesthesia Gas Blender Market Volume (No. of Unit) Forecast, by System Type, 2017–2025

Table 05: Global Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by End-user, 2017–2025

Table 06: Global Anesthesia Gas Blender Market Volume (No. of Unit) Forecast, by End-user, 2017–2025

Table 07: Global Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Region, 2017–2025

Table 08: Global Anesthesia Gas Blender Market Volume (No. of Unit) Forecast, by Region, 2017–2025

Table 09: North America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 10: North America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Technology, 2017–2025

Table 11: North America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by System Type, 2017–2025

Table 12: North America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by End-user 2017–2025

Table 13: Europe Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 14: Europe Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Technology, 2017–2025

Table 15: Europe Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by System Type, 2017–2025

Table 16: Europe Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by End-user, 2017–2025

Table 17: Asia Pacific Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 18: Asia Pacific Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Technology, 2017–2025

Table 19: Asia Pacific Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by System Type, 2017–2025

Table 20: Asia Pacific Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by End-user, 2017–2025

Table 21: Latin America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

Table 22: Latin America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Technology, 2017–2025

Table 23: Latin America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by System Type, 2017–2025

Table 24: Latin America Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by End-user, 2017–2025

Table 25: Middle East & Africa Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2025

Table 26: Middle East & Africa Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by Technology, 2017–2025

Table 27: Middle East & Africa Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by System Type, 2017–2025

Table 28: Middle East & Africa Anesthesia Gas Blender Market Size (US$ Mn) Forecast, by End-user, 2017–2025

List of Figures

Figure 1: Global Anesthesia Gas Blender Market Revenue Projections (US$ Mn), 2015–2025

Figure 2: Market Value Share, by Technology (2017)

Figure 3: Market Value Share, by System Type (2017)

Figure 4: Market Value Share, by End-user (2017)

Figure 5: Market Value Share, by Region (2017)

Figure 06: Global Anesthesia Gas Blender Market Value Share Analysis, by Technology, 2016 and 2025

Figure 07: Global Anesthesia Gas Blender Market Value (US$ Mn) and Volume (Units) Forecast Projection, by Tube Flow Meter, 2015–2025

Figure 08: Global Anesthesia Gas Blender Market Value (US$ Mn) and Volume (Units) Forecast Projection, by Dual Tube Flow Meter, 2015–2025

Figure 09: Global Anesthesia Gas Blender Market Attractiveness, by Technology

Figure 10: Global Anesthesia Gas Blender Market Value Share Analysis, by System Type, 2016 and 2025

Figure 11: Global Anesthesia Gas Blender Market Value (US$ Mn) and Volume (Units) Forecast Projection, by Electronic, 2015–2025

Figure 12: Global Anesthesia Gas Blender Market Value (US$ Mn) and Volume (Units) Forecast Projection, by Manual, 2015–2025

Figure 13: Global Anesthesia Gas Blender Market Attractiveness, by System Type

Figure 14: Global Anesthesia Gas Blender Market Value Share Analysis, by End-user, 2016 and 2025

Figure 15: Global Anesthesia Gas Blender Market Value (US$ Mn) and Volume (Units) Forecast Projection, by Hospitals, 2015–2025

Figure 16: Global Anesthesia Gas Blender Market Value (US$ Mn) and Volume (Units) Forecast Projection, by Ambulatory Surgical Centers, 2015–2025

Figure 17: Global Anesthesia Gas Blender Market Value (US$ Mn) and Volume (Units) Forecast Projection by Others, 2015–2025

Figure 18: Global Anesthesia Gas Blender Market Attractiveness Analysis, by End-user, 2015–2025

Figure 19: North America Anesthesia Gas Blender Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2025

Figure 20: Europe Anesthesia Gas Blender Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2025

Figure 21: Asia Pacific Anesthesia Gas Blender Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2025

Figure 22: Latin America Anesthesia Gas Blender Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2025

Figure 23: Middle East & Africa Anesthesia Gas Blender Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2025

Figure 24: North America Anesthesia Gas Blender Market Value Share, by Country, 2016 and 2025

Figure 25: Global Anesthesia Gas Blender Market Attractiveness Analysis, by Region, 2017–2025

Figure 26: U.S. Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 27: Canada Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 28: North America Anesthesia Gas Blender Market Value Share, by Country, 2016 and 2025

Figure 29: North America Anesthesia Gas Blender Market Attractiveness, by Country, 2017–2025

Figure 30: North America Anesthesia Gas Blender Market Value Share, by Technology, 2016 and 2025

Figure 31: North America Anesthesia Gas Blender Market Attractiveness, by Technology, 2017–2025

Figure 32: North America Anesthesia Gas Blender Market Value Share, by System Type, 2016 and 2025

Figure 33: North America Anesthesia Gas Blender Market Attractiveness, by System Type, 2017–2025

Figure 34: North America Anesthesia Gas Blender Market Value Share, by End-user, 2016 and 2025

Figure 35: North America Anesthesia Gas Blender Market Attractiveness, by End-user, 2017–2025

Figure 36: Germany Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 37: U.K. Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 38: France Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 39: Italy Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 40: Spain Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 41: Russia Anesthesia Gas Blender Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2015–2025

Figure 42: Europe Anesthesia Gas Blender Market Value Share, by Country, 2016 and 2025

Figure 43: Europe Anesthesia Gas Blender Market Attractiveness, by Country, 2017–2025

Figure 44: Europe Anesthesia Gas Blender Market Value Share, by Technology, 2016 and 2025

Figure 45: Europe Anesthesia Gas Blender Market Attractiveness, by Technology, 2017–2025

Figure 46: Europe Anesthesia Gas Blender Market Value Share, by System Type, 2016 and 2025

Figure 47: Europe Anesthesia Gas Blender Market Attractiveness, by System Type, 2017–2025

Figure 48: Europe Anesthesia Gas Blender Market Value Share, by End-user, 2016 and 2025

Figure 49: Europe Anesthesia Gas Blender Market Attractiveness, by End-user, 2017–2025

Figure 50: China Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

Figure 51: India Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

Figure 52: Japan Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

Figure 53: Rest of Asia Pacific Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

Figure 54: Asia Pacific Anesthesia Gas Blender Market Value Share, by Country, 2016 and 2025

Figure 55: Asia Pacific Anesthesia Gas Blender Market Attractiveness, by Country, 2017–2025

Figure 56: Asia Pacific Anesthesia Gas Blender Market Value Share, by Technology, 2016 and 2025

Figure 57: Asia Pacific Anesthesia Gas Blender Market Attractiveness, by Technology, 2017–2025

Figure 58: Asia Pacific Anesthesia Gas Blender Market Value Share, by System Type, 2016 and 2025

Figure 59: Asia Pacific Anesthesia Gas Blender Market Attractiveness, by System Type, 2017–2025

Figure 60: Asia Pacific Anesthesia Gas Blender Market Value Share, by End-user, 2016 and 2025

Figure 61: Asia Pacific Anesthesia Gas Blender Market Attractiveness, by End-user, 2017–2025

Figure 62: Brazil Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 63: Mexico Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 64: Rest of Latin America Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 65: Latin America Anesthesia Gas Blender Market Value Share, by Country/Sub-region, 2016 and 2025

Figure 66: Latin America Anesthesia Gas Blender Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 67: Latin America Anesthesia Gas Blender Market Value Share, by Technology, 2016 and 2025

Figure 68: Latin America Anesthesia Gas Blender Market Attractiveness, by Technology, 2017–2025

Figure 69: Latin America Anesthesia Gas Blender Market Value Share, by System Type, 2016 and 2025

Figure 70: Latin America Anesthesia Gas Blender Market Attractiveness, by System Type, 2017–2025

Figure 71: Latin America Anesthesia Gas Blender Market Value Share, by End-user, 2016 and 2025

Figure 72: Latin America Anesthesia Gas Blender Market Attractiveness, by End-user, 2017–2025

Figure 73: GCC Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 74: South Africa Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 75: Rest of Middle East & Africa Anesthesia Gas Blender Market Size (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2015–2025

Figure 76: Middle East & Africa Anesthesia Gas Blender Market Value Share, by Country/Sub-region, 2016 and 2025

Figure 77: Middle East & Africa Anesthesia Gas Blender Market Attractiveness, by Country/Sub-region, 2017–2025

Figure 78: Middle East & Africa Anesthesia Gas Blender Market Value Share, by Technology, 2016 and 2025

Figure 79: Middle East & Africa Anesthesia Gas Blender Market Attractiveness, by Technology, 2017–2025

Figure 80: Middle East & Africa Anesthesia Gas Blender Market Value Share, by System Type, 2016 and 2025

Figure 81: Middle East & Africa Anesthesia Gas Blender Market Attractiveness, by System Type, 2017–2025

Figure 82: Middle East & Africa Anesthesia Gas Blender Market Value Share, by End-user, 2017 and 2025

Figure 83: Middle East & Africa Anesthesia Gas Blender Market Attractiveness, by End-user, 2017–2025

Figure 84: Heat Map Analysis By Company (2016)