Ambulatory cardiac monitors are small, movable electrocardiograph machines that can record the heart’s rhythm. The features in such monitors vary based on the length of recording time and the ability to send the recordings over the phone. Most professional experts use ambulatory cardiac monitors to assess heartbeat rate over time, correlate symptoms with the heartbeat, diagnose abnormal heart rhythms, and analyze other symptoms a heart can have. These devices help monitor the heart with increased detection time and with more precise results as compared to conventional heart monitors. This is likely to boost the global ambulatory cardiac monitoring devices market during the forecast period.

In simpler terms, ambulatory cardiac monitoring devices are used to assist doctors to diagnose irregular cardiac arrhythmias that occur only sporadically and unpredictably. Such arrhythmias often exhibit sudden symptoms, but usually are not present by the time the patient gets to a doctor. For this reason, many symptom-producing cardiac arrhythmias are challenging or unlikely to diagnose with conventional ECGs. Ambulatory cardiac monitoring devices have proven useful to monitor and record the heartbeats for longer spans to capture a brief, irregular, but potentially vital arrhythmia. The growing number of heart-related cases across the world owing to factors such as increasing obesity, diabetes mellitus, smoking, high cholesterol, high blood pressure, and sedentary lifestyles, are expected to be major factors driving the global ambulatory cardiac monitoring devices market.

COVID-19 has posed various kinds of challenges for doctors whose cardiac patients are at-risk and hesitant to schedule a visit. People with cardiac issues are concerned about coronavirus, but in their caution, they can die from an unmonitored, untreated cardiac condition. Besides, the number of deaths from cardiac diseases is more than that of COVID-19 patients. However, at a time when cardiac monitoring is more critically important than ever, patients may have greater hesitation to visit a hospital. Moreover, people in rural areas face more challenges of having to travel to the doctor, as they might not have at least one cardiologist nearby. Interns and practitioners are being trained to use cardiac monitoring devices in case of emergencies. This has propelled the ambulatory cardiac monitoring devices market. However, stringent regulations for travel, manufacturing, supply chain, and trade to limit the virus have impacted the production and distribution of such devices.

There has been a notable decrease in admissions for cardiac arrests and failure, owing to the threat coronavirus poses on heart patients. Moreover, there is accumulating evidence to suggest COVD-19 has vital and even long-term cardiac effects, which may lead to a series of heart failure patients leading to a new crisis. Thus, the demand for the use of ambulatory cardiac monitoring devices is hindered during this time. However, with the growing number of vaccinations in various nations and innovation in medicines and drugs, the global ambulatory cardiac monitoring devices market is expected to surge post-COVID-19.

The most advanced and minimally invasive surgery utilization to improve patients' heart activity and intensify the outcomes of various cardiac procedures is one of the key factors propelling the growth of the ambulatory cardiac monitoring devices market. Moreover, the rising demand for advanced cardiac devices, such as Holter monitors, event monitors, implantable loop recorders, mobile cardiac telemetry helping the future ambulatory cardiac monitoring devices market growth. Furthermore, rising government and people investment in healthcare and favorable reimbursement policies are among the major factors expanding the ambulatory cardiac monitoring devices market.

Analysts’ Viewpoint

The global medical data suggests that one out of 10 people suffers from heart-related issues, including coronary heart disease, angina, high and low blood pressure, heart attack, arrhythmia, and valve blockage. Thus, ambulatory cardiac monitoring devices have become necessary to track and monitor the heart to avoid fatal outcomes of such diseases. Cardiac monitoring is also crucial in the administration of heart attacks, the value of cardiac output, and for monitoring of sepsis cases. Ambulatory cardiac monitoring devices are also used to detect, eliminate, and restrict mycoplasma infection in cell culture, making them fit for use in research institutions and organizations. The growing concerns of heart patients and an increasing number of such patients are driving the ambulatory cardiac monitoring devices market.

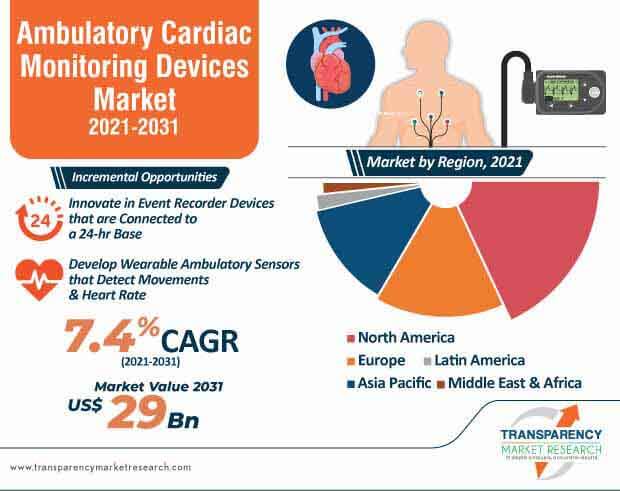

Ambulatory cardiac monitoring devices market to cross valuation of US$29 Bn by 2031

Ambulatory cardiac monitoring devices market is driven by rise in demand for prolonged ECG monitoring & self-care management and increase in burden of cardiovascular diseases

North America accounted for a major share of the global ambulatory cardiac monitoring devices market

The ECG devices segment captured the largest market share in 2020 and the trend is likely to continue during the forecast period

Key players operating in the global ambulatory cardiac monitoring devices market are Abbott, Boston Scientific Corporation, GE Healthcare, Hill-Rom Holdings, Koninklijke Philips N.V., Medtronic, Nihon Kohden Corporation, Asahi Kasei Medical Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Ambulatory Cardiac Monitoring Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Prevalence of Heart Failure

5.2. Brand Analysis

5.3. Patient Pathway for Ambulatory Cardiac Monitoring

5.4. Value Chain Analysis

5.5. Pricing Analysis

5.6. Reimbursement Scenario

5.7. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

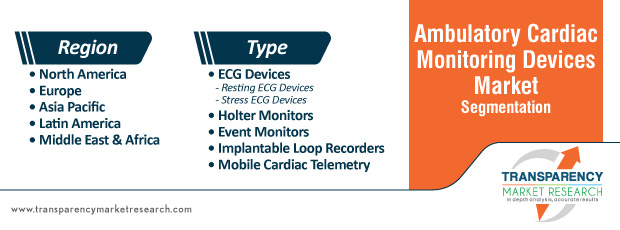

6. Global Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. ECG Devices

6.3.1.1. Resting ECG Devices

6.3.1.2. Stress ECG Devices

6.3.2. Holter Monitors

6.3.3. Event Monitors

6.3.4. Implantable Loop Recorders

6.3.5. Mobile Cardiac Telemetry

6.4. Market Attractiveness Analysis, by Type

7. Global Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Market Value Forecast, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness Analysis, by Country/Region

8. North America Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast, by Type, 2017–2031

8.2.1. ECG Devices

8.2.1.1. Resting ECG Devices

8.2.1.2. Stress ECG Devices

8.2.2. Holter Monitors

8.2.3. Event Monitors

8.2.4. Implantable Loop Recorders

8.2.5. Mobile Cardiac Telemetry

8.3. Market Value Forecast, by Country, 2017–2031

8.3.1. U.S.

8.3.2. Canada

8.4. Market Attractiveness Analysis

8.4.1. By Type

8.4.2. By Country

9. Europe Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Type, 2017–2031

9.2.1. ECG Devices

9.2.1.1. Resting ECG Devices

9.2.1.2. Stress ECG Devices

9.2.2. Holter Monitors

9.2.3. Event Monitors

9.2.4. Implantable Loop Recorders

9.2.5. Mobile Cardiac Telemetry

9.3. Market Value Forecast, by Country/Sub-region, 2017–2031

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Spain

9.3.5. Italy

9.3.6. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Type

9.4.2. By Country/Sub-region

10. Asia Pacific Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017–2031

10.2.1. ECG Devices

10.2.1.1. Resting ECG Devices

10.2.1.2. Stress ECG Devices

10.2.2. Holter Monitors

10.2.3. Event Monitors

10.2.4. Implantable Loop Recorders

10.2.5. Mobile Cardiac Telemetry

10.3. Market Value Forecast, by Country/Sub-region, 2017–2031

10.3.1. China

10.3.2. Japan

10.3.3. India

10.3.4. Australia & New Zealand

10.3.5. Rest of Asia Pacific

10.4. Market Attractiveness Analysis

10.4.1. By Type

10.4.2. By Country/Sub-region

11. Latin America Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017–2031

11.2.1. ECG Devices

11.2.1.1. Resting ECG Devices

11.2.1.2. Stress ECG Devices

11.2.2. Holter Monitors

11.2.3. Event Monitors

11.2.4. Implantable Loop Recorders

11.2.5. Mobile Cardiac Telemetry

11.3. Market Value Forecast, by Country/Sub-region, 2017–2031

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Rest of Latin America

11.4. Market Attractiveness Analysis

11.4.1. By Type

11.4.2. By Country/Sub-region

12. Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. ECG Devices

12.2.1.1. Resting ECG Devices

12.2.1.2. Stress ECG Devices

12.2.2. Holter Monitors

12.2.3. Event Monitors

12.2.4. Implantable Loop Recorders

12.2.5. Mobile Cardiac Telemetry

12.3. Market Value Forecast, by Country/Sub-region, 2017–2031

12.3.1. GCC Countries

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

12.4. Market Attractiveness Analysis

12.4.1. By Type

12.4.2. By Country/Sub-region

13. Competition Landscape

13.1. Market Share Analysis, by Company, 2020

13.2. Company Profiles

13.2.1. Abbott

13.2.1.1. Company Overview

13.2.1.2. Company Financials

13.2.1.3. Growth Strategies

13.2.1.4. SWOT Analysis

13.2.2. Boston Scientific Corporation

13.2.2.1. Company Overview

13.2.2.2. Company Financials

13.2.2.3. Growth Strategies

13.2.2.4. SWOT Analysis

13.2.3. GE Healthcare

13.2.3.1. Company Overview

13.2.3.2. Company Financials

13.2.3.3. Growth Strategies

13.2.3.4. SWOT Analysis

13.2.4. Hill-Rom Holdings

13.2.4.1. Company Overview

13.2.4.2. Company Financials

13.2.4.3. Growth Strategies

13.2.4.4. SWOT Analysis

13.2.5. Koninklijke Philips N.V.

13.2.5.1. Company Overview

13.2.5.2. Company Financials

13.2.5.3. Growth Strategies

13.2.5.4. SWOT Analysis

13.2.6. Medtronic

13.2.6.1. Company Overview

13.2.6.2. Company Financials

13.2.6.3. Growth Strategies

13.2.6.4. SWOT Analysis

13.2.7. Nihon Kohden Corporation

13.2.7.1. Company Overview

13.2.7.2. Company Financials

13.2.7.3. Growth Strategies

13.2.7.4. SWOT Analysis

13.2.8. Asahi Kasei Medical Co., Ltd.

13.2.8.1. Company Overview

13.2.8.2. Company Financials

13.2.8.3. Growth Strategies

13.2.8.4. SWOT Analysis

List of Tables

Table 01: Global Stroke Incident Cases

Table 02: Global Prevalence of Heart Failure (2017)

Table 03: Status of Cardiac Surgeries in Countries in South Asia 2016–2017

Table 04: Status of Cardiac Surgeries in North America

Table 05: New Zealand all cardiac surgery patients in 2016: age and gender

Table 06: Europe Hospital discharge rates for in-patients with diseases of the cardiovascular system, 2016-2017

Table 07: Key Product/Brand Analysis of Implantable Loop Recorder

Table 08: Key Product/Brand Analysis of Holter Monitors

Table 09: Key Product/Brand Analysis of ECG

Table 10: Key Product/Brand Analysis of Event Monitors

Table 11: Key Product/Brand Analysis of Event Monitors

Table 12: Key Product/Brand Analysis of Mobile Cardiac Telemetry

Table 13: Ambulatory Cardiac Monitoring Devices Procedures performed till 2018

Table 14: Ambulatory Cardiac Monitoring Devices Procedures performed after January 2019

Table 15: Global Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 16: Global Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 17: Global Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 18: North America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 19: North America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 20: North America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 21: Europe Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Europe Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 23: Europe Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 24: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 25: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 26: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 27: Latin America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 28: Latin America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 29: Latin America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 30: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 31: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 32: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, by ECG Devices, 2017-2031

Table 33: GE Healthcare Business Overview

Table 34: Koninklijke Philips N.V. Business Overview

Table 35: Medtronic plc Business Overview

Table 36: Abbott Laboratories Business Overview

Table 37: Boston Scientific Corporation Business Overview

Table 38: Hill-Rom Holdings, Inc. Business Overview

Table 39: Nihon Kohden Corporation Business Overview

Table 40: Asahi Kasei Medical Co., Ltd. Business Overview

List of Figures

Figure 01: Global Ambulatory Cardiac Monitoring Devices Market Share, by Type

Figure 02: Global Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, 2017-2031

Figure 03: Procedures performed in 2017 (New Zealand)

Figure 04: Procedures performed in 2017 (Australia)

Figure 05: Value Chain Analysis

Figure 06: Global Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 07: Global Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 08: Global Ambulatory Cardiac Monitoring Devices Market Analysis, by Region

Figure 09: Global Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Region, 2020 and 2031

Figure 10: Global Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Region, 2021–2031

Figure 11: North America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 12: North America Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Country, 2020 and 2031

Figure 13: North America Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Country, 2021–2031

Figure 14: North America Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 15: North America Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 16: Europe Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 17: Europe Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 18: Europe Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 19: Europe Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 20: Europe Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 21: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 22: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 23: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 24: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 25: Asia Pacific Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 26: Latin America Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 27: Latin America Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 28: Latin America Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 29: Latin America Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 30: Latin America Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 31: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 33: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 34: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Attractiveness Analysis, by Type, 2021–2031

Figure 35: Middle East & Africa Ambulatory Cardiac Monitoring Devices Market Value Share Analysis, by Type, 2020 and 2031

Figure 36: GE Healthcare Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 37: GE Healthcare Breakdown of Net Sales (%), by Region/Country, 2019

Figure 38: GE Healthcare Breakdown of Net Sales (%), by Business Segment, 2019

Figure 39: GE Healthcare R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 40: Koninklijke Philips N.V. Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 41: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Region/Country, 2019

Figure 42: Koninklijke Philips N.V. Breakdown of Net Sales (%), by Business Segment, 2019

Figure 43: Koninklijke Philips N.V. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 44: Medtronic plc Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 45: Medtronic plc Breakdown of Net Sales (%), by Region/Country, 2020

Figure 46: Medtronic plc Breakdown of Net Sales (%), by Business Segment, 2020

Figure 47: Medtronic plc R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 48: Abbott Laboratories Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 49: Abbott Laboratories Breakdown of Net Sales (%), by Region/Country, 2019

Figure 50: Abbott Laboratories Breakdown of Net Sales (%), by Business Segment, 2019

Figure 51: Abbott Laboratories R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 52: Boston Scientific Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 53: Boston Scientific Corporation Breakdown of Net Sales (%), by Region/Country, 2019

Figure 54: Boston Scientific Corporation Breakdown of Net Sales (%), by Business Segment, 2019

Figure 55: Boston Scientific Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 56: Hill-Rom Holdings, Inc. Revenue (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 57: Hill-Rom Holdings, Inc. Breakdown of Net Sales (%), by Region/Country, 2020

Figure 58: Hill-Rom Holdings, Inc. Breakdown of Net Sales (%), by Business Segment, 2020

Figure 59: Hill-Rom Holdings, Inc. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2017–2020

Figure 60: Nihon Kohden Corporation Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 61: Nihon Kohden Corporation Breakdown of Net Sales (%), by Region/Country, 2019

Figure 62: Nihon Kohden Corporation Breakdown of Net Sales (%), by Business Segment, 2019

Figure 63: Nihon Kohden Corporation R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 64: Asahi Kasei Medical Co., Ltd. Revenue (US$ Mn) and Y-o-Y Growth (%), 2016–2019

Figure 65: Asahi Kasei Medical Co., Ltd. Breakdown of Net Sales (%), by Region/Country, 2019

Figure 66: Asahi Kasei Medical Co., Ltd. Breakdown of Net Sales (%), by Business Segment, 2019

Figure 67: Asahi Kasei Medical Co., Ltd. R&D Expenses (US$ Mn) and Y-o-Y Growth (%), 2016–2019