Analysts’ Viewpoint

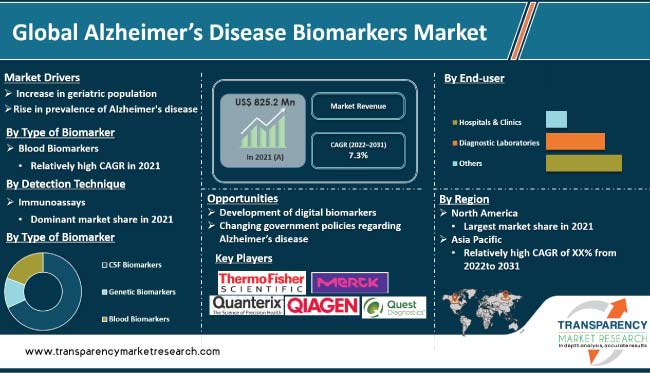

Rise in prevalence of senile dementia associated with Alzheimer's disease due to rapidly aging population is driving the global Alzheimer's disease biomarkers industry. Introduction of specific biomarkers, such as peptides and genes, for diagnosis of Alzheimer's disease is likely to be major business catalyst. These biomarkers play an important role in the predictive and confirmatory diagnosis of the disease.

The Alzheimer's disease biomarker business is highly competitive. Companies are adopting strategies, such as product launches and approvals, to expand their global footprint and product portfolio. Collaboration is one of the key strategies employed by Alzheimer disease biomarker market participants to increase their global customer base.

Alzheimer's disease is a progressive, irreversible neural condition. It is characterized by the degeneration of neurons in the brain that affect memory and other essential central nervous system functions (CNS). Biomarkers are measurable indicators of what is going on in the body. These can be found in blood, other body fluids, organs, and tissues. Some can even be measured digitally. Biomarkers can assist doctors and researchers in tracking health processes, diagnosing diseases & other health conditions, monitoring medication responses, and identifying health risks in individuals.

Alzheimer's disease is a neurodegenerative disorder that causes significant cognitive deficits, behavioral changes, sleep disturbances, and loss of functional autonomy. The number of Alzheimer's patients is rapidly increasing as the world's population ages. The disease is the leading cause of senile dementia and has become a major public health concern. Early diagnosis is important for initiating treatment, which could be more effective at this stage. Hence, scientists' primary focus is on early detection and development of personalized therapeutic solutions for individual patients.

Aging is the most significant risk factor for dementia. As a person gets older, the risk of developing dementia rises significantly. Senile dementia is caused by diseases that result in brain damage such as Alzheimer’s disease or vascular disease. Hence, increase in geriatric population is expected to propel the Alzheimer’s disease biomarkers market demand in the near future.

According to Harvard Chan School (2020), 47 million people are living with dementia across the globe. The number is expected to triple in the next 30 years due to the rapidly aging population. As per Alzheimer's Society 2022, around two in every 100 people aged 65 to 69 suffer from dementia. The risk rises with age, roughly doubling every five years. This means that nearly 33 in every 100 people over the age of 90 years are afflicted with senile dementia.

The direct effects of a traumatic brain injury (TBI) could include unconsciousness, inability to recall the traumatic event, depression, confusion, difficulty in learning & remembering new information, difficulty in speaking coherently, unsteadiness, lack of coordination, and vision or hearing issues. Certain types of TBI could increase the risk of developing Alzheimer's disease or another type of dementia years after the injury.

According to the Centers for Disease Control and Prevention (CDC), around 223,135 TBI-related hospitalizations and 64,362 TBI-related deaths were reported in the U.S. in in 2019 and 2020, respectively. According to data, more than 611 TBI-related hospitalizations and 176 TBI-related deaths are reported every day. A study conducted by Stanford Medicine found that smoking increases the risk of mental decline and senile dementia significantly. People who smoke are more likely to develop atherosclerosis and other types of vascular diseases, which could be the underlying causes of dementia.

High consumption of alcohol increases the risk of dementia. However, studies have found that people who drink moderately have a lower risk of dementia than those who drink heavily or completely abstain from alcohol. Lack of a nutritious diet, physical activity, social engagement, sleep, and mentally stimulating pursuits are risk factors for cognitive decline and Alzheimer's disease.

In terms of type of biomarker, the CSF (cerebrospinal fluid) biomarkers segment held major share of the global Alzheimer’s disease biomarkers industry in 2021. Increase in incidence of the Alzheimer’s disease is likely to drive the segment. According to the World Health Organization's September 2021 report, around 55 million people worldwide are living with senile dementia, with nearly 10 million cases recorded each year.

CSF biomarkers are useful in predicting disease progression and guiding outcome assessments and prognostic decisions in disease-modifying therapy clinical trials. Cerebrospinal fluid (CSF) has the most physical contact with the brain, making it a potentially reliable biomarker source. CSF, unlike plasma, is not kept separate from the brain by the tightly controlled blood-brain barrier.

Proteins/peptides that are directly reflective of brain or brain damage activity or disease pathology are likely to diffuse into the CSF. Furthermore, CSF can be tested serially, allowing for the study of protein changes reflecting the evolving pathology throughout the disease's clinical course.

Based on detection technique, the immunoassays segment is likely to account for significant share of the global Alzheimer’s disease biomarkers market growth during the forecast period. Immunoassay is a simple, low-cost technique that can be developed and applied to biological samples. Immunoassays have been developed and are available from pharmaceutical companies across the world.

North America held the largest share of around 35.0% in 2021. It is expected to record significant market progress during the forecast period. North America's dominance can be ascribed to the increase in incidence of major neurological diseases in the region. The U.S. dominated the region owing to factors such as presence of key players and increase in the research & development activities in the Alzheimer’s disease biomarkers field.

Asia Pacific is projected to be the fastest growing region during the forecast period. The business in the region is anticipated to grow at a rapid pace from 2022 to 2031 due to the high incidence rate of the Alzheimer’s disease, dementia, and Parkinson’s disease.

The global Alzheimer’s disease biomarkers market is fragmented, with the presence of large number of players. Most of the companies are making significant investments in research & development activities, primarily to develop innovative biomarkers such as digital biomarkers products. Leading players have adopted strategies such as product portfolio expansion and mergers & acquisitions in order to gain competitive advantage. Enzo Life Sciences, Inc., Thermo Fisher Scientific, Inc., AnaSpec, Inc., Merck KGaA, Cell Signaling Technology, Inc., Fujirebio, Imagilys, NanoSomiX, QIAGEN, 23andMe, Inc., Quanterix, C₂N Diagnostics, and Quest Diagnostics are the prominent players operating in the marketplace.

Leading players in the Alzheimer’s disease biomarkers market have been profiled in this report based on parameters such as company overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 825.2 Bn |

|

Forecast in 2031 |

More than US$ 1.7 Bn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The industry was valued at US$ 825.2 Mn in 2021.

It is projected to reach more than US$ 1.7 Bn by 2031.

The market is anticipated to grow at a CAGR of 7.3% from 2022 to 2031.

Increase in geriatric population and rise in prevalence of Alzheimer's disease across the world.

North America is likely to account for dominant share during the forecast period.

Enzo Life Sciences, Inc., Thermo Fisher Scientific, Inc., AnaSpec, Inc., Merck KGaA, Cell Signaling Technology, Inc., Fujirebio, Imagilys, NanoSomiX, QIAGEN, 23andMe, Inc., Quanterix, C₂N Diagnostics, and Quest Diagnostics.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Alzheimer’s Disease Biomarkers Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Alzheimer’s Disease Biomarkers Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Key Mergers & Acquisitions

5.2. Pipeline Analysis

5.3. Disease Prevalence and Incidence Rate globally with key countries/ region

5.4. COVID-19 Impact Analysis

6. Global Alzheimer's Disease Biomarkers Market Analysis and Forecast, by Type of Biomarker

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type of Biomarker, 2017–2031

6.3.1. CSF Biomarkers

6.3.1.1. Amyloid Beta

6.3.1.2. Tau Protein

6.3.1.3. Others

6.3.2. Genetic Biomarkers

6.3.2.1. Apolipoprotein E

6.3.2.2. Others

6.3.3. Blood Biomarkers

6.4. Market Attractiveness Analysis, by Type of Biomarker

7. Global Alzheimer's Disease Biomarkers Market Analysis and Forecast, by Detection Technique

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Detection Technique, 2017–2031

7.3.1. Molecular Diagnostics

7.3.2. Immunoassays

7.4. Market Attractiveness Analysis, by Detection Technique

8. Global Alzheimer's Disease Biomarkers Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals & Clinics

8.3.2. Diagnostic Laboratories

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Alzheimer’s Disease Biomarkers Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Rest of the World

9.3. Market Attractiveness Analysis, by Region

10. North America Alzheimer's Disease Biomarkers Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type of Biomarker, 2017–2031

10.2.1. CSF Biomarkers

10.2.1.1. Amyloid Beta

10.2.1.2. Tau Protein

10.2.1.3. Others

10.2.2. Genetic Biomarkers

10.2.2.1. Apolipoprotein E

10.2.2.2. Others

10.2.3. Blood Biomarkers

10.3. Market Value Forecast, by Detection Technique, 2017–2031

10.3.1. Molecular Diagnostics

10.3.2. Immunoassays

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals & Clinics

10.4.2. Diagnostic Laboratories

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type of Biomarker

10.6.2. By Detection Technique

10.6.3. By End-user

10.6.4. By Country

11. Europe Alzheimer's Disease Biomarkers Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type of Biomarker, 2017–2031

11.2.1. CSF Biomarkers

11.2.1.1. Amyloid Beta

11.2.1.2. Tau Protein

11.2.1.3. Others

11.2.2. Genetic Biomarkers

11.2.2.1. Apolipoprotein E

11.2.2.2. Others

11.2.3. Blood Biomarkers

11.3. Market Value Forecast, by Detection Technique, 2017–2031

11.3.1. Molecular Diagnostics

11.3.2. Immunoassays

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals & Clinics

11.4.2. Diagnostic Laboratories

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type of Biomarker

11.6.2. By Detection Technique

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Alzheimer's Disease Biomarkers Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type of Biomarker, 2017–2031

12.2.1. CSF Biomarkers

12.2.1.1. Amyloid Beta

12.2.1.2. Tau Protein

12.2.1.3. Others

12.2.2. Genetic Biomarkers

12.2.2.1. Apolipoprotein E

12.2.2.2. Others

12.2.3. Blood Biomarkers

12.3. Market Value Forecast, by Detection Technique, 2017–2031

12.3.1. Molecular Diagnostics

12.3.2. Immunoassays

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals & Clinics

12.4.2. Diagnostic Laboratories

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type of Biomarker

12.6.2. By Detection Technique

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Rest of the World Alzheimer's Disease Biomarkers Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type of Biomarker, 2017–2031

13.2.1. CSF Biomarkers

13.2.1.1. Amyloid Beta

13.2.1.2. Tau Protein

13.2.1.3. Others

13.2.2. Genetic Biomarkers

13.2.2.1. Apolipoprotein E

13.2.2.2. Others

13.2.3. Blood Biomarkers

13.3. Market Value Forecast, by Detection Technique, 2017–2031

13.3.1. Molecular Diagnostics

13.3.2. Immunoassays

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals & Clinics

13.4.2. Diagnostic Laboratories

13.4.3. Others

13.5. Market Attractiveness Analysis

13.5.1. By Type of Biomarker

13.5.2. By Detection Technique

13.5.3. By End-user

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Company Profiles

14.2.1. Enzo Life Sciences, Inc.

14.2.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.1.2. Product Portfolio

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.1.5. SWOT Analysis

14.2.2. Thermo Fisher Scientific, Inc.

14.2.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.2.2. Product Portfolio

14.2.2.3. Strategic Overview

14.2.2.4. SWOT Analysis

14.2.3. AnaSpec, Inc.

14.2.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.3.2. Product Portfolio

14.2.3.3. Strategic Overview

14.2.3.4. SWOT Analysis

14.2.4. Merck KGaA

14.2.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.4.2. Product Portfolio

14.2.4.3. Strategic Overview

14.2.4.4. SWOT Analysis

14.2.5. Cell Signaling Technology, Inc.

14.2.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.5.2. Product Portfolio

14.2.5.3. Strategic Overview

14.2.5.4. SWOT Analysis

14.2.6. Fujirebio

14.2.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.6.2. Product Portfolio

14.2.6.3. Strategic Overview

14.2.6.4. SWOT Analysis

14.2.7. Imagilys

14.2.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.7.2. Product Portfolio

14.2.7.3. Strategic Overview

14.2.7.4. SWOT Analysis

14.2.8. NanoSomiX

14.2.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.8.2. Product Portfolio

14.2.8.3. Strategic Overview

14.2.8.4. SWOT Analysis

14.2.9. QIAGEN

14.2.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.9.2. Product Portfolio

14.2.9.3. Strategic Overview

14.2.9.4. SWOT Analysis

14.2.10. 23andMe, Inc.

14.2.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.10.2. Product Portfolio

14.2.10.3. Strategic Overview

14.2.10.4. SWOT Analysis

14.2.11. Quanterix

14.2.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.11.2. Product Portfolio

14.2.11.3. Strategic Overview

14.2.11.4. SWOT Analysis

14.2.12. C2N Diagnostics

14.2.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.12.2. Product Portfolio

14.2.12.3. Strategic Overview

14.2.12.4. SWOT Analysis

14.2.13. Quest Diagnostics

14.2.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.2.13.2. Product Portfolio

14.2.13.3. Strategic Overview

List of Tables

Table 01: Global Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Type of Biomarker, 2017–2031

Table 02: Global Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by CSF Biomarkers, 2017–2031

Table 03: Global Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Genetic Biomarkers, 2017–2031

Table 04: Global Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Detection Technique, 2017–2031

Table 05: Global Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Type of Biomarker, 2017–2031

Table 09: North America Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by CSF Biomarkers, 2017–2031

Table 10: North America Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Genetic Biomarkers, 2017–2031

Table 11: North America Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Detection Technique, 2017–2031

Table 12: North America Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Type of Biomarker, 2017–2031

Table 15: Europe Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by CSF Biomarkers, 2017–2031

Table 16: Europe Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Genetic Biomarkers, 2017–2031

Table 17: Europe Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Detection Technique, 2017–2031

Table 18: Europe Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Type of Biomarker, 2017–2031

Table 21: Asia Pacific Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by CSF Biomarkers, 2017–2031

Table 22: Asia Pacific Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Genetic Biomarkers, 2017–2031

Table 23: Asia Pacific Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Detection Technique, 2017–2031

Table 24: Asia Pacific Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Rest of the World Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Type of Biomarker, 2017–2031

Table 26: Rest of the World Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by CSF Biomarkers, 2017–2031

Table 27: Rest of the World Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Genetic Biomarkers, 2017–2031

Table 28: Rest of the World Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by Detection Technique, 2017–2031

Table 29: Rest of the World Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Alzheimer's disease Biomarkers Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Alzheimer’s Disease Biomarkers Market Value Share, by Type of Biomarker (2021)

Figure 03: Global Alzheimer’s Disease Biomarkers Market Value Share, by Detection Technique (2021)

Figure 04: Global Alzheimer’s Disease Biomarkers Market Value Share, by End-user (2021)

Figure 05: Global Alzheimer’s Disease Biomarkers Market Value Share, by Region (2021)

Figure 06: Global Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Type of Biomarker, 2021 and 2031

Figure 07: Global Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Type of Biomarker, 2022–2031

Figure 08: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by CSF Biomarkers, 2017–2031

Figure 09: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by Genetic Biomarkers, 2017–2031

Figure 10: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by Blood Biomarkers, 2017–2031

Figure 11: Global Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Detection Technique, 2021 and 2031

Figure 12: Global Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Detection Technique, 2022–2031

Figure 13: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by Molecular Diagnostics, 2017–2031

Figure 14: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by Immunoassays, 2017–2031

Figure 15: Global Alzheimer’s Disease Biomarkers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 16: Global Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 17: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by Hospitals & Clinics, 2017–2031

Figure 18: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by Diagnostic Laboratories, 2017–2031

Figure 19: Global Alzheimer’s Disease Biomarkers Market Revenue (US$ Mn), by Others, 2017–2031

Figure 20: Global Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Region, 2021 and 2031

Figure 21: Global Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Region, 2022-2031

Figure 22: North America Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 23: North America Alzheimer’s Disease Biomarkers Market Value Share (%), by Country, 2021 and 2031

Figure 24: North America Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Country, 2022–2031

Figure 25: North America Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Type of Biomarker, 2021 and 2031

Figure 26: North America Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Type of Biomarker, 2022–2031

Figure 27: North America Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Detection Technique, 2021 and 2031

Figure 28: North America Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Detection Technique, 2022–2031

Figure 29: North America Alzheimer’s Disease Biomarkers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 30: North America Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 31: Europe Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 32: Europe Alzheimer’s Disease Biomarkers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 33: Europe Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Type of Biomarker, 2021 and 2031

Figure 35: Europe Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Type of Biomarker, 2022–2031

Figure 36: Europe Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Detection Technique, 2021 and 2031

Figure 37: Europe Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Detection Technique, 2022–2031

Figure 38: Europe Alzheimer’s Disease Biomarkers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 39: Europe Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 40: Asia Pacific Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 41: Asia Pacific Alzheimer’s Disease Biomarkers Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 42: Asia Pacific Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 43: Asia Pacific Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Type of Biomarker, 2021 and 2031

Figure 44: Asia Pacific Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Type of Biomarker, 2022–2031

Figure 45: Asia Pacific Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Detection Technique, 2021 and 2031

Figure 46: Asia Pacific Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Detection Technique, 2022–2031

Figure 47: Asia Pacific Alzheimer’s Disease Biomarkers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: Asia Pacific Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by End-user, 2022–2031

Figure 49: Rest of the World Alzheimer’s Disease Biomarkers Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 50: Rest of the World Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Type of Biomarker, 2021 and 2031

Figure 51: Rest of the World Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Type of Biomarker, 2022–2031

Figure 52: Rest of the World Alzheimer’s Disease Biomarkers Market Value Share Analysis, by Detection Technique, 2021 and 2031

Figure 53: Rest of the World Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by Detection Technique, 2022–2031

Figure 54: Rest of the World Alzheimer’s Disease Biomarkers Market Value Share Analysis, by End-user, 2021 and 2031

Figure 55: Rest of the World Alzheimer’s Disease Biomarkers Market Attractiveness Analysis, by End-user, 2022–2031