Analysts’ Viewpoint

Alternative powertrains are built to minimize the usage of IC engine vehicles in order to reduce carbon emissions. Electric powertrains are being increasingly adopted, as they help lower the dependence on fossil fuels or non-renewable energy sources. Increase in demand for highly efficient powertrain assembly, which does not get affected in different road terrains, is fueling market statistics. Rise in demand for fuel-efficient vehicles with higher safety features is another key factor driving market growth.

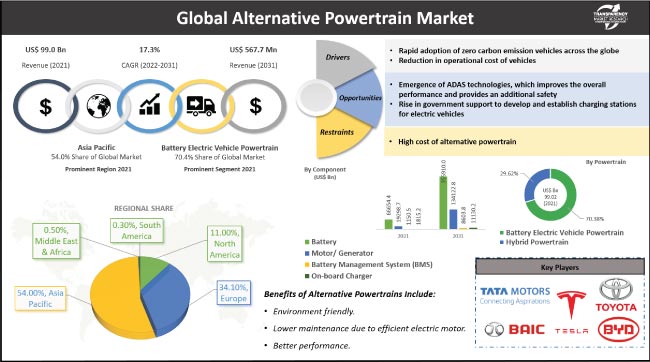

Prominent vehicle companies in the global alternative powertrain industry, such as Toyota, Volkswagen, BYD, BAIC Group, TATA Motors, Tesla, and General Motors, are focusing on the development of innovative, technologically advanced, durable, and cost-efficient electric powertrains in order to grab lucrative alternative powertrain business opportunities.

Powertrain is a group of parts assembled to produce the energy needed to propel a vehicle. Electric powertrains are gaining popularity, due to the increase in demand for fuel-efficient vehicles across the globe. Demand for improvement in performance, comfort, and safety in vehicles is rising. Manufacturers are increasingly focusing on developing innovative powertrains to grab incremental opportunities. In addition to the engine and transmission system, powertrain includes other parts such as drive shaft, clutch or torque converter, and axles.

Powertrains are often used in battery electric vehicles (BEV), which run entirely on electricity. They are also employed in plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs). The global alternative powertrain market share is projected to increase significantly during the forecast period, owing to the growth in automobile sector and rapid adoption of zero-emission vehicles across the globe.

The popularity of electric vehicles (EVs) is rising significantly across the world. Increase in penetration of advanced technologies in automobiles is encouraging customers to opt for zero-emission vehicles. Furthermore, depletion of non-renewable energy resources and rise in concerns about carbon emissions have prompted several governments invest in electric vehicles.

Countries in Europe are among the early adopters of electric transportation. In Europe, battery electric vehicles (BEVs) accounted for 6.0% of all new car registrations in 2020, while plug-in hybrid electric vehicles (PHEVs) constituted 5.0% of the total number of newly registered passenger cars. This represents a sharp increase in usage of electric vehicles in countries in Europe. Additionally, favorable regulatory environment, including subsidies and tax exemptions, in Asia Pacific and Europe is augmenting the sale of electric vehicles.

Key manufacturers are expanding their production capabilities to meet the rising demand for electric vehicles. For instance, in 2020, Volvo Motors declared that it will produce just hybrid and electric vehicles. Thus, rise in adoption of electric vehicles across the globe is likely to augment alternative powertrain market development during the forecast period.

Engine developers are coming up with improved strategies, such as downsizing the engine, in order to increase the fuel efficiency of internal combustion engines. Energy downsizing is the usage of a smaller engine that offers the power of a larger engine through the adoption of advanced technology.

In September 2021, Hitachi Astemo Ltd. and Hitachi Ltd. jointly announced the creation of a small, light, direct-drive assembly system for the EV market. The complete apparatus was installed inside the wheel by combining the motor, brake, and inverter into a single unit. As a result, motor power is delivered directly for electric vehicle operation, thus decreasing the loss of energy by eliminating drive shafts and other intermediary systems. Thus, rise in trend of engine downsizing is likely to boost alternative powertrain industry growth during the forecast period.

Based on powertrain, the alternative powertrain market has been classified into battery electric vehicle powertrain and hybrid powertrain. The battery electric vehicle powertrain segment accounted for major share of 70.4% in 2021.

BEVs use electric energy that has been stored. They have a relatively high level of efficiency compared to hybrid and internal combustion cars. Transmission system, motor, battery pack, and power converters are the primary powertrain components of a BEV. The regenerative braking feature is also gaining popularity in BEVs. This is projected to bolster alternative powertrain market development during the forecast period.

Based on component, the industry has been segmented into battery, motor/generator, battery management system (BMS), and on-board charger. In terms of volume and revenue, the battery segment dominated the alternative powertrain market in 2021. It is anticipated to maintain its dominance throughout the forecast period.

Battery is a powerhouse or power source of an electric vehicle. In contrast to conventional vehicles, EVs completely rely on batteries to generate electricity. Therefore, batteries are regarded as the core of the EV technology. Researchers have developed a number of battery technologies that quickly replace the conventional means of powering automobiles. These include lithium-ion, lead-acid, nickel-cadmium, lithium-ion polymer, and sodium-nickel chloride batteries.

Asia Pacific dominated the global alternative powertrain market in 2021, owing to growth in the automobile sector in countries such as China, India, Japan, Singapore, and South Korea. Technological advancements in vehicles and rise in number of vehicle manufacturers are key factors augmenting market progress in Asia Pacific.

Asia Pacific is followed by Europe in terms of revenue and volume. Lucrative presence of prominent vehicle manufacturers such as Volkswagen Group, BMW Group, and Mercedes-Benz Group AG is contributing to market growth in the region. These players are investing significantly in research and development of alternative powertrains to minimize the dependence on fossil fuels.

The global business is consolidated, with just a few manufacturers accounting for majority of the share. Prominent companies are adopting innovative technologies to gain revenue benefits. Expansion of product portfolios, partnerships, and acquisitions are some of the key strategies adopted by leading players.

Toyota, Volkswagen, Daimler, Ford Motor, Honda, General Motors, BMW, Hyundai, BYD, BAIC Group, GAC Group, Kia, Geely, Volvo, TATA Motors, and Tesla are some of the major players operating in the global alternative powertrain market.

Key players have been profiled in the alternative powertrain market research report based on pointers such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 99.0 Bn |

|

Market Forecast Value in 2031 |

US$ 567.7 Bn |

|

Growth Rate (CAGR) |

17.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 99.0 Bn in 2021

It is expected to advance at a CAGR of 17.3% during the forecast period

It would be worth US$ 567.7 Bn in 2031

Asia Pacific was the most lucrative region that held 54.4% share in 2021

The battery electric vehicle powertrain segment held 70.4% share in 2021

Rapid adoption of zero-emission vehicles across globe and growth in automobile industry

Toyota, Volkswagen, Daimler, Ford Motor, Honda, General Motors, BMW, Hyundai, BYD, BAIC Group, GAC Group, Kia, Geely, Volvo, TATA Motors, and Tesla

1. Preface

1.1. About TMR

1.2. Market Coverage / Taxonomy

1.3. Assumptions and Research Methodology

2. Executive Summary

2.1. Market Outlook

2.1.1. Market Size, Euro Mn, 2017-2031

2.2. Demand & Supply Side Trends

2.3. TMR Analysis and Recommendations

2.4. Competitive Dashboard Analysis

3. Market Overview

3.1. Macro-Economic Factors

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunity

3.3. Market Factor Analysis

3.3.1. Porter’s Five Force Analysis

3.3.2. SWOT Analysis

3.4. Key Trend Analysis

4. Regulatory Scenario

4.1. National/ Country Legislation

4.2. Norms and Subsidies by Government for electric vehicles

5. Supply Chain Analysis

5.1. Key Component Suppliers/ producers by Country

5.1.1. Key Decision Maker for each key player for each of the component

5.1.1.1. Battery

5.1.1.2. Motor/ Generator

5.1.1.3. Battery Management System (BMS)

5.1.1.4. On-board Charger

5.2. Electric Vehicle Players, by Country (Top 10 EV players for each vehicle type and each country mentioned)

5.3. Supply Chain Constraints

6. Battery Analysis for Electric Powertrain, by Country

6.1. Battery Cell à Battery Module à Battery Pack

6.2. Battery Cell

6.2.1. Prismatic or Cylindrical

6.2.2. Dimensions and Weight

6.3. Battery Module

6.3.1. Series and/ or Parallel

6.3.2. Number of Cells

6.4. Supply Chain Analysis

6.4.1. Battery Cells/ Battery Modules/ Recycling

6.4.1.1. Key Players for Cells and Modules

7. Actual packaging needs & spend (corrugated and other materials), by Country

8. Packaging manufacturers active in this area (offering packaging for this segment)

8.1. Specific packaging solution offering

9. Global Alternative Powertrain Market, by Powertrain

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Powertrain

9.2.1. Battery Electric Vehicle Powertrain

9.2.2. Hybrid Powertrain

10. Global Alternative Powertrain Market, by Components

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Components

10.2.1. Battery

10.2.2. Motor/ Generator

10.2.3. Battery Management System (BMS)

10.2.4. On-board Charger

11. Global Alternative Powertrain Market, by Region

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Middle East & Africa

11.2.5. South America

12. North America Alternative Powertrain Market

12.1. Market Snapshot

12.2. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Powertrain

12.2.1. Battery Electric Vehicle Powertrain

12.2.2. Hybrid Powertrain

12.3. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Components

12.3.1. Battery

12.3.2. Motor/ Generator

12.3.3. Battery Management System (BMS)

12.3.4. On-board Charger

12.4. Key Country Analysis – North America Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031

12.4.1. The U. S.

12.4.2. Canada

12.4.3. Mexico

13. Europe Alternative Powertrain Market

13.1. Market Snapshot

13.2. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Powertrain

13.2.1. Battery Electric Vehicle Powertrain

13.2.2. Hybrid Powertrain

13.3. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Components

13.3.1. Battery

13.3.2. Motor/ Generator

13.3.3. Battery Management System (BMS)

13.3.4. On-board Charger

13.4. Key Country Analysis – Europe Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031

13.4.1. Germany

13.4.2. U. K.

13.4.3. France

13.4.4. Italy

13.4.5. Spain

13.4.6. Hungary

13.4.7. Poland

13.4.8. Rest of Europe

14. Asia Pacific Alternative Powertrain Market

14.1. Market Snapshot

14.2. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Powertrain

14.2.1. Battery Electric Vehicle Powertrain

14.2.2. Hybrid Powertrain

14.3. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Components

14.3.1. Battery

14.3.2. Motor/ Generator

14.3.3. Battery Management System (BMS)

14.3.4. On-board Charger

14.4. Key Country Analysis – Asia Pacific Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031

14.4.1. China

14.4.2. India

14.4.3. ASEAN Countries

14.4.4. Rest of Asia Pacific

15. Middle East & Africa Alternative Powertrain Market

15.1. Market Snapshot

15.2. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Powertrain

15.2.1. Battery Electric Vehicle Powertrain

15.2.2. Hybrid Powertrain

15.3. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Components

15.3.1. Battery

15.3.2. Motor/ Generator

15.3.3. Battery Management System (BMS)

15.3.4. On-board Charger

15.4. Key Country Analysis – Middle East & Africa Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031

15.4.1. GCC

15.4.2. South Africa

15.4.3. Turkey

15.4.4. Rest of Middle East & Africa

16. South America Alternative Powertrain Market

16.1. Market Snapshot

16.2. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Powertrain

16.2.1. Battery Electric Vehicle Powertrain

16.2.2. Hybrid Powertrain

16.3. Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031, By Components

16.3.1. Battery

16.3.2. Motor/ Generator

16.3.3. Battery Management System (BMS)

16.3.4. On-board Charger

16.4. Key Country Analysis – South America Alternative Powertrain Market Revenue (Euro Mn) Analysis & Forecast, 2017-2031

16.4.1. Brazil

16.4.2. Argentina

16.4.3. Rest of South America

17. Competitive Landscape

17.1. Company Share Analysis/ Brand Share Analysis, 2021

17.2. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share, Executive Bios)

17.3. Company Profile, by Components

17.3.1. Battery

17.3.2. Motor/ Generator

17.3.3. Battery Management System (BMS)

17.3.4. On-board Charger

**Companies covering more than 75% market share for each component would be covered in the research report

17.4. Company Profile - OEMs

**OEMs covering more than 75% market share for alternative powertrain would be covered in the research report

17.5. Tentative list of Key Players – Components/ System

17.5.1. Duracell Inc.

17.5.1.1. Company Overview

17.5.1.2. Company Footprints

17.5.1.3. Production Locations

17.5.1.4. Product Portfolio

17.5.1.5. Competitors & Customers

17.5.1.6. Subsidiaries & Parent Organization

17.5.1.7. Recent Developments

17.5.1.8. Financial Analysis

17.5.1.9. Profitability

17.5.1.10. Revenue Share

17.5.1.11. Executive Bios

17.5.2. Energizer Brands, LLC

17.5.2.1. Company Overview

17.5.2.2. Company Footprints

17.5.2.3. Production Locations

17.5.2.4. Product Portfolio

17.5.2.5. Competitors & Customers

17.5.2.6. Subsidiaries & Parent Organization

17.5.2.7. Recent Developments

17.5.2.8. Financial Analysis

17.5.2.9. Profitability

17.5.2.10. Revenue Share

17.5.2.11. Executive Bios

17.5.3. Samsung SDI Co. Ltd.

17.5.3.1. Company Overview

17.5.3.2. Company Footprints

17.5.3.3. Production Locations

17.5.3.4. Product Portfolio

17.5.3.5. Competitors & Customers

17.5.3.6. Subsidiaries & Parent Organization

17.5.3.7. Recent Developments

17.5.3.8. Financial Analysis

17.5.3.9. Profitability

17.5.3.10. Revenue Share

17.5.3.11. Executive Bios

17.5.4. Toshiba Corporation

17.5.4.1. Company Overview

17.5.4.2. Company Footprints

17.5.4.3. Production Locations

17.5.4.4. Product Portfolio

17.5.4.5. Competitors & Customers

17.5.4.6. Subsidiaries & Parent Organization

17.5.4.7. Recent Developments

17.5.4.8. Financial Analysis

17.5.4.9. Profitability

17.5.4.10. Revenue Share

17.5.4.11. Executive Bios

17.5.5. Contemporary Amperex Technology Co., Limited

17.5.5.1. Company Overview

17.5.5.2. Company Footprints

17.5.5.3. Production Locations

17.5.5.4. Product Portfolio

17.5.5.5. Competitors & Customers

17.5.5.6. Subsidiaries & Parent Organization

17.5.5.7. Recent Developments

17.5.5.8. Financial Analysis

17.5.5.9. Profitability

17.5.5.10. Revenue Share

17.5.5.11. Executive Bios

17.5.6. Hitachi Chemical Co. Ltd.

17.5.6.1. Company Overview

17.5.6.2. Company Footprints

17.5.6.3. Production Locations

17.5.6.4. Product Portfolio

17.5.6.5. Competitors & Customers

17.5.6.6. Subsidiaries & Parent Organization

17.5.6.7. Recent Developments

17.5.6.8. Financial Analysis

17.5.6.9. Profitability

17.5.6.10. Revenue Share

17.5.6.11. Executive Bios

17.5.7. Automotive Energy Supply Corporation

17.5.7.1. Company Overview

17.5.7.2. Company Footprints

17.5.7.3. Production Locations

17.5.7.4. Product Portfolio

17.5.7.5. Competitors & Customers

17.5.7.6. Subsidiaries & Parent Organization

17.5.7.7. Recent Developments

17.5.7.8. Financial Analysis

17.5.7.9. Profitability

17.5.7.10. Revenue Share

17.5.7.11. Executive Bios

17.5.8. GS Yuasa International Ltd.

17.5.8.1. Company Overview

17.5.8.2. Company Footprints

17.5.8.3. Production Locations

17.5.8.4. Product Portfolio

17.5.8.5. Competitors & Customers

17.5.8.6. Subsidiaries & Parent Organization

17.5.8.7. Recent Developments

17.5.8.8. Financial Analysis

17.5.8.9. Profitability

17.5.8.10. Revenue Share

17.5.8.11. Executive Bios

17.5.9. Johnson Controls Inc.

17.5.9.1. Company Overview

17.5.9.2. Company Footprints

17.5.9.3. Production Locations

17.5.9.4. Product Portfolio

17.5.9.5. Competitors & Customers

17.5.9.6. Subsidiaries & Parent Organization

17.5.9.7. Recent Developments

17.5.9.8. Financial Analysis

17.5.9.9. Profitability

17.5.9.10. Revenue Share

17.5.9.11. Executive Bios

17.5.10. Future Hi-Tech Batteries Limited

17.5.10.1. Company Overview

17.5.10.2. Company Footprints

17.5.10.3. Production Locations

17.5.10.4. Product Portfolio

17.5.10.5. Competitors & Customers

17.5.10.6. Subsidiaries & Parent Organization

17.5.10.7. Recent Developments

17.5.10.8. Financial Analysis

17.5.10.9. Profitability

17.5.10.10. Revenue Share

17.5.10.11. Executive Bios

17.5.11. Tianjin Lishen Battery Co. Ltd.

17.5.11.1. Company Overview

17.5.11.2. Company Footprints

17.5.11.3. Production Locations

17.5.11.4. Product Portfolio

17.5.11.5. Competitors & Customers

17.5.11.6. Subsidiaries & Parent Organization

17.5.11.7. Recent Developments

17.5.11.8. Financial Analysis

17.5.11.9. Profitability

17.5.11.10. Revenue Share

17.5.11.11. Executive Bios

17.5.12. Hunan Shanshan Toda Advanced Materials Co. Ltd.

17.5.12.1. Company Overview

17.5.12.2. Company Footprints

17.5.12.3. Production Locations

17.5.12.4. Product Portfolio

17.5.12.5. Competitors & Customers

17.5.12.6. Subsidiaries & Parent Organization

17.5.12.7. Recent Developments

17.5.12.8. Financial Analysis

17.5.12.9. Profitability

17.5.12.10. Revenue Share

17.5.12.11. Executive Bios

17.5.13. Panasonic Corporation

17.5.13.1. Company Overview

17.5.13.2. Company Footprints

17.5.13.3. Production Locations

17.5.13.4. Product Portfolio

17.5.13.5. Competitors & Customers

17.5.13.6. Subsidiaries & Parent Organization

17.5.13.7. Recent Developments

17.5.13.8. Financial Analysis

17.5.13.9. Profitability

17.5.13.10. Revenue Share

17.5.13.11. Executive Bios

17.5.14. Other Key Players

**This is not exhaustive list and we have provided few of players, while doing research report, we cover more number of key players

17.6. Tentative list of OEMs – Alternative Powertrain

17.6.1. Toyota

17.6.2. Volkswagen

17.6.3. Daimler

17.6.4. Ford Motor

17.6.5. Honda

17.6.6. General Motors

17.6.7. BMW

17.6.8. Hyundai

17.6.9. Renault-Nissan-Mitsubishi

17.6.10. BYD

17.6.11. BAIC Group

17.6.12. GAC Group

17.6.13. Kia

17.6.14. Geely

17.6.15. Volvo

17.6.16. TATA Motors

17.6.17. Tesla

17.6.18. Other Key Players

List of Tables

Table 1: Global Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Table 2: Global Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Table 3: Global Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 4: Global Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 5: Global Alternative Powertrain Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Table 6: Global Alternative Powertrain Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 7: North America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Table 8: North America Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Table 9: North America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 10: North America Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 11: North America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 12: North America Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 13: Europe Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Table 14: Europe Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Table 15: Europe Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 16: Europe Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 17: Europe Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 18: Europe Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 19: Asia Pacific Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Table 20: Asia Pacific Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Table 21: Asia Pacific Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 22: Asia Pacific Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 23: Asia Pacific Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 24: Asia Pacific Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 25: Middle East & Africa Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Table 26: Middle East & Africa Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Table 27: Middle East & Africa Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 28: Middle East & Africa Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 29: Middle East & Africa Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 30: Middle East & Africa Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 31: South America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Table 32: South America Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Table 33: South America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Table 34: South America Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Table 35: South America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Table 36: South America Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Figure 2: Global Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Figure 3: Global Alternative Powertrain Market, Incremental Opportunity, by Powertrain, Value (US$ Bn), 2022‒2031

Figure 4: Global Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 5: Global Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 6: Global Alternative Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 7: Global Alternative Powertrain Market Volume (Thousand Units) Forecast, by Region, 2017‒2031

Figure 8: Global Alternative Powertrain Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Figure 9: Global Alternative Powertrain Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022‒2031

Figure 10: North America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Figure 11: North America Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Figure 12: North America Alternative Powertrain Market, Incremental Opportunity, by Powertrain, Value (US$ Bn), 2022‒2031

Figure 13: North America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 14: North America Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 15: North America Alternative Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 16: North America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 17: North America Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 18: North America Alternative Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 19: Europe Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Figure 20: Europe Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Figure 21: Europe Alternative Powertrain Market, Incremental Opportunity, by Powertrain, Value (US$ Bn), 2022‒2031

Figure 22: Europe Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 23: Europe Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 24: Europe Alternative Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 25: Europe Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 26: Europe Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 27: Europe Alternative Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 28: Asia Pacific Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Figure 29: Asia Pacific Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Figure 30: Asia Pacific Alternative Powertrain Market, Incremental Opportunity, by Powertrain, Value (US$ Bn), 2022‒2031

Figure 31: Asia Pacific Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 32: Asia Pacific Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 33: Asia Pacific Alternative Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 34: Asia Pacific Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 35: Asia Pacific Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 36: Asia Pacific Alternative Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 37: Middle East & Africa Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Figure 38: Middle East & Africa Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Figure 39: Middle East & Africa Alternative Powertrain Market, Incremental Opportunity, by Powertrain, Value (US$ Bn), 2022‒2031

Figure 40: Middle East & Africa Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 41: Middle East & Africa Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 42: Middle East & Africa Alternative Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 43: Middle East & Africa Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 44: Middle East & Africa Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 45: Middle East & Africa Alternative Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031

Figure 46: South America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Powertrain, 2017‒2031

Figure 47: South America Alternative Powertrain Market Value (US$ Bn) Forecast, by Powertrain, 2017‒2031

Figure 48: South America Alternative Powertrain Market, Incremental Opportunity, by Powertrain, Value (US$ Bn), 2022‒2031

Figure 49: South America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Component, 2017‒2031

Figure 50: South America Alternative Powertrain Market Value (US$ Bn) Forecast, by Component, 2017‒2031

Figure 51: South America Alternative Powertrain Market, Incremental Opportunity, by Component, Value (US$ Bn), 2022‒2031

Figure 52: South America Alternative Powertrain Market Volume (Thousand Units) Forecast, by Country, 2017‒2031

Figure 53: South America Alternative Powertrain Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Figure 54: South America Alternative Powertrain Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022‒2031