Algorithmic Trading Market - Snapshot

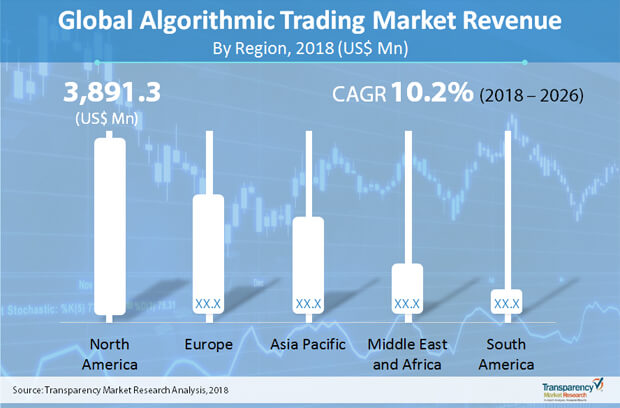

Algorithmic trading is a process of using an automated computer programed to follow a defined set of trading instructions for placing a trade, accounting for factors such as time, price, and volume. Algorithmic trading or algo trading is a technology platform providing advantage of both artificial intelligence and human intelligence. Algorithmic trading helps in reducing transaction costs, allowing investment managers to take control of their own trading procedures. The main objective of such software is not just to maximize profits but also to control market risk and execution costs. The market for algorithmic trading is forecasted to grow to US$ 21,807.6Mn by 2026, recording a CAGR of 10.2%.

End users and prospective adopters are attracted to the several benefits that algorithmic trading over manual ones. Faster execution, less risk of errors, concurrent focus on several market conditions are some of the key benefits which is evident in high-frequency trading (HFT). In addition, adopters have been able to backtest their tradition system. Most importantly, the popularity of products in the algorithmic trading market has stemmed from the fact that it has been successful in taking more rationalized decision, the reason having to do with stripping the decisions of human emotions. Post the economic recession of 2008, rules-based decision-making was internalized in algorithmic trading strategies. Rise in different forms of trading has made people look toward the advantages of algorithmic trading. A slew of new strategies have emerged in the market attracting the attention of investment firms and traders of all size.

Key strategies in the marketplace include trend-following strategies, arbitrage opportunities, index fund rebalancing, and mathematical model-based strategies. However, some genuine concerns are worrying end users and market players. Since, a large part of the trading process is automated, this removes any scope of applying discretion in making choices, a key pillar of economic and financial decision-making. Moreover, system issues, such as power losses and connectivity problems, need to be constantly monitored so as to prevent any huge crash. Also, the need for high-end resources might hurt cost-sensitive consumers in the algorithmic trading market.

Moreover, there is a lack of agreement among regulators on how the algorithmic trading must be adopted and monitored, leading to some serious snags for adopters and industry players in the market. Moreover, since there always exist the possibility of irrationality in economic models, at times this type of trading may fall short. In the times of Covid-19 customer sentiment has reached an all-time low, hampering the prospect of substantive spending. This has also hurt the prospects of the algorithmic trading market. Nonetheless, last few months have also seen improvement in overall consumer spending, which will add momentum to the market.

The algorithm trading market has experienced substantial growth due to large number of financial firms opting for increasing automation in trading processes. Integrated financial markets or an open market economy such as the European Union helps local vendors in buying foreign assets with reduced risks. Contribution of several international markets has aided developing countries in generating opportunities for portfolio diversification, global distribution of savings, and also risk sharing.

The algorithmic trading market is driven by the emergence of AI and algorithms in the financial service sector. This in turn is boosting the algorithmic trading sector globally. Furthermore, increasing adoption of non-equity trading algorithms by institutional asset managers is enhancing the use of artificial intelligence in the financial services sector. The global algorithmic trading market is anticipated to grow significantly during the forecast period, attributed to rapidly growing demand for market surveillance. By using market surveillance technology, traders are able to keep track of their trading activities and investment pattern.The rising need to build an economy with global as well as regional interdependencies force key vendors to formulate effective marketing strategies and develop new solutions for market surveillance. In addition, many companies are inclined toward the use of algorithmic trading in order to reduce market risks and transaction cost.

However, stringent regulatory guidelines are affecting the large-scale use of algorithmic trading. To conduct algorithmic trading and high frequency trading (HFT), all trading companies should inform the national regulatory authority and submit an application for approval from the regulatory authority.The regulatory environment for algorithmic trading and HFT practices are not favorable in some of the major countries such as China. There are barriers to the widespread application of automated trading, specifically for high frequency trading in financial markets across the country. This is consequently restricting the growth of the algorithmic trading market across the Asia Pacific region, as China is one of the major markets for the stock exchange.

A key trend boosting market growth is the growing adoption of cloud based solutions. The technology is gaining popularity in capital markets due to its flexibility, scalability, cost-effectiveness, and massive processing power. Presently, capital markets and financial institutions are unceasingly adopting cloud-based applications in order to enhance their efficiency and productivity as well as providing better custom applications and security to their customers.

The algorithmic trading market is segmented on the basis of components and trading type. Based on components, the market is segmented into software (on premise, cloud (private and public cloud) hybrid) and services (managed services, professional services (maintenance, integration and consulting). Based on trading type, the market is segmented into forex, stock markets, commodities, bonds, and cryptocurrency.

From a geographical standpoint, North America is expected to hold a major share in the algorithmic trading market.Growth in this region is attributed to strong adoption and penetration of algorithmic trading platform, software and services, as well as considerable application of algorithm trading in different end-user segments across the region. Developed markets and emerging markets have embraced this technology in the securities market. Asia Pacific region is expected to witness lucrative growth due to rising adoption of such software from countries such as India, Japan, Philippines, and Singapore. Furthermore, the markets in Middle East and Africa (MEA) and South America regions are also expected to grow significantly during the forecast period.

Growing awareness and adoption of algorithmic trading across Asia Pacific and South America is offering new opportunities for key players operating in the global algorithmic trading market. The algorithmic commodity market in India is expected to expand at a faster pace during the forecast period, owing to SEBI’s efforts to ease algo trade rules in the commodity market. In April 2018, SEBI raised the limit of orders that can be processed per second by a user from 20 orders per second to 100 orders per second.

Attracted by this fast expanding market, underlying technological advancements, and rising trend of algorithmic trading, many players are driven to develop comprehensive suites of software and services for all trading types. Existing software providers are rapidly expanding their distribution network in order to reach the most distant customers.Some of the key players profiled in the algorithmic trading market report include Trading Technologies International, Inc., Argo Software Engineering, Inc., Automated Trading SoftTech Pvt. Ltd., InfoReach, Inc., Kuberre Systems, MetaQuotes Software Corp., Software AG, Thomson Reuters Corporation, uTrade, and Vela Trading Systems LLC (OptionsCity Software, Inc.).

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary : Global Algorithmic Trading Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. GDP Indicator

4.2.2. Global ICT Spending (US$ Mn), 2012, 2018, 2026

4.2.3. Key Regional Socio-Political-Technological Developments and their Impact Considerations

4.3. Technology/Product Roadmap

4.4. Key Market Indicators

4.5. Analysis of Pricing Model

4.5.1. Subscription Based

4.5.2. Licensing Based

4.6. Market Factor Analysis

4.6.1. Porter’s Five Forces Analysis

4.6.2. PESTEL Analysis

4.6.3. Value Chain Analysis

4.6.3.1. Key End User/Customers Analysis

4.6.3.2. Market Channel Development Trends

4.6.4. Market Dynamics (Growth Influencers)

4.6.4.1. Drivers

4.6.4.2. Restraints

4.6.4.3. Opportunities

4.6.4.4. Impact Analysis of Drivers & Restraints

4.6.4.5. Key Trends

4.7. Global Algorithmic Trading Market Analysis and Forecast, 2016 - 2026

4.7.1. Market Revenue Analysis (US$ Mn)

4.7.1.1. Historic Growth Trends, 2012-2017

4.7.1.2. Forecast Trends, 2017-2026

4.8. Market Attractiveness Analysis– by Region (Global/North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.8.1. By Region/Country

4.8.2. By Components

4.8.3. By Trading Type

4.9. Market Outlook

4.10. Competitive Scenario and Trends

4.10.1. Algorithmic Trading Market Concentration Rate

4.10.1.1. List of New Entrants

4.10.2. Mergers & Acquisitions, Expansions

5. Global Algorithmic Trading Market Analysis and Forecasts, By Components

5.1. Introduction & Definitions

5.2. Key Findings

5.3. Market Size (US$ Mn) Forecast By Components, 2016-2026

5.3.1. Software

5.3.1.1. On-Premise

5.3.1.2. Cloud

5.3.1.1.1. Private Cloud

5.3.1.2.2. Public Cloud

5.3.1.3. Hybrid

5.3.2. Services

5.3.2.1. Managed Services

5.3.2.2. Professional Services (Maintenance, Integration, Consulting)

6. Global Algorithmic Trading Market Analysis and Forecasts, By Trading Type

6.1. Key Findings

6.2. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

6.2.1. Forex

6.2.2. Stock Markets

6.2.3. Commodities

6.2.4. Bonds

6.2.5. Cryptocurrency

7. Global Algorithmic Trading Market Analysis and Forecast, by Region

7.1. Overview

7.2. Key Segment Analysis

7.3. Algorithmic Trading Market Size (US$ Mn) Forecast, by Region, 2016 – 2026

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Middle East & Africa

7.3.5. South America

8. North America Algorithmic Trading Market Analysis and Forecast

8.1. Key Findings

8.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

8.2.1. Software

8.2.1.1. On-Premise

8.2.1.2. Cloud

8.2.1.2.1. Private Cloud

8.2.1.2.2. Public Cloud

8.2.1.3. Hybrid

8.2.2. Services

8.2.2.1. Managed Services

8.2.2.2. Professional Services (Maintenance, Integration, Consulting)

8.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

8.3.1. Forex

8.3.2. Stock Markets

8.3.3. Commodities

8.3.4. Bonds

8.3.5. Cryptocurrency

8.4. Market Size (US$ Mn) Forecast By Country, 2016-2026

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

9. Europe Algorithmic Trading Market Analysis and Forecast

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

9.2.1. Software

9.2.1.1. On-Premise

9.2.1.2. Cloud

9.2.1.2.1. Private Cloud

9.2.1.2.2. Public Cloud

9.2.1.3. Hybrid

9.2.2. Services

9.2.2.1. Managed Services

9.2.2.2. Professional Services (Maintenance, Integration, Consulting)

9.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

9.3.1. Forex

9.3.2. Stock Markets

9.3.3. Commodities

9.3.4. Bonds

9.3.5. Cryptocurrency

9.4. Market Size (US$ Mn) Forecast By Country, 2016-2026

9.4.1. UK

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

10. Asia Pacific Algorithmic Trading Market Analysis and Forecast

10.1. Key Findings

10.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

10.2.1. Software

10.2.1.1. On-Premise

10.2.1.2. Cloud

10.2.1.2.1. Private Cloud

10.2.1.2.2. Public Cloud

10.2.1.3. Hybrid

10.2.2. Services

10.2.2.1. Managed Services

10.2.2.2. Professional Services (Maintenance, Integration, Consulting)

10.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

10.3.1. Forex

10.3.2. Stock Markets

10.3.3. Commodities

10.3.4. Bonds

10.3.5. Cryptocurrency

10.4. Market Size (US$ Mn) Forecast By Country, 2016-2026

10.4.1. China

10.4.1.1. Mainland

10.4.1.2. Hong Kong

10.4.2. India

10.4.3. Japan

10.4.4. Australia

10.4.5. South Korea

10.4.6. ASEAN

10.4.6.1. Indonesia

10.4.6.2. Thailand

10.4.6.3. Malaysia

10.4.6.4. Philippines

10.4.6.5. Singapore

10.4.7. Rest of Asia Pacific

11. China Algorithmic Trading Market Analysis and Forecast

11.1. Key Findings

11.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

11.2.1. Software

11.2.1.1. On-Premise

11.2.1.2. Cloud

11.2.1.2.1. Private Cloud

11.2.1.2.2. Public Cloud

11.2.1.3. Hybrid

11.2.2. Services

11.2.2.1. Managed Services

11.2.2.2. Professional Services (Maintenance, Integration, Consulting)

11.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

11.3.1. Forex

11.3.2. Stock Markets

11.3.3. Commodities

11.3.4. Bonds

11.3.5. Cryptocurrency

12. India Algorithmic Trading Market Analysis and Forecast

12.1. Key Findings

12.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

12.2.1. Software

12.2.1.1. On-Premise

12.2.1.2. Cloud

12.2.1.2.1. Private Cloud

12.2.1.2.2. Public Cloud

12.2.1.3. Hybrid

12.2.2. Services

12.2.2.1. Managed Services

12.2.2.2. Professional Services (Maintenance, Integration, Consulting)

12.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

12.3.1. Forex

12.3.2. Stock Markets

12.3.3. Commodities

12.3.4. Bonds

12.3.5. Cryptocurrency

13. Japan Algorithmic Trading Market Analysis and Forecast

13.1. Key Findings

13.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

13.2.1. Software

13.2.1.1. On-Premise

13.2.1.2. Cloud

13.2.1.2.1. Private Cloud

13.2.1.2.2. Public Cloud

13.2.1.3. Hybrid

13.2.2. Services

13.2.2.1. Managed Services

13.2.2.2. Professional Services (Maintenance, Integration, Consulting)

13.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

13.3.1. Forex

13.3.2. Stock Markets

13.3.3. Commodities

13.3.4. Bonds

13.3.5. Cryptocurrency

14. Australia Algorithmic Trading Market Analysis and Forecast

14.1. Key Findings

14.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

14.2.1. Software

14.2.1.1. On-Premise

14.2.1.2. Cloud

14.2.1.2.1. Private Cloud

14.2.1.2.2. Public Cloud

14.2.1.3. Hybrid

14.2.2. Services

14.2.2.1. Managed Services

14.2.2.2. Professional Services (Maintenance, Integration, Consulting)

14.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

14.3.1. Forex

14.3.2. Stock Markets

14.3.3. Commodities

14.3.4. Bonds

14.3.5. Cryptocurrency

15. South Korea Algorithmic Trading Market Analysis and Forecast

15.1. Key Findings

15.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

15.2.1. Software

15.2.1.1. On-Premise

15.2.1.2. Cloud

15.2.1.2.1. Private Cloud

15.2.1.2.2. Public Cloud

15.2.1.3. Hybrid

15.2.2. Services

15.2.2.1. Managed Services

15.2.2.2. Professional Services (Maintenance, Integration, Consulting)

15.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

15.3.1. Forex

15.3.2. Stock Markets

15.3.3. Commodities

15.3.4. Bonds

15.3.5. Cryptocurrency

16. Indonesia Algorithmic Trading Market Analysis and Forecast

16.1. Key Findings

16.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

16.2.1. Software

16.2.1.1. On-Premise

16.2.1.2. Cloud

16.2.1.2.1. Private Cloud

16.2.1.2.2. Public Cloud

16.2.1.3. Hybrid

16.2.2. Services

16.2.2.1. Managed Services

16.2.2.2. Professional Services (Maintenance, Integration, Consulting)

16.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

16.3.1. Forex

16.3.2. Stock Markets

16.3.3. Commodities

16.3.4. Bonds

16.3.5. Cryptocurrency

17. Thailand Algorithmic Trading Market Analysis and Forecast

17.1. Key Findings

17.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

17.2.1. Software

17.2.1.1. On-Premise

17.2.1.2. Cloud

17.2.1.2.1. Private Cloud

17.2.1.2.2. Public Cloud

17.2.1.3. Hybrid

17.2.2. Services

17.2.2.1. Managed Services

17.2.2.2. Professional Services (Maintenance, Integration, Consulting)

17.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

17.3.1. Forex

17.3.2. Stock Markets

17.3.3. Commodities

17.3.4. Bonds

17.3.5. Cryptocurrency

18. Malaysia Algorithmic Trading Market Analysis and Forecast

18.1. Key Findings

18.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

18.2.1. Software

18.2.1.1. On-Premise

18.2.1.2. Cloud

18.2.1.2.1. Private Cloud

18.2.1.2.2. Public Cloud

18.2.1.3. Hybrid

18.2.2. Services

18.2.2.1. Managed Services

18.2.2.2. Professional Services (Maintenance, Integration, Consulting)

18.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

18.3.1. Forex

18.3.2. Stock Markets

18.3.3. Commodities

18.3.4. Bonds

18.3.5. Cryptocurrency

19. Philippines Algorithmic Trading Market Analysis and Forecast

19.1. Key Findings

19.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

19.2.1. Software

19.2.1.1. On-Premise

19.2.1.2. Cloud

19.2.1.2.1. Private Cloud

19.2.1.2.2. Public Cloud

19.2.1.3. Hybrid

19.2.2. Services

19.2.2.1. Managed Services

19.2.2.2. Professional Services (Maintenance, Integration, Consulting)

19.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

19.3.1. Forex

19.3.2. Stock Markets

19.3.3. Commodities

19.3.4. Bonds

19.3.5. Cryptocurrency

20. Singapore Algorithmic Trading Market Analysis and Forecast

20.1. Key Findings

20.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

20.2.1. Software

20.2.1.1. On-Premise

20.2.1.2. Cloud

20.2.1.2.1. Private Cloud

20.2.1.2.2. Public Cloud

20.2.1.3. Hybrid

20.2.2. Services

20.2.2.1. Managed Services

20.2.2.2. Professional Services (Maintenance, Integration, Consulting)

20.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

20.3.1. Forex

20.3.2. Stock Markets

20.3.3. Commodities

20.3.4. Bonds

20.3.5. Cryptocurrency

21. Middle East & Africa Algorithmic Trading Market Analysis and Forecast

21.1. Key Findings

21.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

21.2.1. Software

21.2.1.1. On-Premise

21.2.1.2. Cloud

21.2.1.2.1. Private Cloud

21.2.1.2.2. Public Cloud

21.2.1.3. Hybrid

21.2.2. Services

21.2.2.1. Managed Services

21.2.2.2. Professional Services (Maintenance, Integration, Consulting)

21.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

21.3.1. Forex

21.3.2. Stock Markets

21.3.3. Commodities

21.3.4. Bonds

21.3.5. Cryptocurrency

21.4. Market Size (US$ Mn) Forecast By Country, 2016-2026

21.4.1. GCC Countries

21.4.2. South Africa

21.4.3. Rest of MEA

22. South America Algorithmic Trading Market Analysis and Forecast

22.1. Key Findings

22.2. Market Size (US$ Mn) Forecast By Components, 2016-2026

22.2.1. Software

22.2.1.1. On-Premise

22.2.1.2. Cloud

22.2.1.2.1. Private Cloud

22.2.1.2.2. Public Cloud

22.2.1.3. Hybrid

22.2.2. Services

22.2.2.1. Managed Services

22.2.2.2. Professional Services (Maintenance, Integration, Consulting)

22.3. Market Size (US$ Mn) Forecast By Trading Type, 2016-2026

22.3.1. Forex

22.3.2. Stock Markets

22.3.3. Commodities

22.3.4. Bonds

22.3.5. Cryptocurrency

22.4. Market Size (US$ Mn) Forecast By Country, 2016-2026

22.4.1. Brazil

22.4.2. Rest of South America

23. Competition Landscape

23.1. Market Player – Competition Matrix

23.2. Market Revenue Share Analysis (%), By Company (2017)

23.3. Regional Presence (Intensity Map)

24. Company Profiles(Details – Basic Overview, Sales Area/Geographical Presence, Revenue, Strategy, Recent Developments)

24.1. Thomson Reuters Corporation

24.1.1. Company Overview

24.1.2. Recent Development

24.1.3. Financial Overview

24.1.4. Strategy

24.2. Argo Software Engineering, Inc.

24.2.1. Company Overview

24.2.2. Recent Development

24.2.3. Financial Overview

24.2.4. Strategy

24.3. Automated Trading SoftTech Pvt. Ltd.

24.3.1. Company Overview

24.3.2. Recent Development

24.3.3. Financial Overview

24.3.4. Strategy

24.4. InfoReach, Inc.

24.4.1. Company Overview

24.4.2. Recent Development

24.4.3. Financial Overview

24.4.4. Strategy

24.5. Kuberre Systems

24.5.1. Company Overview

24.5.2. Recent Development

24.5.3. Financial Overview

24.5.4. Strategy

24.6. MetaQuotes Software Corp.

24.6.1. Company Overview

24.6.2. Recent Development

24.6.3. Financial Overview

24.6.4. Strategy

24.7. Vela Trading Systems LLC (OptionsCity Software, Inc.)

24.7.1. Company Overview

24.7.2. Recent Development

24.7.3. Financial Overview

24.7.4. Strategy

24.8. uTrade

24.8.1. Company Overview

24.8.2. Recent Development

24.8.3. Financial Overview

24.8.4. Strategy

24.9. Software AG

24.9.1. Company Overview

24.9.2. Recent Development

24.9.3. Financial Overview

24.9.4. Strategy

24.10. Trading Technologies International, Inc.

24.10.1. Company Overview

24.10.2. Recent Development

24.10.3. Financial Overview

24.10.4. Strategy

25. Key Takeaways

List of Tables

Table 1:Volume of Contracts Traded Globally for Futures and Options

Table 2: Global Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 3: Global Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 4: Global Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 5: Global Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 6: Global Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 7: Global Algorithmic Trading Market Size (US$ Mn) Forecast, by Region, 2016 – 2026

Table 8: North America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 9: North America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 10: North America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 11: North America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 12: North America Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 13: North America Algorithmic Trading Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 14: Europe Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 15: Europe Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 16: Europe Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 17: Europe Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 18: Europe Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 19: Europe Algorithmic Trading Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 20: Asia Pacific Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 21: Asia Pacific Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 22: Asia Pacific Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 23: Asia Pacific Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 24: Asia Pacific Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 25: Asia Pacific Algorithmic Trading Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 26: ASEAN Algorithmic Trading Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 27: China Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 28: China Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 29: China Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 30: China Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 31: China Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 32: China Algorithmic Trading Market Size (US$ Mn) Forecast, by Sub-region, 2016 – 2026

Table 33: India Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 34: India Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 35: India Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 36: India Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 37: India Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 38: Japan Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 39: Japan Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 40: Japan Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 41: Japan Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 42: Japan Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 43: Australia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 44: Australia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 45: Australia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 46: Australia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 47: Australia Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 48: South Korea Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 49: South Korea Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 50: South Korea Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 51: South Korea Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 52: South Korea Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 53: Indonesia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 54: Indonesia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 55: Indonesia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 56: Indonesia Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 57: Singapore Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 58: Singapore Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 59: Singapore Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 60: Singapore Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 61: Singapore Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 62: Philippines Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 63: Philippines Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 64: Philippines Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 65: Philippines Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 66: Philippines Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 67: Malaysia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 68: Malaysia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 69: Malaysia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 70: Malaysia Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 71: Malaysia Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 72: Thailand Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 73: Thailand Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 74: Thailand Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 75: Thailand Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 76: Thailand Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 77: MEA Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 78: MEA Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 79: MEA Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 80: MEA Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 81: MEA Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 82: MEA Algorithmic Trading Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

Table 83: South America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, 2016 – 2026

Table 84: South America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, 2016 – 2026

Table 85: South America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Software, Cloud, 2016 – 2026

Table 86: South America Algorithmic Trading Market Size (US$ Mn) Forecast, by Components, Services, 2016 – 2026

Table 87: South America Algorithmic Trading Market Size (US$ Mn) Forecast, by Trading Type, 2016 – 2026

Table 88: South America Algorithmic Trading Market Size (US$ Mn) Forecast, by Country, 2016 – 2026

List of Figures

Figure 1: Algorithmic Trading Market: Global Industry Analysis, Size, Share, Growth, Trends and Forecasts, 2018 – 2026

Figure 2: Global Algorithmic Trading Market Value (US$) Opportunity Assessment, by Trading Type, 2018E

Figure 3: Global Algorithmic Trading Market Value (US$) Opportunity Assessment, by Trading Type, 2026F

Figure 4: Top Segment Analysis

Figure 5: Global Algorithmic Trading Market Value (US$) Opportunity Assessment, by Region, 2018E

Figure 6: Global Algorithmic Trading Market Value (US$) Opportunity Assessment, by Region, 2026F

Figure 7: North America Market Growth

Figure 8: North America Algorithmic Trading Market Share Analysis, By Component, 2017

Figure 9: North America Algorithmic Trading Market Share Analysis, By Trading Type, 2017

Figure 10: Europe Market Growth

Figure 11: Europe Algorithmic Trading Market Share Analysis, By Component, 2017

Figure 12: Europe Algorithmic Trading Market Share Analysis, By Trading Type, 2017

Figure 13: Asia Pacific Market Growth

Figure 14: Asia Pacific Algorithmic Trading Market Share Analysis, By Component, 2017

Figure 15: Asia Pacific Algorithmic Trading Market Share Analysis, By Trading Type, 2017

Figure 16: MEA Market Growth

Figure 17: MEA Algorithmic Trading Market Share Analysis, By Component, 2017

Figure 18: MEA Algorithmic Trading Market Share Analysis, By Trading Type, 2017

Figure 19: South America Market Growth

Figure 20: South America Algorithmic Trading Market Share Analysis, By Component, 2017

Figure 21: South America Algorithmic Trading Market Share Analysis, By Trading Type, 2017

Figure 22: Gross Domestic Product (GDP) per Capita; Analysis (1/2) (US$ Tn), By Major Countries, 2011-2016

Figure 23: Gross Domestic Product (GDP) Analysis (2/2) (US$ Tn), By Major Countries, 2011-2016

Figure 24: Global Algorithmic Trading Market Size (US$ Mn) and Forecast, 2012 – 2026

Figure 25: Global Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 26: North America Algorithmic Trading Market Attractiveness Analysis, by Component, (2018)

Figure 27: North America Algorithmic Trading Market Attractiveness Analysis, by Trading Type, (2018)

Figure 28: North America Algorithmic Trading Market Attractiveness Analysis, by Country, (2018)

Figure 29: Europe Algorithmic Trading Market Attractiveness Analysis, by Component, (2018)

Figure 30: Europe Algorithmic Trading Market Attractiveness Analysis, by Trading Type, (2018)

Figure 31: Europe Algorithmic Trading Market Attractiveness Analysis, by Country, (2018)

Figure 32: Asia Pacific Algorithmic Trading Market Attractiveness Analysis, by Component, (2018)

Figure 33: Asia Pacific Algorithmic Trading Market Attractiveness Analysis, by Trading Type, (2018)

Figure 34: Asia Pacific Algorithmic Trading Market Attractiveness Analysis, by Country, (2018)

Figure 35: ASEAN Algorithmic Trading Market Attractiveness Analysis, by Component, (2018)

Figure 36: ASEAN Algorithmic Trading Market Attractiveness Analysis, by Trading Type, (2018)

Figure 37: ASEAN Algorithmic Trading Market Attractiveness Analysis, by Country, (2018)

Figure 38: MEA Algorithmic Trading Market Attractiveness Analysis, by Component, (2018)

Figure 39: MEA Algorithmic Trading Market Attractiveness Analysis, by Trading Type, (2018)

Figure 40: MEA Algorithmic Trading Market Attractiveness Analysis, by Country, (2018)

Figure 41: South America Algorithmic Trading Market Attractiveness Analysis, by Component, (2018)

Figure 42: South America Algorithmic Trading Market Attractiveness Analysis, by Trading Type, (2018)

Figure 43: South America Algorithmic Trading Market Attractiveness Analysis, by Country, (2018)

Figure 45: Global Algorithmic Trading Market Value Share (Value %), by Component, 2018

Figure 44: Global Algorithmic Trading Market Value Share (Value %), by Country, 2018

Figure 46: Global Algorithmic Trading Market Value Share (Value %), by Trading Type, 2018

Figure 47: Global Algorithmic Trading Market Analysis and Forecast, by Component

Figure 48: Global Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 49: Global Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 50: Global Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 51: Global Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 52: Global Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 53: Global Algorithmic Trading Market Share Analysis, by Region (2018)

Figure 54: Global Algorithmic Trading Market Share Analysis, by Region (2026)

Figure 55: North America Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 56: North America Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 57: North America Algorithmic Trading Market Analysis and Forecast, by Component

Figure 58: North America Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 59: North America Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 60: North America Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 61: North America Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 62: North America Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 63: North America Algorithmic Trading Market Share Analysis, by Country (2018)

Figure 64: North America Algorithmic Trading Market Share Analysis, by Country (2026)

Figure 65: Europe Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 66: Europe Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 67: Europe Algorithmic Trading Market Analysis and Forecast, by Component

Figure 68: Europe Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 69: Europe Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 70: Europe Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 71: Europe Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 72: Europe Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 73: Europe Algorithmic Trading Market Share Analysis, by Country (2018)

Figure 74: Europe Algorithmic Trading Market Share Analysis, by Country (2026)

Figure 75: Asia Pacific Algorithmic Trading Market Analysis and Forecast, by Component

Figure 76: Asia Pacific Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 77: Asia Pacific Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 78: Asia Pacific Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 79: Asia Pacific Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 80: Asia Pacific Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 81: Asia Pacific Algorithmic Trading Market Share Analysis, by Country (2018)

Figure 82: Asia Pacific Algorithmic Trading Market Share Analysis, by Country (2026)

Figure 83: China Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 84: China Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 85: China Algorithmic Trading Market Analysis and Forecast, by Component

Figure 86: China Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 87: China Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 88: China Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 89: China Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 90: China Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 91: India Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 92: India Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 93: India Algorithmic Trading Market Analysis and Forecast, by Component

Figure 94: India Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 95: India Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 96: India Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 97: India Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 98: India Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 99: Japan Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 100: Japan Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 101: Japan Algorithmic Trading Market Analysis and Forecast, by Component

Figure 102: Japan Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 103: Japan Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 104: Japan Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 105: Japan Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 106: Japan Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 107: Australia Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 108: Australia Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 109: Australia Algorithmic Trading Market Analysis and Forecast, by Component

Figure 110: Australia Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 111: Australia Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 112: Australia Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 113: Australia Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 114: Australia Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 115: South Korea Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 116: South Korea Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 117: South Korea Algorithmic Trading Market Analysis and Forecast, by Component

Figure 118: South Korea Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 119: South Korea Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 120: South Korea Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 121: South Korea Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 122: South Korea Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 123: Indonesia Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 124: Indonesia Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 125: Indonesia Algorithmic Trading Market Analysis and Forecast, by Component

Figure 126: Indonesia Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 127: Indonesia Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 128: Indonesia Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 129: Indonesia Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 130: Indonesia Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 131: Singapore Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 132: Singapore Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 133: Singapore Algorithmic Trading Market Analysis and Forecast, by Component

Figure 134: Singapore Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 135: Singapore Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 136: Singapore Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 137: Singapore Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 138: Singapore Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 139: Philippines Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 140: Philippines Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 141: Philippines Algorithmic Trading Market Analysis and Forecast, by Component

Figure 142: Philippines Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 143: Philippines Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 144: Philippines Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 145: Philippines Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 146: Philippines Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 147: Malaysia Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 148: Malaysia Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 149: Malaysia Algorithmic Trading Market Analysis and Forecast, by Component

Figure 150: Malaysia Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 151: Malaysia Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 152: Malaysia Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 153: Malaysia Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 154: Malaysia Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 155: Thailand Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 156: Thailand Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 157: Thailand Algorithmic Trading Market Analysis and Forecast, by Component

Figure 158: Thailand Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 159: Thailand Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 160: Thailand Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 161: Thailand Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 162: Thailand Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 163: MEA Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 164: MEA Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 165: MEA Algorithmic Trading Market Analysis and Forecast, by Component

Figure 166: MEA Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 167: MEA Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 168: MEA Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 169: MEA Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 170: MEA Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 171: MEA Algorithmic Trading Market Share Analysis, by Country (2018)

Figure 172: MEA Algorithmic Trading Market Share Analysis, by Country (2026)

Figure 173: South America Algorithmic Trading Market Size (US$ Mn) and Forecast, 2016 – 2026

Figure 174: South America Algorithmic Trading Market Opportunity Analysis, 2016 – 2026

Figure 175: South America Algorithmic Trading Market Analysis and Forecast, by Component

Figure 176: South America Algorithmic Trading Market Analysis and Forecast, by Component, Software

Figure 177: South America Algorithmic Trading Market Analysis and Forecast, by Component, Services

Figure 178: South America Algorithmic Trading Market Analysis and Forecast, by Component, Software, Cloud

Figure 179: South America Algorithmic Trading Market Share Analysis, by Trading Type (2018)

Figure 180: South America Algorithmic Trading Market Share Analysis, by Trading Type (2026)

Figure 181: South America Algorithmic Trading Market Share Analysis, by Country (2018)

Figure 182: South America Algorithmic Trading Market Share Analysis, by Country (2026)