Analyst Viewpoint

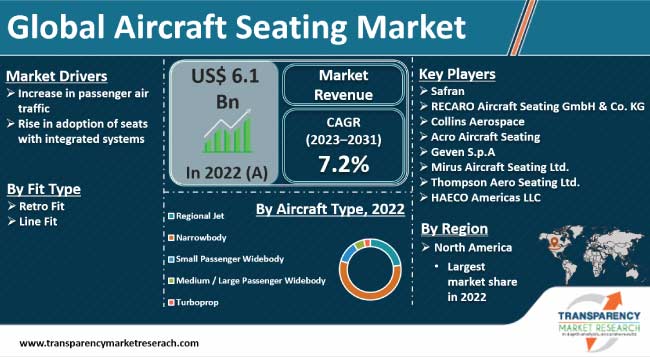

Increase in passenger air traffic and rise in adoption of seats with integrated systems are driving the aircraft seating market size. Air travel has emerged as a secure, convenient, and rapid means of transportation over the recent decades. Surge in passenger numbers is prompting airline companies to introduce new routes and destinations, thereby boosting demand for upgraded and safe aircraft seats.

Rise in adoption of In-flight Entertainment and Connectivity (IFEC) is likely to offer lucrative opportunities to vendors in the global aircraft seating industry. Vendors are focusing on strategic collaborations to expand their product portfolio and increase their aircraft seating market share. High initial cost of installing integrated systems in aircraft seating is expected to hinder the market development.

Aircraft seats are chairs in the aircraft where passengers are accommodated during their journey. Aircraft seats consist of foam, actuators, and electric fittings. The seats are generally arranged in rows to ensure passenger safety and comfort with a good travel experience. Aircraft seats are developed to meet the needs and comfort of passengers. Thus, power ports, safety belts, and reclining seats are provided on flights.

A widebody aircraft is a passenger aircraft with a fuselage wide enough to accommodate two passenger aisles. It has at least seven seats across and only one aisle. A regional jet, also known as a private jet, can transport a small group of people.

In the past few decades, air travel has been a safe, comfortable, and fast mode of transportation that has significantly raised passenger loads and boosted airline companies to develop more routes and places. Rise in preference for air travel around the globe has raised the need for upgraded and safe aircraft seats. This, in turn, is propelling the aircraft seating market progress.

Airline companies across the globe are seeking upgraded modern aircraft and seats to provide an efficient and comfortable experience to passengers. Additionally, rise in trend of offers and availability of low-cost carriers are contributing to a surge in air ticket bookings.

According to Airbus, India is expected to require 1,750 new passenger and cargo aircraft over the next 20 years to meet an exponential rise in passenger and freight traffic. To help meet this growth, the country is projected to need 1,320 new single-aisle aircraft and 430 widebody aircraft valued at US$ 255.0 Bn. Hence, rise in number of passenger and cargo aircraft is boosting the aircraft seating market expansion.

Airline companies around the globe are focusing on delivering a much more comfortable seating experience through various amenities including entertainment and in-flight connectivity. In-flight entertainment allows passengers to watch various programs and television during their journey.

Major airline companies are modifying existing aircraft/planes with the latest technologies such as integrated In-flight Entertainment and Connectivity (IFEC) systems. IFEC is redefining the overall flight experience of passengers. Most aircraft companies are implementing stringent rules to select aircraft interiors as it significantly impacts passenger safety and overall travel experience. Hence, aircraft seating manufacturers are aiming to provide passengers with an experience full of comfort and safety.

In September 2022, Emirates, one of the largest and most prestigious international airlines, selected Thales's AVANT Up, the next-generation inflight entertainment system, for its new fleet of Airbus A350s, with deliveries beginning in 2024. This new fleet of A350s is expected to be equipped with Thales’s premier AVANT Up inflight entertainment solution to offer the finest cinematic and personalized customer experience. Thus, surge in investment in in-flight connectivity and entertainment is driving the aircraft seating market value.

Most business jet owners are modifying their private jet seats with sustainable materials. Eco-friendly materials in aviation seat manufacturing include recycled plastics, lightweight materials, bamboo, and water-based adhesives and finishes.

According to the latest aircraft seating industry trends, North America held the largest share in 2022. Presence of major airlines is fueling the market dynamics of the region. North America is home to the three largest airlines in the world by revenue and two of the three largest by passengers carried. Rise in demand for advanced seating facilities and technologies is augmenting the aircraft seating market statistics in the region. Increase in preference for air travel is also boosting demand for aircraft seating.

According to the latest aircraft seating market forecast, the industry in Asia Pacific is anticipated to grow at a steady pace from 2023 to 2031. Rise in investment in the aviation sector is driving the market trajectory in the region. In September 2021, Air China and Recaro Aircraft Seating Gmbh & Co. KG signed a contract for A350 business class seats. Air China placed an order for 10 CL6720 business class seats from Recaro Aircraft Seating.

Key players in the market are focusing on developing new technologies and upgrading current features that can be included in aircraft to meet customer needs. Safran, RECARO Aircraft Seating GmbH & Co.KG, Collins Aerospace, Acro Aircraft Seating, Geven S.p.A, Mirus Aircraft Seating Ltd., Thompson Aero Seating Ltd., HAECO Americas LLC, Stelia Aerospace S.A.S, Tenryu Aero Component Co., Ltd., Martin Baker Aircraft Co., Ltd., and Pitch Aircraft Seating Systems Ltd. are some of the key players of the market.

Each of these companies has been profiled in the aircraft seating market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 6.1 Bn |

| Market Forecast (Value) in 2031 | US$ 11.4 Bn |

| Growth Rate (CAGR) | 7.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 6.1 Bn in 2022

It is anticipated to grow at a CAGR of 7.2% from 2023 to 2031

Increase in passenger air traffic and rise in adoption of seats with integrated systems

The narrowbody aircraft type segment held the largest share in 2022

North America was the leading region in 2022

Safran, RECARO Aircraft Seating GmbH & Co.KG, Collins Aerospace, Acro Aircraft Seating, Geven S.p.A., Mirus Aircraft Seating Ltd., Thompson Aero Seating Ltd., HAECO Americas LLC, Stelia Aerospace S.A.S, Tenryu Aero Component Co., Ltd., Martin Baker Aircraft Co., Ltd., and Pitch Aircraft Seating Systems Ltd.

1. Preface

1.1. Market Introduction

1.2. Market and Segment Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Aircraft Seating Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Aircraft Seating Market Analysis By Aircraft Type

5.1. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2017–2031

5.1.1. Regional Jet

5.1.2. Narrowbody

5.1.3. Small Passenger Widebody

5.1.4. Medium/Large Passenger Widebody

5.1.5. Turboprop

5.2. Market Attractiveness Analysis, By Aircraft Type

6. Aircraft Seating Market Analysis By Seating Class Type

6.1. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Seating Class Type, 2017–2031

6.1.1. Economy Class

6.1.2. Business Class

6.1.3. First Class

6.2. Market Attractiveness Analysis, By Seating Class Type

7. Aircraft Seating Market Analysis By Fit Type

7.1. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Fit Type, 2017–2031

7.1.1. Retro Fit

7.1.2. Line Fit

7.2. Market Attractiveness Analysis, By Fit Type

8. Aircraft Seating Market Analysis and Forecast, By Region

8.1. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. Latin America

8.2. Market Attractiveness Analysis, By Region

9. North America Aircraft Seating Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2017–2031

9.3.1. Regional Jet

9.3.2. Narrowbody

9.3.3. Small Passenger Widebody

9.3.4. Medium/ Large Passenger Widebody

9.3.5. Turboprop

9.4. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Seating Class Type, 2017–2031

9.4.1. Economy Class

9.4.2. Business Class

9.4.3. First Class

9.5. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Fit Type, 2017–2031

9.5.1. Retro Fit

9.5.2. Line Fit

9.6. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Country, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Aircraft Type

9.7.2. By Seating Class Type

9.7.3. By Fit Type

9.7.4. By Country

10. Europe Aircraft Seating Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2017–2031

10.3.1. Regional Jet

10.3.2. Narrowbody

10.3.3. Small Passenger Widebody

10.3.4. Medium/ Large Passenger Widebody

10.3.5. Turboprop

10.4. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Seating Class Type, 2017–2031

10.4.1. Economy Class

10.4.2. Business Class

10.4.3. First Class

10.5. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Fit Type, 2017–2031

10.5.1. Retro Fit

10.5.2. Line Fit

10.6. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Aircraft Type

10.7.2. By Seating Class Type

10.7.3. By Fit Type

10.7.4. By Country/Sub-region

11. Asia Pacific Aircraft Seating Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2017–2031

11.3.1. Regional Jet

11.3.2. Narrowbody

11.3.3. Small Passenger Widebody

11.3.4. Medium/Large Passenger Widebody

11.3.5. Turboprop

11.4. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Seating Class Type, 2017–2031

11.4.1. Economy Class

11.4.2. Business Class

11.4.3. First Class

11.5. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Fit Type, 2017–2031

11.5.1. Retro Fit

11.6. 2. Line Fit

11.7. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. China

11.7.2. Japan

11.7.3. India

11.7.4. South Korea

11.7.5. ASEAN

11.7.6. Rest of Asia Pacific

11.8. Market Attractiveness Analysis

11.8.1. By Aircraft Type

11.8.2. By Seating Class Type

11.8.3. By Fit Type

11.8.4. By Country/Sub-region

12. Middle East & Africa Aircraft Seating Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2017–2031

12.3.1. Regional Jet

12.3.2. Narrowbody

12.3.3. Small Passenger Widebody

12.3.4. Medium/Large Passenger Widebody

12.3.5. Turboprop

12.4. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Seating Class Type, 2017–2031

12.4.1. Economy Class

12.4.2. Business Class

12.4.3. First Class

12.5. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Fit Type, 2017–2031

12.5.1. Retro Fit

12.6. 2. Line Fit

12.7. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. GCC

12.7.2. Latin America

12.7.3. Rest of Middle East & Africa

12.8. Market Attractiveness Analysis

12.8.1. By Aircraft Type

12.8.2. By Seating Class Type

12.8.3. By Fit Type

12.8.4. By Country/Sub-region

13. Latin America Aircraft Seating Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2017–2031

13.3.1. Regional Jet

13.3.2. Narrowbody

13.3.3. Small Passenger Widebody

13.3.4. Medium/Large Widebody

13.3.5. Turboprop

13.4. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Seating Class Type, 2017–2031

13.4.1. Economy Class

13.4.2. Business Class

13.4.3. First Class

13.5. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Fit Type, 2017–2031

13.5.1. Retro Fit

13.5.2. Line Fit

13.6. Aircraft Seating Market Size (US$ Mn) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Aircraft Type

13.7.2. By Seating Class Type

13.7.3. By Fit Type

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Aircraft Seating Market Competition Matrix - Dashboard View

14.1.1. Global Aircraft Seating Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Safran

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. RECARO Aircraft Seating GmbH & Co. KG

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Collins Aerospace

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Acro Aircraft Seating

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Geven S.p.A.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Mirus Aircraft Seating Ltd.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Thompson Aero Seating Ltd.

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. HAECO Americas LLC

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Stelia Aerospace S.A.S.

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Tenryu Aero Component Co., Ltd.

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Martin Baker Aircraft Co., Ltd.

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Pitch Aircraft Seating Systems Ltd.

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Understanding Buying Process of Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Aircraft Seating Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 2: Global Aircraft Seating Market Value (US$ Mn) & Forecast, by Seating Class Type, 2017‒2031

Table 3: Global Aircraft Seating Market Value (US$ Mn) & Forecast, by Fit Type, 2017‒2031

Table 5: Global Aircraft Seating Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 6: North America Aircraft Seating Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 7: North America Aircraft Seating Market Value (US$ Mn) & Forecast, by Seating Class Type, 2017‒2031

Table 8: North America Aircraft Seating Market Value (US$ Mn) & Forecast, by Fit Type, 2017‒2031

Table 9: North America Aircraft Seating Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 10: Europe Aircraft Seating Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 11: Europe Aircraft Seating Market Value (US$ Mn) & Forecast, by Seating Class Type, 2017‒2031

Table 12: Europe Aircraft Seating Market Value (US$ Mn) & Forecast, by Fit Type, 2017‒2031

Table 13: Europe Aircraft Seating Market Value (US$ Mn) & Forecast, by Fit Type, 2017‒2031

Table 14: Europe Aircraft Seating Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 15: Asia Pacific Aircraft Seating Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 16: Asia Pacific Aircraft Seating Market Value (US$ Mn) & Forecast, by Seating Class Type, 2017‒2031

Table 17: Asia Pacific Aircraft Seating Market Value (US$ Mn) & Forecast, by Fit Type, 2017‒2031

Table 18: Asia Pacific Aircraft Seating Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 19: Middle East & Africa Aircraft Seating Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 20: Middle East & Africa Aircraft Seating Market Value (US$ Mn) & Forecast, by Seating Class Type, 2017‒2031

Table 21: Middle East & Africa Aircraft Seating Market Value (US$ Mn) & Forecast, by Fit Type, 2017‒2031

Table 22: Middle East & Africa Aircraft Seating Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 23: Latin America Aircraft Seating Market Value (US$ Mn) & Forecast, by Aircraft Type, 2017‒2031

Table 24: Latin America Aircraft Seating Market Value (US$ Mn) & Forecast, by Seating Class Type, 2017‒2031

Table 25: Latin America Aircraft Seating Market Value (US$ Mn) & Forecast, by Fit Type, 2017‒2031

Table 26: Latin America Aircraft Seating Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Aircraft Seating Market

Figure 02: Porter Five Forces Analysis - Global Aircraft Seating Market

Figure 03: Technology Road Map - Global Aircraft Seating Market

Figure 04: Global Aircraft Seating Market, Value (US$ Mn), 2017-2031

Figure 05: Global Aircraft Seating Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Aircraft Seating Market Projections by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Aircraft Seating Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 08: Global Aircraft Seating Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 09: Global Aircraft Seating Market Projections by Seating Class Type, Value (US$ Mn), 2017‒2031

Figure 10: Global Aircraft Seating Market, Incremental Opportunity, by Seating Class Type, 2023‒2031

Figure 11: Global Aircraft Seating Market Share Analysis, by Seating Class Type, 2022 and 2031

Figure 12: Global Aircraft Seating Market Projections by Fit Type, Value (US$ Mn), 2017‒2031

Figure 13: Global Aircraft Seating Market, Incremental Opportunity, by Fit Type, 2023‒2031

Figure 14: Global Aircraft Seating Market Share Analysis, by Fit Type, 2022 and 2031

Figure 15: Global Aircraft Seating Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 16: Global Aircraft Seating Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global Aircraft Seating Market Share Analysis, by Region, 2022 and 2031

Figure 18: North America Aircraft Seating Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America Aircraft Seating Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America Aircraft Seating Market Projections by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 21: North America Aircraft Seating Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 22: North America Aircraft Seating Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 23: North America Aircraft Seating Market Projections by Seating Class Type, Value (US$ Mn), 2017‒2031

Figure 24: North America Aircraft Seating Market, Incremental Opportunity, by Seating Class Type, 2023‒2031

Figure 25: North America Aircraft Seating Market Share Analysis, by Seating Class Type, 2022 and 2031

Figure 26: North America Aircraft Seating Market Projections by Fit Type (US$ Mn), 2017‒2031

Figure 27: North America Aircraft Seating Market, Incremental Opportunity, by Fit Type, 2023‒2031

Figure 28: North America Aircraft Seating Market Share Analysis, by Fit Type, 2022 and 2031

Figure 29: North America Aircraft Seating Market Projections by Country, Value (US$ Mn), 2017‒2031

Figure 30: North America Aircraft Seating Market, Incremental Opportunity, by Country, 2023‒2031

Figure 31: North America Aircraft Seating Market Share Analysis, by Country, 2022 and 2031

Figure 32: Europe Aircraft Seating Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 33: Europe Aircraft Seating Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 34: Europe Aircraft Seating Market Projections by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 35: Europe Aircraft Seating Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 36: Europe Aircraft Seating Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 37: Europe Aircraft Seating Market Projections by Seating Class Type, Value (US$ Mn), 2017‒2031

Figure 38: Europe Aircraft Seating Market, Incremental Opportunity, by Seating Class Type, 2023‒2031

Figure 39: Europe Aircraft Seating Market Share Analysis, by Seating Class Type, 2022 and 2031

Figure 40: Europe Aircraft Seating Market Projections by Fit Type, Value (US$ Mn), 2017‒2031

Figure 41: Europe Aircraft Seating Market, Incremental Opportunity, by Fit Type, 2023‒2031

Figure 42: Europe Aircraft Seating Market Share Analysis, by Fit Type, 2022 and 2031

Figure 43: Europe Aircraft Seating Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 44: Europe Aircraft Seating Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe Aircraft Seating Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 46: Asia Pacific Aircraft Seating Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 47: Asia Pacific Aircraft Seating Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific Aircraft Seating Market Projections by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific Aircraft Seating Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 50: Asia Pacific Aircraft Seating Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 51: Asia Pacific Aircraft Seating Market Projections by Seating Class Type, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific Aircraft Seating Market, Incremental Opportunity, by Seating Class Type, 2023‒2031

Figure 53: Asia Pacific Aircraft Seating Market Share Analysis, by Seating Class Type, 2022 and 2031

Figure 54: Asia Pacific Aircraft Seating Market Projections by Fit Type, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific Aircraft Seating Market, Incremental Opportunity, by Fit Type, 2023‒2031

Figure 56: Asia Pacific Aircraft Seating Market Share Analysis, by Fit Type, 2022 and 2031

Figure 57: Asia Pacific Aircraft Seating Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific Aircraft Seating Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific Aircraft Seating Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 60: Middle East & Africa Aircraft Seating Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa Aircraft Seating Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 62: Middle East & Africa Aircraft Seating Market Projections by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 63: Middle East & Africa Aircraft Seating Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 64: Middle East & Africa Aircraft Seating Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 65: Middle East & Africa Aircraft Seating Market Projections by Seating Class Type, Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa Aircraft Seating Market, Incremental Opportunity, by Seating Class Type, 2023‒2031

Figure 67: Middle East & Africa Aircraft Seating Market Share Analysis, by Seating Class Type, 2022 and 2031

Figure 68: Middle East & Africa Aircraft Seating Market Projections by Fit Type, Value (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa Aircraft Seating Market, Incremental Opportunity, by Fit Type, 2023‒2031

Figure 70: Middle East & Africa Aircraft Seating Market Share Analysis, by Fit Type, 2022 and 2031

Figure 71: Middle East & Africa Aircraft Seating Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa Aircraft Seating Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa Aircraft Seating Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 74: Latin America Aircraft Seating Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 75: Latin America Aircraft Seating Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 76: Latin America Aircraft Seating Market Projections by Aircraft Type, Value (US$ Mn), 2017‒2031

Figure 77: Latin America Aircraft Seating Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 78: Latin America Aircraft Seating Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 79: Latin America Aircraft Seating Market Projections by Seating Class Type, Value (US$ Mn), 2017‒2031

Figure 80: Latin America Aircraft Seating Market, Incremental Opportunity, by Seating Class Type, 2023‒2031

Figure 81: Latin America Aircraft Seating Market Share Analysis, by Seating Class Type, 2022 and 2031

Figure 82: Latin America Aircraft Seating Market Projections by Fit Type, Value (US$ Mn), 2017‒2031

Figure 83: Latin America Aircraft Seating Market, Incremental Opportunity, by Fit Type, 2023‒2031

Figure 84: Latin America Aircraft Seating Market Share Analysis, by Fit Type, 2022 and 2031

Figure 85: Latin America Aircraft Seating Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 86: Latin America Aircraft Seating Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: Latin America Aircraft Seating Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 88: Global Aircraft Seating Market Competition

Figure 89: Global Aircraft Seating Market Company Share Analysis