Analyst Viewpoint

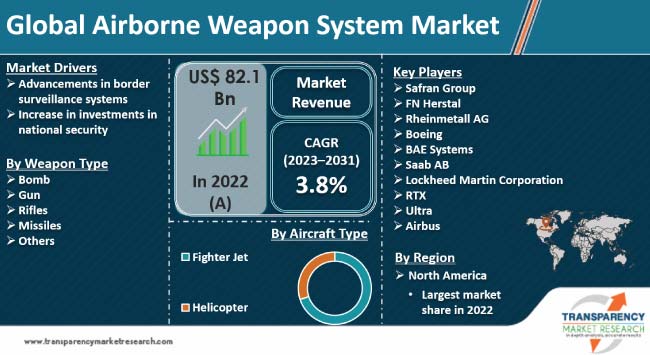

Advancements in border surveillance systems are propelling the global airborne weapon system industry. Rise in border security concerns and surge in global conflicts are driving demand for airborne weapon systems. Cyber threats and national data security concerns are on the rise, which is increasing demand for technically advanced national security systems. Furthermore, increase in investment in national security is expected to bolster the global airborne weapon system market size during the forecast period.

Rise in adoption of remote weapon systems are fueling the market value. Manufacturers in the market are forming collaborations and mergers by signing business agreements to gain lucrative airborne weapon system market opportunities. They are heavily investing in technological developments to launch new weapon systems with high accuracy and precision.

Airborne weapon system is a set of devices comprising delivery vehicles and weapons along with the integral equipment required for transporting or carrying the weapon system by air. These systems hold weapons and components necessary for proper functioning, such as targeting or guidance devices.

Airborne weapon systems are utilized for military aviation weapons such as automatic gun fire control systems, multiple weapon release systems, fuse function control systems, jettison systems, and missile control systems.

Offensive counter air and defensive counter air are some of the major types of airborne weapon system. These systems hold various aircraft weapons according to its capacity and specifications. Airborne weapons should be managed and controlled precisely to ensure effective results and avoid conflicts. These systems are employed in strategic, operational, and tactical levels of warfare.

Border surveillance systems are developed to assess weather and monitor border area. These systems play pivotal role in security management of the specified areas. Rapid developments and advancements in border surveillance systems, such as remote weapon systems and autonomous fighter drones are augmenting the airborne weapon system market revenue. Portable weapon stations, including Containerized Based Remote Weapon Systems (CBRWS), are likely to enhance border security of countries.

Increase in adoption of remote weapon stations to increase intrusion detection rates at borders is fueling market expansion. These remote weapon stations are deployed strategically to restrict illegal immigration and drug trafficking issues. Moreover, implementation of stringent government regulations on border surveillance system security is propelling market progress.

Major disruptions in global defense and aerospace industry are driving the demand for military equipment. Governments across the globe are investing significantly in research & development to incorporate advanced technologies in order to enhance national security systems.

Artificial intelligence, robotics, cyber security, information warfare, and cloud computing are some of the advanced technologies incorporated in national security systems. Thus, rapid adoption of these technologies is bolstering the airborne weapon system market dynamics.

Rise in demand for airborne laser weapon systems is boosting market statistics. Laser weapon systems ensure accuracy and efficiency along with high operational capacity. These systems are utilized to improve border security during conflicts or other potential threats. Targeting systems widely use laser weapon systems to precisely point their targets.

As per the airborne weapon system market analysis, North America dominated the global industry in 2022. Increase in investments in national security by public and government organizations in likely to propel the airborne weapon system industry in the region in the next few years. For instance, the United States Army awarded a 5-year IDIQ contract valued US$ 1.5 Bn to Kongsberg Defence & Aerospace AS to continue the supply of the Common Remotely Operated Weapon Station (CROWS).

Increase in research and development activities in military and defense sector to improve border surveillance systems in the region is driving market value. Leading players in the industry are focusing on mounting sensors and day cameras to enhance border security levels.

Leading manufacturers of airborne weapon system are focusing on adopting advanced technologies to ensure accuracy and increase operational capacity of their weapon systems. Launch of new and fully equipped weapons allow companies to increase security by providing precise features to manage the weapons. Moreover, leading companies in the industry are signing agreements to provide their security services for specified period of time, which in turn is fueling profitability.

Safran Group, FN Herstal, Rheinmetall AG, Boeing, BAE Systems, Saab AB, Lockheed Martin Corporation, RTX, Ultra, and Airbus are the prominent players in the market.

These companies have been profiled in the airborne weapon system market report based on various parameters such as business strategies, financial overview, product portfolio, company overview, recent developments, and business segments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 82.1 Bn |

| Market Forecast (Value) in 2031 | US$ 114.4 Bn |

| Growth Rate (CAGR) | 3.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 82.1 Bn in 2022.

It is projected to register a CAGR of 3.8% from 2023 to 2031

Advancements in border surveillance systems and increase in investments in national security

North America was the most lucrative region in 2022

Safran Group, FN Herstal, Rheinmetall AG, Boeing, BAE Systems, Saab AB, Lockheed Martin Corporation, RTX, Ultra, and Airbus

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Airborne Weapon System Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Airborne Weapon System Market Analysis, by Aircraft Type

5.1. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Aircraft Type, 2017–2031

5.1.1. Fighter Jet

5.1.2. Helicopter

5.2. Market Attractiveness Analysis, by Aircraft Type

6. Global Airborne Weapon System Market Analysis, by Weapon Type

6.1. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Weapon Type, 2017–2031

6.1.1. Bomb

6.1.2. Gun

6.1.3. Rifles

6.1.4. Missiles

6.1.5. Others

6.2. Market Attractiveness Analysis, by Weapon Type

7. Global Airborne Weapon System Market Analysis and Forecast, by Region

7.1. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Region, 2017–2031

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. South America

7.2. Market Attractiveness Analysis, by Region

8. North America Airborne Weapon System Market Analysis and Forecast

8.1. Market Snapshot

8.2. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Aircraft Type, 2017–2031

8.2.1. Fighter Jet

8.2.2. Helicopter

8.3. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Weapon Type, 2017–2031

8.3.1. Bomb

8.3.2. Gun

8.3.3. Rifles

8.3.4. Missiles

8.3.5. Others

8.4. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Country, 2017–2031

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

8.5. Market Attractiveness Analysis

8.5.1. By Aircraft Type

8.5.2. By Weapon Type

8.5.3. By Country

9. Europe Airborne Weapon System Market Analysis and Forecast

9.1. Market Snapshot

9.2. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Aircraft Type, 2017–2031

9.2.1. Fighter Jet

9.2.2. Helicopter

9.3. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Weapon Type, 2017–2031

9.3.1. Bomb

9.3.2. Gun

9.3.3. Rifles

9.3.4. Missiles

9.3.5. Others

9.4. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Country/Sub-region, 2017–2031

9.4.1. U.K.

9.4.2. Germany

9.4.3. France

9.4.4. Rest of Europe

9.5. Market Attractiveness Analysis

9.5.1. By Aircraft Type

9.5.2. By Weapon Type

9.5.3. By Country/Sub-region

10. Asia Pacific Airborne Weapon System Market Analysis and Forecast

10.1. Market Snapshot

10.2. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Aircraft Type, 2017–2031

10.2.1. Fighter Jet

10.2.2. Helicopter

10.3. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Weapon Type, 2017–2031

10.3.1. Bomb

10.3.2. Gun

10.3.3. Rifles

10.3.4. Missiles

10.3.5. Others

10.4. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Country/Sub-region, 2017–2031

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. South Korea

10.4.5. ASEAN

10.4.6. Rest of Asia Pacific

10.5. Market Attractiveness Analysis

10.5.1. By Aircraft Type

10.5.2. By Weapon Type

10.5.3. By Country/Sub-region

11. Middle East & Africa Airborne Weapon System Market Analysis and Forecast

11.1. Market Snapshot

11.2. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Aircraft Type, 2017–2031

11.2.1. Fighter Jet

11.2.2. Helicopter

11.3. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Weapon Type, 2017–2031

11.3.1. Bomb

11.3.2. Gun

11.3.3. Rifles

11.3.4. Missiles

11.3.5. Others

11.4. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Country/Sub-region, 2017–2031

11.4.1. GCC

11.4.2. South Africa

11.4.3. Rest of Middle East & Africa

11.5. Market Attractiveness Analysis

11.5.1. By Aircraft Type

11.5.2. By Weapon Type

11.5.3. By Country/Sub-region

12. South America Airborne Weapon System Market Analysis and Forecast

12.1. Market Snapshot

12.2. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Aircraft Type, 2017–2031

12.2.1. Fighter Jet

12.2.2. Helicopter

12.3. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Weapon Type, 2017–2031

12.3.1. Bomb

12.3.2. Gun

12.3.3. Rifles

12.3.4. Missiles

12.3.5. Others

12.4. Airborne Weapon System Market Size (US$ Bn) Analysis & Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Rest of South America

12.5. Market Attractiveness Analysis

12.5.1. By Aircraft Type

12.5.2. By Weapon Type

12.5.3. By Country/Sub-region

13. Competition Assessment

13.1. Global Airborne Weapon System Market Competition Matrix - a Dashboard View

13.1.1. Global Airborne Weapon System Market Company Share Analysis, by Value (2022)

13.1.2. Technological Differentiator

14. Company Profiles (Global Manufacturers/Suppliers)

14.1. Safran Group

14.1.1. Overview

14.1.2. Product Portfolio

14.1.3. Sales Footprint

14.1.4. Key Subsidiaries or Distributors

14.1.5. Strategy and Recent Developments

14.1.6. Key Financials

14.2. FN Herstal

14.2.1. Overview

14.2.2. Product Portfolio

14.2.3. Sales Footprint

14.2.4. Key Subsidiaries or Distributors

14.2.5. Strategy and Recent Developments

14.2.6. Key Financials

14.3. Rheinmetall AG

14.3.1. Overview

14.3.2. Product Portfolio

14.3.3. Sales Footprint

14.3.4. Key Subsidiaries or Distributors

14.3.5. Strategy and Recent Developments

14.3.6. Key Financials

14.4. Boeing

14.4.1. Overview

14.4.2. Product Portfolio

14.4.3. Sales Footprint

14.4.4. Key Subsidiaries or Distributors

14.4.5. Strategy and Recent Developments

14.4.6. Key Financials

14.5. BAE Systems

14.5.1. Overview

14.5.2. Product Portfolio

14.5.3. Sales Footprint

14.5.4. Key Subsidiaries or Distributors

14.5.5. Strategy and Recent Developments

14.5.6. Key Financials

14.6. Saab AB

14.6.1. Overview

14.6.2. Product Portfolio

14.6.3. Sales Footprint

14.6.4. Key Subsidiaries or Distributors

14.6.5. Strategy and Recent Developments

14.6.6. Key Financials

14.7. Lockheed Martin Corporation

14.7.1. Overview

14.7.2. Product Portfolio

14.7.3. Sales Footprint

14.7.4. Key Subsidiaries or Distributors

14.7.5. Strategy and Recent Developments

14.7.6. Key Financials

14.8. RTX

14.8.1. Overview

14.8.2. Product Portfolio

14.8.3. Sales Footprint

14.8.4. Key Subsidiaries or Distributors

14.8.5. Strategy and Recent Developments

14.8.6. Key Financials

14.9. Ultra

14.9.1. Overview

14.9.2. Product Portfolio

14.9.3. Sales Footprint

14.9.4. Key Subsidiaries or Distributors

14.9.5. Strategy and Recent Developments

14.9.6. Key Financials

14.10. Airbus

14.10.1. Overview

14.10.2. Product Portfolio

14.10.3. Sales Footprint

14.10.4. Key Subsidiaries or Distributors

14.10.5. Strategy and Recent Developments

14.10.6. Key Financials

15. Go to Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Airborne Weapon System Market Value (US$ Bn) & Forecast, by Aircraft Type, 2017‒2031

Table 2: Global Airborne Weapon System Market Value (US$ Bn) & Forecast, by Weapon Type, 2017‒2031

Table 3: Global Airborne Weapon System Market Value (US$ Bn) & Forecast, by Region, 2017‒2031

Table 4: North America Airborne Weapon System Market Value (US$ Bn) & Forecast, by Aircraft Type, 2017‒2031

Table 5: North America Airborne Weapon System Market Value (US$ Bn) & Forecast, by Weapon Type, 2017‒2031

Table 6: North America Airborne Weapon System Market Value (US$ Bn) & Forecast, by Country/Sub-region, 2017‒2031

Table 7: Europe Airborne Weapon System Market Value (US$ Bn) & Forecast, by Aircraft Type, 2017‒2031

Table 8: Europe Airborne Weapon System Market Value (US$ Bn) & Forecast, by Weapon Type, 2017‒2031

Table 9: Europe Airborne Weapon System Market Value (US$ Bn) & Forecast, by Country/Sub-region, 2017‒2031

Table 10: Asia Pacific Airborne Weapon System Market Value (US$ Bn) & Forecast, by Aircraft Type, 2017‒2031

Table 11: Asia Pacific Airborne Weapon System Market Value (US$ Bn) & Forecast, by Weapon Type, 2017‒2031

Table 12: Asia Pacific Airborne Weapon System Market Value (US$ Bn) & Forecast, by Country/Sub-region, 2017‒2031

Table 13: Middle East & Africa Airborne Weapon System Market Value (US$ Bn) & Forecast, by Aircraft Type, 2017‒2031

Table 14: Middle East & Africa Airborne Weapon System Market Value (US$ Bn) & Forecast, by Weapon Type, 2017‒2031

Table 15: Middle East & Africa Airborne Weapon System Market Value (US$ Bn) & Forecast, by Country/Sub-region, 2017‒2031

Table 16: South America Airborne Weapon System Market Value (US$ Bn) & Forecast, by Aircraft Type, 2017‒2031

Table 17: South America Airborne Weapon System Market Value (US$ Bn) & Forecast, by Weapon Type, 2017‒2031

Table 18: South America Airborne Weapon System Market Value (US$ Bn) & Forecast, by Country/Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Airborne Weapon System Market

Figure 02: Porter Five Forces Analysis - Global Airborne Weapon System Market

Figure 03: Technology Road Map - Global Airborne Weapon System Market

Figure 04: Global Airborne Weapon System Market Value (US$ Bn), 2017-2031

Figure 05: Global Airborne Weapon System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global Airborne Weapon System Market Projections, by Aircraft Type, Value (US$ Bn), 2017‒2031

Figure 7: Global Airborne Weapon System Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 8: Global Airborne Weapon System Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 9: Global Airborne Weapon System Market Projections, by Weapon Type, Value (US$ Bn), 2017‒2031

Figure 10: Global Airborne Weapon System Market, Incremental Opportunity, by Weapon Type, 2023‒2031

Figure 11: Global Airborne Weapon System Market Share Analysis, by Weapon Type, 2022 and 2031

Figure 12: Global Airborne Weapon System Market Projections, by Region, Value (US$ Bn), 2017‒2031

Figure 13: Global Airborne Weapon System Market, 2023‒2031 Opportunity, by Region, 2023‒2031

Figure 14: Global Airborne Weapon System Market Share Analysis, by Region, 2022 and 2031

Figure 15: North America Airborne Weapon System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 16: North America Airborne Weapon System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 17: North America Airborne Weapon System Market Projections, by Aircraft Type (US$ Bn), 2017‒2031

Figure 18: North America Airborne Weapon System Market, 2023‒2031 Opportunity, by Aircraft Type, 2023‒2031

Figure 19: North America Airborne Weapon System Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 20: North America Airborne Weapon System Market Projections, by Weapon Type Value (US$ Bn), 2017‒2031

Figure 21: North America Airborne Weapon System Market, 2023‒2031 Opportunity, by Weapon Type, 2023‒2031

Figure 22: North America Airborne Weapon System Market Share Analysis, by Weapon Type, 2022 and 2031

Figure 23: North America Airborne Weapon System Market Projections, by Country, Value (US$ Bn), 2017‒2031

Figure 24: North America Airborne Weapon System Market, 2023‒2031 Opportunity, by Country/Sub-region, 2023‒2031

Figure 25: North America Airborne Weapon System Market Share Analysis, by Country, 2022 and 2031

Figure 26: Europe Airborne Weapon System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 27: Europe Airborne Weapon System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 28: Europe Airborne Weapon System Market Projections, by Aircraft Type, Value (US$ Bn), 2017‒2031

Figure 29: Europe Airborne Weapon System Market, 2023‒2031 Opportunity, by Aircraft Type, 2023‒2031

Figure 30: Europe Airborne Weapon System Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 31: Europe Airborne Weapon System Market Projections, by Weapon Type, Value (US$ Bn), 2017‒2031

Figure 32: Europe Airborne Weapon System Market, 2023‒2031 Opportunity, by Weapon Type, 2023‒2031

Figure 33: Europe Airborne Weapon System Market Share Analysis, by Weapon Type, 2022 and 2031

Figure 34: Europe Airborne Weapon System Market Projections, by Country/Sub-region, Value (US$ Bn), 2017‒2031

Figure 35: Europe Airborne Weapon System Market, 2023‒2031 Opportunity, by Country/Sub-region, 2023‒2031

Figure 36: Europe Airborne Weapon System Market Share Analysis, by Country/Sub-region 2022 and 2031

Figure 37: Asia Pacific Airborne Weapon System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 38: Asia Pacific Airborne Weapon System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 39: Asia Pacific Airborne Weapon System Market Projections, by Aircraft Type, Value (US$ Bn), 2017‒2031

Figure 40: Asia Pacific Airborne Weapon System Market, 2023‒2031 Opportunity, by Aircraft Type, 2023‒2031

Figure 41: Asia Pacific Airborne Weapon System Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 42: Asia Pacific Airborne Weapon System Market Projections, by Weapon Type, Value (US$ Bn), 2017‒2031

Figure 43: Asia Pacific Airborne Weapon System Market, Incremental Opportunity, by Weapon Type, 2023‒2031

Figure 44: Asia Pacific Airborne Weapon System Market Share Analysis, by Weapon Type, 2022 and 2031

Figure 45: Asia Pacific Airborne Weapon System Market Projections, by Country/Sub-region, Value (US$ Bn), 2017‒2031

Figure 46: Asia Pacific Airborne Weapon System Market, Incremental Opportunity, by Country/Sub-region, 2023‒2031

Figure 47: Asia Pacific Airborne Weapon System Market Share Analysis, by Country/Sub-region 2022 and 2031

Figure 48: Middle East & Africa Airborne Weapon System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 49: Middle East & Africa Airborne Weapon System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 50: Middle East & Africa Airborne Weapon System Market Projections, by Aircraft Type, Value (US$ Bn), 2017‒2031

Figure 51: Middle East & Africa Airborne Weapon System Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 52: Middle East & Africa Airborne Weapon System Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 53: Middle East & Africa Airborne Weapon System Market Projections, by Weapon Type, Value (US$ Bn), 2017‒2031

Figure 54: Middle East & Africa Airborne Weapon System Market, Incremental Opportunity, by Weapon Type, 2023‒2031

Figure 55: Middle East & Africa Airborne Weapon System Market Share Analysis, by Weapon Type, 2022 and 2031

Figure 56: Middle East & Africa Airborne Weapon System Market Projections, by Country/Sub-region, Value (US$ Bn), 2017‒2031

Figure 57: Middle East & Africa Airborne Weapon System Market, Incremental Opportunity, by Country/Sub-region, 2023‒2031

Figure 58: Middle East & Africa Airborne Weapon System Market Share Analysis, by Country/Sub-region 2022 and 2031

Figure 59: South America Airborne Weapon System Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 60: South America Airborne Weapon System Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 61: South America Airborne Weapon System Market Projections, by Aircraft Type, Value (US$ Bn), 2017‒2031

Figure 62: South America Airborne Weapon System Market, Incremental Opportunity, by Aircraft Type, 2023‒2031

Figure 63: South America Airborne Weapon System Market Share Analysis, by Aircraft Type, 2022 and 2031

Figure 64: South America Airborne Weapon System Market Projections, by Weapon Type Value (US$ Bn), 2017‒2031

Figure 65: South America Airborne Weapon System Market, Incremental Opportunity, by Weapon Type, 2023‒2031

Figure 66: South America Airborne Weapon System Market Share Analysis, by Weapon Type, 2022 and 2031

Figure 67: South America Airborne Weapon System Market Projections, by Country/Sub-region, Value (US$ Bn), 2017‒2031

Figure 68: South America Airborne Weapon System Market, Incremental Opportunity, by Country/Sub-region, 2023‒2031

Figure 69: South America Airborne Weapon System Market Share Analysis, by Country/Sub-region 2022 and 2031

Figure 70: Global Airborne Weapon System Market Competition

Figure 71: Global Airborne Weapon System Market Company Share Analysis