Analyst Viewpoint

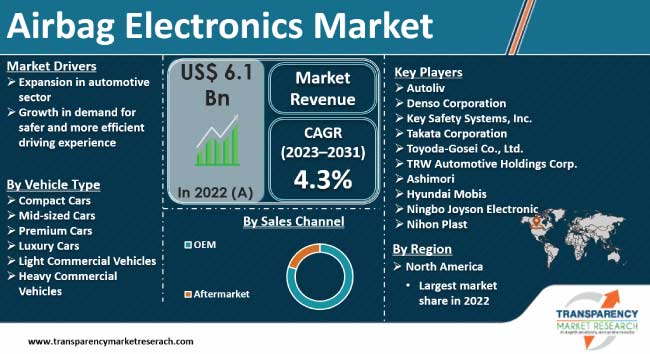

Expansion in automotive sector and growth in demand for safer & more efficient driving experiences are driving the airbag electronics market size. Expansion in the automotive sector calls for higher deployment of airbags, with government agencies mandating their deployment for protection against damage during accidents.

Deployment of airbag electronics ascertains that the drivers as well as passengers sustain minimum injuries in case of a vehicle crash. Vehicle density worldwide has increased twofold between 2022 and 2023 alone and the scenario is expected to persist even during the forecast period. Increase in demand for safer transit on roads is expected to spur the airbag electronics market growth during the forecast period. Vendors in the industry are investing in the R&D of new products to expand their product portfolio.

OEMs are engaged in the upgradation of electronic control units used for regulating the deployment of airbags in automobiles. At present, smart airbags are integrated in various vehicles, thereby extending the efficiency of airbag electronics in the modulation of safety of automobiles and occupants. Advanced airbag sensor technology comprising crash sensors uses intelligent sensing technologies for side and front crash detection. Freescale’s Xtrinsic MMA65xxKW accelerometers have been employed in automobiles for crash detection since 2012.

However, the fact that airbags are unsafe for women who are driving during pregnancy can’t be ignored, as abrupt push could hurt the womb. If pets are sitting on the thighs of the driver, they might succumb to push-force. These factors may restrain the airbag electronics market landscape during the forecast period.

Airbag electronics has been made compulsory for Light Commercial Vehicles (LCVs) and trucks. This is in the wake of a noticeable increase in fatal accidents. As per the Association for Safe International Road Travel, 3,287 deaths are witnessed due to traffic accidents every single day. Automakers are concentrating on the inclusion of safety features in their vehicles. ZF Friedrichshafen AG provided knee airbags in 2019. One of the advantages of airbag electronics is that even if a driver misses to fasten their seatbelt, they would be saved from hitting their head in case of collision.

Various government agencies have laid down regulations wherein they ask for the installation of vehicle safety modules stating the advantages of airbag electronics in automobiles. As per the European Automobile Manufacturers’ Association, 82 million automobiles are sold every year, with Europe witnessing an addition of 11 million new vehicles per year. Thus, exponential expansion in the automotive sector is driving the airbag electronics market progress forecast during the forecast period.

Airbag electronics, also known as airbag deployment systems, start measuring impact severity the moment the automotive starts crashing. If a crash is severe, the systems instruct inflators to have the bags filled immediately. As per the National Center for Statistics and Analysis, 2020, front airbags in frontal crashes cut down drivers’ deaths by 29% and those of front-seat passengers aged 13 and older by 32%. It further states that side airbags along with head protection curtail car driver’s fatality risk in driver-side crashes by 37%. In the case of SUV drivers, the risk gets reduced by 52%. Mandatory deployment of automotive airbag technology in developed countries due to the advantages mentioned above is expected to drive the airbag electronics market dynamics during the forecast period.

North America held the largest airbag electronics market share. This can be ascribed to the increase in the frequency of road accidents followed by stringent regulations laid down by the governments in the U.S. and Canada regarding airbags to be made mandatory in vehicles, especially luxury ones.

Rise in demand for safety features in vehicles coupled with growth in number of regulations regarding vehicle safety is expected to drive the airbag electronics market value in Europe during the forecast period. Growth in need for safety of driver as well as passengers, increase in production of vehicles, and expanding usage of active and passive safety technologies in Korea, Japan, and China are expected to drive the airbag electronics demand in Asia Pacific during the forecast period.

Airbag electronics manufacturers are involved in expanding their product portfolio in unexplored geographies to cater to the demands by various car manufacturers. Airbag electronics market analysis highlights that the year 2026 is bound to see sales of over 237,500 thousand units of airbag electronics worldwide.

Autoliv, Denso Corporation, Key Safety Systems, Inc., Takata Corporation, Toyoda-Gosei Co., Ltd., TRW Automotive Holdings Corp., Ashimori, Hyundai Mobis, Ningbo Joyson Electronic, and Nihon Plast have been profiled in the airbag electronics market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 6.1 Bn |

| Forecast (Value) in 2031 | US$ 9.1 Bn |

| Growth Rate (CAGR) | 4.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

It was valued at US$ 6.1 Bn in 2022

It is projected to grow at a CAGR of 4.3% from 2023 to 2031

Expansion in automotive sector and growth in demand for safer and more efficient driving experiences

The OEM segment held the largest share in 2022

North America is estimated to dominate in the next few years

Autoliv, Denso Corporation, Key Safety Systems, Inc., Takata Corporation, Toyoda-Gosei Co., Ltd., TRW Automotive Holdings Corp., Ashimori, Hyundai Mobis, Ningbo Joyson Electronic, and Nihon Plast

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Mn, 2017-2031

1.2. Go to Market Strategy

1.2.1. Demand & Supply Side Trends

1.2.2. Identification of Potential Market Spaces

1.2.3. Understanding the Buying Process of Customers

1.2.4. Preferred Sales & Marketing Strategy

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Market Definition / Scope / Limitations

2.2. Macro-Economic Factors

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Market Factor Analysis

2.4.1. Porter’s Five Force Analysis

2.4.2. SWOT Analysis

2.5. Regulatory Scenario

2.6. Key Trend Analysis

2.7. Value Chain Analysis

2.8. Cost Structure Analysis

2.9. Profit Margin Analysis

3. Global Airbag Electronics Market, by Vehicle Type

3.1. Market Snapshot

3.1.1. Introduction, Definition, and Key Findings

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

3.2.1. Compact Cars

3.2.2. Mid-sized Cars

3.2.3. Premium Cars

3.2.4. Luxury Cars

3.2.5. Light Commercial Vehicles

3.2.6. Heavy Commercial Vehicles

4. Global Airbag Electronics Market, by Sales Channel

4.1. Market Snapshot

4.1.1. Introduction, Definition, and Key Findings

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Sales Channel

4.2.1. OEM

4.2.2. Aftermarket

5. Global Airbag Electronics Market, by Region

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Region

5.2.1. North America

5.2.2. Europe

5.2.3. Asia Pacific

5.2.4. Middle East & Africa

5.2.5. South America

6. North America Airbag Electronics Market

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. North America Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

6.2.1. Compact Cars

6.2.2. Mid-sized Cars

6.2.3. Premium Cars

6.2.4. Luxury Cars

6.2.5. Light Commercial Vehicles

6.2.6. Heavy Commercial Vehicles

6.3. North America Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Sales Channel

6.3.1. OEM

6.3.2. Aftermarket

6.4. Key Country Analysis – North America Airbag Electronics Market Size Analysis & Forecast, 2017-2031

6.4.1. U.S.

6.4.2. Canada

6.4.3. Mexico

7. Europe Airbag Electronics Market

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Europe Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

7.2.1. Compact Cars

7.2.2. Mid-sized Cars

7.2.3. Premium Cars

7.2.4. Luxury Cars

7.2.5. Light Commercial Vehicles

7.2.6. Heavy Commercial Vehicles

7.3. Europe Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Sales Channel

7.3.1. OEM

7.3.2. Aftermarket

7.4. Key Country Analysis – Europe Airbag Electronics Market Size Analysis & Forecast, 2017-2031

7.4.1. Germany

7.4.2. U. K.

7.4.3. France

7.4.4. Italy

7.4.5. Spain

7.4.6. Nordic Countries

7.4.7. Russia & CIS

7.4.8. Rest of Europe

8. Asia Pacific Airbag Electronics Market

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Asia Pacific Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

8.2.1. Compact Cars

8.2.2. Mid-sized Cars

8.2.3. Premium Cars

8.2.4. Luxury Cars

8.2.5. Light Commercial Vehicles

8.2.6. Heavy Commercial Vehicles

8.3. Asia Pacific Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Sales Channel

8.3.1. OEM

8.3.2. Aftermarket

8.4. Key Country Analysis – Asia Pacific Airbag Electronics Market Size Analysis & Forecast, 2017-2031

8.4.1. China

8.4.2. India

8.4.3. Japan

8.4.4. ASEAN Countries

8.4.5. South Korea

8.4.6. ANZ

8.4.7. Rest of Asia Pacific

9. Middle East & Africa Airbag Electronics Market

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Middle East & Africa Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

9.2.1. Compact Cars

9.2.2. Mid-sized Cars

9.2.3. Premium Cars

9.2.4. Luxury Cars

9.2.5. Light Commercial Vehicles

9.2.6. Heavy Commercial Vehicles

9.3. Middle East & Africa Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Sales Channel

9.3.1. OEM

9.3.2. Aftermarket

9.4. Key Country Analysis – Middle East & Africa Airbag Electronics Market Size Analysis & Forecast, 2017-2031

9.4.1. GCC

9.4.2. South Africa

9.4.3. Turkey

9.4.4. Rest of Middle East & Africa

10. South America Airbag Electronics Market

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. South America Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

10.2.1. Compact Cars

10.2.2. Mid-sized Cars

10.2.3. Premium Cars

10.2.4. Luxury Cars

10.2.5. Light Commercial Vehicles

10.2.6. Heavy Commercial Vehicles

10.3. South America Airbag Electronics Market Size Analysis & Forecast, 2017-2031, by Sales Channel

10.3.1. OEM

10.3.2. Aftermarket

10.4. Key Country Analysis – South America Airbag Electronics Market Size Analysis & Forecast, 2017-2031

10.4.1. Brazil

10.4.2. Argentina

10.4.3. Rest of South America

11. Competitive Landscape

11.1. Company Share Analysis/ Brand Share Analysis, 2022

11.2. Company Analysis for Each Player Company Overview, Company Footprints, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis

12. Company Profiles/ Key Players

12.1. Autoliv

12.1.1. Company Overview

12.1.2. Company Footprints

12.1.3. Product Portfolio

12.1.4. Competitors & Customers

12.1.5. Subsidiaries & Parent Organization

12.1.6. Recent Developments

12.1.7. Financial Analysis

12.2. Denso Corporation

12.2.1. Company Overview

12.2.2. Company Footprints

12.2.3. Product Portfolio

12.2.4. Competitors & Customers

12.2.5. Subsidiaries & Parent Organization

12.2.6. Recent Developments

12.2.7. Financial Analysis

12.3. Key Safety Systems, Inc.

12.3.1. Company Overview

12.3.2. Company Footprints

12.3.3. Product Portfolio

12.3.4. Competitors & Customers

12.3.5. Subsidiaries & Parent Organization

12.3.6. Recent Developments

12.3.7. Financial Analysis

12.4. Takata Corporation

12.4.1. Company Overview

12.4.2. Company Footprints

12.4.3. Product Portfolio

12.4.4. Competitors & Customers

12.4.5. Subsidiaries & Parent Organization

12.4.6. Recent Developments

12.4.7. Financial Analysis

12.5. Toyoda-Gosei Co., Ltd.

12.5.1. Company Overview

12.5.2. Company Footprints

12.5.3. Product Portfolio

12.5.4. Competitors & Customers

12.5.5. Subsidiaries & Parent Organization

12.5.6. Recent Developments

12.5.7. Financial Analysis

12.6. TRW Automotive Holdings Corp.

12.6.1. Company Overview

12.6.2. Company Footprints

12.6.3. Product Portfolio

12.6.4. Competitors & Customers

12.6.5. Subsidiaries & Parent Organization

12.6.6. Recent Developments

12.6.7. Financial Analysis

12.7. Ashimori

12.7.1. Company Overview

12.7.2. Company Footprints

12.7.3. Product Portfolio

12.7.4. Competitors & Customers

12.7.5. Subsidiaries & Parent Organization

12.7.6. Recent Developments

12.7.7. Financial Analysis

12.8. Hyundai Mobis

12.8.1. Company Overview

12.8.2. Company Footprints

12.8.3. Product Portfolio

12.8.4. Competitors & Customers

12.8.5. Subsidiaries & Parent Organization

12.8.6. Recent Developments

12.8.7. Financial Analysis

12.9. Ningbo Joyson Electronic

12.9.1. Company Overview

12.9.2. Company Footprints

12.9.3. Product Portfolio

12.9.4. Competitors & Customers

12.9.5. Subsidiaries & Parent Organization

12.9.6. Recent Developments

12.9.7. Financial Analysis

12.10. Nihon Plast

12.10.1. Company Overview

12.10.2. Company Footprints

12.10.3. Product Portfolio

12.10.4. Competitors & Customers

12.10.5. Subsidiaries & Parent Organization

12.10.6. Recent Developments

12.10.7. Financial Analysis

List of Tables

Table 1: Global Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 2: Global Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 3: Global Airbag Electronics Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 4: North America Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 5: North America Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 6: North America Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 7: Europe Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 8: Europe Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 9: Europe Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 10: Asia Pacific Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 11: Asia Pacific Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 12: Asia Pacific Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 13: Middle East & Africa Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 14: Middle East & Africa Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 15: Middle East & Africa Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 16: South America Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 17: South America Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Table 18: South America Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 2: Global Airbag Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 3: Global Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 4: Global Airbag Electronics Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 5: Global Airbag Electronics Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Figure 6: Global Airbag Electronics Market, Incremental Opportunity, by Region, Value (US$ Mn), 2023‒2031

Figure 7: North America Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 8: North America Airbag Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 9: North America Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 10: North America Airbag Electronics Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 11: North America Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 12: North America Airbag Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 13: Europe Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 14: Europe Airbag Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 15: Europe Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 16: Europe Airbag Electronics Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 17: Europe Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 18: Europe Airbag Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 19: Asia Pacific Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 20: Asia Pacific Airbag Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 21: Asia Pacific Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 22: Asia Pacific Airbag Electronics Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 23: Asia Pacific Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 24: Asia Pacific Airbag Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 25: Middle East & Africa Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 26: Middle East & Africa Airbag Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 27: Middle East & Africa Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 28: Middle East & Africa Airbag Electronics Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 29: Middle East & Africa Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 30: Middle East & Africa Airbag Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031

Figure 31: South America Airbag Electronics Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 32: South America Airbag Electronics Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2023‒2031

Figure 33: South America Airbag Electronics Market Value (US$ Mn) Forecast, by Sales Channel, 2017‒2031

Figure 34: South America Airbag Electronics Market, Incremental Opportunity, by Sales Channel, Value (US$ Mn), 2023‒2031

Figure 35: South America Airbag Electronics Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 36: South America Airbag Electronics Market, Incremental Opportunity, by Country, Value (US$ Mn), 2023‒2031