Analysts’ Viewpoint on Market Scenario

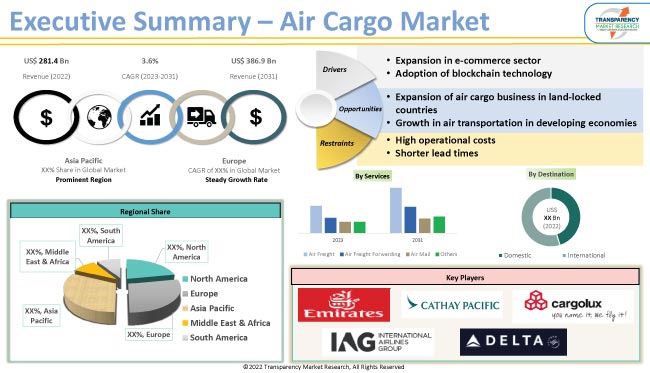

Expansion in the e-commerce sector and adoption of blockchain technology are expected to propel the global air cargo market value in the near future. Expansion of the air cargo business in landlocked countries and growth in air transportation in developing economies are likely to offer lucrative opportunities for service providers in the global air cargo industry.

High operational costs and shorter lead times are major challenges leading to market limitations. Service providers are opting for fuel-efficient aircraft and outsourcing some of their non-core operations to lower operational costs.

Air cargo service is a mode of cargo transportation that uses aircraft, such as planes and helicopters, to provide contract air transportation of cargo and mail over fixed international or domestic routes. It is provided by specialized cargo airlines and passenger airlines that offer cargo services as an additional revenue stream. Air cargo services are typically faster and more reliable than other forms of transportation, such as sea or ground transportation, making them an ideal choice for time-sensitive shipments.

The COVID-19 pandemic adversely impacted the air cargo market growth due to decline in international trade and economic activity worldwide. However, according to data published by the International Air Transport Association (IATA) in January 2021, for the first time since the start of the crisis, airfreight demand reached pre-COVID levels of January 2019. Pre-crisis volumes of the airfreight business increased due to the movement of PPE, vaccines, and life-saving medical equipment. Moreover, e-commerce delivery during lockdowns also propelled the market growth significantly.

Rise in penetration of smartphones and internet has led to significant growth in the e-commerce sector worldwide. Air cargo services offer several advantages over other forms of transportation for e-commerce shipments. They are much faster and more reliable than sea or ground transportation, making them an ideal choice for time-sensitive shipments. They also offer greater flexibility and security, with the ability to transport goods of almost any size or weight, as well as the ability to accommodate special handling requirements. Thus, growth in the e-commerce sector is boosting the air cargo market dynamics.

Shipping of special commodities and postal parcels has witnessed significant rise in the last few years. As per IATA’s data, the number of postal parcels grew from 6.7 billion to 7.4 billion in 2021. This, in turn, is likely to augment the demand for air cargo.

Blockchain technology can help air cargo businesses boost productivity, reduce losses, and avoid cargo damage. It has the potential to improve the management of Unit Load Devices (ULDs), which are standardized containers and pallets used in air cargo transportation. Blockchain can be employed to track and monitor ULDs throughout their lifecycle, from production to disposal. This can help reduce the loss of ULDs, improve asset utilization, and increase transparency in the supply chain.

The Blockchain in Transport Association (BiTA) is advocating for a uniform implementation of blockchain in the logistics sector. Union Pacific, UPS, FedEx, DHL, and other significant market participants have joined BiTA. Blockchain technology has the potential to save the airfreight sector US$ 400 Mn annually, according to SITA, a communications and information technology business for the aviation industry. Therefore, rise in usage of blockchain technology is projected to boost the air cargo market development.

According to the latest air cargo market trends, the air freight services segment is expected to hold largest share from 2023 to 2031. Growth of the segment can be ascribed to rise in number of air cargo routes and development of effective tracking solutions. Air freights have better lead times, which makes them ideal for time-sensitive shipments.

According to the latest air cargo market research, the freighter carrier type segment is projected to dominate the industry during the forecast period. Freighters are typically more efficient for transporting large volumes of cargo over long distances than passenger aircraft. They are designed to maximize cargo space and can carry heavier loads than passenger aircraft.

Freighters are widely employed in Asia Pacific, North America, and Europe for daily cargo operations. Dedicated freighters are gaining popularity in land-locked countries for better, faster, and more efficient cargo handling.

According to the latest air cargo market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Growth in air transportation is driving market statistics in the region. As per an International Air Transport Association (IATA) data report, in August 2022, at 54.7%, Asia Pacific remained the region with the highest cargo load factor, globally, followed by Europe as the next best performer at 50.2%. Furthermore, Asia Pacific witnessed the most significant increase in seasonally adjusted air cargo tonne-kilometers (CTKs) from 2.4% Y-o-Y in July to 12.4% Y-o-Y in August, and Latin America maintained its double-digit growth of 24.7% Y-o-Y.

FedEx, United Parcel Service Inc., The Emirates Group, Cathay Pacific Airways Limited, Cargolux Airlines International S.A., China Airlines Ltd., Japan Airlines Co., Ltd., Qatar Airways Company QCSC, Deutsche Lufthansa AG, All Nippon Airways Co., Ltd (ANA), International Consolidated Airlines Group S.A., Magma Aviation Limited, Deutsche Post DHL, Kuehne + Nagel International AG, United Airlines, American Airlines, GOL Airlines, Azul Airlines, LATAM, Copa Airlines, AirBridgeCargo Airlines, Cargojet Inc., and Delta Air Lines, Inc. are some of the key air cargo service providers worldwide.

Key players have been profiled in the air cargo market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Air cargo companies are optimizing their routes to reduce their fuel consumption and operating costs. They are also implementing comprehensive maintenance programs to reduce their maintenance costs over time. Major service providers are investing in process automation to increase their air cargo market share.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 281.4 Bn |

|

Market Forecast Value in 2031 |

US$ 386.9 Bn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 281.4 Bn in 2022

It is projected to grow at a CAGR of 3.6% from 2023 to 2031

It is projected to reach US$ 386.9 Bn by the end of 2031

Expansion in e-commerce sector and change in regulations regarding handling, storage, and distribution of air cargo

The air freight services segment is likely to hold largest share during the forecast period

Asia Pacific is projected to record the highest demand from 2023 to 2031

FedEx, United Parcel Service Inc., The Emirates Group, Cathay Pacific Airways Limited, Cargolux Airlines International S.A., China Airlines Ltd., Japan Airlines Co., Ltd., Qatar Airways Company QCSC, Deutsche Lufthansa AG, All Nippon Airways Co., Ltd (ANA), International Consolidated Airlines Group S.A., Magma Aviation Limited, Deutsche Post DHL, Kuehne + Nagel International AG, United Airlines, American Airlines, GOL Airlines, Azul Airlines, LATAM, Copa Airlines, AirBridgeCargo Airlines, Cargoj

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Size, Volume in Tons and Value in US$ Bn, 2017-2031

1.2. TMR Analysis and Recommendations

1.3. Competitive Dashboard Analysis

2. Go to Market Strategy

2.1. Demand & Supply Side Trends

2.1.1. GAP Analysis

2.2. Identification of Potential Market Spaces

2.3. Understanding Buying Process of Customers

2.4. Preferred Sales & Marketing Strategy

3. Market Overview

3.1. Market Coverage / Taxonomy

3.2. Market Definition / Scope / Limitations

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunity

3.4. Market Factor Analysis

3.4.1. Porter’s Five Force Analysis

3.4.2. SWOT Analysis

3.5. Regulatory Scenario

3.6. Key Trend Analysis

3.7. Value Chain Analysis

3.8. Cost Structure Analysis

3.9. Profit Margin Analysis

4. Special Storage and Handling Requirements and Industry-specific Expertise - Air Cargo Market

4.1. Cold Chain

4.2. Temperature Control

4.3. Perishable Commodities

4.4. Small Package Services

4.5. Sensitive Equipment

4.6. Heavy Cargo

5. Global Air Cargo Market, by Services

5.1. Market Snapshot

5.1.1. Introduction, Definition, and Key Findings

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Air Cargo Market Size & Forecast, 2017-2031, by Services

5.2.1. Air Freight

5.2.2. Air Freight Forwarding

5.2.3. Air Mail

5.2.4. Others

6. Global Air Cargo Market, by Mode of Shipping

6.1. Market Snapshot

6.1.1. Introduction, Definition, and Key Findings

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Air Cargo Market Size & Forecast, 2017-2031, by Mode of Shipping

6.2.1. Express

6.2.2. Standard

6.2.3. Economy

7. Global Air Cargo Market, by Carrier Type

7.1. Market Snapshot

7.1.1. Introduction, Definition, and Key Findings

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Air Cargo Market Size & Forecast, 2017-2031, by Carrier Type

7.2.1. Belly Cargo

7.2.2. Freighter

8. Global Air Cargo Market, by End-user

8.1. Market Snapshot

8.1.1. Introduction, Definition, and Key Findings

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Air Cargo Market Size & Forecast, 2017-2031, by End-user

8.2.1. Consumer Electronics

8.2.2. Retail

8.2.3. Third-party Logistics

8.2.4. Food and Beverages

8.2.5. Pharmaceuticals and Healthcare

8.2.6. Military

8.2.7. Others

9. Global Air Cargo Market, by Destination

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Air Cargo Market Size & Forecast, 2017-2031, by Destination

9.2.1. Domestic

9.2.2. International

10. Global Air Cargo Market, by Region

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Air Cargo Market Size & Forecast, 2017-2031, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Air Cargo Market

11.1. Market Snapshot

11.2. Air Cargo Market Size & Forecast, 2017-2031, by Services

11.2.1. Air Freight

11.2.2. Air Freight Forwarding

11.2.3. Air Mail

11.2.4. Others

11.3. Air Cargo Market Size & Forecast, 2017-2031, by Mode of Shipping

11.3.1. Express

11.3.2. Standard

11.3.3. Economy

11.4. Air Cargo Market Size & Forecast, 2017-2031, by Carrier Type

11.4.1. Belly Cargo

11.4.2. Freighter

11.5. Air Cargo Market Size & Forecast, 2017-2031, by End-user

11.5.1. Consumer Electronics

11.5.2. Retail

11.5.3. Third-party Logistics

11.5.4. Food and Beverages

11.5.5. Pharmaceuticals and Healthcare

11.5.6. Military

11.5.7. Others

11.6. Air Cargo Market Size & Forecast, 2017-2031, by Destination

11.6.1. Domestic

11.6.2. International

11.7. Key Country Analysis - North America Air Cargo Market Size & Forecast, 2017-2031

11.7.1. U. S.

11.7.2. Canada

11.7.3. Mexico

12. Europe Air Cargo Market

12.1. Market Snapshot

12.2. Air Cargo Market Size & Forecast, 2017-2031, by Services

12.2.1. Air Freight

12.2.2. Air Freight Forwarding

12.2.3. Air Mail

12.2.4. Others

12.3. Air Cargo Market Size & Forecast, 2017-2031, by Mode of Shipping

12.3.1. Express

12.3.2. Standard

12.3.3. Economy

12.4. Air Cargo Market Size & Forecast, 2017-2031, by Carrier Type

12.4.1. Belly Cargo

12.4.2. Freighter

12.5. Air Cargo Market Size & Forecast, 2017-2031, by End-user

12.5.1. Consumer Electronics

12.5.2. Retail

12.5.3. Third-party Logistics

12.5.4. Food and Beverages

12.5.5. Pharmaceuticals and Healthcare

12.5.6. Military

12.5.7. Others

12.6. Air Cargo Market Size & Forecast, 2017-2031, by Destination

12.6.1. Domestic

12.6.2. International

12.7. Key Country Analysis - Europe Air Cargo Market Size & Forecast, 2017-2031

12.7.1. Germany

12.7.2. U.K.

12.7.3. France

12.7.4. Italy

12.7.5. Spain

12.7.6. Nordic Countries

12.7.7. Russia & CIS

12.7.8. Rest of Europe

13. Asia Pacific Air Cargo Market

13.1. Market Snapshot

13.2. Air Cargo Market Size & Forecast, 2017-2031, by Services

13.2.1. Air Freight

13.2.2. Air Freight Forwarding

13.2.3. Air Mail

13.2.4. Others

13.3. Air Cargo Market Size & Forecast, 2017-2031, by Mode of Shipping

13.3.1. Express

13.3.2. Standard

13.3.3. Economy

13.4. Air Cargo Market Size & Forecast, 2017-2031, by Carrier Type

13.4.1. Belly Cargo

13.4.2. Freighter

13.5. Air Cargo Market Size & Forecast, 2017-2031, by End-user

13.5.1. Consumer Electronics

13.5.2. Retail

13.5.3. Third-party Logistics

13.5.4. Food and Beverages

13.5.5. Pharmaceuticals and Healthcare

13.5.6. Military

13.5.7. Others

13.6. Air Cargo Market Size & Forecast, 2017-2031, by Destination

13.6.1. Domestic

13.6.2. International

13.7. Key Country Analysis - Asia Pacific Air Cargo Market Size & Forecast, 2017-2031

13.7.1. China

13.7.2. India

13.7.3. Japan

13.7.4. ASEAN Countries

13.7.5. South Korea

13.7.6. ANZ

13.7.7. Rest of Asia Pacific

14. Middle East & Africa Air Cargo Market

14.1. Market Snapshot

14.2. Air Cargo Market Size & Forecast, 2017-2031, by Services

14.2.1. Air Freight

14.2.2. Air Freight Forwarding

14.2.3. Air Mail

14.2.4. Others

14.3. Air Cargo Market Size & Forecast, 2017-2031, by Mode of Shipping

14.3.1. Express

14.3.2. Standard

14.3.3. Economy

14.4. Air Cargo Market Size & Forecast, 2017-2031, by Carrier Type

14.4.1. Belly Cargo

14.4.2. Freighter

14.5. Air Cargo Market Size & Forecast, 2017-2031, by End-user

14.5.1. Consumer Electronics

14.5.2. Retail

14.5.3. Third-party Logistics

14.5.4. Food and Beverages

14.5.5. Pharmaceuticals and Healthcare

14.5.6. Military

14.5.7. Others

14.6. Air Cargo Market Size & Forecast, 2017-2031, by Destination

14.6.1. Domestic

14.6.2. International

14.7. Key Country Analysis - Middle East & Africa Air Cargo Market Size & Forecast, 2017-2031

14.7.1. GCC

14.7.2. South Africa

14.7.3. Turkey

14.7.4. Rest of Middle East & Africa

15. South America Air Cargo Market

15.1. Market Snapshot

15.2. Air Cargo Market Size & Forecast, 2017-2031, by Services

15.2.1. Air Freight

15.2.2. Air Freight Forwarding

15.2.3. Air Mail

15.2.4. Others

15.3. Air Cargo Market Size & Forecast, 2017-2031, by Mode of Shipping

15.3.1. Express

15.3.2. Standard

15.3.3. Economy

15.4. Air Cargo Market Size & Forecast, 2017-2031, by Carrier Type

15.4.1. Belly Cargo

15.4.2. Freighter

15.5. Air Cargo Market Size & Forecast, 2017-2031, by End-user

15.5.1. Consumer Electronics

15.5.2. Retail

15.5.3. Third-party Logistics

15.5.4. Food and Beverages

15.5.5. Pharmaceuticals and Healthcare

15.5.6. Military

15.5.7. Others

15.6. Air Cargo Market Size & Forecast, 2017-2031, by Destination

15.6.1. Domestic

15.6.2. International

15.7. Key Country Analysis - South America Air Cargo Market Size & Forecast, 2017-2031

15.7.1. Brazil

15.7.2. Argentina

15.7.3. Rest of South America

16. Competitive Landscape

16.1. Company Share Analysis/ Brand Share Analysis, 2022

16.2. Company Analysis for Each Player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

17. Company Profile/ Key Players

17.1. FedEx

17.1.1. Company Overview

17.1.2. Company Footprints

17.1.3. Production Locations

17.1.4. Product Portfolio

17.1.5. Competitors & Customers

17.1.6. Subsidiaries & Parent Organization

17.1.7. Recent Developments

17.1.8. Financial Analysis

17.1.9. Profitability

17.1.10. Revenue Share

17.2. United Parcel Service Inc.

17.2.1. Company Overview

17.2.2. Company Footprints

17.2.3. Production Locations

17.2.4. Product Portfolio

17.2.5. Competitors & Customers

17.2.6. Subsidiaries & Parent Organization

17.2.7. Recent Developments

17.2.8. Financial Analysis

17.2.9. Profitability

17.2.10. Revenue Share

17.3. The Emirates Group

17.3.1. Company Overview

17.3.2. Company Footprints

17.3.3. Production Locations

17.3.4. Product Portfolio

17.3.5. Competitors & Customers

17.3.6. Subsidiaries & Parent Organization

17.3.7. Recent Developments

17.3.8. Financial Analysis

17.3.9. Profitability

17.3.10. Revenue Share

17.4. Cathay Pacific Airways Limited

17.4.1. Company Overview

17.4.2. Company Footprints

17.4.3. Production Locations

17.4.4. Product Portfolio

17.4.5. Competitors & Customers

17.4.6. Subsidiaries & Parent Organization

17.4.7. Recent Developments

17.4.8. Financial Analysis

17.4.9. Profitability

17.4.10. Revenue Share

17.5. Cargolux Airlines International S.A.

17.5.1. Company Overview

17.5.2. Company Footprints

17.5.3. Production Locations

17.5.4. Product Portfolio

17.5.5. Competitors & Customers

17.5.6. Subsidiaries & Parent Organization

17.5.7. Recent Developments

17.5.8. Financial Analysis

17.5.9. Profitability

17.5.10. Revenue Share

17.6. China Airlines Ltd.

17.6.1. Company Overview

17.6.2. Company Footprints

17.6.3. Production Locations

17.6.4. Product Portfolio

17.6.5. Competitors & Customers

17.6.6. Subsidiaries & Parent Organization

17.6.7. Recent Developments

17.6.8. Financial Analysis

17.6.9. Profitability

17.6.10. Revenue Share

17.7. Japan Airlines Co., Ltd.

17.7.1. Company Overview

17.7.2. Company Footprints

17.7.3. Production Locations

17.7.4. Product Portfolio

17.7.5. Competitors & Customers

17.7.6. Subsidiaries & Parent Organization

17.7.7. Recent Developments

17.7.8. Financial Analysis

17.7.9. Profitability

17.7.10. Revenue Share

17.8. Qatar Airways Company QCSC

17.8.1. Company Overview

17.8.2. Company Footprints

17.8.3. Production Locations

17.8.4. Product Portfolio

17.8.5. Competitors & Customers

17.8.6. Subsidiaries & Parent Organization

17.8.7. Recent Developments

17.8.8. Financial Analysis

17.8.9. Profitability

17.8.10. Revenue Share

17.9. Deutsche Lufthansa AG

17.9.1. Company Overview

17.9.2. Company Footprints

17.9.3. Production Locations

17.9.4. Product Portfolio

17.9.5. Competitors & Customers

17.9.6. Subsidiaries & Parent Organization

17.9.7. Recent Developments

17.9.8. Financial Analysis

17.9.9. Profitability

17.9.10. Revenue Share

17.10. All Nippon Airways Co., Ltd. (ANA)

17.10.1. Company Overview

17.10.2. Company Footprints

17.10.3. Production Locations

17.10.4. Product Portfolio

17.10.5. Competitors & Customers

17.10.6. Subsidiaries & Parent Organization

17.10.7. Recent Developments

17.10.8. Financial Analysis

17.10.9. Profitability

17.10.10. Revenue Share

17.11. International Consolidated Airlines Group S.A.

17.11.1. Company Overview

17.11.2. Company Footprints

17.11.3. Production Locations

17.11.4. Product Portfolio

17.11.5. Competitors & Customers

17.11.6. Subsidiaries & Parent Organization

17.11.7. Recent Developments

17.11.8. Financial Analysis

17.11.9. Profitability

17.11.10. Revenue Share

17.12. Magma Aviation Limited

17.12.1. Company Overview

17.12.2. Company Footprints

17.12.3. Production Locations

17.12.4. Product Portfolio

17.12.5. Competitors & Customers

17.12.6. Subsidiaries & Parent Organization

17.12.7. Recent Developments

17.12.8. Financial Analysis

17.12.9. Profitability

17.12.10. Revenue Share

17.13. Deutsche Post DHL

17.13.1. Company Overview

17.13.2. Company Footprints

17.13.3. Production Locations

17.13.4. Product Portfolio

17.13.5. Competitors & Customers

17.13.6. Subsidiaries & Parent Organization

17.13.7. Recent Developments

17.13.8. Financial Analysis

17.13.9. Profitability

17.13.10. Revenue Share

17.14. Kuehne + Nagel International AG

17.14.1. Company Overview

17.14.2. Company Footprints

17.14.3. Production Locations

17.14.4. Product Portfolio

17.14.5. Competitors & Customers

17.14.6. Subsidiaries & Parent Organization

17.14.7. Recent Developments

17.14.8. Financial Analysis

17.14.9. Profitability

17.14.10. Revenue Share

17.15. United Airlines

17.15.1. Company Overview

17.15.2. Company Footprints

17.15.3. Production Locations

17.15.4. Product Portfolio

17.15.5. Competitors & Customers

17.15.6. Subsidiaries & Parent Organization

17.15.7. Recent Developments

17.15.8. Financial Analysis

17.15.9. Profitability

17.15.10. Revenue Share

17.16. American Airlines

17.16.1. Company Overview

17.16.2. Company Footprints

17.16.3. Production Locations

17.16.4. Product Portfolio

17.16.5. Competitors & Customers

17.16.6. Subsidiaries & Parent Organization

17.16.7. Recent Developments

17.16.8. Financial Analysis

17.16.9. Profitability

17.16.10. Revenue Share

17.17. Delta Air Lines, Inc.

17.17.1. Company Overview

17.17.2. Company Footprints

17.17.3. Production Locations

17.17.4. Product Portfolio

17.17.5. Competitors & Customers

17.17.6. Subsidiaries & Parent Organization

17.17.7. Recent Developments

17.17.8. Financial Analysis

17.17.9. Profitability

17.17.10. Revenue Share

17.18. GOL Airlines

17.18.1. Company Overview

17.18.2. Company Footprints

17.18.3. Production Locations

17.18.4. Product Portfolio

17.18.5. Competitors & Customers

17.18.6. Subsidiaries & Parent Organization

17.18.7. Recent Developments

17.18.8. Financial Analysis

17.18.9. Profitability

17.18.10. Revenue Share

17.19. Azul Airlines

17.19.1. Company Overview

17.19.2. Company Footprints

17.19.3. Production Locations

17.19.4. Product Portfolio

17.19.5. Competitors & Customers

17.19.6. Subsidiaries & Parent Organization

17.19.7. Recent Developments

17.19.8. Financial Analysis

17.19.9. Profitability

17.19.10. Revenue Share

17.20. LATAM

17.20.1. Company Overview

17.20.2. Company Footprints

17.20.3. Production Locations

17.20.4. Product Portfolio

17.20.5. Competitors & Customers

17.20.6. Subsidiaries & Parent Organization

17.20.7. Recent Developments

17.20.8. Financial Analysis

17.20.9. Profitability

17.20.10. Revenue Share

17.21. Copa Airlines

17.21.1. Company Overview

17.21.2. Company Footprints

17.21.3. Production Locations

17.21.4. Product Portfolio

17.21.5. Competitors & Customers

17.21.6. Subsidiaries & Parent Organization

17.21.7. Recent Developments

17.21.8. Financial Analysis

17.21.9. Profitability

17.21.10. Revenue Share

17.22. AirBridgeCargo Airlines

17.22.1. Company Overview

17.22.2. Company Footprints

17.22.3. Production Locations

17.22.4. Product Portfolio

17.22.5. Competitors & Customers

17.22.6. Subsidiaries & Parent Organization

17.22.7. Recent Developments

17.22.8. Financial Analysis

17.22.9. Profitability

17.22.10. Revenue Share

17.23. Cargojet Inc.

17.23.1. Company Overview

17.23.2. Company Footprints

17.23.3. Production Locations

17.23.4. Product Portfolio

17.23.5. Competitors & Customers

17.23.6. Subsidiaries & Parent Organization

17.23.7. Recent Developments

17.23.8. Financial Analysis

17.23.9. Profitability

17.23.10. Revenue Share

17.24. Others

17.24.1. Company Overview

17.24.2. Company Footprints

17.24.3. Production Locations

17.24.4. Product Portfolio

17.24.5. Competitors & Customers

17.24.6. Subsidiaries & Parent Organization

17.24.7. Recent Developments

17.24.8. Financial Analysis

17.24.9. Profitability

17.24.10. Revenue Share

List of Tables

Table 1: Global Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Table 2: Global Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Table 3: Global Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Table 4: Global Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Table 5: Global Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Table 6: Global Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Table 7: Global Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Table 8: Global Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 9: Global Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Table 10: Global Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Table 11: Global Air Cargo Market Volume (Tons) Forecast, by Region, 2017-2031

Table 12: Global Air Cargo Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 13: North America Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Table 14: North America Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Table 15: North America Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Table 16: North America Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Table 17: North America Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Table 18: North America Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Table 19: North America Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Table 20: North America Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 21: North America Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Table 22: North America Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Table 23: North America Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Table 24: North America Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 25: Europe Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Table 26: Europe Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Table 27: Europe Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Table 28: Europe Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Table 29: Europe Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Table 30: Europe Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Table 31: Europe Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Table 32: Europe Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 33: Europe Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Table 34: Europe Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Table 35: Europe Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Table 36: Europe Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 37: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Table 38: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Table 39: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Table 40: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Table 41: Asia Pacific Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Table 42: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Table 43: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Table 44: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 45: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Table 46: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Table 47: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Table 48: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 49: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Table 50: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Table 51: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Table 52: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Table 53: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Table 54: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Table 55: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Table 56: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 57: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Table 58: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Table 59: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Table 60: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 61: South America Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Table 62: South America Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Table 63: South America Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Table 64: South America Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Table 65: South America Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Table 66: South America Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Table 67: South America Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Table 68: South America Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Table 69: South America Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Table 70: South America Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Table 71: South America Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Table 72: South America Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Figure 2: Global Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Figure 3: Global Air Cargo Market, Incremental Opportunity, by Services, Value (US$ Bn), 2023-2031

Figure 4: Global Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Figure 5: Global Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Figure 6: Global Air Cargo Market, Incremental Opportunity, by Mode of Shipping, Value (US$ Bn), 2023-2031

Figure 7: Global Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Figure 8: Global Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Figure 9: Global Air Cargo Market, Incremental Opportunity, By Carrier Type, Value (US$ Bn), 2023-2031

Figure 10: Global Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Figure 11: Global Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 12: Global Air Cargo Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 13: Global Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Figure 14: Global Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Figure 15: Global Air Cargo Market, Incremental Opportunity, by Destination, Value (US$ Bn), 2023-2031

Figure 16: Global Air Cargo Market Volume (Tons) Forecast, by Region, 2017-2031

Figure 17: Global Air Cargo Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 18: Global Air Cargo Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 19: North America Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Figure 20: North America Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Figure 21: North America Air Cargo Market, Incremental Opportunity, by Services, Value (US$ Bn), 2023-2031

Figure 22: North America Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Figure 23: North America Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Figure 24: North America Air Cargo Market, Incremental Opportunity, by Mode of Shipping, Value (US$ Bn), 2023-2031

Figure 25: North America Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Figure 26: North America Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Figure 27: North America Air Cargo Market, Incremental Opportunity, By Carrier Type, Value (US$ Bn), 2023-2031

Figure 28: North America Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Figure 29: North America Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 30: North America Air Cargo Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 31: North America Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Figure 32: North America Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Figure 33: North America Air Cargo Market, Incremental Opportunity, by Destination, Value (US$ Bn), 2023-2031

Figure 34: North America Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Figure 35: North America Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 36: North America Air Cargo Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 37: Europe Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Figure 38: Europe Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Figure 39: Europe Air Cargo Market, Incremental Opportunity, by Services, Value (US$ Bn), 2023-2031

Figure 40: Europe Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Figure 41: Europe Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Figure 42: Europe Air Cargo Market, Incremental Opportunity, by Mode of Shipping, Value (US$ Bn), 2023-2031

Figure 43: Europe Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Figure 44: Europe Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Figure 45: Europe Air Cargo Market, Incremental Opportunity, By Carrier Type, Value (US$ Bn), 2023-2031

Figure 46: Europe Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Figure 47: Europe Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 48: Europe Air Cargo Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 49: Europe Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Figure 50: Europe Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Figure 51: Europe Air Cargo Market, Incremental Opportunity, by Destination, Value (US$ Bn), 2023-2031

Figure 52: Europe Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Figure 53: Europe Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 54: Europe Air Cargo Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Figure 56: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Figure 57: Asia Pacific Air Cargo Market, Incremental Opportunity, by Services, Value (US$ Bn), 2023-2031

Figure 58: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Figure 59: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Figure 60: Asia Pacific Air Cargo Market, Incremental Opportunity, by Mode of Shipping, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Figure 62: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Figure 63: Asia Pacific Air Cargo Market, Incremental Opportunity, By Carrier Type, Value (US$ Bn), 2023-2031

Figure 64: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Figure 65: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 66: Asia Pacific Air Cargo Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Figure 68: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Figure 69: Asia Pacific Air Cargo Market, Incremental Opportunity, by Destination, Value (US$ Bn), 2023-2031

Figure 70: Asia Pacific Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Figure 71: Asia Pacific Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 72: Asia Pacific Air Cargo Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 73: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Figure 74: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Figure 75: Middle East & Africa Air Cargo Market, Incremental Opportunity, by Services, Value (US$ Bn), 2023-2031

Figure 76: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Figure 77: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Figure 78: Middle East & Africa Air Cargo Market, Incremental Opportunity, by Mode of Shipping, Value (US$ Bn), 2023-2031

Figure 79: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Figure 80: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Figure 81: Middle East & Africa Air Cargo Market, Incremental Opportunity, By Carrier Type, Value (US$ Bn), 2023-2031

Figure 82: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Figure 83: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 84: Middle East & Africa Air Cargo Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Figure 86: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Figure 87: Middle East & Africa Air Cargo Market, Incremental Opportunity, by Destination, Value (US$ Bn), 2023-2031

Figure 88: Middle East & Africa Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Figure 89: Middle East & Africa Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 90: Middle East & Africa Air Cargo Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 91: South America Air Cargo Market Volume (Tons) Forecast, by Services, 2017-2031

Figure 92: South America Air Cargo Market Value (US$ Bn) Forecast, by Services, 2017-2031

Figure 93: South America Air Cargo Market, Incremental Opportunity, by Services, Value (US$ Bn), 2023-2031

Figure 94: South America Air Cargo Market Volume (Tons) Forecast, by Mode of Shipping, 2017-2031

Figure 95: South America Air Cargo Market Value (US$ Bn) Forecast, by Mode of Shipping, 2017-2031

Figure 96: South America Air Cargo Market, Incremental Opportunity, by Mode of Shipping, Value (US$ Bn), 2023-2031

Figure 97: South America Air Cargo Market Volume (Tons) Forecast, By Carrier Type, 2017-2031

Figure 98: South America Air Cargo Market Value (US$ Bn) Forecast, By Carrier Type, 2017-2031

Figure 99: South America Air Cargo Market, Incremental Opportunity, By Carrier Type, Value (US$ Bn), 2023-2031

Figure 100: South America Air Cargo Market Volume (Tons) Forecast, by End-user, 2017-2031

Figure 101: South America Air Cargo Market Value (US$ Bn) Forecast, by End-user, 2017-2031

Figure 102: South America Air Cargo Market, Incremental Opportunity, by End-user, Value (US$ Bn), 2023-2031

Figure 103: South America Air Cargo Market Volume (Tons) Forecast, by Destination, 2017-2031

Figure 104: South America Air Cargo Market Value (US$ Bn) Forecast, by Destination, 2017-2031

Figure 105: South America Air Cargo Market, Incremental Opportunity, by Destination, Value (US$ Bn), 2023-2031

Figure 106: South America Air Cargo Market Volume (Tons) Forecast, by Country, 2017-2031

Figure 107: South America Air Cargo Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 108: South America Air Cargo Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031