Analysts’ Viewpoint

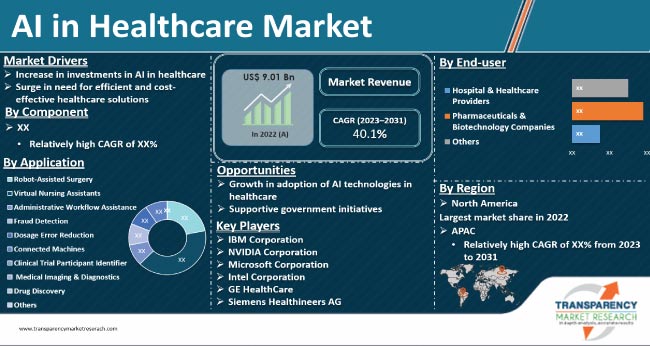

Artificial intelligence (AI) technologies are becoming increasingly prevalent in businesses and society, and are significantly being adopted in the healthcare sector. AI applications have the potential to transform various areas of healthcare delivery, including patient care and management, as well as streamlining administrative processes for healthcare providers, payers, and pharmaceutical companies.

AI and automation solutions are lowering healthcare costs and reforming administrative operations such as patient registration, patient data entry, and claims processing. Healthcare providers are looking for better tools to help them meet their clinical needs. AI in healthcare automates time-consuming processes while improving the accuracy, quality, and safety of the work. This has led to an increase in demand for artificial intelligence in healthcare solutions globally.

AI in healthcare refers to the use of machine learning (ML) algorithms and other cognitive technologies such as computer vision, natural language processing, robotics, and deep learning in medical contexts. It is the use of machines to analyze and respond to medical data, frequently with the intention of forecasting a specific outcome. AI in healthcare improves preventative care and quality of life, generates accurate diagnosis and treatment plans, and results in overall better patient outcomes.

Investments in AI in healthcare industry have significantly increased, and the trend is expected to continue in the future. The reason for this increase is the rise in awareness about the benefits of AI in medicine and healthcare. Governments, healthcare organizations, and private investors are realizing the importance of investing in AI research industry to improve patient care, reduce healthcare costs, and increase operational efficiency. These are the latest artificial intelligence in healthcare market trends.

In March 2023, the U.K government invested US$ 17 Mn in AI research, for cancer checks, to diagnose rare diseases, identify women at highest risk of premature birth, and to improve speed and accuracy of diagnoses, tackle waiting lists, and free up clinician time.

In September 2022, the UNICEF Venture Fund invested in nine startups that are focused on developing platforms based on Open Source, machine learning in healthcare. These platforms are expected to accelerate learning outcomes, generate data for forecasting health and healthcare needs, and provide access to online tools at affordable cost, particularly in areas with low connectivity.

In September 2022, The National Institutes of Health (NIH) invested US$ 130 Mn over four years, to accelerate the use of AI in healthcare by biomedical and behavioral research communities.

Thus, the rise in investments from governments and private companies are expected to drive AI in healthcare market progress in the next few years.

Government initiatives create a supportive environment, driving AI in healthcare market demand. These initiatives from governments include funding for research and development, regulations to promote the use of AI in healthcare, and partnerships with healthcare organizations to implement AI solutions.

Governments play a vital role in promoting the use of AI in healthcare by offering incentives to healthcare providers. These incentives include tax credits or subsidies, which help providers overcome financial barriers to investing in AI.

The U.S. General Services Administration (GSA) launched the Applied AI Healthcare Challenge, a prize competition to encourage the development of practical and diverse solutions, to deliver top-quality medical care for federal agencies.

UK Research and Innovation (UKRI) announced funding of US$ 12 Mn, to develop and innovate AI applications and technologies to address healthcare challenges and bring researchers together across different sectors. The UK government launched the AI in Health and Care Award, a US$ 140 Mn fund to support the development and adoption of AI applications in healthcare.

These initiatives produce a favorable environment for AI in healthcare market development, which offer significant opportunities in the sector.

North America accounted for major share in 2022 and is expected to dominate the global AI in healthcare market during the forecast period. Rise in demand for operational efficacy within healthcare organizations and supportive government initiatives are propelling the AI in healthcare market share in the region.

The AI in healthcare market size of Asia Pacific is expected to be substantial during the forecast period due to increase in investment in healthcare infrastructure, and strong presence of AI companies collaborating with healthcare providers in the region to develop new AI applications in healthcare.

Detailed profiles of some of the key vendors in the global AI in healthcare market are included in the market report. The profiles include financials, key product offerings, recent developments, and strategies adopted by the companies.

Prominent companies in the AI in healthcare market include IBM Corporation, NVIDIA Corporation, Microsoft Corporation, Intel Corporation, GE HealthCare, Siemens Healthineers AG, Medtronic Plc, Koninklijke Philips N.V, Google LLC, CloudMinds Technology Inc., General Vision Inc., and BenevolentAI. The profile of each of these players in the AI in healthcare market report include sections on company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 9.01 Bn |

|

Market Forecast Value in 2031 |

US$ 187.76 Bn |

|

Growth Rate (CAGR) |

40.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2018-2022 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, ecosystem analysis, and key trends analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 9.01 Bn in 2022.

It is projected to advance at a CAGR of 40.1% from 2023 to 2031.

Increase in investments in AI in healthcare, and growth in need for efficient and cost-effective healthcare solutions.

Based on component, the software/platform segment dominated in 2022.

North America is expected to be one of the lucrative regions in the next few years.

IBM Corporation, NVIDIA Corporation, Microsoft Corporation, Intel Corporation, and GE HealthCare.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Artificial Intelligence (AI) in Healthcare Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Artificial Intelligence (AI) in Healthcare Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Application

4.5.3. By End-user

5. Global Artificial Intelligence (AI) in Healthcare Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2017-2031

5.1.1. Historic Growth Trends, 2017-2022

5.1.2. Forecast Trends, 2023-2031

6. Global Artificial Intelligence (AI) in Healthcare Market Analysis, by Component

6.1. Key Segment Analysis

6.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.2.1. Software/Platform

6.2.2. Services

6.2.2.1. Managed Services

6.2.2.2. Professional Services

7. Global Artificial Intelligence (AI) in Healthcare Market Analysis, by Application

7.1. Key Segment Analysis

7.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by Application, 2018 - 2031

7.2.1. Robot-assisted Surgery

7.2.2. Virtual Nursing Assistants

7.2.3. Administrative Workflow Assistance

7.2.4. Fraud Detection

7.2.5. Dosage Error Reduction

7.2.6. Connected Machines

7.2.7. Clinical Trial Participant Identifier

7.2.8. Medical imaging & Diagnostics

7.2.9. Drug Discovery

7.2.10. Others

8. Global Artificial Intelligence (AI) in Healthcare Market Analysis, by End-user

8.1. Key Segment Analysis

8.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

8.2.1. Hospital & Healthcare Providers

8.2.2. Pharmaceuticals & Biotechnology Companies

8.2.3. Others

9. Global Artificial Intelligence (AI) in Healthcare Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Artificial Intelligence (AI) in Healthcare Market Analysis and Forecast

10.1. Regional Outlook

10.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

10.2.1. By Component

10.2.2. By Application

10.2.3. By End-user

10.3. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Artificial Intelligence (AI) in Healthcare Market Analysis and Forecast

11.1. Regional Outlook

11.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By Application

11.2.3. By End-user

11.3. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. UK

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Artificial Intelligence (AI) in Healthcare Market Analysis and Forecast

12.1. Regional Outlook

12.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

12.2.1. By Component

12.2.2. By Application

12.2.3. By End-user

12.3. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Artificial Intelligence (AI) in Healthcare Market Analysis and Forecast

13.1. Regional Outlook

13.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By Application

13.2.3. By End-user

13.3. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Artificial Intelligence (AI) in Healthcare Market Analysis and Forecast

14.1. Regional Outlook

14.2. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Analysis and Forecast (2018 - 2031)

14.2.1. By Component

14.2.2. By Application

14.2.3. By End-user

14.3. Artificial Intelligence (AI) in Healthcare Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Competitive Landscape by Tier Structure of Companies

15.3. Scale of Competition, 2022

15.4. Scale of Competition at Regional Level, 2022

15.5. Market Revenue Share Analysis (%), by Leading Players (2022)

15.6. List of Startups

15.7. Competition Evolution

15.7.1. Major Mergers & Acquisitions, Expansions, Partnership, Contracts, Deals, etc.

16. Company Profiles

16.1. IBM Corporation

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Recent Developments

16.1.6. Impact of COVID-19

16.1.7. TMR View

16.1.8. Competitive Threats and Weakness

16.2. NVIDIA Corporation

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Recent Developments

16.2.6. Impact of COVID-19

16.2.7. TMR View

16.2.8. Competitive Threats and Weakness

16.3. Microsoft Corporation

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Recent Developments

16.3.6. Impact of COVID-19

16.3.7. TMR View

16.3.8. Competitive Threats and Weakness

16.4. Intel Corporation

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Recent Developments

16.4.6. Impact of COVID-19

16.4.7. TMR View

16.4.8. Competitive Threats and Weakness

16.5. GE HealthCare

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Recent Developments

16.5.6. Impact of COVID-19

16.5.7. TMR View

16.5.8. Competitive Threats and Weakness

16.6. Siemens Healthineers AG

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Recent Developments

16.6.6. Impact of COVID-19

16.6.7. TMR View

16.6.8. Competitive Threats and Weakness

16.7. Medtronic Plc

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Recent Developments

16.7.6. Impact of COVID-19

16.7.7. TMR View

16.7.8. Competitive Threats and Weakness

16.8. Koninklijke Philips N.V.

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Recent Developments

16.8.6. Impact of COVID-19

16.8.7. TMR View

16.8.8. Competitive Threats and Weakness

16.9. Google LLC

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Recent Developments

16.9.6. Impact of COVID-19

16.9.7. TMR View

16.9.8. Competitive Threats and Weakness

16.10. CloudMinds Technology Inc.

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Recent Developments

16.10.6. Impact of COVID-19

16.10.7. TMR View

16.10.8. Competitive Threats and Weakness

16.11. General Vision Inc.

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Recent Developments

16.11.6. Impact of COVID-19

16.11.7. TMR View

16.11.8. Competitive Threats and Weakness

16.12. BenevolentAI

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Recent Developments

16.12.6. Impact of COVID-19

16.12.7. TMR View

16.12.8. Competitive Threats and Weakness

16.13. Others

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Recent Developments

16.13.6. Impact of COVID-19

16.13.7. TMR View

16.13.8. Competitive Threats and Weakness

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in AI in Healthcare Market

Table 2: North America AI in Healthcare Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 3: Europe AI in Healthcare Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 4: Asia Pacific AI in Healthcare Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 5: Middle East & Africa AI in Healthcare Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 6: South America AI in Healthcare Market Revenue Analysis, by Country, 2023 and 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact

Table 8: Impact Analysis of Drivers & Restraints

Table 9: Global AI in Healthcare Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 10: Global AI in Healthcare Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 11: Global AI in Healthcare Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 12: Global AI in Healthcare Market Value (US$ Bn) Forecast, by Region, 2018 - 2031

Table 13: North America AI in Healthcare Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 14: North America AI in Healthcare Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 15: North America AI in Healthcare Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 16: North America AI in Healthcare Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 17: U.S. AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 18: Canada AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Mexico AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Europe AI in Healthcare Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 21: Europe AI in Healthcare Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 22: Europe AI in Healthcare Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 23: Europe AI in Healthcare Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 24: Germany AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: U.K. AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: France AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Spain AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Italy AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Asia Pacific AI in Healthcare Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 30: Asia Pacific AI in Healthcare Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 31: Asia Pacific AI in Healthcare Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 32: Asia Pacific AI in Healthcare Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 33: China AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: India AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: Japan AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: ASEAN AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: Middle East & Africa AI in Healthcare Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 38: Middle East & Africa AI in Healthcare Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 39: Middle East & Africa AI in Healthcare Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 40: Middle East & Africa AI in Healthcare Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 41: Saudi Arabia AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: United Arab Emirates AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: South Africa AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: South America AI in Healthcare Market Value (US$ Bn) Forecast, by Component, 2018 - 2031

Table 45: South America AI in Healthcare Market Value (US$ Bn) Forecast, by Application, 2018 - 2031

Table 46: South America AI in Healthcare Market Value (US$ Bn) Forecast, by End-user, 2018 - 2031

Table 47: South America AI in Healthcare Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 48: Brazil AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 49: Argentina AI in Healthcare Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: Mergers & Acquisitions, Partnerships (1/2)

Table 51: Mergers & Acquisitions, Partnerships (2/2)

List of Figures

Figure 1: Global AI in Healthcare Market Size (US$ Bn) Forecast, 2018-2031

Figure 2: Global AI in Healthcare Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of AI in Healthcare Market

Figure 4: Global AI in Healthcare Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global AI in Healthcare Market Attractiveness Assessment, by Component

Figure 6: Global AI in Healthcare Market Attractiveness Assessment, by Application

Figure 7: Global AI in Healthcare Market Attractiveness Assessment, by End-user

Figure 8: Global AI in Healthcare Market Attractiveness Assessment, by Region

Figure 9: Global AI in Healthcare Market Revenue (US$ Bn) Historic Trends, 2018 - 2021

Figure 10: Global AI in Healthcare Market Revenue Opportunity (US$ Bn) Historic Trends, 2018 - 2021

Figure 11: Global AI in Healthcare Market Value Share Analysis, by Component, 2023

Figure 12: Global AI in Healthcare Market Value Share Analysis, by Component, 2031

Figure 13: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Software/Platform, 2023 - 2031

Figure 14: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 15: Global AI in Healthcare Market Value Share Analysis, by Application, 2023

Figure 16: Global AI in Healthcare Market Value Share Analysis, by Application, 2031

Figure 17: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Robot-Assisted Surgery, 2023 - 2031

Figure 18: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Virtual Nursing Assistants, 2023 - 2031

Figure 19: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Administrative Workflow Assistance, 2023 - 2031

Figure 20: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Fraud Detection, 2023 - 2031

Figure 21: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Dosage Error Reduction, 2023 - 2031

Figure 22: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Connected Machines, 2023 - 2031

Figure 23: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Clinical Trial Participant Identifier, 2023 - 2031

Figure 24: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Medical Imaging & Diagnostics, 2023 - 2031

Figure 25: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Drug Discovery, 2023 - 2031

Figure 26: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 27: Global AI in Healthcare Market Value Share Analysis, by End-user, 2023

Figure 28: Global AI in Healthcare Market Value Share Analysis, by End-user, 2031

Figure 29: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Hospital & Healthcare Providers, 2023 - 2031

Figure 30: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Pharmaceuticals & Biotechnology Companies, 2023 - 2031

Figure 31: Global AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 32: Global AI in Healthcare Market Opportunity (US$ Bn), by Region

Figure 33: Global AI in Healthcare Market Opportunity Share (%), by Region, 2023-2031

Figure 34: Global AI in Healthcare Market Size (US$ Bn), by Region, 2023 & 2031

Figure 35: Global AI in Healthcare Market Value Share Analysis, by Region, 2023

Figure 36: Global AI in Healthcare Market Value Share Analysis, by Region, 2031

Figure 37: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 38: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 39: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 40: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 41: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), 2023 - 2031

Figure 42: North America Absolute Dollar Opportunity

Figure 43: North America AI in Healthcare Market Value Share Analysis, by Component, 2023

Figure 44: North America AI in Healthcare Market Value Share Analysis, by Component, 2031

Figure 45: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Software/Platform, 2023 - 2031

Figure 46: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 47: North America AI in Healthcare Market Value Share Analysis, by Application, 2023

Figure 48: North America AI in Healthcare Market Value Share Analysis, by Application, 2031

Figure 49: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Robot-Assisted Surgery, 2023 - 2031

Figure 50: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Virtual Nursing Assistants, 2023 - 2031

Figure 51: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Administrative Workflow Assistance, 2023 - 2031

Figure 52: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Fraud Detection, 2023 - 2031

Figure 53: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Dosage Error Reduction, 2023 - 2031

Figure 54: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Connected Machines, 2023 - 2031

Figure 55: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Clinical Trial Participant Identifier, 2023 - 2031

Figure 56: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Medical Imaging & Diagnostics, 2023 - 2031

Figure 57: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Drug Discovery, 2023 - 2031

Figure 58: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 59: North America AI in Healthcare Market Value Share Analysis, by End-user, 2023

Figure 60: North America AI in Healthcare Market Value Share Analysis, by End-user, 2031

Figure 61: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Hospital & Healthcare Providers, 2023 - 2031

Figure 62: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Pharmaceuticals & Biotechnology Companies, 2023 - 2031

Figure 63: North America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 64: North America AI in Healthcare Market Value Share Analysis, by Country, 2023

Figure 65: North America AI in Healthcare Market Value Share Analysis, by Country, 2031

Figure 66: U.S. AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 67: Canada AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 68: Mexico AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 69: Europe Absolute Dollar Opportunity

Figure 70: Europe AI in Healthcare Market Value Share Analysis, by Component, 2023

Figure 71: Europe AI in Healthcare Market Value Share Analysis, by Component, 2031

Figure 72: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Software/Platform, 2023 - 2031

Figure 73: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 74: Europe AI in Healthcare Market Value Share Analysis, by Application, 2023

Figure 75: Europe AI in Healthcare Market Value Share Analysis, by Application, 2031

Figure 76: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Robot-Assisted Surgery, 2023 - 2031

Figure 77: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Virtual Nursing Assistants, 2023 - 2031

Figure 78: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Administrative Workflow Assistance, 2023 - 2031

Figure 79: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Fraud Detection, 2023 - 2031

Figure 80: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Dosage Error Reduction, 2023 - 2031

Figure 81: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Connected Machines, 2023 - 2031

Figure 82: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Clinical Trial Participant Identifier, 2023 - 2031

Figure 83: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Medical Imaging & Diagnostics, 2023 - 2031

Figure 84: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Drug Discovery, 2023 - 2031

Figure 85: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 86: Europe AI in Healthcare Market Value Share Analysis, by End-user, 2023

Figure 87: Europe AI in Healthcare Market Value Share Analysis, by End-user, 2031

Figure 88: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Hospital & Healthcare Providers, 2023 - 2031

Figure 89: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Pharmaceuticals & Biotechnology Companies, 2023 - 2031

Figure 90: Europe AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 91: Europe AI in Healthcare Market Value Share Analysis, by Country, 2023

Figure 92: Europe AI in Healthcare Market Value Share Analysis, by Country, 2031

Figure 93: Germany AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 94: U.K. AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 95: France AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 96: Spain AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 97: Italy AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 98: Asia Pacific Absolute Dollar Opportunity

Figure 99: Asia Pacific AI in Healthcare Market Value Share Analysis, by Component, 2023

Figure 100: Asia Pacific AI in Healthcare Market Value Share Analysis, by Component, 2031

Figure 101: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Software/Platform, 2023 - 2031

Figure 102: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 103: Asia Pacific AI in Healthcare Market Value Share Analysis, by Application, 2023

Figure 104: Asia Pacific AI in Healthcare Market Value Share Analysis, by Application, 2031

Figure 105: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Robot-Assisted Surgery, 2023 - 2031

Figure 106: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Virtual Nursing Assistants, 2023 - 2031

Figure 107: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Administrative Workflow Assistance, 2023 - 2031

Figure 108: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Fraud Detection, 2023 - 2031

Figure 109: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Dosage Error Reduction, 2023 - 2031

Figure 110: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Connected Machines, 2023 - 2031

Figure 111: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Clinical Trial Participant Identifier, 2023 - 2031

Figure 112: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Medical Imaging & Diagnostics, 2023 - 2031

Figure 113: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Drug Discovery, 2023 - 2031

Figure 114: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 115: Asia Pacific AI in Healthcare Market Value Share Analysis, by End-user, 2023

Figure 116: Asia Pacific AI in Healthcare Market Value Share Analysis, by End-user, 2031

Figure 117: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Hospital & Healthcare Providers, 2023 - 2031

Figure 118: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Pharmaceuticals & Biotechnology Companies, 2023 - 2031

Figure 119: Asia Pacific AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 120: Asia Pacific AI in Healthcare Market Value Share Analysis, by Country, 2023

Figure 121: Asia Pacific AI in Healthcare Market Value Share Analysis, by Country, 2031

Figure 122: China AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 123: India AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 124: Japan AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 125: ASEAN AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 126: Middle East & Africa Absolute Dollar Opportunity

Figure 127: Middle East & Africa AI in Healthcare Market Value Share Analysis, by Component, 2023

Figure 128: Middle East & Africa AI in Healthcare Market Value Share Analysis, by Component, 2031

Figure 129: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Software/Platform, 2023 - 2031

Figure 130: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 131: Middle East & Africa AI in Healthcare Market Value Share Analysis, by Application, 2023

Figure 132: Middle East & Africa AI in Healthcare Market Value Share Analysis, by Application, 2031

Figure 133: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Robot-Assisted Surgery, 2023 - 2031

Figure 134: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Virtual Nursing Assistants, 2023 - 2031

Figure 135: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Administrative Workflow Assistance, 2023 - 2031

Figure 136: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Fraud Detection, 2023 - 2031

Figure 137: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Dosage Error Reduction, 2023 - 2031

Figure 138: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Connected Machines, 2023 - 2031

Figure 139: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Clinical Trial Participant Identifier, 2023 - 2031

Figure 140: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Medical Imaging & Diagnostics, 2023 - 2031

Figure 141: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Drug Discovery, 2023 - 2031

Figure 142: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 143: Middle East & Africa AI in Healthcare Market Value Share Analysis, by End-user, 2023

Figure 144: Middle East & Africa AI in Healthcare Market Value Share Analysis, by End-user, 2031

Figure 145: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Hospital & Healthcare Providers, 2023 - 2031

Figure 146: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Pharmaceuticals & Biotechnology Companies, 2023 - 2031

Figure 147: Middle East & Africa AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 148: Middle East & Africa AI in Healthcare Market Value Share Analysis, by Country, 2023

Figure 149: Middle East & Africa AI in Healthcare Market Value Share Analysis, by Country, 2031

Figure 150: Saudi Arabia AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 151: United Arab Emirates AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 152: South Africa AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 153: South America Absolute Dollar Opportunity

Figure 154: South America AI in Healthcare Market Value Share Analysis, by Component, 2023

Figure 155: South America AI in Healthcare Market Value Share Analysis, by Component, 2031

Figure 156: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Software/Platform, 2023 - 2031

Figure 157: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Services, 2023 - 2031

Figure 158: South America AI in Healthcare Market Value Share Analysis, by Application, 2023

Figure 159: South America AI in Healthcare Market Value Share Analysis, by Application, 2031

Figure 160: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Robot-Assisted Surgery, 2023 - 2031

Figure 161: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Virtual Nursing Assistants, 2023 - 2031

Figure 162: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Administrative Workflow Assistance, 2023 - 2031

Figure 163: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Fraud Detection, 2023 - 2031

Figure 164: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Dosage Error Reduction, 2023 - 2031

Figure 165: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Connected Machines, 2023 - 2031

Figure 166: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Clinical Trial Participant Identifier, 2023 - 2031

Figure 167: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Medical Imaging & Diagnostics, 2023 - 2031

Figure 168: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Drug Discovery, 2023 - 2031

Figure 169: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 170: South America AI in Healthcare Market Value Share Analysis, by End-user, 2023

Figure 171: South America AI in Healthcare Market Value Share Analysis, by End-user, 2031

Figure 172: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Hospital & Healthcare Providers, 2023 - 2031

Figure 173: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Pharmaceuticals & Biotechnology Companies, 2023 - 2031

Figure 174: South America AI in Healthcare Market Absolute Opportunity (US$ Bn), by Others, 2023 - 2031

Figure 175: South America AI in Healthcare Market Value Share Analysis, by Country, 2023

Figure 176: South America AI in Healthcare Market Value Share Analysis, by Country, 2031

Figure 177: Brazil AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031

Figure 178: Argentina AI in Healthcare Market Opportunity Growth Analysis (US$ Bn) Forecast, 2023 - 2031