Analysts’ Viewpoint on Market Scenario

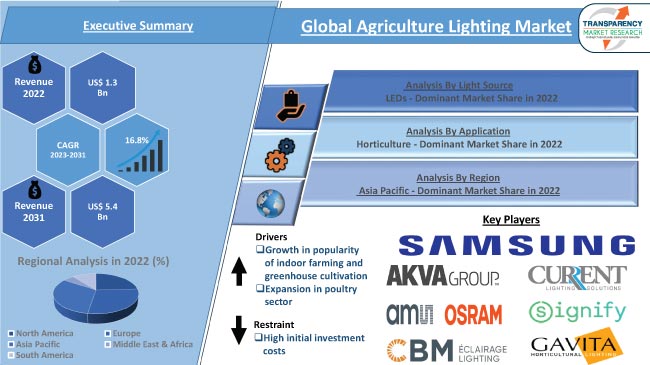

Rise in popularity of indoor farming and greenhouse cultivation is expected to propel the agriculture lighting market size during the forecast period. Expansion in the poultry sector is also projected to boost market progress in the near future.

Surge in adoption of sustainable agriculture practices is likely to offer lucrative opportunities to players in the global agriculture lighting industry. LED-based agriculture lighting consumes significantly less energy compared to traditional lighting technologies such as high-pressure sodium (HPS) lamps. The energy efficiency of LEDs reduces electricity costs and minimizes the carbon footprint of indoor farming operations, making them more environmentally friendly.

Agriculture lighting plays an important role in modern agricultural practices, especially in indoor farming or Controlled Environment Agriculture (CEA) setups. Farm lighting systems use artificial lighting to provide the necessary light spectrum, intensity, and duration for optimal plant growth and development.

Year-round crop production, extended photoperiod control, crop-specific spectrum optimization, and increased crop yield and quality are some of the major advantages of agriculture lighting. Indoor farming, greenhouse farming, supplemental lighting, and seedling propagation are some of the key applications of agriculture lighting.

Light-emitting Diodes (LEDs) are widely employed in the agriculture sector as they are energy-efficient, long-lasting, and emit specific light spectra that can be customized for different plant species and growth stages. The efficiency and effectiveness of LED lighting have made it the preferred choice for indoor farmers, leading to increase in demand for LED-based agriculture lighting solutions. This, in turn, is projected to spur the agriculture lighting market growth in the near future.

Indoor farming and greenhouse cultivation allow for year-round crop production by creating controlled environments. Plant growth lighting plays an important role in these setups by providing artificial light to compensate for the reduced natural sunlight during shorter days or in regions with limited sunlight availability.

Indoor farming lighting allows precise control over light intensity, ensuring that plants receive the appropriate amount of light for optimal growth. By adjusting the light intensity, users can adapt to various crop requirements, growth stages, and environmental conditions. This control enables fine-tuning of light levels to prevent overexposure or underexposure, thus promoting healthy and vigorous plant growth. Hence, surge in popularity of indoor farming and greenhouse cultivation is propelling the agriculture lighting market development.

With the use of advanced LED technology and smart lighting controls, indoor farming and greenhouse systems can optimize plant growth, improve resource efficiency, and contribute to sustainable agriculture practices. Agriculture lighting manufacturers are developing hybrid LED lighting systems to reduce energy usage in greenhouses. In 2019, Signify Holding collaborated with AppHarvest to help the company increase efficiency and boost yields using fewer resources in their 25-hectare greenhouse in Morehead, U.S. The greenhouse was fitted with a hybrid LED lighting system, using Agrolux high-pressure sodium lighting and Signify’s Philips GreenPower LED toplighting compact.

Agricultural lighting solutions can be used in poultry farming to increase the productivity and welfare of poultry birds. Controlling the day length with the help of agricultural lighting can influence the production and reproductive behaviors of poultry birds. By adjusting the lighting schedule, farmers can stimulate or suppress certain physiological responses in poultry, such as egg production and growth rates. This allows for more efficient flock management and improved productivity. Hence, expansion in the poultry sector is augmenting the agriculture lighting market value.

Lighting manipulation can play a crucial role in enhancing reproductive performance in poultry, particularly in the case of broiler breeders and layer hens. Consistent and appropriate lighting conditions promote uniform growth and development of poultry birds. Properly managed lighting schedules ensure that all birds receive equal exposure to light, minimizing variations in growth rates and body weights within a flock. This results in improved flock uniformity and better overall productivity.

According to the latest agriculture lighting market trends, the LEDs light source segment is expected to hold largest share from 2023 to 2031. The segment accounted for 32.4% share in 2022. It is likely to maintain the status quo and advance at a CAGR of 17.3% during the forecast period.

LEDs are highly energy-efficient as they convert a larger percentage of electricity into usable light compared to traditional lighting sources such as incandescent or fluorescent lights. This efficiency results in significant energy savings, lower electricity costs, and reduced environmental impact. Additionally, LED lights generate very little heat compared to traditional lighting technologies. This is advantageous for agriculture lighting as it helps to reduce the risk of heat stress or damage to plants, allowing them to grow closer to the light source without negative effects.

According to the latest agriculture lighting market analysis, the horticulture application segment held 35.8% share in 2022. It is likely to maintain the status quo and advance at a CAGR of 17.2% during the forecast period.

Horticultural lighting is used to supplement natural sunlight in greenhouses, especially in regions with limited sunlight or during periods of low light intensity. It ensures that plants receive sufficient light for photosynthesis and growth, enabling year-round cultivation and enhanced productivity.

According to the latest agriculture lighting market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. The region accounted for 31.7% share in 2022. Presence of major agriculture lighting companies and expansion in the agriculture sector are fueling market expansion in the region.

Europe held 28.4% share in 2022. Rise in investment in the R&D of new products is fueling market statistics in the region. European countries have strong research and development initiatives focused on agriculture lighting. Leading research institutions, universities, and technology companies are working collaboratively to advance agriculture lighting technologies.

The global industry is fragmented, with the presence of several players including AKVA Group, ams OSRAM AG, California LightWorks, CBM Lighting, Current Lighting Solutions, LLC., DeLaval, Gavita International B.V, HATO Agricultural Lighting, Heliospectra AB, Hubbell Incorporated, Lely, Luminus, Inc., Samsung, Signify Holding, and Sunbird.

Each of these players has been profiled in the agriculture lighting market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

Most companies are investing significantly in the R&D of new products to expand their product portfolio. The research and development efforts in the field of agriculture lighting are fueling innovations and contributing to surge in demand. Key manufacturers in the industry are continuously working on improving light spectra, optimizing energy efficiency, and integrating smart controls to enhance crop quality, yield, and profitability. They are also focusing on various growth strategies such as collaborations with key players, mergers & acquisitions, product launches, and developing a worldwide distribution network, to increase their agriculture lighting market share.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 1.3 Bn |

|

Market Forecast Value in 2031 |

US$ 5.4 Bn |

|

Growth Rate (CAGR) |

16.8% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.3 Bn in 2022

It is projected to be 16.8% from 2023 to 2031

Growth in popularity of indoor farming and greenhouse cultivation and expansion in poultry sector

The LEDs light source segment accounted for major share of 32.4% in 2022

Asia Pacific recorded the highest demand in 2022

China accounted for US$ 178.7 Mn in 2022

AKVA Group, ams OSRAM AG, California LightWorks, CBM Lighting, Current Lighting Solutions, LLC., DeLaval, Gavita International B.V, HATO Agricultural Lighting, Heliospectra AB, Hubbell Incorporated, Lely, Luminus, Inc., Samsung, Signify Holding, and Sunbird

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Agriculture Lighting Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Lighting Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Agriculture Lighting Market Analysis, By Component

5.1. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017-2031

5.1.1. Lamps

5.1.2. Luminaries

5.1.3. Lighting Controls

5.1.4. Sensing Devices

5.1.5. Others (Timer, Accessories, etc.)

5.2. Market Attractiveness Analysis, By Component

6. Global Agriculture Lighting Market Analysis, By Light Source

6.1. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Light Source, 2017-2031

6.1.1. Incandescent Lamps

6.1.2. Fluorescent Lamps

6.1.3. High Intensity Discharge Lamps

6.1.4. LEDs

6.1.5. Others (Halogen, Metal-halide, etc.)

6.2. Market Attractiveness Analysis, By Light Source

7. Global Agriculture Lighting Market Analysis, By Wattage Type

7.1. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Wattage Type, 2017-2031

7.1.1. Up to 100W

7.1.2. 100W - 300W

7.1.3. 300W - 500W

7.1.4. Above 500W

7.2. Market Attractiveness Analysis, By Wattage Type

8. Global Agriculture Lighting Market Analysis, By Application

8.1. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

8.1.1. Horticulture

8.1.2. Livestock

8.1.3. Aquaculture

8.1.4. Vertical Farming

8.1.4.1. Hydroponics

8.1.4.2. Aeroponics

8.1.4.3. Aquaponics

8.2. Market Attractiveness Analysis, By Application

9. Global Agriculture Lighting Market Analysis and Forecast, By Region

9.1. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Agriculture Lighting Market Analysis and Forecast

10.1. Market Snapshot

10.2. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017-2031

10.2.1. Lamps

10.2.2. Luminaries

10.2.3. Lighting Controls

10.2.4. Sensing Devices

10.2.5. Others (Timer, Accessories, etc.)

10.3. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Light Source, 2017-2031

10.3.1. Incandescent Lamps

10.3.2. Fluorescent Lamps

10.3.3. High Intensity Discharge Lamps

10.3.4. LEDs

10.3.5. Others (Halogen, Metal-halide, etc.)

10.4. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Wattage Type, 2017-2031

10.4.1. Up to 100W

10.4.2. 100W - 300W

10.4.3. 300W - 500W

10.4.4. Above 500W

10.5. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

10.5.1. Horticulture

10.5.2. Livestock

10.5.3. Aquaculture

10.5.4. Vertical Farming

10.5.4.1. Hydroponics

10.5.4.2. Aeroponics

10.5.4.3. Aquaponics

10.6. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Component

10.7.2. By Light Source

10.7.3. By Wattage Type

10.7.4. By Application

10.7.5. By Country/Sub-region

11. Europe Agriculture Lighting Market Analysis and Forecast

11.1. Market Snapshot

11.2. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017-2031

11.2.1. Lamps

11.2.2. Luminaries

11.2.3. Lighting Controls

11.2.4. Sensing Devices

11.2.5. Others (Timer, Accessories, etc.)

11.3. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Light Source, 2017-2031

11.3.1. Incandescent Lamps

11.3.2. Fluorescent Lamps

11.3.3. High Intensity Discharge Lamps

11.3.4. LEDs

11.3.5. Others (Halogen, Metal-halide, etc.)

11.4. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Wattage Type, 2017-2031

11.4.1. Up to 100W

11.4.2. 100W - 300W

11.4.3. 300W - 500W

11.4.4. Above 500W

11.5. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

11.5.1. Horticulture

11.5.2. Livestock

11.5.3. Aquaculture

11.5.4. Vertical Farming

11.5.4.1. Hydroponics

11.5.4.2. Aeroponics

11.5.4.3. Aquaponics

11.6. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Component

11.7.2. By Light Source

11.7.3. By Wattage Type

11.7.4. By Application

11.7.5. By Country/Sub-region

12. Asia Pacific Agriculture Lighting Market Analysis and Forecast

12.1. Market Snapshot

12.2. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017-2031

12.2.1. Lamps

12.2.2. Luminaries

12.2.3. Lighting Controls

12.2.4. Sensing Devices

12.2.5. Others (Timer, Accessories, etc.)

12.3. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Light Source, 2017-2031

12.3.1. Incandescent Lamps

12.3.2. Fluorescent Lamps

12.3.3. High Intensity Discharge Lamps

12.3.4. LEDs

12.3.5. Others (Halogen, Metal-halide, etc.)

12.4. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Wattage Type, 2017-2031

12.4.1. Up to 100W

12.4.2. 100W - 300W

12.4.3. 300W - 500W

12.4.4. Above 500W

12.5. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

12.5.1. Horticulture

12.5.2. Livestock

12.5.3. Aquaculture

12.5.4. Vertical Farming

12.5.4.1. Hydroponics

12.5.4.2. Aeroponics

12.5.4.3. Aquaponics

12.6. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Component

12.7.2. By Light Source

12.7.3. By Wattage Type

12.7.4. By Application

12.7.5. By Country/Sub-region

13. Middle East & Africa Agriculture Lighting Market Analysis and Forecast

13.1. Market Snapshot

13.2. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017-2031

13.2.1. Lamps

13.2.2. Luminaries

13.2.3. Lighting Controls

13.2.4. Sensing Devices

13.2.5. Others (Timer, Accessories, etc.)

13.3. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Light Source, 2017-2031

13.3.1. Incandescent Lamps

13.3.2. Fluorescent Lamps

13.3.3. High Intensity Discharge Lamps

13.3.4. LEDs

13.3.5. Others (Halogen, Metal-halide, etc.)

13.4. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Wattage Type, 2017-2031

13.4.1. Up to 100W

13.4.2. 100W - 300W

13.4.3. 300W - 500W

13.4.4. Above 500W

13.5. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

13.5.1. Horticulture

13.5.2. Livestock

13.5.3. Aquaculture

13.5.4. Vertical Farming

13.5.4.1. Hydroponics

13.5.4.2. Aeroponics

13.5.4.3. Aquaponics

13.6. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Component

13.7.2. By Light Source

13.7.3. By Wattage Type

13.7.4. By Application

13.7.5. By Country/Sub-region

14. South America Agriculture Lighting Market Analysis and Forecast

14.1. Market Snapshot

14.2. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Component, 2017-2031

14.2.1. Lamps

14.2.2. Luminaries

14.2.3. Lighting Controls

14.2.4. Sensing Devices

14.2.5. Others (Timer, Accessories, etc.)

14.3. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Light Source, 2017-2031

14.3.1. Incandescent Lamps

14.3.2. Fluorescent Lamps

14.3.3. High Intensity Discharge Lamps

14.3.4. LEDs

14.3.5. Others (Halogen, Metal-halide, etc.)

14.4. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Wattage Type, 2017-2031

14.4.1. Up to 100W

14.4.2. 100W - 300W

14.4.3. 300W - 500W

14.4.4. Above 500W

14.5. Agriculture Lighting Market Size (US$ Mn) Analysis & Forecast, By Application, 2017-2031

14.5.1. Horticulture

14.5.2. Livestock

14.5.3. Aquaculture

14.5.4. Vertical Farming

14.5.4.1. Hydroponics

14.5.4.2. Aeroponics

14.5.4.3. Aquaponics

14.6. Agriculture Lighting Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Component

14.7.2. By Light Source

14.7.3. By Wattage Type

14.7.4. By Application

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Agriculture Lighting Market Competition Matrix - a Dashboard View

15.1.1. Global Agriculture Lighting Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. AKVA Group

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. ams OSRAM AG

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. California LightWorks

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. CBM Lighting

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Current Lighting Solutions, LLC.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. DeLaval

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Gavita International B.V

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. HATO Agricultural Lighting

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Heliospectra AB

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Hubbell Incorporated

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Lely

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Luminus, Inc.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Samsung

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Signify Holding

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. Sunbird

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. Other Key Players

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Agriculture Lighting Market Value (US$ Mn) & Forecast, by Component, 2017-2031

Table 2: Global Agriculture Lighting Market Volume (Million Units) & Forecast, by Component, 2017-2031

Table 3: Global Agriculture Lighting Market Value (US$ Mn) & Forecast, by Light Source, 2017-2031

Table 4: Global Agriculture Lighting Market Volume (Million Units) & Forecast, by Light Source, 2017-2031

Table 5: Global Agriculture Lighting Market Value (US$ Mn) & Forecast, by Wattage Type, 2017-2031

Table 6: Global Agriculture Lighting Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 7: Global Agriculture Lighting Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 8: Global Agriculture Lighting Market Volume (Million Units) & Forecast, by Region, 2017-2031

Table 9: North America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Component, 2017-2031

Table 10: North America Agriculture Lighting Market Volume (Million Units) & Forecast, by Component, 2017-2031

Table 11: North America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Light Source, 2017-2031

Table 12: North America Agriculture Lighting Market Volume (Million Units) & Forecast, by Light Source, 2017-2031

Table 13: North America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Wattage Type, 2017-2031

Table 14: North America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 15: North America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 16: North America Agriculture Lighting Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 17: Europe Agriculture Lighting Market Value (US$ Mn) & Forecast, by Component, 2017-2031

Table 18: Europe Agriculture Lighting Market Volume (Million Units) & Forecast, by Component, 2017-2031

Table 19: Europe Agriculture Lighting Market Value (US$ Mn) & Forecast, by Light Source, 2017-2031

Table 20: Europe Agriculture Lighting Market Volume (Million Units) & Forecast, by Light Source, 2017-2031

Table 21: Europe Agriculture Lighting Market Value (US$ Mn) & Forecast, by Wattage Type, 2017-2031

Table 22: Europe Agriculture Lighting Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 23: Europe Agriculture Lighting Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Europe Agriculture Lighting Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Asia Pacific Agriculture Lighting Market Value (US$ Mn) & Forecast, by Component, 2017-2031

Table 26: Asia Pacific Agriculture Lighting Market Volume (Million Units) & Forecast, by Component, 2017-2031

Table 27: Asia Pacific Agriculture Lighting Market Value (US$ Mn) & Forecast, by Light Source, 2017-2031

Table 28: Asia Pacific Agriculture Lighting Market Volume (Million Units) & Forecast, by Light Source, 2017-2031

Table 29: Asia Pacific Agriculture Lighting Market Value (US$ Mn) & Forecast, by Wattage Type, 2017-2031

Table 30: Asia Pacific Agriculture Lighting Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 31: Asia Pacific Agriculture Lighting Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 32: Asia Pacific Agriculture Lighting Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 33: Middle East & Africa Agriculture Lighting Market Value (US$ Mn) & Forecast, by Component, 2017-2031

Table 34: Middle East & Africa Agriculture Lighting Market Volume (Million Units) & Forecast, by Component, 2017-2031

Table 35: Middle East & Africa Agriculture Lighting Market Value (US$ Mn) & Forecast, by Light Source, 2017-2031

Table 36: Middle East & Africa Agriculture Lighting Market Volume (Million Units) & Forecast, by Light Source, 2017-2031

Table 37: Middle East & Africa Agriculture Lighting Market Value (US$ Mn) & Forecast, by Wattage Type, 2017-2031

Table 38: Middle East & Africa Agriculture Lighting Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 39: Middle East & Africa Agriculture Lighting Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 40: Middle East & Africa Agriculture Lighting Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 41: South America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Component, 2017-2031

Table 42: South America Agriculture Lighting Market Volume (Million Units) & Forecast, by Component, 2017-2031

Table 43: South America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Light Source, 2017-2031

Table 44: South America Agriculture Lighting Market Volume (Million Units) & Forecast, by Light Source, 2017-2031

Table 45: South America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Wattage Type, 2017-2031

Table 46: South America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Application, 2017-2031

Table 47: South America Agriculture Lighting Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017-2031

Table 48: South America Agriculture Lighting Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Agriculture Lighting Market

Figure 02: Porter Five Forces Analysis - Global Agriculture Lighting Market

Figure 03: Technology Road Map - Global Agriculture Lighting Market

Figure 04: Global Agriculture Lighting Market, Value (US$ Mn), 2017-2031

Figure 05: Global Agriculture Lighting Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 06: Global Agriculture Lighting Market Projections by Component, Value (US$ Mn), 2017-2031

Figure 07: Global Agriculture Lighting Market, Incremental Opportunity, by Component, 2023-2031

Figure 08: Global Agriculture Lighting Market Share Analysis, by Component, 2023 and 2031

Figure 09: Global Agriculture Lighting Market Projections by Light Source, Value (US$ Mn), 2017-2031

Figure 10: Global Agriculture Lighting Market, Incremental Opportunity, by Light Source, 2023-2031

Figure 11: Global Agriculture Lighting Market Share Analysis, by Light Source, 2023 and 2031

Figure 12: Global Agriculture Lighting Market Projections by Wattage Type, Value (US$ Mn), 2017-2031

Figure 13: Global Agriculture Lighting Market, Incremental Opportunity, by Wattage Type, 2023-2031

Figure 14: Global Agriculture Lighting Market Share Analysis, by Wattage Type, 2023 and 2031

Figure 15: Global Agriculture Lighting Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 16: Global Agriculture Lighting Market, Incremental Opportunity, by Application, 2023-2031

Figure 17: Global Agriculture Lighting Market Share Analysis, by Application, 2023 and 2031

Figure 18: Global Agriculture Lighting Market Projections by Region, Value (US$ Mn), 2017-2031

Figure 19: Global Agriculture Lighting Market, Incremental Opportunity, by Region, 2023-2031

Figure 20: Global Agriculture Lighting Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America Agriculture Lighting Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 22: North America Agriculture Lighting Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 23: North America Agriculture Lighting Market Projections by Component Value (US$ Mn), 2017-2031

Figure 24: North America Agriculture Lighting Market, Incremental Opportunity, by Component, 2023-2031

Figure 25: North America Agriculture Lighting Market Share Analysis, by Component, 2023 and 2031

Figure 26: North America Agriculture Lighting Market Projections by Light Source (US$ Mn), 2017-2031

Figure 27: North America Agriculture Lighting Market, Incremental Opportunity, by Light Source, 2023-2031

Figure 28: North America Agriculture Lighting Market Share Analysis, by Light Source, 2023 and 2031

Figure 29: North America Agriculture Lighting Market Projections by Wattage Type, Value (US$ Mn), 2017-2031

Figure 30: North America Agriculture Lighting Market, Incremental Opportunity, by Wattage Type, 2023-2031

Figure 31: North America Agriculture Lighting Market Share Analysis, by Wattage Type, 2023 and 2031

Figure 32: North America Agriculture Lighting Market Projections by Application Value (US$ Mn), 2017-2031

Figure 33: North America Agriculture Lighting Market, Incremental Opportunity, by Application, 2023-2031

Figure 34: North America Agriculture Lighting Market Share Analysis, by Application, 2023 and 2031

Figure 35: North America Agriculture Lighting Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 36: North America Agriculture Lighting Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 37: North America Agriculture Lighting Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 38: Europe Agriculture Lighting Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 39: Europe Agriculture Lighting Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 40: Europe Agriculture Lighting Market Projections by Component, Value (US$ Mn), 2017-2031

Figure 41: Europe Agriculture Lighting Market, Incremental Opportunity, by Component, 2023-2031

Figure 42: Europe Agriculture Lighting Market Share Analysis, by Component, 2023 and 2031

Figure 43: Europe Agriculture Lighting Market Projections by Light Source, Value (US$ Mn), 2017-2031

Figure 44: Europe Agriculture Lighting Market, Incremental Opportunity, by Light Source, 2023-2031

Figure 45: Europe Agriculture Lighting Market Share Analysis, by Light Source, 2023 and 2031

Figure 46: Europe Agriculture Lighting Market Projections by Wattage Type, Value (US$ Mn), 2017-2031

Figure 47: Europe Agriculture Lighting Market, Incremental Opportunity, by Wattage Type, 2023-2031

Figure 48: Europe Agriculture Lighting Market Share Analysis, by Wattage Type, 2023 and 2031

Figure 49: Europe Agriculture Lighting Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 50: Europe Agriculture Lighting Market, Incremental Opportunity, by Application, 2023-2031

Figure 51: Europe Agriculture Lighting Market Share Analysis, by Application, 2023 and 2031

Figure 52: Europe Agriculture Lighting Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 53: Europe Agriculture Lighting Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 54: Europe Agriculture Lighting Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 55: Asia Pacific Agriculture Lighting Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 56: Asia Pacific Agriculture Lighting Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 57: Asia Pacific Agriculture Lighting Market Projections by Component Value (US$ Mn), 2017-2031

Figure 58: Asia Pacific Agriculture Lighting Market, Incremental Opportunity, by Component, 2023-2031

Figure 59: Asia Pacific Agriculture Lighting Market Share Analysis, by Component, 2023 and 2031

Figure 60: Asia Pacific Agriculture Lighting Market Projections by Light Source, Value (US$ Mn), 2017-2031

Figure 61: Asia Pacific Agriculture Lighting Market, Incremental Opportunity, by Light Source, 2023-2031

Figure 62: Asia Pacific Agriculture Lighting Market Share Analysis, by Light Source, 2023 and 2031

Figure 63: Asia Pacific Agriculture Lighting Market Projections by Wattage Type, Value (US$ Mn), 2017-2031

Figure 64: Asia Pacific Agriculture Lighting Market, Incremental Opportunity, by Wattage Type, 2023-2031

Figure 65: Asia Pacific Agriculture Lighting Market Share Analysis, by Wattage Type, 2023 and 2031

Figure 66: Asia Pacific Agriculture Lighting Market Projections by Application, Value (US$ Mn), 2017-2031

Figure 67: Asia Pacific Agriculture Lighting Market, Incremental Opportunity, by Application, 2023-2031

Figure 68: Asia Pacific Agriculture Lighting Market Share Analysis, by Application, 2023 and 2031

Figure 69: Asia Pacific Agriculture Lighting Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 70: Asia Pacific Agriculture Lighting Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 71: Asia Pacific Agriculture Lighting Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 72: Middle East & Africa Agriculture Lighting Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 73: Middle East & Africa Agriculture Lighting Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 74: Middle East & Africa Agriculture Lighting Market Projections by Component Value (US$ Mn), 2017-2031

Figure 75: Middle East & Africa Agriculture Lighting Market, Incremental Opportunity, by Component, 2023-2031

Figure 76: Middle East & Africa Agriculture Lighting Market Share Analysis, by Component, 2023 and 2031

Figure 77: Middle East & Africa Agriculture Lighting Market Projections by Light Source, Value (US$ Mn), 2017-2031

Figure 78: Middle East & Africa Agriculture Lighting Market, Incremental Opportunity, by Light Source, 2023-2031

Figure 79: Middle East & Africa Agriculture Lighting Market Share Analysis, by Light Source, 2023 and 2031

Figure 80: Middle East & Africa Agriculture Lighting Market Projections by Wattage Type, Value (US$ Mn), 2017-2031

Figure 81: Middle East & Africa Agriculture Lighting Market, Incremental Opportunity, by Wattage Type, 2023-2031

Figure 82: Middle East & Africa Agriculture Lighting Market Share Analysis, by Wattage Type, 2023 and 2031

Figure 83: Middle East & Africa Agriculture Lighting Market Projections by Application Value (US$ Mn), 2017-2031

Figure 84: Middle East & Africa Agriculture Lighting Market, Incremental Opportunity, by Application, 2023-2031

Figure 85: Middle East & Africa Agriculture Lighting Market Share Analysis, by Application, 2023 and 2031

Figure 86: Middle East & Africa Agriculture Lighting Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 87: Middle East & Africa Agriculture Lighting Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 88: Middle East & Africa Agriculture Lighting Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 89: South America Agriculture Lighting Market Size & Forecast, Value (US$ Mn), 2017-2031

Figure 90: South America Agriculture Lighting Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017-2031

Figure 91: South America Agriculture Lighting Market Projections by Component Value (US$ Mn), 2017-2031

Figure 92: South America Agriculture Lighting Market, Incremental Opportunity, by Component, 2023-2031

Figure 93: South America Agriculture Lighting Market Share Analysis, by Component, 2023 and 2031

Figure 94: South America Agriculture Lighting Market Projections by Light Source, Value (US$ Mn), 2017-2031

Figure 95: South America Agriculture Lighting Market, Incremental Opportunity, by Light Source, 2023-2031

Figure 96: South America Agriculture Lighting Market Share Analysis, by Light Source, 2023 and 2031

Figure 97: South America Agriculture Lighting Market Projections by Wattage Type, Value (US$ Mn), 2017-2031

Figure 98: South America Agriculture Lighting Market, Incremental Opportunity, by Wattage Type, 2023-2031

Figure 99: South America Agriculture Lighting Market Share Analysis, by Wattage Type, 2023 and 2031

Figure 100: South America Agriculture Lighting Market Projections by Application Value (US$ Mn), 2017-2031

Figure 101: South America Agriculture Lighting Market, Incremental Opportunity, by Application, 2023-2031

Figure 102: South America Agriculture Lighting Market Share Analysis, by Application, 2023 and 2031

Figure 103: South America Agriculture Lighting Market Projections by Country and Sub-region, Value (US$ Mn), 2017-2031

Figure 104: South America Agriculture Lighting Market, Incremental Opportunity, by Country and Sub-region, 2023-2031

Figure 105: South America Agriculture Lighting Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 106: Global Agriculture Lighting Market Competition

Figure 107: Global Agriculture Lighting Market Company Share Analysis