Lockdown relaxations in orange and green zones of India’s several states are bearing a positive news for companies in India’s agricultural & forestry machinery market amidst the coronavirus (COVID-19) outbreak. Since agriculture is one of the primary revenue-generating industries of India, lockdown relaxations are offering a relief to farmers that will help reduce the stress on supply chains. However, heads of agricultural organizations are instructed to ensure proper hygiene measures and social distancing norms among farm workers.

Shops of agricultural & forestry machineries and spare part & repair shops have been exempted from lockdown norms to facilitate farm produce. Such constructive measures by the Indian Government are benefitting equipment manufacturers in the agricultural & forestry machinery market. Even the tea industry is allowed to conduct plantations with a functional workforce of maximum 50 percent.

Driverless Tractors Overcome Challenges of Furrows and Eliminate Need for Drivers

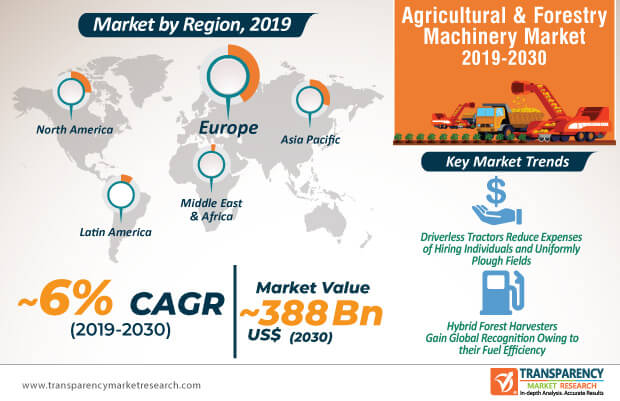

There is a growing demand for low-cost innovations in the agricultural & forestry machinery market. This demand has led to innovations in driverless tractors. For instance, the driverless tractor introduced by Yogesh, a first-year engineering student in Rajasthan, India, is gaining increased recognition in India’s agricultural & forestry machinery market that eliminates the costs associated with hiring a driver. India, being one of the leading economies in Asia Pacific, is contributing toward its highest estimated revenue among all regions by the end of 2030, with a global market value reaching ~US$ 400 Bn. Hence, companies in the market for agricultural & forestry machineries should collaborate with budding engineering talents to further innovate in driverless tractors.

Driverless tractors are also being highly publicized for uniformly ploughing the fields. Even a slight acceleration or sudden brake by the driver results in furrows that are too deep or too shallow. Hence, companies in the agricultural & forestry machinery market should increase the availability of driverless tractors to overcome such challenges of tractor owners.

Hybrid forest harvesters are gaining increased popularity for their fuel efficiency. For instance, Logset Oy— a Finnish forest machine manufacturer, is gaining global recognition for its 8H GTE hybrid harvester that is improving ergonomics for operators in the agricultural & forestry machinery market. As such, companies in the market for agricultural & forestry machineries are participating in international trade events and exhibitions to gain increased visibility and acknowledgment in the global market landscape.

Small design hybrid harvester models are being increasingly talked about in the agricultural & forestry machinery market, after the wheel-based harvesters. Manufacturers in the market for agricultural & forestry machineries are increasing efforts to meet the demand for sustainable, productive, and economical solutions for the modern forestry industry. Hence, they are increasing their R&D efforts to introduce small and compact harvesters with electric motors and supercapacitors that are used for energy storage.

Forests play a crucial role in the procurement of building materials and biomass to deploy renewable energy. Hence, the European Union’s Horizon 2020 research and innovation program, announced the launch of a €3 Mn undertaking for the Forwarder2020 project to strike the right balance between commercial applications and the need to safeguard forest covers. Thus, the trend of sustainable wood production and smart logging is gaining popularity in the agricultural & forestry machinery market. Hence, companies in the market for agricultural & forestry machineries are manufacturing forwarders that help to reduce fuel consumption and lower the impact of the machine on the soil in order to deploy sustainable logging.

Reduced ground pressure under the wheels of forwarders offering high travel speeds are some of the key focus points for equipment manufacturers of the agricultural & forestry machinery market.

Analysts’ Viewpoint

The Association of Equipment Manufacturers (AEM), North America, is urging the government to streamline existing manufacturing programs amidst the COVID-19 crisis. Driverless tractors are being associated with work and cost cuts for farm owners.

The agricultural & forestry machinery market is estimated to progress at a CAGR of ~6% during the forecast period. However, the need for sustainable, productive, and economical machinery solutions are not being met in all countries of the market. Hence, companies should indulge in development programs such as innovate in hybrid harvesters that offer fuel and ergonomic efficiency. Several workers have associated themselves with forestry development projects to buy forwarders that are comfortable and reliable in operation.

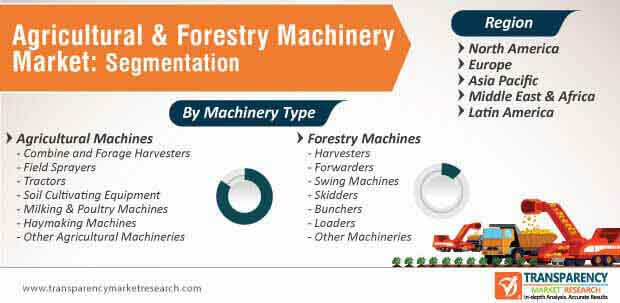

Agricultural & Forestry Machinery Market – Segmentation

The report on the global agricultural & forestry machinery market provides information on the basis of machinery type and region.

|

Machinery Type |

Agricultural Machines

Forestry Machines

|

|

Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

The global Agricultural & Forestry Machinery Market is projected to reach a value of US$ 400 Bn by the end of 2029

Key players in the global Agricultural & Forestry Machinery Market include Deere & Company, AGCO Corporation, Caterpillar Inc., Kubota Corporation, Class KGaA mbH, and Mahindra & Mahindra.

Rising food demand has encouraged the adoption of advanced farming and forestry practices to increase crop yields, which is further resulting in the demand for agricultural machinery globally.

The forecast period considered for the Agricultural & Forestry Machinery Market is 2020 - 2029

Asia Pacific is more attractive region for vendors in the Agricultural & Forestry Machinery Market

Section 1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

Section 2. Assumptions

Section 3. Research Methodology

Section 4. Executive Summary

Section 5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Agricultural Industry Overview

5.4.2. Overall Forestry Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Industry SWOT Analysis

5.8. Key Trends Analysis

5.8.1. Supplier Side

5.8.2. Demand Side

5.9. Global Agricultural & Forestry Machinery Market Analysis and Forecast, 2020 - 2029

5.9.1. Market Revenue Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

Section 6. Global Agricultural & Forestry Machinery Market Analysis and Forecast, By Machinery Type

6.1. Global Agricultural & Forestry Machinery Market Size (US$ Mn) Forecast, By Machinery Type, 2020 - 2029

6.1.1. Agricultural Machines

6.1.1.1. Combine and forage harvesters

6.1.1.2. Field Sprayers

6.1.1.3. Tractors

6.1.1.4. Soil cultivating equipment

6.1.1.5. Milking & poultry machines

6.1.1.6. Haymaking machines

6.1.1.7. Other Agricultural Machineries

6.1.2. Forestry Machines

6.1.2.1. Harvesters

6.1.2.2. Forwarders

6.1.2.3. Swing Machines

6.1.2.4. Skidders

6.1.2.5. Bunchers

6.1.2.6. Loaders

6.1.2.7. Other Machineries

6.2. Incremental Opportunity, By Machinery Type

Section 7. Global Agricultural & Forestry Machinery Market Analysis and Forecast, By Region

7.1. Global Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Region, 2020 - 2029

7.1.1. North America

7.1.2. Europe

7.1.3. Asia Pacific

7.1.4. Middle East & Africa

7.1.5. Latin America

7.2. Incremental Opportunity, By Region

Section 8. North America Agricultural & Forestry Machinery Market Analysis and Forecast

8.1. Regional Snapshot

8.2. Key Trends Analysis

8.2.1. Supplier Side

8.2.2. Demand Side

8.3. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Machinery Type, 2020 - 2029

8.3.1. Agricultural Machines

8.3.1.1. Combine and forage harvesters

8.3.1.2. Field Sprayers

8.3.1.3. Tractors

8.3.1.4. Soil cultivating equipment

8.3.1.5. Milking & poultry machines

8.3.1.6. Haymaking machines

8.3.1.7. Other Agricultural Machineries

8.3.2. Forestry Machines

8.3.2.1. Harvesters

8.3.2.2. Forwarders

8.3.2.3. Swing Machines

8.3.2.4. Skidders

8.3.2.5. Bunchers

8.3.2.6. Loaders

8.3.2.7. Other Machineries

8.4. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Country & Sub-region, 2020 - 2029

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

8.5. Incremental Opportunity Analysis

Section 9. Europe Agricultural & Forestry Machinery Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Key Trends Analysis

9.2.1. Supplier Side

9.2.2. Demand Side

9.3. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Machinery Type, 2020 - 2029

9.3.1. Agricultural Machines

9.3.1.1. Combine and forage harvesters

9.3.1.2. Field Sprayers

9.3.1.3. Tractors

9.3.1.4. Soil cultivating equipment

9.3.1.5. Milking & poultry machines

9.3.1.6. Haymaking machines

9.3.1.7. Other Agricultural Machineries

9.3.2. Forestry Machines

9.3.2.1. Harvesters

9.3.2.2. Forwarders

9.3.2.3. Swing Machines

9.3.2.4. Skidders

9.3.2.5. Bunchers

9.3.2.6. Loaders

9.3.2.7. Other Machineries

9.4. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Country & Sub-region, 2020 - 2029

9.4.1. Germany

9.4.2. France

9.4.3. Italy

9.4.4. Spain

9.4.5. U.K.

9.4.6. Benelux

9.4.7. Nordic

9.4.8. Russia

9.4.9. Poland

9.4.10. Rest of Europe

9.5. Incremental Opportunity Analysis

Section 10. Asia Pacific Agricultural & Forestry Machinery Market Analysis and Forecast

10.1. Key Trends Analysis

10.1.1. Supplier Side

10.1.2. Demand Side

10.2. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Machinery Type, 2020 - 2029

10.2.1. Agricultural Machines

10.2.1.1. Combine and forage harvesters

10.2.1.2. Field Sprayers

10.2.1.3. Tractors

10.2.1.4. Soil cultivating equipment

10.2.1.5. Milking & poultry machines

10.2.1.6. Haymaking machines

10.2.1.7. Other Agricultural Machineries

10.2.2. Forestry Machines

10.2.2.1. Harvesters

10.2.2.2. Forwarders

10.2.2.3. Swing Machines

10.2.2.4. Skidders

10.2.2.5. Bunchers

10.2.2.6. Loaders

10.2.2.7. Other Machineries

10.3. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Country & Sub-region, 2020 - 2029

10.3.1. China

10.3.2. India

10.3.3. ASEAN

10.3.4. South Korea

10.3.5. Oceania

10.3.6. Japan

10.4. Incremental Opportunity Analysis

Section 11. Middle East & Africa Agricultural & Forestry Machinery Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Trends Analysis

11.2.1. Supplier Side

11.2.2. Demand Side

11.3. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Machinery Type, 2020 - 2029

11.3.1. Agricultural Machines

11.3.1.1. Combine and forage harvesters

11.3.1.2. Field Sprayers

11.3.1.3. Tractors

11.3.1.4. Soil cultivating equipment

11.3.1.5. Milking & poultry machines

11.3.1.6. Haymaking machines

11.3.1.7. Other Agricultural Machineries

11.3.2. Forestry Machines

11.3.2.1. Harvesters

11.3.2.2. Forwarders

11.3.2.3. Swing Machines

11.3.2.4. Skidders

11.3.2.5. Bunchers

11.3.2.6. Loaders

11.3.2.7. Other Machineries

11.4. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Country & Sub-region, 2020- 2029

11.4.1. GCC

11.4.2. South Africa

11.4.3. Turkey

11.4.4. Iran

11.4.5. Israel

11.4.6. Rest of Middle East & Africa

11.5. Incremental Opportunity Analysis

Section 12. Latin America Agricultural & Forestry Machinery Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trends Analysis

12.2.1. Supplier Side

12.2.2. Demand Side

12.3. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Machinery Type, 2020 - 2029

12.3.1. Agricultural Machines

12.3.1.1. Combine and forage harvesters

12.3.1.2. Field Sprayers

12.3.1.3. Tractors

12.3.1.4. Soil cultivating equipment

12.3.1.5. Milking & poultry machines

12.3.1.6. Haymaking machines

12.3.1.7. Other Agricultural Machineries

12.3.2. Forestry Machines

12.3.2.1. Harvesters

12.3.2.2. Forwarders

12.3.2.3. Swing Machines

12.3.2.4. Skidders

12.3.2.5. Bunchers

12.3.2.6. Loaders

12.3.2.7. Other Machineries

12.4. Agricultural & Forestry Machinery Market Size (US$ Mn & Thousand Units) Forecast, By Country & Sub-region, 2020 –2029

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Chile

12.4.4. Peru

12.4.5. Argentina

12.4.6. Rest of Latin America

12.5. Incremental Opportunity Analysis

Section 13. Competition Landscape

13.1. Market Player – Competition Dashboard

13.2. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue,

13.2.1. Deere & Company

13.2.1.1. Company Overview

13.2.1.2. Sales Area/Geographical Presence

13.2.1.3. Revenue

13.2.2. AGCO Corporation

13.2.2.1. Company Overview

13.2.2.2. Sales Area/Geographical Presence

13.2.2.3. Revenue

13.2.3. Komatsu Ltd.

13.2.3.1. Company Overview

13.2.3.2. Sales Area/Geographical Presence

13.2.3.3. Revenue

13.2.4. Caterpillar Inc.

13.2.4.1. Company Overview

13.2.4.2. Sales Area/Geographical Presence

13.2.4.3. Revenue

13.2.5. Alamo Group, Inc.

13.2.5.1. Company Overview

13.2.5.2. Sales Area/Geographical Presence

13.2.5.3. Revenue

13.2.6. Mahindra & Mahindra Ltd.

13.2.6.1. Company Overview

13.2.6.2. Sales Area/Geographical Presence

13.2.6.3. Revenue

13.2.7. J C Bamford Excavators Ltd.

13.2.7.1. Company Overview

13.2.7.2. Sales Area/Geographical Presence

13.2.7.3. Revenue

13.2.8. Kesla Oyj

13.2.8.1. Company Overview

13.2.8.2. Sales Area/Geographical Presence

13.2.8.3. Revenue

13.2.9. Ponsse Oyj

13.2.9.1. Company Overview

13.2.9.2. Sales Area/Geographical Presence

13.2.9.3. Revenue

13.2.10. Kubota Corporation

13.2.10.1. Company Overview

13.2.10.2. Sales Area/Geographical Presence

13.2.10.3. Revenue

13.2.11. EXEL Industries SA

13.2.11.1. Company Overview

13.2.11.2. Sales Area/Geographical Presence

13.2.11.3. Revenue

13.2.12. Tigercat International Inc.

13.2.12.1. Company Overview

13.2.12.2. Sales Area/Geographical Presence

13.2.12.3. Revenue

13.2.13. Escorts Group

13.2.13.1. Company Overview

13.2.13.2. Sales Area/Geographical Presence

13.2.13.3. Revenue

13.2.14. CNH Industrial N.V.

13.2.14.1. Company Overview

13.2.14.2. Sales Area/Geographical Presence

13.2.14.3. Revenue

13.2.15. Iseki & Co. Ltd.

13.2.15.1. Company Overview

13.2.15.2. Sales Area/Geographical Presence

13.2.15.3. Revenue

13.2.16. SDF Group

13.2.16.1. Company Overview

13.2.16.2. Sales Area/Geographical Presence

13.2.16.3. Revenue

13.2.17. CLAAS KGaA mbH

13.2.17.1. Company Overview

13.2.17.2. Sales Area/Geographical Presence

13.2.17.3. Revenue

13.2.18. The Heico Companies LLC

13.2.18.1. Company Overview

13.2.18.2. Sales Area/Geographical Presence

13.2.18.3. Revenue

13.2.19. AB Volvo

13.2.19.1. Company Overview

13.2.19.2. Sales Area/Geographical Presence

13.2.19.3. Revenue

13.2.20. Rottne Industri AB

13.2.20.1. Company Overview

13.2.20.2. Sales Area/Geographical Presence

13.2.20.3. Revenue

Section 14. Key Takeaway

List of Tables

Table 1: Global Agricultural & Forestry Machinery Market Value Size & Forecast, Machinery Type, US$ Mn,2020-2029

Table 2: Global Agricultural & Forestry Machinery Market Volume Size & Forecast, Machinery Type, Thousand Units,2020-2029

Table 3: Global Agricultural & Forestry Machinery Market Value Size & Forecast, By Region, US$ Mn,2020-2029

Table 4: Global Agricultural & Forestry Machinery Market Volume Size & Forecast, By Region, Thousand Units, 2020-2029

Table 5: North America Agricultural & Forestry Machinery Market Value Size & Forecast, Machinery Type, US$ Mn,2020-2029

Table 6: North America Agricultural & Forestry Machinery Market Volume Size & Forecast, Machinery Type, Thousand Units, 2020-2029

Table 7: North America Agricultural & Forestry Machinery Market Value Size & Forecast, By Country, US$ Mn,2020-2029

Table 8: North America Agricultural & Forestry Machinery Market Volume Size & Forecast, By Country, Thousand Units,2020-2029

Table 9: Latin America Agricultural & Forestry Machinery Market Value Size & Forecast, Machinery Type, US$ Mn,2020-2029

Table 10: Latin America Agricultural & Forestry Machinery Market Volume Size & Forecast, Machinery Type, Thousand Units, 2020-2029

Table 11: Latin America Agricultural & Forestry Machinery Market Value Size & Forecast, By Country, US$ Mn,2020-2029

Table 12: Latin America Agricultural & Forestry Machinery Market Volume Size & Forecast, By Country, Thousand Units,2020-2029

Table 13: Europe Agricultural & Forestry Machinery Market Value Size & Forecast, Machinery Type, US$ Mn,2020-2029

Table 14: Europe Agricultural & Forestry Machinery Market Volume Size & Forecast, Machinery Type, Thousand Units,2020-2029

Table 15: Europe Agricultural & Forestry Machinery Market Value Size & Forecast, By Country, US$ Mn,2020-2029

Table 16: Europe Agricultural & Forestry Machinery Market Volume Size & Forecast, By Country, Thousand Units, 2020-2029

Table 17: Asia Pacific Agricultural & Forestry Machinery Market Value Size & Forecast, Machinery Type, US$ Mn,2020-2029

Table 18: Asia Pacific Agricultural & Forestry Machinery Market Volume Size & Forecast, Machinery Type, Thousand Units, 2020-2029

Table 19: Asia Pacific Agricultural & Forestry Machinery Market Value Size & Forecast, By Country, US$ Mn,2020-2029

Table 20: Asia Pacific Agricultural & Forestry Machinery Market Volume Size & Forecast, By Country, Thousand Units,2020-2029

Table 21: Middle East & Africa Agricultural & Forestry Machinery Market Value Size & Forecast, Machinery Type, US$ Mn,2020-2029

Table 22: Middle East & Africa Agricultural & Forestry Machinery Market Volume Size & Forecast, Machinery Type, Thousand Units, 2020-2029

Table 23: Middle East & Africa Agricultural & Forestry Machinery Market Value Size & Forecast, By Country, US$ Mn,2020-2029

Table 24: Middle East & Africa Agricultural & Forestry Machinery Market Volume Size & Forecast, By Country, Thousand Units, 2020-2029

List of Figure

Figure 1: Global Agricultural & Forestry Machinery Market Projections by Machine Type, Thousand Units, 2020-2029

Figure 2: Global Agricultural & Forestry Machinery Market Projections by Machine Type, US$ Mn, 2020-2029

Figure 3: Global Agricultural & Forestry Machinery Market, Market Attractiveness, by Machine Type, US$ Mn, 2020-2029

Figure 4: Global Agricultural & Forestry Machinery Market Projections by Region, Thousand Units, 2020-2029

Figure 5: Global Agricultural & Forestry Machinery Market Projections by Region, US$ Mn, 2020-2029

Figure 6: Global Agricultural & Forestry Machinery Market, Market Attractiveness, by Region, US$ Mn, 2020-2029

Figure 7: North America Agricultural & Forestry Machinery Market Projections by Machine Type, Thousand Units, 2020-2029

Figure 8: North America Agricultural & Forestry Machinery Market Projections by Machine Type, US$ Mn, 2020-2029

Figure 9: North America Agricultural & Forestry Machinery Market, Market Attractiveness, by Machine Type, US$ Mn, 2020-2029

Figure 10: North America Agricultural & Forestry Machinery Market Projections by Country, Thousand Units, 2020-2029

Figure 11: North America Agricultural & Forestry Machinery Market Projections by Country, US$ Mn, 2020-2029

Figure 12: North America Agricultural & Forestry Machinery Market, Market Attractiveness, by Country, US$ Mn, 2020-2029

Figure 13: Latin America Agricultural & Forestry Machinery Market Projections by Machine Type, Thousand Units, 2020-2029

Figure 14: Latin America Agricultural & Forestry Machinery Market Projections by Machine Type, US$ Mn, 2020-2029

Figure 15: Latin America Agricultural & Forestry Machinery Market, Market Attractiveness, by Machine Type, US$ Mn, 2020-2029

Figure 16: Latin America Agricultural & Forestry Machinery Market Projections by Country, Thousand Units, 2020-2029

Figure 17: Latin America Agricultural & Forestry Machinery Market Projections by Country, US$ Mn, 2020-2029

Figure 18: Latin America Agricultural & Forestry Machinery Market, Market Attractiveness, by Country, US$ Mn, 2020-2029

Figure 19: Europe Agricultural & Forestry Machinery Market Projections by Machine Type, Thousand Units, 2020-2029

Figure 20: Europe Agricultural & Forestry Machinery Market Projections by Machine Type, US$ Mn, 2020-2029

Figure 21: Europe Agricultural & Forestry Machinery Market, Market Attractiveness, by Machine Type, US$ Mn, 2020-2029

Figure 22: Europe Agricultural & Forestry Machinery Market Projections by Country, Thousand Units, 2020-2029

Figure 23: Europe Agricultural & Forestry Machinery Market Projections by Country, US$ Mn, 2020-2029

Figure 24: Europe Agricultural & Forestry Machinery Market, Market Attractiveness, by Country, US$ Mn, 2020-2029

Figure 25: Asia Pacific Agricultural & Forestry Machinery Market Projections by Machine Type, Thousand Units, 2020-2029

Figure 26: Asia Pacific Agricultural & Forestry Machinery Market Projections by Machine Type, US$ Mn, 2020-2029

Figure 27: Asia Pacific Agricultural & Forestry Machinery Market, Market Attractiveness, by Machine Type, US$ Mn, 2020-2029

Figure 28: Asia Pacific Agricultural & Forestry Machinery Market Projections by Country, Thousand Units, 2020-2029

Figure 29: Asia Pacific Agricultural & Forestry Machinery Market Projections by Country, US$ Mn, 2020-2029

Figure 30: Asia Pacific Agricultural & Forestry Machinery Market, Market Attractiveness, by Country, US$ Mn, 2020-2029

Figure 31: Middle East & Africa Agricultural & Forestry Machinery Market Projections by Machine Type, Thousand Units, 2020-2029

Figure 32: Middle East & Africa Agricultural & Forestry Machinery Market Projections by Machine Type, US$ Mn, 2020-2029

Figure 33: Middle East & Africa Agricultural & Forestry Machinery Market, Market Attractiveness, by Machine Type, US$ Mn, 2020-2029

Figure 34: Middle East & Africa Agricultural & Forestry Machinery Market Projections by Country, Thousand Units, 2020-2029

Figure 35: Middle East & Africa Agricultural & Forestry Machinery Market Projections by Country, US$ Mn, 2020-2029

Figure 36: Middle East & Africa Agricultural & Forestry Machinery Market, Market Attractiveness, by Country, US$ Mn, 2020-2029