Food fortification is emerging as a key pillar as a response to the COVID-19 outbreak. Though coronavirus cases are relatively low in Africa, concerned authorities are taking precautionary measures to become resilient to future shocks. Companies in the Africa wheat flour market are taking advantage of this opportunity to strengthen their supply chains. They are increasing efforts to assess current rates of hunger and malnutrition, since the pandemic has potentially worsened the situation, due to low employment rates and interruptions in daily wages.

Proper nutrition is critical for building a strong immune system, and helping the body fight off disease and infection. Since the World Health Organization (WHO) is stressing on the importance of good nutrition, manufacturers in the Africa wheat flour market are strengthening their supply chains to help consumers maintain optimum immunity.

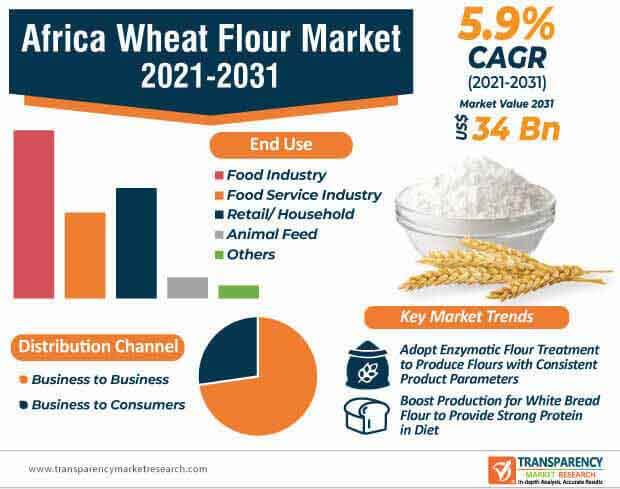

The Africa wheat flour market is projected to reach the valuation of US$ 34 Bn by 2031. However, South African bakers are facing the salt-reduction directive, since excessive intake of sodium chloride (NaCl) can lead to serious cardiovascular and vascular diseases.

Regulations by the South African National Department of Health are posing as a challenge for bakeries ,as low salt dosage can have a detrimental effect on fermentation tolerance, texture, and shred of the loaf porosity. Mühlenchemie - a Germany-based specialist in flour production and fortification, is gaining recognition for working with its sister companies DeutscheBack and SternEnzym for developing a functional solution that effectively improves the texture of low-salt baked foods. Stakeholders in the Africa wheat flour market are taking cues from such developments to adopt highly effective enzyme systems, specially designed to maintain the dough structure and machinability.

Manufacturers in the Africa wheat flour market are increasing efforts to improve their milling operations. Olam International - a major food and agri-business company, is increasing its focus for milling operations within Sub-Saharan Africa (SSA), which is one of the largest consumers of wheat after North Africa and the Middle East. Companies in the Africa wheat flour market are expanding their milling operations in Nigeria, Ghana, Senegal, and Cameroon. It has been found that Nigeria is one of the most populous countries in Africa and major importer in SSA. Company acquisitions are helping stakeholders to gain in-depth understanding of local market dynamics.

Companies in the Africa wheat flour market are identifying the best crop regions to bolster their output capacities. Wheat-breeding programs in South Africa during winter rainfall, summer rainfall, and irrigation areas are gaining prominence. Manufacturers are procuring their supply from the Western Cape province, which has a Mediterranean climate characterized by cool, wet winters, and hot, dry summers. Major irrigation areas are situated in Northern Cape, along the Orange River in Limpopo, Gauteng, and Mpumalanga.

Manufacturers in the Africa wheat flour market are boosting their production capacities in white bread flour, cake flour, and brown bread flour. Cake flour is a low extraction flour with a fine texture, and primarily used for puff pastry applications, cakes, biscuits, and scones. There is a demand for white bread flour.

As per the USDA (United States Department of Agriculture) and the GAIN (Global Agricultural Information Network), an expected increase in the local wheat production, owing to favorable weather conditions in Africa will lower imports in 2021. South Africa’s local wheat price increased sharply to reach record high levels in April 2020 and again in August 2020 amidst the COVID-19 lockdown, diminishing any major increase in the local demand for wheat. Hence, stakeholders in the Africa wheat flour market are bullish on exports to nearby countries.

Stakeholders in the Africa wheat flour market are gaining awareness that local wheat prices are primarily influenced by developments in the global market as well as the strength of the South African Rand exchange rate.

The Africa wheat flour market is expected to register a healthy CAGR of 5.9% during the forecast period. However, wheat-related intolerances among consumers are concerning stakeholders. These intolerances involve a complex interplay of different grain components, all of which stimulate the immune cells in the intestine and trigger complaints in sensitive individuals. This has brought Michael Gusko, managing director at GoodMills Innovation, in the limelight for their work on ancient grains.

The 2ab wheat is found to be well-tolerated in sensitive individuals, and manufacturers in the Africa wheat flour market are increasing their research on the product. The 2ab wheat contains two original genomes i.e. AA and BB that are naturally free from the D gluten contained in modern wheat varieties. This wheat convinces in terms of taste and technology. As such, it is potentially challenging to produce pure ancient grain baked products with a good sensorial profile.

Sandwich bread production is creating stable income sources for stakeholders. South African consumers expect an attractive volume, a fine and even texture in breads with a longer shelf life. Industrial bakeries are found to be the main producers of sandwich bread who use the Chorleywood Bread Process (CBP). The CBP process combines high-speed mixer with the option of varying the pressure. The development of the gluten and dough can, therefore, be promoted at the mixing stage.

The CBP helps to improve the quality of baked foods, mainly by physical means. Nevertheless, few additives and ingredients are essential for ensuring uniform quality in this process. The oxidizing and maturing agent ascorbic acid is indispensable, along with the use of emulsifiers & enzymes that ensure a fine texture in breads.

Analysts’ Viewpoint

Due to favorable weather conditions and record yields in South Africa, stakeholders are bullish on exports due to poor market sentiments, owing to the COVID-19 outbreak. However, South African mills are struggling with inhomogeneous wheat qualities that exhibit highly variable rheological properties and protein levels. Hence, companies in the Africa wheat flour market should adopt the enzymatic flour treatment, which enables millers to produce high-performance flours with consistent product parameters, despite the difficult raw material supply. Stakeholders are improving their milling activities by working closely with bakeries, undertaking product trials, and listening to consumer feedback for product development. This helps to increase the availability of tailor-made products.

The high fiber content in wheat is known to promote gut health and reduce the risk of colon cancer. Consumption of wheat flour has also showed positive effects on blood sugar levels and cholesterol levels, which are some of the reasons that are contributing to change in dietary preferences of individuals. Weight gain, diarrhea, constipation, stomach pain, and fatigue are some of the symptoms associated with celiac diseases caused due to high gluten content. The low gluten content in wheat flour can be considered as a major factor to bolster the sales for wheat flour market.

Digital adoption by the African and Middle East consumers has been benefiting all kinds of businesses, including import-export markets. Key players are also offering wheat flour in bulk quantities for its customers in the food industry, which makes it convenient for them to choose and order for the right product.

The producers of wheat flour products have seen positive outlook post the digital consumers' awareness phase. The rising penetration of both e-business and retail stores in Middle East & Africa is expected to drive increased sales for wheat flour products.

Availability of diverse wheat flour products has also increased consumer attraction towards consuming customized wheat flour. Consumers are becoming aware regarding the health benefits and properties of wheat flour. This has further influenced consumer choices regarding the use of wheat flour as per the specific needs.

In 2021, Africa Wheat Flour Market was valued at US$ 19 Bn

Africa Wheat Flour Market is expected to reach US$ 34 Bn by 2031

Africa Wheat Flour Market is estimated to rise at a CAGR of 5.9% during forecast period

Rise in demand for healthy food products are expected to drive the Africa Wheat Flour Market during the forecast period

Key players of Africa Wheat Flour Market are The Grands Moulins de Mauritanie, Bakhresa Group Ltd, Honeywell Flour Mills, SOMDIAA S.A, Olam International, Supreme Flour, GIDEON MILLING, Tiger Brands Ltd, Elnefeidi Group Holding Co. Ltd, Rotana Flour Mills, Grain Millers, Inc, Archer Daniels Midland Company, Arrowhead Mills, Ardent Mills, LLC, General Mills Inc, Bob’s Red Mill Natural Foods, Pioneer Food Group, Premier Foods Group Ltd, VKB Flour Mills and others

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation / Development Trends

4. Key Success Factors

4.1. Product Adoption / Usage Analysis

4.2. Product USPs / Features

5. Trade Analysis

5.1. Wheat Flour Market Exports to the World

5.1.1. List of key exporters

5.1.2. Value (US$ Mn) of Export

5.1.3. Volume (Tons) of Export

5.2. Wheat Flour Market Imports to the World

5.2.1. List of Key Importers

5.2.2. Value (US$ Mn) of Import

5.2.3. Volume (Units) of Import

5.3. Comparative Analysis of Brands by Key Importing Countries

6. Wheat Flour Market Demand Analysis 2016-2020 and Forecast, 2021-2031

6.1. Global Historical Market Volume (Tons) Analysis, 2016-2020

6.2. Current and Future Market Volume (Tons) Projections, 2021–2031

7. Global Wheat Flour Market - Pricing Analysis

7.1. Regional Pricing Analysis By Nature

7.2. Pricing Break-up

7.2.1. Manufacturer Level Pricing

7.2.2. Distributor Level Pricing

7.3. Global Average Pricing Analysis Benchmark

8. Global Wheat Flour Market Demand (in Value or Size in US$ Mn) Analysis 2016-2020 and Forecast, 2021-2031

8.1. Historical Market Value (US$ Mn) Analysis, 2016–2020

8.2. Current and Future Market Value (US$ Mn) Projections, 2021–2031

8.2.1. Y-o-Y Growth Trend Analysis

8.2.2. Absolute $ Opportunity Analysis

9. Market Background

9.1. Macro-Economic Factors

9.1.1. Global GDP Growth Outlook

9.1.2. Global Industry Value Added

9.1.3. Global Urbanization Growth Outlook

9.1.4. Global Food Security Index Outlook

9.1.5. Global Rank – Ease of Doing Business Rank, 2019

9.1.6. Global Rank – Trading Across Borders

9.2. Impact of COVID-19 on Wheat Flour Industry

9.2.1. Manufacturers/ Processors

9.2.2. Supply Chain and Logistics

9.2.3. Wholesalers/ Traders

9.2.4. Retailers

9.3. Impact on COVID-19 on Wheat Flour Market

9.4. Impact of COVID-19 on Food and Beverage Industry

9.5. COVID-19 Risk Assessment/Impact

9.6. Global Food & Beverage Industry Outlook

9.7. Global Organic Agriculture Land Outlook

9.8. Global Wheat Market Overview

9.8.1. Harvested Area Under Cultivation

9.8.2. Wheat Production by Country

9.9. Export/ Import Trade Analysis of Wheat by Country

9.9.1. List of Key Exporters

9.9.1.1. By Value (US$ Mn)

9.9.1.2. By Volume (Tons)

9.9.2. List of Key Importers

9.9.2.1. By Value (US$ Mn)

9.9.2.2. By Volume (Tons)

9.10. List of Key Wheat Flour Manufacturers/ Traders

9.10.1. Africa

9.11. End User Demand Analysis

9.12. Industry Value and Supply Chain Analysis

9.12.1. Profit Margin Analysis at each point of sales

9.12.2. List and Role of Key Participants

9.12.2.1. Distributors/ Suppliers/ Wholesalers

9.12.2.2. Potential Buyers

9.13. Modern Wheat Flour Processing Overview

9.14. Wheat flour Processing Technology Overview

9.15. Wheat Flour Association in Africa

9.16. Key Certifications/Claims

9.17. Milling Technologies in Wheat Flour Industry

9.18. Key Regulations

9.19. Market Dynamics

9.19.1. Drivers

9.19.2. Restraints

9.19.3. Opportunity Analysis

9.20. Forecast Factors - Relevance & Impact

10. Industries Related to Wheat Flour Applications for Business Expansion

10.1. Bread

10.2. Cake, Muffins, & Doughnuts

10.3. Biscuit

10.4. Food Service Industry

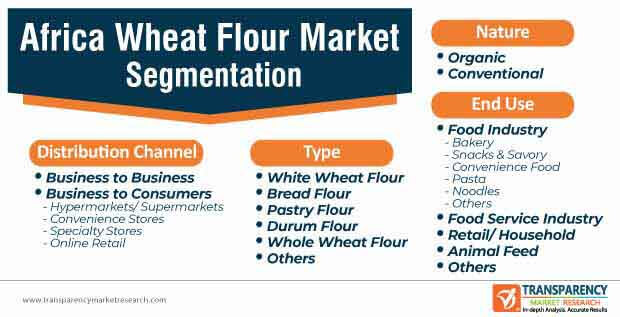

11. Africa Wheat Flour Market Analysis 2016-2020 and Forecast 2021-2031, By Nature

11.1. Introduction / Key Findings

11.2. Historical Market Size (US$ Mn) and Volume Analysis By Nature, 2016-2020

11.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Nature, 2021-2031

11.3.1. Organic

11.3.2. Conventional

11.4. Market Attractiveness Analysis By Nature

12. Africa Wheat Flour Market Analysis 2016-2020 and Forecast 2021-2031, By End Use

12.1. Introduction / Key Findings

12.2. Historical Market Size (US$ Mn) and Volume Analysis By End Use, 2016-2020

12.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By End Use, 2021-2031

12.3.1. Food Industry

12.3.1.1. Biscuits

12.3.1.2. Cookies

12.3.1.3. Snacks & Savory

12.3.1.4. Convenience Food

12.3.1.5. Pasta

12.3.1.6. Noodles

12.3.1.7. Others

12.3.2. Foodservice Industry

12.3.3. Animal Feed

12.3.4. Retail/ Household

12.3.5. Others

12.4. Market Attractiveness Analysis By End Use

13. Africa Wheat Flour Market Analysis 2016-2020 and Forecast 2021-2031, By Distribution Channel

13.1. Introduction / Key Findings

13.2. Historical Market Size (US$ Mn) and Volume Analysis By Distribution Channel, 2016-2020

13.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Distribution Channel, 2021-2031

13.3.1. Business to Business

13.3.2. Business to Consumers

13.3.2.1. Hypermarkets/ Supermarkets

13.3.2.2. Specialty Stores

13.3.2.3. Conventional Stores

13.3.2.4. Online Retail

13.4. Market Attractiveness Analysis By Distribution Channel

14. Africa Wheat Flour Market Analysis 2016-2020 and Forecast 2021-2031, By Type

14.1. Introduction / Key Findings

14.2. Historical Market Size (US$ Mn) and Volume Analysis By Distribution Channel, 2016-2020

14.3. Current and Future Market Size (US$ Mn) and Volume Analysis and Forecast By Distribution Channel, 2021-2031

14.3.1. All-purpose flour

14.3.2. Bread Flour

14.3.3. Pastry Flour

14.3.4. Durum Flour

14.3.5. Whole Wheat Flour

14.3.6. Others

14.4. Market Attractiveness Analysis By Distribution Channel

15. Market Structure Analysis

15.1. Market Analysis by Tier of Companies

15.2. Market Concentration

15.3. Market Presence Analysis

16. Competition Analysis

16.1. Competition Dashboard

16.2. Competition Benchmarking

16.3. Competition Deep Dive (Key Players: Africa)

16.3.1. The Grands Moulins de Mauritanie

16.3.1.1. Overview

16.3.1.2. Product Portfolio

16.3.1.3. Production Footprint

16.3.1.4. Sales Footprint

16.3.1.5. Channel Footprint

16.3.1.6. Strategy Overview

16.3.2. Bakhresa Group Ltd.

16.3.2.1. Overview

16.3.2.2. Product Portfolio

16.3.2.3. Production Footprint

16.3.2.4. Sales Footprint

16.3.2.5. Channel Footprint

16.3.2.6. Strategy Overview

16.3.3. Honeywell Flour Mills

16.3.3.1. Overview

16.3.3.2. Product Portfolio

16.3.3.3. Production Footprint

16.3.3.4. Sales Footprint

16.3.3.5. Channel Footprint

16.3.3.6. Strategy Overview

16.3.4. SOMDIAA S.A.

16.3.4.1. Overview

16.3.4.2. Product Portfolio

16.3.4.3. Production Footprint

16.3.4.4. Sales Footprint

16.3.4.5. Channel Footprint

16.3.4.6. Strategy Overview

16.3.5. Olam International

16.3.5.1. Overview

16.3.5.2. Product Portfolio

16.3.5.3. Production Footprint

16.3.5.4. Sales Footprint

16.3.5.5. Channel Footprint

16.3.5.6. Strategy Overview

16.3.6. Supreme Flour

16.3.6.1. Overview

16.3.6.2. Product Portfolio

16.3.6.3. Production Footprint

16.3.6.4. Sales Footprint

16.3.6.5. Channel Footprint

16.3.6.6. Strategy Overview

16.3.7. GIDEON MILLING

16.3.7.1. Overview

16.3.7.2. Product Portfolio

16.3.7.3. Production Footprint

16.3.7.4. Sales Footprint

16.3.7.5. Channel Footprint

16.3.7.6. Strategy Overview

16.3.8. Tiger Brands Ltd.

16.3.8.1. Overview

16.3.8.2. Product Portfolio

16.3.8.3. Production Footprint

16.3.8.4. Sales Footprint

16.3.8.5. Channel Footprint

16.3.8.6. Strategy Overview

16.3.9. Elnefeidi Group Holding Co. Ltd.

16.3.9.1. Overview

16.3.9.2. Product Portfolio

16.3.9.3. Production Footprint

16.3.9.4. Sales Footprint

16.3.9.5. Channel Footprint

16.3.9.6. Strategy Overview

16.3.10. Rotana Flour Mills

16.3.10.1. Overview

16.3.10.2. Product Portfolio

16.3.10.3. Production Footprint

16.3.10.4. Sales Footprint

16.3.10.5. Channel Footprint

16.3.10.6. Strategy Overview

16.3.11. Grain Millers, Inc.

16.3.11.1. Overview

16.3.11.2. Product Portfolio

16.3.11.3. Production Footprint

16.3.11.4. Sales Footprint

16.3.11.5. Channel Footprint

16.3.11.6. Strategy Overview

16.3.12. Archer Daniels Midland Company

16.3.12.1. Overview

16.3.12.2. Product Portfolio

16.3.12.3. Production Footprint

16.3.12.4. Sales Footprint

16.3.12.5. Channel Footprint

16.3.12.6. Strategy Overview

16.3.13. Arrowhead Mills

16.3.13.1. Overview

16.3.13.2. Product Portfolio

16.3.13.3. Production Footprint

16.3.13.4. Sales Footprint

16.3.13.5. Channel Footprint

16.3.13.6. Strategy Overview

16.3.14. Ardent Mills, LLC

16.3.14.1. Overview

16.3.14.2. Product Portfolio

16.3.14.3. Production Footprint

16.3.14.4. Sales Footprint

16.3.14.5. Channel Footprint

16.3.14.6. Strategy Overview

16.3.15. General Mills Inc.

16.3.15.1. Overview

16.3.15.2. Product Portfolio

16.3.15.3. Production Footprint

16.3.15.4. Sales Footprint

16.3.15.5. Channel Footprint

16.3.15.6. Strategy Overview

16.3.16. Bob’s Red Mill Natural Foods

16.3.16.1. Overview

16.3.16.2. Product Portfolio

16.3.16.3. Production Footprint

16.3.16.4. Sales Footprint

16.3.16.5. Channel Footprint

16.3.16.6. Strategy Overview

16.3.17. Pioneer Food Group

16.3.17.1. Overview

16.3.17.2. Product Portfolio

16.3.17.3. Production Footprint

16.3.17.4. Sales Footprint

16.3.17.5. Channel Footprint

16.3.17.6. Strategy Overview

16.3.18. Premier Foods Group Ltd.

16.3.18.1. Overview

16.3.18.2. Product Portfolio

16.3.18.3. Production Footprint

16.3.18.4. Sales Footprint

16.3.18.5. Channel Footprint

16.3.18.6. Strategy Overview

16.3.19. VKB Flour Mills

16.3.19.1. Overview

16.3.19.2. Product Portfolio

16.3.19.3. Production Footprint

16.3.19.4. Sales Footprint

16.3.19.5. Channel Footprint

16.3.19.6. Strategy Overview

16.3.20. Flour Mills of Nigeria

16.3.20.1. Overview

16.3.20.2. Product Portfolio

16.3.20.3. Production Footprint

16.3.20.4. Sales Footprint

16.3.20.5. Channel Footprint

16.3.20.6. Strategy Overview

16.3.21. Others (On Additional Request)

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Africa Wheat Flour Market Value (US$ Mn) Analysis and Forecast by Nature, 2016-2031

Table 02: Africa Wheat Flour Market Volume ('000 Tons) Analysis and Forecast by Nature, 2016-2031

Table 03: Africa Wheat Flour Market Value (US$ Mn) Analysis and Forecast by End Use, 2016-2031

Table 04: Africa Wheat Flour Market Volume ('000 Tons) Analysis and Forecast by End Use, 2016-2031

Table 05: Africa Wheat Flour Market Value (US$ Mn) Analysis and Forecast by Food Industry Segment, 2016-2031

Table 06: Africa Wheat Flour Market Volume ('000 Tons) Analysis and Forecast by Food Industry Segment, 2016-2031

Table 07: Africa Wheat Flour Market Value (US$ Mn) Analysis and Forecast by Distribution Channel, 2016-2031

Table 08: Africa Wheat Flour Market Volume ('000 Tons) Analysis and Forecast by Distribution Channel, 2016-2031

Table 09: Africa Wheat Flour Market Value (US$ Mn) Analysis and Forecast by Business to Consumer Segment, 2016-2031

Table 10: Africa Wheat Flour Market Volume ('000 Tons) Analysis and Forecast by Business to Consumer Segment, 2016-2031

Table 11: Africa Wheat Flour Market Value (US$ Mn) Analysis and Forecast by Type, 2016-2031

Table 12: Africa Wheat Flour Market Volume ( '000 Tons) Analysis and Forecast by Type, 2016-2031

List of Figures

Figure 01: Africa Wheat Flour Market Volume ('000 Tons) 2016-2020

Figure 02: Africa Wheat Flour Market Volume ('000 Tons) 2021-2031

Figure 03: Africa Wheat Flour Market Value (US$ Mn) Forecast, 2021–2031

Figure 04: Africa Wheat Flour Market Volume (‘000 Tons) Forecast, 2021 –2031

Figure 05: Africa Wheat Flour Market Value Share Analysis by Nature, 2021 E

Figure 06: Africa Wheat Flour Market Y-o-Y Growth Rate by Nature, 2021-2031

Figure 07: Africa Wheat Flour Market Value (US$ Mn) Analysis & Forecast by Nature, 2021-2031

Figure 08: Africa Wheat Flour Market Volume ('000 Tons) Analysis & Forecast by Nature, 2021-2031

Figure 09: Africa Wheat Flour Market Value Share Analysis by End Use, 2021 E

Figure 10: Africa Wheat Flour Market Y-o-Y Growth Rate by End Use, 2021-2031

Figure 11: Africa Wheat Flour Market Value (US$ Mn) Analysis & Forecast by End Use, 2021-2031

Figure 12: Africa Wheat Flour Market Volume ('000 Tons) Analysis & Forecast by End Use, 2021-2031

Figure 13: Africa Wheat Flour Market Value Share Analysis by Distribution Channel, 2021 E

Figure 14: Africa Wheat Flour Market Y-o-Y Growth Rate by Distribution Channel, 2021-2031

Figure 15: Africa Wheat Flour Market Value (US$ Mn) Analysis & Forecast by Distribution Channel, 2021-2031

Figure 16: Africa Wheat Flour Market Volume ('000 Tons) Analysis & Forecast by Distribution Channel, 2021-2031

Figure 17: Africa Wheat Flour Market Value Share Analysis by Type, 2021 E

Figure 18: Africa Wheat Flour Market Y-o-Y Growth Rate by Type, 2021-2031

Figure 19: Africa Wheat Flour Market Value (US$ Mn) Analysis & Forecast by Type, 2021-2031

Figure 20: Africa Wheat Flour Market Volume ('000 Tons) Analysis & Forecast by Type, 2021-2031

Figure 21: Africa Wheat Flour Market Attractiveness Analysis by Type, 2021-2031

Figure 22: Africa Wheat Flour Market Attractiveness Analysis by Nature, 2021-2031

Figure 23: Africa Wheat Flour Market Attractiveness Analysis by End Use, 2021-2031

Figure 24: Africa Wheat Flour Market Attractiveness Analysis by Distribution Channel, 2021-2031