One of the key factors currently driving the Africa small hydropower market is the low requirement of capital investments to get projects set up. Players as well as governments are aware of this and intend to make full use of the fact that small hydropower can be cheaper than several other alternative renewables in the long run. The market is also being driven by the minimal impact that small hydropower installations can have on the environment, in comparison to non-renewable sources as well as several large scale renewable power projects. However, the Africa small hydropower market is currently being hampered by the lack of access that several regions have to the key technologies required to successfully run a large-scale implementation process. The market is also being restricted by the lack of grid-based infrastructure that can support and make use of multiple small hydropower installations within an area.

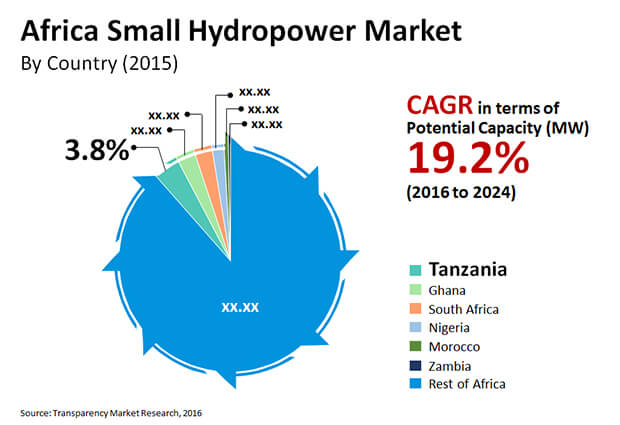

In terms of production capacity, the African Small Hydropower market had reached 9,752.9 MW in 2015. It is very likely to reach 49,706.1 MW by the end of 2024, after expanding at a CAGR of 19.2% within the forecast period from 2016 to 2024.

In terms of nations, the Africa small hydropower market can be segmented into Zambia, Morocco, South Africa, Tanzania, Nigeria, Ghana, and a collective minority of other nations. For 2015, it was observed that the southern and northern African nations held the leading shares in the Africa small hydropower market in terms of potential capacity for power generation. Emerging economies from Eastern Africa, Central Africa, and Western Africa are likely to be the core upcoming markets for small hydropower over the coming years.

The significant expansion of hydropower and the increasing emphasis put on hydroelectricity in developing regions are anticipated to be key drivers to the Africa small hydropower market. The future for small hydropower in Africa is expected to witness two tracks running in parallel to each other. One of them is the number of grid-connected projects that are popping up and that are intended to generate power to be fed into the national grid. The other is the growing number of small scale systems intended for private use. The future of grid-tied systems is linked to the policies adopted by several nations regarding the development of renewable energy sources.

In terms of potential growth in the Africa small hydropower market in production capacities, Zambia is likely to show an above-average CAGR of 20% within the forecast period from 2016 to 2024. This is currently considered the leading growth rate amongst all the African countries included in the Africa small hydropower market and under consideration within this report.

Ghana is expected to have a very strong impact on the increase in the overall capacity for the forecast period of 2015-2024. Ghana’s share of potential capacity for the year 2024 is expected to be close to 10% of the entire potential capacity for Africa. Small hydro plants have a longer life span of up to 50 years which makes it reliable and economical source of energy conversion. Small hydro has high capacity utilization factor up to 50% which results in higher output as compared to wind and solar power which accounts for 25% and 20% respectively. Small hydro plant can be operated continuously at any temperature and wind condition which makes it economical and flexible.

Key players in the global small hydropower market so far, have included Mecamidi, Africa Infrastructure Investment Managers (AIIM), Eco Power Holdings, Artelia, Lesotho Electricity Company, Agder Energi AS, Ontario Power Generation, Inc., Voith GmbH, Alstom SA, Andritz, Siemens AG, Eskom Holdings, BC Hydro and Power Authority, StatKraft AS, RusHydro PJSC, ZESCO Ltd., Fortum OYJ, and Mozambique Electricity Company.

Rise in Rural Electrification Initiatives to Increase the Growth Opportunities across the Small Hydropower Market

The small hydropower market will observe a stable growth rate across the assessment period of 2016-2024 owing to an increase in the rural electrification initiatives around the world and the low capital investment requirements to set up projects. All these factors bring tremendous growth opportunities for the small hydropower market. Furthermore, the rising popularity of small hydropower plants as a cost-effective renewable energy source option will bring immense growth prospects during the forecast period.

1. Preface

1.1. Market Definition & Segmentation

1.2. Research Highlights

1.3. Report Assumptions

1.4. Research Methodology

2. Executive Summary

2.1. Africa Small Hydropower Market, 2015 - 2024, (Potential Capacity – MW)

2.2. Africa – Potential Capacity Trends – By Country (2016)

2.3. Africa Small Hydropower Market, By Potential Capacity (MW) Forecast, 2015–2024

3. Africa Small Hydropower Market – Market Overview

3.1. Introduction

3.1.1. Small Hydropower Definition

3.1.2. Key Countries

3.1.3. Key Players

3.1.4. Key Industry Developments

3.1.5. Market Indicators

3.2. Market Dynamics

3.2.1. Market Drivers

3.2.1.1. Low Capital Investment

3.2.1.2. Low Generation Cost

3.2.1.3. Minimum Environment Impact

3.2.2. Market Restraints

3.2.2.1. Lack of access to appropriate technologies

3.2.2.2. Absence of infrastructure for manufacturing, installation and operation

3.2.2.3. Dearth of local capacity to design and develop small hydropower

3.3. Opportunity Analysis

3.3.1. Growing need for off-grid electricity in the future

3.4. Porter’s Five Forces Analysis

3.4.1. Bargaining Power of Suppliers

3.4.2. Bargaining Power of Buyers

3.4.3. Threat of Substitutes

3.4.4. Threat of New Entrants

3.4.5. Degree of Competition

3.5. Africa Small Hydropower Market – Value Chain Analysis

4. Africa Small Hydropower Market Analysis – By Country

4.1. Key Findings

4.2. Introduction – Small Hydropower Market

4.2.1. Morocco Potential Capacity (MW) 2015-2024

4.2.2. South Africa Potential Capacity (MW) 2015-2024

4.2.3. Tanzania Potential Capacity (MW) 2015-2024

4.2.4. Zambia Potential Capacity (MW) 2015-2024

4.2.5. Ghana Potential Capacity (MW) 2015-2024

4.2.6. Nigeria Potential Capacity (MW) 2015-2024

4.2.7. Rest of Africa Potential Capacity (MW) 2015-2024

4.3. Africa Small Hydropower Market Potential Capacity Share Analysis, by Country

4.4. Africa Small Hydropower Market Forecast, by Country

4.5. Africa Small Hydropower Market – Current Market Trends

4.6. Africa Small Hydropower Market Attractiveness Analysis By Country

5. Competitive Landscape

5.1. Company Market Share Analysis

5.2. Competition Matrix

5.2.1. AIIM Pty. Ltd

5.2.2. Ontario Power Generation, Inc.

5.2.3. Siemens AG

5.2.4. ESKOM Holdings

5.3. Company Profiles

5.3.1. Mecamidi

5.3.1.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.1.2. Company Description

5.3.1.3. Product & Services

5.3.2. Africa Infrastructure Investment Managers (AIIM)

5.3.2.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.2.2. Company Description

5.3.2.3. Product & Services

5.3.3. Eco Power Holdings

5.3.3.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.3.2. Company Description

5.3.3.3. Product & Services

5.3.4. Artelia

5.3.4.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.4.2. Company Description

5.3.4.3. Product & Services

5.3.4.4. Net Projects Breakdown, by Geography

5.3.4.5. Global Turnover

5.3.4.6. Key Insights

5.3.5. Lesotho Electricity Company

5.3.5.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.5.2. Company Description

5.3.5.3. Product & Services

5.3.5.4. SWOT Analysis

5.3.5.5. Strategic Overview

5.3.5.6. Financial Details

5.3.6. Agder Energi AS

5.3.6.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.6.2. Company Description

5.3.6.3. Product & Services

5.3.6.4. SWOT Analysis

5.3.6.5. Strategic Overview

5.3.6.6. Financial Details

5.3.7. Ontario Power Generation Inc.

5.3.7.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.7.2. Company Description

5.3.7.3. Product & Services

5.3.7.4. SWOT Analysis

5.3.7.5. Strategic Overview

5.3.7.6. Financial Details

5.3.8. Voith GmbH

5.3.8.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.8.2. Company Description

5.3.8.3. Product & Services

5.3.8.4. SWOT Analysis

5.3.8.5. Strategic Overview

5.3.8.6. Financial Details

5.3.9. Alstom SA

5.3.9.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.9.2. Company Description

5.3.9.3. Product & Services

5.3.9.4. Global Turnover

5.3.9.5. Key Insights

5.3.10. Andritz

5.3.10.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.10.2. Company Description

5.3.10.3. Product & Services

5.3.10.4. Key Insights

5.3.10.5. Financial Details

5.3.11. Siemens AG

5.3.11.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.11.2. Company Description

5.3.11.3. Product & Services

5.3.11.4. SWOT Analysis

5.3.11.5. Financial Details

5.3.11.6. Strategic Overview

5.3.12. Eskom Holdings

5.3.12.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.12.2. Company Description

5.3.12.3. Product & Services

5.3.12.4. SWOT Analysis

5.3.12.5. Financial Details

5.3.12.6. Strategic Overview

5.3.13. BC Hydro and Power Authority

5.3.13.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.13.2. Company Description

5.3.13.3. Product & Services

5.3.13.4. SWOT Analysis

5.3.13.5. Financial Details

5.3.14. StatKraft

5.3.14.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.14.2. Company Description

5.3.14.3. Product & Services

5.3.14.4. SWOT Analysis

5.3.14.5. Financial Details

5.3.15. RusHydro PJSC

5.3.15.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.15.2. Company Description

5.3.15.3. Product & Services

5.3.15.4. SWOT Analysis

5.3.15.5. Strategic Overview

5.3.15.6. Financial Details

5.3.16. Fortum Oyj

5.3.16.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.16.2. Company Description

5.3.16.3. Product & Services

5.3.16.4. SWOT Analysis

5.3.16.5. Financial Details

5.3.17. ZESCO Ltd.

5.3.17.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.17.2. Company Description

5.3.17.3. Product & Services

5.3.17.4. SWOT Analysis

5.3.17.5. Strategic Overview

5.3.17.6. Financial Details

5.3.18. Mozambique Electricity Company

5.3.18.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.18.2. Company Description

5.3.18.3. Business Lines

5.3.18.4. SWOT Analysis

5.3.18.5. Strategic Overview

5.3.18.6. Financial Details

5.3.19. Practical Action

5.3.19.1. Company Details (HQ, Established Year, Revenue, Employee Strength, Key Management and Website)

5.3.19.2. Company Description

5.3.19.3. Financial Details

5.3.19.4. SWOT Analysis

5.3.19.5. Strategic Overview

5.3.19.6. Financial Details

List of Tables

Table 01: Africa Small Hydropower Market Potential Capacity (MW) Forecast, by Country, 2015–2024

List of Figures

Figure 01: Africa Small Hydropower Market, By Potential Capacity (MW) Forecast, 2015–2024

Figure 02: Morocco Potential Capacity (MW) 2015–2024

Figure 03: South Africa Potential Capacity (MW) 2015–2024

Figure 04: Tanzania Potential Capacity (MW) 2015–2024

Figure 05: Zambia Potential Capacity (MW) 2015–2024

Figure 06: Ghana Potential Capacity (MW) 2015–2024

Figure 07: Nigeria Potential Capacity (MW) 2015–2024

Figure 09: Africa Small Hydropower Market Value Share Analysis, by Country, 2016 and 2024

Figure 10: Africa Small Hydropower Market Attractiveness Analysis by Country

Figure 11: Africa Small Hydropower Market – Market Share Analysis by Company (2015)