Analysts’ Viewpoint

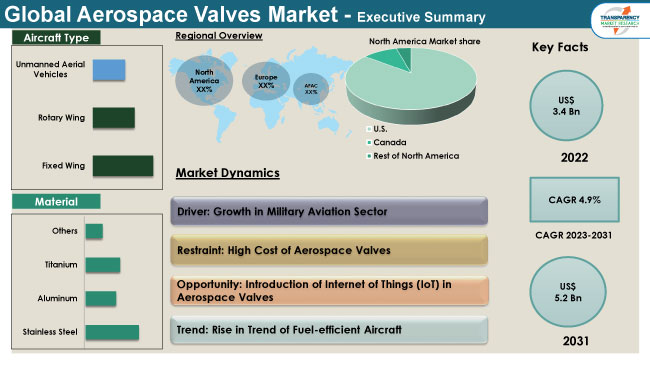

Growth in the military aviation sector, regular need for replacement of aerospace valves, and rise in demand for unmanned aerial vehicles are key factors driving the aerospace valves market size. Increase in investment in space exploration and satellite launches is also one of the prominent factors of market expansion. Developing economies such as China and India are increasing their investments in the aerospace sector. This is anticipated to augment market progress in the next few years.

Key aerospace valves manufacturers are focusing on designing and producing valves that meet the specific requirements of the aerospace sector such as high reliability, precise control, and ability to operate in extreme conditions. They are adopting the latest aerospace valves market trends and working closely with customers to provide tailor-made solutions in order to increase their market share.

Aerospace valves are designed for usage in aircraft, spacecraft, and other aerospace applications. These valves play a critical role in controlling the flow of various fluids and gases, such as fuel, hydraulic fluid, and air, throughout an aerospace system.

Aerospace check valves are highly reliable, lightweight, and able to withstand extreme conditions of space and high-altitude flight. These valves also operate at high pressures and temperatures, and are resistant to corrosion, vibration, and shock.

Aerospace valves are designed to minimize fluid and gas leaks, which can be dangerous in the vacuum of space or in high-altitude environments. These valves are employed in a wide range of applications in aerospace such as fuel systems, pneumatic systems, hydraulic systems, coolant systems, and water & wastewater systems. This is fueling market development.

The global aerospace valves industry is likely to expand at a steady pace during the forecast period owing to the rise in demand for these valves in the military aviation sector and growth in investments in space exploration and satellite launches.

Aerospace valves are used extensively in the military aviation sector. Continuous advancements in valve technology, such as introduction of lightweight and high-performance valves, is one of the significant factors of aerospace valves market growth.

Aircraft have become more advanced and complex; therefore, they require more sophisticated systems to operate efficiently and safely. These systems need a variety of valves to control the flow of fluids and gases. As a result, need for high-quality valves that can withstand demanding conditions of the aerospace environment is rising across the globe.

The military sector plays a prominent role in the demand for aerospace valves. Valves are used in a wide range of applications in military aircraft. Countries around the world are continuing to invest substantially in military capabilities. This is boosting market dynamics.

Some of the key manufacturers and suppliers of aerospace valves are concentrating on product development. In July 2021, Honeywell International Inc. designed and developed one of its valves using the additive manufacturing technique. This bleed pressure regulating aircraft valve is being used for installation of the William FJ44-4M engine on the M345 military trainer aircraft. It is used in high temperature bleed system applications. Thus, increase in focus on product development activities is estimated to positively impact the aerospace valves market structure evolution.

Unmanned aerial vehicles (UAVs), also known as drones, are increasingly being used for various applications such as surveillance, inspection, mapping, and delivery. Hydraulic and pneumatic systems of UAVs have become more complex due to advancement and sophistication of these drones. This has led to a rise in need for valves to control the flow of fluids or gases. Valves play a vital role in regulating the pressure and flow rate of fluids and gases in UAV systems, thus ensuring that they operate efficiently and safely.

The aerospace sector is constantly evolving, with new technologies and materials being developed to improve the performance and reliability of UAVs. This has resulted in the development of specialized valves that are designed to withstand harsh operating conditions of UAVs such as high altitude, extreme temperatures, and rapid changes in pressure.

Thus, development of new technologies and rise in usage of drones are likely to provide lucrative aerospace valves market opportunities to aerospace valves distributors, suppliers, and manufacturers.

In terms of type, the global aerospace valves market segmentation entails ball valves, butterfly valves, emergency inflation valves, shut-off valves, check/non-return valves, flow control valves, relief valves, solenoid valves, heater valves, and others (isolation valves, drain valves, etc.).

Butterfly valves is expected to be one of the rapidly growing segments during the forecast period, led by the advantageous properties of these valves such as ease of usage, compact size, and fewer space requirements.

Butterfly valves are employed in fuel systems to control the flow of fuel to engines. These valves are designed to withstand high pressures and temperatures. This makes them ideal for usage in aircraft fuel systems.

They are lightweight and compact, which makes them suitable for aerospace applications where weight and space are critical factors. Butterfly valves are also low maintenance vis-à-vis other types of valves. They also possess fewer moving parts, thus rendering them less prone to wear and tear.

As per aerospace valves market research, the global industry has been classified into fuel systems, pneumatic systems, hydraulic systems, coolant systems, water & wastewater systems, and others (inflation, environmental control system, etc.) based on application.

The hydraulic systems segment held the largest aerospace valves market share in 2022. Rise in demand for air travel, especially after the peak of the COVID-19 pandemic, is driving the need for new aircraft. This, in turn, is bolstering market statistics.

Hydraulic systems are used for various functions of an aircraft, including landing gear actuation, flight control surfaces, and reversal of thrust. Valves used in aerospace hydraulic systems must be able to withstand extreme conditions, including high pressure, high temperature, and vibration. Aerospace valves must also be designed to minimize weight, while maintaining high performance. Therefore, high-quality valves that meet strict safety and reliability standards are employed in the global aerospace sector.

According to aerospace valves market analysis, North America accounted for significant share of the global landscape in 2022 owing to the presence of leading players and availability of a large aircraft fleet in the U.S. High government spending on development of the aerospace industry in the U.S. is contributing to market growth in North America.

Asia Pacific is also a prominent region of the global aerospace valves industry. Increase in demand for air travel in countries such as China, India, and Japan, growth in investments in the aerospace sector, and presence of leading aircraft manufacturers and suppliers are projected to drive the market trajectory in the region.

Substantial number of large-scale vendors operate in the global aerospace valves market, which is fragmented. These vendors hold the maximum market share. Expansion of product portfolios, partnerships, and acquisitions are major strategies adopted by the leading manufacturers.

CACPL Aerospace, CIRCOR International, Inc., Eaton, Honeywell International Inc., Hy-Lok USA, Inc, ITT Aerospace Controls, JARECKI Valves, Magnet-Schultz GmbH & Co. KG, Nutek Aerospace, PARKER HANNIFIN CORP, Sitec Aerospace GmbH, Spectrum Valves, The Lee Company, and Valcor Engineering Corporation are prominent manufacturers of aerospace valves.

The aerospace valves market report summarizes the companies mentioned above based on financial overview, company overview, product portfolio, business strategies, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Size in 2022 |

US$ 3.4 Bn |

|

Market Forecast Value in 2031 |

US$ 5.2 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 3.4 Bn in 2022

It is anticipated to grow at a CAGR of 4.9% by 2031

It is projected to reach US$ 5.2 Bn in 2031

CACPL Aerospace, CIRCOR International, Inc., Eaton, Honeywell International Inc., Hy-Lok USA, Inc, ITT Aerospace Controls, JARECKI Valves, Magnet-Schultz GmbH & Co. KG, Nutek Aerospace, PARKER HANNIFIN CORP, Sitec Aerospace GmbH, Spectrum Valves, The Lee Company, and Valcor Engineering Corporation

The U.S. accounted for approximately 23.0% share in 2022

Based on application, the hydraulic systems segment constituted the largest share in 2022

Growth in the military aviation sector and increase in demand for unmanned aerial vehicles

North America is a highly lucrative region for vendors

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Aerospace Valves Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macroeconomic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Aerospace Industry Overview

4.2. Supply chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Aerospace Valves Market Analysis By Type

5.1. Aerospace Valves Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2023-2031

5.1.1. Ball Valves

5.1.2. Butterfly Valves

5.1.3. Emergency Inflation Valves

5.1.4. Shut-off Valves

5.1.5. Check/Non-return Valves

5.1.6. Flow Control Valves

5.1.7. Relief Valves

5.1.8. Solenoid Valves

5.1.9. Heater Valves

5.1.10. Others

5.2. Market Attractiveness Analysis, By Type

6. Global Aerospace Valves Market Analysis By Material

6.1. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Material, 2023-2031

6.1.1. Stainless Steel

6.1.2. Aluminum

6.1.3. Titanium

6.1.4. Others

6.2. Market Attractiveness Analysis, By Material

7. Global Aerospace Valves Market Analysis By Aircraft Type

7.1. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2023-2031

7.1.1. Fixed Wing

7.1.2. Rotary Wing

7.1.3. Unmanned Aerial Vehicles

7.2. Market Attractiveness Analysis, By Aircraft Type

8. Global Aerospace Valves Market Analysis By Application

8.1. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Application, 2023-2031

8.1.1. Fuel Systems

8.1.2. Pneumatic Systems

8.1.3. Hydraulic Systems

8.1.4. Coolant Systems

8.1.5. Water & Wastewater Systems

8.1.6. Others

8.2. Market Attractiveness Analysis, By Application

9. Global Aerospace Valves Market Analysis By End-use

9.1. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By End-use, 2023-2031

9.1.1. Civil Aviation

9.1.1.1. OEM

9.1.1.2. Aftermarket

9.1.2. Military Aviation

9.1.2.1. OEM

9.1.2.2. Aftermarket

9.2. Market Attractiveness Analysis, By End-use

10. Global Aerospace Valves Market Analysis and Forecast, By Region

10.1. Aerospace Valves Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Region, 2023-2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, By Region

11. North America Aerospace Valves Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Aerospace Valves Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2023-2031

11.3.1. Ball Valves

11.3.2. Butterfly Valves

11.3.3. Emergency Inflation Valves

11.3.4. Shut-off Valves

11.3.5. Check/Non-return Valves

11.3.6. Flow Control Valves

11.3.7. Relief Valves

11.3.8. Solenoid Valves

11.3.9. Heater Valves

11.3.10. Others

11.4. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Material, 2023-2031

11.4.1. Stainless Steel

11.4.2. Aluminum

11.4.3. Titanium

11.4.4. Others

11.5. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2023-2031

11.5.1. Fixed Wing

11.5.2. Rotary Wing

11.5.3. Unmanned Aerial Vehicles

11.6. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Application, 2023-2031

11.6.1. Fuel Systems

11.6.2. Pneumatic Systems

11.6.3. Hydraulic Systems

11.6.4. Coolant Systems

11.6.5. Water & Wastewater Systems

11.6.6. Others

11.7. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By End-use, 2023-2031

11.7.1. Civil Aviation

11.7.1.1. OEM

11.7.1.2. Aftermarket

11.7.2. Military Aviation

11.7.2.1. OEM

11.7.2.2. Aftermarket

11.8. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Country & Sub-Region, 2023-2031

11.8.1. The U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. By Type

11.9.2. By Material

11.9.3. By Aircraft Type

11.9.4. By Application

11.9.5. By End-use

11.9.6. By Country/Sub-region

12. Europe Aerospace Valves Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Aerospace Valves Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2023-2031

12.3.1. Ball Valves

12.3.2. Butterfly Valves

12.3.3. Emergency Inflation Valves

12.3.4. Shut-off Valves

12.3.5. Check/Non-return Valves

12.3.6. Flow Control Valves

12.3.7. Relief Valves

12.3.8. Solenoid Valves

12.3.9. Heater Valves

12.3.10. Others

12.4. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Material, 2023-2031

12.4.1. Stainless Steel

12.4.2. Aluminum

12.4.3. Titanium

12.4.4. Others

12.5. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2023-2031

12.5.1. Fixed Wing

12.5.2. Rotary Wing

12.5.3. Unmanned Aerial Vehicles

12.6. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Application, 2023-2031

12.6.1. Fuel Systems

12.6.2. Pneumatic Systems

12.6.3. Hydraulic Systems

12.6.4. Coolant Systems

12.6.5. Water & Wastewater Systems

12.6.6. Others

12.7. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By End-use, 2023-2031

12.7.1. Civil Aviation

12.7.1.1. OEM

12.7.1.2. Aftermarket

12.7.2. Military Aviation

12.7.2.1. OEM

12.7.2.2. Aftermarket

12.8. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Country & Sub-Region, 2023-2031

12.8.1. The U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. By Type

12.9.2. By Material

12.9.3. By Aircraft Type

12.9.4. By Application

12.9.5. By End-use

12.9.6. By Country/Sub-region

13. Asia Pacific Aerospace Valves Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Aerospace Valves Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2023-2031

13.3.1. Ball Valves

13.3.2. Butterfly Valves

13.3.3. Emergency Inflation Valves

13.3.4. Shut-off Valves

13.3.5. Check/Non-return Valves

13.3.6. Flow Control Valves

13.3.7. Relief Valves

13.3.8. Solenoid Valves

13.3.9. Heater Valves

13.3.10. Others

13.4. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Material, 2023-2031

13.4.1. Stainless Steel

13.4.2. Aluminum

13.4.3. Titanium

13.4.4. Others

13.5. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2023-2031

13.5.1. Fixed Wing

13.5.2. Rotary Wing

13.5.3. Unmanned Aerial Vehicles

13.6. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Application, 2023-2031

13.6.1. Fuel Systems

13.6.2. Pneumatic Systems

13.6.3. Hydraulic Systems

13.6.4. Coolant Systems

13.6.5. Water & Wastewater Systems

13.6.6. Others

13.7. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By End-use, 2023-2031

13.7.1. Civil Aviation

13.7.1.1. OEM

13.7.1.2. Aftermarket

13.7.2. Military Aviation

13.7.2.1. OEM

13.7.2.2. Aftermarket

13.8. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Country & Sub-Region, 2023-2031

13.8.1. China

13.8.2. Japan

13.8.3. South Korea

13.8.4. Taiwan

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. By Type

13.9.2. By Material

13.9.3. By Aircraft Type

13.9.4. By Application

13.9.5. By End-use

13.9.6. By Country/Sub-region

14. Middle East & Africa Aerospace Valves Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Aerospace Valves Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2023-2031

14.3.1. Ball Valves

14.3.2. Butterfly Valves

14.3.3. Emergency Inflation Valves

14.3.4. Shut-off Valves

14.3.5. Check/Non-return Valves

14.3.6. Flow Control Valves

14.3.7. Relief Valves

14.3.8. Solenoid Valves

14.3.9. Heater Valves

14.3.10. Others

14.4. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Material, 2023-2031

14.4.1. Stainless Steel

14.4.2. Aluminum

14.4.3. Titanium

14.4.4. Others

14.5. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2023-2031

14.5.1. Fixed Wing

14.5.2. Rotary Wing

14.5.3. Unmanned Aerial Vehicles

14.6. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Application, 2023-2031

14.6.1. Fuel Systems

14.6.2. Pneumatic Systems

14.6.3. Hydraulic Systems

14.6.4. Coolant Systems

14.6.5. Water & Wastewater Systems

14.6.6. Others

14.7. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By End-use, 2023-2031

14.7.1. Civil Aviation

14.7.1.1. OEM

14.7.1.2. Aftermarket

14.7.2. Military Aviation

14.7.2.1. OEM

14.7.2.2. Aftermarket

14.8. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Country, 2023-2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. By Type

14.9.2. By Material

14.9.3. By Aircraft Type

14.9.4. By Application

14.9.5. By End-use

14.9.6. By Region

15. South America Aerospace Valves Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Aerospace Valves Market Size (US$ Mn) and Volume (Million Units) Analysis & Forecast, By Type, 2023-2031

15.3.1. Ball Valves

15.3.2. Butterfly Valves

15.3.3. Emergency Inflation Valves

15.3.4. Shut-off Valves

15.3.5. Check/Non-return Valves

15.3.6. Flow Control Valves

15.3.7. Relief Valves

15.3.8. Solenoid Valves

15.3.9. Heater Valves

15.3.10. Others

15.4. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Material, 2023-2031

15.4.1. Stainless Steel

15.4.2. Aluminum

15.4.3. Titanium

15.4.4. Others

15.5. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Aircraft Type, 2023-2031

15.5.1. Fixed Wing

15.5.2. Rotary Wing

15.5.3. Unmanned Aerial Vehicles

15.6. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Application, 2023-2031

15.6.1. Fuel Systems

15.6.2. Pneumatic Systems

15.6.3. Hydraulic Systems

15.6.4. Coolant Systems

15.6.5. Water & Wastewater Systems

15.6.6. Others

15.7. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By End-use, 2023-2031

15.7.1. Civil Aviation

15.7.1.1. OEM

15.7.1.2. Aftermarket

15.7.2. Military Aviation

15.7.2.1. OEM

15.7.2.2. Aftermarket

15.8. Aerospace Valves Market Size (US$ Mn) Analysis & Forecast, By Country, 2023-2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. By Type

15.9.2. By Material

15.9.3. By Aircraft Type

15.9.4. By Application

15.9.5. By End-use

15.9.6. By Region

16. Competition Assessment

16.1. Global Aerospace Valves Market Competition Matrix - Aerospace Valves Dashboard View

16.1.1. Global Market Company Share Analysis, by Value (2022)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. CACPL Aerospace

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Key Financials

17.2. CIRCOR International, Inc.

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Key Financials

17.3. Eaton

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Key Financials

17.4. Honeywell International Inc.

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Key Financials

17.5. Hy-Lok USA, Inc.

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Key Financials

17.6. ITT Aerospace Controls

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Key Financials

17.7. JARECKI Valves

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Key Financials

17.8. Magnet-Schultz GmbH & Co. KG

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Key Financials

17.9. Nutek Aerospace

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Key Financials

17.10. PARKER HANNIFIN CORP

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Key Financials

17.11. Sitec Aerospace GmbH

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Key Financials

17.12. Spectrum Valves

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Key Financials

17.13. The Lee Company

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Key Financials

17.14. Valcor Engineering Corporation

17.14.1. Overview

17.14.2. Product Portfolio

17.14.3. Sales Footprint

17.14.4. Key Subsidiaries or Distributors

17.14.5. Strategy and Recent Developments

17.14.6. Key Financials

18. Recommendation

18.1. Identification of Potential Market Spaces

18.1.1. By Type

18.1.2. By Material

18.1.3. By Aircraft Type

18.1.4. By Application

18.1.5. By End-use

18.2. Understanding Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Aerospace Valves Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 2: Global Aerospace Valves Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 3: Global Aerospace Valves Market Size & Forecast, By Material, Value (US$ Mn), 2017-2031

Table 4: Global Aerospace Valves Market Size & Forecast, By Aircraft Type, Value (US$ Mn), 2017-2031

Table 5: Global Aerospace Valves Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 6: Global Aerospace Valves Market Size & Forecast, By End-use, Value (US$ Mn), 2017-2031

Table 7: Global Aerospace Valves Market Size & Forecast, By Region, Value (US$ Mn), 2017-2031

Table 8: Global Aerospace Valves Market Size & Forecast, By Region, Volume (Million Units), 2017-2031

Table 9: North America Aerospace Valves Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 10: North America Aerospace Valves Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 11: North America Aerospace Valves Market Size & Forecast, By Material, Value (US$ Mn), 2017-2031

Table 12: North America Aerospace Valves Market Size & Forecast, By Aircraft Type, Value (US$ Mn), 2017-2031

Table 13: North America Aerospace Valves Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 14: North America Aerospace Valves Market Size & Forecast, By End-use, Value (US$ Mn), 2017-2031

Table 15: North America Aerospace Valves Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 16: North America Aerospace Valves Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 17: Europe Aerospace Valves Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 18: Europe Aerospace Valves Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 19: Europe Aerospace Valves Market Size & Forecast, By Material, Value (US$ Mn), 2017-2031

Table 20: Europe Aerospace Valves Market Size & Forecast, By Aircraft Type, Value (US$ Mn), 2017-2031

Table 21: Europe Aerospace Valves Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 22: Europe Aerospace Valves Market Size & Forecast, By End-use, Value (US$ Mn), 2017-2031

Table 23: Europe Aerospace Valves Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 24: Europe Aerospace Valves Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 25: Asia Pacific Aerospace Valves Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 26: Asia Pacific Aerospace Valves Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 27: Asia Pacific Aerospace Valves Market Size & Forecast, By Material, Value (US$ Mn), 2017-2031

Table 28: Asia Pacific Aerospace Valves Market Size & Forecast, By Aircraft Type, Value (US$ Mn), 2017-2031

Table 29: Asia Pacific Aerospace Valves Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 30: Asia Pacific Aerospace Valves Market Size & Forecast, By End-use, Value (US$ Mn), 2017-2031

Table 31: Asia Pacific Aerospace Valves Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 32: Asia Pacific Aerospace Valves Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 33: Middle East & Africa Aerospace Valves Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 34: Middle East & Africa Aerospace Valves Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 35: Middle East & Africa Aerospace Valves Market Size & Forecast, By Material, Value (US$ Mn), 2017-2031

Table 36: Middle East & Africa Aerospace Valves Market Size & Forecast, By Aircraft Type, Value (US$ Mn), 2017-2031

Table 37: Middle East & Africa Aerospace Valves Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 38: Middle East & Africa Aerospace Valves Market Size & Forecast, By End-use, Value (US$ Mn), 2017-2031

Table 39: Middle East & Africa Aerospace Valves Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 40: Middle East & Africa Aerospace Valves Market Size & Forecast, By Country Volume (Million Units), 2017-2031

Table 41: South America Aerospace Valves Market Size & Forecast, By Type, Value (US$ Mn), 2017-2031

Table 42: South America Aerospace Valves Market Size & Forecast, By Type, Volume (Million Units), 2017-2031

Table 43: South America Aerospace Valves Market Size & Forecast, By Material, Value (US$ Mn), 2017-2031

Table 44: South America Aerospace Valves Market Size & Forecast, By Aircraft Type, Value (US$ Mn), 2017-2031

Table 45: South America Aerospace Valves Market Size & Forecast, By Application, Value (US$ Mn), 2017-2031

Table 46: South America Aerospace Valves Market Size & Forecast, By End-use, Value (US$ Mn), 2017-2031

Table 47: South America Aerospace Valves Market Size & Forecast, By Country Value (US$ Mn), 2017-2031

Table 48: South America Aerospace Valves Market Size & Forecast, By Country Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Aerospace Valves Market Share Analysis, by Region

Figure 02: Global Aerospace Valves Price Trend Analysis (Average Price, Thousand US$)

Figure 03: Global Aerospace Valves Market, Value (US$ Mn), 2017-2031

Figure 04: Global Aerospace Valves Market, Volume (Million Units), 2017-2031

Figure 05: Global Aerospace Valves Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 06: Global Aerospace Valves Market Share Analysis, by Type, 2023 and 2031

Figure 07: Global Aerospace Valves Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 08: Global Aerospace Valves Market Size & Forecast, By Material, Revenue (US$ Mn), 2017-2031

Figure 09: Global Aerospace Valves Market Share Analysis, by Material, 2023 and 2031

Figure 10: Global Aerospace Valves Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 11: Global Aerospace Valves Market Size & Forecast, By Aircraft Type, Revenue (US$ Mn), 2017-2031

Figure 12: Global Aerospace Valves Market Share Analysis, by Aircraft Type, 2023 and 2031

Figure 13: Global Aerospace Valves Market Attractiveness, By Aircraft Type, Value (US$ Mn), 2023-2031

Figure 14: Global Aerospace Valves Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 15: Global Aerospace Valves Market Share Analysis, by Application, 2023 and 2031

Figure 16: Global Aerospace Valves Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 17: Global Aerospace Valves Market Size & Forecast, By End-use, Revenue (US$ Mn), 2017-2031

Figure 18: Global Aerospace Valves Market Share Analysis, by End-use, 2023 and 2031

Figure 19: Global Aerospace Valves Market Attractiveness, By End-use, Value (US$ Mn), 2023-2031

Figure 20: Global Aerospace Valves Market Size & Forecast, By Region, Revenue (US$ Mn), 2017-2031

Figure 21: Global Aerospace Valves Market Share Analysis, by Region, 2023 and 2031

Figure 22: Global Aerospace Valves Market Attractiveness, By Region, Value (US$ Mn), 2023-2031

Figure 23: North America Aerospace Valves Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 24: North America Aerospace Valves Market Share Analysis, by Type, 2023 and 2031

Figure 25: North America Aerospace Valves Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 26: North America Aerospace Valves Market Size & Forecast, By Material, Revenue (US$ Mn), 2017-2031

Figure 27: North America Aerospace Valves Market Share Analysis, by Material, 2023 and 2031

Figure 28: North America Aerospace Valves Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 29: North America Aerospace Valves Market Size & Forecast, By Aircraft Type, Revenue (US$ Mn), 2017-2031

Figure 30: North America Aerospace Valves Market Share Analysis, by Aircraft Type, 2023 and 2031

Figure 31: North America Aerospace Valves Market Attractiveness, By Aircraft Type, Value (US$ Mn), 2023-2031

Figure 32: North America Aerospace Valves Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 33: North America Aerospace Valves Market Share Analysis, by Application, 2023 and 2031

Figure 34: North America Aerospace Valves Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 35: North America Aerospace Valves Market Size & Forecast, By End-use, Revenue (US$ Mn), 2017-2031

Figure 36: North America Aerospace Valves Market Share Analysis, by End-use, 2023 and 2031

Figure 37: North America Aerospace Valves Market Attractiveness, By End-use, Value (US$ Mn), 2023-2031

Figure 38: North America Aerospace Valves Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 39: North America Aerospace Valves Market Share Analysis, by Country 2023 and 2031

Figure 40: North America Aerospace Valves Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 41: Europe Aerospace Valves Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 42: Europe Aerospace Valves Market Share Analysis, by Type, 2023 and 2031

Figure 43: Europe Aerospace Valves Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 44: Europe Aerospace Valves Market Size & Forecast, By Material, Revenue (US$ Mn), 2017-2031

Figure 45: Europe Aerospace Valves Market Share Analysis, by Material, 2023 and 2031

Figure 46: Europe Aerospace Valves Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 47: Europe Aerospace Valves Market Size & Forecast, By Aircraft Type, Revenue (US$ Mn), 2017-2031

Figure 48: Europe Aerospace Valves Market Share Analysis, by Aircraft Type, 2023 and 2031

Figure 49: Europe Aerospace Valves Market Attractiveness, By Aircraft Type, Value (US$ Mn), 2023-2031

Figure 50: Europe Aerospace Valves Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 51: Europe Aerospace Valves Market Share Analysis, by Application, 2023 and 2031

Figure 52: Europe Aerospace Valves Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 53: Europe Aerospace Valves Market Size & Forecast, By End-use, Revenue (US$ Mn), 2017-2031

Figure 54: Europe Aerospace Valves Market Share Analysis, by End-use, 2023 and 2031

Figure 55: Europe Aerospace Valves Market Attractiveness, By End-use, Value (US$ Mn), 2023-2031

Figure 56: Europe Aerospace Valves Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 57: Europe Aerospace Valves Market Share Analysis, by Country 2023 and 2031

Figure 58: Europe Aerospace Valves Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 59: Asia Pacific Aerospace Valves Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 60: Asia Pacific Aerospace Valves Market Share Analysis, by Type, 2023 and 2031

Figure 61: Asia Pacific Aerospace Valves Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 62: Asia Pacific Aerospace Valves Market Size & Forecast, By Material, Revenue (US$ Mn), 2017-2031

Figure 63: Asia Pacific Aerospace Valves Market Share Analysis, by Material, 2023 and 2031

Figure 64: Asia Pacific Aerospace Valves Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 65: Asia Pacific Aerospace Valves Market Size & Forecast, By Aircraft Type, Revenue (US$ Mn), 2017-2031

Figure 66: Asia Pacific Aerospace Valves Market Share Analysis, by Aircraft Type, 2023 and 2031

Figure 67: Asia Pacific Aerospace Valves Market Attractiveness, By Aircraft Type, Value (US$ Mn), 2023-2031

Figure 68: Asia Pacific Aerospace Valves Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 69: Asia Pacific Aerospace Valves Market Share Analysis, by Application, 2023 and 2031

Figure 70: Asia Pacific Aerospace Valves Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 71: Asia Pacific Aerospace Valves Market Size & Forecast, By End-use, Revenue (US$ Mn), 2017-2031

Figure 72: Asia Pacific Aerospace Valves Market Share Analysis, by End-use, 2023 and 2031

Figure 73: Asia Pacific Aerospace Valves Market Attractiveness, By End-use, Value (US$ Mn), 2023-2031

Figure 74: Asia Pacific Aerospace Valves Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 75: Asia Pacific Aerospace Valves Market Share Analysis, by Country 2023 and 2031

Figure 76: Asia Pacific Aerospace Valves Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 77: Middle East & Africa Aerospace Valves Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 78: Middle East & Africa Aerospace Valves Market Share Analysis, by Type, 2023 and 2031

Figure 79: Middle East & Africa Aerospace Valves Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 80: Middle East & Africa Aerospace Valves Market Size & Forecast, By Material, Revenue (US$ Mn), 2017-2031

Figure 81: Middle East & Africa Aerospace Valves Market Share Analysis, by Material, 2023 and 2031

Figure 82: Middle East & Africa Aerospace Valves Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 83: Middle East & Africa Aerospace Valves Market Size & Forecast, By Aircraft Type, Revenue (US$ Mn), 2017-2031

Figure 84: Middle East & Africa Aerospace Valves Market Share Analysis, by Aircraft Type, 2023 and 2031

Figure 85: Middle East & Africa Aerospace Valves Market Attractiveness, By Aircraft Type, Value (US$ Mn), 2023-2031

Figure 86: Middle East & Africa Aerospace Valves Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 87: Middle East & Africa Aerospace Valves Market Share Analysis, by Application, 2023 and 2031

Figure 88: Middle East & Africa Aerospace Valves Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 89: Middle East & Africa Aerospace Valves Market Size & Forecast, By End-use, Revenue (US$ Mn), 2017-2031

Figure 90: Middle East & Africa Aerospace Valves Market Share Analysis, by End-use, 2023 and 2031

Figure 91: Middle East & Africa Aerospace Valves Market Attractiveness, By End-use, Value (US$ Mn), 2023-2031

Figure 92: Middle East & Africa Aerospace Valves Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 93: Middle East & Africa Aerospace Valves Market Share Analysis, by Country 2023 and 2031

Figure 94: Middle East & Africa Aerospace Valves Market Attractiveness, By Country Value (US$ Mn), 2023-2031

Figure 95: South America Aerospace Valves Market Size & Forecast, By Type, Revenue (US$ Mn), 2017-2031

Figure 96: South America Aerospace Valves Market Share Analysis, by Type, 2023 and 2031

Figure 97: South America Aerospace Valves Market Attractiveness, By Type, Value (US$ Mn), 2023-2031

Figure 98: South America Aerospace Valves Market Size & Forecast, By Material, Revenue (US$ Mn), 2017-2031

Figure 99: South America Aerospace Valves Market Share Analysis, by Material, 2023 and 2031

Figure 100: South America Aerospace Valves Market Attractiveness, By Material, Value (US$ Mn), 2023-2031

Figure 101: South America Aerospace Valves Market Size & Forecast, By Aircraft Type, Revenue (US$ Mn), 2017-2031

Figure 102: South America Aerospace Valves Market Share Analysis, by Aircraft Type, 2023 and 2031

Figure 103: South America Aerospace Valves Market Attractiveness, By Aircraft Type, Value (US$ Mn), 2023-2031

Figure 104: South America Aerospace Valves Market Size & Forecast, By Application, Revenue (US$ Mn), 2017-2031

Figure 105: South America Aerospace Valves Market Share Analysis, by Application, 2023 and 2031

Figure 106: South America Aerospace Valves Market Attractiveness, By Application, Value (US$ Mn), 2023-2031

Figure 107: South America Aerospace Valves Market Size & Forecast, By End-use, Revenue (US$ Mn), 2017-2031

Figure 108: South America Aerospace Valves Market Share Analysis, by End-use, 2023 and 2031

Figure 109: South America Aerospace Valves Market Attractiveness, By End-use, Value (US$ Mn), 2023-2031

Figure 110: South America Aerospace Valves Market Size & Forecast, By Country Revenue (US$ Mn), 2017-2031

Figure 111: South America Aerospace Valves Market Share Analysis, by Country 2023 and 2031

Figure 112: South America Aerospace Valves Market Attractiveness, By Country Value (US$ Mn), 2023-2031