Analyst Viewpoint

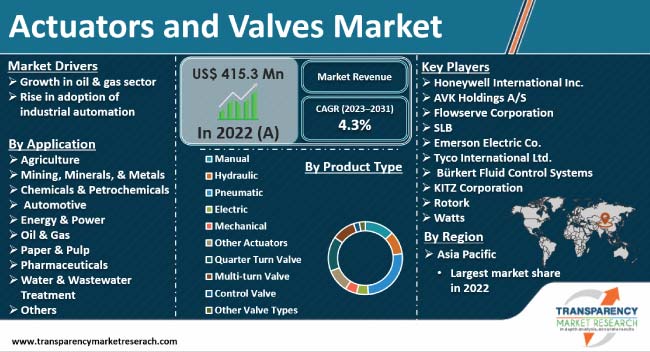

Growth in oil & gas sector and rise in adoption of industrial automation are propelling the actuators and valves market size. Actuators and valves are designed to withstand extreme conditions and are employed in several services of refining and extraction such as hydrocracking and natural gas gathering.

Pneumatic and quarter-turn valves are gaining traction in the global actuators and valves industry. These valves are widely employed in wastewater management, pulp & paper manufacturing, power generation, agriculture, and other industries. Prominent players are developing better designs to explore novel applications for their products and increase their actuators and valves market share.

Actuators and valves are essential components in an industrial system that control the flow of semi-solids, liquids, and gases to increase efficiency. A valve controls the flow of liquid or matter within a process while an actuator offers the necessary mechanical force to operate the valves automatically. Various actuators convert energy from compressed air into mechanical motion. These air actuators are commonly used in various industrial applications for controlling valves, dampers, and other mechanical components.

Actuators and valves have become synonymous with some of the world’s most profitable business verticals due to increase in industrial automation. These components are employed in various industries such as pharmaceuticals, petrochemicals, and manufacturing. In such complex sectors, actuators and valves are used to control pipeline operations and implement system-wide efficient automation. Waterproof electric actuators for marine applications are designed to withstand the challenges posed by marine environments. Rise in demand for water and energy fueled by rapid population growth is boosting the need for essential automation components such as actuators and valves in key industries.

Valves and actuators are commonly employed in the oil & gas sector to manage the flow of oil, gas, water, and condensate in offshore and onshore operations. These equipment must operate in extreme conditions of high temperatures and high corrosion. They must also meet strict government and international agency guidelines.

Oil & gas sector processes that seek the application of actuators and valves include drilling, extraction, transportation, processing, and storage. More specifically, actuators and valves find several service applications such as oil sands, natural gas gathering, and hydrocracking in the sector.

In 2021, a total of 4.2 billion tons (metric tons) of oil was produced globally while the total revenue generated by the oil & gas sector was around US$ 5.0 Trn. In recent years, Asia Pacific has been the only region to register an oil & gas production capacity growth, which offers favorable actuators and valves market opportunities to vendors.

The recent rise of industrial automation is meant to streamline processes, improve operational efficiency, and reduce wastage. Actuators and valves find several applications as most prominent industries in the world are shifting toward digitization and automation.

Smart valves, incorporating sensors and communication capabilities, are gaining prominence and are employed for various tasks such as remote monitoring and optimizing the operational performance of industrial systems in real time. In the water treatment and wastewater sector, actuators and valves with smart sensors are used for data collection in real time. Hence, rise in adoption of industrial automation is driving the actuators and valves market demand.

According to recent actuators and valves market trends, pneumatic valves and quarter-turn valves are witnessing high demand compared to other types of valves in the market. Quarter turn valves offer bi-directional operational capabilities whereas pneumatic valves showcase excellent operational ability to sustain overload pressure. Air actuators, butterfly valves and actuators, and actuated ball valves are other popular types of actuators and valves in the market.

Asia Pacific held largest share in 2022. Expansion in the oil & gas sector is fueling the market dynamics of the region. China is a major oil producer in Asia Pacific. Growth in pharmaceuticals and automotive sectors is also driving market statistics in the region.

According to the latest actuators and valves market forecast, the industry in North America and Europe is projected to grow at a steady pace during the forecast period due to expansion in industries such as oil & gas, petrochemicals, power generation, water and wastewater treatment, and manufacturing. Growth in petrochemical sector and increase in investment in infrastructure development are augmenting the actuators and valves market revenue in Middle East & Africa.

Prominent manufacturers of actuators and valves are investing heavily in advancements in smart technologies and the integration of novel sensors to enhance the functionality of actuators and valves industry components. A key strategy for vendors is the constant adoption of better designs to extend the scope of applications and meet the rising demand from several lucrative industries.

Honeywell International Inc., AVK Holdings A/S., Flowserve Corporation, SLB, Emerson Electric Co., Tyco International Ltd., KITZ Corporation, Burkert Fluid Control Systems, Watts, and Rotork are key vendors in the actuators and valves business.

These companies have been profiled in the actuators and valves market report based on parameters such as company overview, business strategies, product portfolio, financial overview, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 415.3 Mn |

| Market Forecast Value in 2031 | US$ 615.6 Mn |

| Growth Rate (CAGR) | 4.3% |

| Forecast Period | 2023 to 2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 415.3 Mn in 2022

It is projected to grow at a CAGR of 4.3% from 2023 to 2031

Growth in oil & gas sector and rise in adoption of industrial automation

The pneumatic valve type segment held the largest share in 2022

Asia Pacific was the leading region in 2022

Honeywell International Inc., AVK Holdings A/S., Flowserve Corporation, SLB, Emerson Electric Co., Tyco International Ltd., KITZ Corporation, Burkert Fluid Control Systems, Watts, and Rotork

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Value Chain Analysis

5.5. Industry SWOT Analysis

5.6. Porter’s Five Forces Analysis

5.7. Raw Material Analysis

5.8. Global Actuators and Valves Market Analysis and Forecast, 2023 - 2031

5.8.1. Market Revenue Projections (US$)

6. Global Actuators and Valves Market Analysis and Forecast, By Product Type

6.1. Actuators and Valves Market Size (US$ Mn) Forecast, By Product Type, 2023 - 2031

6.1.1. Manual

6.1.2. Hydraulic

6.1.3. Pneumatic

6.1.4. Electric

6.1.5. Mechanical

6.1.6. Other Actuators

6.1.7. Quarter Turn Valves

6.1.8. Multi-turn Valves

6.1.9. Control Valves

6.1.10. Other Valve Types

6.2. Incremental Opportunity, By Product Type

7. Global Actuators and Valves Market Analysis and Forecast, By Application

7.1. Actuators and Valves Market Size (US$ Mn) Forecast, By Application, 2023 - 2031

7.1.1. Agriculture

7.1.2. Mining, Minerals, & Metals

7.1.3. Chemicals & Petrochemicals

7.1.4. Automotive

7.1.5. Energy & Power

7.1.6. Oil & Gas

7.1.7. Paper & Pulp

7.1.8. Pharmaceuticals

7.1.9. Water & Wastewater Treatment

7.1.10. Others

7.2. Incremental Opportunity, By Application

8. Global Actuators and Valves Market Analysis and Forecast, By Region

8.1. Actuators and Valves Market Size (US$ Mn) Forecast, By Region, 2023 - 2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, By Region

9. North America Actuators and Valves Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Demographic Overview

9.3. Key Trend Analysis

9.3.1. Demand Side

9.3.2. Supply Side

9.4. Consumer Buying Behavior Analysis

9.5. Pricing Analysis

9.5.1. Weighted Average Selling Price (US$)

9.6. Market Share Analysis (%)

9.6.1. Local Manufacturers vs Import

9.7. Actuators and Valves Market Size (US$ Mn) Forecast, By Product Type, 2023 - 2031

9.7.1. Manual

9.7.2. Hydraulic

9.7.3. Pneumatic

9.7.4. Electric

9.7.5. Mechanical

9.7.6. Other Actuators

9.7.7. Quarter Turn Valves

9.7.8. Multi-turn Valves

9.7.9. Control Valves

9.7.10. Other Valve Types

9.8. Actuators and Valves Market Size (US$ Mn) Forecast, By Application, 2023 - 2031

9.8.1. Agriculture

9.8.2. Mining, Minerals, & Metals

9.8.3. Chemicals & Petrochemicals

9.8.4. Automotive

9.8.5. Energy & Power

9.8.6. Oil & Gas

9.8.7. Paper & Pulp

9.8.8. Pharmaceuticals

9.8.9. Water & Wastewater Treatment

9.8.10. Others

9.9. Actuators and Valves Market Size (US$ Mn) Forecast, By Country, 2023 - 2031

9.9.1. U.S.

9.9.2. Canada

9.9.3. Rest of North America

9.10. Incremental Opportunity Analysis

10. Europe Actuators and Valves Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Demographic Overview

10.3. Key Trend Analysis

10.3.1. Demand Side

10.3.2. Supply Side

10.4. Consumer Buying Behavior Analysis

10.5. Pricing Analysis

10.5.1. Weighted Average Selling Price (US$)

10.6. Market Share Analysis (%)

10.6.1. Local Manufacturers vs Import

10.7. Actuators and Valves Market Size (US$ Mn) Forecast, By Product Type, 2023 - 2031

10.7.1. Manual

10.7.2. Hydraulic

10.7.3. Pneumatic

10.7.4. Electric

10.7.5. Mechanical

10.7.6. Other Actuators

10.7.7. Quarter Turn Valves

10.7.8. Multi-turn Valves

10.7.9. Control Valves

10.7.10. Other Valve Types

10.8. Actuators and Valves Market Size (US$ Mn) Forecast, By Application, 2023 - 2031

10.8.1. Agriculture

10.8.2. Mining, Minerals, & Metals

10.8.3. Chemicals & Petrochemicals

10.8.4. Automotive

10.8.5. Energy & Power

10.8.6. Oil & Gas

10.8.7. Paper & Pulp

10.8.8. Pharmaceuticals

10.8.9. Water & Wastewater Treatment

10.8.10. Others

10.9. Actuators and Valves Market Size (US$ Mn) Forecast, By Country, 2023 - 2031

10.9.1. U.K.

10.9.2. Germany

10.9.3. France

10.9.4. France

10.9.5. Italy

10.9.6. Spain

10.9.7. The Netherlands

10.9.8. Rest of Europe

10.10. Incremental Opportunity Analysis

11. Asia Pacific Actuators and Valves Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Demographic Overview

11.3. Key Trend Analysis

11.3.1. Demand Side

11.3.2. Supply Side

11.4. Consumer Buying Behavior Analysis

11.5. Pricing Analysis

11.5.1. Weighted Average Selling Price (US$)

11.6. Market Share Analysis (%)

11.6.1. Local Manufacturers vs Import

11.7. Actuators and Valves Market Size (US$ Mn) Forecast, By Product Type, 2023 - 2031

11.7.1. Manual

11.7.2. Hydraulic

11.7.3. Pneumatic

11.7.4. Electric

11.7.5. Mechanical

11.7.6. Other Actuators

11.7.7. Quarter Turn Valves

11.7.8. Multi-turn Valves

11.7.9. Control Valves

11.7.10. Other Valve Types

11.8. Actuators and Valves Market Size (US$ Mn) Forecast, By Application, 2023 - 2031

11.8.1. Agriculture

11.8.2. Mining, Minerals, & Metals

11.8.3. Chemicals & Petrochemicals

11.8.4. Automotive

11.8.5. Energy & Power

11.8.6. Oil & Gas

11.8.7. Paper & Pulp

11.8.8. Pharmaceuticals

11.8.9. Water & Wastewater Treatment

11.8.10. Others

11.9. Actuators and Valves Market Size (US$ Mn) Forecast, By Country, 2023 - 2031

11.9.1. China

11.9.2. India

11.9.3. Japan

11.9.4. South Korea

11.9.5. Australia

11.9.6. ASEAN

11.9.7. Rest of Asia Pacific

11.10. Incremental Opportunity Analysis

12. Middle East & Africa Actuators and Valves Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Demographic Overview

12.3. Key Trend Analysis

12.3.1. Demand Side

12.3.2. Supply Side

12.4. Consumer Buying Behavior Analysis

12.5. Pricing Analysis

12.5.1. Weighted Average Selling Price (US$)

12.6. Market Share Analysis (%)

12.6.1. Local Manufacturers vs Import

12.7. Actuators and Valves Market Size (US$ Mn) Forecast, By Product Type, 2023 - 2031

12.7.1. Manual

12.7.2. Hydraulic

12.7.3. Pneumatic

12.7.4. Electric

12.7.5. Mechanical

12.7.6. Other Actuators

12.7.7. Quarter Turn Valves

12.7.8. Multi-turn Valves

12.7.9. Control Valves

12.7.10. Other Valve Types

12.8. Actuators and Valves Market Size (US$ Mn) Forecast, By Application, 2023 - 2031

12.8.1. Agriculture

12.8.2. Mining, Minerals, & Metals

12.8.3. Chemicals & Petrochemicals

12.8.4. Automotive

12.8.5. Energy & Power

12.8.6. Oil & Gas

12.8.7. Paper & Pulp

12.8.8. Pharmaceuticals

12.8.9. Water & Wastewater Treatment

12.8.10. Others

12.9. Actuators and Valves Market Size (US$ Mn) Forecast, By Country, 2023 - 2031

12.9.1. UAE

12.9.2. Saudi Arabia

12.9.3. Kuwait

12.9.4. Qatar

12.9.5. Nigeria

12.9.6. South Africa

12.9.7. Rest of Middle East & Africa

13. South America Actuators and Valves Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Demographic Overview

13.3. Key Trend Analysis

13.3.1. Demand Side

13.3.2. Supply Side

13.4. Consumer Buying Behavior Analysis

13.5. Pricing Analysis

13.5.1. Weighted Average Selling Price (US$)

13.6. Market Share Analysis (%)

13.6.1. Local Manufacturers vs Import

13.7. Actuators and Valves Market Size (US$ Mn) Forecast, By Product Type, 2023 - 2031

13.7.1. Manual

13.7.2. Hydraulic

13.7.3. Pneumatic

13.7.4. Electric

13.7.5. Mechanical

13.7.6. Other Actuators

13.7.7. Quarter Turn Valves

13.7.8. Multi-turn Valves

13.7.9. Control Valves

13.7.10. Other Valve Types

13.8. Actuators and Valves Market Size (US$ Mn) Forecast, By Application, 2023 - 2031

13.8.1. Agriculture

13.8.2. Mining, Minerals, & Metals

13.8.3. Chemicals & Petrochemicals

13.8.4. Automotive

13.8.5. Energy & Power

13.8.6. Oil & Gas

13.8.7. Paper & Pulp

13.8.8. Pharmaceuticals

13.8.9. Water & Wastewater Treatment

13.8.10. Others

13.9. Actuators and Valves Market Size (US$ Mn) Forecast, By Country, 2023 - 2031

13.9.1. Brazil

13.9.2. Argentina

13.9.3. Rest of South America

13.10. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Market Share Analysis (%), 2022

14.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

14.3.1. Honeywell International Inc.

14.3.1.1. Company Overview

14.3.1.2. Sales Area/Geographical Presence

14.3.1.3. Revenue

14.3.1.4. Strategy & Business Overview

14.3.1.5. Go-To-Market Strategy

14.3.2. AVK Holdings A/S

14.3.2.1. Company Overview

14.3.2.2. Sales Area/Geographical Presence

14.3.2.3. Revenue

14.3.2.4. Strategy & Business Overview

14.3.2.5. Go-To-Market Strategy

14.3.3. Flowserve Corporation

14.3.3.1. Company Overview

14.3.3.2. Sales Area/Geographical Presence

14.3.3.3. Revenue

14.3.3.4. Strategy & Business Overview

14.3.3.5. Go-To-Market Strategy

14.3.4. SLB

14.3.4.1. Company Overview

14.3.4.2. Sales Area/Geographical Presence

14.3.4.3. Revenue

14.3.4.4. Strategy & Business Overview

14.3.4.5. Go-To-Market Strategy

14.3.5. Emerson Electric Co.

14.3.5.1. Company Overview

14.3.5.2. Sales Area/Geographical Presence

14.3.5.3. Revenue

14.3.5.4. Strategy & Business Overview

14.3.5.5. Go-To-Market Strategy

14.3.6. Tyco International Ltd.

14.3.6.1. Company Overview

14.3.6.2. Sales Area/Geographical Presence

14.3.6.3. Revenue

14.3.6.4. Strategy & Business Overview

14.3.6.5. Go-To-Market Strategy

14.3.7. KITZ Corporation

14.3.7.1. Company Overview

14.3.7.2. Sales Area/Geographical Presence

14.3.7.3. Revenue

14.3.7.4. Strategy & Business Overview

14.3.7.5. Go-To-Market Strategy

14.3.8. Burkert Fluid Control Systems

14.3.8.1. Company Overview

14.3.8.2. Sales Area/Geographical Presence

14.3.8.3. Revenue

14.3.8.4. Strategy & Business Overview

14.3.8.5. Go-To-Market Strategy

14.3.9. Watts

14.3.9.1. Company Overview

14.3.9.2. Sales Area/Geographical Presence

14.3.9.3. Revenue

14.3.9.4. Strategy & Business Overview

14.3.9.5. Go-To-Market Strategy

14.3.10. Rotork

14.3.10.1. Company Overview

14.3.10.2. Sales Area/Geographical Presence

14.3.10.3. Revenue

14.3.10.4. Strategy & Business Overview

14.3.10.5. Go-To-Market Strategy

14.3.11. Other Key Players

14.3.11.1. Company Overview

14.3.11.2. Sales Area/Geographical Presence

14.3.11.3. Revenue

14.3.11.4. Strategy & Business Overview

14.3.11.5. Go-To-Market Strategy

15. Go To Market Strategy

15.1. Identification of Potential Market Spaces

15.2. Understanding the Buying Process of the Customers

List of Tables

Table 1: Global Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Table 2: Global Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Table 3: Global Actuators and Valves Market Value, by Region, US$ Mn, 2023-2031

Table 4: North America Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Table 5: North America Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Table 6: North America Actuators and Valves Market Value, by Country, US$ Mn, 2023-2031

Table 7: Europe Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Table 8: Europe Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Table 9: Europe Actuators and Valves Market Value, by Country, US$ Mn, 2023-2031

Table 10: Asia Pacific Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Table 11: Asia Pacific Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Table 12: Asia Pacific Actuators and Valves Market Value, by Country, US$ Mn, 2023-2031

Table 13: Middle East & Africa Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Table 14: Middle East & Africa Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Table 15: Middle East & Africa Actuators and Valves Market Value, by Country, US$ Mn, 2023-2031

Table 16: South America Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Table 17: South America Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Table 18: South America Actuators and Valves Market Value, by Country, US$ Mn, 2023-2031

List of Figures

Figure 1: Global Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Figure 2: Global Actuators and Valves Market Incremental Opportunity, by Product Type, 2023-2031

Figure 3: Global Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Figure 4: Global Actuators and Valves Market Incremental Opportunity, by Application, 2023-2031

Figure 5: Global Actuators and Valves Market Value, by Region, US$ Mn, 2023-2031

Figure 6: Global Actuators and Valves Market Incremental Opportunity, by Region,2023-2031

Figure 7: North America Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Figure 8: North America Actuators and Valves Market Incremental Opportunity, by Product Type, 2023-2031

Figure 9: North America Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Figure 10: North America Actuators and Valves Market Incremental Opportunity, by Application, 2023-2031

Figure 11: North America Actuators and Valves Market Value, by Country, US$ Mn, 2023-2031

Figure 12: North America Actuators and Valves Market Incremental Opportunity, by Country/Sub-Region, 2023-2031

Figure 13: Europe Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Figure 14: Europe Actuators and Valves Market Incremental Opportunity, by Product Type, 2023-2031

Figure 15: Europe Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Figure 16: Europe Actuators and Valves Market Incremental Opportunity, by Application, 2023-2031

Figure 17: Europe Actuators and Valves Market Value, by Country/Sub-Region, US$ Mn, 2023-2031

Figure 18: Europe Actuators and Valves Market Incremental Opportunity, by Country/Sub-Region, 2023-2031

Figure 19: Asia Pacific Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Figure 20: Asia Pacific Actuators and Valves Market Incremental Opportunity, by Product Type, 2023-2031

Figure 21: Asia Pacific Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Figure 22: Asia Pacific Actuators and Valves Market Incremental Opportunity, by Application, 2023-2031

Figure 23: Asia Pacific Actuators and Valves Market Value, by Country/Sub-Region, US$ Mn, 2023-2031

Figure 24: Asia Pacific Actuators and Valves Market Incremental Opportunity, by Country/Sub-Region, 2023-2031

Figure 25: Middle East & Africa Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Figure 26: Middle East & Africa Actuators and Valves Market Incremental Opportunity, by Product Type, 2023-2031

Figure 27: Middle East & Africa Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Figure 28: Middle East & Africa Actuators and Valves Market Incremental Opportunity, by Application, 2023-2031

Figure 29: Middle East & Africa Actuators and Valves Market Value, by Country/Sub-Region, US$ Mn, 2023-2031

Figure 30: Middle East & Africa Actuators and Valves Market Incremental Opportunity, by Country/Sub-Region, 2023-2031

Figure 31: South America Actuators and Valves Market Value, by Product Type, US$ Mn, 2023-2031

Figure 32: South America Actuators and Valves Market Incremental Opportunity, by Product Type, 2023-2031

Figure 33: South America Actuators and Valves Market Value, by Application, US$ Mn, 2023-2031

Figure 34: South America Actuators and Valves Market Incremental Opportunity, by Application, 2023-2031

Figure 35: South America Actuators and Valves Market Value, by Country/Sub-Region, US$ Mn, 2023-2031

Figure 36: South America Actuators and Valves Market Incremental Opportunity, by Country/Sub-Region, 2023-2031