Analyst Viewpoint

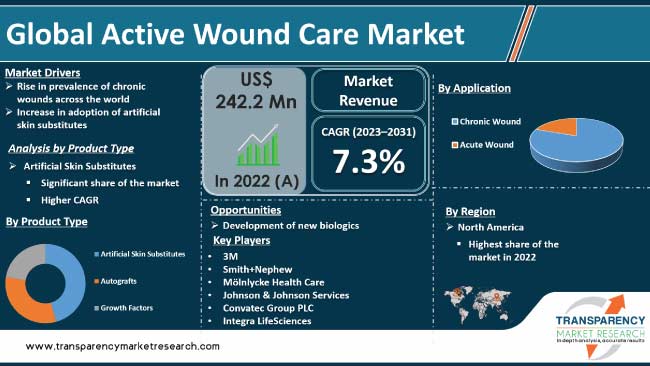

Rise in prevalence of chronic wounds across the world is driving the global active wound care market. Chronic conditions such as diabetes and vascular diseases lead to complex wounds and ulcers. Increase in awareness and acceptance of innovative wound care products among healthcare professionals and patients, especially geriatric people, are propelling market growth. Furthermore, surge in adoption of artificial skin substitutes is expected to bolster the global active wound care industry size during the forecast period.

Development of new biologics offers lucrative opportunities to market players. Companies are focusing on introducing advanced wound care technologies such as new dressings, bioengineered skin substitutes, and therapeutic devices in order to increase market share and revenue.

The active wound care market includes various advanced technologies, with products designed to aid the healing process and enhance outcomes for individuals with acute or chronic wounds. This evolving sector incorporates innovative solutions such as bioengineered dressings, growth factor therapies, and tissue-engineered skin substitutes.

The primary goal of active wound care is to expedite healing, diminish infection risks, and improve overall wound management. Recent developments in the market feature the incorporation of smart technologies, including sensors for continuous wound monitoring, and the utilization of 3D printing methods to craft tailored dressings.

These advancements signify a shift toward personalized and technologically advanced approaches to wound care, meeting the diverse needs of patients with various types of wounds. The market's dynamic nature is continually influenced by ongoing research and development endeavors, aiming to introduce novel and effective solutions that enhance patient outcomes in the realm of wound care.

Increase in global prevalence of chronic wounds among patients is driving the active wound care market. Conditions such as diabetes, vascular diseases, and various chronic ailments contribute to the rise in complex wounds, ulcers, and infections.

Over 65 million people across the globe grapple with chronic wounds, with a notable portion experiencing diabetic foot ulcers. The U.S. Agency highlights the rising demand for advanced wound care solutions for Healthcare Research and Quality, indicating that chronic wounds consume up to 4% of healthcare budgets in developed countries, signifying a substantial economic burden.

Active wound care, including therapeutic dressings, bioengineered skin substitutes, and other interventions, plays a pivotal role in addressing the challenges associated with chronic wounds. Ongoing research and development endeavors are focused on introducing more innovative products and personalized treatment options to meet the diverse needs of the expanding chronic wound patient population.

Increase in the number of patients with chronic wounds underscores the urgent requirement for effective and innovative active wound care solutions to manage the intricate nature of these wounds and enhance overall healing outcomes.

The active wound care market is experiencing significant growth, propelled by the rising adoption of artificial skin substitutes. This is ascribed to advanced capabilities of these substitutes, effectively fostering wound healing.

Artificial skin substitutes, which encompass bioengineered grafts and tissue-engineered skin, offer distinct advantages over traditional wound care methods. They provide a structured framework that promotes tissue regeneration, accelerates the healing process, and reduces the risk of infections.

As the medical community increasingly recognizes the benefits of artificial skin substitutes in managing complex wounds, their adoption has notably increased. Examples of prominent synthetic skin substitutes in the market include Biobrane, Dermagraft, Integra, Apligraft, Matriderm, Orcel, Hyalomatrix, and Renoskin.

These substitutes play a crucial role in addressing challenges associated with chronic wounds, diabetic ulcers, and other intricate wound types. Their ability to replicate the natural healing environment and stimulate tissue regeneration positions them as essential components in the evolving landscape of active wound care, contributing to improved patient outcomes and overall quality of life.

In terms of product type, the artificial skin substitutes segment dominated the global active wound care market in 2022. This is ascribed to their crucial role in addressing intricate wounds and facilitating effective healing. These substitutes, including bioengineered grafts and tissue-engineered skin, bring distinct advantages compared to traditional wound care methods.

Artificial skin substitutes provide a structured framework that supports tissue regeneration, expedites the healing process, and reduces the risk of infections. These substitutes have evolved beyond their initial application in severe burns.

Ongoing advancements in biomaterials and technology are expanding their utility to diverse wound types, encompassing diabetic foot ulcers, pressure ulcers, and chronic wounds. Recognized for their ability to mimic the natural healing environment, artificial skin substitutes are now considered a cornerstone in managing various wounds.

The market's acknowledgment of their efficacy, combined with continuous research and development efforts to further enhance their capabilities, solidifies artificial skin substitutes as a dominant product type within the active wound care market.

Based on application, the chronic wounds segment accounted for the largest global active wound care market share in 2022. Chronic wounds include diabetic foot ulcers, pressure ulcers, venous leg ulcers, and burns. These present diverse challenges as they tend to heal slowly, cause pain, and are susceptible to infections. This not only significantly affects patients' quality of life, but also increases the risk of amputation.

Acknowledging the substantial impact of chronic wounds, governments are prioritizing research and development efforts in this field. For instance, the U.S. National Institutes of Health allocates funding for numerous studies aimed at exploring innovative approaches to wound care.

Leading wound care companies such as Convatec and Mölnlycke are making substantial investments in developing solutions tailored specifically for chronic wounds. This collective focus on research and development underscores the importance of addressing the unique complexities associated with chronic wounds and improving patient outcomes.

As per active wound care market research, North America is a hub for medical advancements, hosting prominent pharmaceutical and medical device companies that invest significantly in the research and development of state-of-the-art active wound care technologies.

This includes innovative solutions such as bioengineered skin substitutes and negative pressure therapy systems. The prevalence of diabetes is substantial in the region, with an estimated 34.2 million people in the U.S. affected, leading to 6.7 million diagnosed cases of diabetic foot ulcers, a significant type of chronic wound.

North America also benefits from a skilled and knowledgeable healthcare workforce proficient in the application and management of advanced wound care technologies, ensuring optimal patient outcomes and fostering widespread adoption within the market.

Growth of the active wound care market in Europe is partially attributed to increase in understanding among healthcare professionals and patients regarding the benefits of advanced wound care.

For instance, in May 2023, Bactiguard’s Wound Care specialist team garnered attention at EWMA 2023 in Milan, the largest wound care conference in Europe that brings together esteemed medical professionals and thought leaders in the field.

European manufacturers play a leading role in advancing active wound care technologies, exemplified by their development of cutting-edge solutions such as bioengineered skin substitutes and negative pressure therapy systems. This collective awareness and collaboration within the healthcare community contribute significantly to the rapid expansion of the active wound care market in Europe.

Asia Pacific is witnessing the fastest-growing elderly population globally, with a projection that over 60% of the world's individuals aged 65 and above will reside in the region by 2050. Countries such as China, India, and Indonesia are contending with escalating rates of diabetes, obesity, and cardiovascular diseases, all significant contributors to the prevalence of chronic wounds.

For instance, India alone has a diabetic population exceeding 77 million, resulting in a substantial burden of diabetic foot ulcers. Additionally, local companies are actively addressing this health challenge by developing and introducing innovative wound care products designed to meet the specific needs and preferences of the region.

The global active wound care market is fragmented, with the presence of several players. Leading companies are adopting strategies such investment in R&D and new product development in order to increase market share.

3M Company, Smith & Nephew, Mölnlycke Health Care, Johnson & Johnson, Convatec Group plc, Integra LifeSciences, Tissue Regenix, and Paul Hartmann AG are the prominent players in the market.

Leading players have been profiled in the active wound care market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and latest developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 242.2 Mn |

| Forecast Value in 2031 | More than US$ 451.9 Mn |

| Growth rate (CAGR) | 7.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope |

Available upon request |

| Pricing |

Available upon request |

It was valued at US$ 242.2 Mn in 2022.

It is projected to reach more than US$ 451.9 Mn by 2031.

The CAGR is anticipated to be 7.3% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

3M, Smith & Nephew, Mölnlycke Health Care, Johnson & Johnson, Convatec Group plc, Integra LifeSciences, Tissue Regenix, and Paul Hartmann AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Active Wound Care Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Active Wound Care Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Global Active Wound Care Market: Key Success Factors of Top Companies

5.2. Regulatory Scenario

5.3. Porter's Five Forces Analysis

5.4. COVID-19 Pandemic impact Analysis

6. Global Active Wound Care Market Analysis and Forecast, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Artificial Skin Substitutes

6.3.2. Autografts

6.3.3. Growth Factors

6.4. Market Attractiveness Analysis, By Product Type

7. Global Active Wound Care Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Chronic Wound

7.3.2. Acute Wound

7.4. Market Attractiveness Analysis, By Application

8. Global Active Wound Care Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Others

8.4. Market Attractiveness Analysis, By End-user

9. Global Active Wound Care Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, By Region

10. North America Active Wound Care Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Artificial Skin Substitutes

10.2.2. Autografts

10.2.3. Growth Factors

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Chronic Wound

10.3.2. Acute Wound

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals

10.4.2. Clinics

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Active Wound Care Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Artificial Skin Substitutes

11.2.2. Autografts

11.2.3. Growth Factors

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Chronic Wound

11.3.2. Acute Wound

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals

11.4.2. Clinics

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Active Wound Care Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Artificial Skin Substitutes

12.2.2. Autografts

12.2.3. Growth Factors

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Chronic Wound

12.3.2. Acute Wound

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals

12.4.2. Clinics

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Active Wound Care Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Artificial Skin Substitutes

13.2.2. Autografts

13.2.3. Growth Factors

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Chronic Wound

13.3.2. Acute Wound

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals

13.4.2. Clinics

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Active Wound Care Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Artificial Skin Substitutes

14.2.2. Autografts

14.2.3. Growth Factors

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Chronic Wound

14.3.2. Acute Wound

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals

14.4.2. Clinics

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of MEA

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2022

15.3. Company Profiles

15.3.1. 3M Company

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Smith & Nephew

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Mölnlycke Health Care

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Johnson & Johnson Services

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Convatec Group plc

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Integra LifeSciences

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Paul Hartmann AG

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Tissue Regenix

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

List of Tables

Table 01: Global Active Wound Care Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Active Wound Care Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Active Wound Care Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Active Wound Care Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Active Wound Care Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 06: North America Active Wound Care Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 07: North America Active Wound Care Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 08: North America Active Wound Care Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Active Wound Care Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 10: Europe Active Wound Care Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Europe Active Wound Care Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Active Wound Care Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Active Wound Care Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 14: Asia Pacific Active Wound Care Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Asia Pacific Active Wound Care Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Active Wound Care Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Active Wound Care Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Latin America Active Wound Care Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Latin America Active Wound Care Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Active Wound Care Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Active Wound Care Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 22: Middle East & Africa Active Wound Care Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Middle East & Africa Active Wound Care Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Middle East & Africa Active Wound Care Market Value (US$ Mn) Forecast, by Country/Sub-region, 201

List of Figures

Figure 01: Global Active Wound Care Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Active Wound Care Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 03: Global Active Wound Care Market Value Share Analysis, by Artificial Skin Substitutes, 2022 and 2031

Figure 04: Global Active Wound Care Market Value Share Analysis, by Autografts, 2022 and 2031

Figure 05: Global Active Wound Care Market Value Share Analysis, by Growth Factors, 2022 and 2031

Figure 06: Global Active Wound Care Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 07: Global Active Wound Care Market Value Share Analysis, by Application 2022 and 2031

Figure 08: Global Active Wound Care Market Value Share Analysis, by Acute Wounds, 2022 and 2031

Figure 09: Global Active Wound Care Market Value Share Analysis, by Chronic Wounds, 2022 and 2031

Figure 10: Global Active Wound Care Market Attractiveness Analysis, by Application, 2023–2031

Figure 11: Global Active Wound Care Market Value Share Analysis, by End-user, 2022 and 2031

Figure 12: Global Active Wound Care Market Value Share Analysis, by Hospitals, 2022 and 2031

Figure 13: Global Active Wound Care Market Value Share Analysis, by Clinics, 2022 and 2031

Figure 14: Global Active Wound Care Market Value Share Analysis, by Others, 2022 and 2031

Figure 15: Global Active Wound Care Market Attractiveness Analysis, by End-user, 2023–2031

Figure 16: Global Active Wound Care Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Active Wound Care Market Attractiveness Analysis, by Region, 2023–2031

Figure 18: North America Active Wound Care Market Value (US$ Mn) Forecast, 2017–2031

Figure 19: North America Active Wound Care Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 20: North America Active Wound Care Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 21: North America Active Wound Care Market Value Share Analysis, by Application, 2022 and 2031

Figure 22: North America Active Wound Care Market Attractiveness Analysis, by Application, 2023–2031

Figure 23: North America Active Wound Care Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Active Wound Care Market Attractiveness Analysis, by End-user, 2023–2031

Figure 25: North America Active Wound Care Market Value Share Analysis, by Country, 2022 and 2031

Figure 26: North America Active Wound Care Market Attractiveness Analysis, by Country, 2023–2031

Figure 27: Europe Active Wound Care Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: Europe Active Wound Care Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 29: Europe Active Wound Care Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 30: Europe Active Wound Care Market Value Share Analysis, by Application, 2022 and 2031

Figure 31: Europe Active Wound Care Market Attractiveness Analysis, by Application, 2023–2031

Figure 32: Europe Active Wound Care Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Active Wound Care Market Attractiveness Analysis, by End-user, 2023–2031

Figure 34: Europe Active Wound Care Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Europe Active Wound Care Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Asia Pacific Active Wound Care Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Asia Pacific Active Wound Care Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 38: Asia Pacific Active Wound Care Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 39: Asia Pacific Active Wound Care Market Value Share Analysis, by Application 2022 and 2031

Figure 40: Asia Pacific Active Wound Care Market Attractiveness Analysis, by Application, 2023–2031

Figure 41: Asia Pacific Active Wound Care Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Asia Pacific Active Wound Care Market Attractiveness Analysis, by End-user, 2023–2031

Figure 43: Asia Pacific Active Wound Care Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Asia Pacific Active Wound Care Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Latin America Active Wound Care Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Latin America Active Wound Care Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 47: Latin America Active Wound Care Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 48: Latin America Active Wound Care Market Value Share Analysis, by Application, 2022 and 2031

Figure 49: Latin America Active Wound Care Market Attractiveness Analysis, by Application, 2023–2031

Figure 50: Latin America Active Wound Care Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Latin America Active Wound Care Market Attractiveness Analysis, by End-user, 2023–2031

Figure 52: Latin America Active Wound Care Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 53: Latin America Active Wound Care Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 54: Middle East & Africa Active Wound Care Market Value (US$ Mn) Forecast, 2017–2031

Figure 55: Middle East & Africa Active Wound Care Market Value Share Analysis, by Product Type, 2022 and 2031

Figure 56: Middle East & Africa Active Wound Care Market Attractiveness Analysis, by Product Type, 2023–2031

Figure 57: Middle East & Africa Active Wound Care Market Value Share Analysis, by Application, 2022 and 2031

Figure 58: Middle East & Africa Active Wound Care Market Attractiveness Analysis, by Application, 2023–2031

Figure 59: Middle East & Africa Active Wound Care Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa Active Wound Care Market Attractiveness Analysis, by End-user, 2023–2031

Figure 61: Middle East & Africa Active Wound Care Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 62: Middle East & Africa Active Wound Care Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 63: Global Active Wound Care Market Share Analysis, by Company, 2022