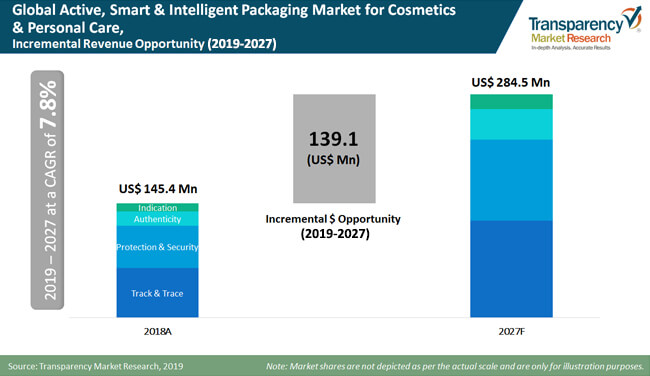

The global active, smart and intelligent packaging market for cosmetics and personal care was valued at US$ 145.4 million in 2018. The active, smart and intelligent packaging market for cosmetics and personal care is projected to expand at a CAGR of 7.8% during the forecast period of 2019-2027.

By function, the global active, smart and intelligent packaging market for cosmetics and personal care is segmented into protection and security, indication, track and trace, and authenticity. The protection and security function in the active, smart and intelligent packaging market for cosmetics and personal care is further categorized into corrosion, atmospheric gas, physical damage, and anti-theft. The indication function in the active, smart and intelligent packaging market for cosmetics and personal care is further categorized into time and temperature, quality and safety, freshness, and product level.

In the active, smart and intelligent packaging market for cosmetics and personal care, the track and trace function is estimated to be a prominent function, followed by protection and security. Active, smart and intelligent packaging for cosmetics and personal care is highly preferred for tracking, tracing, and security functions. Active, smart and intelligent packaging for cosmetics and personal care has significant applications in retail outlets and supply chain processes for security, protection, and track and trace. The shipment of cosmetics and personal care products through different modes is creating the extensive need for proper track and trace functions embedded with multifunctional sensors.

In the protection and security function in the active, smart and intelligent packaging market for cosmetics and personal care, the anti-theft sub-segment is expected to experience growing demand, owing to the availability of cost-efficient RFID and NFC tags and labels in the market. Anti-theft tags and labels with high and low frequencies are estimated to be more popular products for organized consumer goods and apparel retail stores. Other than the anti-theft functionality, the corrosion-resistant and physical damage segments are anticipated to witness impressive growth in the active, smart and intelligent packaging market for cosmetics and personal care.

In the active, smart and intelligent packaging market for cosmetics and personal care, the indication function is estimated to hold a market share of less than 7% in 2019, and expected to witness sluggish growth during the forecast period. As compared to food packaging, the adoption of active packaging is low in cosmetics and personal care packaging. Ongoing research and development for the acceptance of active packaging to reduce preservatives in products and increase shelf life is expected to boost the demand for active packaging from key players of cosmetics and personal care.

Consumer interaction and counterfeiting are estimated to be key concerning factors in the active, smart and intelligent packaging market for cosmetics and personal care. In the active, smart and intelligent packaging market for cosmetics and personal care, the implementation of smart codes and labels is increasing for improving the interaction between consumers and brands with the help of Internet of Things (IoT) technologies. In the global active, smart and intelligent packaging market for cosmetics and personal care, authenticity is expected to witness high demand throughout the forecast period.

Significant key players performing in the active, smart and intelligent packaging market for cosmetics and personal care are 3M Company, LCR Hallcrest LLC, Thin Film Electronics ASA., Amcor Limited, Bemis Company, Inc., CCL Industries Inc., Coveris Holdings S.A., Sealed Air Corporation, Crown Holdings, Inc., Landec Corporation, PakSense, Inc., Temptime Corporation, Multisorb Technologies, Inc., Vitsab International AB, Varcode, Ltd., Cosmogen, Deltatrak Inc., Cryolog S.A., Timestrip UK Ltd., and ShockWatch, Inc.

Global Active and Smart Intelligent Packaging Market to Expand with Advancements in the Domain of Electronic Manufacturing

The global packaging industry has revolutionized the growth of several industries and sectors. There is no contention about the relevance and indispensable nature of packaging technologies across the domain of manufacturing. Besides, packaging is not just a means to enclose the products into a presentable form, but also a media to attract the attention of the consumers. Large packaging houses and entities consider packaging as a safety net around fragile products. Moreover, the total volume of revenues flowing into the global packaging industry have increased alongside development of new packaging products.

Active smart and intelligent packaging market is projected to rise at a CAGR of 7.8% between 2019 and 2027

Active smart and intelligent packaging market is driven by increasing need for smart packaging solutions from various industries

Global active, smart and intelligent packaging market is dominated collectively by North America and Europe

The end-use segments in active smart and intelligent packaging market are Skin Care, Hair Care, Makeup, Nail Care, and Perfumes

Key players of the global active smart and intelligent packaging market include Timestrip UK Ltd., Temptime Corporation, Sealed Air Corporation, LCR Hallcrest LLC, Crown Holdings Inc., 3M, Varcode Ltd

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Definition

2.2. Functions of Active, Smart & Intelligent Packaging

2.3. Market Taxonomy

3. Market Viewpoint

3.1. Global Cosmetics Packaging Market

3.2. Product Life Cycle: Active, Smart & Intelligent Packaging

3.3. Global Active, Smart, and Intelligent Packaging Market Overview

3.4. Packaging Manufacturers’ Perspective on Advanced Packaging Technologies

3.5. Consumer Sentiment Analysis

3.6. Active, Smart and Intelligent Packaging: What Key Industry Leaders are saying?

3.7. Porters Five Forces Analysis

3.8. PESTLE Analysis for Key Countries

3.9. Macro-Economic Factors and Co-relation Analysis

3.10. Forecast Factors – Relevance and Impact

3.11. Value Chain Analysis

3.11.1. Exhaustive List of Active Participants

3.11.1.1. Raw Material Suppliers

3.11.1.2. Converters

3.11.1.3. Manufacturers

3.11.1.4. Packaging End Users

3.12. Market Dynamics

3.12.1. Drivers

3.12.1.1. Supply Side

3.12.1.2. Demand Side

3.12.2. Restraints

3.12.3. Opportunities

3.12.4. Trends

4. Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Value (‘000 US$) and Volume (‘000 Units) Analysis & Forecast

4.3. Y-o-Y Growth Projections

4.4. Absolute $ Opportunity Analysis

5. Global Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast, By Product Type

5.1. Section Summary

5.2. Introduction

5.2.1. Market share and Basis Points (BPS) Analysis By Product Type

5.2.2. Y-o-Y Growth Projections By Product Type

5.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Product Type

5.3.1. Active Packaging

5.3.1.1. O2 Scavengers

5.3.1.2. Gas Scavengers

5.3.1.3. Corrosion Inhibitors

5.3.1.4. Shock And Vibration

5.3.2. Smart & Intelligent Packaging

5.3.2.1. Time-Temperature Indicator (TTI) Labels

5.3.2.2. Microbial Growth

5.3.2.3. Biosensors

5.3.2.4. Freshness Indicators

5.3.2.5. RFID Tags & Smart Labels

5.3.2.6. Smart Codes

5.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Product Type

5.4.1. Active Packaging

5.4.1.1. O2 Scavengers

5.4.1.2. Gas Scavengers

5.4.1.3. Corrosion Inhibitors

5.4.1.4. Shock And Vibration

5.4.2. Smart & Intelligent Packaging

5.4.2.1. Time-Temperature Indicator (TTI) Labels

5.4.2.2. Microbial Growth

5.4.2.3. Biosensors

5.4.2.4. Freshness Indicators

5.4.2.5. RFID Tags & Smart Labels

5.4.2.6. Smart Codes

5.5. Market Attractiveness Analysis By Product Type

6. Global Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast, By Function Type

6.1. Section Summary

6.2. Introduction

6.2.1. Market share and Basis Points (BPS) Analysis By Function Type

6.2.2. Y-o-Y Growth Projections By Function Type

6.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Function Type

6.3.1. Protection & Security

6.3.1.1. Corrosion

6.3.1.2. Atmospheric Gas

6.3.1.3. Physical Damage

6.3.1.4. Anti-theft

6.3.2. Indication

6.3.2.1. Time & Temperature

6.3.2.2. Quality & Safety

6.3.2.3. Freshness

6.3.2.4. Product Level

6.3.3. Track & Trace

6.3.4. Authenticity

6.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Function Type

6.4.1. Protection & Security

6.4.1.1. Corrosion

6.4.1.2. Atmospheric Gas

6.4.1.3. Physical Damage

6.4.1.4. Anti-theft

6.4.2. Indication

6.4.2.1. Time & Temperature

6.4.2.2. Quality & Safety

6.4.2.3. Freshness

6.4.2.4. Product Level

6.4.3. Track & Trace

6.4.4. Authenticity

6.5. Market Attractiveness Analysis By Function Type

7. Global Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast, By Application Type

7.1. Section Summary

7.2. Introduction

7.2.1. Market share and Basis Points (BPS) Analysis By Application Type

7.2.2. Y-o-Y Growth Projections By Application Type

7.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Application Type

7.3.1. Flexible Packaging

7.3.1.1. Sachets

7.3.1.2. Pouches

7.3.1.3. Tubes

7.3.1.4. Others

7.3.2. Rigid Packaging

7.3.2.1. Jars

7.3.2.2. Bottles

7.3.2.3. Boxes & Cartons

7.3.2.4. Customized Formats

7.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Application Type

7.4.1. Flexible Packaging

7.4.1.1. Sachets

7.4.1.2. Pouches

7.4.1.3. Tubes

7.4.1.4. Others

7.4.2. Rigid Packaging

7.4.2.1. Jars

7.4.2.2. Bottles

7.4.2.3. Customized Formats

7.5. Market Attractiveness Analysis By Application Type

8. Global Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast, By Packaging End Use

8.1. Section Summary

8.2. Introduction

8.2.1. Market share and Basis Points (BPS) Analysis By Packaging End Use

8.2.2. Y-o-Y Growth Projections By Packaging End Use

8.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Packaging End Use

8.3.1. Skin Care

8.3.2. Hair Care

8.3.3. Make Up

8.3.4. Nail Care

8.3.5. Perfumes

8.3.6. Other Personal hygiene products

8.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Packaging End Use

8.4.1. Skin Care

8.4.2. Hair Care

8.4.3. Make Up

8.4.4. Nail Care

8.4.5. Perfumes

8.4.6. Other Personal hygiene products

8.5. Market Attractiveness Analysis By Packaging End Use

9. Global Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast, By Region

9.1. Section Summary

9.2. Introduction

9.2.1. Market share and Basis Points (BPS) Analysis By Region

9.2.2. Y-o-Y Growth Projections By Region

9.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Region

9.3.1. North America

9.3.2. Latin America

9.3.3. Europe

9.3.4. Asia Pacific

9.3.5. Middle East and Africa (MEA)

9.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027 By Region

9.4.1. North America

9.4.2. Latin America

9.4.3. Europe

9.4.4. Asia Pacific

9.4.5. Middle East and Africa (MEA)

9.5. Market Attractiveness Analysis By Region

10. North America Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast

10.1. Section Summary

10.2. Introduction

10.2.1. Market share and Basis Points (BPS) Analysis By Country

10.2.2. Y-o-Y Growth Projections By Country

10.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Country

10.3.1. U.S.

10.3.2. Canada

10.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027 By Country

10.4.1. U.S.

10.4.2. Canada

10.5. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Product Type

10.5.1. Active Packaging

10.5.1.1. O2 Scavengers

10.5.1.2. Gas Scavengers

10.5.1.3. Corrosion Inhibitors

10.5.1.4. Shock And Vibration

10.5.2. Smart & Intelligent Packaging

10.5.2.1. Time-Temperature Indicator (TTI) Labels

10.5.2.2. Microbial Growth

10.5.2.3. Biosensors

10.5.2.4. Freshness Indicators

10.5.2.5. RFID Tags & Smart Labels

10.5.2.6. Smart Codes

10.6. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Product Type

10.6.1. Active Packaging

10.6.1.1. O2 Scavengers

10.6.1.2. Gas Scavengers

10.6.1.3. Corrosion Inhibitors

10.6.1.4. Shock And Vibration

10.6.2. Smart & Intelligent Packaging

10.6.2.1. Time-Temperature Indicator (TTI) Labels

10.6.2.2. Microbial Growth

10.6.2.3. Biosensors

10.6.2.4. Freshness Indicators

10.6.2.5. RFID Tags & Smart Labels

10.6.2.6. Smart Codes

10.7. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Function Type

10.7.1. Protection & Security

10.7.1.1. Corrosion

10.7.1.2. Atmospheric Gas

10.7.1.3. Physical Damage

10.7.1.4. Anti-theft

10.7.2. Indication

10.7.2.1. Time & Temperature

10.7.2.2. Quality & Safety

10.7.2.3. Freshness

10.7.2.4. Product Level

10.7.3. Track & Trace

10.7.4. Authenticity

10.8. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Function Type

10.8.1. Protection & Security

10.8.1.1. Corrosion

10.8.1.2. Atmospheric Gas

10.8.1.3. Physical Damage

10.8.1.4. Anti-theft

10.8.2. Indication

10.8.2.1. Time & Temperature

10.8.2.2. Quality & Safety

10.8.2.3. Freshness

10.8.2.4. Product Level

10.8.3. Track & Trace

10.8.4. Authenticity

10.9. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Application Type

10.9.1. Flexible Packaging

10.9.1.1. Sachets

10.9.1.2. Pouches

10.9.1.3. Tubes

10.9.1.4. Others

10.9.2. Rigid Packaging

10.9.2.1. Jars

10.9.2.2. Bottles

10.9.2.3. Customized Formats

10.10. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Application Type

10.10.1. Flexible Packaging

10.10.1.1. Sachets

10.10.1.2. Pouches

10.10.1.3. Tubes

10.10.1.4. Others

10.10.2. Rigid Packaging

10.10.2.1. Jars

10.10.2.2. Bottles

10.10.2.3. Boxes & Cartons

10.10.2.4. Customized Formats

10.11. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Packaging End Use

10.11.1. Skin Care

10.11.2. Hair Care

10.11.3. Make Up

10.11.4. Nail Care

10.11.5. Perfumes

10.11.6. Other Personal hygiene products

10.12. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Packaging End Use

10.12.1. Skin Care

10.12.2. Hair Care

10.12.3. Make Up

10.12.4. Nail Care

10.12.5. Perfumes

10.12.6. Other Personal hygiene products

10.13. Prominent Trends

10.14. Drivers and Restraints: Impact Analysis

10.15. Key Market Participants – Intensity Mapping

11. Latin America Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast

11.1. Section Summary

11.2. Introduction

11.2.1. Market share and Basis Points (BPS) Analysis By Country

11.2.2. Y-o-Y Growth Projections By Country

11.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Country

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Argentina

11.3.4. Rest of Latin America

11.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027By Country

11.4.1. Brazil

11.4.2. Mexico

11.4.3. Argentina

11.4.4. Rest of Latin America

11.5. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Product Type

11.5.1. Active Packaging

11.5.1.1. O2 Scavengers

11.5.1.2. Gas Scavengers

11.5.1.3. Corrosion Inhibitors

11.5.1.4. Shock And Vibration

11.5.2. Smart & Intelligent Packaging

11.5.2.1. Time-Temperature Indicator (TTI) Labels

11.5.2.2. Microbial Growth

11.5.2.3. Biosensors

11.5.2.4. Freshness Indicators

11.5.2.5. RFID Tags & Smart Labels

11.5.2.6. Smart Codes

11.6. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Product Type

11.6.1. Active Packaging

11.6.1.1. O2 Scavengers

11.6.1.2. Gas Scavengers

11.6.1.3. Corrosion Inhibitors

11.6.1.4. Shock And Vibration

11.6.2. Smart & Intelligent Packaging

11.6.2.1. Time-Temperature Indicator (TTI) Labels

11.6.2.2. Microbial Growth

11.6.2.3. Biosensors

11.6.2.4. Freshness Indicators

11.6.2.5. RFID Tags & Smart Labels

11.6.2.6. Smart Codes

11.7. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Function Type

11.7.1. Protection & Security

11.7.1.1. Corrosion

11.7.1.2. Atmospheric Gas

11.7.1.3. Physical Damage

11.7.1.4. Anti-theft

11.7.2. Indication

11.7.2.1. Time & Temperature

11.7.2.2. Quality & Safety

11.7.2.3. Freshness

11.7.2.4. Product Level

11.7.3. Track & Trace

11.7.4. Authenticity

11.8. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Function Type

11.8.1. Protection & Security

11.8.1.1. Corrosion

11.8.1.2. Atmospheric Gas

11.8.1.3. Physical Damage

11.8.1.4. Anti-theft

11.8.2. Indication

11.8.2.1. Time & Temperature

11.8.2.2. Quality & Safety

11.8.2.3. Freshness

11.8.2.4. Product Level

11.8.3. Track & Trace

11.8.4. Authenticity

11.9. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Application Type

11.9.1. Flexible Packaging

11.9.1.1. Sachets

11.9.1.2. Pouches

11.9.1.3. Tubes

11.9.1.4. Others

11.9.2. Rigid Packaging

11.9.2.1. Jars

11.9.2.2. Bottles

11.9.2.3. Boxes & Cartons

11.9.2.4. Customized Formats

11.10. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Application Type

11.10.1. Flexible Packaging

11.10.1.1. Sachets

11.10.1.2. Pouches

11.10.1.3. Tubes

11.10.1.4. Others

11.10.2. Rigid Packaging

11.10.2.1. Jars

11.10.2.2. Bottles

11.10.2.3. Boxes & Cartons

11.10.2.4. Customized Formats

11.11. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Packaging End Use

11.11.1. Skin Care

11.11.2. Hair Care

11.11.3. Make Up

11.11.4. Nail Care

11.11.5. Perfumes

11.11.6. Other Personal hygiene products

11.12. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Packaging End Use

11.12.1. Skin Care

11.12.2. Hair Care

11.12.3. Make Up

11.12.4. Nail Care

11.12.5. Perfumes

11.12.6. Other Personal hygiene products

11.13. Prominent Trends

11.14. Drivers and Restraints: Impact Analysis

11.15. Key Market Participants – Intensity Mapping

12. Europe Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast

12.1. Section Summary

12.2. Introduction

12.2.1. Market share and Basis Points (BPS) Analysis By Country

12.2.2. Y-o-Y Growth Projections By Country

12.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Country

12.3.1. Germany

12.3.2. Spain

12.3.3. Italy

12.3.4. France

12.3.5. U.K.

12.3.6. BENELUX

12.3.7. NORDIC

12.3.8. Russia

12.3.9. Poland

12.3.10. Rest of Europe

12.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027 By Country

12.4.1. Germany

12.4.2. Spain

12.4.3. Italy

12.4.4. France

12.4.5. U.K.

12.4.6. BENELUX

12.4.7. NORDIC

12.4.8. Russia

12.4.9. Poland

12.4.10. Rest of Europe

12.5. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Product Type

12.5.1. Active Packaging

12.5.1.1. O2 Scavengers

12.5.1.2. Gas Scavengers

12.5.1.3. Corrosion Inhibitors

12.5.1.4. Shock And Vibration

12.5.2. Smart & Intelligent Packaging

12.5.2.1. Time-Temperature Indicator (TTI) Labels

12.5.2.2. Microbial Growth

12.5.2.3. Biosensors

12.5.2.4. Freshness Indicators

12.5.2.5. RFID Tags & Smart Labels

12.5.2.6. Smart Codes

12.6. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Product Type

12.6.1. Active Packaging

12.6.1.1. O2 Scavengers

12.6.1.2. Gas Scavengers

12.6.1.3. Corrosion Inhibitors

12.6.1.4. Shock And Vibration

12.6.2. Smart & Intelligent Packaging

12.6.2.1. Time-Temperature Indicator (TTI) Labels

12.6.2.2. Microbial Growth

12.6.2.3. Biosensors

12.6.2.4. Freshness Indicators

12.6.2.5. RFID Tags & Smart Labels

12.6.2.6. Smart Codes

12.7. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Function Type

12.7.1. Protection & Security

12.7.1.1. Corrosion

12.7.1.2. Atmospheric Gas

12.7.1.3. Physical Damage

12.7.1.4. Anti-theft

12.7.2. Indication

12.7.2.1. Time & Temperature

12.7.2.2. Quality & Safety

12.7.2.3. Freshness

12.7.2.4. Product Level

12.7.3. Track & Trace

12.7.4. Authenticity

12.8. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Function Type

12.8.1. Protection & Security

12.8.1.1. Corrosion

12.8.1.2. Atmospheric Gas

12.8.1.3. Physical Damage

12.8.1.4. Anti-theft

12.8.2. Indication

12.8.2.1. Time & Temperature

12.8.2.2. Quality & Safety

12.8.2.3. Freshness

12.8.2.4. Product Level

12.8.3. Track & Trace

12.8.4. Authenticity

12.9. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Application Type

12.9.1. Flexible Packaging

12.9.1.1. Sachets

12.9.1.2. Pouches

12.9.1.3. Tubes

12.9.1.4. Others

12.9.2. Rigid Packaging

12.9.2.1. Jars

12.9.2.2. Bottles

12.9.2.3. Boxes & Cartons

12.9.2.4. Customized Formats

12.10. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Application Type

12.10.1. Flexible Packaging

12.10.1.1. Sachets

12.10.1.2. Pouches

12.10.1.3. Tubes

12.10.1.4. Others

12.10.2. Rigid Packaging

12.10.2.1. Jars

12.10.2.2. Bottles

12.10.2.3. Boxes & Cartons

12.10.2.4. Customized Formats

12.11. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Packaging End Use

12.11.1. Skin Care

12.11.2. Hair Care

12.11.3. Make Up

12.11.4. Nail Care

12.11.5. Perfumes

12.11.6. Other Personal hygiene products

12.12. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Packaging End Use

12.12.1. Skin Care

12.12.2. Hair Care

12.12.3. Make Up

12.12.4. Nail Care

12.12.5. Perfumes

12.12.6. Other Personal hygiene products

12.13. Prominent Trends

12.14. Drivers and Restraints: Impact Analysis

12.15. Key Market Participants – Intensity Mapping

13. Asia Pacific Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast

13.1. Section Summary

13.2. Introduction

13.2.1. Market share and Basis Points (BPS) Analysis By Country

13.2.2. Y-o-Y Growth Projections By Country

13.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Country

13.3.1. China

13.3.2. India

13.3.3. Japan

13.3.4. ASEAN Countries

13.3.5. Australia and New Zealand

13.3.6. Rest of APAC

13.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027 By Country

13.4.1. China

13.4.2. India

13.4.3. Japan

13.4.4. ASEAN Countries

13.4.5. Australia and New Zealand

13.4.6. Rest of APAC

13.5. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Product Type

13.5.1. Active Packaging

13.5.1.1. O2 Scavengers

13.5.1.2. Gas Scavengers

13.5.1.3. Corrosion Inhibitors

13.5.1.4. Shock And Vibration

13.5.2. Smart & Intelligent Packaging

13.5.2.1. Time-Temperature Indicator (TTI) Labels

13.5.2.2. Microbial Growth

13.5.2.3. Biosensors

13.5.2.4. Freshness Indicators

13.5.2.5. RFID Tags & Smart Labels

13.5.2.6. Smart Codes

13.6. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Product Type

13.6.1. Active Packaging

13.6.1.1. O2 Scavengers

13.6.1.2. Gas Scavengers

13.6.1.3. Corrosion Inhibitors

13.6.1.4. Shock And Vibration

13.6.2. Smart & Intelligent Packaging

13.6.2.1. Time-Temperature Indicator (TTI) Labels

13.6.2.2. Microbial Growth

13.6.2.3. Biosensors

13.6.2.4. Freshness Indicators

13.6.2.5. RFID Tags & Smart Labels

13.6.2.6. Smart Codes

13.7. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Function Type

13.7.1. Protection & Security

13.7.1.1. Corrosion

13.7.1.2. Atmospheric Gas

13.7.1.3. Physical Damage

13.7.1.4. Anti-theft

13.7.2. Indication

13.7.2.1. Time & Temperature

13.7.2.2. Quality & Safety

13.7.2.3. Freshness

13.7.2.4. Product Level

13.7.3. Track & Trace

13.7.4. Authenticity

13.8. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Function Type

13.8.1. Protection & Security

13.8.1.1. Corrosion

13.8.1.2. Atmospheric Gas

13.8.1.3. Physical Damage

13.8.1.4. Anti-theft

13.8.2. Indication

13.8.2.1. Time & Temperature

13.8.2.2. Quality & Safety

13.8.2.3. Freshness

13.8.2.4. Product Level

13.8.3. Track & Trace

13.8.4. Authenticity

13.9. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Application Type

13.9.1. Flexible Packaging

13.9.1.1. Sachets

13.9.1.2. Pouches

13.9.1.3. Tubes

13.9.1.4. Others

13.9.2. Rigid Packaging

13.9.2.1. Jars

13.9.2.2. Bottles

13.9.2.3. Boxes & Cartons

13.9.2.4. Customized Formats

13.10. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Application Type

13.10.1. Flexible Packaging

13.10.1.1. Sachets

13.10.1.2. Pouches

13.10.1.3. Tubes

13.10.1.4. Others

13.10.2. Rigid Packaging

13.10.2.1. Jars

13.10.2.2. Bottles

13.10.2.3. Boxes & Cartons

13.10.2.4. Customized Formats

13.11. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Packaging End Use

13.11.1. Skin Care

13.11.2. Hair Care

13.11.3. Make Up

13.11.4. Nail Care

13.11.5. Perfumes

13.11.6. Other Personal hygiene products

13.12. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Packaging End Use

13.12.1. Skin Care

13.12.2. Hair Care

13.12.3. Make Up

13.12.4. Nail Care

13.12.5. Perfumes

13.12.6. Other Personal hygiene products

13.13. Prominent Trends

13.14. Drivers and Restraints: Impact Analysis

13.15. Key Market Participants – Intensity Mapping

14. Middle East and Africa Active, Smart and Intelligent Packaging Market for Cosmetics & Personal Care Analysis and Forecast

14.1. Section Summary

14.2. Introduction

14.2.1. Market share and Basis Points (BPS) Analysis By Country

14.2.2. Y-o-Y Growth Projections By Country

14.3. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Country

14.3.1. GCC countries

14.3.2. Northern Africa

14.3.3. South Africa

14.3.4. Rest of MEA

14.4. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027 By Country

14.4.1. GCC countries

14.4.2. Northern Africa

14.4.3. South Africa

14.4.4. Rest of MEA

14.5. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Product Type

14.5.1. Active Packaging

14.5.1.1. O2 Scavengers

14.5.1.2. Gas Scavengers

14.5.1.3. Corrosion Inhibitors

14.5.1.4. Shock And Vibration

14.5.2. Smart & Intelligent Packaging

14.5.2.1. Time-Temperature Indicator (TTI) Labels

14.5.2.2. Microbial Growth

14.5.2.3. Biosensors

14.5.2.4. Freshness Indicators

14.5.2.5. RFID Tags & Smart Labels

14.5.2.6. Smart Codes

14.6. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Product Type

14.6.1. Active Packaging

14.6.1.1. O2 Scavengers

14.6.1.2. Gas Scavengers

14.6.1.3. Corrosion Inhibitors

14.6.1.4. Shock And Vibration

14.6.2. Smart & Intelligent Packaging

14.6.2.1. Time-Temperature Indicator (TTI) Labels

14.6.2.2. Microbial Growth

14.6.2.3. Biosensors

14.6.2.4. Freshness Indicators

14.6.2.5. RFID Tags & Smart Labels

14.6.2.6. Smart Codes

14.7. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Function Type

14.7.1. Protection & Security

14.7.1.1. Corrosion

14.7.1.2. Atmospheric Gas

14.7.1.3. Physical Damage

14.7.1.4. Anti-theft

14.7.2. Indication

14.7.2.1. Time & Temperature

14.7.2.2. Quality & Safety

14.7.2.3. Freshness

14.7.2.4. Product Level

14.7.3. Track & Trace

14.7.4. Authenticity

14.8. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Function Type

14.8.1. Protection & Security

14.8.1.1. Corrosion

14.8.1.2. Atmospheric Gas

14.8.1.3. Physical Damage

14.8.1.4. Anti-theft

14.8.2. Indication

14.8.2.1. Time & Temperature

14.8.2.2. Quality & Safety

14.8.2.3. Freshness

14.8.2.4. Product Level

14.8.3. Track & Trace

14.8.4. Authenticity

14.9. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Application Type

14.9.1. Flexible Packaging

14.9.1.1. Sachets

14.9.1.2. Pouches

14.9.1.3. Tubes

14.9.1.4. Others

14.9.2. Rigid Packaging

14.9.2.1. Jars

14.9.2.2. Bottles

14.9.2.3. Boxes & Cartons

14.9.2.4. Customized Formats

14.10. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Application Type

14.10.1. Flexible Packaging

14.10.1.1. Sachets

14.10.1.2. Pouches

14.10.1.3. Tubes

14.10.1.4. Others

14.10.2. Rigid Packaging

14.10.2.1. Jars

14.10.2.2. Bottles

14.10.2.3. Boxes & Cartons

14.10.2.4. Customized Formats

14.11. Historical Market Size (‘000 US$) and Volume (‘000 Units) Analysis 2014-2018 By Packaging End Use

14.11.1. Skin Care

14.11.2. Hair Care

14.11.3. Make Up

14.11.4. Nail Care

14.11.5. Perfumes

14.11.6. Other Personal hygiene products

14.12. Market Size (‘000 US$) and Volume (‘000 Units) Forecast 2019-2027, By Packaging End Use

14.12.1. Skin Care

14.12.2. Hair Care

14.12.3. Make Up

14.12.4. Nail Care

14.12.5. Perfumes

14.12.6. Other Personal hygiene products

14.13. Prominent Trends

14.14. Drivers and Restraints: Impact Analysis

14.15. Key Market Participants – Intensity Mapping

15. Market Structure Analysis

16. Competitive Landscape

16.1.1. 3M Company

16.1.2. Amcor Limited

16.1.3. Bemis Company, Inc.

16.1.4. CCL Industries Inc.

16.1.5. Coveris Holdings S.A.

16.1.6. Crown Holdings, Inc.

16.1.7. Sealed Air Corporation

16.1.8. Landec Corporation

16.1.9. PakSense, Inc.

16.1.10. Temptime Corporation

16.1.11. Vitsab International AB

16.1.12. Varcode, Ltd.

16.1.13. LCR Hallcrest LLC

16.1.14. Thin Film Electronics ASA.

16.1.15. Multisorb Technologies, Inc.

16.1.16. Cosmogen

16.1.17. Deltatrak Inc.

16.1.18. Cryolog S.A.

16.1.19. Timestrip UK Ltd.

16.1.20. ShockWatch, Inc.

List of Tables

Table 01: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 02: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 03: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 04: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 05: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 06: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 07: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by End Use, 2014H – 2027F

Table 08: Global ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Region, 2014H – 2027F

Table 09: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 10: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 11: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 12: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 13: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 14: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 15: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by End-use, 2014H – 2027F

Table 16: North America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Country, 2014H – 2027F

Table 17: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 18: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 19: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 20: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 21: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 22: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 23: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by End Use, 2014H – 2027F

Table 24: Latin America ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Country, 2014H – 2027F

Table 25: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 26: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 27: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 28: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 29: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 30: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 31: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by End Use, 2014H – 2027F

Table 32: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Country, 2014H – 2027F

Table 33: Europe ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Country, 2014H – 2027F

Table 34: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 35: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 36: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 37: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 38: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 39: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 40: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by End Use, 2014H – 2027F

Table 41: Asia Pacific ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Country, 2014H – 2027F

Table 42: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 43: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Product Type, 2014H – 2027F

Table 44: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 45: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Function, 2014H – 2027F

Table 46: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 47: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Application, 2014H – 2027F

Table 48: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by End Use, 2014H – 2027F

Table 49: MEA ASIP Market for Cosmetics & Personal Care Value (‘000 US$) and Volume (‘000 units) Forecast, by Country, 2014H – 2027F

List of Figures

Figure 01: Global ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Product, 2014H, 2019E, 2027F

Figure 02: Global ASIP Market for Cosmetics & Personal Care Y-o-Y Growth, by Product, 2015H-2027F

Figure 03: Global ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Product, 2019-2027

Figure 04: Global ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Function, 2014H, 2019E, 2027F

Figure 05: Global ASIP Market for Cosmetics & Personal Care Y-o-Y Growth, by Function, 2015H-2027F

Figure 06: Global ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Function, 2019-2027

Figure 07: Global ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Application, 2014H, 2019E, 2027F

Figure 08: Global ASIP Market for Cosmetics & Personal Care Y-o-Y Growth, by Application, 2015H-2027F

Figure 09: Global ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Application, 2019-2027

Figure 10: Global ASIP Market for Cosmetics & Personal Care Value Share & BPS, by End Use, 2014H, 2019E, 2027F

Figure 11: Global ASIP Market for Cosmetics & Personal Care Y-o-Y Growth, by End Use, 2015H-2027F

Figure 12: Global ASIP Market for Cosmetics & Personal Care Attractiveness Index, by End Use, 2019-2027

Figure 13: Global ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Region, 2014H, 2019E, 2027F

Figure 14: Global ASIP Market for Cosmetics & Personal Care Y-o-Y Growth, by Region, 2015H-2027F

Figure 15: Global ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Region, 2019-2027

Figure 16: North America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Product, 2014H, 2019E, 2027F

Figure 17: North America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Product, 2019-2027

Figure 18: North America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Function, 2014H, 2019E, 2027F

Figure 19: North America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Function, 2019-2027

Figure 20: North America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Application, 2014H, 2019E, 2027F

Figure 21: North America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Application, 2019-2027

Figure 22: North America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by End Use, 2014H, 2019E, 2027F

Figure 23: North America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by End Use, 2019-2027

Figure 24: North America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Country, 2014H, 2019E, 2027F

Figure 25: North America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Country, 2019-2027

Figure 26: Latin America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Product, 2014H, 2019E, 2027F

Figure 27: Latin America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Product, 2019-2027

Figure 28: Latin America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Function, 2014H, 2019E, 2027F

Figure 29: Latin America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Function, 2019-2027

Figure 30: Latin America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Application, 2014H, 2019E, 2027F

Figure 31: Latin America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Application, 2019-2027

Figure 32: Latin America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by End Use, 2014H, 2019E, 2027F

Figure 33: Latin America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by End Use, 2019-2027

Figure 34: Latin America ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Country, 2014H, 2019E, 2027F

Figure 35: Latin America ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Country, 2019-2027

Figure 36: Europe ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Product, 2014H, 2019E, 2027F

Figure 37: Europe ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Product, 2019-2027

Figure 38: Europe ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Function, 2014H, 2019E, 2027F

Figure 39: Europe ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Function, 2019-2027

Figure 40: Europe ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Application, 2014H, 2019E, 2027F

Figure 41: Europe ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Application, 2019-2027

Figure 42: Europe ASIP Market for Cosmetics & Personal Care Value Share & BPS, by End Use, 2014H, 2019E, 2027F

Figure 43: Europe ASIP Market for Cosmetics & Personal Care Attractiveness Index, by End Use, 2019-2027

Figure 44: Europe ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Country, 2014H, 2019E, 2027F

Figure 45: Europe ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Country, 2019-2027

Figure 46: Asia Pacific ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Product, 2014H, 2019E, 2027F

Figure 47: Asia Pacific ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Product, 2019-2027

Figure 48: Asia Pacific ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Function, 2014H, 2019E, 2027F

Figure 49: Asia Pacific ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Function, 2019-2027

Figure 50: Asia Pacific ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Application, 2014H, 2019E, 2027F

Figure 51: Asia Pacific ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Application, 2019-2027

Figure 52: Asia Pacific ASIP Market for Cosmetics & Personal Care Value Share & BPS, by End Use, 2014H, 2019E, 2027F

Figure 53: Asia Pacific ASIP Market for Cosmetics & Personal Care Attractiveness Index, by End Use, 2019-2027

Figure 54: Asia Pacific ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Country, 2014H, 2019E, 2027F

Figure 55: Asia Pacific ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Country, 2019-2027

Figure 56: MEA ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Product, 2014H, 2019E, 2027F

Figure 57: MEA ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Product, 2019-2027

Figure 58: MEA ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Function, 2014H, 2019E, 2027F

Figure 59: MEA ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Function, 2019-2027

Figure 60: MEA ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Application, 2014H, 2019E, 2027F

Figure 61: MEA ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Application, 2019-2027

Figure 62: MEA ASIP Market for Cosmetics & Personal Care Value Share & BPS, by End Use, 2014H, 2019E, 2027F

Figure 63: MEA ASIP Market for Cosmetics & Personal Care Attractiveness Index, by End Use, 2019-2027

Figure 64: MEA ASIP Market for Cosmetics & Personal Care Value Share & BPS, by Country, 2014H, 2019E, 2027F

Figure 65: MEA ASIP Market for Cosmetics & Personal Care Attractiveness Index, by Country, 2019-2027