The Global Active Implantable Medical Devices Market: Overview

Few of the most notable and prominent driving factors positively influencing the demand dynamics within the global active implantable medical devices market include rise in the elderly and aging global population, rising funds and investments intended for development of the technically advanced solutions, favorable reimbursement scenario for ear, nose, and throat or ENT procedures in developed economies, rising prevalence of neurological as well as cardiovascular disorders, and rising applications of neurostimulators. On the other hand, problems related to usage of implantable medical devices, high cost of these implants, and unfavorable healthcare policies in developed countries such as the United States may restrict the growth within the global active implantable medical devices market in coming years.

Key types of products offered by the players in the global active implantable medical devices market include implantable cardioverter defibrillators, ventricular assist devices, implantable heart monitors, neurostimulators, insert able loop recorders, and implantable hearing devices, including passive or non-active hearing implants and active hearing implants. Implantable cardioverter defibrillators are further classified into subcutaneous implantable cardioverter defibrillators and trans venous implantable cardioverter defibrillators including biventricular implantable cardioverter defibrillators, dual chamber implantable cardioverter defibrillators, cardiac resynchronization therapy defibrillators, and single chamber implantable cardioverter defibrillators. Types of neurostimulators products offered by the players in global active implantable medical devices market include deep brain stimulators, vagus nerve stimulators, spinal cord stimulators, sacral nerve stimulators, and gastric electrical stimulators.

Major and leading players and manufacturers operational within the global active implantable medical devices market are adopting various corporate growth strategies in order to amass a major share in the global active implantable medical devices market in coming years. Some of the key strategies employed by these vendors in the global active implantable medical devices market include new product launches, agreements and collaborations, strategic partnerships, mergers and acquisitions, and geographical expansion. The global active implantable medical devices market was led by three major players in the last few years, namely, Medtronic PLC, Boston Scientific Corporation, and Abbott Laboratories. Together, these three players are thought to account for 95 % of the industry share.

Active Implantable Medical Devices Market: Snapshot

The global market for active implantable medical devices is gaining remarkably from the increasing prevalence of several chronic diseases, such as cardiovascular and neurological disorders. The constant product launches, and simplified approval process is also supporting the growth of this market substantially.

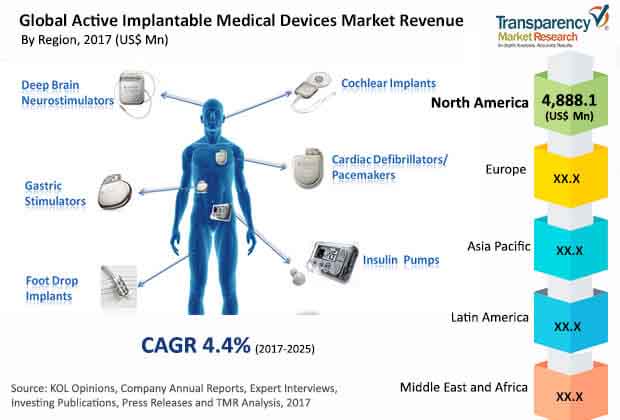

Going forward, the rising expenditure on healthcare, owing to the increasing number of patients with cardiovascular diseases and neurological disorders, is anticipated to fuel the demand for active implantable medical devices across the world over the next few years. However, the issues regarding the usage of active implantable medical devices, such as device failure and concerns related to cybersecurity may hinder the growth of the market in the near future. The global market for active implantable medical devices is likely to present an opportunity worth US$20.73 bn by 2025, expanding at a CAGR of 4.40% between 2017 and 2025.

Demand for Implantable Cardioverter Defibrillators to Remain Strong

The global active implantable medical devices market is assessed on the basis of the product type, procedure, and the end user. Based on the product type, the market is classified into implantable cardioverter defibrillators (ICD), cardiac pacemaker, nerve stimulators, cochlear implants, ventricular assist devices (VAD), and insertable cardiac monitor (implantable monitoring devices). Among these, the demand for implantable cardioverter defibrillators (ICD) is greater at present and is expected to remain so over the next few years. However, insertable cardiac monitors are expected to register a robust rise in their demand in the near future, thanks to the increasing prevalence of cardiovascular diseases across the world.

Based on the procedure, the market is categorized into cardiovascular implants, neurological implants, and hearing implants. By the end user, the market is divided into hospitals, ambulatory surgery centers, and specialty clinics. With significantly rising investments, the hospital sector is likely to emerge as the most prominent end user of active implantable medical devices in the years to come.

Presence of Leading Players to Ensure North America’s Lead

Asia Pacific, Latin America, North America, Europe, and the Middle East Africa are the main geographical segments of the worldwide market for active implantable medical devices. With a share of more than 33%, North America dominated the global market in 2016, thanks to the technological advancements in developing novel active implantable devices. On account of the considerable presence of a number of implantable medical device manufacturers, such as Medtronic Plc, Boston Scientific Corp., and Abbott Laboratories, this regional market is anticipated to remain on the top over the forthcoming years.

Europe, with a share of 28.4%, stood at the second position in 2016. It is expected to retain its position over the next few years, thanks to the frequent product launches. Asia Pacific, however, is projected to present the most promising growth opportunities to market players in the near future, owing to the remarkable rise in Asian economies, such as China, India, and South Korea, leading to increase in investments by implantable medical device manufacturers.

Boston Scientific Corp., Abbott Laboratories, Medtronic Plc, Sonova Holding AG, LivaNova Plc, BIOTRONIK SE & Co. KG, Cochlear Ltd., William Demant Holding A/S, Nurotron Biotechnology Co. Ltd., and MED-EL Medical Electronics are some of the leading vendors of active implantable medical devices across the world. The market is demonstrating a highly competitive landscape and is expected remain intensely competitive over the forthcoming years.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Active Implantable Medical Devices Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Active Implantable Medical Devices Market Analysis and Forecasts, 2017–2025

4.5. Porter’s Five Force Analysis

4.6. Market Outlook

5. Global Active Implantable Medical Devices Market Analysis and Forecasts, By Product

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Market Value Forecast By Product

5.4.1. Cardiac Pacemaker

5.4.1.1. Single Chamber Pacemaker

5.4.1.2. Dual Chamber Pacemaker

5.4.1.3. Others

5.4.2. Implantable Cardioverter Defibrillators (ICD)

5.4.2.1. Transvenous Implantable Cardioverter Defibrillators

5.4.2.2. Subcutaneous Implantable Cardioverter Defibrillators

5.4.3. Nerve Stimulators

5.4.4. Cochlear Implants

5.4.5. Ventricular Assist Devices (VAD)

5.4.6. Insertable Cardiac Monitor (Implantable Monitoring Devices)

5.5. Market Attractiveness By Product

6. Global Active Implantable Medical Devices Market Analysis and Forecasts, By Procedure

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Market Value Forecast By Procedure

6.4.1. Cardiovascular Implants

6.4.2. Neurological Implants

6.4.3. Hearing Implants

6.4.4. Others

6.5. Market Attractiveness By Procedure

7. Global Active Implantable Medical Devices Market Analysis and Forecasts, By End-User

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Key Trends

7.4. Market Value Forecast By End-User

7.4.1. Hospitals

7.4.2. Ambulatory Surgery Centers

7.4.3. Specialty Clinics

7.5. Market Attractiveness By End-User

8. Global Active Implantable Medical Devices Market Analysis and Forecasts, By Region

8.1. Key Findings

8.2. Market Value Forecast By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East and Africa

8.3. Market Attractiveness By Country/Region

9.North America Active Implantable Medical Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.1.2. Key Trends

9.2. Market Value Forecast By Product

9.2.1. Cardiac Pacemaker

9.2.1.1. Single Chamber Pacemaker

9.2.1.2. Dual Chamber Pacemaker

9.2.1.3. Others

9.2.2. Implantable Cardioverter Defibrillators (ICD)

9.2.2.1. Transvenous Implantable Cardioverter Defibrillators

9.2.2.2. Subcutaneous Implantable Cardioverter Defibrillators

9.2.3. Nerve Stimulators

9.2.4. Cochlear Implants

9.2.5. Ventricular Assist Devices (VAD)

9.2.6. Insertable Cardiac Monitor (Implantable Monitoring Devices)

9.3. Market Value Forecast By Procedure

9.3.1. Cardiovascular Implants

9.3.2. Neurological Implants

9.3.3. Hearing Implants

9.3.3. Others

9.4. Market Value Forecast By End-User

9.4.1. Hospitals

9.4.2. Ambulatory Surgery Centers

9.4.3. Specialty Clinics

9.5. Market Value Forecast By Country

9.5.1. U.S.

9.5.2. Canada

9.6. Market Attractiveness Analysis

10. Europe Active Implantable Medical Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.1.2. Key Trends

10.2. Market Value Forecast By Product

10.2.1. Cardiac Pacemaker

10.2.1.1. Single Chamber Pacemaker

10.2.1.2. Dual Chamber Pacemaker

10.2.1.3. Others

10.2.2. Implantable Cardioverter Defibrillators (ICD)

10.2.2.1. Transvenous Implantable Cardioverter Defibrillators

10.2.2.2. Subcutaneous Implantable Cardioverter Defibrillators

10.2.3. Nerve Stimulators

10.2.4. Cochlear Implants

10.2.5. Ventricular Assist Devices (VAD)

10.2.6. Insertable Cardiac Monitor (Implantable Monitoring Devices)

10.3. Market Value Forecast By Procedure

10.3.1 Cardiovascular Implants

10.3.2.Neurological Implants

10.3.3.Hearing Implants

10.3.4.Others

10.4. Market Value Forecast By End-User , 2015–2025

10.4.1. Hospitals

10.4.2. Ambulatory Surgery Centers

10.4.3. Specialty Clinics

10.5. Market Value Forecast By Country , 2015–2025

10.5.1. Germany

10.5.2. France

10.5.3. U.K.

10.5.4. Italy

10.5.4. Spain

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

11. Asia Pacific Active Implantable Medical Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.1.2. Key Trends

11.2. Market Value Forecast By Product

11.2.1. Cardiac Pacemaker

11.2.1.1. Single Chamber Pacemaker

11.2.1.2. Dual Chamber Pacemaker

11.2.1.3. Others

11.2.2. Implantable Cardioverter Defibrillators (ICD)

11.2.2.1. Transvenous Implantable Cardioverter Defibrillators

11.2.2.2. Subcutaneous Implantable Cardioverter Defibrillators

11.2.3. Nerve Stimulators

11.2.4. Cochlear Implants

11.2.5. Ventricular Assist Devices (VAD)

11.2.6. Insertable Cardiac Monitor (Implantable Monitoring Devices)

11.3. Market Value Forecast By Procedure

11.3.1 Cardiovascular Implants

11.3.2.Neurological Implants

11.3.3.Hearing Implants

11.3.4.Others

11.4. Market Value Forecast By End-User

11.4.1. Hospitals

11.4.2. Ambulatory Surgery Centers

11.4.3. Specialty Clinics

11.5. Market Value Forecast By Country

11.5.1. Japan

11.5.2. China

11.5.3. India

11.5.4. Australia

11.5.5. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

12. Latin America Active Implantable Medical Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.1.2. Key Trends

12.2. Market Value Forecast By Product

12.2.1. Cardiac Pacemaker

12.2.1.1. Single Chamber Pacemaker

12.2.1.2. Dual Chamber Pacemaker

12.2.1.3. Others

12.2.2. Implantable Cardioverter Defibrillators (ICD)

12.2.2.1. Transvenous Implantable Cardioverter Defibrillators

12.2.2.2. Subcutaneous Implantable Cardioverter Defibrillators

12.2.3. Nerve Stimulators

12.2.4. Cochlear Implants

12.2.5. Ventricular Assist Devices (VAD)

12.2.6. Insertable Cardiac Monitor (Implantable Monitoring Devices)

12.3. Market Value Forecast By Procedure

12.3.1 Cardiovascular Implants

12.3.2.Neurological Implants

12.3.3.Hearing Implants

12.3.4.Others

12.4. Market Value Forecast By End-User

12.4.1. Hospitals

12.4.2. Ambulatory Surgery Centers

12.4.3. Specialty Clinics

12.5. Market Value Forecast By Country

12.5.1. Brazil

12.5.2. Mexico

12.5.3. Rest of Latin America

12.6. Market Attractiveness Analysis

13. Middle East and Africa Active Implantable Medical Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.1.2. Key Trends

13.2. Market Value Forecast By Product

13.2.1. Cardiac Pacemaker

13.2.1.1. Single Chamber Pacemaker

13.2.1.2. Dual Chamber Pacemaker

13.2.1.3. Others

13.2.2. Implantable Cardioverter Defibrillators (ICD)

13.2.2.1. Transvenous Implantable Cardioverter Defibrillators

13.2.2.2. Subcutaneous Implantable Cardioverter Defibrillators

13.2.3. Nerve Stimulators

13.2.4. Cochlear Implants

13.2.5. Ventricular Assist Devices (VAD)

13.2.6. Insertable Cardiac Monitor (Implantable Monitoring Devices)

13.3. Market Value Forecast By Procedure

13.3.1 Cardiovascular Implants

13.3.2.Neurological Implants

13.3.3.Hearing Implants

13.3.4.Others

13.4. Market Value Forecast By End-User

13.4.1. Hospitals

13.4.2. Ambulatory Surgery Centers

13.4.3. Specialty Clinics

13.5. Market Value Forecast By Country

13.5.1. South Africa

13.5.2. Israel

13.5.3. GCC countries

13.5.4. Rest of MEA

13.6. Market Attractiveness Analysis

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of companies)

14.2. Market Share Analysis By Company (2016)

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

14.3.1 Abbott Laboratories

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Business Overview

14.3.1.3. Product Portfolio

14.3.1.4. Financial Overview

14.3.1.5. SWOT Analysis

14.3.1.6. Strategic overview

14.3.2. BIOTRONIK SE & Co. KG

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Business Overview

14.3.2.3. Product Portfolio

14.3.2.4. Financial Overview

14.3.2.5. SWOT Analysis

14.3.2.6. Strategic overview

14.3.3. Boston Scientific Corporation

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Business Overview

14.3.3.3. Product Portfolio

14.3.3.4. Financial Overview

14.3.3.5. SWOT Analysis

14.3.3.6. Strategic overview

14.3.4. Cochlear Ltd

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Business Overview

14.3.4.3. Product Portfolio

14.3.4.4. Financial Overview

14.3.4.5. SWOT Analysis

14.3.4.6. Strategic overview

14.3.5. Sonova Holding AG

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Business Overview

14.3.5.3. Product Portfolio

14.3.5.4. Financial Overview

14.3.5.5. SWOT Analysis

14.3.5.6. Strategic overview

14.3.6. LivaNova PLC

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Business Overview

14.3.6.3. Product Portfolio

14.3.6.4. Financial Overview

14.3.6.5. SWOT Analysis

14.3.6.6. Strategic overview

14.3.7. Medtronic Plc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Business Overview

14.3.7.3. Product Portfolio

14.3.7.4. Financial Overview

14.3.7.5. SWOT Analysis

14.3.7.6. Strategic overview

14.3.8. MED-EL Medical Electronics

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Business Overview

14.3.8.3. Product Portfolio

14.3.8.4. Financial Overview

14.3.8.5. SWOT Analysis

14.3.8.6. Strategic overview

14.3.9. Nurotron Biotechnology Co. Ltd

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Business Overview

14.3.9.3. Product Portfolio

14.3.9.4. Financial Overview

14.3.9.5. SWOT Analysis

14.3.9.6. Strategic overview

14.3.10. William Demant Holding A/S

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Business Overview

14.3.10.3. Product Portfolio

14.3.10.4. Financial Overview

14.3.10.5. SWOT Analysis

14.3.10.6. Strategic overview

List of Tables

Table 01: Global Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 02: Global Cardiac Pacemaker Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 03: Global Implantable Cardioverter Defibrillators (ICD) Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 04: Global Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Procedure Type, 2017–2025

Table 05: Global Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by End user, 2017–2025

Table 06: Global Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Region, 2017–2025

Table 07: North America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 08: North America Cardiac Pacemaker Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 09: North America Implantable Cardioverter Defibrillators (ICD) Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 10: North America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Procedure, 2017–2025

Table 11: North America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by End user, 2017–2025

Table 12: North America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 13: Europe Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 14: Europe Cardiac Pacemaker Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 15: Europe Implantable Cardioverter Defibrillators (ICD) Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 16: Europe Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Procedure, 2017–2025

Table 17: Europe Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by End user, 2017–2025

Table 18: Europe Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 19: Asia Pacific Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 20: Asia Pacific Cardiac Pacemaker Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 21: Asia Pacific Implantable Cardioverter Defibrillators (ICD) Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 22: Asia Pacific Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Procedure, 2017–2025

Table 23: Asia Pacific Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by End user, 2017–2025

Table 24: Asia Pacific Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 25: Latin America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 26: Latin America Cardiac Pacemaker Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 27: Latin America Implantable Cardioverter Defibrillators (ICD) Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 28: Latin America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Procedure, 2017–2025

Table 29: Latin America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by End user, 2017–2025

Table 30: Latin America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Country, 2017–2025

Table 31: Middle East and Africa Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Product, 2017–2025

Table 32: Middle East and Africa Cardiac Pacemaker Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 33: Middle East and Africa Implantable Cardioverter Defibrillators (ICD) Market Size (US$ Mn) Forecast, by Product Type, 2017–2025

Table 34: Middle East and Africa Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Procedure, 2017–2025

Table 35: Middle East and Africa Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by End user, 2017–2025

Table 36: Middle East and Africa Active Implantable Medical Devices Market Size (US$ Mn) Forecast, by Country, 2017–2025

List of Figures

Figure 01: Global Active Implantable Medical Devices Market Size (US$ Mn) Forecast, 2017–2025

Figure 02: Global Active Implantable Medical Devices Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 03: Global Cardiac Pacemaker Market Revenue (US$ Mn), 2015-2025

Figure 04: Global Implantable Cardioverter Defibrillators Market Revenue, US$ Mn, 2015–2025

Figure 05: Global Nerve Stimulators Market Revenue (US$ Mn), 2015-2025

Figure 06: Global Insertable Cardiac Monitor Market Revenue, US$ Mn, 2015–2025

Figure 07: Global Cochlear Implants Market Revenue (US$ Mn), 2015-2025

Figure 08: Global Ventricular Assist Devices (VAD) Market Revenue, US$ Mn, 2015–2025

Figure 09: Active Implantable Medical Devices Market Attractiveness Analysis By Product Type

Figure 10: Global Active Implantable Medical Devices Market Value Share Analysis By Procedure Type, 2016 and 2024

Figure 07: Cardiovascular Implants Market Revenue, US$ Mn, 2015–2025

Figure 08: Neurological Implants Market Revenue, US$ Mn, 2015–2025

Figure 07: Hearing implants Market Revenue, US$ Mn, 2015–2025

Figure 08: Other Implants Market Revenue, US$ Mn, 2015–2025

Figure 10: Global Active Implantable Medical Devices Market Attractiveness Analysis, By Procedure Type

Figure 11: Global Active Implantable Medical Devices Market Value Share Analysis By End users, 2016 and 2024

Figure 12: Global Hospitals Market Revenue (US$ Mn), 2015–2025

Figure 13: Global Ambulatory Surgery Centers Market Revenue (US$ Mn), 2015–2025

Figure 14: Global Academic & Research Institutes Market Revenue (US$ Mn), 2015–2025

Figure 15: Active Implantable Medical Devices Market Attractiveness Analysis, by End user

Figure 16: Global Active Implantable Medical Devices Market Analysis By Region, 2017 and 2025

Figure 17: Global Active Implantable Medical Devices Market Attractiveness Analysis, By Region Type

Figure 18: North America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 19: North America Market Attractiveness Analysis By Country

Figure 20: North America Active Implantable Medical Devices Market Value Share Analysis By Product Type, 2017 and 2025

Figure 21: North America Active Implantable Medical Devices Market Value Share Analysis By Procedure Type, 2017 and 2025

Figure 22: North America Active Implantable Medical Devices Market Value Share Analysis By End User Type, 2017 and 2025

Figure 23: North America Market Value Share Analysis By Country, 2017 and 2025

Figure 24: North America Market Attractiveness Analysis, by Product

Figure 25: North America Market Attractiveness Analysis, by Procedure

Figure 26: North America Market Attractiveness Analysis, by End User

Figure 27: Europe Active Implantable Medical Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 28: Europe Market Attractiveness Analysis, by Country

Figure 29: Europe Market Value Share Analysis By Product Type, 2017 and 2025

Figure 30: Europe Market Value Share Analysis By Procedure Type, 2017 and 2025

Figure 31: Europe Active Implantable Medical Devices Market Value Share Analysis By End User Type, 2017 and 2025

Figure 32: Europe Market Value Share Analysis, by Country, 2017 and 2025

Figure 33: Europe Market Attractiveness Analysis, by Product

Figure 34: Europe Market Attractiveness Analysis, by Procedure

Figure 35: Europe Market Attractiveness Analysis, by End User

Figure 36: Asia Pacific Active Implantable Medical Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 37: Asia Pacific Market Attractiveness Analysis, by Country

Figure 38: Asia Pacific Market Value Share Analysis By Product Type, 2017 and 2025

Figure 39: Asia Pacific Market Value Share Analysis By Procedure Type, 2017 and 2025

Figure 40: Asia Pacific Active Implantable Medical Devices Market Value Share Analysis By End User Type, 2017 and 2025

Figure 41: Asia Pacific Market Value Share Analysis, by Country, 2017 and 2025

Figure 42: Asia Pacific Market Attractiveness Analysis, by Product

Figure 43: Asia Pacific Market Attractiveness Analysis, by Procedure

Figure 44: Asia Pacific Market Attractiveness Analysis, by End User

Figure 45: Latin America Active Implantable Medical Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 46: Latin America Market Attractiveness Analysis, by Country

Figure 47: Latin America Market Value Share Analysis By Product Type, 2017 and 2025

Figure 48: Latin America Market Value Share Analysis By Procedure Type, 2017 and 2025

Figure 49: Latin America Active Implantable Medical Devices Market Value Share Analysis By End User Type, 2017 and 2025

Figure 50: Latin America Market Value Share Analysis, by Country, 2017 and 2025

Figure 51: Latin America Market Attractiveness Analysis, by Product

Figure 52: Latin America Market Attractiveness Analysis, by Procedure

Figure 53: Latin America Market Attractiveness Analysis, by End User

Figure 54: Middle East and Africa Active Implantable Medical Devices Market Size (US$ Mn) Forecast, 2015–2025

Figure 55: Middle East and Africa Market Attractiveness Analysis, by Country

Figure 56: Middle East and Africa Market Value Share Analysis By Product Type, 2017 and 2025

Figure 57: Middle East and Africa Market Value Share Analysis By Procedure Type, 2017 and 2025

Figure 58: Middle East and Africa Active Implantable Medical Devices Market Value Share Analysis By End User Type, 2017 and 2025

Figure 59: Middle East and Africa Market Value Share Analysis, by Country, 2017 and 2025

Figure 60: Middle East and Africa Market Attractiveness Analysis, by Product

Figure 61: Middle East and Africa Market Attractiveness Analysis, by Procedure

Figure 62: Middle East and Africa Market Attractiveness Analysis, by End User

Figure 63: Global Active Implantable Medical Devices Market Share Analysis By Cardiac Rhythm Management (2016)

Figure 64: Global Active Implantable Medical Devices Market Share Analysis By Neuromodulation (2016)

Figure 65: Global Active Implantable Medical Devices Market Share Analysis By Cochlear Implants (2016)