Analysts’ Viewpoint

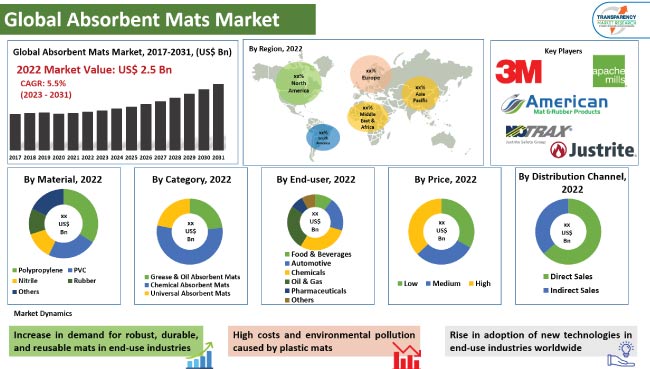

Rise in demand for protective mats in industries to reduce the time and effort taken to effectively clean up chemical, oil, and solvent spills is one of the key factors driving the global absorbent mats market. These mats are increasingly being adopted in end-use industries such as food & beverages, oil & gas, and chemical owing to their several benefits, including durability and reusability.

Several government and regulatory bodies are implementing stringent rules to increase safety measures in industrial workplaces. Growth in hygiene awareness is further fueling market progress. Workers in manufacturing and industrial environments typically work on their feet for long periods of time. This is expected to augment absorbent mats market demand. Leading manufacturers are following the latest global absorbent mats market trends and developing innovative products to cater to the rise in demand from industries worldwide.

Absorbent mats are designed to be placed on the floor in high-traffic areas to protect the floor and prevent slips and falls. These mats are made from a variety of materials, including polypropylene, PVC, nitrile, and rubber. They are available in different colors, sizes, and thicknesses. Absorbent mats are often used in restaurants and other places that experience high risk of spillage.

Different types of absorbent mats, such as soaker pads and saturation mats, are available in the market. The absorbent mats market is expected to record steady expansion during the forecast period, owing to the rise in awareness about their benefits in industries, increase in safety measures in industrial workplaces, and surge in demand for robust and recyclable floor mats in emerging economies.

Rise in adoption of floor mats manufactured using polypropylene (PP) material that absorb large amount of liquid compared to traditional materials such as wood, stone, or glass is likely to fuel absorbent mats market size in the near future.

PP absorbent mats are used in various applications, including sludge dewatering and wastewater treatment systems, in industries such as food & beverages and chemicals. Absorbent mats are robust, durable, and reusable; hence, they are widely used in many end-use industries. This is driving market statistics.

Absorbent mats can also be used on floors or in worktops to quickly absorb solvents after washing operation of parts. These mats or moisture pads can quickly absorb large amounts of spilled drippings than traditional methods.

Usage of stocking absorbent pads in areas where leaks and drips are common helps prevent employees from using a spill kit or two to get the job done. Oil mist and coolant overspray can also make production floors slippery. Absorbent mats catch these fluids when they hit the floor and provide a safer walking surface on work surfaces, aisles, and other walkways.

Placing rolls of absorbent mats on floors reduces the likelihood of slipping and may even extend the life of the floor. This is creating lucrative growth prospects for absorbent mats market.

Absorbent mat is an essential part of a wide range of industries. From aircraft facilities to manufacturing buildings, absorbent mats absorb a variety of liquids, such as oil, water, and coolants, that are constantly used in or around machinery.

Expansion in end-use industries such as food & beverages, chemicals, oil & gas, automotive, and pharmaceuticals is augmenting the global absorbent mats market growth.

Disposable absorbent pad, often called pig pad or pig sock, is a common industrial solution for absorbing liquids, but it is not the ideal choice. These pads require three pieces to absorb the same amount of liquid absorbed by just one reusable absorbent pad. They also result in air pollution and emit harmful chemicals into the soil when disposed of.

Hence, grease & oil absorbing mats, chemical absorbent mats, and universal absorbent mats are gaining traction across the globe.

According to the global absorbent mats market report, demand for absorbent mats with polypropylene material is rising across the globe. Polypropylene fabric is a thermoplastic polymer that is significantly used in automobile parts, food packaging, plastic furniture, and medical equipment.

Polypropylene fabric resists fading, staining, and water absorption. Additionally, polypropylene is flexible and lightweight. Polypropylene material is also recyclable, breathable, moisture-wicking, and durable. This plastic is a linear hydrocarbon polymer. It is one of the most popular plastics due to its low cost and ease of manufacture.

Stains formed on polypropylene fabric settle between the fibers. This allows for easy cleaning without the risk of discoloration. Hence, demand for polypropylene absorbent mats is rising in various end-use industries across the globe.

According to the global absorbent mats market forecast, Asia Pacific accounted for major share in 2022, owing to rapid urbanization and industrialization in developing countries of the region. Growth in industries such as chemicals, pharmaceuticals, food & beverages, and automotive is driving market expansion in Asia Pacific.

North America and Europe are expected to record significant market growth in the next few years due to enactment of strict government regulations related to employee/worker safety in factories. This is anticipated to positively impact market development in these regions during the forecast period.

The global landscape is fragmented, with the presence of large-scale manufacturers as well as local players that control majority of the absorbent mats market share.

NoTrax Justrite Safety Group, Liquid Safety Solutions (Spilfyter), New Pig Corporation, Little Rapids Corporation (Graham Medical), Safetec of America, Inc., McAllister Mills, Inc., COBA Europe Ltd, Can-Ross Environmental Services Ltd, Brady Corporation, and PONZI Srl are some of the leading players operating in the industry.

Each of these companies has been profiled in the global absorbent mats market research report based on parameters such as business strategies, business segments, product portfolio, company overview, recent developments, and financial overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 2.5 Bn |

|

Market Forecast Value in 2031 |

US$ 4.1 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 2.5 Bn in 2022.

The CAGR is estimated to be 5.5% during 2023-2031.

It is anticipated to reach US$ 4.1 Bn by 2031.

Increase in demand for robust, durable, and reusable mats in end-use industries, industrial growth in emerging economies, and rise in safety measures in industrial workplaces.

The polypropylene material segment dominated with maximum share in 2022.

NoTrax Justrite Safety Group, Liquid Safety Solutions (Spilfyter), New Pig Corporation, Little Rapids Corporation (Graham Medical), Safetec of America, Inc., McAllister Mills, Inc., COBA Europe Ltd, Can-Ross Environmental Services Ltd, Brady Corporation, and PONZI Srl.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Industry SWOT Analysis

5.5. Technology Overview

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Regulatory Framework

5.10. Trade Analysis

5.11. Global Absorbent Mats Analysis and Forecast,

5.11.1. Market Revenue Projections (US$ Mn)

5.11.2. Market Revenue Projections (Thousand Units)

6. Global Absorbent Mats Analysis and Forecast, by Material

6.1. Global Absorbent Mats Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

6.1.1. Polypropylene

6.1.2. PVC

6.1.3. Nitrile

6.1.4. Rubber

6.1.5. Others

6.2. Incremental Opportunity, by Material

7. Global Absorbent Mats Analysis and Forecast, by Category

7.1. Global Absorbent Mats Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

7.1.1. Grease & Oil Absorbent Mats

7.1.2. Chemical Absorbent Mats

7.1.3. Universal Absorbent Mats

7.2. Incremental Opportunity, by Category

8. Global Absorbent Mats Analysis and Forecast, by End-user

8.1. Global Absorbent Mats Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

8.1.1. Food & Beverages

8.1.2. Automotive

8.1.3. Chemicals

8.1.4. Oil & Gas

8.1.5. Pharmaceuticals

8.1.6. Others

8.2. Incremental Opportunity, by End-user

9. Global Absorbent Mats Analysis and Forecast, by Price

9.1. Global Absorbent Mats Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

9.1.1. Low

9.1.2. Medium

9.1.3. High

9.2. Incremental Opportunity, by Price

10. Global Absorbent Mats Analysis and Forecast, by Distribution Channel

10.1. Global Absorbent Mats Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. Global Absorbent Mats Analysis and Forecast, by Region

11.1. Global Absorbent Mats Size (US$ Mn) (Thousand Units), by Region, 2017- 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Absorbent Mats Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. Absorbent Mats Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

12.5.1. Polypropylene

12.5.2. PVC

12.5.3. Nitrile

12.5.4. Rubber

12.5.5. Others

12.6. Absorbent Mats Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

12.6.1. Grease & Oil Absorbent Mats

12.6.2. Chemical Absorbent Mats

12.6.3. Universal Absorbent Mats

12.7. Absorbent Mats Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

12.7.1. Food & Beverages

12.7.2. Automotive

12.7.3. Chemicals

12.7.4. Oil & Gas

12.7.5. Pharmaceuticals

12.7.6. Others

12.8. Absorbent Mats Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

12.8.1. Low

12.8.2. Medium

12.8.3. High

12.9. Absorbent Mats Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Absorbent Mats Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Absorbent Mats Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. Absorbent Mats Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

13.5.1. Polypropylene

13.5.2. PVC

13.5.3. Nitrile

13.5.4. Rubber

13.5.5. Others

13.6. Absorbent Mats Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

13.6.1. Grease & Oil Absorbent Mats

13.6.2. Chemical Absorbent Mats

13.6.3. Universal Absorbent Mats

13.7. Absorbent Mats Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

13.7.1. Food & Beverages

13.7.2. Automotive

13.7.3. Chemicals

13.7.4. Oil & Gas

13.7.5. Pharmaceuticals

13.7.6. Others

13.8. Absorbent Mats Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

13.8.1. Low

13.8.2. Medium

13.8.3. High

13.9. Absorbent Mats Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Absorbent Mats Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Absorbent Mats Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. Absorbent Mats Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

14.5.1. Polypropylene

14.5.2. PVC

14.5.3. Nitrile

14.5.4. Rubber

14.5.5. Others

14.6. Absorbent Mats Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

14.6.1. Grease & Oil Absorbent Mats

14.6.2. Chemical Absorbent Mats

14.6.3. Universal Absorbent Mats

14.7. Absorbent Mats Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

14.7.1. Food & Beverages

14.7.2. Automotive

14.7.3. Chemicals

14.7.4. Oil & Gas

14.7.5. Pharmaceuticals

14.7.6. Others

14.8. Absorbent Mats Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

14.8.1. Low

14.8.2. Medium

14.8.3. High

14.9. Absorbent Mats Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Absorbent Mats Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Absorbent Mats Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. Absorbent Mats Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

15.5.1. Polypropylene

15.5.2. PVC

15.5.3. Nitrile

15.5.4. Rubber

15.5.5. Others

15.6. Absorbent Mats Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

15.6.1. Grease & Oil Absorbent Mats

15.6.2. Chemical Absorbent Mats

15.6.3. Universal Absorbent Mats

15.7. Absorbent Mats Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

15.7.1. Food & Beverages

15.7.2. Automotive

15.7.3. Chemicals

15.7.4. Oil & Gas

15.7.5. Pharmaceuticals

15.7.6. Others

15.8. Absorbent Mats Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

15.8.1. Low

15.8.2. Medium

15.8.3. High

15.9. Absorbent Mats Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Absorbent Mats Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Absorbent Mats Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Key Trends Analysis

16.3.1. Supply side

16.3.2. Demand Side

16.4. Price Trend Analysis

16.4.1. Weighted Average Selling Price (US$)

16.5. Absorbent Mats Size (US$ Mn) (Thousand Units), by Material, 2017- 2031

16.5.1. Polypropylene

16.5.2. PVC

16.5.3. Nitrile

16.5.4. Rubber

16.5.5. Others

16.6. Absorbent Mats Size (US$ Mn) (Thousand Units), by Category, 2017- 2031

16.6.1. Grease & Oil Absorbent Mats

16.6.2. Chemical Absorbent Mats

16.6.3. Universal Absorbent Mats

16.7. Absorbent Mats Size (US$ Mn) (Thousand Units), by End-user, 2017- 2031

16.7.1. Food & Beverages

16.7.2. Automotive

16.7.3. Chemicals

16.7.4. Oil & Gas

16.7.5. Pharmaceuticals

16.7.6. Others

16.8. Absorbent Mats Size (US$ Mn) (Thousand Units), by Price, 2017- 2031

16.8.1. Low

16.8.2. Medium

16.8.3. High

16.9. Absorbent Mats Size (US$ Mn) (Thousand Units), by Distribution Channel, 2017- 2031

16.9.1. Direct Sales

16.9.2. Indirect Sales

16.10. Absorbent Mats Size (US$ Mn) (Thousand Units), by Country, 2017- 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Competition Dashboard

17.2. Market Share Analysis % (2022)

17.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Distribution channel overview, Business Strategies / Recent Developments]

17.3.1. NoTrax Justrite Safety Group

17.3.1.1. Company Overview

17.3.1.2. Product Portfolio

17.3.1.3. Financial Information

17.3.1.4. (Subject to Data Availability)

17.3.1.5. Distribution channel overview

17.3.1.6. Business Strategies / Recent Developments

17.3.2. Liquid Safety Solutions (Spilfyter)

17.3.2.1. Company Overview

17.3.2.2. Product Portfolio

17.3.2.3. Financial Information

17.3.2.4. (Subject to Data Availability)

17.3.2.5. Distribution channel overview

17.3.2.6. Business Strategies / Recent Developments

17.3.3. New Pig Corporation

17.3.3.1. Company Overview

17.3.3.2. Product Portfolio

17.3.3.3. Financial Information

17.3.3.4. (Subject to Data Availability)

17.3.3.5. Distribution channel overview

17.3.3.6. Business Strategies / Recent Developments

17.3.4. Little Rapids Corporation (Graham Medical)

17.3.4.1. Company Overview

17.3.4.2. Product Portfolio

17.3.4.3. Financial Information

17.3.4.4. (Subject to Data Availability)

17.3.4.5. Distribution channel overview

17.3.4.6. Business Strategies / Recent Developments

17.3.5. Safetec of America, Inc.

17.3.5.1. Company Overview

17.3.5.2. Product Portfolio

17.3.5.3. Financial Information

17.3.5.4. (Subject to Data Availability)

17.3.5.5. Distribution channel overview

17.3.5.6. Business Strategies / Recent Developments

17.3.6. McAllister Mills, Inc.

17.3.6.1. Company Overview

17.3.6.2. Product Portfolio

17.3.6.3. Financial Information

17.3.6.4. (Subject to Data Availability)

17.3.6.5. Distribution channel overview

17.3.6.6. Business Strategies / Recent Developments

17.3.7. COBA Europe Ltd

17.3.7.1. Company Overview

17.3.7.2. Product Portfolio

17.3.7.3. Financial Information

17.3.7.4. (Subject to Data Availability)

17.3.7.5. Distribution channel overview

17.3.7.6. Business Strategies / Recent Developments

17.3.8. Can-Ross Environmental Services Ltd

17.3.8.1. Company Overview

17.3.8.2. Product Portfolio

17.3.8.3. Financial Information

17.3.8.4. (Subject to Data Availability)

17.3.8.5. Distribution channel overview

17.3.8.6. Business Strategies / Recent Developments

17.3.9. Brady Corporation

17.3.9.1. Company Overview

17.3.9.2. Product Portfolio

17.3.9.3. Financial Information

17.3.9.4. (Subject to Data Availability)

17.3.9.5. Distribution channel overview

17.3.9.6. Business Strategies / Recent Developments

17.3.10. PONZI Srl

17.3.10.1. Company Overview

17.3.10.2. Product Portfolio

17.3.10.3. Financial Information

17.3.10.4. (Subject to Data Availability)

17.3.10.5. Distribution channel overview

17.3.10.6. Business Strategies / Recent Developments

17.3.11. Other Key Players

17.3.11.1. Company Overview

17.3.11.2. Product Portfolio

17.3.11.3. Financial Information

17.3.11.4. (Subject to Data Availability)

17.3.11.5. Distribution channel overview

17.3.11.6. Business Strategies / Recent Developments

18. Go To Market Strategy

18.1. Identification of Potential Market Spaces

18.1.1. By Material

18.1.2. By Category

18.1.3. By End-user

18.1.4. By Distribution Channel

18.1.5. By Region

18.2. Understanding the Procurement Process of the End Users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Table 2: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Table 3: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Table 4: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Table 5: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Table 6: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Table 7: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Table 8: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Table 9: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Region

Table 10: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Region

Table 11: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Table 12: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Table 13: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Table 14: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Table 15: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Table 16: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Table 17: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Table 18: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Table 19: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Table 20: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Table 21: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Table 22: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Table 23: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Table 24: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Table 25: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Table 26: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Table 27: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Table 28: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Table 29: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Table 30: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Table 31: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Table 32: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Table 33: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Table 34: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Table 35: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Table 36: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Table 37: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Table 38: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Table 39: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Table 40: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Table 41: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Table 42: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Table 43: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Table 44: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Table 45: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Table 46: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Table 47: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Table 48: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Table 49: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Table 50: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Table 51: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Table 52: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Table 53: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Table 54: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Table 55: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Table 56: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Table 57: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Table 58: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Table 59: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Table 60: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

List of Figures

Figure 1: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Figure 2: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Figure 3: Global Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031 By Material

Figure 4: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Figure 5: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Figure 6: Global Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Category

Figure 7: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Figure 8: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Figure 9: Global Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2033, By End-user

Figure 10: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Figure 11: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Figure 12: Global Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Distribution Channel

Figure 13: Global Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Region

Figure 14: Global Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Region

Figure 15: Global Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2035By Region

Figure 16: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Figure 17: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Figure 18: North America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031 By Material

Figure 19: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Figure 20: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Figure 21: North America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031 By Category

Figure 22: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Figure 23: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Figure 24: North America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031 By End-user

Figure 25: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Figure 26: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Figure 27: North America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031 By Distribution Channel

Figure 28: North America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Figure 29: North America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Figure 30: North America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031 By Country

Figure 31: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Figure 32: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Figure 33: Europe Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Material

Figure 34: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Figure 35: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Figure 36: Europe Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Category

Figure 37: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Figure 38: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Figure 39: Europe Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By End-user

Figure 40: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Figure 41: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Figure 42: Europe Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Distribution Channel

Figure 43: Europe Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Figure 44: Europe Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Figure 45: Europe Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Country

Figure 46: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Figure 47: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Figure 48: Asia Pacific Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Material

Figure 49: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Figure 50: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Figure 51: Asia Pacific Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Category

Figure 52: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Figure 53: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Figure 54: Asia Pacific Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By End-user

Figure 55: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Figure 56: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Figure 57: Asia Pacific Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Distribution Channel

Figure 58: Asia Pacific Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Figure 59: Asia Pacific Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Figure 60: Asia Pacific Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Country

Figure 61: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Figure 62: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Figure 63: Middle East & Africa Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Material

Figure 64: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Figure 65: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Figure 66: Middle East & Africa Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Category

Figure 67: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Figure 68: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Figure 69: Middle East & Africa Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By End-user

Figure 70: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Figure 71: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Figure 72: Middle East & Africa Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Distribution Channel

Figure 73: Middle East & Africa Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Figure 74: Middle East & Africa Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Figure 75: Middle East & Africa Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Country

Figure 76: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Material

Figure 77: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Material

Figure 78: South America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Material

Figure 79: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Category

Figure 80: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Category

Figure 81: South America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Category

Figure 82: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By End-user

Figure 83: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By End-user

Figure 84: South America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By End-user

Figure 85: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Distribution Channel

Figure 86: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Distribution Channel

Figure 87: South America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Distribution Channel

Figure 88: South America Absorbent Mats Market Value (US$ Mn) Projection, 2017-2031, By Country

Figure 89: South America Absorbent Mats Market Volume (Thousand Units) Projection, 2017-2031, By Country

Figure 90: South America Absorbent Mats Market Incremental Opportunities, (US$ Mn) Forecast, 2023-2031, By Country