Analyst Viewpoint

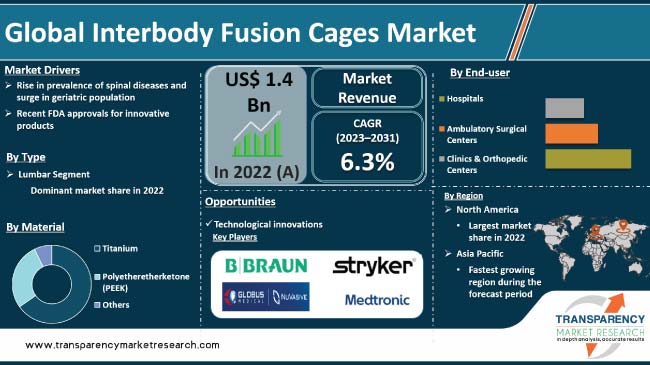

Rise in prevalence of spine-related diseases is driving the global interbody fusion cages market. These devices serve as stabilizers, distributing forces between vertebral bodies and restoring intervertebral and foramina space. Increase in geriatric population and rise in obesity cases across the globe are the other major factors propelling market expansion. Furthermore, recent FDA approvals for innovative products is expected to bolster the global interbody fusion cages industry size during the forecast period.

Introduction of technologically advanced interbody fusion cages offers lucrative opportunities to market players. Companies are investing significantly in 3D printing technology for implant production and development of interbody implants for spinal fusion in order to diversify revenue streams.

Interbody fusion cages are medical devices used in spinal surgery to facilitate the fusion of adjacent vertebrae, providing stability and promoting bone growth between the vertebral bodies. This surgical technique is commonly employed to treat various spinal conditions, including degenerative disc disease, spinal deformities, and instability.

Interbody fusion cages have revolutionized spinal fusion procedures, offering an alternative to traditional bone grafts. These cages are typically inserted into the intervertebral space, replacing the damaged or removed disc. The design of interbody fusion cages allows for proper spinal alignment and provides structural support, addressing issues such as disc height loss and spinal misalignment.

The primary goals of using interbody fusion cages are restoring disc height, decompressing nerve roots, and promoting spinal stability. Surgeons could choose from different types of cages, such as anterior, posterior, or lateral interbody cages, based on the specific requirements of the surgical procedure and the patient's condition. As advancements in spinal surgery continue, interbody fusion cages remain pivotal in enhancing patient outcomes and contributing to the evolution of minimally invasive spinal procedures.

Recent approvals by the U.S. FDA have the potential to significantly drive global interbody fusion cages market demand. The FDA plays a critical role in regulating medical devices, ensuring their safety and efficacy before they can be brought to market.

In May 2023, HAPPE Spine, a medical device firm focusing on developing innovative materials to orthopedic implants, announced that its INTEGRATE-C Interbody Fusion System received FDA 510k clearance.

NTEGRATE-C, powered by the innovative HAPPE platform, stands out as the pioneering interbody fusion cage that offers complete integration of porosity and hydroxyapatite, creating an optimal environment for superior healing.

In May 2023, CTL Amedica Corporation, world's exclusive provider of innovative spine products, received 510k clearance from the FDA) to market the NITRO Interbody Fusion Cage System Family, made entirely of the fusion biomaterial silicon nitride. The products showcase distinct biomaterial properties, incorporating innovative enhancements for the bacteriostatic and osteogenic response.

In May 2022, Accelus, a prominent player in expandable spinal implant technology, received 510(k) clearance from the FDA for its FlareHawk TiHawk 11 Interbody Fusion System. TiHawk11 boasts an insertion profile width of 11mm, expanding to 17mm in width and 14mm in height. This expansion results in a 70% larger footprint compared to a 10mm-wide interbody device of the same length. The enhanced interbody footprint is strategically designed to enhance stability and facilitate post-packing of bone grafts after expansion, thereby increasing graft volume.

Rapid rise in the geriatric population is increasing the incidence of degenerative spine conditions, which, in turn, is fueling demand for advanced spinal solutions.

Spinal diseases, including degenerative disc diseases and spinal deformities, are becoming more prevalent, necessitating effective interventions such as interbody fusion surgeries. The geriatric demographic, in particular, is more susceptible to these conditions due to age-related degeneration, leading to an upsurge in surgical procedures involving interbody fusion cages.

The geriatric population often seeks medical interventions to maintain or improve their quality of life, driving the adoption of advanced technologies such as interbody fusion cages. These devices play a crucial role in enhancing spinal stability, reducing pain, and improving overall patient outcomes.

The interbody fusion cages industry is poised to expand as healthcare providers increasingly incorporate these innovative solutions into their treatment protocols to address the growing challenges posed by spinal diseases in an aging global population. This trend underscores the importance of technological advancements in spinal healthcare to meet the evolving needs of patients and healthcare professionals alike.

In terms of type, the lumbar segment accounted for the largest global interbody fusion cages market share in 2022. Lumbar spine disorders, including, herniated discs, DDD, and spinal stenosis, are frequent conditions affecting large number of individuals globally.

Lumbar interbody fusion cages are specifically designed to address these conditions, making them the preferred choice for surgeons and patients. These disorders cause significant pain, discomfort, and loss of function for individuals, leading to a high demand for effective treatment options.

Interbody fusion cages specifically designed for the lumbar spine are widely used in surgical interventions to address these conditions, contributing to the segment’s dominance.

According to the latest Interbody Fusion Cages market trends, the polyetheretherketone (PEEK) material segment is projected to dominate the industry from 2023 to 2031. PEEK is a biocompatible material widely used in medical implants. It has excellent mechanical properties, including high strength and stiffness, which make it suitable for interbody fusion cages.

PEEK cages provide stability to the spinal column, promoting fusion between vertebral bodies. The material's biocompatibility and stability have led to its increased adoption and dominance in the global interbody fusion cages market.

PEEK is radiolucent, meaning it does not interfere with imaging techniques such as X-rays and magnetic resonance imaging (MRI). This property allows for clear visualization of the fusion site during postoperative monitoring and follow-up evaluations.

Surgeons and healthcare professionals can assess fusion progress and make informed decisions based on accurate imaging, driving the preference for PEEK interbody fusion cages.

PEEK is a versatile material that can be easily machined and customized to match patient anatomy and surgical requirements. Surgeons can select from various sizes and shapes of PEEK interbody fusion cages, allowing for personalized treatment approaches.

The ability to tailor PEEK cages to individual patients' needs enhances surgical outcomes and patient satisfaction, further driving the dominance of the segment. Also, PEEK has a similar modulus of elasticity to bone, which helps reduce stress shielding. Stress shielding occurs when the implant absorbs most of the mechanical stress, leading to bone resorption and decreased bone density.

North America dominated the global interbody fusion cages market in 2023. This can be ascribed to expansion in the microelectronic medical implants market, rise in prevalence of spinal diseases & obesity, and increase in number of spinal implant procedures in the region. For instance, as per information published by American Academy of Orthopaedic Surgeons, 4% to 6% of the U.S. citizens have spondylolisthesis and spondylolysis.

Successful launch of innovative products is also driving the interbody fusion cages market in North America. For instance, in August, 2020, Zavation Medical Products, the U.S based manufacturer of advanced spinal implants announced the launch of the Titanium/PEEK Posterior Lateral Expandable Interbody Fusion (LEIF) cage. The cage is manufactured to offer structural stability with a design suitable for either a posterior or transforaminal approach to the lumbar spine. It comes in diverse heights and geometric configurations, ensuring it aligns with the anatomical requirements of a broad spectrum of patients.

According to interbody fusion cages market forecast, the industry in Asia Pacific is expected to grow at a rapid pace during the forecast period. This is ascribed to large patient population in countries such as India and China, improvement in healthcare facilities, and rise in awareness about spinal diseases and treatments. Additionally, surge in geriatric population is fueling demand for interbody fusion cages in Asia Pacific.

The global interbody fusion cages market is consolidated, with small number of key players accounting for majority share. Companies are investing significantly in R&D to expand product portfolio. Collaborations, partnerships, and mergers & acquisitions are key strategies adopted by interbody fusion cages manufacturers.

Medtronic plc, Johnson & Johnson, Stryker Corporation, Zimmer Biomet, B. Braun Melsungen AG, NuVasive, Inc., Alphatec Holdings, Inc., LASAK s.r.o., Xtant Medical Holdings, Inc., and Spineology, Inc. are the prominent players in the market.

Key companies have been profiled in the interbody fusion cages market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.4 Bn |

| Forecast (Value) in 2031 | US$ 2.5 Bn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.4 Bn in 2022

It is projected to reach US$ 2.5 Bn by 2031

It is anticipated to grow at a CAGR of 6.3% from 2023 to 2031

Rise in prevalence of spinal diseases & surge in geriatric population and recent FDA approvals for innovative products

The lumbar type segment accounted for largest share in 2022

North America accounted for major share during the forecast period

Medtronic plc, Johnson & Johnson, Stryker Corporation, Zimmer Biomet, B. Braun Melsungen AG, NuVasive, Inc., Alphatec Holdings, Inc., LASAK s.r.o., Xtant Medical Holdings, Inc., and Spineology, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Interbody Fusion Cages Market

4. Market Overview

4.1. Introduction

4.1.1. Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Interbody Fusion Cages Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Regulatory Scenario by Region/Globally

5.2. Key Industry Events (Key Mergers & Acquisitions )

5.3. Disease Epidemiology

5.4. COVID-19 Impact Analysis

6. Global Interbody Fusion Cages Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017–2031

6.3.1. Cervical

6.3.2. Lumbar

6.3.3. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Interbody Fusion Cages Market Analysis and Forecast, by Material

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Material, 2017–2031

7.3.1. Titanium

7.3.2. Polyetheretherketone (PEEK)

7.3.3. Others

7.4. Market Attractiveness Analysis, by Material

8. Global Interbody Fusion Cages Market Analysis and Forecast, by Product

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Product, 2017–2031

8.3.1. Expandable Cages

8.3.2. Static Cages

8.4. Market Attractiveness Analysis, by Product

9. Global Interbody Fusion Cages Market Analysis and Forecast, by Indication

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Indication, 2017–2031

9.3.1. Degenerative Disc Disease

9.3.2. Spondylolisthesis

9.3.3. Spinal Tumors or Masse

9.3.4. Spinal Stenosis

9.3.5. Others

9.4. Market Attractiveness Analysis, by Indication

10. Global Interbody Fusion Cages Market Analysis and Forecast, by End-user

10.1. Introduction & Definition

10.2. Key Findings/Developments

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Ambulatory Surgical Centers

10.3.3. Clinics & Orthopedic Centers

10.4. Market Attractiveness Analysis, by End-user

11. Global Interbody Fusion Cages Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region, 2017–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness Analysis, by Region

12. North America Interbody Fusion Cages Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017–2031

12.2.1. Cervical

12.2.2. Lumbar

12.2.3. Others

12.3. Market Value Forecast, by Material , 2017–2031

12.3.1. Titanium

12.3.2. Polyetheretherketone (PEEK)

12.3.3. Others

12.4. Market Value Forecast, by Product, 2017–2031

12.4.1. Expandable Cages

12.4.2. Static Cages

12.5. Market Value Forecast, by Indication, 2017–2031

12.5.1. Degenerative Disc Disease

12.5.2. Spondylolisthesis

12.5.3. Spinal Tumors or Masse

12.5.4. Spinal Stenosis

12.5.5. Others

12.6. Market Value Forecast, by End-user, 2017–2031

12.6.1. Hospitals

12.6.2. Ambulatory Surgical Centers

12.6.3. Clinics & Orthopedic Centers

12.7. Market Value Forecast, by Country, 2017–2031

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Type

12.8.2. By Material

12.8.3. By Product

12.8.4. By Indication

12.8.5. By End-user

12.8.6. By Country

13. Europe Interbody Fusion Cages Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017–2031

13.2.1. Cervical

13.2.2. Lumbar

13.2.3. Others

13.3. Market Value Forecast, by Material , 2017–2031

13.3.1. Titanium

13.3.2. Polyetheretherketone (PEEK)

13.3.3. Others

13.4. Market Value Forecast, by Product, 2017–2031

13.4.1. Expandable Cages

13.4.2. Static Cages

13.5. Market Value Forecast, by Indication, 2017–2031

13.5.1. Degenerative Disc Disease

13.5.2. Spondylolisthesis

13.5.3. Spinal Tumors or Masse

13.5.4. Spinal Stenosis

13.5.5. Others

13.6. Market Value Forecast, by End-user, 2017–2031

13.6.1. Hospitals

13.6.2. Ambulatory Surgical Centers

13.6.3. Clinics & Orthopedic Centers

13.7. Market Value Forecast, by Country/Sub-region, 2017–2031

13.7.1. Germany

13.7.2. U.K.

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Type

13.8.2. By Material

13.8.3. By Product

13.8.4. By Indication

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Interbody Fusion Cages Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017–2031

14.2.1. Cervical

14.2.2. Lumbar

14.2.3. Others

14.3. Market Value Forecast, by Material , 2017–2031

14.3.1. Titanium

14.3.2. Polyetheretherketone (PEEK)

14.3.3. Others

14.4. Market Value Forecast, by Product, 2017–2031

14.4.1. Expandable Cages

14.4.2. Static Cages

14.5. Market Value Forecast, by Indication, 2017–2031

14.5.1. Degenerative Disc Disease

14.5.2. Spondylolisthesis

14.5.3. Spinal Tumors or Masse

14.5.4. Spinal Stenosis

14.5.5. Others

14.6. Market Value Forecast, by End-user, 2017–2031

14.6.1. Hospitals

14.6.2. Ambulatory Surgical Centers

14.6.3. Clinics & Orthopedic Centers

14.7. Market Value Forecast, by Country/Sub-region, 2017–2031

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Type

14.8.2. By Material

14.8.3. By Product

14.8.4. By Indication

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Interbody Fusion Cages Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Type, 2017–2031

15.2.1. Cervical

15.2.2. Lumbar

15.2.3. Others

15.3. Market Value Forecast, by Material , 2017–2031

15.3.1. Titanium

15.3.2. Polyetheretherketone (PEEK)

15.3.3. Others

15.4. Market Value Forecast, by Product, 2017–2031

15.4.1. Expandable Cages

15.4.2. Static Cages

15.5. Market Value Forecast, by Indication, 2017–2031

15.5.1. Degenerative Disc Disease

15.5.2. Spondylolisthesis

15.5.3. Spinal Tumors or Masse

15.5.4. Spinal Stenosis

15.5.5. Others

15.6. Market Value Forecast, by End-user, 2017–2031

15.6.1. Hospitals

15.6.2. Ambulatory Surgical Centers

15.6.3. Clinics & Orthopedic Centers

15.7. Market Value Forecast, by Country/Sub-region, 2017–2031

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Type

15.8.2. By Material

15.8.3. By Product

15.8.4. By Indication

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Interbody Fusion Cages Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Type, 2017–2031

16.2.1. Cervical

16.2.2. Lumbar

16.2.3. Others

16.3. Market Value Forecast, by Material , 2017–2031

16.3.1. Titanium

16.3.2. Polyetheretherketone (PEEK)

16.3.3. Others

16.4. Market Value Forecast, by Product, 2017–2031

16.4.1. Expandable Cages

16.4.2. Static Cages

16.5. Market Value Forecast, by Indication, 2017–2031

16.5.1. Degenerative Disc Disease

16.5.2. Spondylolisthesis

16.5.3. Spinal Tumors or Masse

16.5.4. Spinal Stenosis

16.5.5. Others

16.6. Market Value Forecast, by End-user, 2017–2031

16.6.1. Hospitals

16.6.2. Ambulatory Surgical Centers

16.6.3. Clinics & Orthopedic Centers

16.7. Market Value Forecast, by Country/Sub-region, 2017–2031

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Type

16.8.2. By Material

16.8.3. By Product

16.8.4. By Indication

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (by tier and size of companies)

17.2. Market Share Analysis, by Company (2022)

17.3. Company Profiles

17.3.1. Medtronic plc

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Product Portfolio

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. Johnson & Johnson

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Product Portfolio

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. Stryker Corporation

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Product Portfolio

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Zimmer Biomet

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Product Portfolio

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. B. Braun Melsungen AG

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Product Portfolio

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. NuVasive, Inc.

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Product Portfolio

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Alphatec Holdings, Inc.

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Product Portfolio

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. LASAK s.r.o.

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Product Portfolio

17.3.8.3. Financial Overview

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. Xtant Medical Holdings, Inc.

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Product Portfolio

17.3.9.3. Financial Overview

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

17.3.10. Spineology, Inc.

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Product Portfolio

17.3.10.3. Financial Overview

17.3.10.4. SWOT Analysis

17.3.10.5. Strategic Overview

List of Tables

Table 01: Global Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 02: Global Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 03: Global Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 04: Global Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 05: Global Interbody Fusion Cages Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 08: North America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 09: North America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 10: North America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 11: North America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Europe Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 14: Europe Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 15: Europe Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 16: Europe Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 17: Europe Interbody Fusion Cages Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Asia Pacific Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 19: Asia Pacific Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 20: Asia Pacific Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 21: Asia Pacific Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 22: Asia Pacific Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 23: Asia Pacific Interbody Fusion Cages Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Latin America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 25: Latin America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 26: Latin America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 27: Latin America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 28: Latin America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 29: Latin America Interbody Fusion Cages Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 30: Middle East & Africa Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 31: Middle East & Africa Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 32: Middle East & Africa Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 33: Middle East & Africa Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 34: Middle East & Africa Interbody Fusion Cages Market Value (US$ Mn) Forecast, by Indication, 2017–2031

Table 35: Middle East & Africa Interbody Fusion Cages Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Interbody Fusion Cages Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Interbody Fusion Cages Market Value Share, by Type, 2022

Figure 03: Global Interbody Fusion Cages Market Value Share, by Material, 2022

Figure 04: Global Interbody Fusion Cages Market Value Share, by Product, 2022

Figure 05: Global Interbody Fusion Cages Market Value Share, by Indication, 2022

Figure 06: Global Interbody Fusion Cages Market Value Share, by End-user, 2022

Figure 07: Global Interbody Fusion Cages Market Value Share Analysis, by Type 2022 and 2031

Figure 08: Global Interbody Fusion Cages Market Attractiveness Analysis, Type, 2023–2031

Figure 09: Global Interbody Fusion Cages Market Value Share Analysis, by Material 2022 and 2031

Figure 10: Global Interbody Fusion Cages Market Attractiveness Analysis, Material, 2023–2031

Figure 11: Global Interbody Fusion Cages Market Value Share Analysis, by Product 2022 and 2031

Figure 12: Global Interbody Fusion Cages Market Attractiveness Analysis, Product, 2023–2031

Figure 13: Global Interbody Fusion Cages Market Value Share Analysis, by Indication 2022 and 2031

Figure 14: Global Interbody Fusion Cages Market Attractiveness Analysis, Indication, 2023–2031

Figure 15: Global Interbody Fusion Cages Market Value Share Analysis, by End-user 2022 and 2031

Figure 16: Global Interbody Fusion Cages Market Attractiveness Analysis, End-user, 2023–2031

Figure 17: Global Interbody Fusion Cages Market Value Share Analysis, by Country, 2022 and 2031

Figure 18: Global Interbody Fusion Cages Market Attractiveness Analysis, by Country, 2023–2031

Figure 19: North America Interbody Fusion Cages Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 20: North America Interbody Fusion Cages Market Value Share Analysis, by Type 2022 and 2031

Figure 21: North America Interbody Fusion Cages Market Attractiveness Analysis, Type, 2023–2031

Figure 22: North America Interbody Fusion Cages Market Value Share Analysis, by Material 2022 and 2031

Figure 23: North America Interbody Fusion Cages Market Attractiveness Analysis, Material, 2023–2031

Figure 24: North America Interbody Fusion Cages Market Value Share Analysis, by Product 2022 and 2031

Figure 25: North America Interbody Fusion Cages Market Attractiveness Analysis, Product, 2023–2031

Figure 26: North America Interbody Fusion Cages Market Value Share Analysis, by Indication 2022 and 2031

Figure 27: North America Interbody Fusion Cages Market Attractiveness Analysis, End-user, 2023–2031

Figure 28: North America Interbody Fusion Cages Market Value Share Analysis, by End-user 2022 and 2031

Figure 29: Europe Interbody Fusion Cages Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 30: Europe Interbody Fusion Cages Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 31: Europe Interbody Fusion Cages Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 32: Europe Interbody Fusion Cages Market Value Share Analysis, by Type 2022 and 2031

Figure 33: Europe Interbody Fusion Cages Market Attractiveness Analysis, Type, 2023–2031

Figure 34: Europe Interbody Fusion Cages Market Value Share Analysis, by Material, 2022 and 2031

Figure 35: Europe Interbody Fusion Cages Market Attractiveness Analysis, Material, 2023–2031

Figure 36: Europe Interbody Fusion Cages Market Value Share Analysis, by Product 2022 and 2031

Figure 37: Europe Interbody Fusion Cages Market Attractiveness Analysis, Product, 2023–2031

Figure 38: Europe Interbody Fusion Cages Market Value Share Analysis, by Indication, 2022 and 2031

Figure 39: Europe Interbody Fusion Cages Market Attractiveness Analysis, Indication, 2023–2031

Figure 40: Europe Interbody Fusion Cages Market Value Share Analysis, by End-user, 2022 and 2031

Figure 41: Europe Interbody Fusion Cages Market Attractiveness Analysis, End-user, 2023–2031

Figure 42: Asia Pacific Interbody Fusion Cages Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 43: Asia Pacific Interbody Fusion Cages Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 44: Asia Pacific Interbody Fusion Cages Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 45: Asia Pacific Interbody Fusion Cages Market Value Share Analysis, by Type 2022 and 2031

Figure 46: Asia Pacific Interbody Fusion Cages Market Attractiveness Analysis, Type, 2023–2031

Figure 47: Asia Pacific Interbody Fusion Cages Market Value Share Analysis, by Material, 2022 and 2031

Figure 48: Asia Pacific Interbody Fusion Cages Market Attractiveness Analysis, Material, 2023–2031

Figure 49: Asia Pacific Interbody Fusion Cages Market Value Share Analysis, by Product 2022 and 2031

Figure 50: Asia Pacific Interbody Fusion Cages Market Attractiveness Analysis, Product, 2023–2031

Figure 51: Asia Pacific Interbody Fusion Cages Market Value Share Analysis, by Indication, 2022 and 2031

Figure 52: Asia Pacific Interbody Fusion Cages Market Attractiveness Analysis, Indication, 2023–2031

Figure 53: Asia Pacific Interbody Fusion Cages Market Value Share Analysis, by End-user, 2022 and 2031

Figure 54: Asia Pacific Interbody Fusion Cages Market Attractiveness Analysis, End-user, 2023–2031

Figure 55: Latin America Interbody Fusion Cages Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 56: Latin America Interbody Fusion Cages Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Latin America Interbody Fusion Cages Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 58: Latin America Interbody Fusion Cages Market Value Share Analysis, by Type 2022 and 2031

Figure 59: Latin America Interbody Fusion Cages Market Attractiveness Analysis, Type, 2023–2031

Figure 60: Latin America Interbody Fusion Cages Market Value Share Analysis, by Material, 2022 and 2031

Figure 61: Latin America Interbody Fusion Cages Market Attractiveness Analysis, Material, 2023–2031

Figure 62: Latin America Interbody Fusion Cages Market Value Share Analysis, by Product 2022 and 2031

Figure 63: Latin America Interbody Fusion Cages Market Attractiveness Analysis, Product, 2023–2031

Figure 64: Latin America Interbody Fusion Cages Market Value Share Analysis, by Indication, 2022 and 2031

Figure 65: Latin America Interbody Fusion Cages Market Attractiveness Analysis, Indication, 2023–2031

Figure 66: Latin America Interbody Fusion Cages Market Value Share Analysis, by End-user, 2022 and 2031

Figure 67: Latin America Interbody Fusion Cages Market Attractiveness Analysis, End-user, 2023–2031

Figure 68: Middle East & Africa Interbody Fusion Cages Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 69: Middle East & Africa Interbody Fusion Cages Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 70: Middle East & Africa Interbody Fusion Cages Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 71: Middle East & Africa Interbody Fusion Cages Market Value Share Analysis, by Type 2022 and 2031

Figure 72: Middle East & Africa Interbody Fusion Cages Market Attractiveness Analysis, Type, 2023–2031

Figure 73: Middle East & Africa Interbody Fusion Cages Market Value Share Analysis, by Material, 2022 and 2031

Figure 74: Middle East & Africa Interbody Fusion Cages Market Attractiveness Analysis, Material, 2023–2031

Figure 75: Middle East & Africa Interbody Fusion Cages Market Value Share Analysis, by Product 2022 and 2031

Figure 76: Middle East & Africa Interbody Fusion Cages Market Attractiveness Analysis, Product, 2023–2031

Figure 77: Middle East & Africa Interbody Fusion Cages Market Value Share Analysis, by Indication, 2022 and 2031

Figure 78: Middle East & Africa Interbody Fusion Cages Market Attractiveness Analysis, Indication, 2023–2031

Figure 79: Middle East & Africa Interbody Fusion Cages Market Value Share Analysis, by End-user, 2022 and 2031

Figure 80: Middle East & Africa Interbody Fusion Cages Market Attractiveness Analysis, End-user, 2023–2031

Figure 81: Global Interbody Fusion Cages Market Share Analysis, by Company, 2022