Analyst Viewpoint

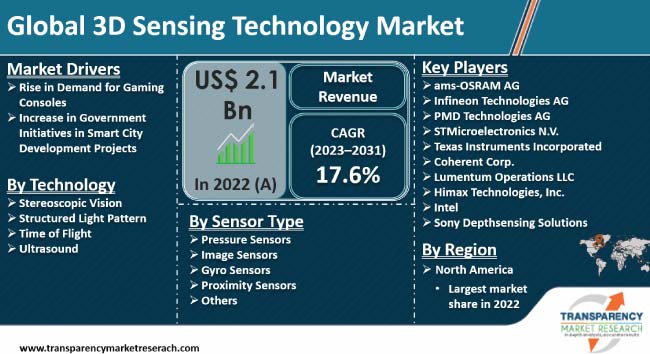

Surge in demand for gaming consoles and increase in government initiatives in smart city development projects are fueling the 3D sensing technology market size. 3D sensing technology is used in various industries including, automotive, industrial, consumer electronics, and security & surveillance. Advanced features and system compatibility make it an ideal technology to improve the performance of industrial applications. Rise in demand for consumer electronics is fostering market development.

Manufacturers in the market are launching new sensors to enhance their business portfolio. Developments in medical imaging technology and navigation systems offer lucrative 3D sensing technology market opportunities. Key players in the market are investing in technological advancements to introduce state-of-the-art sensors to meet consumer demands from different verticals.

3D sensing technology refers to the capability of detecting and interpreting spatial information in three dimensions. It typically involves technologies, such as structured light, time-of-flight, or stereoscopic vision to capture depth and create a detailed three-dimensional representation of objects. These technologies are extensively used in applications, such as facial recognition, augmented reality, and gesture control.

Three-dimensional scanning is extensively employed in the automotive sector for several applications including, product design and development, quality control, crash analysis and safety testing, customization and personalization, and maintenance and repair. Depth perception sensors are installed in automobiles as these sensors measure the distance between sensors and objects in their field of view, providing depth information. Depth sensing cameras, Lidar sensors, structured light sensors, Time-of-Flight (ToF) sensors, and eye tracking systems are used in 3D sensing technology for immersive virtual reality experiences.

3D sensing technology in gaming consoles employs depth-sensing cameras, such as ToF sensors or structured light systems, enabling enhanced experiences. These sensors enable gesture control, facial recognition, and accurate motion tracking, thereby driving the demand for 3D sensing technology for facial recognition in smartphones. 3D imaging technology facilitates enhanced user experience by incorporating augmented reality and virtual reality. Thus, growth in popularity of gaming consoles among teenagers and young adults is contributing to the 3D sensing technology market value.

Increase in adoption of robotics in healthcare sector is fostering market expansion. Multi-dimensional sensing technology allows surgeons to conduct minimally invasive surgeries through precise diagnosis and drug delivery techniques. 3D sensing technology is incorporated into various medical applications, such as medical imaging, surgical planning, and patient monitoring. Robotic surgeries improve diagnosis accuracy, drug delivery, and ensure quick recovery, thereby being widely used in medical imaging and diagnostics with 3D sensing technology.

Dimensional inspection, surface defect detection, assembly verification, tooling inspection, and non-destructive testing are some of the major industrial uses of 3D sensing technology for quality control. 3D sensing technology plays a vital role in smart city development by providing comprehensive data for urban planning and management. This technology allows infrastructure planning, environmental monitoring, smart lighting, waste management, public safety, and augmented reality navigation. Smart city development projects are proposed in emerging countries due to rapid industrialization and urbanization. Thus, growth in government initiatives and approvals for smart city development projects is boosting the 3D sensing technology market revenue.

Surge in demand for self-driven cars and developments in advanced navigation systems are augmenting the 3D sensing technology market statistics. Lidar and Radar systems are incorporated into navigation systems to provide real-time updates regarding road traffic and weather conditions. Increase in production of vehicles in driving the demand for 3D sensing technology. According to the China Association of Automobile Manufacturers, in April 2022, around 210,000 commercial motorcars and 996,000 passenger vehicles were produced in China.

As per the 3D sensing technology market analysis, North America dominated the global market in 2022. Rise in demand for consumer electronics and technological advancements in automobile sector are likely to propel the 3D sensing technology industry share during the forecast period. 3D sensing technology is employed in smartphones to improve navigation systems, user interface, facial recognition, and biometric security. Hence, increase in demand for smartphones is fueling market progress. For instance, around 310 million people in the U.S. use smartphones.

Technological advancements in automobile sector are contributing to the growth of the 3D sensing technology market. Automobile manufacturers in the region are employing 3D sensors in vehicles to enhance the driving experience and add cutting-edge features to the vehicles.

According to the latest 3D sensing technology market trends, adoption of virtual reality, augmented reality, Internet of Things (IoT), and robotics in automotive, healthcare, and industrial sectors allows manufacturers to introduce innovative sensors. Leading players in the industry are signing partnerships to improve their brand presence by promoting their product range to the global markets. Moreover, they are launching new services to enhance device compatibility and meet consumer demands.

Some of the leading players in the market are ams-OSRAM AG, Infineon Technologies AG, PMD Technologies AG, STMicroelectronics N.V., Texas Instruments Incorporated, Coherent Corp., Lumentum Operations LLC, Himax Technologies, Inc., Intel, and Sony Depthsensing Solutions.

These companies have been profiled in the 3D sensing technology market report based on various parameters including company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 2.1 Bn |

| Market Forecast (Value) in 2031 | US$ 8.9 Bn |

| Growth Rate (CAGR) | 17.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.1 Bn in 2022

It is projected to register a CAGR of 17.6% from 2023 to 2031

Rise in demand for gaming consoles and increase in government initiatives in smart city development projects

North America was the most lucrative region in 2022

ams-OSRAM AG, Infineon Technologies AG, PMD Technologies AG, STMicroelectronics N.V., Texas Instruments Incorporated, Coherent Corp., Lumentum Operations LLC, Himax Technologies, Inc., Intel, and Sony Depthsensing Solutions.

1. Preface

1.1. Market and Segment Definitions

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global 3D Sensing Technology Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Industry Automation Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global 3D Sensing Technology Market Analysis, by Technology

5.1. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

5.1.1. Stereoscopic Vision

5.1.2. Structured Light Pattern

5.1.3. Time of Flight

5.1.4. Ultrasound

5.2. Market Attractiveness Analysis, by Technology

6. Global 3D Sensing Technology Market Analysis, by Sensor Type

6.1. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Sensor Type, 2017–2031

6.1.1. Pressure Sensors

6.1.2. Image Sensors

6.1.3. Gyro Sensors

6.1.4. Proximity Sensors

6.1.5. Others

6.2. Market Attractiveness Analysis, by Sensor Type

7. Global 3D Sensing Technology Market Analysis, by End-user

7.1. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

7.1.1. Consumer Electronics

7.1.2. Media & Entertainment

7.1.3. Automotive

7.1.4. Security & Surveillance

7.1.5. Industrial

7.1.6. Others

7.2. Market Attractiveness Analysis, by End-user

8. Global 3D Sensing Technology Market Analysis and Forecast, by Region

8.1. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America 3D Sensing Technology Market Analysis and Forecast

9.1. Market Snapshot

9.2. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

9.2.1. Stereoscopic Vision

9.2.2. Structured Light Pattern

9.2.3. Time of Flight

9.2.4. Ultrasound

9.3. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Sensor Type, 2017–2031

9.3.1. Pressure Sensors

9.3.2. Image Sensors

9.3.3. Gyro Sensors

9.3.4. Proximity Sensors

9.3.5. Others

9.4. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

9.4.1. Consumer Electronics

9.4.2. Media & Entertainment

9.4.3. Automotive

9.4.4. Security & Surveillance

9.4.5. Industrial

9.4.6. Others

9.5. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Country, 2017–2031

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. Market Attractiveness Analysis

9.6.1. By Technology

9.6.2. By Sensor Type

9.6.3. By End-user

9.6.4. By Country

10. Europe 3D Sensing Technology Market Analysis and Forecast

10.1. Market Snapshot

10.2. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

10.2.1. Stereoscopic Vision

10.2.2. Structured Light Pattern

10.2.3. Time of Flight

10.2.4. Ultrasound

10.3. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Sensor Type, 2017–2031

10.3.1. Pressure Sensors

10.3.2. Image Sensors

10.3.3. Gyro Sensors

10.3.4. Proximity Sensors

10.3.5. Others

10.4. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

10.4.1. Consumer Electronics

10.4.2. Media & Entertainment

10.4.3. Automotive

10.4.4. Security & Surveillance

10.4.5. Industrial

10.4.6. Others

10.5. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.5.1. U.K.

10.5.2. Germany

10.5.3. France

10.5.4. Rest of Europe

10.6. Market Attractiveness Analysis

10.6.1. By Technology

10.6.2. By Sensor Type

10.6.3. By End-user

10.6.4. By Country/Sub-region

11. Asia Pacific 3D Sensing Technology Market Analysis and Forecast

11.1. Market Snapshot

11.2. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

11.2.1. Stereoscopic Vision

11.2.2. Structured Light Pattern

11.2.3. Time of Flight

11.2.4. Ultrasound

11.3. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Sensor Type, 2017–2031

11.3.1. Pressure Sensors

11.3.2. Image Sensors

11.3.3. Gyro Sensors

11.3.4. Proximity Sensors

11.3.5. Others

11.4. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

11.4.1. Consumer Electronics

11.4.2. Media & Entertainment

11.4.3. Automotive

11.4.4. Security & Surveillance

11.4.5. Industrial

11.4.6. Others

11.5. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.5.1. China

11.5.2. Japan

11.5.3. India

11.5.4. South Korea

11.5.5. ASEAN

11.5.6. Rest of Asia Pacific

11.6. Market Attractiveness Analysis

11.6.1. By Technology

11.6.2. By Sensor Type

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Middle East & Africa 3D Sensing Technology Market Analysis and Forecast

12.1. Market Snapshot

12.2. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

12.2.1. Stereoscopic Vision

12.2.2. Structured Light Pattern

12.2.3. Time of Flight

12.2.4. Ultrasound

12.3. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Sensor Type, 2017–2031

12.3.1. Pressure Sensors

12.3.2. Image Sensors

12.3.3. Gyro Sensors

12.3.4. Proximity Sensors

12.3.5. Others

12.4. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

12.4.1. Consumer Electronics

12.4.2. Media & Entertainment

12.4.3. Automotive

12.4.4. Security & Surveillance

12.4.5. Industrial

12.4.6. Others

12.5. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Technology

12.6.2. By Sensor Type

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. South America 3D Sensing Technology Market Analysis and Forecast

13.1. Market Snapshot

13.2. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Technology, 2017–2031

13.2.1. Stereoscopic Vision

13.2.2. Structured Light Pattern

13.2.3. Time of Flight

13.2.4. Ultrasound

13.3. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Sensor Type, 2017–2031

13.3.1. Pressure Sensors

13.3.2. Image Sensors

13.3.3. Gyro Sensors

13.3.4. Proximity Sensors

13.3.5. Others

13.4. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by End-user, 2017–2031

13.4.1. Consumer Electronics

13.4.2. Media & Entertainment

13.4.3. Automotive

13.4.4. Security & Surveillance

13.4.5. Industrial

13.4.6. Others

13.5. 3D Sensing Technology Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Rest of South America

13.6. Market Attractiveness Analysis

13.6.1. By Technology

13.6.2. By Sensor Type

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Competition Assessment

14.1. Global 3D Sensing Technology Market Competition Matrix - a Dashboard View

14.1.1. Global 3D Sensing Technology Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ams-OSRAM AG

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Infineon Technologies AG

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. PMD Technologies AG

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. STMicroelectronics N.V.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Texas Instruments Incorporated

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Coherent Corp.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Lumentum Operations LLC

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Himax Technologies, Inc.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Intel

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Sony Depthsensing Solutions

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Go to Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 2: Global 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Sensor Type, 2017‒2031

Table 3: Global 3D Sensing Technology Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 4: Global 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 5: North America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 6: North America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Sensor Type, 2017‒2031

Table 7: North America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 8: North America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Country, 2017‒2031

Table 9: Europe 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 10: Europe 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Sensor Type, 2017‒2031

Table 11: Europe 3D Sensing Technology Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 12: Europe 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Asia Pacific 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 14: Asia Pacific 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Sensor Type, 2017‒2031

Table 15: Asia Pacific 3D Sensing Technology Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 16: Asia Pacific 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 17: Middle East & Africa 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 18: Middle East & Africa 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Sensor Type, 2017‒2031

Table 19: Middle East & Africa 3D Sensing Technology Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 20: Middle East & Africa 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: South America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 22: South America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Sensor Type, 2017‒2031

Table 23: South America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by End-user, 2017‒2031

Table 24: South America 3D Sensing Technology Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global 3D Sensing Technology Market

Figure 02: Porter Five Forces Analysis – Global 3D Sensing Technology Market

Figure 03: Technology Road Map - Global 3D Sensing Technology Market

Figure 04: Global 3D Sensing Technology Market, Value (US$ Mn), 2017-2031

Figure 05: Global 3D Sensing Technology Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global 3D Sensing Technology Market Projections, by Technology, Value (US$ Mn), 2017‒2031

Figure 07: Global 3D Sensing Technology Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 08: Global 3D Sensing Technology Market Share Analysis, by Technology, 2022 and 2031

Figure 09: Global 3D Sensing Technology Market Projections, by Sensor Type, Value (US$ Mn), 2017‒2031

Figure 10: Global 3D Sensing Technology Market, Incremental Opportunity, by Sensor Type, 2023‒2031

Figure 11: Global 3D Sensing Technology Market Share Analysis, by Sensor Type, 2022 and 2031

Figure 12: Global 3D Sensing Technology Market Projections, by End-user, Value (US$ Mn), 2017‒2031

Figure 13: Global 3D Sensing Technology Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 14: Global 3D Sensing Technology Market Share Analysis, by End-user, 2022 and 2031

Figure 15: Global 3D Sensing Technology Market Projections, by Region, Value (US$ Mn), 2017‒2031

Figure 16: Global 3D Sensing Technology Market, Incremental Opportunity, by Region, 2023‒2031

Figure 17: Global 3D Sensing Technology Market Share Analysis, by Region, 2022 and 2031

Figure 18: North America 3D Sensing Technology Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 19: North America 3D Sensing Technology Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 20: North America 3D Sensing Technology Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 21: North America 3D Sensing Technology Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 22: North America 3D Sensing Technology Market Share Analysis, by Technology, 2022 and 2031

Figure 23: North America 3D Sensing Technology Market Projections, by Sensor Type (US$ Mn), 2017‒2031

Figure 24: North America 3D Sensing Technology Market, Incremental Opportunity, by Sensor Type, 2023‒2031

Figure 25: North America 3D Sensing Technology Market Share Analysis, by Sensor Type, 2022 and 2031

Figure 26: North America 3D Sensing Technology Market Projections, by End-user Value (US$ Mn), 2017‒2031

Figure 27: North America 3D Sensing Technology Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 28: North America 3D Sensing Technology Market Share Analysis, by End-user, 2022 and 2031

Figure 29: North America 3D Sensing Technology Market Projections, by Country, Value (US$ Mn), 2017‒2031

Figure 30: North America 3D Sensing Technology Market, Incremental Opportunity, by Country, 2023‒2031

Figure 31: North America 3D Sensing Technology Market Share Analysis, by Country, 2022 and 2031

Figure 32: Europe 3D Sensing Technology Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 33: Europe 3D Sensing Technology Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 34: Europe 3D Sensing Technology Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 35: Europe 3D Sensing Technology Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 36: Europe 3D Sensing Technology Market Share Analysis, by Technology, 2022 and 2031

Figure 37: Europe 3D Sensing Technology Market Projections, by Sensor Type, Value (US$ Mn), 2017‒2031

Figure 38: Europe 3D Sensing Technology Market, Incremental Opportunity, by Sensor Type, 2023‒2031

Figure 39: Europe 3D Sensing Technology Market Share Analysis, by Sensor Type, 2022 and 2031

Figure 40: Europe 3D Sensing Technology Market Projections, by End-user, Value (US$ Mn), 2017‒2031

Figure 41: Europe 3D Sensing Technology Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 42: Europe 3D Sensing Technology Market Share Analysis, by End-user, 2022 and 2031

Figure 43: Europe 3D Sensing Technology Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 44: Europe 3D Sensing Technology Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 45: Europe 3D Sensing Technology Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 46: Asia Pacific 3D Sensing Technology Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 47: Asia Pacific 3D Sensing Technology Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 48: Asia Pacific 3D Sensing Technology Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 49: Asia Pacific 3D Sensing Technology Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 50: Asia Pacific 3D Sensing Technology Market Share Analysis, by Technology, 2022 and 2031

Figure 51: Asia Pacific 3D Sensing Technology Market Projections, by Sensor Type, Value (US$ Mn), 2017‒2031

Figure 52: Asia Pacific 3D Sensing Technology Market, Incremental Opportunity, by Sensor Type, 2023‒2031

Figure 53: Asia Pacific 3D Sensing Technology Market Share Analysis, by Sensor Type, 2022 and 2031

Figure 54: Asia Pacific 3D Sensing Technology Market Projections, by End-user, Value (US$ Mn), 2017‒2031

Figure 55: Asia Pacific 3D Sensing Technology Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 56: Asia Pacific 3D Sensing Technology Market Share Analysis, by End-user, 2022 and 2031

Figure 57: Asia Pacific 3D Sensing Technology Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 58: Asia Pacific 3D Sensing Technology Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 59: Asia Pacific 3D Sensing Technology Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 60: Middle East & Africa 3D Sensing Technology Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa 3D Sensing Technology Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 62: Middle East & Africa 3D Sensing Technology Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 63: Middle East & Africa 3D Sensing Technology Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 64: Middle East & Africa 3D Sensing Technology Market Share Analysis, by Technology, 2022 and 2031

Figure 65: Middle East & Africa 3D Sensing Technology Market Projections, by Sensor Type, Value (US$ Mn), 2017‒2031

Figure 66: Middle East & Africa 3D Sensing Technology Market, Incremental Opportunity, by Sensor Type, 2023‒2031

Figure 67: Middle East & Africa 3D Sensing Technology Market Share Analysis, by Sensor Type, 2022 and 2031

Figure 68: Middle East & Africa 3D Sensing Technology Market Projections, by End-user Value (US$ Mn), 2017‒2031

Figure 69: Middle East & Africa 3D Sensing Technology Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 70: Middle East & Africa 3D Sensing Technology Market Share Analysis, by End-user, 2022 and 2031

Figure 71: Middle East & Africa 3D Sensing Technology Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 72: Middle East & Africa 3D Sensing Technology Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 73: Middle East & Africa 3D Sensing Technology Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 74: South America 3D Sensing Technology Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 75: South America 3D Sensing Technology Market Size & Forecast, Y-O-Y, Value (US$ Mn), 2017‒2031

Figure 76: South America 3D Sensing Technology Market Projections, by Technology Value (US$ Mn), 2017‒2031

Figure 77: South America 3D Sensing Technology Market, Incremental Opportunity, by Technology, 2023‒2031

Figure 78: South America 3D Sensing Technology Market Share Analysis, by Technology, 2022 and 2031

Figure 79: South America 3D Sensing Technology Market Projections, by Sensor Type, Value (US$ Mn), 2017‒2031

Figure 80: South America 3D Sensing Technology Market, Incremental Opportunity, by Sensor Type, 2023‒2031

Figure 81: South America 3D Sensing Technology Market Share Analysis, by Sensor Type, 2022 and 2031

Figure 82: South America 3D Sensing Technology Market Projections, by End-user Value (US$ Mn), 2017‒2031

Figure 83: South America 3D Sensing Technology Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 84: South America 3D Sensing Technology Market Share Analysis, by End-user, 2022 and 2031

Figure 85: South America 3D Sensing Technology Market Projections, by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 86: South America 3D Sensing Technology Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 87: South America 3D Sensing Technology Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 88: Global 3D Sensing Technology Market Competition

Figure 89: Global 3D Sensing Technology Market Company Share Analysis