Waterproofing Chemicals Market: Construction Industry to Build Monumental Growth

The waterproofing chemicals market is expected to register healthy growth in the near future, thanks to rising demand in construction industry. The waterproofing chemicals market is likely to grow at the CAGR of 5.10% during 2016-2024. The market is expected to reach a total valuation of US$12.3 bn by 2024 end. The waterproofing chemicals market stood at a modest US$7.6 bn.

The growing demand for waterproofing chemicals market in applications such as protection of buildings from leakage and seepage. Additionally, growing urbanization across the world and industrialization are further expected to drive demand for constructions. Moreover, rise in technology such as automation in manufacturing of the waterproofing chemicals are expected to increase their uptake and production simultaneously. Additionally, new technologies like big data are also making it easier to find new materials and combinations which make way for advancements in waterproofing chemicals. The reduction in costs due to mass manufacturing will also drive considerable growth in the waterproofing chemicals market.

Waterproofing Chemicals Market: Applications Rise to Drive Robust Growth

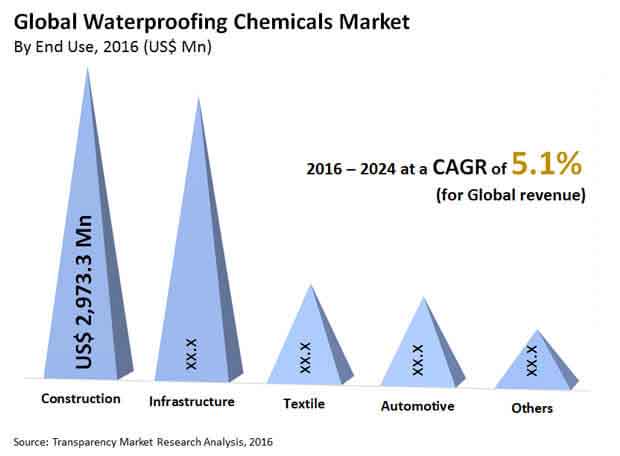

Waterproofing chemicals market is experiencing robust growth in construction, thanks to growing infrastructure developments across the world, especially in Asia Pacific. Additionally, the waterproofing chemicals market is witnessing a growing demand in new applications such as textiles, construction, leather, and automotive as well. The waterproofing chemicals play an important role in wearable goods like textile and leather items like bags. The chemicals help keep moisture away from important personal valuables and are expected to create new opportunities in the waterproofing chemicals market.

In the construction industry, the waterproofing chemicals market is expected to play a key role in roofing applications. Major regional markets like North America are seeing a rise in home and office renovations. Additionally, roofing and renovation applications in general are growing in importance due to extreme climatic changes witnessed across the world recently. Additionally, regions like Asia Pacific are witnessing substantial increase in infrastructure developments. This is expected to create several opportunities for waterproofing chemicals market.

The Waterproofing Chemicals Market: Bitumen Binds Growth

The global waterproofing chemicals market is segmented into thermoplastic olefin, PVC, polytetrafluoroethylene (PTFE), ethylene propylene, bitumen, and silicone. Among these, bitumen dominated the growth of the waterproofing chemicals market recently. The segment is expected to continue its robust growth, thanks to its exceptional binding properties and high viscosity. Additionally, silicone and PVC are also expected to register strong growth over the forecast period.

The rising infrastructure projects such as bridges, pavements, and tunnels in Asia Pacific and Europe are expected to drive growth. Additionally, North America region is witnessing a growing public outcry about crumbling infrastructure in some parts. This can also make way for significant growth in the waterproofing chemicals market in the near future. Additionally, Europe is constructing environment friendly bridges, which can keep natural pathways for animals and humans intact in accordance with nature. Similarly, underwater bridges like the newly under-construction one in Norway is also expected to drive significant growth in the waterproofing chemicals market.

The Middle East region is also expected to grow at a significant CAGR over the forecast period. The region is witnessing major initiatives for oil explorations as well as construction of several new oil refineries. The rising demand for advanced waterproofing chemicals and reliable materials can make way for new opportunities in the waterproofing chemicals market in this region.

Magnifying Investments in Infrastructure and Construction Sector Waterproofing Chemicals Market

The construction sector has witnessed extensive advancements over the years. The rising disposable income, increasing purchasing power parity, and the increase in the rural-to-urban migration percentage have served as positive growth indicators for the construction sector. The expanding number of construction activities also proves to be a boon for the associated industries. The waterproofing chemicals sector is one of them. Thus, based on all these aspects, the waterproofing chemicals market will observe considerable growth across the assessment period of 2016-2024.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Size, Indicative (US$ Mn)

3.2. Top 3 Trends

4. Market Overview

4.1. Product Overview

4.2. Market Indicators

4.3. Drivers and Restraints Snapshot Analysis

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Waterproofing chemicals Market Analysis and Forecasts

4.5. Porter’s Analysis

4.5.1. Threat of Substitutes

4.5.2. Bargaining Power of Buyers

4.5.3. Bargaining Power of Suppliers

4.5.4. Threat of New Entrants

4.5.5. Degree of Competition

4.5.6. Value Chain Analysis

5. Global Waterproofing chemicals Market Analysis, By Product

5.1. Key Findings

5.2. Introduction

5.3. Global Waterproofing chemicals Market Value Share Analysis, By Product

5.4. Global Waterproofing chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, By Product

5.5. Global Waterproofing chemicals Market Attractiveness Analysis, By Application

6. Global Waterproofing chemicals Market Analysis, By Technology

6.1. Key Findings

6.2. Introduction

6.3. Global Waterproofing chemicals Market Value Share Analysis, By Technology

6.4. Global Waterproofing chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, By Technology

6.5. Global Waterproofing chemicals Market Attractiveness Analysis, By Technology

7. Global Waterproofing chemicals Market Analysis, By End Use

7.1. Key Findings

7.2. Introduction

7.3. Global Waterproofing chemicals Market Value Share Analysis, By End Use

7.4. Global Waterproofing chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, By End Use

7.5. Global Waterproofing chemicals Market Attractiveness Analysis, By End Use

8. Global Waterproofing chemicals Market Analysis, By Region

8.1. Global Regulatory Scenario

8.2. Global Waterproofing chemicals Market Value Share Analysis, By Region

8.3. Global Waterproofing chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, By Region

8.4. Global Waterproofing chemicals Market Attractiveness Analysis, By Region

9. North America Waterproofing chemicals Market Analysis

9.1. Key Findings

9.2. North America Waterproofing chemicals Market Overview

9.3. North America Market Forecast By Product

9.4. North America Market Value Share Analysis By Product

9.5. North America Market Forecast By Technology

9.6. North America Market Value Share Analysis By Technology

9.7. North America Market Forecast By End Use

9.8. North America Market Value Share Analysis By End Use

9.9. North America Market Forecast By Country

9.10. North America Market Value Share Analysis By Country

9.11. Market Trends

10. Europe Waterproofing chemicals Market Analysis

10.1. Key Findings

10.2. Europe Market Forecast By Product

10.3. Europe Market Value Share Analysis By Product

10.4. Europe Market Forecast By Technology

10.5. Europe Market Value Share Analysis By Technology

10.6. Europe Market Forecast By End Use

10.7. Europe Market Value Share Analysis By End Use

10.8. Europe Market Forecast By Country

10.9. Europe Market Value Share Analysis By Country

10.10. Market Trends

11. Asia Pacific Waterproofing chemicals Market Analysis

11.1. Key Findings

11.2. Asia Pacific Market Forecast By Product

11.3. Asia Pacific Market Value Share Analysis By Product

11.4. Asia Pacific Market Forecast By Technology

11.5. Asia Pacific Market Value Share Analysis By Technology

11.6. Asia Pacific Market Forecast By End Use

11.7. Asia Pacific Market Value Share Analysis By End Use

11.8. Asia Pacific Market Forecast By Country

11.9. Asia Pacific Market Value Share Analysis By Country

11.10. Market Trends

12. Latin America Waterproofing chemicals Market Analysis

12.1. Key Findings

12.2. Latin America Market Forecast By Product

12.3. Latin America Market Value Share Analysis By Product

12.4. Latin America Market Forecast By Technology

12.5. Latin America Market Value Share Analysis By Technology

12.6. Latin America Market Forecast By End Use

12.7. Latin America Market Value Share Analysis By End Use

12.8. Latin America Market Forecast By Country

12.9. Latin America Market Value Share Analysis By Country

12.10. Market Trends

13. Middle East & Africa Waterproofing chemicals Market Analysis

13.1. Key Findings

13.2. Middle East & Africa Market Forecast By Product

13.3. Middle East & Africa Market Value Share Analysis By Product

13.4. Middle East & Africa Market Forecast By Technology

13.5. Middle East & Africa Market Value Share Analysis By Technology

13.6. Middle East & Africa Market Forecast By End Use

13.7. Middle East & Africa Market Value Share Analysis By End Use

13.8. Middle East & Africa Market Forecast By Country

13.9. Middle East & Africa Market Value Share Analysis By Country

13.10. Market Trends

14. Competition Landscape

14.1. Waterproofing chemicals Market Share Analysis by Company (2015)

14.2. Competition Matrix

14.2.1. The Dow Chemical Company

14.2.2. BASF SE

14.2.3. E.I. du Pont de Nemours and Company

14.2.4. Evonik Industries

14.2.5. W.R. Grace and Company

14.2.6. H.B. Fuller

14.2.7. Mapei spA

14.2.8. Sika AG

14.3. Company Profiles

14.3.1. BASF SE

14.3.1.1. Company Description

14.3.1.2. Business Overview

14.3.1.3. SWOT Analysis

14.3.1.4. Financial Details

14.3.1.5. Strategic Overview

14.3.2. The Dow Chemical Company

14.3.2.1. Company Description

14.3.2.2. Business Overview

14.3.2.3. SWOT Analysis

14.3.2.4. Financial Details

14.3.2.5. Strategic Overview

14.3.3. E.I. du Pont de Nemours and Company

14.3.3.1. Company Description

14.3.3.2. Business Overview

14.3.3.3. SWOT Analysis

14.3.3.4. Financial Details

14.3.3.5. Strategic Overview

14.3.4. Mapei spA

14.3.4.1. Company Description

14.3.4.2. Business Overview

14.3.4.3. SWOT Analysis

14.3.4.4. Financial Details

14.3.4.5. Strategic Overview

14.3.5. Wacker Chemie AG

14.3.5.1. Company Description

14.3.5.2. Business Overview

14.3.5.3. SWOT Analysis

14.3.5.4. Financial Details

14.3.5.5. Strategic Overview

14.3.6. Akzo Nobel NV.

14.3.6.1. Company Description

14.3.6.2. Business Overview

14.3.6.3. SWOT Analysis

14.3.6.4. Financial Details

14.3.6.5. Strategic Overview

14.3.7. Evonik Industries

14.3.7.1. Company Description

14.3.7.2. Business Overview

14.3.7.3. SWOT Analysis

14.3.7.4. Financial Details

14.3.7.5. Strategic Overview

14.3.8. Sika AG

14.3.8.1. Company Description

14.3.8.2. Business Overview

14.3.8.3. SWOT Analysis

14.3.8.4. Financial Details

14.3.8.5. Strategic Overview

14.3.9. W.R. Grace and Company

14.3.9.1. Company Description

14.3.9.2. Business Overview

14.3.9.3. SWOT Analysis

14.3.9.4. Financial Details

14.3.9.5. Strategic Overview

14.3.10. H.B. Fuller

14.3.10.1. Company Description

14.3.10.2. Business Overview

14.3.10.3. SWOT Analysis

14.3.10.4. Financial Details

14.3.10.5. Strategic Overview

14.3.11. Pidilite Industries Limited

14.3.11.1. Company Description

14.3.11.2. Business Overview

14.3.11.3. SWOT Analysis

14.3.11.4. Financial Details

14.3.11.5. Strategic Overview

14.3.12. Sibelco AG

14.3.12.1. Company Description

14.3.12.2. Business Overview

14.3.13. Archroma Management LLC

14.3.13.1. Company Description

14.3.13.2. Business Overview

14.3.14. Jiahua Chemicals Inc.

14.3.14.1. Company Description

14.3.14.2. Business Overview

14.3.15. MUHU (China) Construction Chemicals

14.3.15.1. Company Description

14.3.15.2. Strategic Overview

14.3.16. RPM International Inc.

14.3.16.1. Company Description

14.3.16.2. Business Overview

14.3.17. Liquipel LLC

14.3.17.1. Company Description

14.3.17.2. Business Overview

15. Key Takeaways

List of Tables

Table 01:Global Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 02: Global Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 03: Global Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-use, 2015–2024

Table 04: Global Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region, 2014–2024

Table 05: North America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 06: North America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 07: North America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-use, 2015–2024

Table 08: North America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 09: Asia-Pacific Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 10: Asia-Pacific Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 11: Asia Pacific Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-use, 2015–2024

Table 12: Asia Pacific Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 13: Global Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 14: Europe Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 15: Europe Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-use, 2015–2024

Table 16: Europe Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 17: Latin America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 18: Latin America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 19: Latin America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-use, 2015–2024

Table 20: Latin America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 21: Middle East & Africa Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2015–2024

Table 22: Middle East & Africa Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Technology, 2015–2024

Table 23: Middle East & Africa Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-use, 2014–2024

Table 24: Middle East & Africa Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

List of Figures

Figure 01: Global Waterproofing Products, Market Size(U.S.$ Mn) and Volume (Kilo Tons) Forecast,2015-2024

Figure 01: Global Waterproofing Products, Market Size(U.S.$ Mn) and Volume (Kilo Tons) Forecast,2015-2024

Figure 02: Global Waterproofing Chemicals Market Consumption Pattern, by Region, 2015

Figure 03: Asia Pacific Waterproofing Chemicals Market Share, 2015–2024

Figure 04: Global Waterproofing Chemicals Volume (Kilo Tons) and Market Size (U.S.$ Mn) Forecast, 2015–2024

Figure 05: Global Waterproofing Chemicals Average Price (US$/ Unit) 2015–2024

Figure 06: Global Waterproofing Chemicals Market Value Share Analysis, by Product, 2016 and 2024

Figure 07: Global Waterproofing Chemicals Market Attractiveness Analysis, by Product, 2015-2024

Figure 08: Bitumen Market Volume and Value Forecast, (Kilo Tons) (U.S.$ Mn), 2015–2024

Figure 09: PVC Market Volume and Value Forecast, (Kilo Tons) (U.S.$ Mn), 2015–2024

Figure 10: EPDM Volume and Value Forecast, (Kilo Tons) (U.S.$ Mn), 2015–2024

Figure 11: TPO Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 12: PTFE Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 13: Silicone Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 14: Global Waterproofing Chemicals Market Value Share Analysis, by Technology, 2016 and 2024

Figure 15: Global Waterproofing Chemicals Market Attractiveness Analysis, by Technology,2015-2024

Figure 16: Membrane Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 17: Liquid Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 18: Cementitious Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 19: Others Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 20: Global Waterproofing Market Value Share Analysis, by End-use, 2016 and 2024

Figure 21: Global Waterproofing Chemicals Market Attractiveness Analysis, by End-use

Figure 22: Bitumen Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 23: PVC Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 24: Automotive Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 25: Textile Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 26: Others Volume and Value Forecast, 2015–2024 (Kilo Tons) (U.S.$ Mn)

Figure 27: Global Waterproofing Chemicals Market Value Share Analysis, by Region, 2016 and 2024

Figure 28: Global Waterproofing Chemicals Market Attractiveness Analysis, by Region

Figure 29: North America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 30: North America Waterproofing Chemicals Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 31: North America Waterproofing Chemicals Market Attractiveness Analysis, by Country

Figure 32: North America Waterproofing Chemicals Market Value Share Analysis, by Product, 2016 and 2024

Figure 33: North America Waterproofing Chemicals Market Value Share Analysis, by Technology, 2016 and 2024

Figure 34: North America Waterproofing Chemicals Market Value Share Analysis, by End-use, 2016 and 2024

Figure 35: North America Waterproofing Chemicals Market Value Share Analysis, by Country, 2016 and 2024

Figure 36: Asia Pacific Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 37: Asia Pacific Waterproofing Chemicals Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 38: Asia Pacific Waterproofing Chemicals Market Attractiveness Analysis, by Country

Figure 39: Asia Pacific Waterproofing Chemicals Market Value Share Analysis, by Product, 2016 and 2024

Figure 40: Asia Pacific Waterproofing Chemicals Market Value Share Analysis, by Technology, 2016 and 2024

Figure 41: Asia Pacific Market Value Share Analysis, by End-use, 2016 and 2024

Figure 42: Asia Pacific Waterproofing Chemicals Market Value Share Analysis, by Country, 2016 and 2024

Figure 43: Europe Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 44: Europe Waterproofing Chemicals Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 45: Europe Waterproofing Chemicals Market Attractiveness Analysis, by Country

Figure 46: Europe Waterproofing Chemicals Market Value Share Analysis, by Product, 2016 and 2024

Figure 47: Europe Waterproofing Chemicals Market Value Share Analysis, by Technology, 2016 and 2024

Figure 48: Europe Waterproofing Chemicals Market Value Share Analysis , by End Use, 2016 and 2024

Figure 49: Europe Waterproofing Chemicals Market Value Share Analysis, by Country, 2016 and 2024

Figure 50: Latin America Waterproofing Chemicals Market Size (US$ Mn) and Volume (Kilo Tons)Forecast 2015-2024

Figure 51: Latin America Waterproofing Chemicals Market Size and Volume Y-o-Y Growth Projection, 2015-2024

Figure 52: Latin America Waterproofing Chemicals Market Attractiveness Analysis by Country

Figure 53: Latin America Waterproofing Chemicals Market Value Share Analysis, by Product ,2016 and 2024

Figure 54: Latin America Waterproofing Chemicals Market Value Share Analysis, by Technology ,2016 and 2024

Figure 55: Latin America Waterproofing Chemicals Market Value Share Analysis, by End Use, 2016 and 2024

Figure 56: Latin America Waterproofing Chemicals Market Value Share Analysis, by Country, 2016 and 2024

Figure 57: Middle East and Africa Waterproofing Chemicals Market Size (US$ Mn)and Volume(Kilo Tons)Forecast 2015-2024

Figure 58: Middle East and Africa Waterproofing Chemicals Market size and Volume Y-o- Y Growth Projection, 2015-2024

Figure 59: Middle East and Africa Waterproofing Chemicals Market Attractiveness Analysis, by Country

Figure 60: Middle East and Africa Waterproofing Chemicals Market Value Share Analysis, by Product,2016 and 2024

Figure 61: Middle East and Africa Waterproofing Chemicals Market Value Share Analysis, by Technology,2016 and 2024

Figure 62: Middle East and Africa Waterproofing Chemicals Market Value Share Analysis, by End Use, 2016 and 2024

Figure 63: Middle East and Africa Waterproofing Chemicals Market Value Share Analysis, by Country, 2016 and 2024

Figure 64: Global Waterproofing Chemicals Market Share Analysis, by Company(2015)