Analysts’ Viewpoint

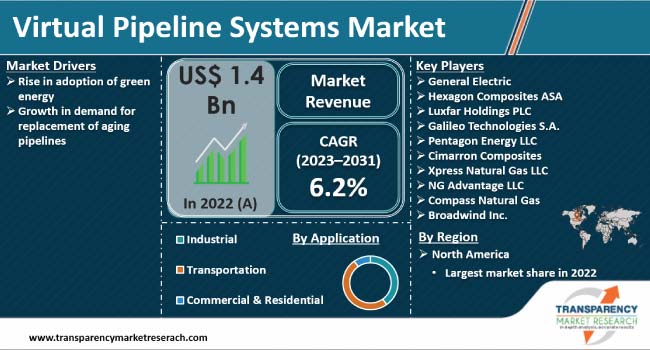

Rise in adoption of green energy and growth in demand for replacement of aging pipelines are expected to propel the virtual pipeline systems market size during the forecast period. Rapid industrialization and urbanization is also boosting demand for virtual natural gas transport.

Specially designed trucks are gaining traction among end-users for the distribution of natural gas to areas without a dedicated pipeline infrastructure. Surge in availability of natural gas is likely to offer lucrative opportunities to vendors in the global virtual pipeline systems industry. Vendors are investing significantly in the R&D of new products to expand their product portfolio.

Virtual pipeline connects gas sources to consumers. It is an effective alternative to physical pipelines and is used to transport fuel supplied by cryogenic tanks or containers in a liquid state. These systems are widely employed in regions not connected through pipeline infrastructure. They can be integrated with mobile platforms transported by rail, ships, and trucks.

Virtual pipelines are primarily utilized to transport natural gas, which is flammable and needs precautionary measures while handling (especially while transporting to remote places). Variations in ambient temperature may alter the properties of natural gas, which could be curbed by having proper insulation. Liquefied Natural Gas (LNG) Virtual Pipeline Solutions incorporate safety protocols, emergency response plans, and state-of-the-art safety equipment to reduce the risks associated with LNG transportation and handling.

Virtual energy distribution is gaining traction in various countries with increase in an investment in infrastructure development. India, China, and other developing countries are witnessing rapid improvement in infrastructure. These countries are promoting the use of clean energy in infrastructure development. Deployment of virtual pipeline infrastructure in developing countries can help address energy challenges and contribute to economic development.

Virtual piping systems are employed for the transportation of clean fuels such as Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG). Specially designed trucks are utilized in the system to extend the reach of natural gas distribution to areas that may not have a dedicated pipeline infrastructure. Thus, rise in adoption of green energy is fueling the virtual pipeline systems market development.

Rapid industrialization and urbanization is projected to drive the demand for virtual pipeline networks in the near future. Reliable and accessible energy sources are in high demand in various cities around the globe. This, in turn, is boosting adoption of virtual pipeline systems that offer a quick and scalable solution to meet these demands.

Governments in various countries are investing in the replacement of aging pipelines to enhance consumer safety. In the U.S., The Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011 mandates the U.S. Department of Transportation, Pipeline, and Materials Safety Administration to conduct state-wise surveys regarding the need for replacement of cast iron pipelines. High-risk pipelines are the ones that are subject to leakage due to the degrading iron alloys used to make them. Hence, surge in need for replacing aging pipelines is expected to spur the virtual pipeline systems market growth in the near future.

Increase in availability of natural gas is boosting demand for mobile gas delivery systems. According to OEC, LNG was the world's 14th most traded product, with a total trade of US$ 162.0 Bn. The exports of LNG grew from US$ 98.9 Bn in 2020 to US$ 162 Bn in 2021.

According to the latest virtual pipeline systems market forecast, North America is projected to hold the largest share from 2023 to 2031. Rise in need for replacing aging pipelines is fueling the market dynamics of the region. The U.S. is a major market for virtual pipeline systems in North America.

Growth in demand for cleaner fuels in remote locations is driving the virtual pipeline systems market statistics in Asia Pacific. Increase in adoption of LNG and CNG as clean fuels in the transportation sector is driving demand for virtual pipeline systems in Europe, with Germany, the U.K., and Poland being the major markets.

Key players are adopting various organic and inorganic strategies to increase their virtual pipeline systems market share. They are also developing advanced mobile gas distribution systems to expand their customer base.

General Electric, Hexagon Composites ASA, Luxfer Holdings PLC, Galileo Technologies S.A., Pentagon Energy LLC, Cimarron Composites, Sub 161 Pty Ltd., Xpress Natural Gas LLC, NG Advantage LLC, Compass Natural Gas, Broadwind Inc., REV LNG, LLC, and Global Partners LP are key companies operating in this market.

Each of these players has been profiled in the virtual pipeline systems market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 1.4 Bn |

| Market Forecast Value in 2031 | US$ 2.4 Bn |

| Growth Rate (CAGR) | 6.2% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 1.4 Bn in 2022

It is projected to grow at a CAGR of 6.2% from 2023 to 2031

Rise in adoption of green energy and growth in demand for replacement of aging pipelines

The industrial application segment held the largest share in 2022

North America is estimated to hold largest share during the forecast period

General Electric, Hexagon Composites ASA, Luxfer Holdings PLC, Galileo Technologies S.A., Pentagon Energy LLC, Cimarron Composites, Sub 161 Pty Ltd., Xpress Natural Gas LLC, NG Advantage LLC, Compass Natural Gas, Broadwind Inc., REV LNG, LLC, and Global Partners LP

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Virtual Pipeline Systems Market Analysis and Forecast, 2023-2031

2.6.1. Global Virtual Pipeline Systems Market Volume (Kilo Tons)

2.6.2. Global Virtual Pipeline Systems Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Virtual Pipeline Systems

3.2. Impact on Demand for Virtual Pipeline Systems– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

5.1. Price Trend Analysis by Application

5.2. Price Trend Analysis by Region

6. Global Virtual Pipeline Systems Market Analysis and Forecast, by Application, 2023–2031

6.1. Introduction and Definitions

6.2. Global Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

6.2.1. Industrial

6.2.2. Transportation

6.2.3. Commercial & Residential

6.3. Global Virtual Pipeline Systems Market Attractiveness, by Application

7. Global Virtual Pipeline Systems Market Analysis and Forecast, by Region, 2023–2031

7.1. Key Findings

7.2. Global Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Region, 2023–2031

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Global Virtual Pipeline Systems Market Attractiveness, by Region

8. North America Virtual Pipeline Systems Market Analysis and Forecast, 2023–2031

8.1. Key Findings

8.2. North America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

8.3. North America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country, 2023–2031

8.3.1. U.S. Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

8.3.2. Canada Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

8.4. North America Virtual Pipeline Systems Market Attractiveness Analysis

9. Europe Virtual Pipeline Systems Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. Europe Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

9.3. Europe Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

9.3.1. Germany Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Type, 2023–2031

9.3.2. France Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

9.3.3. U.K. Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

9.3.4. Italy Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

9.3.5. Russia & CIS Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

9.3.6. Rest of Europe Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

9.4. Europe Virtual Pipeline Systems Market Attractiveness Analysis

10. Asia Pacific Virtual Pipeline Systems Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Asia Pacific Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application

10.3. Asia Pacific Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

10.3.1. China Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

10.3.2. Japan Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

10.3.3. India Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

10.3.4. ASEAN Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

10.3.5. Rest of Asia Pacific Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

10.4. Asia Pacific Virtual Pipeline Systems Market Attractiveness Analysis

11. Latin America Virtual Pipeline Systems Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Latin America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

11.3. Latin America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

11.3.1. Brazil Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

11.3.2. Mexico Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

11.3.3. Rest of Latin America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

11.4. Latin America Virtual Pipeline Systems Market Attractiveness Analysis

12. Middle East & Africa Virtual Pipeline Systems Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Middle East & Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

12.3. Middle East & Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2022-2031

12.3.1. GCC Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

12.3.2. South Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

12.3.3. Rest of Middle East & Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

12.4. Middle East & Africa Virtual Pipeline Systems Market Attractiveness Analysis

13. Competition Landscape

13.1. Global Virtual Pipeline Systems Market Company Share Analysis, 2022

13.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

13.2.1. General Electric

13.2.1.1. Company Revenue

13.2.1.2. Business Overview

13.2.1.3. Product Segments

13.2.1.4. Geographic Footprint

13.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.2. Hexagon Composites ASA

13.2.2.1. Company Revenue

13.2.2.2. Business Overview

13.2.2.3. Product Segments

13.2.2.4. Geographic Footprint

13.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.3. Luxfer Holdings PLC

13.2.3.1. Company Revenue

13.2.3.2. Business Overview

13.2.3.3. Product Segments

13.2.3.4. Geographic Footprint

13.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.4. Galileo Technologies S.A.

13.2.4.1. Company Revenue

13.2.4.2. Business Overview

13.2.4.3. Product Segments

13.2.4.4. Geographic Footprint

13.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.5. Pentagon Energy LLC

13.2.5.1. Company Revenue

13.2.5.2. Business Overview

13.2.5.3. Product Segments

13.2.5.4. Geographic Footprint

13.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.6. Cimarron Composites

13.2.6.1. Company Revenue

13.2.6.1. Business Overview

13.2.6.2. Product Segments

13.2.6.3. Geographic Footprint

13.2.6.4. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.6.5. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.Sub 161 Pty Ltd.

13.2.7. Xpress Natural Gas LLC

13.2.7.1. Company Revenue

13.2.7.2. Business Overviewwait

13.2.7.3. Product Segments

13.2.7.4. Geographic Footprint

13.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.NG Advantage LLC

13.2.8. Compass Natural Gas

13.2.8.1. Company Revenue

13.2.8.2. Business Overview

13.2.8.3. Product Segments

13.2.8.4. Geographic Footprint

13.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.9. Broadwind Inc.

13.2.9.1. Company Revenue

13.2.9.2. Business Overview

13.2.9.3. Product Segments

13.2.9.4. Geographic Footprint

13.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.10. REV LNG, LLC

13.2.10.1. Company Revenue

13.2.10.2. Business Overview

13.2.10.3. Product Segments

13.2.10.4. Geographic Footprint

13.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

13.2.11. Global Partners LP

13.2.11.1. Company Revenue

13.2.11.2. Business Overview

13.2.11.3. Product Segments

13.2.11.4. Geographic Footprint

13.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14. Primary Research: Key Insights

15. Appendix

List of Tables

Table 1: Global Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 2: Global Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 3: North America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 4: North America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 5: U.S. Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 6: Canada Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 7: Europe Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 8: Europe Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 9: Germany Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 10: France Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 11: U.K. Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 12: Italy Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 13: Spain Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 14: Russia & CIS Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 15: Rest of Europe Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 16: Asia Pacific Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 17: Asia Pacific Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 18: China Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 19: Japan Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 20: India Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 21: ASEAN Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 22: Rest of Asia Pacific Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 23: Latin America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 24: Latin America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 25: Brazil Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 26: Mexico Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 27: Rest of Latin America Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 28: Middle East & Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 29: Middle East & Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 30: GCC Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 31: South Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 32: Rest of Middle East & Africa Virtual Pipeline Systems Market Value (US$ Bn) Forecast, by Application, 2023–2031

List of Figures

Figure 1: Global Virtual Pipeline Systems Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 2: Global Virtual Pipeline Systems Market Attractiveness, by Application

Figure 3: Global Virtual Pipeline Systems Market Value Share Analysis, by Region, 2022, 2027, and 2031

Figure 4: Global Virtual Pipeline Systems Market Attractiveness, by Region

Figure 5: North America Virtual Pipeline Systems Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: North America Virtual Pipeline Systems Market Attractiveness, by Application

Figure 7: North America Virtual Pipeline Systems Market Value Share Analysis, by Country, 2022, 2027, and 2031

Figure 8: North America Virtual Pipeline Systems Market Attractiveness, by Country

Figure 9: Europe Virtual Pipeline Systems Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 10: Europe Virtual Pipeline Systems Market Attractiveness, by Application

Figure 11: Europe Virtual Pipeline Systems Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: Europe Virtual Pipeline Systems Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Virtual Pipeline Systems Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 14: Asia Pacific Virtual Pipeline Systems Market Attractiveness, by Application

Figure 15: Asia Pacific Virtual Pipeline Systems Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: Asia Pacific Virtual Pipeline Systems Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Virtual Pipeline Systems Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 18: Latin America Virtual Pipeline Systems Market Attractiveness, by Application

Figure 19: Latin America Virtual Pipeline Systems Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: Latin America Virtual Pipeline Systems Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Virtual Pipeline Systems Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Middle East & Africa Virtual Pipeline Systems Market Attractiveness, by Application

Figure 23: Middle East & Africa Virtual Pipeline Systems Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Middle East & Africa Virtual Pipeline Systems Market Attractiveness, by Country and Sub-region