Analysts’ Viewpoint on Video Surveillance and VSaaS Market Scenario

Demand for video surveillance and VSaaS solutions is rising in various end-use sectors such as government, transportation, hospitality, and retail. Video surveillance and VSaaS solutions offer real-time surveillance and security to critical infrastructure. Advancements in the artificial intelligence market and machine learning technologies, introduction of novel surveillance cameras, and increase in adoption of cloud-based video surveillance are expected to augment the global market during the forecast period. Governments of countries across the globe are establishing robust security in cities through camera surveillance systems to maintain law and order. Prominent players in the market are launching new CCTV monitoring solutions to broaden their revenue streams. They are also adopting M&A strategies to expand their geographical reach.

Video surveillance has evolved from analog CCTV surveillance systems to digital solutions integrated with IoT and the cloud. It is a source of telemetry to both business intelligence and physical security platforms. Video surveillance solutions comprise a complex ecosystem that includes cameras, storage, software, and miscellaneous hardware & services. Video surveillance and Video Surveillance-as-a-Service (VSaaS) solutions help prevent undesirable activities by maintaining a vigilant eye on every move at every place of importance. These solutions are helpful to government and law enforcement agencies, as they aid in maintaining law and order. Video surveillance and VSaaS solutions also help to monitor and recognize threats and investigate/prevent criminal activities. Security camera systems verify alarms (intrusion, fire, hold-up), detect criminal offenses (thefts, defalcations), document security-related events, deter offenders (tampering, arson, and vandalism), track movements, and offer alerts in case of accidents. Storage, video management, and analytics solutions are hosted centrally on a cloud environment and are accessed over the internet through the VSaaS delivery model.

Rapid urbanization has led to an increase in population in cities. According to the United Nations Department of Economic and Social Affairs, 68% of the global population is expected to reside in cities by 2025. Video surveillance and VSaaS solutions help secure and monitor public places, manage transportation systems, and improve emergency response. According to Otonomo, a platform powering the mobility economy, New York City has installed cameras and sensors at 10,000 city intersections as part of adaptive signals and connected infrastructure. Such investments are fueling the video analytics market in the U.S.

Governments of countries across the globe are investing significantly in the development of smart cities. This is likely to boost the demand for video surveillance and VSaaS solutions in the next few years. According to Vestian, a commercial real estate firm, 88 smart cities are expected to be in existence by 2025; of these, 25 cities are anticipated to be across the Americas, 31 cities in Europe, and 32 cities in Asia Pacific. According to the new smart city spending guide from International Data Corporation, smart city initiatives are forecast to drive US$ 189 Bn in spending in 2023. According to Barclays, smart cities have the potential to generate US$ 20 Trn in economic benefits by 2026.

Surge in investment in smart city projects is prompting R&D of new platforms in the commercial building automation market. In December 2021, Dassault Systèmes SE, a France-based software corporation, and NTT Communications, a Japan-based telecommunications company, entered into an alliance to offer a scalable smart city platform. The platform aims to address urban challenges associated with sustainability and resilience in various domains such as energy and optimized mobility in Japan.

Advancements in platforms and solutions are projected to offer growth opportunities for key vendors in the video surveillance and VSaaS market. Technology evolutions, including Artificial Intelligence (AI) and IoT, improve the operational performance of video surveillance and VSaaS solutions. Edge AI video surveillance and VSaaS solutions offer enhanced performance and faster response to business organizations. Gorilla Technology, a privately held company specializing in video intelligence and IoT technology, offers IVAR Edge AI, an intelligent video surveillance and VSaaS recorder that comprises All-in-One VMS + IVA Solution. IVAR real-time analytics technology provides insights with event-based solutions such as tracking vehicles, people, and objects. Real-time detection helps to extract suspicious events.

According to recent trends in the video surveillance and VSaaS market, companies in retail and hospitality sectors are increasingly investing in IVAR. Integration of IVAR can help in scheduling camera and analytics recording times to instantly detect and alert staff to restricted area intrusion, blacklisted people, and suspicious loiters. Furthermore, IVAR offers premium services such as assisted shopping and loyalty rewards, as it can detect and recognize loyal customers and VIPs through face recognition.

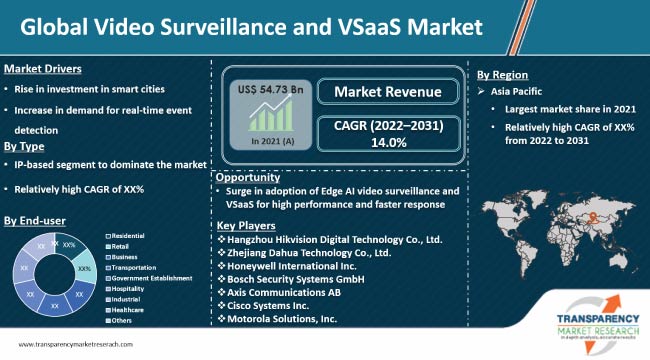

Asia Pacific is expected to dominate the global video surveillance and VSaaS market during the forecast period, followed by North America. Rise in investment in infrastructure modernization and smart city projects, and increase in adoption of advanced video surveillance cameras in national security systems in countries such as China, India, South Korea, and Japan are anticipated to propel the demand for video surveillance and VSaaS in the region. Future of the video surveillance and VSaaS market in China appears promising, led by the expansion of the CCTV market and surge in adoption of security surveillance systems in the country. China is anticipated to account for major share of the market in Asia Pacific during the forecast period.

Detailed profiles of companies offering video surveillance and VSaaS solutions have been provided in the market report to evaluate their financials, key product offerings, recent developments, and strategies. Significant investment in R&D activities is a key marketing strategy for video surveillance and VSaaS market players. Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Zhejiang Uniview Technologies Co., Ltd., Axis Communications AB, Honeywell International Inc., Bosch Security Systems GmbH, Hanwha Techwin Co., Ltd., Avigilon Corporation, Cisco Systems Inc., i-PRO Co., Ltd., Genetec Inc., Motorola Solutions, Inc., and Milestones Systems A/S are prominent players operating in the market.

Each of these players has been profiled in the video surveillance and VSaaS market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 54.73 Bn |

|

Market Forecast Value in 2031 |

US$ 201.63 Bn |

|

Growth Rate (CAGR) |

14.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2016–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The video surveillance and VSaaS market was valued at US$ 54.73 Bn in 2021

The video surveillance and VSaaS market is expected to reach US$ 201.63 Bn by 2031

The video surveillance and VSaaS market is estimated to advance at a CAGR of 14.0% during the forecast period

Rise in investment in smart cities, and increase in adoption of edge AI video surveillance and VSaaS for high performance and faster response

Asia Pacific held largest share of the video surveillance and VSaaS market in 2021

Cloud-based video surveillance, proliferation of data and analytics, and rise in awareness about VSaaS business model

Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co., Ltd., Zhejiang Uniview Technologies Co., Ltd., Axis Communications AB, Honeywell International Inc., Bosch Security Systems GmbH, Hanwha Techwin Co., Ltd., Avigilon Corporation, Cisco Systems Inc., i-PRO Co., Ltd., Genetec Inc., Motorola Solutions, Inc., and Milestones Systems A/S

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary: Global Video Surveillance and VSaaS Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Video Surveillance and VSaaS Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short-term and Long-term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.5.1. By Component

4.5.2. By Type

4.5.3. By End-user

5. Global Video Surveillance and VSaaS Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

6. Global Video Surveillance and VSaaS Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.1.1. Camera

6.3.1.2. Recorder & Storage Device

6.3.1.3. Monitor & Display

6.3.2. Software

6.3.2.1. Video Management System

6.3.2.2. Video Analytics

6.3.3. Services

6.3.3.1. Hosted

6.3.3.2. Managed

7. Global Video Surveillance and VSaaS Market Analysis, by Type

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by Type, 2018 - 2031

7.3.1. IP-based

7.3.2. Analog

8. Global Video Surveillance and VSaaS Market Analysis, by End-user

8.1. Overview and Definitions

8.2. Key Segment Analysis

8.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by End-user, 2018 - 2031

8.3.1. Residential

8.3.2. Retail

8.3.3. Business

8.3.4. Transportation

8.3.5. Government Establishment

8.3.6. Hospitality

8.3.7. Industrial

8.3.8. Healthcare

8.3.9. Others

9. Global Video Surveillance and VSaaS Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Video Surveillance and VSaaS Market Analysis and Forecast

10.1. Regional Outlook

10.2. Video Surveillance and VSaaS Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By Type

10.2.3. By End-user

10.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Video Surveillance and VSaaS Market Analysis and Forecast

11.1. Regional Outlook

11.2. Video Surveillance and VSaaS Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By Type

11.2.3. By End-user

11.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Video Surveillance and VSaaS Market Analysis and Forecast

12.1. Regional Outlook

12.2. Video Surveillance and VSaaS Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By Type

12.2.3. By End-user

12.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Video Surveillance and VSaaS Market Analysis and Forecast

13.1. Regional Outlook

13.2. Video Surveillance and VSaaS Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By Type

13.2.3. By End-user

13.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. United Arab Emirates

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Video Surveillance and VSaaS Market Analysis and Forecast

14.1. Regional Outlook

14.2. Video Surveillance and VSaaS Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

14.2.1. By Component

14.2.2. By Type

14.2.3. By End-user

14.3. Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Market Revenue Share Analysis (%), by Leading Players (2021)

15.3. Competitive Scenario

15.3.1. List of Emerging, Prominent and Leading Players

15.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. Hangzhou Hikvision Digital Technology Co., Ltd.

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.2. Zhejiang Dahua Technology Co., Ltd.

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.3. Zhejiang Uniview Technologies Co., Ltd.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.4. Axis Communications AB

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.5. Honeywell International Inc.

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.6. Bosch Security Systems GmbH

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.7. Hanwha Techwin Co., Ltd.

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.8. Avigilon Corporation

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.9. Cisco Systems Inc.

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.10. i-PRO Co., Ltd.

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.11. Genetec Inc.

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.12. Motorola Solutions, Inc.

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.13. Milestones Systems A/S

16.13.1. Business Overview

16.13.2. Company Revenue

16.13.3. Product Portfolio

16.13.4. Geographic Footprint

16.13.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

16.14. Others

16.14.1. Business Overview

16.14.2. Company Revenue

16.14.3. Product Portfolio

16.14.4. Geographic Footprint

16.14.5. Strategic Partnership, Merger & Acquisition, Business Expansion, New Product Launch, Innovation etc.

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in Video Surveillance and VSaaS Market

Table 2: North America Video Surveillance and VSaaS Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 3: Europe Video Surveillance and VSaaS Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 4: Asia Pacific Video Surveillance and VSaaS Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 5: Middle East & Africa Video Surveillance and VSaaS Market Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 6: South America Video Surveillance and VSaaS Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 11: Global Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 12: Global Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 13: Global Video Surveillance and VSaaS Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 14: North America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 15: North America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 16: North America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 17: North America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 18: U.S. Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Canada Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Mexico Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Europe Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 22: Europe Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 23: Europe Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 24: Europe Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 25: Germany Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: UK Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: France Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Italy Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Spain Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Asia Pacific Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 31: Asia Pacific Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 32: Asia Pacific Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 33: Asia Pacific Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 34: China Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: India Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Japan Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: ASEAN Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Middle East & Africa Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 39: Middle East & Africa Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 40: Middle East & Africa Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 41: Middle East & Africa Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 42: Saudi Arabia Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: United Arab Emirates Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: South Africa Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: South America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 46: South America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Type, 2018 – 2031

Table 47: South America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by End-user, 2018 – 2031

Table 48: South America Video Surveillance and VSaaS Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 49: Brazil Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: Argentina Video Surveillance and VSaaS Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: Mergers & Acquisitions, Partnerships (1/2)

Table 52: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Video Surveillance and VSaaS Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global Video Surveillance and VSaaS Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2022

Figure 3: Top Segment Analysis of Video Surveillance and VSaaS Market

Figure 4: Global Video Surveillance and VSaaS Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031

Figure 5: Global Video Surveillance and VSaaS Market Attractiveness Assessment, by Component

Figure 6: Global Video Surveillance and VSaaS Market Attractiveness Assessment, by Type

Figure 7: Global Video Surveillance and VSaaS Market Attractiveness Assessment, by End-user

Figure 8: Global Video Surveillance and VSaaS Market Attractiveness Assessment, by Region

Figure 9: Global Video Surveillance and VSaaS Market Revenue (US$ Bn) Historic Trends, 2016 – 2021

Figure 10: Global Video Surveillance and VSaaS Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 – 2021

Figure 11: Global Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2022

Figure 12: Global Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2031

Figure 13: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 14: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 15: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 16: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031 Global Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2022

Figure 17: Global Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2031

Figure 18: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 19: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by IP-Based, 2022 – 2031

Figure 20: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Analog, 2022 – 2031

Figure 21: Global Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2022

Figure 22: Global Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2031

Figure 23: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by 2022 – 2031

Figure 24: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, Residential 2022 – 2031

Figure 25: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 26: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Businesses, 2022 – 2031

Figure 27: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 28: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Government Establishment, 2022 – 2031

Figure 29: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hospitality, 2022 – 2031

Figure 30: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Industrial, 2022 – 2031

Figure 31: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 32: Global Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 33: Global Video Surveillance and VSaaS Market Opportunity (US$ Bn), by Region

Figure 34: Global Video Surveillance and VSaaS Market Opportunity Share (%), by Region, 2022–2031

Figure 35: Global Video Surveillance and VSaaS Market Size (US$ Bn), by Region, 2022 & 2031

Figure 36: Global Video Surveillance and VSaaS Market Value Share Analysis, by Region, 2022

Figure 37: Global Video Surveillance and VSaaS Market Value Share Analysis, by Region, 2031

Figure 38: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 39: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 40: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 41: Middle East & Africa Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 42: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 43: North America Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2022

Figure 44: North America Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2031

Figure 45: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 46: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 47: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 48: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031 Global Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2022

Figure 49: North America Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2031

Figure 50: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 51: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by IP-Based, 2022 – 2031

Figure 52: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Analog, 2022 – 2031

Figure 53: North America Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2022

Figure 54: North America Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2031

Figure 55: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by 2022 – 2031

Figure 56: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, Residential 2022 – 2031

Figure 57: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 58: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Businesses, 2022 – 2031

Figure 59: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 60: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Government Establishment, 2022 – 2031

Figure 61: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hospitality, 2022 – 2031

Figure 62: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Industrial, 2022 – 2031

Figure 63: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 64: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 65: North America Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2022

Figure 66: North America Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2031

Figure 67: U.S. Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 68: Canada Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 69: Mexico Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 70: Europe Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2022

Figure 71: Europe Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2031

Figure 72: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 73: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 74: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 75: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031 Global Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2022

Figure 76: Europe Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2031

Figure 77: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 78: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by IP-Based, 2022 – 2031

Figure 79: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Analog, 2022 – 2031

Figure 80: Europe Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2022

Figure 81: Europe Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2031

Figure 82: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by 2022 – 2031

Figure 83: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, Residential 2022 – 2031

Figure 84: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 85: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Businesses, 2022 – 2031

Figure 86: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 87: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Government Establishment, 2022 – 2031

Figure 88: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hospitality, 2022 – 2031

Figure 89: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Industrial, 2022 – 2031

Figure 90: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 91: Europe Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 92: Europe Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2022

Figure 93: Europe Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2031

Figure 94: Germany Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 95: U.K. Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 96: France Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 97: Italy Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 98: Spain Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 99: Asia Pacific Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2022

Figure 100: Asia Pacific North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 101: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 102: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 103: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031 Global Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2022

Figure 104: Asia Pacific Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2031

Figure 105: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 106: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by IP-Based, 2022 – 2031

Figure 107: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Analog, 2022 – 2031

Figure 108: Asia Pacific Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2022

Figure 109: Asia Pacific Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2031

Figure 110: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by 2022 – 2031

Figure 111: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, Residential 2022 – 2031

Figure 112: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 113: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Businesses, 2022 – 2031

Figure 114: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 115: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Government Establishment, 2022 – 2031

Figure 116: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hospitality, 2022 – 2031

Figure 117: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Industrial, 2022 – 2031

Figure 118: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 119: Asia Pacific Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 120: Market Revenue Opportunity Share, by Country

Figure 121: China Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 122: India Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 123: Japan Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 124: ASEAN Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 125: MEA Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2022

Figure 126: MEA Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2031

Figure 127: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 128: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 129: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 130: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031 Global Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2022

Figure 131: MEA Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2031

Figure 132: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 133: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by IP-Based, 2022 – 2031

Figure 134: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Analog, 2022 – 2031

Figure 135: MEA Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2022

Figure 136: MEA Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2031

Figure 137: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by 2022 – 2031

Figure 138: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, Residential 2022 – 2031

Figure 139: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 140: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Businesses, 2022 – 2031

Figure 141: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 142: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Government Establishment, 2022 – 2031

Figure 143: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hospitality, 2022 – 2031

Figure 144: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Industrial, 2022 – 2031

Figure 145: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 146: MEA Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 147: MEA Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2022

Figure 148: MEA Africa Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2031

Figure 149: Saudi Arabia Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 150: United Arab Emirates Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 151: South Africa Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 152: South America Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2022

Figure 153: South America Video Surveillance and VSaaS Market Value Share Analysis, by Component, 2031

Figure 154: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 155: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 156: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 157: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031 Global Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2022

Figure 158: South America Video Surveillance and VSaaS Market Value Share Analysis, by Type, 2031

Figure 159: North America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, 2022 – 2031

Figure 160: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by IP-Based, 2022 – 2031

Figure 161: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Analog, 2022 – 2031

Figure 162: South America Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2022

Figure 163: South America Video Surveillance and VSaaS Market Value Share Analysis, by End-user, 2031

Figure 164: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by 2022 – 2031

Figure 165: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by, Residential 2022 – 2031

Figure 166: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Retail, 2022 – 2031

Figure 167: v America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Businesses, 2022 – 2031

Figure 168: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 169: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Government Establishment, 2022 – 2031

Figure 170: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Hospitality, 2022 – 2031

Figure 171: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Industrial, 2022 – 2031

Figure 172: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 173: South America Video Surveillance and VSaaS Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 174: South America Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2022

Figure 175: South America Video Surveillance and VSaaS Market Value Share Analysis, by Country, 2031

Figure 176: Brazil Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 177: Argentina Video Surveillance and VSaaS Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031