The global demand for urolithiasis management devices has seen a steady rise in the past few years owing to the increasing prevalence of kidney stones. A 2015 study by the National Kidney Foundation of the U.S. states that one in 10 people in the country has kidney stones and that more than a half a million people are admitted to emergency rooms for kidney stone management every year. Across the globe as well, factors such as obesity, rising geriatric population, which is highly susceptible to kidney stones owing to reduced renal function and diabetes, and change in lifestyles are contributing to increased prevalence of kidney stone formation.

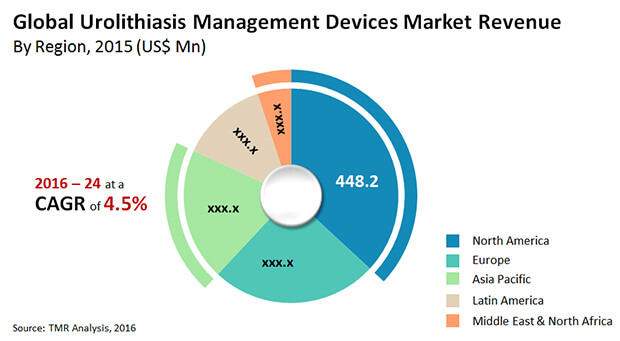

Transparency Market Research estimates that the global urolithiasis management devices market will exhibit a healthy 4.5% CAGR over the period between 2016 and 2024 and rise to a valuation of US$1.78 bn by 2024.

Clinics and Ambulatory Surgical Centers to Remain Dominant End-use Segments

Of the key end-users of urolithiasis management devices, including hospitals, ambulatory surgery centers (ASCs), and clinics, the segment of clinics led the global market in terms of both revenue and volume in 2015. In terms of revenue, the segment accounted for over 55% in the said year. The leading position of the market segment can be attributed to factors such as the significant rise in the number of people opting for urolithiasis surgeries and advancements in treatment options that have reduced the time required for undertaking the procedures. Over the period between 2016 and 2024 as well, the segment is expected to hold a commanding position in the global market, retaining its status as the leading revenue generator.

The demand for urolithiasis management devices across ambulatory surgical centers is expected to exhibit a strong growth over the next few years, with the end-user segment emerging as one of the most promising investment grounds for the global urolithiasis management devices market. The segment is expected to exhibit strong growth owing to high demand for ambulatory surgical centers and preference for day care surgeries across developing as well as developed parts of the world. Applications of urolithiasis management devices across the hospitals end-use segment is expected to witness stagnant growth as clinics and ambulatory surgical settings become more preferred owing to the lower cost of treatment and the need to be hospitalized for shorter lengths of time.

Rising Geriatric Population in Asia Pacific to Stimulate Increased Adoption

North America held a dominant share of nearly 36% in the global urolithiasis management devices market in 2015. Factors such as the rising prevalence of kidney stone, rising geriatric population, and campaigns undertaken to raise awareness about the risks associated with kidney stones by government bodies are central to the growth of the market in the region. Additionally, the introduction of new and innovative urolithiasis management devices such as laser lithotripters and flexible ureterenoscopes have also aided the healthy growth of the North America urolithiasis management devices market. The presence of high disposable income groups across developed economies such as the U.S. and Canada in North America, with a high prevalence of lifestyle-induced diseases such as obesity and a large base of geriatric population have also influenced the increased adoption of urolithiasis management devices.

The urolithiasis management devices market in Asia Pacific is expected to exhibit an impressive CAGR of 4.6% over the period between 2016 and 2024. The mounting geriatric population in the region is the key factor driving the urolithiasis management devices market in the next few years. According to the United Nations ESCAP (Economic and Social Commission for Asia and the Pacific), is region is presently home to more than half of the world’s population of people aged over 60 years and the number is expected to rise to more than 2.45 bn by 2050. Owing to this, the regions is expected to lead to a substantial rise in demand for urolithiasis management devices in the next few years.

Some of the key vendors operating in the global urolithiasis management devices market are C. R. Bard, Inc., Allengers Medical Systems Ltd, Dornier Medtech GmbH, Boston Scientific Corporation, Cook Group, Inc., Electro Medical Systems S.A., DirexGroup, Olympus Corporation, Karl Storz, and Siemens Healthcare.

Efficacy for Management of Renal Diseases fuels Urolithiasis Management Devices Market

The urolithiasis management devices market is largely consolidated with a handful of players commanding leading share in the overall market. These players command leading position due to their strong geographic presence, outstanding distribution networks, and financial might to acquire niche device developers located in regional pockets of the urolithiasis management devices market. Large budgets for R&D of novel devices gives these players an edge to remain at the fore in the urolithiasis management devices market. Nonetheless, competition in the urolithiasis management devices market is escalating with fast adoption of advancing supporting technologies by small and mid-size players for the development of urolithiasis management devices.

Primarily, efficacy of urolithiasis management devices for the management of kidney stones is fuelling the urolithiasis management devices market. Worldwide, factors such as obesity, changing lifestyle, and age-related ailments are associated with kidney stones that requires reliable treatment to manage the condition. According to statistics, at least 30% population worldwide is obese or overweight that is an underlying cause of lifestyle diseases including kidney stone. Moreover, rapid rise in the geriatric population who are susceptible to kidney disorders requires a reliable line of treatment to manage the condition. According to statistics of the United Nations Department of Economic and Social Affairs, the geriatric population is projected to be 1.4 bn by 2030 – a 56% increase from the geriatric population in 2015.

However, on the flip side, transmit of shockwaves across the body to precisely trigger kidney stones for certain urolithiasis procedures that can damage adjoining soft tissues, and could also potentially lead to permanent damage of renal functions is limiting the adoption of these procedures. Patients are thus are wary of permanent loss of renal functions and potential side-effects of novel technologies underlying urolithiasis management devices. Besides this, high cost of novel urolithiasis management devices is a roadblock to the growth of urolithiasis management devices market.

1. Preface

1.1.Urolithiasis Management Devices Market Definition and Scope

1.2 Urolithiasis Management Devices Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary: Global Urolithiasis Management Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Urolithiasis Management Devices Market Overview

4.3. Key Urolithiasis Management Devices Market Indicators

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.5. Global Urolithiasis Management Devices Market Analysis and Forecasts, 2014-2024

4.5.1.Urolithiasis Management Devices Market Volume Projection, 2014-2024 (in units)

4.5.2. Pricing Analysis, 2014-2024 (US$ per unit)

4.5.3. Urolithiasis Management Devices Market Revenue Projection (US$ Mn)

4.6. Urolithiasis Management Devices Market - Global Supply Demand Scenario

4.7. Value Chain Analysis

4.7.1. List of active market participants (suppliers/distributors/manufacturers/vendors)

4.7.2. Forward – Backward Integration Scenario

4.8. Porter’s Five Force Analysis for the Global Urolithiasis Management Devices Market Devices Market

4.9. Market Outlook

5. Global Urolithiasis Management Devices Market Analysis and Forecast, By Device Type

5.1. Introduction & Definition

5.2. Key Findings / Developments

5.3. Key Trends

5.4. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By Device Type

5.4.1. Shock Wave Lithotripters

5.4.1.1. Intracorporeal lithotripter

5.4.1.1.1. Ultrasound Lithotripter

5.4.1.1.2. Pneumatic Lithotripter

5.4.1.1.3. Laser Lithotripter

5.4.1.2. Extracorporeal lithotripter

5.4.2. Ureterorenoscopes

5.4.2.1. Rigid Ureterorenoscopes

5.4.2.2. Semi Rigid Ureterorenoscopes

5.4.2.3. Flexible Ureterorenoscopes

5.5. Market Attractiveness, By Device Type, 2015

6. Global Urolithiasis Management Devices Market Analysis and Forecasts, By End-user

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Key Trends

6.4. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

6.4.1. Hospitals

6.4.2. Clinics

6.4.3. Ambulatory surgical centers

6.5. Market Attractiveness By End-user, 2015

7. Global Urolithiasis Management Devices Market Analysis and Forecasts, By Region

7.1. Key Findings

7.2. Policies and Regulations

7.3. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By Region

7.3.1. North America

7.3.2. Europe

7.3.3. Asia-Pacific

7.3.4. Latin America

7.3.5. Middle East and Africa

7.4. Market Attractiveness By Region, 2015

8. North America Urolithiasis Management Devices Market Analysis and Forecast

8.1. Key Findings

8.2. Policies and Regulations

8.3. Key Trends

8.4. Market Size (US$ Mn) Forecast, By Device Type

8.4.1. Shock Wave Lithotripters

8.4.1.1. Intracorporeal lithotripter

8.4.1.1.1. Ultrasound Lithotripter

8.4.1.1.2. Pneumatic Lithotripter

8.4.1.1.3. Laser Lithotripter

8.4.1.2. Extracorporeal lithotripter

8.4.2. Ureterorenoscopes

8.4.2.1. Rigid Ureterorenoscopes

8.4.2.2. Semi Rigid Ureterorenoscopes

8.4.2.3. Flexible Ureterorenoscopes

8.5. Market Size (US$ Mn) Forecast, By End-user

8.5.1. Hospitals

8.5.2. Clinics

8.5.3. Ambulatory surgical centers

8.6. Urolithiasis Management Devices Market Attractiveness Analysis

8.6.1. By Device Type

8.6.2. By End-user

8.6.3. By Country

8.7. U.S. Urolithiasis Management Devices Market Analysis and Forecast

8.7.1. Market Size (US$ Mn) Forecast, By Device Type

8.7.1.1. Shock Wave Lithotripters

8.7.1.1.1. Intracorporeal lithotripter

8.7.1.1.1.1. Ultrasound Lithotripter

8.7.1.1.1.2. Pneumatic Lithotripter

8.7.1.1.1.3. Laser Lithotripter

8.7.1.1.2. Extracorporeal lithotripter

8.7.1.2. Ureterorenoscopes

8.7.1.2.1. Rigid Ureterorenoscopes

8.7.1.2.2. Semi Rigid Ureterorenoscopes

8.7.1.2.3. Flexible Ureterorenoscopes

8.7.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

8.7.2.1. Hospitals

8.7.2.2. Clinics

8.7.2.3. Ambulatory surgical centers

8.8. Canada Urolithiasis Management Devices Market Analysis and Forecast

8.8.1. Market Size (US$ Mn) Forecast, By Device Type

8.8.1.1. Shock Wave Lithotripters

8.8.1.1.1. Intracorporeal lithotripter

8.8.1.1.1.1. Ultrasound Lithotripter

8.8.1.1.1.2. Pneumatic Lithotripter

8.8.1.1.1.3. Laser Lithotripter

8.8.1.1.2. Extracorporeal lithotripter

8.8.1.2. Ureterorenoscopes

8.8.1.2.1. Rigid Ureterorenoscopes

8.8.1.2.2. Semi Rigid Ureterorenoscopes

8.8.1.2.3. Flexible Ureterorenoscopes

8.8.2. Market Size (US$ Mn) Forecast, By End-user

8.8.2.1. Hospitals

8.8.2.2. Clinics

8.8.2.3. Ambulatory surgical centers

9. Europe Urolithiasis Management Devices Market Analysis and Forecast

9.1. Market Size (US$ Mn) Forecast, By Device Type

9.1.1. Shock Wave Lithotripters

9.1.1.1. Intracorporeal lithotripter

9.1.1.1.1. Ultrasound Lithotripter

9.1.1.1.2. Pneumatic Lithotripter

9.1.1.1.3. Laser Lithotripter

9.1.1.2. Extracorporeal lithotripter

9.1.2. Ureterorenoscopes

9.1.2.1. Rigid Ureterorenoscopes

9.1.2.2. Semi Rigid Ureterorenoscopes

9.1.2.3. Flexible Ureterorenoscopes

9.2. Market Size (US$ Mn) Forecast, By End-user

9.2.1. Hospitals

9.2.2. Clinics

9.2.3. Ambulatory surgical centers

9.3. Urolithiasis Management Devices Market Attractiveness Analysis

9.3.1. By Device Type

9.3.2. By End-user

9.3.3. By Country

9.4. Germany Urolithiasis Management Devices Market Analysis and Forecast

9.4.1. Market Size (US$ Mn) Forecast, By Device Type

9.4.1.1. Shock Wave Lithotripters

9.4.1.1.1. Intracorporeal lithotripter

9.4.1.1.1.1. Ultrasound Lithotripter

9.4.1.1.1.2. Pneumatic Lithotripter

9.4.1.1.1.3. Laser Lithotripter

9.4.1.1.2. Extracorporeal lithotripter

9.4.1.2. Ureterorenoscopes

9.4.1.2.1. Rigid Ureterorenoscopes

9.4.1.2.2. Semi Rigid Ureterorenoscopes

9.4.1.2.3. Flexible Ureterorenoscopes

9.4.2. Market Size (US$ Mn) Forecast, By End-user

9.4.2.1. Hospitals

9.4.2.2. Clinics

9.4.2.3. Ambulatory surgical centers

9.5. France Urolithiasis Management Devices Market Analysis and Forecast

9.5.1. Market Size (US$ Mn) Forecast, By Device Type

9.5.1.1. Shock Wave Lithotripters

9.5.1.1.1. Intracorporeal lithotripter

9.5.1.1.1.1. Ultrasound Lithotripter

9.5.1.1.1.2. Pneumatic Lithotripter

9.5.1.1.1.3. Laser Lithotripter

9.5.1.1.2. Extracorporeal lithotripter

9.5.1.2. Ureterorenoscopes

9.5.1.2.1. Rigid Ureterorenoscopes

9.5.1.2.2. Semi Rigid Ureterorenoscopes

9.5.1.2.3. Flexible Ureterorenoscopes

9.5.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

9.5.2.1. Hospitals

9.5.2.2. Clinics

9.5.2.3. Ambulatory surgical centers

9.6. U.K Urolithiasis Management Devices Market Analysis and Forecast

9.6.1. Market Size (US$ Mn) Forecast, By Device Type

9.6.1.1. Shock Wave Lithotripters

9.6.1.1.1. Intracorporeal lithotripter

9.6.1.1.1.1. Ultrasound Lithotripter

9.6.1.1.1.2. Pneumatic Lithotripter

9.6.1.1.1.3. Laser Lithotripter

9.6.1.1.2. Extracorporeal lithotripter

9.6.1.2. Ureterorenoscopes

9.6.1.2.1. Rigid Ureterorenoscopes

9.6.1.2.2. Semi Rigid Ureterorenoscopes

9.6.1.2.3. Flexible Ureterorenoscopes

9.6.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

9.6.2.1. Hospitals

9.6.2.2. Clinics

9.6.2.3. Ambulatory surgical centers

9.7. Spain Urolithiasis Management Devices Market Analysis and Forecast

9.7.1. Market Size (US$ Mn) Forecast, By Device Type

9.7.1.1. Shock Wave Lithotripters

9.7.1.1.1. Intracorporeal lithotripter

9.7.1.1.1.1. Ultrasound Lithotripter

9.7.1.1.1.2. Pneumatic Lithotripter

9.7.1.1.1.3. Laser Lithotripter

9.7.1.1.2. Extracorporeal lithotripter

9.7.1.2. Ureterorenoscopes

9.7.1.2.1. Rigid Ureterorenoscopes

9.7.1.2.2. Semi Rigid Ureterorenoscopes

9.7.1.2.3. Flexible Ureterorenoscopes

9.7.2. Market Size (US$ Mn) Forecast, By End-user

9.7.2.1. Hospitals

9.7.2.2. Clinics

9.7.2.3. Ambulatory surgical centers

9.8. Italy Urolithiasis Management Devices Market Analysis and Forecast

9.8.1. Market Size (US$ Mn) Forecast, By Device Type

9.8.1.1. Shock Wave Lithotripters

9.8.1.1.1. Intracorporeal lithotripter

9.8.1.1.1.1. Ultrasound Lithotripter

9.8.1.1.1.2. Pneumatic Lithotripter

9.8.1.1.1.3. Laser Lithotripter

9.8.1.1.2. Extracorporeal lithotripter

9.8.1.2. Ureterorenoscopes

9.8.1.2.1. Rigid Ureterorenoscopes

9.8.1.2.2. Semi Rigid Ureterorenoscopes

9.8.1.2.3. Flexible Ureterorenoscopes

9.8.2. Market Size (US$ Mn) Forecast, By End-user

9.8.2.1. Hospitals

9.8.2.2. Clinics

9.8.2.3. Ambulatory surgical centers

10. Asia Pacific Urolithiasis Management Devices Market Analysis and Forecast

10.1. Market Size (US$ Mn) Forecast, By Device Type

10.1.1. Shock Wave Lithotripters

10.1.1.1. Intracorporeal lithotripter

10.1.1.1.1. Ultrasound Lithotripter

10.1.1.1.2. Pneumatic Lithotripter

10.1.1.1.3. Laser Lithotripter

10.1.1.2. Extracorporeal lithotripter

10.1.2. Ureterorenoscopes

10.1.2.1. Rigid Ureterorenoscopes

10.1.2.2. Semi Rigid Ureterorenoscopes

10.1.2.3. Flexible Ureterorenoscopes

10.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

10.2.1. Hospitals

10.2.2. Clinics

10.2.3. Ambulatory surgical centers

10.3. Urolithiasis Management Devices Market Attractiveness Analysis

10.3.1. By Device Type

10.3.2. By End-user

10.3.3. By Country

10.4. India Urolithiasis Management Devices Market Analysis and Forecast

10.4.1. Market Size (US$ Mn) Forecast, By Device Type

10.4.1.1. Shock Wave Lithotripters

10.4.1.1.1. Intracorporeal lithotripter

10.4.1.1.1.1. Ultrasound Lithotripter

10.4.1.1.1.2. Pneumatic Lithotripter

10.4.1.1.1.3. Laser Lithotripter

10.4.1.1.2. Extracorporeal lithotripter

10.4.1.2. Ureterorenoscopes

10.4.1.2.1. Rigid Ureterorenoscopes

10.4.1.2.2. Semi Rigid Ureterorenoscopes

10.4.1.2.3. Flexible Ureterorenoscopes

10.4.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

10.4.2.1. Hospitals

10.4.2.2. Clinics

10.4.2.3. Ambulatory surgical centers

10.5. China Urolithiasis Management Devices Market Analysis and Forecast

10.5.1. Market Size (US$ Mn) Forecast, By Device Type

10.5.1.1. Shock Wave Lithotripters

10.5.1.1.1. Intracorporeal lithotripter

10.5.1.1.1.1. Ultrasound Lithotripter

10.5.1.1.1.2. Pneumatic Lithotripter

10.5.1.1.1.3. Laser Lithotripter

10.5.1.1.2. Extracorporeal lithotripter

10.5.1.2. Ureterorenoscopes

10.5.1.2.1. Rigid Ureterorenoscopes

10.5.1.2.2. Semi Rigid Ureterorenoscopes

10.5.1.2.3. Flexible Ureterorenoscopes

10.5.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

10.5.2.1. Hospitals

10.5.2.2. Clinics

10.5.2.3. Ambulatory surgical centers

10.6. Japan Urolithiasis Management Devices Market Analysis and Forecast

10.6.1. Market Size (US$ Mn) Forecast, By Device Type

10.6.1.1. Shock Wave Lithotripters

10.6.1.1.1. Intracorporeal lithotripter

10.6.1.1.1.1. Ultrasound Lithotripter

10.6.1.1.1.2. Pneumatic Lithotripter

10.6.1.1.1.3. Laser Lithotripter

10.6.1.1.2. Extracorporeal lithotripter

10.6.1.2. Ureterorenoscopes

10.6.1.2.1. Rigid Ureterorenoscopes

10.6.1.2.2. Semi Rigid Ureterorenoscopes

10.6.1.2.3. Flexible Ureterorenoscopes

10.6.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

10.6.2.1. Hospitals

10.6.2.2. Clinics

10.6.2.3. Ambulatory surgical centers

10.7. Australia and New Zealand Urolithiasis Management Devices Market Analysis and Forecast

10.7.1. Market Size (US$ Mn) Forecast, By Device Type

10.7.1.1. Shock Wave Lithotripters

10.7.1.1.1. Intracorporeal lithotripter

10.7.1.1.1.1. Ultrasound Lithotripter

10.7.1.1.1.2. Pneumatic Lithotripter

10.7.1.1.1.3. Laser Lithotripter

10.7.1.1.2. Extracorporeal lithotripter

10.7.1.2. Ureterorenoscopes

10.7.1.2.1. Rigid Ureterorenoscopes

10.7.1.2.2. Semi Rigid Ureterorenoscopes

10.7.1.2.3. Flexible Ureterorenoscopes

10.7.2. Market Size (US$ Mn) Forecast, By End-user

10.7.2.1. Hospitals

10.7.2.2. Clinics

10.7.2.3. Ambulatory surgical centers

10.8. Rest of APAC Urolithiasis Management Devices Market Analysis and Forecast

10.8.1. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By Device Type

10.8.1.1. Shock Wave Lithotripters

10.8.1.1.1. Intracorporeal lithotripter

10.8.1.1.1.1. Ultrasound Lithotripter

10.8.1.1.1.2. Pneumatic Lithotripter

10.8.1.1.1.3. Laser Lithotripter

10.8.1.1.2. Extracorporeal lithotripter

10.8.1.2. Ureterorenoscopes

10.8.1.2.1. Rigid Ureterorenoscopes

10.8.1.2.2. Semi Rigid Ureterorenoscopes

10.8.1.2.3. Flexible Ureterorenoscopes

10.8.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

10.8.2.1. Hospitals

10.8.2.2. Clinics

10.8.2.3. Ambulatory surgical centers

11. Latin America Urolithiasis Management Devices Market Analysis and Forecast

11.1. Market Size (US$ Mn) Forecast, By Device Type

11.1.1. Shock Wave Lithotripters

11.1.1.1. Intracorporeal lithotripter

11.1.1.1.1. Ultrasound Lithotripter

11.1.1.1.2. Pneumatic Lithotripter

11.1.1.1.3. Laser Lithotripter

11.1.1.2. Extracorporeal lithotripter

11.1.2. Ureterorenoscopes

11.1.2.1. Rigid Ureterorenoscopes

11.1.2.2. Semi Rigid Ureterorenoscopes

11.1.2.3. Flexible Ureterorenoscopes

11.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

11.2.1. Hospitals

11.2.2. Clinics

11.2.3. Ambulatory surgical centers

11.3. Urolithiasis Management Devices Market Attractiveness Analysis

11.3.1. By Device Type

11.3.2. By End-user

11.3.3. By Country

11.4. Brazil Urolithiasis Management Devices Market Analysis and Forecast

11.4.1. Market Size (US$ Mn) Forecast, By Device Type

11.4.1.1. Shock Wave Lithotripters

11.4.1.1.1. Intracorporeal lithotripter

11.4.1.1.1.1. Ultrasound Lithotripter

11.4.1.1.1.2. Pneumatic Lithotripter

11.4.1.1.1.3. Laser Lithotripter

11.4.1.1.2. Extracorporeal lithotripter

11.4.1.2. Ureterorenoscopes

11.4.1.2.1. Rigid Ureterorenoscopes

11.4.1.2.2. Semi Rigid Ureterorenoscopes

11.4.1.2.3. Flexible Ureterorenoscopes

11.4.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

11.4.2.1. Hospitals

11.4.2.2. Clinics

11.4.2.3. Ambulatory surgical centers

11.5. Mexico Urolithiasis Management Devices Market Analysis and Forecast

11.5.1. Market Size (US$ Mn) Forecast, By Device Type

11.5.1.1. Shock Wave Lithotripters

11.5.1.1.1. Intracorporeal lithotripter

11.5.1.1.1.1. Ultrasound Lithotripter

11.5.1.1.1.2. Pneumatic Lithotripter

11.5.1.1.1.3. Laser Lithotripter

11.5.1.1.2. Extracorporeal lithotripter

11.5.1.2. Ureterorenoscopes

11.5.1.2.1. Rigid Ureterorenoscopes

11.5.1.2.2. Semi Rigid Ureterorenoscopes

11.5.1.2.3. Flexible Ureterorenoscopes

11.5.2. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By End-user

11.5.2.1. Hospitals

11.5.2.2. Clinics

11.5.2.3. Ambulatory surgical centers

11.6. Rest of LATAM Urolithiasis Management Devices Market Analysis and Forecast

11.6.1. Urolithiasis Management Devices Market Size (US$ Mn) Forecast, By Device Type

11.6.1.1. Shock Wave Lithotripters

11.6.1.1.1. Intracorporeal lithotripter

11.6.1.1.1.1. Ultrasound Lithotripter

11.6.1.1.1.2. Pneumatic Lithotripter

11.6.1.1.1.3. Laser Lithotripter

11.6.1.1.2. Extracorporeal lithotripter

11.6.1.2. Ureterorenoscopes

11.6.1.2.1. Rigid Ureterorenoscopes

11.6.1.2.2. Semi Rigid Ureterorenoscopes

11.6.1.2.3. Flexible Ureterorenoscopes

11.6.2. Market Size (US$ Mn) Forecast, By End-user

11.6.2.1. Hospitals

11.6.2.2. Clinics

11.6.2.3. Ambulatory surgical centers

12. Middle East and Africa Urolithiasis Management Devices Market Analysis and Forecast

12.1. Market Size (US$ Mn) Forecast, By Device Type

12.1.1. Shock Wave Lithotripters

12.1.1.1. Intracorporeal lithotripter

12.1.1.1.1. Ultrasound Lithotripter

12.1.1.1.2. Pneumatic Lithotripter

12.1.1.1.3. Laser Lithotripter

12.1.1.2. Extracorporeal lithotripter

12.1.2. Ureterorenoscopes

12.1.2.1. Rigid Ureterorenoscopes

12.1.2.2. Semi Rigid Ureterorenoscopes

12.1.2.3. Flexible Ureterorenoscopes

12.2. Market Size (US$ Mn) Forecast, By End-user

12.2.1. Hospitals

12.2.2. Clinics

12.2.3. Ambulatory surgical centers

12.3. Market Attractiveness Analysis

12.3.1. By Device Type

12.3.2. By End-user

12.3.3. By Country

12.4. South Africa Urolithiasis Management Devices Market Analysis and Forecast

12.4.1. Market Size (US$ Mn) Forecast, By Device Type

12.4.1.1. Shock Wave Lithotripters

12.4.1.1.1. Intracorporeal lithotripter

12.4.1.1.1.1. Ultrasound Lithotripter

12.4.1.1.1.2. Pneumatic Lithotripter

12.4.1.1.1.3. Laser Lithotripter

12.4.1.1.2. Extracorporeal lithotripter

12.4.1.2. Ureterorenoscopes

12.4.1.2.1. Rigid Ureterorenoscopes

12.4.1.2.2. Semi Rigid Ureterorenoscopes

12.4.1.2.3. Flexible Ureterorenoscopes

12.4.2. Market Size (US$ Mn) Forecast, By End-user

12.4.2.1. Hospitals

12.4.2.2. Clinics

12.4.2.3. Ambulatory surgical centers

12.5. Saudi Arabia Urolithiasis Management Devices Market Analysis and Forecast

12.5.1. Market Size (US$ Mn) Forecast, By Device Type

12.5.1.1. Shock Wave Lithotripters

12.5.1.1.1. Intracorporeal lithotripter

12.5.1.1.1.1. Ultrasound Lithotripter

12.5.1.1.1.2. Pneumatic Lithotripter

12.5.1.1.1.3. Laser Lithotripter

12.5.1.1.2. Extracorporeal lithotripter

12.5.1.2. Ureterorenoscopes

12.5.1.2.1. Rigid Ureterorenoscopes

12.5.1.2.2. Semi Rigid Ureterorenoscopes

12.5.1.2.3. Flexible Ureterorenoscopes

12.5.2. Market Size (US$ Mn) Forecast, By End-user

12.5.2.1. Hospitals

12.5.2.2. Clinics

12.5.2.3. Ambulatory surgical centers

12.6. UAE Urolithiasis Management Devices Market Analysis and Forecast

12.6.1. Market Size (US$ Mn) Forecast, By Device Type

12.6.1.1. Shock Wave Lithotripters

12.6.1.1.1. Intracorporeal lithotripter

12.6.1.1.1.1. Ultrasound Lithotripter

12.6.1.1.1.2. Pneumatic Lithotripter

12.6.1.1.1.3. Laser Lithotripter

12.6.1.1.2. Extracorporeal lithotripter

12.6.1.2. Ureterorenoscopes

12.6.1.2.1. Rigid Ureterorenoscopes

12.6.1.2.2. Semi Rigid Ureterorenoscopes

12.6.1.2.3. Flexible Ureterorenoscopes

12.6.2. Market Size (US$ Mn) Forecast, By End-user

12.6.2.1. Hospitals

12.6.2.2. Clinics

12.6.2.3. Ambulatory surgical centers

12.7. Rest of MEA Urolithiasis Management Devices Market Analysis and Forecast

12.7.1. Market Size (US$ Mn) Forecast, By Device Type

12.7.1.1. Shock Wave Lithotripters

12.7.1.1.1. Intracorporeal lithotripter

12.7.1.1.1.1. Ultrasound Lithotripter

12.7.1.1.1.2. Pneumatic Lithotripter

12.7.1.1.1.3. Laser Lithotripter

12.7.1.1.2. Extracorporeal lithotripter

12.7.1.2. Ureterorenoscopes

12.7.1.2.1. Rigid Ureterorenoscopes

12.7.1.2.2. Semi Rigid Ureterorenoscopes

12.7.1.2.3. Flexible Ureterorenoscopes

12.7.2. Market Size (US$ Mn) Forecast, By End-user

12.7.2.1. Hospitals

12.7.2.2. Clinics

12.7.2.3. Ambulatory surgical centers

13. Competition Landscape

13.1. Market Player – Competition Matrix (By Tier and Size of companies)

13.1.1. C. R. Bard, Inc.

13.1.2. Cook Group Inc.

13.1.3. Boston Scientific Corporation

13.1.4. Olympus Corporation

13.2. Market Share Analysis By Company (2015)

13.3. Company Profiles (Details – Overview, Financials, Recent Developments, Strategy)

13.3.1. Allengers Medical Systems Ltd

13.3.1.1. Company Details

13.3.1.2. Business Overview

13.3.1.3. Product Portfolio

13.3.1.4. Financial Overview

13.3.1.5. Business Strategies

13.3.1.6. Recent Developments

13.3.2. C.R. Bard, Inc.

13.3.2.1.1. Company Details

13.3.2.1.2. Business Overview

13.3.2.1.3. Product Portfolio

13.3.2.1.4. Financial Overview

13.3.2.1.5. Business Strategies

13.3.2.1.6. Recent Developments

13.3.3. Cook Group, Inc.

13.3.3.1.1. Company Details

13.3.3.1.2. Business Overview

13.3.3.1.3. Product Portfolio

13.3.3.1.4. Financial Overview

13.3.3.1.5. Business Strategies

13.3.3.1.6. Recent Developments

13.3.4. Dornier Medtech GmbH

13.3.4.1.1. Company Details

13.3.4.1.2. Business Overview

13.3.4.1.3. Product Portfolio

13.3.4.1.4. Financial Overview

13.3.4.1.5. Business Strategies

13.3.4.1.6. Recent Developments

13.3.5. Direx Group

13.3.5.1.1. Company Details

13.3.5.1.2. Business Overview

13.3.5.1.3. Product Portfolio

13.3.5.1.4. Financial Overview

13.3.5.1.5. Business Strategies

13.3.5.1.6. Recent Developments

13.3.6. Karl Storz GmbH & Co. KG

13.3.6.1.1. Company Details

13.3.6.1.2. Business Overview

13.3.6.1.3. Product Portfolio

13.3.6.1.4. Financial Overview

13.3.6.1.5. Business Strategies

13.3.6.1.6. Recent Developments

13.3.7. Boston Scientific Corporation

13.3.7.1.1. Company Details

13.3.7.1.2. Business Overview

13.3.7.1.3. Product Portfolio

13.3.7.1.4. Financial Overview

13.3.7.1.5. Business Strategies

13.3.7.1.

List of Tables

Table 01: Global Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2015–2024

Table 02: Global Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, By Device Type, 2015–2024

Table 03: Global Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2015–2024

Table 04: Global Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, By Device Type, 2015–2024

Table 05: Global Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by End-user, 2015–2024

Table 06: Global Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Region, 2014–2024

Table 07: North America Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 08: North America Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 09: North America Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 10: North America Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 11: North America Urolithiasis Management Device Market Size (US$ Mn) and Volume (Units) Forecast, by End-user, 2015–2024

Table 12: North America Urolithiasis Management Device Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2015–2024

Table 13: Europe Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 14: Europe Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 15: Europe Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 16: Europe Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device, 2015–2024

Table 17: Global Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by End-user, 2015–2024

Table 18: Europe Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2015–2024

Table 19: APAC Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 20: APAC Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 21: APAC Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 22: APAC Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 23: APAC Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by End-User, 2014–2024

Table 24: APAC Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

Table 25: LATAM Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 26: LATAM Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 27: LATAM Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 28: LATAM Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 29: LATAM Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by End-user, 2014–2024

Table 30: LATAM Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

Table 31: MEA Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 32: MEA Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 33: MEA Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 34: MEA Market Size (US$ Mn) and Volume (Units) Forecast, by Device Type, 2014–2024

Table 35: MEA Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, by End-user, 2014–2024

Table 36: MEA Urolithiasis Management DevicesMarket Size (US$ Mn) and Volume (Units) Forecast, by Country, 2014–2024

List of Figures

Figure 01: Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, 2014–2024

Figure 02: Urolithiasis Management Devices Average Price (US$/ Unit) 2014–2024

Figure 03: Urolithiasis Management Devices Market Value Share By Device Type (2016)

Figure 04: Market Value Share By End User (2016)

Figure 05: Urolithiasis Management DevicesMarket Value Share By Region (2016)

Figure 06: Global Urolithiasis Management Device Market Value Share Analysis, by Device Type, 2016 and 2024

Figure 07: Global Shockwave Lithotripter Market Size (US$ Mn), 2015–2024

Figure 08: Global Ureterorenoscopes Market Size (US$ Mn), 2015–2024

Figure 09: Urolithiasis Management Device Market Attractiveness Analysis, By Device Type

Figure 10: Hospitals Market (US$ Mn), 2014–2024

Figure 11: Clinics Market (US$ Mn) 2014–2024

Figure 12: Ambulatory surgical centers Market (US$ Mn), 2014–2024

Figure 13: Urolithiasis Management Device Market Attractiveness Analysis, by End-user

Figure 14: Global Urolithiasis Management Devices Market Value Share Analysis, by Region, 2016 and 2024

Figure 15: Urolithiasis Management Devices Market Attractiveness Analysis, by Region

Figure 16: North America Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 17: North America Urolithiasis Management Devices Market Attractiveness Analysis, by Country

Figure 18: North America Urolithiasis Management Devices Market Value Share Analysis, by Device, 2016 and 2024

Figure 19: North America Urolithiasis Management Devices Market Value Share Analysis, by End-user, 2016 and 2024

Figure 20: North America Urolithiasis Management Device Market Value Share Analysis, by Country, 2016 and 2024

Figure 21: By Device (US$ Mn), 2014–2024

Figure 22: By End-user (US$ Mn), 2014–2024

Figure 23: By Device (US$ Mn), 2014–2024

Figure 24: By End-user (US$ Mn), 2014–2024

Figure 25: North America Urolithiasis Management Devices Market Attractiveness Analysis, by Device Type, (2015)

Figure 26: North America Urolithiasis Management Devices Market Attractiveness Analysis, by End-User, (2015)

Figure 27: Europe Urolithiasis Management Device Market Size (US$ Mn) and Volume (Units) Forecast, 2015–2024

Figure 28: Europe Urolithiasis Management Devices Market Attractiveness Analysis, by Country (2015)

Figure 29: Europe Urolithiasis Management Devices Market Value Share Analysis, by Device, 2016 and 2024

Figure 30: Europe Urolithiasis Management Devices Market Value Share Analysis, by End-user, 2016 and 2024

Figure 31: Europe Urolithiasis Management Devices Market Value Share Analysis, by Country, 2016 and 2024

Figure 32: Urolithiasis Management Devices Market By Device (US$ Mn), 2014–2024

Figure 33: Urolithiasis Management Devices Market By End-user (US$ Mn), 2014–2024

Figure 34: By Device (US$ Mn), 2014–2024

Figure 35: By End-user (US$ Mn), 2014–2024

Figure 36: By Device (US$ Mn), 2014–2024

Figure 37: By End-user (US$ Mn), 2014–2024

Figure 38: By Device (US$ Mn), 2014–2024

Figure 39: Urolithiasis Management Devices Market By End-user (US$ Mn), 2014–2024

Figure 40: Urolithiasis Management Devices Market By Device (US$ Mn), 2014–2024

Figure 41: By End-user (US$ Mn), 2014–2024

Figure 42: By Device (US$ Mn), 2014–2024

Figure 43: Urolithiasis Management Devices By End-user (US$ Mn), 2014–2024

Figure 44: Europe Urolithiasis Management Devices Market Attractiveness Analysis, by Device Type, (2015)

Figure 45: Europe Market Attractiveness Analysis, by End-User, (2015)

Figure 46: APAC Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, 2014–2024

Figure 47: APAC Urolithiasis Management Devices Market Attractiveness, by Country

Figure 48: APAC Urolithiasis Management Devices Market Value Share Analysis, by Device Type, 2015 and 2024

Figure 49: APAC Urolithiasis Management Devices Market Value Share Analysis, by End-user, 2015 and 2024

Figure 50: APAC Urolithiasis Management Devices Market Value Share Analysis, by Country, 2015 and 2024

Figure 51: China Urolithiasis Management Devices Market By Device, US$ Mn, 2014–2024

Figure 52: China Urolithiasis Management Devices Market By End-user, US$ Mn, 2014–2024

Figure 53: Japan Urolithiasis Management Devices Market By Device, US$ Mn, 2014–2024

Figure 54: Japan Urolithiasis Management Devices Market By End-user, US$ Mn, 2014–2024

Figure 55: India Urolithiasis Management Devices Market By Device, US$ Mn, 2014–2024

Figure 56: India Urolithiasis Management Devices Market By End-user, US$ Mn, 2014–2024

Figure 57: Australia and New Zealand Urolithiasis Management Devices Market By Device, US$ Mn, 2014–2024

Figure 58: Australia and New Zealand Urolithiasis Management Devices Market By End-user, US$ Mn, 2014–2024

Figure 59: Rest of APAC Urolithiasis Management Devices Market By Device, US$ Mn, 2014–2024

Figure 60: Rest of APAC Urolithiasis Management Devices Market By End-user, US$ Mn, 2014–2024

Figure 61: APAC Urolithiasis Management Devices Market Attractiveness, by Device Type

Figure 62: APAC Urolithiasis Management Devices Market Attractiveness, by End-user

Figure 63: LATAM Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, 2014–2024

Figure 64: LATAM Urolithiasis Management Devices Market Attractiveness, by Country, 2014–2024

Figure 65: LATAM Urolithiasis Management Devices Market Value Share Analysis, by Device Type, 2015 and 2024

Figure 66: LATAM Urolithiasis Management Devices Market Value Share Analysis, by End-user, 2015 and 2024

Figure 67: LATAM Urolithiasis Management Devices Market Value Share Analysis, by Country, 2015 and 2024

Figure 68: By Device Type, (US$ Mn), 2014–2024

Figure 69: By End-user, (US$ Mn), 2014–2024

Figure 70: By Device Type, (US$ Mn) 2014–2024

Figure 71: By End-user, (US$ Mn) 2014–2024

Figure 72: By Device Type, (US$ Mn), 2014–2024

Figure 73: By End-user, (US$ Mn), 2014–2024

Figure 74: LATAM Urolithiasis Management Devices Market Attractiveness Analysis, by Device Type

Figure 75: LATAM Urolithiasis Management Devices Market Attractiveness Analysis, by End-user

Figure 76: MEA Urolithiasis Management Devices Market Size (US$ Mn) and Volume (Units) Forecast, 2014–2024

Figure 77: MEA Urolithiasis Management Devices Market Attractiveness Analysis, by Country, 2014–2024

Figure 78: MEA Market Value Share Analysis, by Device, 2015 and 2024

Figure 79: Middle East & Africa Urolithiasis Management Devices Market Value Share Analysis, by End-user, 2015 and 2024

Figure 80: MEA Market Value Share Analysis, by Country, 2015 and 2024

Figure 81: By Device (US$ Mn), 2014–2024

Figure 82: By End-user (US$ Mn), 2014-2024

Figure 83: UAE Urolithiasis Management Devices Market Analysis, by Device (US$ Mn), 2014–2024

Figure 84: UAE Urolithiasis Management Devices Market Analysis, by End-user (US$ Mn), 2014–2024

Figure 85: South Africa Urolithiasis Management Devices Market Analysis, by Device (US$ Mn), 2014-2024

Figure 86: South Africa Urolithiasis Management Devices Market Analysis, by End-user (US$ Mn) 2014-2024

Figure 87: North Africa Urolithiasis Management Devices Market Analysis, by Device (US$ Mn), 2014–2024

Figure 88: North Africa Urolithiasis Management Devices Market Analysis, by End-user, US$ Mn, 2014–2024

Figure 89: Rest of Middle East & Africa Urolithiasis Management Devices Market Analysis, by Device (US$ Mn), 2014–2024

Figure 90: Rest of Middle East & Africa Urolithiasis Management Devices Market Analysis, by End-user, US$ Mn, 2014–2024

Figure 91: MEA Urolithiasis Management Devices Market Attractiveness, by Device Type, 2014–2024

Figure 92: MEA Urolithiasis Management Devices Market Attractiveness, by End-user, 2014–2024