Analyst Viewpoint

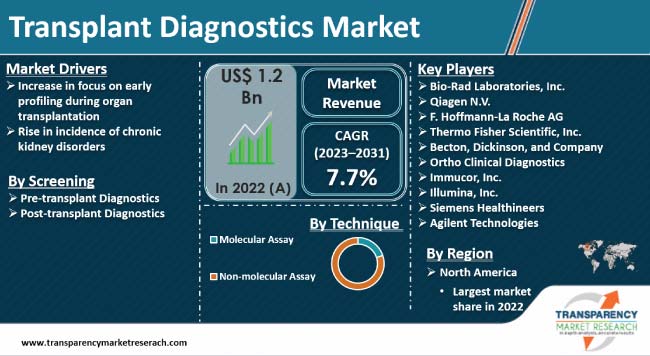

Increase in focus on early profiling during organ transplantation and rise in incidence of chronic kidney disorders are propelling the transplant diagnostics market size. Early profiling and organ transplant monitoring are gaining traction among healthcare professionals to minimize the risk of rejection and improve overall transplant outcomes.

Transplantation is a viable and often preferred treatment option for patients suffering from chronic kidney diseases. R&D in noninvasive transplant diagnostic methods, immunosuppressive medications, and post-transplant care is likely to offer lucrative opportunities to players in the global transplant diagnostics industry. Vendors are developing novel assays and antigen products to expand their product portfolio.

Transplant diagnostics are tests and procedures performed before, during, and after organ transplantation. They ensure the compatibility between the donor organ and the recipient's immune system. Rise in risk of organ rejection is boosting demand for transplant diagnostics.

Organizations across the globe are promoting organ harvesting, which is fueling the number of donated organs. Next Generation Sequencing (NGS) technology has had a significant impact on organ transplantation. NGS is utilized for high-resolution typing of Human Leukocyte Antigens (HLA), which are crucial for immune system compatibility.

High costs associated with transplant diagnostic procedures, such as histocompatibility tests, genomic profiling, and blood profiling, are projected to limit the transplant diagnostics market growth in the near future. These procedures are conducted through exclusive molecular diagnostic platforms, which leads to high costs. Moreover, there are various challenges in integrating these technologies with traditional PCR/NGS instruments. There is a noticeable gap between the number of organs needed and the number of organs donated. These factors are estimated to restrain the transplant diagnostics industry progress during the forecast period.

Healthcare professionals are relentlessly investigating the potential of biomarkers in organ transplantation for improving patient outcomes and the overall success of transplant procedures. Biomarkers provide valuable information about the status of the transplanted organ and the recipient's immune response.

Rise in focus on early profiling during organ transplantation is boosting demand for transplant diagnostics. Early profiling involves the systematic assessment of various factors including genetic, molecular, and clinical markers. It helps healthcare professionals to draft patient-specific transplant procedures and post-transplant care. Hence, growth in focus on demonstration and validation of the clinical utility of biomarkers is driving the transplant diagnostics market trajectory.

Chronic kidney disease implies a progressive condition that affects more than 10% of the global population. The disease is more prevalent among women, elderly people, and those suffering from hypertension and diabetes mellitus. The adversities related to chronic kidney diseases require improvised efforts for better treatment. Kidney transplantation kidney transplantation improves the quality of life compared to long-term dialysis. As per the National Institute of Diabetes and Digestive and Kidney Disequencingases (NIDDK), 661,000 people in the U.S. suffer from kidney failure. Thus, surge in cases of chronic kidney disease is driving the transplant diagnostics market expansion.

According to the latest transplant diagnostics market trends, North America held largest share in 2022. Rise in investment in R&D for organ transplantation is fueling the market dynamics of the region. According to The National Institute of Health, funding for research in transplantation was US$ 735 Mn in 2022. Additionally, as per the Organ Donation Statistics, over 40,000 organ transplantations were conducted in the U.S. in 2021.

According to the latest transplant diagnostics market forecast, the industry in Europe is estimated to grow at a steady pace during the forecast period. Rise in expenditure in healthcare sector and availability of smoother applications in all transplantation processes and donor-recipient relationships are boosting the market landscape in Europe.

Increase in investment in advanced healthcare infrastructure is propelling the transplant diagnostics market value in Asia Pacific. India and China are major markets for transplant diagnostics due to growth in prevalence of chronic diseases. However, cultural considerations in Hong Kong, Japan, and Philippines may impact attitudes toward organ transplantation. People in these countries emphasize ancestor worship and respect for the deceased and do not believe in parting with their organs after death.

Major players are investing in R&D and launch of new products to expand their product portfolio and increase their transplant diagnostics market share. Bio-Rad Laboratories, Inc., Qiagen N.V., F. Hoffmann-La Roche AG, Thermo Fisher Scientific, Inc., Becton, Dickinson, and Company, Ortho Clinical Diagnostics, Immucor, Inc., Illumina, Inc., Siemens Healthineers, and Agilent Technologies are major companies operating in this market.

These companies have been profiled in the transplant diagnostics industry report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Size in 2022 | US$ 1.2 Bn |

| Market Forecast (Value) in 2031 | US$ 2.3 Bn |

| Growth Rate (CAGR) | 7.7% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.2 Bn in 2022

It is projected to grow at a CAGR of 7.7% from 2023 to 2031

Increase in focus on early profiling during organ transplantation and rise in incidence of chronic kidney disorders

North America is estimated to dominate in the next few years

Bio-Rad Laboratories, Inc., Qiagen N.V., F. Hoffmann-La Roche AG, Thermo Fisher Scientific, Inc., Becton, Dickinson, and Company, Ortho Clinical Diagnostics, Immucor, Inc., Illumina, Inc., Siemens Healthineers, and Agilent Technologies

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Transplant Diagnostics Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Transplant Diagnostics Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Transplant Diagnostics Market Analysis and Forecast, by Screening

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Screening, 2017–2031

6.3.1. Pre-transplant Diagnostics

6.3.2. Post-transplant Diagnostics

6.4. Market Attractiveness, by Screening

7. Global Transplant Diagnostics Market Analysis and Forecast, by Technique

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Technique, 2017–2031

7.3.1. Molecular Assay

7.3.2. Non-molecular Assay

7.3.3. 7.4 Market Attractiveness, by Technique

8. Global Transplant Diagnostics Market Analysis and Forecast, by Application

8.1. Introduction and Definitions

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Solid Organ Transplantation

8.3.1.1. Kidney

8.3.1.2. Liver

8.3.1.3. Heart

8.3.1.4. Lungs

8.3.1.5. Pancreas

8.3.1.6. Small Bowel

8.3.2. Stem Cell Transplantation

8.4. Market Attractiveness, by Application

9. Global Transplant Diagnostics Market Analysis and Forecast, by Products & Services

9.1. Introduction and Definitions

9.2. Key Findings/Developments

9.3. Market Value Forecast, by Products & Services, 2017–2031

9.3.1. Reagents & Consumables

9.3.2. Instruments

9.3.3. Software & Services

9.4. Market Attractiveness, by Products & Services

10. Global Transplant Diagnostics Market Analysis and Forecast, by End-user

10.1. Introduction and Definitions

10.2. Key Findings/Developments

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals & Transplant Centers

10.3.2. Research Laboratories

10.3.3. Others

10.4. Market Attractiveness, by End-user

11. Global Transplant Diagnostics Market Analysis and Forecast, by Region

11.1. Key Findings

11.2. Market Value Forecast, by Region, 2017–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness, by Region

12. North America Transplant Diagnostics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Screening, 2017–2031

12.2.1. Pre-transplant Diagnostics

12.2.2. Post-transplant Diagnostics

12.3. Market Attractiveness, by Screening

12.4. Market Value Forecast, by Technique, 2017–2031

12.4.1. Molecular Assay

12.4.2. Non-molecular Assay

12.5. Market Attractiveness, by Technique

12.6. Market Value Forecast, by Application, 2017–2031

12.6.1. Solid Organ Transplantation

12.6.1.1. Kidney

12.6.1.2. Liver

12.6.1.3. Heart

12.6.1.4. Lungs

12.6.1.5. Pancreas

12.6.1.6. Small Bowel

12.6.2. Stem Cell Transplantation

12.7. Market Attractiveness, by Application

12.8. Market Value Forecast, by Products & Services, 2017–2031

12.8.1. Reagents & Consumables

12.8.2. Instruments

12.8.3. Software & Services

12.9. Market Attractiveness, by Products & Services

12.10. Market Value Forecast, by End-user, 2017–2031

12.10.1. Hospitals & Transplant Centers

12.10.2. Research Laboratories

12.10.3. Others

12.11. Market Attractiveness, by End-user

12.12. Market Value Forecast, by Country/Sub-region, 2017–2031

12.12.1. U.S.

12.12.2. Canada

12.13. Market Attractiveness Analysis

12.13.1. By Screening

12.13.2. By Technique

12.13.3. By Application

12.13.4. By Products & Services

12.13.5. By End-user

12.13.6. By Country

13. Europe Transplant Diagnostics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Screening, 2017–2031

13.2.1. Pre-transplant Diagnostics

13.2.2. Post-transplant Diagnostics

13.3. Market Attractiveness, by Screening

13.4. Market Value Forecast, by Technique, 2017–2031

13.4.1. Molecular Assay

13.4.2. Non-molecular Assay

13.5. Market Attractiveness, by Technique

13.6. Market Value Forecast, by Application, 2017–2031

13.6.1. Solid Organ Transplantation

13.6.1.1. Kidney

13.6.1.2. Liver

13.6.1.3. Heart

13.6.1.4. Lungs

13.6.1.5. Pancreas

13.6.1.6. Small Bowel

13.6.2. Stem Cell Transplantation

13.7. Market Attractiveness, by Application

13.8. Market Value Forecast, by Products & Services, 2017–2031

13.8.1. Reagents & Consumables

13.8.2. Instruments

13.8.3. Software & Services

13.9. Market Attractiveness, by Products & Services

13.10. Market Value Forecast, by End-user, 2017–2031

13.10.1. Hospitals & Transplant Centers

13.10.2. Research Laboratories

13.10.3. Others

13.11. Market Attractiveness, by End-user

13.12. Market Value Forecast, by Country/Sub-region, 2017–2031

13.12.1. Germany

13.12.2. U.K.

13.12.3. France

13.12.4. Italy

13.12.5. Spain

13.12.6. Rest of Europe

13.13. Market Attractiveness Analysis

13.13.1. By Screening

13.13.2. By Technique

13.13.3. By Application

13.13.4. By Products & Services

13.13.5. By End-user

13.13.6. By Country/Sub-region

14. Asia Pacific Transplant Diagnostics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Screening, 2017–2031

14.2.1. Pre-transplant Diagnostics

14.2.2. Post-transplant Diagnostics

14.3. Market Attractiveness, by Screening

14.4. Market Value Forecast, by Technique, 2017–2031

14.4.1. Molecular Assay

14.4.2. Non-molecular Assay

14.5. Market Attractiveness, by Technique

14.6. Market Value Forecast, by Application, 2017–2031

14.6.1. Solid Organ Transplantation

14.6.1.1. Kidney

14.6.1.2. Liver

14.6.1.3. Heart

14.6.1.4. Lungs

14.6.1.5. Pancreas

14.6.1.6. Small Bowel

14.6.2. Stem Cell Transplantation

14.7. Market Attractiveness, by Application

14.8. Market Value Forecast, by Products & Services, 2017–2031

14.8.1. Reagents & Consumables

14.8.2. Instruments

14.8.3. Software & Services

14.9. Market Attractiveness, by Products & Services

14.10. Market Value Forecast, by End-user, 2017–2031

14.10.1. Hospitals & Transplant Centers

14.10.2. Research Laboratories

14.10.3. Others

14.11. Market Attractiveness, by End-user

14.12. Market Value Forecast, by Country/Sub-region, 2017–2031

14.12.1. China

14.12.2. Japan

14.12.3. India

14.12.4. Australia & New Zealand

14.12.5. Rest of Asia Pacific

14.13. Market Attractiveness Analysis

14.13.1. By Screening

14.13.2. By Technique

14.13.3. By Application

14.13.4. By Products & Services

14.13.5. By End-user

14.13.6. By Country/Sub-region

15. Latin America Transplant Diagnostics Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Screening, 2017–2031

15.2.1. Pre-transplant Diagnostics

15.2.2. Post-transplant Diagnostics

15.3. Market Attractiveness, by Screening

15.4. Market Value Forecast, by Technique, 2017–2031

15.4.1. Molecular Assay

15.4.2. Non-molecular Assay

15.5. Market Attractiveness, by Technique

15.6. Market Value Forecast, by Application, 2017–2031

15.6.1. Solid Organ Transplantation

15.6.1.1. Kidney

15.6.1.2. Liver

15.6.1.3. Heart

15.6.1.4. Lungs

15.6.1.5. Pancreas

15.6.1.6. Small Bowel

15.6.2. Stem Cell Transplantation

15.7. Stem Cell Transplantation Market Attractiveness, by Application

15.8. Market Value Forecast, by Products & Services, 2017–2031

15.8.1. Reagents & Consumables

15.8.2. Instruments

15.8.3. Software & Services

15.9. Market Attractiveness, by Products & Services

15.10. Market Value Forecast, by End-user, 2017–2031

15.10.1. Hospitals & Transplant Centers

15.10.2. Research Laboratories

15.10.3. Others

15.11. Market Attractiveness, by End-user

15.12. Market Value Forecast, by Country/Sub-region, 2017–2031

15.12.1. Brazil

15.12.2. Mexico

15.12.3. Rest of Latin America

15.13. Market Attractiveness Analysis

15.13.1. By Screening

15.13.2. By Technique

15.13.3. By Application

15.13.4. By Products & Services

15.13.5. By End-user

15.13.6. By Country/Sub-region

16. Middle East & Africa Transplant Diagnostics Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast, by Screening, 2017–2031

16.2.1. Pre-transplant Diagnostics

16.2.2. Post-transplant Diagnostics

16.3. Market Attractiveness, by Screening

16.4. Market Value Forecast, by Technique, 2017–2031

16.4.1. Molecular Assay

16.4.2. Non-molecular Assay

16.5. Market Attractiveness, by Technique

16.6. Market Value Forecast, by Application, 2017–2031

16.6.1. Solid Organ Transplantation

16.6.1.1. Kidney

16.6.1.2. Liver

16.6.1.3. Heart

16.6.1.4. Lungs

16.6.1.5. Pancreas

16.6.1.6. Small Bowel

16.6.2. Stem Cell Transplantation

16.7. Market Attractiveness, by Application

16.8. Market Value Forecast, by Products & Services, 2017–2031

16.8.1. Reagents & Consumables

16.8.2. Instruments

16.8.3. Software & Services

16.9. Market Attractiveness, by Products & Services

16.10. Market Value Forecast, by End-user, 2017–2031

16.10.1. Hospitals & Transplant Centers

16.10.2. Research Laboratories

16.10.3. Others

16.11. Market Attractiveness, by End-user

16.12. Market Value Forecast, by Country/Sub-region, 2017–2031

16.12.1. GCC Countries

16.12.2. South Africa

16.12.3. Rest of Middle East & Africa

16.13. Market Attractiveness Analysis

16.13.1. By Screening

16.13.2. By Technique

16.13.3. By Application

16.13.4. By Products & Services

16.13.5. By End-user

16.13.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of Companies)

17.2. Market Share Analysis, by Company (2022)

17.3. Company Profiles

17.3.1. Bio-Rad laboratories, Inc.

17.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.1.2. Product Portfolio

17.3.1.3. Financial Overview

17.3.1.4. SWOT Analysis

17.3.1.5. Strategic Overview

17.3.2. Qiagen N.V.

17.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.2.2. Product Portfolio

17.3.2.3. Financial Overview

17.3.2.4. SWOT Analysis

17.3.2.5. Strategic Overview

17.3.3. F. Hoffmann-La Roche AG

17.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.3.2. Product Portfolio

17.3.3.3. Financial Overview

17.3.3.4. SWOT Analysis

17.3.3.5. Strategic Overview

17.3.4. Thermo Fisher Scientific, Inc.

17.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.4.2. Product Portfolio

17.3.4.3. Financial Overview

17.3.4.4. SWOT Analysis

17.3.4.5. Strategic Overview

17.3.5. Becton, Dickinson and Company

17.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.5.2. Product Portfolio

17.3.5.3. Financial Overview

17.3.5.4. SWOT Analysis

17.3.5.5. Strategic Overview

17.3.6. Ortho Clinical Diagnostics

17.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.6.2. Product Portfolio

17.3.6.3. Financial Overview

17.3.6.4. SWOT Analysis

17.3.6.5. Strategic Overview

17.3.7. Immucor, Inc.

17.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.7.2. Product Portfolio

17.3.7.3. Financial Overview

17.3.7.4. SWOT Analysis

17.3.7.5. Strategic Overview

17.3.8. Illumina, Inc.

17.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.8.2. Product Portfolio

17.3.8.3. Financial Overview

17.3.8.4. SWOT Analysis

17.3.8.5. Strategic Overview

17.3.9. Siemens Healthineers (Siemens AG)

17.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.9.2. Product Portfolio

17.3.9.3. Financial Overview

17.3.9.4. SWOT Analysis

17.3.9.5. Strategic Overview

17.3.10. Agilent Technologies

17.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

17.3.10.2. Product Portfolio

17.3.10.3. Financial Overview

17.3.10.4. SWOT Analysis

17.3.10.5. Strategic Overview

List of Tables

Table 01: Global Transplant Diagnostics Market Size (US$ Mn) Forecast, by Screening, 2017–2031

Table 02: Global Transplant Diagnostics Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 03: Global Transplant Diagnostics Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 04: Global Transplant Diagnostics Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 05: Global Transplant Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: Global Transplant Diagnostics Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 07: North America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 08: North America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Screening, 2017–2031

Table 09: North America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 10: North America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 11: North America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 12: North America Transplant Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Europe Transplant Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Europe Transplant Diagnostics Market Size (US$ Mn) Forecast, by Screening, 2017–2031

Table 15: Europe Transplant Diagnostics Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 16: Europe Transplant Diagnostics Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Europe Transplant Diagnostics Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 18: Europe Transplant Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 19: Asia Pacific Transplant Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 20: Asia Pacific Transplant Diagnostics Market Size (US$ Mn) Forecast, by Screening, 2017–2031

Table 21: Asia Pacific Transplant Diagnostics Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 22: Asia Pacific Transplant Diagnostics Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Asia Pacific Transplant Diagnostics Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 24: Asia Pacific Transplant Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 25: Latin America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 26: Latin America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Screening, 2017–2031

Table 27: Latin America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 28: Latin America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 29: Latin America Transplant Diagnostics Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 30: Latin America Transplant Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: Middle East & Africa Transplant Diagnostics Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 32: Middle East & Africa Transplant Diagnostics Market Size (US$ Mn) Forecast, by Screening, 2017–2031

Table 33: Middle East & Africa Transplant Diagnostics Market Size (US$ Mn) Forecast, by Technique, 2017–2031

Table 34: Middle East & Africa Transplant Diagnostics Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 35: Middle East & Africa Transplant Diagnostics Market Size (US$ Mn) Forecast, by Products & Services, 2017–2031

Table 36: Middle East & Africa Transplant Diagnostics Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Transplant Diagnostics Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Transplant Diagnostics Market Revenue (US$ Mn), by Screening, 2022

Figure 03: Global Transplant Diagnostics Market Value Share, by Screening, 2022

Figure 04: Global Transplant Diagnostics Market Revenue (US$ Mn), by Technique, 2022

Figure 05: Global Transplant Diagnostics Market Value Share, by Technique, 2022

Figure 06: Global Transplant Diagnostics Market Revenue (US$ Mn), by Application, 2022

Figure 07: Global Transplant Diagnostics Market Value Share, by Application, 2022

Figure 08: Global Transplant Diagnostics Market Revenue (US$ Mn), by Products & Services, 2022

Figure 09: Global Transplant Diagnostics Market Value Share, by Products & Services, 2022

Figure 10: Global Transplant Diagnostics Market Revenue (US$ Mn), by End-user, 2022

Figure 11: Global Transplant Diagnostics Market Value Share, by End-user, 2022

Figure 12: Global Transplant Diagnostics Market Value Share, by Region, 2022

Figure 13: Global Transplant Diagnostics Market Value (US$ Mn) Forecast, 2017–2031

Figure 14: Global Transplant Diagnostics Market Value Share Analysis, by Screening, 2022 and 2031

Figure 15: Global Transplant Diagnostics Market Attractiveness Analysis, by Screening, 2023-2031

Figure 16: Global Transplant Diagnostics Market Value Share Analysis, by Technique, 2022 and 2031

Figure 17: Global Transplant Diagnostics Market Attractiveness Analysis, by Technique, 2023-2031

Figure 18: Global Transplant Diagnostics Market Value Share Analysis, by Application, 2022 and 2031

Figure 19: Global Transplant Diagnostics Market Attractiveness Analysis, by Application, 2023-2031

Figure 20: Global Transplant Diagnostics Market Revenue (US$ Mn), by Products & Services, 2022

Figure 21: Global Transplant Diagnostics Market Value Share, by Products & Services, 2022

Figure 22: Global Transplant Diagnostics Market Revenue (US$ Mn), by End-user, 2022

Figure 23: Global Transplant Diagnostics Market Value Share, by End-user, 2022

Figure 24: Global Transplant Diagnostics Market Value Share Analysis, by Region, 2022 and 2031

Figure 25: Global Transplant Diagnostics Market Attractiveness Analysis, by Region, 2023-2031

Figure 26: North America Transplant Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 27: North America Transplant Diagnostics Market Attractiveness Analysis, by Country, 2023–2031

Figure 28: North America Transplant Diagnostics Market Value Share Analysis, by Country, 2022 and 2031

Figure 29: North America Transplant Diagnostics Market Value Share Analysis, by Screening, 2022 and 2031

Figure 30: North America Transplant Diagnostics Market Value Share Analysis, by Technique, 2022 and 2031

Figure 31: North America Transplant Diagnostics Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: North America Transplant Diagnostics Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 33: North America Transplant Diagnostics Market Value Share Analysis, by End-user, 2023 and 2031

Figure 34: North America Transplant Diagnostics Market Attractiveness Analysis, by Screening, 2023–2031

Figure 35: North America Transplant Diagnostics Market Attractiveness Analysis, by Technique, 2023–2031

Figure 36: North America Transplant Diagnostics Market Attractiveness Analysis, by Application, 2023–2031

Figure 37: North America Transplant Diagnostics Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 38: North America Transplant Diagnostics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 39: Europe Transplant Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 40: Europe Transplant Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 41: Europe Transplant Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Europe Transplant Diagnostics Market Value Share Analysis, by Screening, 2022 and 2031

Figure 43: Europe Transplant Diagnostics Market Value Share Analysis, by Technique, 2022 and 2031

Figure 44: Europe Transplant Diagnostics Market Value Share Analysis, by Application, 2022 and 2031

Figure 45: Europe Transplant Diagnostics Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 46: Europe Transplant Diagnostics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 47: Europe Transplant Diagnostics Market Attractiveness Analysis, by Screening, 2023–2031

Figure 48: Europe Transplant Diagnostics Market Attractiveness Analysis, by Technique, 2023–2031

Figure 49: Europe Transplant Diagnostics Market Attractiveness Analysis, by Application, 2023–2031

Figure 50: Europe Transplant Diagnostics Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 51: Europe Transplant Diagnostics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 52: Asia Pacific Transplant Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 53: Asia Pacific Transplant Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 54: Asia Pacific Transplant Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 55: Asia Pacific Transplant Diagnostics Market Value Share Analysis, by Screening, 2022 and 2031

Figure 56: Asia Pacific Transplant Diagnostics Market Value Share Analysis, by Technique, 2022 and 2031

Figure 57: Asia Pacific Transplant Diagnostics Market Value Share Analysis, by Application, 2022 and 2031

Figure 58: Asia Pacific Transplant Diagnostics Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 59: Asia Pacific Transplant Diagnostics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Asia Pacific Transplant Diagnostics Market Attractiveness Analysis, by Screening, 2023–2031

Figure 61: Asia Pacific Transplant Diagnostics Market Attractiveness Analysis, by Technique, 2023–2031

Figure 62: Asia Pacific Transplant Diagnostics Market Attractiveness Analysis, by Application, 2023–2031

Figure 63: Asia Pacific Transplant Diagnostics Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 64: Asia Pacific Transplant Diagnostics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 65: Latin America Transplant Diagnostics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 66: Latin America Transplant Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 67: Latin America Transplant Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 68: Latin America Transplant Diagnostics Market Value Share Analysis, by Screening, 2022 and 2031

Figure 69: Latin America Transplant Diagnostics Market Value Share Analysis, by Technique, 2022 and 2031

Figure 70: Latin America Transplant Diagnostics Market Value Share Analysis, by Application, 2022 and 2031

Figure 71: Latin America Transplant Diagnostics Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 72: Latin America Transplant Diagnostics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 73: Latin America Transplant Diagnostics Market Attractiveness Analysis, by Screening, 2023–2031

Figure 74: Latin America Transplant Diagnostics Market Attractiveness Analysis, by Technique, 2023–2031

Figure 75: Latin America Transplant Diagnostics Market Attractiveness Analysis, by Application, 2023–2031

Figure 76: Latin America Transplant Diagnostics Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 77: Latin America Transplant Diagnostics Market Attractiveness Analysis, by End-user, 2023–2031

Figure 78: Middle East & Africa Transplant Diagnostics Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 79: Middle East & Africa Transplant Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 80: Middle East & Africa Transplant Diagnostics Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 81: Middle East & Africa Transplant Diagnostics Market Value Share Analysis, by Screening, 2022 and 2031

Figure 82: Middle East & Africa Transplant Diagnostics Market Value Share Analysis, by Technique, 2022 and 2031

Figure 83: Middle East & Africa Transplant Diagnostics Market Value Share Analysis, by Application, 2022 and 2031

Figure 84: Middle East & Africa Transplant Diagnostics Market Value Share Analysis, by Products & Services, 2022 and 2031

Figure 85: Middle East & Africa Transplant Diagnostics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 86: Middle East & Africa Transplant Diagnostics Market Attractiveness Analysis, by Screening, 2023–2031

Figure 87: Middle East & Africa Transplant Diagnostics Market Attractiveness Analysis, by Technique, 2023–2031

Figure 88: Middle East & Africa Transplant Diagnostics Market Attractiveness Analysis, by Application, 2023–2031

Figure 89: Middle East & Africa Transplant Diagnostics Market Attractiveness Analysis, by Products & Services, 2023–2031

Figure 90: Middle East & Africa Transplant Diagnostics Market Attractiveness Analysis, by End-user, 2023–2031