Surgical sutures refer to a medical device that is used for the purpose of closure of most of the wound types. A suture should ideally enable the healing tissue to recover enough to hold the wound closures together once they are absorbed or removed.

The time that a healing tissue takes to do away with the use of sutures depends on the type of tissue. The global surgical sutures market is expected to be driven by increased effectiveness and safety of various surgeries owing to technological advancements. Various strategic decisions by market players such as partnerships and acquisitions for expanded network for distribution and product development are likely to boost the global surgical sutures market.

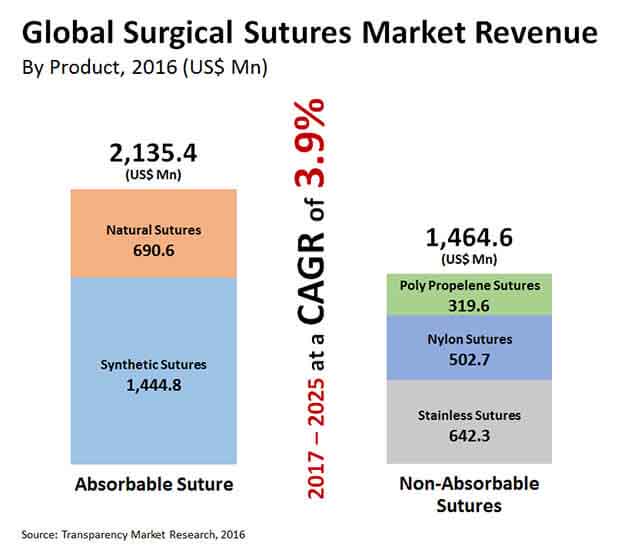

The global surgical sutures market is likely to register a growth rate of 3.9 % CAGR over the period of forecast, from 2017 to 2025.

Some of the key players in the global surgical sutures market comprise Internacional Farmaceutica S.A. De C.V, Internacional Farmaceutica S.A. De C.V., Medtronic Plc., B. Braun Melsungen AG, Hollister Incorporated, and Endoevolution LLC.

Relentless Research and Development Holds Key to the Market Growth

Over a period of time, significant developments in the field of surgical sutures such as development of advanced capabilities and materials, which exert considerable influence on the global surgical sutures market. A case in point is high biocompatibility enabled non-resorbable sutures like polytetrafluoroethylene (PTFE) sutures are used in the prevention of bacterial colonization and microdamage in the deep layers of any wound. These are smooth and soft in nature. Surgical knots that are produced utilizing polytetrafluoroethylene sutures do not get loose easily and last very long. Technological advancements are likely to work in favor of the global surgical sutures market over projection period.

In addition, development of surgical sutures equipped with advanced features such as elastic and electronic sutures, knotless barbed sutures, antimicrobial sutures, bioactive sutures, and antibacterial sutures. Bioactive sutures comprise stem cell-seeded and drug-eluting sutures. Availability of such feature rich surgical sutures is likely to boost the global surgical sutures market in near future.

The rising inclination toward minimally invasive surgeries is mainly owing to the advantages associated with this type of surgeries. The advantages of minimally invasive surgeries comprise less pain and bleeding, rapid recovery, and shorter stay at hospitals. The increasing preference for minimally invasive procedures over the regular procedures has reduced the utilization of surgical sutures, which is likely to pose challenge to the global surgical sutures market.

North America Likely to Lead the Market, Asia Pacific to Clock High Growth Rate

In a bid to offer a better understanding of the market, TMR analysts have divided the global surgical sutures market on the regional parameter. North America, Latin America, Asia Pacific, Middle East and Africa, and Europe are the major territories of the global surgical sutures market.

In terms of region, North America is expected to account for a leading share of the global surgical sutures market over the timeframe of projection, from 2017 to 2025. Territorial dominance of North America lies in the quick and high adoption of technologically advanced surgical sutures. In addition, increased prevalence of chronic diseases together with need for surgeries is estimated to drive the surgical sutures market in North America.

Asia Pacific is estimated to offer avenues of rapid expansion for the surgical sutures market in the region. The market is likely to be driven by countries like China, South Korea, and India due to increased investment in the healthcare infrastructure, rise in the disposable income of people, and the booming medical tourism in the region.

Surgical Sutures Market to Gain Impetus from Increasing Cases of Minimally Invasive Surgeries

The increasing number of surgical cases stands as a key factor boosting the global surgical sutures market. Surgical stitch or suture is a clinical gadget used to hold body tissues together after a physical issue or medical procedure. Application by and large includes utilizing a needle with a connected length of string. A stitch should in a perfect world empower the recuperating tissue to recuperate enough to hold the injury terminations together whenever they are consumed or eliminated.

The development of the worldwide surgical sutures market is significantly determined by flood in occurrence of mishaps, increment in consumption on medical care, coupled with the ascending popularity of corrective medical procedures, and improvement of cutting edge sutures, for example, film covered sutures. Nonetheless, ascent in inclination for negligibly intrusive surgical strategies and presence of elective injury care items go about as the major the market requirements. On the other hand, increment in mindfulness about novel medical procedures, flood in geriatric populace, and ascend popular for better medical care offices are relied upon to give rewarding freedoms to the surgical sutures market development during the conjecture time frame.

The rising tendency toward negligibly intrusive medical procedures is basically inferable from the benefits related with this kind of medical procedures. The upsides of negligibly intrusive medical procedures involve less torment and dying, fast recuperation, and more limited stay at emergency clinics. The expanding inclination for negligibly intrusive methods over the normal techniques has decreased the usage of surgical sutures, which is probably going to present test to the worldwide surgical sutures market.

The worldwide surgical sutures market is required to be driven by expanded viability and security of different medical procedures attributable to innovative headways. Different vital choices by market players, for example, organizations and acquisitions for extended organization for circulation and item improvement are probably going to support the worldwide surgical sutures market.

Global Surgical Sutures Market Segmentation

|

By Product |

|

|

By Application |

|

|

By End-user |

|

|

By Region |

|

Surgical sutures market is likely to register a growth rate of 3.9 % CAGR over the period of forecast, from 2017 to 2025

Surgical sutures market is driven by increased effectiveness and safety of various surgeries owing to technological advancements

The end-use segments in surgical sutures market are Hospitals, Specialty Clinics and Ambulatory Surgery Centers

North America is expected to account for a leading share of the global surgical sutures market over the timeframe of projection, from 2017 to 2025

Key players in the global surgical sutures market include Cardinal Health, Medela AG, Integra LifeSciences Corporation, Acelity L.P. Inc., and Smith and Nephew plc

Section 1: Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Section 2: Assumptions and Research Methodology

2.1 Assumptions

2.2 Research Methodology

Section 3: Executive Summary

3.1 Global Surgical Sutures: Market Snapshot

3.2 Global Market Share Analysis by Region, 2015

3.3 Global Surgical Sutures Market: Opportunity Map

Section 4: Market Overview

4.1 Product Overview

4.2 Global Surgical Sutures Market: Key Industry Developments

Section 5: Market Dynamics

5.1 Drivers and Restraints Snapshot Analysis

5.2 Drivers

5.3 Restraints

5.4 Opportunities

5.5 Porters Analysis

5.6 Value Chain Analysis

5.7 Surgical Sutures Market Outlook

Section 6: Surgical Sutures Market Analysis, by Product Type

6.1 Key Findings

6.2 Introduction

6.3 Global Surgical Sutures Market Value Share Analysis, by Product Type

6.4 Surgical Sutures Market Forecast, by Product Type

6.5 Surgical Sutures Market Analysis, by Product Type

6.5.1 Absorbable Sutures

6.5.1.1. Natural Sutures

6.5.1.2. Synthetic Sutures

6.5.2 Non-Absorbable Sutures

6.5.2.1. Nylon Sutures

6.5.2.2. Poly Propelene Sutures

5.5.2.3. Stainless Steel Sutures

6.6 Surgical Sutures Market Attractiveness Analysis By Product Type

6.6 Key Trends

Section 7: Surgical Sutures Market Analysis, by Application

7.1 Key Findings

7.2 Introduction

7.3 Global Surgical Sutures Market Value Share Analysis, by Application

7.4 Surgical Sutures Market Forecast, by Application

7.5 Surgical Sutures Market Analysis, by Application

7.5.1 General Surgeries

7.5.2 Gynecological Surgeries

7.5.3 Cardiovascular Surgeries

7.5.4 Orthopedic Surgeries

7.5.5 Other Surgeries

7.6 Surgical Sutures Market Attractiveness Analysis By Application Type

7.7 Key Trends

Section 8: Surgical Sutures Market Analysis, by End-Users

8.1 Key Findings

8.2 Introduction

8.3 Global Surgical Sutures Market Value Share Analysis, by End-Users

8.4 Surgical Sutures Market Forecast, by End-Users

8.5 Surgical Sutures Market Analysis, by End-Users

8.5.1 Hospitals

8.5.2 Specialty Clinics

8.5.3 Ambulatory Surgery Centers

8.6 Surgical Sutures Market Attractiveness Analysis By End-Users

8.7 Key Trends

Section 9: Surgical Sutures Market Analysis, by Region

9.1 Global Surgical Sutures Market Snapshot, by Country

9.2 Global Surgical Sutures Market Value Share Analysis, by Region

9.3 Surgical Sutures Market Forecast, by Region

9.4 Market Attractiveness Analysis, by Region

Section 10: North America Surgical Sutures Market Analysis

10.1 Key Findings

10.2 Market Overview

10.3 Market Analysis, By Country

10.3.1 North America Market Value Share Analysis, By Country

10.3.2 North America Market Forecast By Country

10.4 Market Analysis, By Product

10.4.1 North America Market Value Share Analysis, By Product Type

10.4.2 North America Market Forecast By Product Type

10.5 Market Analysis, By Application

10.5.1 North America Market Value Share Analysis, By Application

10.5.2 North America Market Forecast By Application

10.6 Market Analysis, By End-Users

10.6.1 North America Market Value Share Analysis, By End-Users

10.6.2 North America Market Forecast, By End-Users

10.7 North America Market Attractiveness Analysis

10.7.1 By Product

10.7.2 By Application

10.7.3 By End-users

Section 11: Europe Surgical Sutures Market Analysis

.11.1 Key Findings

11.2 Market Overview

11.3 Market Analysis, By Country

11.3.1 Europe Market Value Share Analysis, By Country

11.3.2 Europe Market Forecast By Country

11.4 Market Analysis, By Product

11.4.1 Europe Market Value Share Analysis, By Product Type

11.4.2 Europe Market Forecast By Product Type

11.5 Market Analysis, By Application

11.5.1 Europe Market Value Share Analysis, By Application

11.5.2 Europe Market Forecast By Application

11.6 Market Analysis, By End-Users

11.6.1 Europe Market Value Share Analysis, By End-Users

11.6.2 Europe Market Forecast, By End-Users

11.7 Europe Market Attractiveness Analysis

11.7.1 By Product

11.7.2 By Application

11.7.3 By End-users

Section 12: Asia Pacific Surgical Sutures Market Analysis

12.1 Key Findings

12.2 Market Overview

12.3 Market Analysis, By Country

12.3.1 Asia Pacific Market Value Share Analysis, By Country

12.3.2 Asia Pacific Market Forecast By Country

12.4 Market Analysis, By Product

12.4.1 Asia Pacific Market Value Share Analysis, By Product Type

12.4.2 Asia Pacific Market Forecast By Product Type

12.5 Market Analysis, By Application

12.5.1 Asia Pacific Market Value Share Analysis, By Application

12.5.2 Asia Pacific Market Forecast By Application

12.6 Market Analysis, By End-Users

12.6.1 Asia Pacific Market Value Share Analysis, By End-Users

12.6.2 Asia Pacific Market Forecast, By End-Users

12.7 Asia Pacific Market Attractiveness Analysis

12.7.1 By Product

12.7.2 By Application

12.7.3 By End-users

Section 13: Latin America Surgical Sutures Market Analysis

13.1 Key Findings

13.2 Market Overview

13.3 Market Analysis, By Country

13.3.1 Latin America Market Value Share Analysis, By Country

13.3.2 Latin America Market Forecast By Country

13.4 Market Analysis, By Product

13.4.1 Latin America Market Value Share Analysis, By Product Type

13.4.2 Latin America Market Forecast By Product Type

13.5 Market Analysis, By Application

13.5.1 Latin America Market Value Share Analysis, By Application

13.5.2 Latin America Market Forecast By Application

13.6 Market Analysis, By End-Users

13.6.1 Latin America Market Value Share Analysis, By End-Users

13.6.2 Latin America Market Forecast, By End-Users

13.7 Latin America Market Attractiveness Analysis

13.7.1 By Product

13.7.2 By Application

13.7.3 By End-users

Section 14: Middle East & Africa Surgical Sutures Market Analysis

14.1 Key Findings

14.2 Market Overview

14.3 Market Analysis, By Country

14.3.1 Middle East & Africa Market Value Share Analysis, By Country

14.3.2 Middle East & Africa Market Forecast By Country

14.4 Market Analysis, By Product

14.4.1 Middle East & Africa Market Value Share Analysis, By Product Type

14.4.2 Middle East & Africa Market Forecast By Product Type

14.5 Market Analysis, By Application

14.5.1 Middle East & Africa Market Value Share Analysis, By Application

14.5.2 Middle East & Africa Market Forecast By Application

14.6 Market Analysis, By End-Users

14.6.1 Middle East & Africa Market Value Share Analysis, By End-Users

14.6.2 Middle East & Africa Market Forecast, By End-Users

14.7 Middle East & Africa Market Attractiveness Analysis

14.7.1 By Product

14.7.2 By Application

14.7.3 By End-users

Section 15: Company Profiles

15.1 Market Share Analysis, by Company

15.2 Competition Matrix

15.3 Company Profiles

15.3.1 B. Braun Melsungen AG

15.3.1.1 Company Details

15.3.1.2 Business Overview

15.3.1.3 Financial Overview

15.3.1.4 Strategic Overview

15.3.1.5 SWOT Analysis

15.3.2 Medtronic

15.3.2.1 Company Details

15.3.2.2 Business Overview

15.3.2.3 Financial Overview

15.3.2.4 Strategic Overview

15.3.2.5 SWOT Analysis

15.3.3 Teleflex Incorporated

15.3.3.1 Company Details

15.3.3.2 Business Overview

15.3.3.3 Financial Overview

15.3.3.4 Strategic Overview

15.3.3.5 SWOT Analysis

15.3.4 Johnson & Johnson

15.3.4.1 Company Details

15.3.4.2 Business Overview

15.3.4.3 Financial Overview

15.3.4.4 Strategic Overview

15.3.4.5 SWOT Analysis

15.3.5 Smith & Nephew plc

15.3.5.1 Company Details

15.3.5.2 Business Overview

15.3.5.3 Financial Overview

15.3.5.4 Strategic Overview

15.3.5.5 SWOT Analysis

15.3.6 Acelity L.P. Inc.

15.3.6.1 Company Details

15.3.6.2 Business Overview

15.3.6.3 Financial Overview

15.3.6.4 Strategic Overview

15.3.6.5 SWOT Analysis

15.3.7 Boston Scientific Corporation

15.3.7.1 Company Details

15.3.7.2 Business Overview

15.3.7.3 Financial Overview

15.3.7.4 Strategic Overview

15.3.7.5 SWOT Analysis

15.3.8 Zimmer Biomet Holdings, Inc.

15.3.8.1 Company Details

15.3.8.2 Business Overview

15.3.8.3 Financial Overview

15.3.8.4 Strategic Overview

15.3.8.5 SWOT Analysis

15.3.9 ConMed Corporation

15.3.9.1 Company Details

15.3.9.2 Business Overview

15.3.9.3 Financial Overview

15.3.9.4 Strategic Overview

15.3.9.5 SWOT Analysis

15.3.10 Integra LifeSciences Holdings Corporation

15.3.10.1 Company Details

15.3.10.2 Business Overview

15.3.10.3 Financial Overview

15.3.10.4 Strategic Overview

15.3.10.5 SWOT Analysis

List of Tables

Table 01: Global Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type, 2015-2025

Table 02: Global Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type-Absorbable Sutures, 2015-2025

Table 03: Global Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type- Non-Absorbable Sutures, 2015-2025

Table 04: Global Surgical Sutures Market Size (US$ Mn) Forecast, by Application, 2015-2025

Table 05: Global Surgical Sutures Market Size (US$ Mn) Forecast, by End-user, 2015-2025

Table 06: Global Surgical Sutures Market Size (US$ Mn) Forecast, by Region, 2015-2025

Table 07: North America Surgical Sutures Market Size (US$ Mn) Forecast, by Country, 2015-2025

Table 08: North America Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type, 2015-2025

Table 09: North America Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type-Absorbable Sutures, 2015-2025

Table 10: North America Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type- Non-Absorbable Sutures, 2015-2025

Table 11: North America Surgical Sutures Market Size (US$ Mn) Forecast, by Application, 2015-2025

Table 12: North America Surgical Sutures Market Size (US$ Mn) Forecast, by End-Users, 2015-2025

Table 13: Global Surgical Sutures Market Size (US$ Mn) Forecast, by Country, 2015-2025

Table 14: Europe Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type, 2015-2025

Table 15: Europe Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type-Absorbable Sutures, 2015-2025

Table 16: Europe Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type- Non-Absorbable Sutures, 2015-2025

Table 17: Europe Surgical Sutures Market Size (US$ Mn) Forecast, by Application, 2015-2025

Table 18: Europe Surgical Sutures Market Size (US$ Mn) Forecast, by End-Users, 2015-2025

Table 19: Asia Pacific Surgical Sutures Market Size (US$ Mn) Forecast, by Country, 2015-2025

Table 20: Asia Pacific Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type, 2015-2025

Table 21: Asia Pacific Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type-Absorbable Sutures, 2015-2025

Table 22: Asia Pacific Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type- Non-Absorbable Sutures, 2015-2025

Table 23: Asia Pacific Surgical Sutures Market Size (US$ Mn) Forecast, by Application, 2015-2025

Table 24: Asia Pacific Surgical Sutures Market Size (US$ Mn) Forecast, by End-user, 2015-2025

Table 25: Latin America Surgical Sutures Market Size (US$ Mn) Forecast, by Country, 2015-2025

Table 26: Latin America Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type, 2015-2025

Table 27: Latin America Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type-Absorbable Sutures, 2015-2025

Table 28: Latin America Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type- Non-Absorbable Sutures, 2015-2025

Table 29: Latin America Surgical Sutures Market Size (US$ Mn) Forecast, by Application, 2015-2025

Table 30: Latin America Surgical Sutures Market Size (US$ Mn) Forecast, by End-user, 2015-2025

Table 31: Middle East & Africa Surgical Sutures Market Size (US$ Mn) Forecast, by Country, 2015-2025

Table 32: Middle East & Africa Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type, 2015-2025

Table 33: Middle East & Africa Surgical Sutures Market Size (US$ Mn) Forecast, by Product Type-Absorbable Sutures, 2015–2025

Table 34: Middle East & Africa Sutures Market Size (US$ Mn) Forecast, by Product Type- Non-Absorbable Sutures, 2015-2025

Table 35: Middle East & Africa Surgical Sutures Market Size (US$ Mn) Forecast, by Application, 2015-2025

Table 36: Middle East & Africa Surgical Sutures Market Size (US$ Mn) Forecast, by End-user, 2015-2025

List of Figures

Figure 01: Global Surgical Sutures Market Size (US$ Mn) Forecast, 2014–2024

Figure 02: Market Value Share By Product Type (2016)

Figure 03: Market Value Share By Application (2016)

Figure 04: Market Value Share By End-Users (2016)

Figure 05: Global Surgical Sutures Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 06: Global Non-Absorbable Sutures Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 07: Global Absorbable Sutures Market Revenue

Figure 08: Surgical Sutures Market Attractiveness Analysis, by Product Type, 2016

Figure 09: Global Surgical Sutures Market Value Share Analysis, by Application, 2017 and 2025

Figure 10: Global General Surgery Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 11: Global Orthopedics Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 12: Global Cardiovascular Surgeries Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 13: Global Obstetrics/Gynecology Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 14: Global Other Surgeries Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 15: Surgical Sutures Market Attractiveness Analysis, by Application, 2015

Figure 16: Global Surgical Sutures Market Value Share Analysis, by End-user, 2017 and 2025

Figure 17: Global Hospitals Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 18: Global Specialty Clinics Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 19: Global Ambulatory Surgery Centers Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015-2025

Figure 20: Surgical Sutures Market Attractiveness Analysis, by End-user, 2015

Figure 21: Global Surgical Sutures Market Value Share Analysis, by Region, 2017 and 2025

Figure 22: Surgical Sutures Market Attractiveness Analysis, by Region, 2015

Figure 23: North America Surgical Sutures Market Size (US$ Mn) Forecast, 2015-2025

Figure 24: North America Market Attractiveness Analysis,

Figure 25: North America Market Value Share Analysis, by Country, 2017 and 2025

Figure 26: North America Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 27: North America Market Value Share Analysis, by Application, 2017 and 2025

Figure 28: North America Market Value Share Analysis, by End-Users, 2017 and 2025

Figure 29: North America Market Attractiveness Analysis, by Product Type, 2015

Figure 30: North America Market Attractiveness Analysis, by Application, 2015

Figure 31: North America Market Attractiveness Analysis, by End-Users, 2015

Figure 32: Europe Surgical Sutures Market Size (US$ Mn) Forecast, 2015-2025

Figure 33: Europe Market Attractiveness Analysis, by Country, 2015

Figure 34: Europe Market Value Share Analysis, by Country,

Figure 35: Europe Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 36: Europe Market Value Share Analysis, by Application, 2017 and 2025

Figure 37: Europe Market Value Share Analysis, by End-Users, 2017 and 2025

Figure 38: Europe Market Attractiveness Analysis, by Product Type, 2015

Figure 39: Europe Market Attractiveness Analysis, by Application, 2015

Figure 40: Europe Market Attractiveness Analysis, by End-Users, 2015

Figure 41: Asia Pacific Surgical Sutures Market Size (US$ Mn) Forecast, 2015-2025

Figure 42: Asia Pacific Market Attractiveness Analysis, by Country, 2015

Figure 43: Asia Pacific Market Value Share Analysis, by Country,

Figure 44: Asia Pacific Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 45: Asia Pacific Market Value Share Analysis, by Application, 2017 and 2025

Figure 46: Asia Pacific Market Value Share Analysis, by End-user, 2017 and 2025

Figure 47: Asia Pacific Market Attractiveness Analysis, by Product Type, 2015

Figure 48: Asia Pacific Market Attractiveness Analysis, by Application, 2015

Figure 49: Asia Pacific Market Attractiveness Analysis, by End-user, 2015

Figure 50: Latin America Surgical Sutures Market Size (US$ Mn) Forecast, 2015-2025

Figure 51: Latin America Market Attractiveness Analysis, by Country, 2015

Figure 52: Latin America Market Value Share Analysis, by Country,

Figure 53: Latin America Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 54: Latin America Market Value Share Analysis, by Application, 2017 and 2025

Figure 55: Latin America Market Value Share Analysis, by End-user, 2017 and 2025

Figure 56: Latin America Market Attractiveness Analysis, by Product Type, 2015

Figure 57: Latin America Market Attractiveness Analysis, by Application, 2015

Figure 58: Latin America Market Attractiveness Analysis, by End-user, 2015

Figure 59: Middle East & Africa Surgical Sutures Market Size (US$ Mn) Forecast, 2015-2025

Figure 60: Middle East & Africa Market Attractiveness Analysis, by Country, 2015

Figure 61: Middle East & Africa Market Value Share Analysis, by Country, 2017 and 2025

Figure 62: Middle East & Africa Market Value Share Analysis, by Product Type, 2017 and 2025

Figure 63: Middle East & Africa Market Value Share Analysis, by Application, 2017 and 2025

Figure 64: Middle East & Africa Market Value Share Analysis, by End-user, 2017 and 2025

Figure 65: Middle East & Africa Market Attractiveness Analysis, by Product Type, 2015

Figure 66: Middle East & Africa Market Attractiveness Analysis, by Application, 2015

Figure 67: Middle East & Africa Market Attractiveness Analysis, by End-user, 2015

Figure 68: Global Surgical Sutures Market Share Analysis By Company (2015)