Analysts’ Viewpoint on the Smoking Cessation and Nicotine De-Addiction Market

Rise in demand for smoking cessation products, such as skin patches, lozenges, and gum, as well as prescription medicines is driving the global smoking cessation and nicotine de-addiction market. North America and Europe are highly mature markets for smoking cessation and nicotine de-addiction. Popularity of e-cigarettes is rising among teenagers across the globe. E-cigarettes help users quit the smoking habit. Key players are focusing on product innovation to gain revenue benefits. Asia Pacific is estimated to witness a significant demand for smoking cessation products during the forecast period.

Smoking cessation therapy lowers the risk of cancer and other serious health issues. Smoking cessation and nicotine de-addiction products include OTC products (with nicotine), prescription products, and prescription products (without nicotine). These products are used to help users quit smoking. Rise in awareness about counseling, behavior therapy, medicines, and nicotine-containing products, such as nicotine patches, gum, lozenges, inhalers, and nasal sprays, is expected to drive the global smoking cessation and nicotine de-addiction market.

According to the World Health Organization (WHO), tobacco kills more than 8 million people each year. More than 7 million of these deaths are the result of direct tobacco use, while around 1.2 million are the result of non-smokers being exposed to secondhand smoke. 80% of the world's 1.3 billion tobacco users reside in low- and middle-income countries where the burden of tobacco-related illness and death is the heaviest. In 2021, 65.3% of youth (middle and high school students) who used smoking cessation medication or products were seriously thinking about quitting the usage of all tobacco products.

Cigarette and tobacco addicts can be better treated with smoking cessation products. Smoking cessation medications and tobacco cessation tools comprise nicotine replacement therapy (NRT), electronic cigarettes, and therapeutic medication such as anti-depressants and nicotine receptor agonists that help in quitting smoking and preventing diseases caused due to smoking. Hence, rise in number of users who quit cigarettes due to the usage of quit-smoking products is a key factor driving the global smoking cessation and nicotine de-addiction market.

Rise in number of users preferring e-cigarettes is driving the smoking cessation and nicotine de-addiction market. E-cigarettes do not produce tar or carbon monoxide ‒ two of the most harmful elements in tobacco smoke. The liquid and vapor contain some harmful chemicals that can also be found in cigarette smoke; however, they are at much lower levels. The number of e-cigarette users increased from around 700,000 in 2012 to 3.6 million in 2019, falling to 3.2 million in 2020, and rising again to 3.6 million in 2021. Popularity of e-cigarettes is higher as they are safer than combustible cigarettes. E‐cigarettes can also help smokers quit combustible cigarettes. Consequently, rise in popularity of e-cigarettes over cigarettes among young users is driving the smoking cessation and nicotine de-addiction market.

According to the Foundation for a Smoke-Free World, based in the U.S., the total retail market for NRT and smoking cessation products stood at US$ 2.5 Bn in terms of value in 2020. NRT gum accounted for 51.4% share, while NRT lozenges held 21.3% share of the market in the same year. NRT patches accounted for 20.4% share, and NRT inhalers held 1.0% share. North America and Europe are the only regions that witnessed substantial sales for NRT products, accounting for 50.3% and 38.8% of total sales, respectively, in terms of value, in 2020.

NRT products include vaping products, heated tobacco, and tobacco-free oral nicotine. North America and Europe hold major share of the total demand for NRT products globally. Penetration of NRT products is low in countries in Asia Pacific compared to that in developed regions. Hence, Asia Pacific is likely to offer significant opportunities for key manufacturers of NRT products.

High Sales of Smoking Cessation and Nicotine De-Addiction Products through Offline Distribution Channel

In terms of distribution channel, the offline segment holds major value share of the global market. The online segment is estimated to grow at a notable CAGR during the forecast period. Users are preferring offline stores such as hospital pharmacies, local medical stores, and supermarkets due to the easy availability of a wide range of products. Users can also choose according to their preference.

In terms of value, North America leads the global smoking cessation and nicotine de-addiction market, followed by Europe and Asia Pacific. The U.S. is the largest smoking cessation and nicotine de-addiction market in the world and accounts for a prominent share in terms of value and volume. High share of the U.S. can be ascribed to the significantly high usage of e-cigarettes among teenagers in the country. Usage of e-cigarettes among high school students in the U.S. increased from 1.5% in 2011 to 19.6% in 2020.

Europe is also a prominent market for smoking cessation and nicotine de-addiction products globally. The U.K. is the second-largest smoking cessation and nicotine de-addiction market in the world, after the U.S. It is the largest smoking cessation and nicotine de-addiction market in Europe. Nicotine-containing OTC smoking cessation products are the most preferred nicotine replacement therapy (NRT) products in the U.K. Rise in awareness about smoking cessation benefits among the people and increase in number of smoking cessation programs are driving the market in Europe.

Detailed profiles of players in the smoking cessation and nicotine de-addiction market have been provided in the report to evaluate their financials, key product offerings, recent developments, and strategies. Majority of firms are spending significantly on comprehensive research and development activities. Expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players.

Pfizer Inc., GlaxoSmithKline plc (GSK), Cipla Ltd., Johnson & Johnson (J&J), ITC Ltd., Takeda Pharmaceutical Company Ltd., Alkalon A/S, 22nd Century Group, Inc., Strides Pharma Science Ltd., and JUUL Labs, Inc are the key players operating in the global smoking cessation and nicotine de-addiction market.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 10.54 Bn |

|

Market Forecast Value in 2031 |

US$ 27.84 Bn |

|

Growth Rate (CAGR) |

10.2% |

|

Forecast Period |

2022‒2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

Market Player – Competition Dashboard and Revenue Share Analysis 2021 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, Strategy & Business Overview) |

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

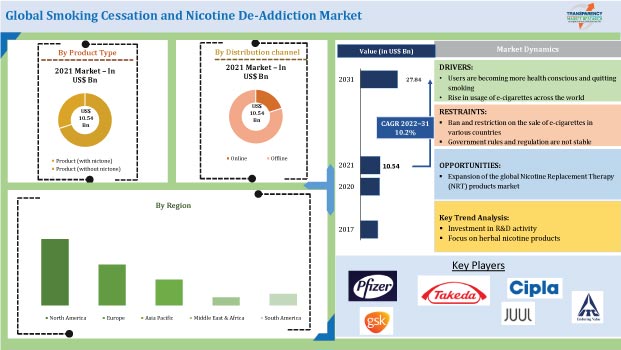

The smoking cessation and nicotine de-addiction market stood at US$ 10.54 Bn in 2021.

The smoking cessation and nicotine de-addiction market is expected to reach a value of US$ 27.84 Bn by 2031.

Rise in health awareness and number of users quitting smoking globally; and increase in usage of e-cigarettes across the world are key factors driving the market.

The e-cigarettes segment accounted for the prominent share of the smoking cessation and nicotine de-addiction market in 2021.

North America accounted for more than 30% share, in terms of value, of the global smoking cessation and nicotine de-addiction market in 2021.

Key players operating in the global smoking cessation and nicotine de-addiction market are Pfizer Inc., GlaxoSmithKline plc (GSK), Cipla Ltd., Johnson & Johnson (J&J), ITC Ltd., Takeda Pharmaceutical Company Ltd., Alkalon A/S, 22nd Century Group, Inc., Strides Pharma Science Ltd., and JUUL Labs, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. Global Smoking Cessation and Nicotine De-Addiction Market Analysis, 2017‒2031

5.7.1. Market Value Projections (US$ Mn)

6. Global Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast, by Product Type

6.1. Global Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Product Type, 2017‒2031

6.1.1. Product (with nicotine)

6.1.1.1. OTC Products

6.1.1.1.1. E-cigarettes

6.1.1.1.2. Nicotine Gums (NRT)

6.1.1.1.3. Nicotine Patches (NRT)

6.1.1.1.4. Nicotine Lozenges (NRT)

6.1.1.1.5. Nicotine Tablets (NRT)

6.1.1.2. Prescription Products

6.1.1.2.1. Nicotine Sprays (NRT)

6.1.1.2.2. Nicotine Inhalers (NRT)

6.1.2. Product (without nicotine)

6.1.2.1. Prescription Products

6.1.2.1.1. Zyban

6.1.2.1.2. Chantix

6.2. Incremental Opportunity, by Product Type

7. Global Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast, by Distribution Channel

7.1. Global Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn)t, By Distribution Channel, 2017‒2031

7.1.1. Online

7.1.2. Offline

7.2. Incremental Opportunity, by Distribution Channel

8. Global Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast, Region

8.1. Global Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Region, 2017‒2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Incremental Opportunity, by Region

9. North America Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast

9.1. Regional Snapshot

9.2. Price Trend Analysis

9.2.1. Weighted Average Selling Price (US$)

9.3. Key Trends Analysis

9.3.1. Demand Side Analysis

9.3.2. Supply Side Analysis

9.4. COVID-19 Impact Analysis

9.5. Key Supplier Analysis

9.6. Consumer Buying Behavior Analysis

9.7. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Product Type, 2017‒2031

9.7.1. Product (with nicotine)

9.7.1.1. OTC Products

9.7.1.1.1. E-cigarettes

9.7.1.1.2. Nicotine Gums (NRT)

9.7.1.1.3. Nicotine Patches (NRT)

9.7.1.1.4. Nicotine Lozenges (NRT)

9.7.1.1.5. Nicotine Tablets (NRT)

9.7.1.2. Prescription Products

9.7.1.2.1. Nicotine Sprays (NRT)

9.7.1.2.2. Nicotine Inhalers (NRT)

9.7.2. Product (without nicotine)

9.7.2.1. Prescription Products

9.7.2.1.1. Zyban

9.7.2.1.2. Chantix

9.8. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Distribution Channel, 2017‒2031

9.8.1. Online

9.8.2. Offline

9.9. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Country and Sub-region, 2017‒2031

9.9.1. U.S.

9.9.2. Canada

9.9.3. Rest of North America

9.10. Incremental Opportunity Analysis

10. Europe Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Selling Price (US$)

10.3. Key Trends Analysis

10.3.1. Demand Side Analysis

10.3.2. Supply Side Analysis

10.4. COVID-19 Impact Analysis

10.5. Key Supplier Analysis

10.6. Consumer Buying Behavior Analysis

10.7. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Product Type, 2017‒2031

10.7.1. Product (with nicotine)

10.7.1.1. OTC Products

10.7.1.1.1. E-cigarettes

10.7.1.1.2. Nicotine Gums (NRT)

10.7.1.1.3. Nicotine Patches (NRT)

10.7.1.1.4. Nicotine Lozenges (NRT)

10.7.1.1.5. Nicotine Tablets (NRT)

10.7.1.2. Prescription Products

10.7.1.2.1. Nicotine Sprays (NRT)

10.7.1.2.2. Nicotine Inhalers (NRT)

10.7.2. Product (without nicotine)

10.7.2.1. Prescription Products

10.7.2.1.1. Zyban

10.7.2.1.2. Chantix

10.8. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

10.8.1. Online

10.8.2. Offline

10.9. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Country and Sub-region, 2017‒2031

10.9.1. U.K.

10.9.2. Germany

10.9.3. France

10.9.4. Rest of Europe

10.10. Incremental Opportunity Analysis

11. Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. COVID-19 Impact Analysis

11.5. Key Supplier Analysis

11.6. Consumer Buying Behavior Analysis

11.7. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Product Type, 2017‒2031

11.7.1. Product (with nicotine)

11.7.1.1. OTC Products

11.7.1.1.1. E-cigarettes

11.7.1.1.2. Nicotine Gums (NRT)

11.7.1.1.3. Nicotine Patches (NRT)

11.7.1.1.4. Nicotine Lozenges (NRT)

11.7.1.1.5. Nicotine Tablets (NRT)

11.7.1.2. Prescription Products

11.7.1.2.1. Nicotine Sprays (NRT)

11.7.1.2.2. Nicotine Inhalers (NRT)

11.7.2. Product (without nicotine)

11.7.2.1. Prescription Products

11.7.2.1.1. Zyban

11.7.2.1.2. Chantix

11.8. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Distribution Channel, 2017‒2031

11.8.1. Online

11.8.2. Offline

11.9. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Country and Sub-region, 2017‒2031

11.9.1. China

11.9.2. India

11.9.3. Japan

11.9.4. Rest of Asia Pacific

11.10. Incremental Opportunity Analysis

12. Middle East & Africa Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. COVID-19 Impact Analysis

12.5. Key Supplier Analysis

12.6. Consumer Buying Behavior Analysis

12.7. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Product Type, 2017‒2031

12.7.1. Product (with nicotine)

12.7.1.1. OTC Products

12.7.1.1.1. E-cigarettes

12.7.1.1.2. Nicotine Gums (NRT)

12.7.1.1.3. Nicotine Patches (NRT)

12.7.1.1.4. Nicotine Lozenges (NRT)

12.7.1.1.5. Nicotine Tablets (NRT)

12.7.1.2. Prescription Products

12.7.1.2.1. Nicotine Sprays (NRT)

12.7.1.2.2. Nicotine Inhalers (NRT)

12.7.2. Product (without nicotine)

12.7.2.1. Prescription Products

12.7.2.1.1. Zyban

12.7.2.1.2. Chantix

12.8. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Distribution Channel, 2017‒2031

12.8.1. Online

12.8.2. Offline

12.9. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Country and Sub-region, 2017‒2031

12.9.1. GCC

12.9.2. South Africa

12.9.3. Rest of Middle East & Africa

12.10. Incremental Opportunity Analysis

13. South America Smoking Cessation and Nicotine De-Addiction Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. COVID-19 Impact Analysis

13.5. Key Supplier Analysis

13.6. Consumer Buying Behavior Analysis

13.7. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Product Type, 2017‒2031

13.7.1. Product (with nicotine)

13.7.1.1. OTC Products

13.7.1.1.1. E-cigarettes

13.7.1.1.2. Nicotine Gums (NRT)

13.7.1.1.3. Nicotine Patches (NRT)

13.7.1.1.4. Nicotine Lozenges (NRT)

13.7.1.1.5. Nicotine Tablets (NRT)

13.7.1.2. Prescription Products

13.7.1.2.1. Nicotine Sprays (NRT)

13.7.1.2.2. Nicotine Inhalers (NRT)

13.7.2. Product (without nicotine)

13.7.2.1. Prescription Products

13.7.2.1.1. Zyban

13.7.2.1.2. Chantix

13.8. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Distribution Channel, 2017‒2031

13.8.1. Online

13.8.2. Offline

13.9. Smoking Cessation and Nicotine De-Addiction Market Size (US$ Mn), by Country and Sub-region, 2017‒2031

13.9.1. Brazil

13.9.2. Rest of South America

13.10. Incremental Opportunity Analysis

14. Competition Landscape

14.1. Market Player – Competition Dashboard

14.2. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

14.2.1. Pfizer Inc.

14.2.1.1. Company Overview

14.2.1.2. Sales Area/Geographical Presence

14.2.1.3. Financial/Revenue

14.2.1.4. Strategy & Business Overview

14.2.1.5. Sales Channel Analysis

14.2.1.6. Size Portfolio

14.2.2. GlaxoSmithKline plc (GSK)

14.2.2.1. Company Overview

14.2.2.2. Sales Area/Geographical Presence

14.2.2.3. Financial/Revenue

14.2.2.4. Strategy & Business Overview

14.2.2.5. Sales Channel Analysis

14.2.2.6. Size Portfolio

14.2.3. Cipla Ltd.

14.2.3.1. Company Overview

14.2.3.2. Sales Area/Geographical Presence

14.2.3.3. Financial/Revenue

14.2.3.4. Strategy & Business Overview

14.2.3.5. Sales Channel Analysis

14.2.3.6. Size Portfolio

14.2.4. Johnson & Johnson (J&J)

14.2.4.1. Company Overview

14.2.4.2. Sales Area/Geographical Presence

14.2.4.3. Financial/Revenue

14.2.4.4. Strategy & Business Overview

14.2.4.5. Sales Channel Analysis

14.2.4.6. Size Portfolio

14.2.5. ITC Ltd.

14.2.5.1. Company Overview

14.2.5.2. Sales Area/Geographical Presence

14.2.5.3. Financial/Revenue

14.2.5.4. Strategy & Business Overview

14.2.5.5. Sales Channel Analysis

14.2.5.6. Size Portfolio

14.2.6. Takeda Pharmaceutical Company Ltd

14.2.6.1. Company Overview

14.2.6.2. Sales Area/Geographical Presence

14.2.6.3. Financial/Revenue

14.2.6.4. Strategy & Business Overview

14.2.6.5. Sales Channel Analysis

14.2.6.6. Size Portfolio

14.2.7. Alkalon A/S

14.2.7.1. Company Overview

14.2.7.2. Sales Area/Geographical Presence

14.2.7.3. Financial/Revenue

14.2.7.4. Strategy & Business Overview

14.2.7.5. Sales Channel Analysis

14.2.7.6. Size Portfolio

14.2.8. 22nd Century Group, Inc.

14.2.8.1. Company Overview

14.2.8.2. Sales Area/Geographical Presence

14.2.8.3. Financial/Revenue

14.2.8.4. Strategy & Business Overview

14.2.8.5. Sales Channel Analysis

14.2.8.6. Size Portfolio

14.2.9. Strides Pharma Science Ltd

14.2.9.1. Company Overview

14.2.9.2. Sales Area/Geographical Presence

14.2.9.3. Financial/Revenue

14.2.9.4. Strategy & Business Overview

14.2.9.5. Sales Channel Analysis

14.2.9.6. Size Portfolio

14.2.10. JUUL Labs, Inc.

14.2.10.1. Company Overview

14.2.10.2. Sales Area/Geographical Presence

14.2.10.3. Financial/Revenue

14.2.10.4. Strategy & Business Overview

14.2.10.5. Sales Channel Analysis

14.2.10.6. Size Portfolio

15. Key Takeaway

List of Tables

Table 1: Global Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Table 2: Global Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn,2017‒2031

Table 3: Global Smoking Cessation and Nicotine De-Addiction Market Value, by Region, US$ Mn, 2017‒2031

Table 4: North America Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Table 5: North America Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn,2017‒2031

Table 6: North America Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-Region, US$ Mn, 2017‒2031

Table 7: Europe Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Table 8: Europe Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn,2017‒2031

Table 9: Europe Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-Region, US$ Mn, 2017‒2031

Table 10: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Table 11: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn,2017‒2031

Table 12: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-Region, US$ Mn, 2017‒2031

Table 15: MEA Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Table 16: MEA Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn,2017‒2031

Table 17: MEA Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-Region, US$ Mn, 2017‒2031

Table 18: South America Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Table 19: South America Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn,2017‒2031

Table 20: South America Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-Region, US$ Mn, 2017‒2031

List of Figures

Figure 1: Global Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Figure 2: Global Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by product Type, 2022‒2031

Figure 3: Global Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn, 2017‒2031

Figure 4: Global Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Distribution Channel, 2022‒2031

Figure 5: Global Smoking Cessation and Nicotine De-Addiction Market Value, by Region, US$ Mn, 2017‒2031

Figure 6: Global Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Region,2022‒2031

Figure 7: North America Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Figure 8: North America Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by product Type, 2022‒2031

Figure 9: North America Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn, 2017‒2031

Figure 10: North America Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Distribution Channel, 2021‒2031

Figure 11: North America Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-region, US$ Mn, 2017‒2031

Figure 12: North America Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 13: Europe Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Figure 14: Europe Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by product Type, 2022‒2031

Figure 15: Europe Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn, 2017‒2031

Figure 16: Europe Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Distribution Channel, 2022‒2031

Figure 17: Europe Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-region, US$ Mn, 2017‒2031

Figure 18: Europe Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 19: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Figure 20: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by product Type, 2022‒2031

Figure 21: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn, 2017‒2031

Figure 22: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Distribution Channel, 2022‒2031

Figure 23: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-region, US$ Mn, 2017‒2031

Figure 24: Asia Pacific Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 25: MEA Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Figure 26: MEA Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Product Type, 2022‒2031

Figure 27: MEA Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn, 2017‒2031

Figure 28: MEA Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Distribution Channel, 2022‒2031

Figure 29: MEA Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-region, US$ Mn, 2017‒2031

Figure 30: MEA Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 31: South America Smoking Cessation and Nicotine De-Addiction Market Value, by product Type, US$ Mn, 2017‒2031

Figure 32: South America Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by product Type, 2022‒2031

Figure 33: South America Smoking Cessation and Nicotine De-Addiction Market Value, by Distribution Channel, US$ Mn, 2017‒2031

Figure 34: South America Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Distribution Channel, 2022‒2031

Figure 35: South America Smoking Cessation and Nicotine De-Addiction Market Value, by Country and Sub-region, US$ Mn, 2017‒2031

Figure 36: South America Smoking Cessation and Nicotine De-Addiction Market Incremental Opportunity, by Country and Sub-region, 2022‒2031