Global Pulmonary Drugs Market: Snapshot

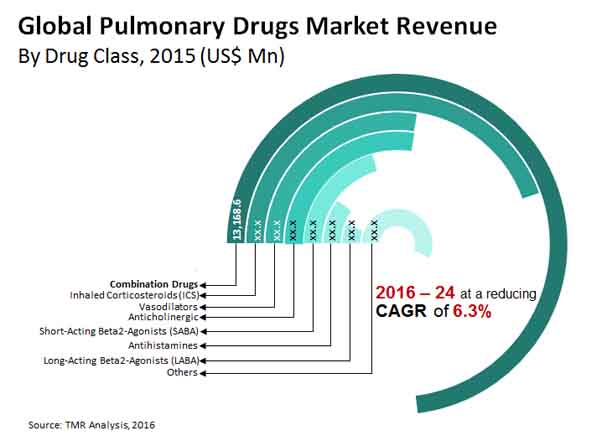

The global pulmonary drugs market has been the key area of focus and the most crucial market for the healthcare industry in the last couple of years. However, the market is expected to witness a significant decline over the forecast period with a -6.3% CAGR from 2016 to 2024. The market is anticipated to fall to US$28,082.1 mn from a valuation of US$48,039.7 mn in 2015. Keeping aside the tremendous fall of the global pulmonary drugs market, it has been expected that the market will find growth prospects from the growing number of respiratory diseases and the fact that they are becoming the leading cause of deaths across the globe at present, especially among the aged population.

According to the Forum of International Respiratory Societies (FIRS), chronic obstructive pulmonary disease affects over 200 million people across the globe and is also one of the leading causes of death globally. On the other, over 235 million people across the globe suffer from asthma. Owing to these alarming statistics, the consumption of pulmonary drugs is likely to gain momentum, thus providing growth opportunities to the market in spite of the negative CAGR. Pulmonary drugs are also being employed for the treatment of conditions such as cystic fibrosis, respiration-related disorders, pulmonary arterial hypertension (PAH), and allergic rhinitis. The launch of many effective and innovative drugs in the global market for pulmonary drugs is also anticipated to have a positive impact on the growth of the market in the coming years.

Medical Professionals to Prefer Combination Drugs among All Others

Based on drug classes, the global market for pulmonary drugs is classified into combination drugs, anticholinergics, short acting beta2-agonists, vasodilators, antihistamines, long-acting beta2-agonists, and inhaled corticosteroids, and others such as antileukotrienes, antibiotics, enzymes, and monoclonal antibodies. Among these, the segment of combination drugs held the leading share of 27.4% in 2015 closely followed by inhaled corticosteroids with a share of 16.7% in the same year in the global pulmonary drugs market. The sales of combination drugs is likely to remain high throughout the forecast period as they are considered to be comparatively safer than the other drugs. Moreover, the advent of triple combination drugs is further projected to propel the growth of the global pulmonary drugs market over the course of the forecast period.

Advent of Middle-income Classes to Catapult Demand in Asia Pacific

Based on geography, the global market for pulmonary drugs has been classified into Asia Pacific, North America, Europe, the Middle East and Africa, and Latin America. In 2015, North America led the global pulmonary drugs market with a share of 41% with Europe closely following with a share of 32.4% in the same year. The growing use of pulmonary drugs in these regions can be attributed to the advanced healthcare infrastructure coupled with high awareness regarding treatment of pulmonary diseases. However, the rise of middle-income classes and their growing expenditure on healthcare is expected to lift Asia Pacific as a prominent region in the global market.

Some of the leading players in the market are Actelion Pharmaceuticals, Inc., Boehringer Ingelheim GmbH, Merck & Co., Inc, Teva Pharmaceutical Industries Ltd., GlaxoSmithKline plc, F. Hoffmann-La Roche Ltd., Bayer AG, Novartis AG, AstraZeneca plc, and Sunovion Pharmaceuticals Inc.

Rise in the Number of Smokers to Bolster Growth of the Pulmonary Drugs Market

Various pulmonary diseases are treated with pulmonary drugs. Medication for conditions ranging from common cold to long time healing diseases, such as COPD and asthma, includes pulmonary medication. Inhalers, oral capsules, liquids, vaccines, and other dosage formulations are amongst the pulmonary drugs available. Due to reasons such as the rising number of people who smoke, growing prevalence of COPD and various respiratory disorders, the global pulmonary drugs market is expected to rise in the coming years. Furthermore, several non-government and government programmes for research and investment in pulmonary drugs therapeutics are projected to provide substantial growth opportunities in the global pulmonary drugs market in the years to come.

High Prevalence of Respiratory Illnesses to Accelerate Demand in the Market

Pulmonary drugs can be utilized to treat a variety of illnesses that fall under the umbrella of pulmonary disorders, including pulmonary hypertension, allergic rhinitis, and pneumonia amongst others. Pulmonary drugs treat a wide range of pulmonary illnesses, which is projected to drive demand in the market in the years to come. According to the World Health Organization (WHO), most respiratory infections are treatable and preventable with the right treatment. As a result, attempts to produce safe and reliable pulmonary drugs and prescriptions have increased. Nebulizers or inhalers are used to prescribe certain respiratory medications.

Tobacco smoking and exposure to it are directly proportional to the rising prevalence of Chronic Obstructive Pulmonary Disease (COPD). According to the World Health Organization (WHO), cigarette smoking is the leading cause of COPD, accounting for almost 90% of all cases. The lifelong effects of smoking contribute to the introduction of dietary changes and medicinal therapies, such as the use of inhaled hormones, inhaled glucocorticoids, bronchodilators, and other pulmonary drugs to alleviate disease symptoms. This factor is estimated to trigger growth of the global pulmonary drugs market in the near future. Tobacco use is a leading cause of death and disease around the world. The number of cigarette smokers is stable across the globe and has not decreased in recent years. Smokers are more likely to develop respiratory conditions like asthma and COPD.

1. Preface

1.1. Report Scope

1.2. Market Segmentation

1.3. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions

2.2. Acronyms Used

2.3. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Drug Class Overview

4.2. Key Industry Events

4.3. Market Opportunity Map

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.3. Restraints

5.4. Opportunity Analysis

5.5. Opportunities

5.6. Trends

5.7. Porter’s Five Forces Analysis

5.8. Value Chain Snapshot

5.9. Pulmonary Drugs Market Outlook

6. Pulmonary Drugs Market Analysis, by Drug Class

6.1. Key Findings

6.2. Introduction

6.3. Global Pulmonary Drugs Market Value Share Analysis, by Drug Class

6.4. Global Pulmonary Drugs Market Forecast, by Drug Class

6.4.1. Global Inhaled Corticosteroids (ICS) Market Revenue, US$ Mn, 2014–2024

6.4.2. Global Long-Acting Beta2-Agonists (LABA) Market Revenue, US$ Mn, 2014–2024

6.4.3. Global Antihistamines Market Revenue, US$ Mn, 2014–2024

6.4.4. Global Vasodilators Market Revenue, US$ Mn, 2014–2024

6.4.5. Global Short-Acting Beta2-Agonists (SABA) Market Revenue, US$ Mn, 2014–2024

6.4.6. Global Anticholinergics Market Revenue, US$ Mn, 2014–2024

6.4.7. Global Combination Drugs Market Revenue, US$ Mn, 2014–2024

6.4.8. Global Other Pulmonary Drugs Market Revenue, US$ Mn, 2014–2024

6.5. Global Pulmonary Drugs Market Attractiveness Analysis, by Drug Class

6.6. Key Trends

7. Pulmonary Drugs Market Analysis, by Application

7.1. Key Findings

7.2. Introduction

7.3. Global Pulmonary Drugs Market Value Share Analysis, By Application, 2016 and 2024

7.4. Global Pulmonary Drugs Market Size (US$ Mn) Forecast, By Application, 2014–2024

7.4.1. Global Asthma and COPD Market Revenue, US$ Mn, 2014–2024

7.4.2. Global Allergic Rhinitis Market Revenue, US$ Mn, 2014–2024

7.4.3. Global Pulmonary Arterial Hypertension Market Revenue, US$ Mn, 2014–2024

7.4.4. Global Cystic Fibrosis Market Revenue, US$ Mn, 2014–2024

7.4.5. Global Other Applications Market Revenue, US$ Mn, 2014–2024

7.5. Global Pulmonary Drugs Market Attractiveness By Application

7.6. Key Trends

8. Pulmonary Drugs Market Analysis, by Distribution Channel

8.1. Key Findings

8.2. Introduction

8.3. Global Pulmonary Drugs Market Value Share Analysis, By Distribution Channel, 2016 and 2024

8.4. Global Pulmonary Drugs Market Size (US$ Mn) Forecast, By Distribution Channel, 2015–2024

8.4.1. Global Hospital Pharmacies Market Revenue, US$ Mn, 2014–2024

8.4.2. Global Retail Pharmacies Market Revenue, US$ Mn, 2014–2024

8.4.3. Global Drug Stores Market Revenue, US$ Mn, 2014–2024

8.4.4. Global E-commerce Market Revenue, US$ Mn, 2014–2024

8.5. Global Pulmonary Drugs Market Attractiveness By Distribution Channel

9. Pulmonary Drugs Market Analysis, By Region

9.1. Global Scenario

9.2. Global Pulmonary Drugs Market Value Share Analysis By Region, 2016 and 2024

9.3. Global Pulmonary Drugs Market Size (US$ Mn) Forecast, By Region, 2016–2024

9.4. Global Pulmonary Drugs Market Attractiveness Analysis, by Region

10. North America Pulmonary Drugs Market Analysis

10.1. Key Findings

10.2. North America Pulmonary Drugs Market Size (US$ Mn) Forecast, 2016–2024

10.3. North America Market Attractiveness Analysis, by Country

10.4. North America Market Value Share Analysis, by Product Type, 2016 and 2024

10.5. North America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

10.6. North America Market Value Share Analysis, by Application, 2016 and 2024

10.7. North America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Application, 2016–2024

10.8. North America Market Value Share Analysis, by Distribution Channel, 2016 and 2024

10.9. North America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

10.10. North America Market Value Share Analysis, by Country, 2016 and 2024

10.11. North America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Country, 2016–2024

10.12. North America Market Attractiveness Analysis, by Drug Class

10.13. North America Market Attractiveness Analysis, by Application

10.14. North America Market Attractiveness Analysis, by Distribution Channel

11. Europe Pulmonary Drugs Market Analysis

11.1. Key Findings

11.2. Europe Pulmonary Drugs Market Size (US$ Mn) Forecast, 2016–2024

11.3. Europe Market Attractiveness Analysis, by Country

11.4. Europe Market Value Share Analysis, by Drug Class, 2016 and 2024

11.5. Europe Pulmonary Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

11.6. Europe Market Value Share Analysis, by Application, 2016 and 2024

11.7. Europe Pulmonary Drugs Market Size (US$ Mn) Forecast, by Application, 2016–2024

11.8. Europe Market Value Share Analysis, by Distribution Channel, 2016 and 2024

11.9. Europe Pulmonary Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

11.10. Europe Market Value Share Analysis, by Country, 2016 and 2024

11.11. Europe Pulmonary Drugs Market Size (US$ Mn) Forecast, by Country, 2016–2024

11.12. Europe Market Attractiveness Analysis, by Drug Class

11.13. Europe Market Attractiveness Analysis, by Application

11.14. Europe Market Attractiveness Analysis, by Distribution Channel

12. Asia Pacific Pulmonary Drugs Market Analysis

12.1. Key Findings

12.2. Asia Pacific Pulmonary Drugs Market Size (US$ Mn) Forecast, 2016–2024

12.3. Asia Pacific Market Attractiveness Analysis, by Country

12.4. Asia Pacific Market Value Share Analysis, by Drug Class, 2016 and 2024

12.5. Asia Pacific Pulmonary Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

12.6. Asia Pacific Market Value Share Analysis, by Application, 2016 and 2024

12.7. Asia Pacific Pulmonary Drugs Market Size (US$ Mn) Forecast, by Application, 2016–2024

12.8. Asia Pacific Market Value Share Analysis, by Distribution Channel, 2016 and 2024

12.9. Asia Pacific Pulmonary Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

12.10. Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

12.11. Asia Pacific Pulmonary Drugs Market Size (US$ Mn) Forecast, by Country, 2016–2024

12.12. Asia Pacific Market Attractiveness Analysis, by Drug Class

12.13. Asia Pacific Market Attractiveness Analysis, by Application

12.14. Asia Pacific Market Attractiveness Analysis, by Distribution Channel

13. Latin America Pulmonary Drugs Market Analysis

13.1. Key Findings

13.2. Latin America Pulmonary Drugs Market Size (US$ Mn) Forecast, 2016–2024

13.3. Latin America Market Attractiveness Analysis, by Country

13.4. Latin America Market Value Share Analysis, by Drug Class, 2016 and 2024

13.5. Latin America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

13.6. Latin America Market Value Share Analysis, by Application, 2016 and 2024

13.7. Latin America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Application, 2016–2024

13.8. Latin America Market Value Share Analysis, by Distribution Channel, 2016 and 2024

13.9. Latin America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

13.10. Latin America Market Value Share Analysis, by Country, 2016 and 2024

13.11. Latin America Pulmonary Drugs Market Size (US$ Mn) Forecast, by Country, 2016–2024

13.12. Latin America Market Attractiveness Analysis, by Drug Class

13.13. Latin America Market Attractiveness Analysis, by Application

13.14. Latin America Market Attractiveness Analysis, by Distribution Channel

14. Middle East & Africa (MEA) Pulmonary Drugs Market Analysis

14.1. Key Findings

14.2. MEA Pulmonary Drugs Market Size (US$ Mn) Forecast, 2016–2024

14.3. MEA Market Attractiveness Analysis, by Country

14.4. MEA Market Value Share Analysis, by Drug Class, 2016 and 2024

14.5. MEA Pulmonary Drugs Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

14.6. MEA Market Value Share Analysis, by Application, 2016 and 2024

14.7. MEA Pulmonary Drugs Market Size (US$ Mn) Forecast, by Application, 2016–2024

14.8. MEA Market Value Share Analysis, by Distribution Channel, 2016 and 2024

14.9. MEA Pulmonary Drugs Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

14.10. MEA Market Value Share Analysis, by Country, 2016 and 2024

14.11. MEA Pulmonary Drugs Market Size (US$ Mn) Forecast, by Country, 2016–2024

14.12. MEA Market Attractiveness Analysis, by Drug Class

14.13. MEA Market Attractiveness Analysis, by Application

14.14. MEA Market Attractiveness Analysis, by Distribution Channel

15. Competition Landscape

15.1. Global Pulmonary Drugs Market Share Analysis, By Company, (2015)

15.2. Competition Matrix

16. Company Profiles

16.1. AstraZeneca plc

16.1.1. Company Overview

16.1.2. Business Overview

16.1.3. Financial Overview

16.1.4. SWOT Analysis

16.1.5. Strategic Overview

16.2. Bayer AG

16.2.1. Company Overview

16.2.2. Business Overview

16.2.3. Financial Overview

16.2.4. SWOT Analysis

16.2.5. Strategic Overview

16.3. Teva Pharmaceutical Industries Ltd.

16.3.1. Company Overview

16.3.2. Business Overview

16.3.3. Financial Overview

16.3.4. SWOT Analysis

16.3.5. Strategic Overview

16.4. Actelion Pharmaceuticals, Inc.

16.4.1. Company Overview

16.4.2. Business Overview

16.4.3. Financial Overview

16.4.4. SWOT Analysis

16.4.5. Strategic Overview

16.5. Boehringer Ingelheim GmbH

16.5.1. Company Overview

16.5.2. Business Overview

16.5.3. Financial Overview

16.5.4. SWOT Analysis

16.5.5. Strategic Overview

16.6. F. Hoffmann-La Roche Ltd.

16.6.1. Company Overview

16.6.2. Business Overview

16.6.3. Financial Overview

16.6.4. SWOT Analysis

16.6.5. Strategic Overview

16.7. Merck & Co., Inc.

16.7.1. Company Overview

16.7.2. Business Overview

16.7.3. Financial Overview

16.7.4. SWOT Analysis

16.7.5. Strategic Overview

16.8. Novartis AG

16.8.1. Company Overview

16.8.2. Business Overview

16.8.3. Financial Overview

16.8.4. SWOT Analysis

16.8.5. Strategic Overview

16.9. GlaxoSmithKline plc

16.9.1. Company Overview

16.9.2. Business Overview

16.9.3. Financial Overview

16.9.4. SWOT Analysis

16.9.5. Strategic Overview

16.10. Sunovion Pharmaceuticals, Inc.

16.10.1. Company Overview

16.10.2. Business Overview

16.10.3. Financial Overview

16.10.4. SWOT Analysis

16.10.5. Strategic Overview

List of Tables

TABLE 1 Global Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 2 Global Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 3 Global Pulmonary Drugs Market Size (US$ Mn) Forecast, 2014–2024

TABLE 4 Global Pulmonary Drugs Market Size (US$ Mn) Forecast, 2014–2024

TABLE 5 Global Pulmonary Drugs Market Size (US$ Mn) Forecast, 2014–2024

TABLE 6 Global Pulmonary Drug Market Size (US$ Mn) Forecast, by Region, 2016–2024

TABLE 7 North America Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 8 North America Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 9 North America Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 10 North America Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 11 North America Pulmonary Drug Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

TABLE 12 North America Pulmonary Drug Market Size (US$ Mn) Forecast, by Country, 2016–2024

TABLE 13 Europe Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 14 Europe Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 15 Europe Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 16 Europe Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 17 Europe Pulmonary Drug Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

TABLE 18 Europe Pulmonary Drug Market Size (US$ Mn) Forecast, by Country, 2016–2024

TABLE 19 Asia Pacific Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 20 Asia Pacific Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 21 Asia Pacific Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 22 Asia Pacific Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 23 Asia Pacific Pulmonary Drug Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

TABLE 24 Asia Pacific Pulmonary Drug Market Size (US$ Mn) Forecast, by Country, 2016–2024

TABLE 25 Latin America Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 26 Latin America Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 27 Latin America Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 28 Latin America Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 29 Latin America Pulmonary Drug Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

TABLE 30 Latin America Pulmonary Drug Market Size (US$ Mn) Forecast, by Country, 2014–2024

TABLE 31 Middle East & Africa Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 32 Middle East & Africa Pulmonary Drug Market Size (US$ Mn) Forecast, by Drug Class, 2016–2024

TABLE 33 Middle East & Africa Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 34 Middle East & Africa Pulmonary Drug Market Size (US$ Mn) Forecast, by Applications, 2016–2024

TABLE 35 Middle East & Africa Pulmonary Drug Market Size (US$ Mn) Forecast, by Distribution Channel, 2016–2024

TABLE 36 Middle East & Africa Pulmonary Drug Market Size (US$ Mn) Forecast, by Country, 2014–2024

List of Figures

FIGURE 1 Global Pulmonary Drug Market Value Share Analysis, by Drug Class, 2016 and 2024

FIGURE 2 Global Inhaled Corticosteroids (ICS) Market Revenue, US$ Mn, 2014–2024

FIGURE 3 Global Long-Acting Beta2-Agonists (LABA) Market Revenue, US$ Mn, 2014–2024

FIGURE 4 Global Combination Drugs Market Revenue, US$ Mn, 2014–2024

FIGURE 5 Global Anticholinergics Market Revenue, US$ Mn, 2014–2024

FIGURE 6 Global Short-Acting Beta2-Agonists (SABA) Market Revenue, US$ Mn, 2014–2024

FIGURE 7 Global Antihistamines Market Revenue, US$ Mn,

FIGURE 8 Global Vasodilators Market Revenue, US$ Mn,

FIGURE 9 Global Other Pulmonary Drugs Market Revenue, US$ Mn, 2014–2024

FIGURE 10 Pulmonary Drug Market Attractiveness Analysis, by Drug Class

FIGURE 11 Global Pulmonary Drug Market Value Share Analysis, by Applications, 2016 and 2024

FIGURE 12 Global Drugs Market Revenue, US$ Mn,

FIGURE 13 Global Vaccines Market Revenue, US$ Mn,

FIGURE 14 Global Drugs Market Revenue, US$ Mn,

FIGURE 15 Global Vaccines Market Revenue, US$ Mn,

FIGURE 16 Global Drugs Market Revenue, US$ Mn,

FIGURE 17 Pulmonary Drug Market Attractiveness Analysis, by Applications

FIGURE 18 Global Pulmonary Drug Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIGURE 19 Global Drugs Market Revenue, US$ Mn,

FIGURE 20 Global Vaccines Market Revenue, US$ Mn,

FIGURE 21 Global Drugs Market Revenue, US$ Mn,

FIGURE 22 Global Vaccines Market Revenue, US$ Mn,

FIGURE 23 Global Pulmonary Drug Market Attractiveness Analysis, by Distribution Channel

FIGURE 24 Global Pulmonary Drug Market Value Share Analysis, by Region, 2016 and 2024

FIGURE 25 Pulmonary Drug Market Attractiveness Analysis, by Region

FIGURE 26 North America Pulmonary Drug Market Size (US$ Mn) Forecast, 2016–2024

FIGURE 27 North America Market Attractiveness Analysis, by Country

FIGURE 28 North America Market Value Share Analysis, by Drug Class, 2016 and 2024

FIGURE 29 North America Market Value Share Analysis, by Applications, 2016 and 2024

FIGURE 30 North America Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIGURE 31 North America Market Value Share Analysis, by Country, 2016 and 2024

FIGURE 32 North America Market Attractiveness Analysis, by Drug Class

FIGURE 33 North America Market Attractiveness Analysis, by Applications

FIGURE 34 North America Market Attractiveness Analysis, by Distribution Channel

FIGURE 35 Europe Pulmonary Drug Market Size (US$ Mn) Forecast, 2016–2024

FIGURE 36 Europe Market Attractiveness Analysis, by Country

FIGURE 37 Europe Market Value Share Analysis, by Drug Class, 2016 and 2024

FIGURE 38 Europe Market Value Share Analysis, by Applications, 2016 and 2024

FIGURE 39 Europe Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIGURE 40 Europe Market Value Share Analysis, by Country, 2016 and 2024

FIGURE 41 Europe Market Attractiveness Analysis, by Drug Class

FIGURE 42 Europe Market Attractiveness Analysis, by Applications

FIGURE 43 Europe Market Attractiveness Analysis, by Distribution Channel

FIGURE 44 Asia Pacific Pulmonary Drug Market Size (US$ Mn) Forecast, 2014–2024

FIGURE 45 Asia Pacific Market Attractiveness Analysis, by Country

FIGURE 46 Asia Pacific Market Value Share Analysis, by Drug Class, 2016 and 2024

FIGURE 47 Asia Pacific Market Value Share Analysis, by Applications, 2016 and 2024

FIGURE 48 Asia Pacific Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIGURE 49 Asia Pacific Market Value Share Analysis, by Country, 2016 and 2024

FIGURE 50 Asia Pacific Market Attractiveness Analysis, by Drug Class

FIGURE 51 Asia Pacific Market Attractiveness Analysis, by Applications

FIGURE 52 Asia Pacific Market Attractiveness Analysis, by Distribution Channel

FIGURE 53 Latin America Pulmonary Drug Market Size (US$ Mn) Forecast, 2014–2024

FIGURE 54 Latin America Market Attractiveness Analysis, by Country

FIGURE 55 Latin America Market Value Share Analysis, by Drug Class, 2016 and 2024

FIGURE 56 Latin America Market Value Share Analysis, by Applications, 2016 and 2024

FIGURE 57 Latin America Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIGURE 58 Latin America Market Value Share Analysis, by Country, 2016 and 2024

FIGURE 59 Latin America Market Attractiveness Analysis, by Drug Class

FIGURE 60 Latin America Market Attractiveness Analysis, by Applications

FIGURE 61 Latin America Market Attractiveness Analysis, by Distribution Channel

FIGURE 62 Middle East & Africa Pulmonary Drug Market Size (US$ Mn) Forecast, 2014–2024

FIGURE 63 Middle East & Africa Market Attractiveness Analysis, by Country

FIGURE 64 Middle East & Africa Market Value Share Analysis, by Drug Class, 2016 and 2024

FIGURE 65 Middle East & Africa Market Value Share Analysis, by Applications, 2016 and 2024

FIGURE 66 Middle East & Africa Market Value Share Analysis, by Distribution Channel, 2016 and 2024

FIGURE 67 Middle East & Africa Market Value Share Analysis, by Country, 2016 and 2024

FIGURE 68 Middle East & Africa Market Attractiveness Analysis, by Drug Class

FIGURE 69 Middle East & Africa Market Attractiveness Analysis, by Applications

FIGURE 70 Middle East & Africa Market Attractiveness Analysis, by Distribution Channel

FIGURE 71 Global Pulmonary Drug Market Share Analysis, by Company (2015)