Analysts’ Viewpoint on Psoriasis Treatment Market Scenario

The global psoriasis treatment market is expected to grow at a rapid pace during the forecast period. Increase in adoption of personalized medicines for improved patient outcomes has encouraged market players to focus on newer modalities and biosimilars post the COVID-19 impact. The trend of tailor-made medicine for effective management of the disease is expected to drive the global psoriasis treatment market. Led by rapid medical advancements, players are focusing on leveraging the popularity of biologics for product innovation to meet the increasing demand in developed regional markets. Manufacturers should also consider strategic collaborations and acquisitions to broaden their product portfolio and strengthen their presence in the global landscape.

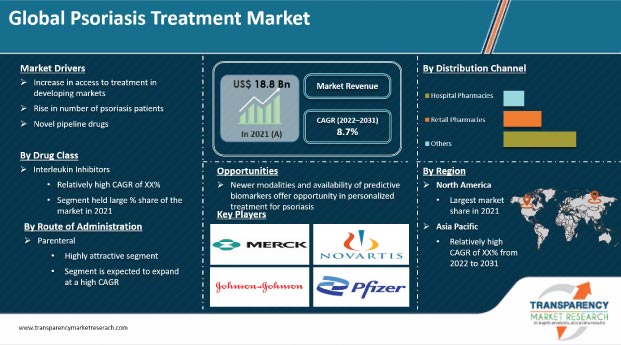

Rise in the psoriasis patient pool, approval of new biologic drugs for psoriasis, novel drug pipeline, and increase in access to psoriasis treatment in developing countries are anticipated to propel the global psoriasis treatment market.

Psoriasis is an autoimmune noncontagious disorder characterized by rapid and excessive proliferation of skin cells, resulting in patches of abnormal skin. Psoriasis is considered a long-term skin disorder characterized by plaques and thickened skin. Commonly affected areas on the body are around the scalp, knees, navel, and back of the forearms. Psoriasis is triggered by various factors, including environmental factors and genetic deformity. It is considered a non-curable disorder; however, a few treatments can ease the symptoms. Patients are likely to develop psoriatic arthritis at a faster rate. The number of patients with psoriatic arthritis has increased significantly over the last few years.

Biologics have altered the landscape in the management of moderate to severe psoriasis by achieving improved skin clearance, control of symptoms, and quality of life for many affected people. Usage of biologics in psoriasis treatment has resulted in lucrative prospects for manufacturers in the market, as they compete for the development of new products to stay competitive in the market.

In April 2019, Novartis AG announced that the China Health Authority NMPA approved Cosentyx (secukinumab), the first-in-class interleukin-17A (IL-17A) inhibitor for moderate-to-severe plaque psoriasis in adult patients who are candidates for systemic therapy or phototherapy. This indicates promising potential of the plaque psoriasis treatment among patients.

Psoriasis diagnosis and treatment alternatives are undergoing a sea change in emerging economies. Awareness about psoriasis is increasing in developing countries such as China and India due to various campaigns by governments and healthcare professionals. It has become easy to access physicians or dermatologists for treatment in developing countries.

In November 2018, Novartis Corporation Malaysia launched ‘Be Pso Positive’, a psoriasis campaign in Malaysia. The campaign was created by Edelman Malaysia in association with the Psoriasis Association of Malaysia and True Complexion. This is expected to increase the number of patients treated for psoriasis, thereby augmenting the psoriasis treatment market during the forecast period.

In terms of drug class, the global psoriasis treatment market has been classified into TNF inhibitors, interleukin inhibitors, vitamin D analogs, corticosteroids, and others. The interleukin inhibitors segment is projected to dominate the global psoriasis treatment market during the forecast period. The segment's large market share can be attributed to the superior efficacy and safety of drugs in this class for the treatment of psoriasis. Rise in acceptance of this drug class is attributable to interleukin blockers, which are considered a viable option for patients who do not respond to other treatments.

Based on route of administration, the global psoriasis treatment market has been segregated into oral, parenteral, and topical. The parenteral segment accounted for the major share of the market in 2021. This trend is expected to continue during the forecast period. Growth of the segment can be ascribed to the increase in launch of new drugs to be administered through injection or intravenous (IV) infusion; and surge in the adoption of biologics for the treatment of psoriasis.

In terms of distribution channel, the global psoriasis treatment market has been divided into hospital pharmacies, retail pharmacies, and others. Retail pharmacies is projected to be a highly lucrative segment of the global market during the forecast period owing to higher sales of biologics in developed countries, including the U.S. and Canada.

North America dominated the global psoriasis treatment market in 2021 owing to the increase in incidence of psoriasis and favorable reimbursement policies in the region. Higher cost of biologics in North America than that in other regions is also likely to make it a primary market for players offering psoriasis treatment products. Additionally, robust product pipeline of key players is projected to boost the market in the region.

The psoriasis treatment market in Asia Pacific is anticipated to grow at a higher CAGR than that in North America during the forecast period due to the increase in awareness about psoriasis in developing countries of the region. Rise in diagnosis and management of psoriasis in healthcare systems & clinics in emerging economies is boosting the market in Asia Pacific. Furthermore, growth in usage of biologics in China and Japan is expected to augment the market in the region.

Recent advancements in psoriasis treatment is being witnessed in terms of new product approvals. In August 2021, Novartis secured a new approval for Cosentyx (secukinumab) for the treatment of pediatric moderate to severe plaque psoriasis in China.

The market in Latin America and Middle East & Africa is likely to grow at a considerable CAGR during the forecast period owing to the increase in psoriasis patient pool and focus of manufacturers on the development of novel therapeutics in these regions.

Manufacturers of psoriasis drugs are focusing on the launch of new products and are promoting their brands in order to increase market share. Psoriasis drug manufacturers emphasize on new marketing strategies to boost product penetration. Companies consider product approval and launch as a critical component of their growth strategy. They also concentrate on developing a value chain for major regional markets, as well as developing new psoriasis drugs and long-term solutions. Key players operating in the global psoriasis treatment market include Amgen, Inc., Eli Lilly and Company, Novartis AG, Merck & Co., Inc., Johnson & Johnson, Pfizer, Inc., AstraZeneca plc, AbbVie, Inc., LEO Pharma A/S, and Biogen, Inc.

Each of these players has been profiled in the psoriasis treatment market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 18.8 Bn |

|

Market Forecast Value in 2031 |

More than US$ 44 Bn |

|

Growth Rate (CAGR) |

8.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global psoriasis treatment market was valued at US$ 18.8 Bn in 2021.

The global market is projected to reach more than US$ 44 Bn by 2031.

The global psoriasis treatment market greew at a CAGR of 10.4% from 2017 to 2021.

The global psoriasis treatment market is anticipated to expand at a CAGR of 8.7% from 2022 to 2031.

Increase in number of psoriasis patients is augmenting the global psoriasis treatment market.

North America is expected to account for major share of the global psoriasis treatment market during the forecast period.

Prominent players in the global psoriasis treatment market include Amgen, Inc., Eli Lilly and Company, Novartis AG, Merck & Co., Inc., Johnson & Johnson, Pfizer, Inc., AstraZeneca plc, AbbVie, Inc., LEO Pharma A/S, and Biogen, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Psoriasis Treatment Market

4. Market Overview

4.1. Introduction

4.1.1. Drug Class Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Psoriasis Treatment Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

4.4.2. Market Volume/Unit Shipments Projections

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Regulatory Scenario by Region/Key Country

5.2. Pipeline Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Impact Analysis

6. Global Psoriasis Treatment Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017–2031

6.3.1. TNF Inhibitors

6.3.2. Interleukin Inhibitors

6.3.3. Vitamin D Analogs

6.3.4. Corticosteroids

6.3.5. Others

6.4. Market Attractiveness Analysis, by Drug Class

7. Global Psoriasis Treatment Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Route of Administration, 2017–2031

7.3.1. Oral

7.3.2. Parenteral

7.3.3. Topical

7.4. Market Attractiveness Analysis, by Route of Administration

8. Global Psoriasis Treatment Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Others

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Psoriasis Treatment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Psoriasis Treatment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017–2031

10.2.1. TNF Inhibitors

10.2.2. Interleukin Inhibitors

10.2.3. Vitamin D Analogs

10.2.4. Corticosteroids

10.2.5. Others

10.3. Market Value Forecast, by Route of Administration, 2017–2031

10.3.1. Oral

10.3.2. Parenteral

10.3.3. Topical

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Route of Administration

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Psoriasis Treatment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017–2031

11.2.1. TNF Inhibitors

11.2.2. Interleukin Inhibitors

11.2.3. Vitamin D Analogs

11.2.4. Corticosteroids

11.2.5. Others

11.3. Market Value Forecast, by Route of Administration, 2017–2031

11.3.1. Oral

11.3.2. Parenteral

11.3.3. Topical

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Route of Administration

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Psoriasis Treatment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017–2031

12.2.1. TNF Inhibitors

12.2.2. Interleukin Inhibitors

12.2.3. Vitamin D Analogs

12.2.4. Corticosteroids

12.2.5. Others

12.3. Market Value Forecast, by Route of Administration, 2017–2031

12.3.1. Oral

12.3.2. Parenteral

12.3.3. Topical

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Route of Administration

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Psoriasis Treatment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017–2031

13.2.1. TNF Inhibitors

13.2.2. Interleukin Inhibitors

13.2.3. Vitamin D Analogs

13.2.4. Corticosteroids

13.2.5. Others

13.3. Market Value Forecast, by Route of Administration, 2017–2031

13.3.1. Oral

13.3.2. Parenteral

13.3.3. Topical

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Route of Administration

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Psoriasis Treatment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017–2031

14.2.1. TNF Inhibitors

14.2.2. Interleukin Inhibitors

14.2.3. Vitamin D Analogs

14.2.4. Corticosteroids

14.2.5. Others

14.3. Market Value Forecast, by Route of Administration, 2017–2031

14.3.1. Oral

14.3.2. Parenteral

14.3.3. Topical

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Route of Administration

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Amgen, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. AstraZeneca plc

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. AbbVie, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. Eli Lilly and Company

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Johnson & Johnson

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Biogen, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Novartis AG

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. Merck & Co., Inc.

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

15.3.9. Pfizer, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Strategic Overview

15.3.10. LEO Pharma A/S

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. SWOT Analysis

15.3.10.4. Strategic Overview

15.3.11. Other Players

List of Table

Table 01: Global Psoriasis Treatment Market Size (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 02: Global Psoriasis Treatment Market Size (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 03: Global Psoriasis Treatment Market Size (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Psoriasis Treatment Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 06: North America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 07: North America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 08: North America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Psoriasis Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 10: Europe Psoriasis Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 11: Europe Psoriasis Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 12: Europe Psoriasis Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Psoriasis Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 14: Asia Pacific Psoriasis Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 15: Asia Pacific Psoriasis Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 16: Asia Pacific Psoriasis Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 18: Latin America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 19: Latin America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 20: Latin America Psoriasis Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Psoriasis Treatment Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 22: Middle East & Africa Psoriasis Treatment Market Value (US$ Mn) Forecast, by Route of Administration, 2017–2031

Table 23: Middle East & Africa Psoriasis Treatment Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 24: Middle East & Africa Psoriasis Treatment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Psoriasis Treatment Market Snapshot, 2021

Figure 02: Global Psoriasis Treatment Market Size (US$ Mn) Forecast, 2017–2031

Figure 04: Global Psoriasis Treatment Market Value Share, by Route of Administration, 2021

Figure 06: Global Psoriasis Treatment Market Value Share, by Region, 2021

Figure 03: Global Psoriasis Treatment Market Value Share, by Drug Class, 2021

Figure 05: Global Psoriasis Treatment Market Value Share, by Distribution Channel, 2021

Figure 07: Regulatory Approval Process - U.S.

Figure 08: Regulatory Approval Process - Europe

Figure 09: Regulatory Approval Process - Japan

Figure 10: Global Psoriasis Treatment Market Value Share, by Drug Class, 2021 and 2031

Figure 11: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by TNF Inhibitors, 2017–2031

Figure 12: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Interleukin Inhibitors, 2017–2031

Figure 13: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Vitamin D Analogs, 2017–2031

Figure 14: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Corticosteroids, 2017–2031

Figure 15: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 16: Global Psoriasis Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 17: Global Psoriasis Treatment Market Value Share, by Route of Administration, 2021 and 2031

Figure 18: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Oral, 2017–2031

Figure 19: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Parenteral, 2017–2031

Figure 20: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Topical, 2017–2031

Figure 21: Global Psoriasis Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 22: Global Psoriasis Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 23: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospital Pharmacies, 2017–2031

Figure 24: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Retail Pharmacies, 2017–2031

Figure 25: Global Psoriasis Treatment Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 26: Global Psoriasis Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 27: Global Psoriasis Treatment Market Value Share, by Region, 2021 and 2031

Figure 28: Global Psoriasis Treatment Market Attractiveness Analysis, by Region, 2022–2031

Figure 29: North America Psoriasis Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 30: North America Psoriasis Treatment Market Attractiveness Analysis, by Country, 2022–2031

Figure 31: North America Psoriasis Treatment Market Value Share, by Drug Class, 2021 and 2031

Figure 32: North America Psoriasis Treatment Market Value Share, by Route of Administration, 2021 and 2031

Figure 33: North America Psoriasis Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 34: North America Psoriasis Treatment Market Value Share Analysis, by Country, 2021 and 2031

Figure 35: North America Psoriasis Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 36: North America Psoriasis Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 37: North America Psoriasis Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 38: Europe Psoriasis Treatment Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017–2031

Figure 39: Europe Psoriasis Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 40: Europe Psoriasis Treatment Market Value Share, by Drug Class, 2021 and 2031

Figure 41: Europe Psoriasis Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 42: Europe Psoriasis Treatment Market Value Share, by Route of Administration, 2021 and 2031

Figure 43: Europe Psoriasis Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 44: Europe Psoriasis Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 45: Europe Psoriasis Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 46: Europe Psoriasis Treatment Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 47: Asia Pacific Psoriasis Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 48: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 49: Asia Pacific Psoriasis Treatment Market Value Share, by Drug Class, 2021 and 2031

Figure 50: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 51: Asia Pacific Psoriasis Treatment Market Value Share, by Route of Administration, 2021 and 2031

Figure 52: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 53: Asia Pacific Psoriasis Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 54: Asia Pacific Psoriasis Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 55: Asia Pacific Psoriasis Treatment Market Value Share, by Country/Sub-region, 2021 and 2031

Figure 56: Latin America Psoriasis Treatment Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 57: Latin America Psoriasis Treatment Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 58: Latin America Psoriasis Treatment Market Value Share, by Drug Class, 2021 and 2031

Figure 59: Latin America Psoriasis Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 60: Latin America Psoriasis Treatment Market Value Share, by Route of Administration, 2021 and 2031

Figure 61: Latin America Psoriasis Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 62: Latin America Psoriasis Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 63: Latin America Psoriasis Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 64: Latin America Psoriasis Treatment Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 65: Middle East & Africa Psoriasis Treatment Market Value (US$ Mn) Forecast, 2017–2031

Figure 66: Middle East & Africa Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 67: Middle East & Africa Psoriasis Treatment Market Value Share, by Drug Class, 2021 and 2031

Figure 68: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 69: Middle East & Africa Psoriasis Treatment Market Value Share, by Route of Administration, 2021 and 2031

Figure 70: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 71: Middle East & Africa Psoriasis Treatment Market Value Share, by Distribution Channel, 2021 and 2031

Figure 72: Middle East & Africa Psoriasis Treatment Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 73: Middle East & Africa Market Value Share, by Country/Sub-region, 2021 and 2031