Global Process Analyzer Market: Snapshot

In the last few years, the demand for process analyzers has scaled higher, thanks to their rising use across diverse industries. A process analyzer, coupled with other embedded advance electronic components, provides a cost-effective handling process, which is the foremost factor coercing manufacturers to invest in them. High speed analysis and cost effecting handling process offered by process analyzers have increased their use in the processing of volatile organization components. Besides this, the market is gaining from the rising demand for chemical proceslyzers have esing equipment witnessed worldwide.

As a result of the recent technological advancements, manufacturers could innovate novel product with better design and performance. Furthermore, these advanced models were more cost-effective. Considering such upgrades, the demand for process analyzers has considerably increased in the water and wastewater treatment market. Moreover, governments around the world are looking to provide clean water to their citizens thus providing an environment conducive to the growth of the global process analyzer market.

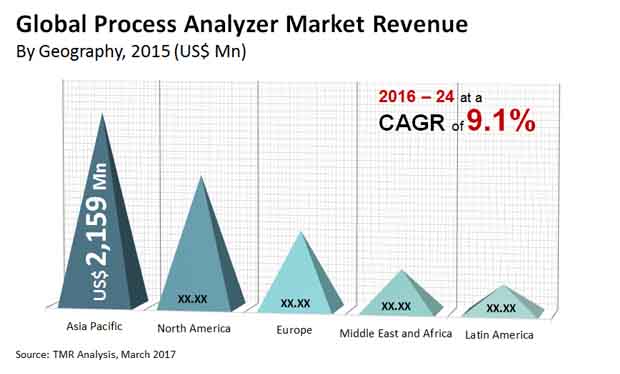

While high cost of installation and maintenance will create bottlenecks, the market will gain from the rising opportunities in Asia Pacific. Between 2016 and 2024, the process analyzer market is forecast to exhibit a CAGR of 9.1%. At this pace, the market will reach US$11.501 bn by the end of 2024, from US$5.29 bn in 2015.

Oil and Gas Industry to Remain at the Fore as Largest End User

In terms of form factor, the global process analyzer market can be segmented into portable, standard, and rack mount. Of these, the standard process analyzers constituted the leading segment, trailed by rack mount process analyzers. The rising demand for organic materials to curb production expenses has had a positive impact on the process analyzer market. Polymers and papers are among the most commonly used organic materials in the process. The demand for portable process analyzers is expected to increase due to their low maintenance cost and easy operation facilities.

By end-use industry, the global process analyzer market can be segmented into chemical, oil and gas, pharmaceutical, power generation and transmission, food and beverage, and mining. Of these, the oil and gas segment held the dominant share of 54% in the market in 2015. The process analyzer technology is used in different verticals such as mineral or liquid separation, adding ingredients, and temperature control among others.

In the coming years the market is expected to witness rising demand from the food and beverage industry. In the food processing industry, analyzers are extensively used to measure raw ingredients and the physical and chemical nature of food. In the coming years, the demand for process analyzers is forecast to increase further in the food and beverage industry.

Asia Pacific to Continue Exhibiting Strong Growth as Regional Process Analyzer Market

Regionally, the global process analyzer market can be segmented into Europe, North America, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific held the dominant share of 40.8% in the overall market in 2015 and is forecast to remain at the fore through the forecast period. While North America and Europe will remain lucrative pockets, saturation in the developed countries will coerce manufacturers to shift focus towards the leading economies of Asia pacific. For instance, in countries such as India, China, and Japan, the process analyzer market will witness lucrative scope for expansion. Besides these nations, the demand for process analyzers will remain high in France, Germany, the UAE, and the US. t through the forecast period. verage industry.

Some of the most prominent players operating in the process analyzer market are ABB Ltd. (Switzerland), Siemens AG (Germany), Modcon Systems Ltd. (The U.K), Applied Analytics, Inc.(The U.S), Endress+Hauser Management AG (Switzerland), Applied Instrument Technologies, Inc.( The U.S), Emerson Electric Co.(The U.S), SICK AG ( Germany), INFICON, Inc.(Switzerland), AMETEK, Inc. (The U.S) andYokogawa Electric Corporation (Japan) among others.

Advances in Analytical Instrumentation Enable Players in Process Analyzer Market to Capture New Consumer Propositions

Process analyzers are widely used in processing industries as access to process analytics is crucial for analyzing the quality of a product during the processing stages. It is used to keep a tab on various processing parameters so as to ensure these comply with the set chemical compositions, boiling points, freezing points, viscosities, pressures, and other parameters. Adhering to these set parameters help end-use industries meet the criterion of quality by design (QbD).This analytics are collected almost in real time so as to minimize the chances of contamination in rapid sampling. Advances made in sample conditioning systems have helped equipment manufacturers meet the various end-use industries in the process analyzers market. The demand is massive in water and wastewater treatment industries for critical process parameters (CPPs). Other industries where new technologies of process analyzers are in high demand are petrochemical refineries, chemical processing, and pharmaceuticals. Over the years, use of portable equipment has caught on momentum in the process analyzers market. Advances made in sensor integrated with process analyzers are also expected to create numerous lucrative avenues in key end-use industries. A key application area where such advances are useful are continuous emissions monitoring.

The COVID-19 pandemic, caused by the SARS-CoV-2 virus, has been causing unprecedented rise in morbidity and mortality in patient population around the world. The production in some industries reached an all-time low, unimagined in decades. The pandemic has also caused massive decline in consumer demand across numerous industries. For some industries, businesses in the process analyzers market have been exploring new consumer propositions and new strategies for improving consumer reach. One way they have been successful is by leveraging the e-commerce platforms to connect with their buyers. Emerging B2B ecommerce channels especially in the developing world are expected to shape the sales initiatives of various brands in the process analyzers market. They are also keen on adopting automation in their production units.

The process analyzer market has been segmented as follows:

|

by Form Factor |

|

|

by End Use Industry |

|

|

by Region |

|

Chapter 1 Report Scope & Market Segmentation

Research Highlights

Chapter 2 Assumptions and Research Methodology

Assumptions and acronyms used

Research Methodology

Chapter 3 Executive Summary

Chapter 4 Market Overview

4.1 Introduction

4.2. Market Indicators

4.2.1. Market Dynamics

4.2.2.1 Drivers

4.2.2.2. Restraints

4.2.2.3. Opportunity Analysis

4.4. Porter’s Analysis

4.5. Competitive Landscape

4.6. Key Strategies Adopting By Companies

4.7. Market Attractiveness Analysis

4.8. Process Analyzer Market Size Forecast

Chapter 5 Process Analyzer Market Analysis, by Form Factor

5.1. Introduction

5.2. Global Process Analyzer Market Value Share Analysis, by Form Factor

5.3. Global Process Analyzer Market Forecast, by Form Factor

Chapter 6 Process Analyzer Market Analysis, by End Use Industry

6.1. Introduction

6.2. Global Process Analyzer Market Value Share Analysis, by End Use Industry

6.3. Global Process Analyzer Market Forecast, by End Use Industry

Chapter 7 Process Analyzer Market Analysis, by Region

7.1. Geographical Scenario

7.2. Global Process Analyzer Market Value Share Analysis, by Region

7.3. Global Process Analyzer Market Revenue Analysis, by Region

Chapter 8 North America Process Analyzer Market Analysis

8.1. Key Trends Analysis

8.2. North America Process Analyzer Market, Value Share Analysis, by Form Factor

8.3. North America Process Analyzer Market, Revenue Analysis, by Form Factor

8.4. North America Process Analyzer Market, Value Share Analysis, by End Use Industry

8.5. North America Process Analyzer Market, Revenue Analysis, by End Use Industry

8.6. North America Process Analyzer Market, Value Share Analysis, by Country

8.7. North America Process Analyzer Market, Revenue Analysis, by Country

Chapter 9 Europe Process Analyzer Market Analysis

9.1. Key Trends Analysis

9.2. Europe Process Analyzer Market, Value Share Analysis, by Form Factor

9.3. Europe Process Analyzer Market, Revenue Analysis, by Form Factor

9.4. Europe Process Analyzer Market, Value Share Analysis, by End Use Industry

9.5. Europe Process Analyzer Market, Revenue Analysis, by End Use Industry

9.6. Europe Process Analyzer Market, Value Share Analysis, by Country

9.7. Europe Process Analyzer Market, Revenue Analysis, by Country

Chapter 10 Asia Pacific Process Analyzer Market Analysis

10.1. Key Trends Analysis

10.2. Asia Pacific Process Analyzer Market, Value Share Analysis, by Form Factor

10.3. Asia Pacific Process Analyzer Market, Revenue Analysis, by Form Factor

10.4. Asia Pacific Process Analyzer Market, Value Share Analysis, by End Use Industry

10.5. Asia Pacific Process Analyzer Market, Revenue Analysis, by End Use Industry

10.6. Asia Pacific Process Analyzer Market, Value Share Analysis, by Country

10.7. Asia Pacific Process Analyzer Market, Revenue Analysis, by Country

Chapter 11 Middle- East and Africa(MEA) Process Analyzer Market Analysis

11.1. Key Trends Analysis

11.2. Middle- East and Africa(MEA) Process Analyzer Market, Value Share Analysis, by Form Factor

11.3. Middle- East and Africa(MEA) Process Analyzer Market, Revenue Analysis, by Form Factor

11.4. Middle- East and Africa(MEA) Process Analyzer Market, Value Share Analysis, by End Use Industry

11.5. Middle- East and Africa(MEA) Process Analyzer Market, Revenue Analysis, by End Use Industry

11.6. Middle- East and Africa(MEA) Process Analyzer Market, Value Share Analysis, by Country

11.7. Middle- East and Africa(MEA) Process Analyzer Market, Revenue Analysis, by Country

Chapter 12 Latin America Process Analyzer Market Analysis

12.1. Key Trends Analysis

12.2. Latin America Process Analyzer Market, Value Share Analysis, by Form Factor

12.3. Latin America Process Analyzer Market, Revenue Analysis, by Form Factor

12.4. Latin America Process Analyzer Market, Value Share Analysis, by End Use Industry

12.5. Latin America Process Analyzer Market, Revenue Analysis, by End Use Industry

12.6. Latin America Process Analyzer Market, Value Share Analysis, by Country

12.7. Latin America Process Analyzer Market, Revenue Analysis, by Country

Chapter 13 Company Profiles

13.1. ABB, Ltd.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.2. Siemens AG

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.3. Modcon Systems Ltd.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.4. Applied Analytics, Inc.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.5. Endress+Hauser Management AG

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.6. Applied Instrument Technologies, Inc.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.7. Emerson Electric Co.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.8. SICK AG

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.9. INFICON, Inc.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.10. AMETEK, Inc.

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

13.11. Yokogawa Electric Corporation

Company Details (HQ, Foundation Year, Employee Strength)

Market Presence, By Segment and Geography

Strategic Overview

SWOT analysis

Strategic Overview

List of Tables

Table 1 Global Process Analyzer Market Revenue (USD Mn) and Forecast, by Form Factor, 2015 – 2024

Table 2 Global Process Analyzer Market Revenue (USD Mn) and Forecast, by End Use Industry, 2015 – 2024

Table 3 Global Process Analyzer Market Revenue (USD Mn) and Forecast, by Region, 2016 – 2024

Table 4 North America Process Analyzer Market, Revenue (USD Mn) and Forecast, by Form Factor, 2015 – 2024

Table 5 North America Process Analyzer Market, Revenue (USD Mn) and Forecast, by End Use Industry, 2016 – 2024

Table 6 North America Process Analyzer Market, Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 7 Europe Process Analyzer Market, Revenue (USD Mn) and Forecast, by Form Factor, 2015 – 2024

Table 8 Europe Process Analyzer Market, Revenue (USD Mn) and Forecast, by End Use Industry, 2015 – 2024

Table 9 Europe Process Analyzer Market, Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 10 Asia Pacific Process Analyzer Market, Revenue (USD Mn) and Forecast, by Form Factor, 2015 – 2024

Table 11 Asia Pacific Process Analyzer Market, Revenue (USD Mn) and Forecast, by End Use Industry, 2015 – 2024

Table 12 Asia Pacific Process Analyzer Market, Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 13 Middle East and Africa (MEA) Process Analyzer Market, Revenue (USD Mn) and Forecast, by Product Type, 2015 – 2024

Table 14 Middle East and Africa (MEA) Process Analyzer Market, Revenue (USD Mn) and Forecast, by End Use Industry, 2015 – 2024

Table 15 Middle East and Africa (MEA) Process Analyzer Market, Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

Table 16 Latin America Process Analyzer Market, Revenue (USD Mn) and Forecast, by Form Factor, 2015 – 2024

Table 17 Latin America Process Analyzer Market, Revenue (USD Mn) and Forecast, by End Use Industry, 2015 – 2024

Table 18 Latin America Process Analyzer Market, Revenue (USD Mn) and Forecast, by Country, 2015 – 2024

List of Figures

Fig 1 Market Snapshot

Fig 2 Market Share of Key Players, 2015 (%)

Fig 3 Market Attractiveness Analysis, by From Factor, 2015

Fig 4 Process Analyzer Market Size (USD Mn) Forecast, 2016–2024

Fig 5 Global Process Analyzer Market

Fig 6 Global Process Analyzer Market Value Share Analysis, by Form Factor, 2015 and 2024

Fig 7 Form Factor of Standard in Process Analyzer (USD Mn), 2015 – 2024

Fig 8 Form Factor of Portable in Process Analyzer (USD Mn), 2015 – 2024

Fig 9 Form Factor of Rackmount in Process Analyzer (USD Mn), 2015 – 2024

Fig 10 Global Process Analyzer Market

Fig 11 Global Process Analyzer Market Value Share Analysis, by End Use Industry, 2015 and 2024

Fig 12 Oil and gas industry of Process Analyzer (USD Mn), 2015 – 2024

Fig 13 Chemical industry of Process Analyzer (USD Mn), 2015 – 2024

Fig 14 Power generation and transmission industry of Process Analyzer (USD Mn), 2015 – 2024

Fig 15 Pharmaceutical industry of Process Analyzer (USD Mn), 2015 – 2024

Fig 16 Mining industry of Process Analyzer (USD Mn), 2015 – 2024

Fig 17 Food and Beverages industry of Process Analyzer (USD Mn), 2015 – 2024

Fig 18 Other industry of Process Analyzer (USD Mn), 2015 – 2024

Fig 19 Global Process Analyzer Market Value Share Analysis, by Region Type, 2016 and 2024

Fig 20 North America Process Analyzer Market, Value Share Analysis by Form Factor, 2015 and 2024

Fig 21 North America Process Analyzer Market, Value Share Analysis, by End Use Industry, 2015 and 2024

Fig 22 North America Process Analyzer Market, Value Share Analysis, by Country, 2015 and 2024

Fig 23 Europe Process Analyzer Market, Value Share Analysis by Form Factor, 2015 and 2024

Fig 24 Europe Process Analyzer Market, Value Share Analysis, by End Use Industry, 2015 and 2024

Fig 25 Europe Process Analyzer Market, Value Share Analysis, by Country, 2016 and 2024

Fig 26 Asia Pacific Process Analyzer Market, Value Share Analysis by Form Factor, 2015 and 2024

Fig 27 Asia Pacific Process Analyzer Market, Value Share Analysis, by End Use Industry, 2015 and 2024

Fig 28 Asia Pacific Process Analyzer Market, Value Share Analysis, by Country, 2015 and 2024

Fig 29 Middle East and Africa (MEA) Process Analyzer Market, Value Share Analysis, by Form Factor, 2015 and 2024

Fig 30 Middle East and Africa (MEA) Process Analyzer Market, Value Share Analysis, by End Use Industry, 2015 and 2024

Fig 31 Middle East and Africa (MEA) Process Analyzer Market, Value Share Analysis, by Country, 2015 and 2024

Fig 32 Latin America Process Analyzer Market, Value Share Analysis, by Form Factor, 2015 and 2024

Fig 33 Latin America Process Analyzer Market, Value Share Analysis, by End Use Industry, 2015 and 2024

Fig 34 Latin America Process Analyzer Market, Value Share Analysis, by Country, 2015 and 2024