Analysts’ Viewpoint on Market Scenario

Technological advancement in turbines used for power generation was key factor boosting the pace of industrialization across the globe. Turbines are used in hydropower generation, steam power plants, wind power generation and propulsion. Wind power generation, both onshore and off-shore, has been growing significantly since 2010. Between 2010 and 2020, the onshore wind capacity grew from 178 GW to 699 GW, while the off-shore wind grew by 3.1GW to 34.4GW during the same period. Wind energy is the fastest-growing clean energy source, and its rise is expected to continue during the forecast period. The global turbines industry is growing considerably as a result of increased government support for adoption of renewable power generation technologies that intend to reduce carbon dioxide emissions. Furthermore, rise in demand for electricity globally is also expected to fuel the demand for turbines and boost market growth.

The kinetic energy of fluids, such as water, steam, air, combustion gases, or nuclear fuel, can be captured by a turbine and converted into the rotating motion of the turbine. The primary function of turbines is to transform energy into a useful source of power. The rotating blades in a turbine start spinning when a hot combustion gas expands through the turbine. The whirling blades have two purposes: powering a generator to generate electricity and operating a compressor to push more pressured air into the combustion chamber.

The global turbine industry is growing due to increase in government support for power generation technologies that aim to reduce carbon dioxide emissions. Rise in consumption of electricity across the globe augments the uses of turbines. The market for turbines and related products is expanding owing to the growth in electricity generation and rise in production of turbine engines.

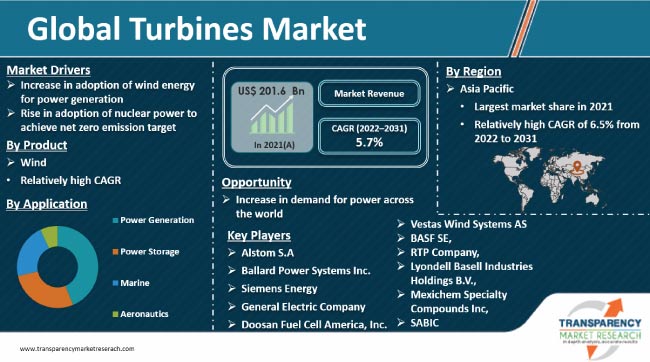

A large number of infrastructure and oil field development projects have been planned across the globe. Demand for wind and steam turbines in the market is anticipated to be dominant till 2031. Demand for turbines is likely to increase significantly owing to the rapid development of the hydrocarbons sector along with various upcoming mega power projects. Consequently, the global turbine market forecast is expected to be optimistic. In terms of volume, the installed turbine capacity stood at 97.5 GW by 2021. In turbine market report, Asia Pacific alone accounted for 40.4% share of the total global turbines industry and its share was valued at US$ 72.5 Bn in 2021. It is expected to reach a value of US$ 127.6 Bn by 2031, growing at a rate of 6.5% from 2022 to 2031.

Wind turbine technology has developed from emerging power to commercially electricity generating technology in the last 20 years. Moreover, reduction in cost of power generation due to improved materials and designs and favorable government policies for wind power in major countries such as China, US, Germany, U.K., and, India are boosting the number of turbine installations. Decline in cost of generation of wind power, financial incentives from various governments across the world, rapid decrease in fossil fuel reserves, and surge in awareness about environmental issues are further boosting market progress.

Wind energy is one of the fastest growing methods of electricity generation in the world. Wind turbines are installed at locations that offer conducive winds and weather patterns. They convert the kinetic energy of flowing air into electricity. Wind turbines may be installed individually, but are often installed in groups to form ‘wind farms’ or wind power plants. Wind energy may also be used to produce hydrogen, which can be employed to generate power or utilized as a fuel for transportation.

The wind turbines market is growing because wind energy reduces the environmental impact of electricity generation as it does not produce greenhouse gases. Moreover, operational cost are nearly zero once the turbine is erected, as wind is free. Mass production and technology advancements are further making turbines cheaper. Additionally, many governments offer tax incentives to boost adoption of wind turbine energy for development. These factors mentioned above are estimated to further augment the turbines market progression during the forecast period.

Nuclear power is key to achieving global net zero target, working in partnership with renewable energy sources and other low carbon options, as part of a sustainable energy system to decarbonize electricity and non-electric energy production. Nuclear power is the second-largest source of low-carbon electricity currently, with 10% of global electricity supply provided by 452 operating reactors. Nuclear power has prevented the emission of about 55 Gt of CO2, or the equivalent of two years of energy-related CO2 emissions, globally, in the last 50 years. Energy production and use are responsible for around three quarters of global CO2 emissions, of which the electricity and heat plants account for about 40%. The nuclear industry in Europe has raised concerns that the Green Deal may increase regulation above and beyond what is legally binding under the Euratom Treaty, which has governed EU nuclear activities since 1958. The European Green Deal aims to promote the effective use of resources by transitioning to a circular economy, reduce pollution, prevent climate change, and readdress the loss of biodiversity.

Rise in population across the globe is augmenting the demand for power. Therefore, power producers have decided to shift from coal to natural gas or renewables as a source for power generation. This trend is likely to continue for the next few decades.

Rise in demand for electricity globally is also expected to boost the demand for turbines. A rising focus on the reduction of fossil fuels consumption is likely to fuel the product's adoption. Expansion of the power generation business, combined with a greater emphasis on generation of electricity from renewable energy sources, is a major driver for adoption of turbines, particularly those with capacities above 200 MW.

A key reason for the high popularity of 200 MW turbines is their smaller size, which enables easy operation and maintenance. The smaller size of 200 MW turbines means they are lighter, making them perfect for offshore locations where the power-to-weight ratio is a key factor in determining whether or not to build a turbine unit.

Presently, several countries across the globe that are experiencing persistent and frequent shortage of power are undertaking measures to enhance their capacity of power generation to cater to the rising demand for energy from households and industries. Several new power plants that are primarily powered by steam and gas turbines are under the process of being commissioned, while construction of a few is currently ongoing. The renewable energy sector has also been growing at a rapid pace for the last few years. Manufacturers of turbines and other power generation products across the globe are focused on diversifying their energy portfolios and are expected to adopt renewable energy technologies in the near future.

Asia Pacific accounted for prominent 40.4% of market share in 2021. The turbines business in Asia Pacific is estimated to grow at a rapid pace in the near future due to the rise in manufacture of turbine products, and surge in demand for turbines in the region. China is one of the prominent markets for turbines in Asia Pacific.

Europe followed Asia Pacific in terms of share of the global turbines business in 2021. Technological advancements are expected to propel the turbines market in the region in the near future. Ongoing technological advancements are prompting turbine manufacturers in Europe to develop turbines with improved energy efficiency. This, in turn, is driving the market size in Europe. Middle East & Africa and Latin America account for a relatively minor share of the total global turbines business.

The global turbines industry comprises several small and large-scale service providers who control a majority of share. Most of the firms are adopting new technologies and strategies and engaging in comprehensive research and development activities, primarily to develop and prioritize sustainable turbines. An in-depth look at the market analysis suggest that expansion of product portfolios and mergers and acquisitions are prominent strategies adopted by key players. Alstom S.A., General Electric Energy, Siemens Energy, Ballard Power Systems Inc., Doosan Fuel Cell America, Inc., Vestas Wind Systems A/S are the prominent entities operating in the market.

Key players in the market research report have been analyzed in terms of financial overview, business strategies, product portfolio, company overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 201.6 Bn |

|

Market Forecast Value in 2031 |

US$ 331.6 Bn |

|

Growth Rate (CAGR) |

5.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, drivers, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market was valued at US$ 201.6 Bn Mn in 2021

It is expected to expand at a CAGR of 5.7% from 2022 to 2031

Increasing adoption of wind energy for power generation and rise in adoption of nuclear power to achieve net zero emission target

Power Generation was the largest application segment in 2021

Asia-Pacific was the most lucrative region of the global market in 2021

Alstom S.A, Ballard Power Systems Inc., Siemens Energy and, General Electric Company

1. Executive Summary

1.1. Global Turbines Market

1.2. Key Trends

1.3. Global Turbines Market Value Share Analysis, by Product, 2021

1.4. Global Turbines Market Value Share Analysis, by Application, 2021

2. Market Overview

2.1. Product Overview

2.2. Market Indicators

2.3. Turbines Process

2.4. Drivers and Restraints Snapshot Analysis

2.4.1. Drivers

2.4.2. Restraints

2.4.3. Drivers

2.5. Porter’s Five Forces Analysis

2.5.1. Threat of Substitutes

2.5.2. Bargaining Power of Buyers

2.5.3. Bargaining Power of Suppliers

2.5.4. Threat of New Entrants

2.5.5. Degree of Competition

2.6. Regulatory Analysis

2.7. Value Chain Analysis

2.7.1. List of Equipment Suppliers

2.7.2. List of Turbines Manufacturers

2.7.3. List of Dealers/Distributors

2.7.4. List of Potential Customers

3. COVID-19 Impact Analysis

3.1. Impact of COVID-19 on Turbines Market Pre-crisis and Post-crisis

4. Impact of Current Geopolitical Scenario on Market

5. Global Turbines Market Analysis and Forecast, by Product, 2022-2031

5.1. Key Findings

5.2. Market Size and Forecast (US$ Mn) by Product, 2020-2031

5.2.1. Hydro

5.2.2. Steam

5.2.3. Gas-based

5.2.4. Wind

5.2.5. Nuclear

5.3. Global Market Attractiveness Analysis, by Product

6. Global Turbines Market Analysis and Forecast, by Application, 2022-2031

6.1. Key Findings

6.2. Market Size and Forecast (US$ Mn) by Application, 2020-2031

6.2.1. Power Generation

6.2.2. Power Storage

6.2.3. Marine

6.2.4. Aeronautics

6.3. Global Market Attractiveness, by Application

7. Global Turbines Market Analysis and Forecast, by Region, 2022–2031

7.1. Key Findings

7.2. Market Size and Forecast (US$ Mn) by Region, 2020-2031

7.2.1. North America

7.2.2. U.S.

7.2.3. Canada

7.3. Europe

7.3.1. Germany

7.3.2. U.K.

7.3.3. France

7.3.4. Spain

7.3.5. Italy

7.3.6. Russia & CIS

7.3.7. Rest of Europe

7.4. Asia Pacific

7.4.1. China

7.4.2. Japan

7.4.3. India

7.4.4. South Korea

7.4.5. ASEAN

7.4.6. Rest of Asia Pacific

7.5. Latin America

7.5.1. Brazil

7.5.2. Mexico

7.5.3. Rest of Latin America

7.6. Middle East & Africa

7.6.1. GCC

7.6.2. Egypt

7.6.3. South Africa

7.6.4. Rest of Middle East & Africa

7.7. Global Market Attractiveness Analysis, by Region

8. North America Turbines Market Analysis and Forecast, 2022–2031

8.1. Key Findings

8.2. North America Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

8.3. North America Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

8.4. North America Turbines Market Value (US$ Mn) Forecast, by Country, 2022–2031

8.4.1.1. U.S. Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.2. U.S. Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

8.4.3. Canada Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.4. Canada Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

8.5. North America Turbines Market Attractiveness Analysis

9. Europe Turbines Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. Europe Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.3. Europe Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4. Europe Turbines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

9.4.1. Germany Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.2. Germany Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4.3. U.K. Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.4. U.K. Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4.5. France Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.6. France Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4.7. Spain Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.8. Spain Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4.9. Italy Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.10. Italy Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4.11. Russia & CIS Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.12. Russia & CIS Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.4.13. Rest of Europe Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.14. Rest of Europe Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

9.5. Europe Turbines Market Attractiveness Analysis

10. Asia Pacific Turbines Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Product

10.3. Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4. Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. China Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.2. China Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.3. Japan Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.4. Japan Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.5. India Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.6. India Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.7. South Korea Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.8. South Korea Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.9. ASEAN Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.10. ASEAN Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.11. Rest of Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.12. Rest of Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

10.5. Asia Pacific Turbines Market Attractiveness Analysis

11. Latin America Turbines Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Latin America Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

11.3. Latin America Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.4. Latin America Turbines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. Brazil Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

11.4.2. Brazil Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.4.3. Mexico Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

11.4.4. Mexico Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.4.5. Rest of Latin America Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

11.4.6. Rest of Latin America Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

11.5. Latin America Turbines Market Attractiveness Analysis

12. Middle East & Africa Turbines Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

12.3. Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.4. Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Country, 2020-2031

12.4.1. GCC Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

12.4.2. GCC Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.4.3. Egypt Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

12.4.4. Egypt Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.4.5. South Africa Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

12.4.6. South Africa Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.4.7. Rest of Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

12.4.8. Rest of Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

12.5. Middle East & Africa Turbines Market Attractiveness Analysis

13. Competition Landscape

13.1. Market Players - Competition Matrix (by Tier and Size of Companies)

13.2. Market Share Analysis, 2021

13.3. Market Footprint Analysis

13.3.1. By Product

13.3.2. By Application

13.4. Company Profiles

13.4.1. Alstom S.A

13.4.1.1. Company Revenue

13.4.1.2. Business Overview

13.4.1.3. Product Segments

13.4.1.4. Geographic Footprint

13.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.2. Ballard Power Systems Inc.

13.4.2.1. Company Revenue

13.4.2.2. Business Overview

13.4.2.3. Product Segments

13.4.2.4. Geographic Footprint

13.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.3. Siemens Energy

13.4.3.1. Company Revenue

13.4.3.2. Business Overview

13.4.3.3. Product Segments

13.4.3.4. Geographic Footprint

13.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.4. General Electric Company

13.4.4.1. Company Revenue

13.4.4.2. Business Overview

13.4.4.3. Product Segments

13.4.4.4. Geographic Footprint

13.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.5. Doosan Fuel Cell America, Inc.

13.4.5.1. Company Revenue

13.4.5.2. Business Overview

13.4.5.3. Product Segments

13.4.5.4. Geographic Footprint

13.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.6. Vestas Wind Systems AS

13.4.6.1. Company Revenue

13.4.6.2. Business Overview

13.4.6.3. Product Segments

13.4.6.4. Geographic Footprint

13.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.7. Sinovel Wind Group Co.

13.4.7.1. Company Revenue

13.4.7.2. Business Overview

13.4.7.3. Product Segments

13.4.7.4. Geographic Footprint

13.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.8. Goldwind Science & Technology Co., Ltd.

13.4.8.1. Business Revenue

13.4.8.2. Business Overview

13.4.8.3. Product Segments

13.4.8.4. Geographic Footprint

13.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.9. ABB

13.4.9.1. Business Revenue

13.4.9.2. Business Overview

13.4.9.3. Product Segments

13.4.9.4. Geographic Footprint

13.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.10. ACCIONA Windpower

13.4.10.1. Business Revenue

13.4.10.2. Business Overview

13.4.10.3. Product Segments

13.4.10.4. Geographic Footprint

13.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.11. Kirloskar Brothers Limited

13.4.11.1. Business Revenue

13.4.11.2. Business Overview

13.4.11.3. Product Segments

13.4.11.4. Geographic Footprint

13.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.4.12. Dongfang Electric Corporation Limited

13.4.12.1. Business Revenue

13.4.12.2. Business Overview

13.4.12.3. Product Segments

13.4.12.4. Geographic Footprint

13.4.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

13.4.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

13.5. Key Primary Research Insights

13.6. Analyst Recommendations

14. Appendix

14.1. Assumptions and Acronyms

14.2. Research Methodology

List of Tables

Table 1: Global Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 2: Global Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 3: Global Turbines Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 4: North America Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 5: North America Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 6: North America Turbines Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 7: U.S. Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 8: U.S. Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 9: Canada Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 10: Canada Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 11: Europe Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 12: Europe Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 13: Europe Turbines Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 14: Germany Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 15: Germany Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 16: U.K. Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 17: U.K. Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 18: Spain Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 19: Spain Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 20: Italy Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 21: Italy Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 22: Russia & CIS Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 23: Russia & CIS Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 24: Rest of Europe Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 25: Rest of Europe Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 26: Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 27: Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 28: Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 29: China Turbines Market Value (US$ Mn) Forecast, by Product 2022–2031

Table 30: China Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 31: Japan Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 32: Japan Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 33: India Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 34: India Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 35: ASEAN Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 36: ASEAN Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 37: Rest of Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 38: Rest of Asia Pacific Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 39: Latin America Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 40: Latin America Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 41: Latin America Turbines Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 42: Brazil Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 43: Brazil Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 44: Mexico Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 45: Mexico Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 46: Rest of Latin America Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 47: Rest of Latin America Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 48: Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 49: Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 50: Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 51: GCC Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 52: GCC Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 53: South Africa Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 54: South Africa Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 55: Rest of Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 56: Rest of Middle East & Africa Turbines Market Value (US$ Mn) Forecast, by Application, 2022–2031

List of Figures

Figure 1: Global Turbines Market Share Analysis, by Product, 2021, 2025, and 2031

Figure 2: Global Turbines Market Attractiveness, by Product

Figure 3: Global Turbines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 4: Global Turbines Market Attractiveness, by Application

Figure 5: Global Turbines Market Share Analysis, by Region, 2021, 2025, and 2031

Figure 6: Global Turbines Market Attractiveness, by Region

Figure 7: North America Turbines Market Share Analysis, by Product, 2021, 2025, and 2031

Figure 8: North America Turbines Market Attractiveness, by Product

Figure 9: North America Turbines Market Attractiveness, by Product

Figure 10: North America Turbines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 11: North America Turbines Market Attractiveness, by Application

Figure 12: North America Turbines Market Attractiveness, by Country

Figure 13: Europe Turbines Market Share Analysis, by Product, 2021, 2025, and 2031

Figure 14: Europe Turbines Market Attractiveness, by Product

Figure 15: Europe Turbines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 16: Europe Turbines Market Attractiveness, by Application

Figure 17: Europe Turbines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 18: Europe Turbines Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Turbines Market Share Analysis, by Product, 2021, 2025, and 2031

Figure 20: Asia Pacific Turbines Market Attractiveness, by Product

Figure 21: Asia Pacific Turbines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Asia Pacific Turbines Market Attractiveness, by Application

Figure 23: Asia Pacific Turbines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Asia Pacific Turbines Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Turbines Market Share Analysis, by Product, 2021, 2025, and 2031

Figure 26: Latin America Turbines Market Attractiveness, by Product

Figure 27: Latin America Turbines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 28: Latin America Turbines Market Attractiveness, by Application

Figure 29: Latin America Turbines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 30: Latin America Turbines Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Turbines Market Share Analysis, by Product, 2021, 2025, and 2031

Figure 32: Middle East & Africa Turbines Market Attractiveness, by Product

Figure 33: Middle East & Africa Turbines Market Share Analysis, by Application, 2021, 2025, and 2031

Figure 34: Middle East & Africa Turbines Market Attractiveness, by Application

Figure 35: Middle East & Africa Turbines Market Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 36: Middle East & Africa Turbines Market Attractiveness, by Country and Sub-region