Reports

Reports

Analysts’ Viewpoint on Terahertz Components and Systems Market Scenario

Terahertz systems and components are widely used for high precision gauging and coating thickness measurement, which include measurement of density, basis weight, coating thickness, single and multilayer thickness, and structural integrity. These systems are widely deployed for threat material detection (for instance, explosives, weapons); biomedical applications (for instance, skin cancer detection); environmental sensing (especially gas detection); and detection of moisture content in consumer products. North America is expected to remain a key market, globally, owing to growing research & development activities across aerospace & defense, automotive, healthcare, and consumer electronics industries. Moreover, increasing research in telecommunication sector for the deployment of 5G and 6G is likely to propel the market. The market in Asia Pacific is projected to grow rapidly, owing to the growing investments in the industrial sector and adoption of 5G & 6G network by China. China is the largest hub for manufacturing, pharmaceutical, chemical, and electronics industries. These factors are anticipated to propel the demand for terahertz components and systems in the region. Thus, manufacturers of THz systems and components should develop innovative products and make these products available commercially.

The terahertz (THz) wave is an electromagnetic wave that has a spectrum range between microwave and the infrared. Terahertz waves have a frequency range of about 100 GHz to 10 THz, and wavelengths 3 mm to 30 µm. They are known as far-infrared or sub-millimeter waves. They also offer some advantages such as low energy, non-invasive, and high resolution and penetration. A key benefit of terahertz waves is that several materials that block visible and IR spectra; however, these can be appear to be transparent in the terahertz region.

Similar to X-ray images, terahertz wavelengths can penetrate through many non-conductive materials and can easily detect imperfections such as voids, cracks, and density variations. THz waves carry very low energies as compared to X-ray or UV radiation; they do not ionize and damage the material that is under observation. Thus, these waves are widely used for non-invasive imaging and non-destructive quality control. Terahertz systems are extensively deployed for non-destructive testing applications, which include NDT in aircraft & fiber-reinforced composites, ceramic coating thickness measurements, evaluation of seams, detection of voids, inspection & repair of pipelines, and automotive fuel tanks.

Improvement in the terahertz (THz) technology is rapidly fueling its demand in various applications such as THz radars, high-rate communications, medical imaging, environmental monitoring, and space exploration. High cost associated with the production and packaging techniques used for terahertz systems poses a significant challenge for the cost-effective and large production of these components while making THZ systems. The current terahertz (THz) technology depends on conventional and expensive serial production and packaging techniques, such as computer numerical control (CNC) high-precision machine, which are fit only for high-end research instrumentation.

Currently, most available technologies have been focusing on frequencies below 100 GHz or higher than 10 THz. MEMS technology is anticipated to be of great importance for industrial utilization and large-scale scientific research applications that employ THz frequency. Advancements in the MEMS technology for terahertz frequency are projected to drive the terahertz components and systems market.

The adoption of the MEMS technology for developing terahertz components offers several benefits such as lightweight, low cost, low power consumption, and miniaturized components, which are important for detection, communication, and sensing applications. Thus, MEMS technology plays vital role in developing terahertz components and systems.

Currently, suitable testing and measuring techniques are still unable to cater to the requirement of process & quality control inspection and detection. Established methods based on ultrasound, thermography, X-ray, optics, and eddy current are effective in structural analysis and fault detection; however, these methods are limited for some applications such as non-destructive testing of foam, fiber reinforced plastics, and hollow structures.

The terahertz technology provides a new opportunity to overcome these limitations, and opens new ways of internal nondestructive testing owing to its excellent penetration capability through most of non-conductive materials such as ceramics, glass, foam, rubber, resin, paint, and composite materials, etc.

The demand of terahertz systems for non-destructive testing (NDT), especially in the aerospace & defense sector, is considerably high. Terahertz (THz) NDT imaging is one of most successful applications to detect defects in the sprayed on foam insulation (SOFI) layers on space shuttle fuel tank. This is estimated to increase the adoption of non-destructive testing in the aerospace & defense sector.

Moreover, non-destructive testing is used in security applications at airports, such as checking explosive, hazardous materials, guns, and other harmful weapons. This, in turn, propels the demand for non-destructive testing.

Researchers and industry players are also increasingly paying attention to the THz technology as a new cost-effective solution for non-destructive testing applications. Thus, increase in penetration of the terahertz technology in various non-destructive testing applications is expected to drive the global terahertz components and systems market during the forecast period.

In terms of component, the global terahertz components and systems market has been bifurcated into source modules and detector module. The source modules segment held a major share of around 64% of the market in 2021. The segment is projected to expand at a CAGR of 18% during the forecast period. This growth can be attributed to the extensive application of various source modules such as broadband THz source for THz spectroscopy and spatial mapping, and THz frequency comb generation. The source module comprises a photoconductive antenna, hyper-hemispherical silicon lens, and thermistor on the built-in bias circuit to deliver stable output. These source modules are available in various frequency ranges such as 100 GHz, 140 GHz, 200 GHz, 300 GHz, 600 GHz, etc. Key players are developing these source modules by utilizing various innovative technologies. Terasense Group Inc., has built terahertz sources with the aid of the IMPATT (Impact Ionization Avalanche Transit-Time Diode) technology integrated with protective isolator, TTL Modulation, and detachable horn antenna.

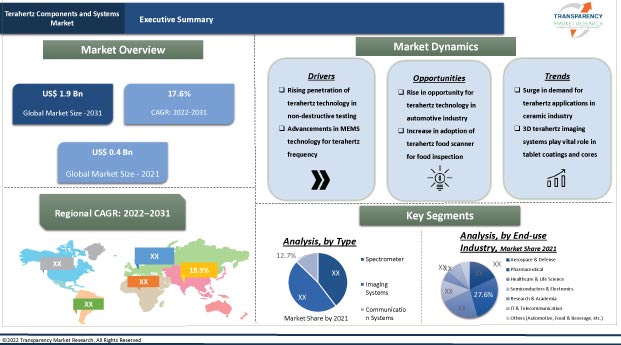

In terms of type, the global terahertz components and systems market has been classified into spectrometer, imaging systems, and communication systems. The imaging systems segment dominated the global terahertz components and systems market, and accounted for 47.6% share of the market in 2021. Furthermore, this segment is also expected to grow at a prominent CAGR of 18.2% during the forecast period.

Terahertz imaging system is being extensively deployed for use in various NDT applications such as detection of the debonding detects in the adhesive layer of thermal protection material, detection of cracks in ceramic materials, corrosion detection under paint, and detection of impact damages on polypropylene composite plates. Thus, all these factors are boosting the demand for THz imaging systems.

North America dominated the global terahertz components and systems market, and held around 38% share in 2021. The market in the region is estimated to grow at a CAGR of 17.9% during the forecast period. Rising investments in the development of terahertz components and systems, and technological advancements offer significant opportunities in the healthcare, pharma, and telecommunication sectors. Furthermore, mature economy, established infrastructure, and penetration of key market players in North America has propelled the market in the region.

The terahertz components and systems market in Asia Pacific and Europe is growing significantly. The regions held value shares of 23.4% and 29.6%, respectively, of the global market in 2021. Aerospace & defense, pharmaceutical, healthcare & life sciences, and semiconductors & electronics are major end-use industries of terahertz components and systems in these regions.

The market in Middle East & Africa is projected to grow at a moderate pace, and greater than the market in South America, at a CAGR of 16.4% during the forecast period.

The global terahertz components and systems market is consolidated with a number of large-scale and small scale vendors controlling majority of the market share. These firms are spending significantly on comprehensive research and development, primarily to develop innovative products. Diversification of product portfolios and mergers & acquisitions are the strategies adopted by key players.

Microtech Instruments Inc., Advantest Corporation, Bruker Corporation, EMCORE Corporation, TeraView Limited, Menlo Systems GmbH, Toptica Photonics AG, Luna Innovations Incorporated, Terasense Group Inc, and Applied Research & Photonics, Inc. are the prominent entities operating in this market.

Each of these players has been profiled in the terahertz components and systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 0.4 Bn |

|

Market Forecast Value in 2031 |

US$ 1.9 Bn |

|

Growth Rate (CAGR) |

17.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

Terahertz components and systems market is expected to cross US$ 1.9 Bn by 2031.

Terahertz components and systems market is estimated to grow at a CAGR of 17.6% during the forecast period.

Rise in demand for spectroscopy applications and increase in penetration of terahertz technology in non-destructive testing applications drive the market.

The industrial non-destructive testing segment accounted for 44.1% share of the terahertz components and systems market in 2021.

North America is more attractive for vendors of the terahertz components and systems market.

Key players of terahertz components and systems market include Microtech Instruments Inc., Advantest Corporation, Bruker Corporation, EMCORE Corporation, TeraView Limited, Menlo Systems GmbH, Toptica Photonics AG, Luna Innovations Incorporated, Terasense Group Inc, and Applied Research & Photonics, Inc.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Terahertz Components and Systems Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Inspection and Detection Systems Industry Overview Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. Covid-19 Impact and Recovery Analysis

5. Global Terahertz Components and Systems Market Analysis, by Component

5.1. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Component, 2017–2031

5.1.1. Source Modules

5.1.2. Detector Module

5.2. Market Attractiveness Analysis, by Component

6. Global Terahertz Components and Systems Market Analysis, by Type

6.1. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

6.1.1. Spectrometer

6.1.2. Imaging Systems

6.1.3. Communication Systems

6.2. Market Attractiveness Analysis, by Type

7. Global Terahertz Components and Systems Market Analysis, by Application

7.1. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

7.1.1. Industrial Non-destructive Testing

7.1.2. Medical Imaging

7.1.3. Defense & Security

7.1.4. Others (Wireless Communication, Research & Development, etc.)

7.2. Market Attractiveness Analysis, by Application

8. Global Terahertz Components and Systems Market Analysis, by End-use Industry

8.1. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

8.1.1. Aerospace & Defense

8.1.2. Pharmaceutical

8.1.3. Healthcare & Life Science

8.1.4. Semiconductors & Electronics

8.1.5. Research & Academia

8.1.6. IT & Telecommunication

8.1.7. Others (Automotive, Food & Beverage, etc.)

8.2. Market Attractiveness Analysis, by End-use Industry

9. Global Terahertz Components and Systems Market Analysis and Forecast, by Region

9.1. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Terahertz Components and Systems Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Component, 2017–2031

10.3.1. Source Modules

10.3.2. Detector Module

10.4. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

10.4.1. Spectrometer

10.4.2. Imaging Systems

10.4.3. Communication Systems

10.5. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.5.1. Industrial Non-destructive Testing

10.5.2. Medical Imaging

10.5.3. Defense & Security

10.5.4. Others (Wireless Communication, Research & Development, etc.)

10.6. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

10.6.1. Aerospace & Defense

10.6.2. Pharmaceutical

10.6.3. Healthcare & Life Science

10.6.4. Semiconductors & Electronics

10.6.5. Research & Academia

10.6.6. IT & Telecommunication

10.6.7. Others (Automotive, Food & Beverage, etc.)

10.7. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Component

10.8.2. By Type

10.8.3. By Application

10.8.4. By End-use Industry

10.8.5. By Country & Sub-region

11. Europe Terahertz Components and Systems Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Component, 2017–2031

11.3.1. Source Modules

11.3.2. Detector Module

11.4. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

11.4.1. Spectrometer

11.4.2. Imaging Systems

11.4.3. Communication Systems

11.5. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.5.1. Industrial Non-destructive Testing

11.5.2. Medical Imaging

11.5.3. Defense & Security

11.5.4. Others (Wireless Communication, Research & Development, etc.)

11.6. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.6.1. Aerospace & Defense

11.6.2. Pharmaceutical

11.6.3. Healthcare & Life Science

11.6.4. Semiconductors & Electronics

11.6.5. Research & Academia

11.6.6. IT & Telecommunication

11.6.7. Others (Automotive, Food & Beverage, etc.)

11.7. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Component

11.8.2. By Type

11.8.3. By Application

11.8.4. By End-use Industry

11.8.5. By Country & Sub-region

12. Asia Pacific Terahertz Components and Systems Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Component, 2017–2031

12.3.1. Source Modules

12.3.2. Detector Module

12.4. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

12.4.1. Spectrometer

12.4.2. Imaging Systems

12.4.3. Communication Systems

12.5. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.5.1. Industrial Non-destructive Testing

12.5.2. Medical Imaging

12.5.3. Defense & Security

12.5.4. Others (Wireless Communication, Research & Development, etc.)

12.6. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.6.1. Aerospace & Defense

12.6.2. Pharmaceutical

12.6.3. Healthcare & Life Science

12.6.4. Semiconductors & Electronics

12.6.5. Research & Academia

12.6.6. IT & Telecommunication

12.6.7. Others (Automotive, Food & Beverage, etc.)

12.7. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017–2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Component

12.8.2. By Type

12.8.3. By Application

12.8.4. By End-use Industry

12.8.5. By Country & Sub-region

13. Middle East & Africa Terahertz Components and Systems Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Component, 2017–2031

13.3.1. Source Modules

13.3.2. Detector Module

13.4. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

13.4.1. Spectrometer

13.4.2. Imaging Systems

13.4.3. Communication Systems

13.5. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.5.1. Industrial Non-destructive Testing

13.5.2. Medical Imaging

13.5.3. Defense & Security

13.5.4. Others (Wireless Communication, Research & Development, etc.)

13.6. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.6.1. Aerospace & Defense

13.6.2. Pharmaceutical

13.6.3. Healthcare & Life Science

13.6.4. Semiconductors & Electronics

13.6.5. Research & Academia

13.6.6. IT & Telecommunication

13.6.7. Others (Automotive, Food & Beverage, etc.)

13.7. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Component

13.8.2. By Type

13.8.3. By Application

13.8.4. By End-use Industry

13.8.5. By Country & Sub-region

14. South America Terahertz Components and Systems Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Component, 2017–2031

14.3.1. Source Modules

14.3.2. Detector Module

14.4. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

14.4.1. Spectrometer

14.4.2. Imaging Systems

14.4.3. Communication Systems

14.5. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

14.5.1. Industrial Non-destructive Testing

14.5.2. Medical Imaging

14.5.3. Defense & Security

14.5.4. Others (Wireless Communication, Research & Development, etc.)

14.6. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

14.6.1. Aerospace & Defense

14.6.2. Pharmaceutical

14.6.3. Healthcare & Life Science

14.6.4. Semiconductors & Electronics

14.6.5. Research & Academia

14.6.6. IT & Telecommunication

14.6.7. Others (Automotive, Food & Beverage, etc.)

14.7. Terahertz Components and Systems Market Size (US$ Mn) Analysis & Forecast, by Country & Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Component

14.8.2. By Type

14.8.3. By Application

14.8.4. By End-use Industry

14.8.5. By Country & Sub-region

15. Competition Assessment

15.1. Global Terahertz Components and Systems Market Competition Matrix - a Dashboard View

15.1.1. Global Terahertz Components and Systems Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Advantest Corporation

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Applied Research & Photonics, Inc.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Bruker Corporation

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. EMCORE Corporation

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Luna Innovations Incorporated

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Menlo Systems GmbH

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Microtech Instruments Inc.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Terasense Group Inc

16.8.1. Overvieiew

16.8.2. Prow

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. TeraView Limited

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Toptica Photonics AG

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Component

17.1.2. By Type

17.1.3. By Application

17.1.4. By End-use Industry

17.1.5. By Region

List of Tables

Table 01: Global Terahertz Components and Systems Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 02: Global Terahertz Components and Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 03: Global Terahertz Components and Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 04: Global Terahertz Components and Systems Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 05: Global Terahertz Components and Systems Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 06: North America Terahertz Components and Systems Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 07: North America Terahertz Components and Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 08: North America Terahertz Components and Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 09: North America Terahertz Components and Systems Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 10: North America Terahertz Components and Systems Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 11: Europe Terahertz Components and Systems Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 12: Europe Terahertz Components and Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 13: Europe Terahertz Components and Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 14: Europe Terahertz Components and Systems Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 15: Europe Terahertz Components and Systems Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 16: Asia Pacific Terahertz Components and Systems Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 17: Asia Pacific Terahertz Components and Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 18: Asia Pacific Terahertz Components and Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 19: Asia Pacific Terahertz Components and Systems Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 20: Asia Pacific Terahertz Components and Systems Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 21: Middle East & Africa Terahertz Components and Systems Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 22: Middle East & Africa Terahertz Components and Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 23: Middle East & Africa Terahertz Components and Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 24: Middle East & Africa Terahertz Components and Systems Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 25: Middle East & Africa Terahertz Components and Systems Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 26: South America Terahertz Components and Systems Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 27: South America Terahertz Components and Systems Market Size & Forecast, by Type, Value (US$ Mn), 2017‒2031

Table 28: South America Terahertz Components and Systems Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 29: South America Terahertz Components and Systems Market Size & Forecast, by End-use Industry, Value (US$ Mn), 2017‒2031

Table 30: South America Terahertz Components and Systems Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

List of Figures

Figure 01: Global Terahertz Components and Systems Market, Year-on-Year Growth, Overview, 2018-2031

Figure 02: Global Terahertz Components and Systems Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 03: Global Terahertz Components and Systems Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022‒2031

Figure 04: Global Terahertz Components and Systems Market Share Analysis, by Component, 2022 and 2031

Figure 05: Global Terahertz Components and Systems Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 06: Global Terahertz Components and Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022‒2031

Figure 07: Global Terahertz Components and Systems Market Share Analysis, by Type, 2022 and 2031

Figure 08: Global Terahertz Components and Systems Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 09: Global Terahertz Components and Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 10: Global Terahertz Components and Systems Market Share Analysis, by Application, 2022 and 2031

Figure 11: Global Terahertz Components and Systems Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 12: Global Terahertz Components and Systems Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 13: Global Terahertz Components and Systems Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 14: Global Terahertz Components and Systems Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 15: Global Terahertz Components and Systems Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022‒2031

Figure 16: Global Terahertz Components and Systems Market Share Analysis, by Region, 2022 and 2031

Figure 17: North America Terahertz Components and Systems Market, Year-on-Year Growth, Overview, 2018-2031

Figure 18: North America Terahertz Components and Systems Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 19: North America Terahertz Components and Systems Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022‒2031

Figure 20: North America Terahertz Components and Systems Market Share Analysis, by Component, 2022 and 2031

Figure 21: North America Terahertz Components and Systems Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 22: North America Terahertz Components and Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022‒2031

Figure 23: North America Terahertz Components and Systems Market Share Analysis, by Type, 2022 and 2031

Figure 24: North America Terahertz Components and Systems Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 25: North America Terahertz Components and Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 26: North America Terahertz Components and Systems Market Share Analysis, by Application, 2022 and 2031

Figure 27: North America Terahertz Components and Systems Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 28: North America Terahertz Components and Systems Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 29: North America Terahertz Components and Systems Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 30: North America Terahertz Components and Systems Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 31: North America Terahertz Components and Systems Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 32: North America Terahertz Components and Systems Market Share Analysis, by Country & Sub-region, 2022 and 2031

Figure 33: Europe Terahertz Components and Systems Market, Year-on-Year Growth, Overview, 2018-2031

Figure 34: Europe Terahertz Components and Systems Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 35: Europe Terahertz Components and Systems Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022‒2031

Figure 36: Europe Terahertz Components and Systems Market Share Analysis, by Component, 2022 and 2031

Figure 37: Europe Terahertz Components and Systems Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 38: Europe Terahertz Components and Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022‒2031

Figure 39: Europe Terahertz Components and Systems Market Share Analysis, by Type, 2022 and 2031

Figure 40: Europe Terahertz Components and Systems Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 41: Europe Terahertz Components and Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 42: Europe Terahertz Components and Systems Market Share Analysis, by Application, 2022 and 2031

Figure 43: Europe Terahertz Components and Systems Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 44: Europe Terahertz Components and Systems Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 45: Europe Terahertz Components and Systems Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 46: Europe Terahertz Components and Systems Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 47: Europe Terahertz Components and Systems Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 48: Europe Terahertz Components and Systems Market Share Analysis, by Country & Sub-region, 2022 and 2031

Figure 49: Asia Pacific Terahertz Components and Systems Market, Year-on-Year Growth, Overview, 2018-2031

Figure 50: Asia Pacific Terahertz Components and Systems Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 51: Asia Pacific Terahertz Components and Systems Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022‒2031

Figure 52: Asia Pacific Terahertz Components and Systems Market Share Analysis, by Component, 2022 and 2031

Figure 53: Asia Pacific Terahertz Components and Systems Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 54: Asia Pacific Terahertz Components and Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022‒2031

Figure 55: Asia Pacific Terahertz Components and Systems Market Share Analysis, by Type, 2022 and 2031

Figure 56: Asia Pacific Terahertz Components and Systems Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 57: Asia Pacific Terahertz Components and Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 58: Asia Pacific Terahertz Components and Systems Market Share Analysis, by Application, 2022 and 2031

Figure 59: Asia Pacific Terahertz Components and Systems Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 60: Asia Pacific Terahertz Components and Systems Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 61: Asia Pacific Terahertz Components and Systems Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 62: Asia Pacific Terahertz Components and Systems Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 63: Asia Pacific Terahertz Components and Systems Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 64: Asia Pacific Terahertz Components and Systems Market Share Analysis, by Country & Sub-region, 2022 and 2031

Figure 65: Middle East & Africa Terahertz Components and Systems Market, Year-on-Year Growth, Overview, 2017-2031

Figure 66: Middle East & Africa Terahertz Components and Systems Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 67: Middle East & Africa Terahertz Components and Systems Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022‒2031

Figure 68: Middle East & Africa Terahertz Components and Systems Market Share Analysis, by Component, 2022 and 2031

Figure 69: Middle East & Africa Terahertz Components and Systems Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 70: Middle East & Africa Terahertz Components and Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022‒2031

Figure 71: Middle East & Africa Terahertz Components and Systems Market Share Analysis, by Type, 2022 and 2031

Figure 72: Middle East & Africa Terahertz Components and Systems Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 73: Middle East & Africa Terahertz Components and Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 74: Middle East & Africa Terahertz Components and Systems Market Share Analysis, by Application, 2022 and 2031

Figure 75: Middle East & Africa Terahertz Components and Systems Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 76: Middle East & Africa Terahertz Components and Systems Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 77: Middle East & Africa Terahertz Components and Systems Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 78: Middle East & Africa Terahertz Components and Systems Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 79: Middle East & Africa Terahertz Components and Systems Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 80: Middle East & Africa Terahertz Components and Systems Market Share Analysis, by Country & Sub-region, 2022 and 2031

Figure 81: South America Terahertz Components and Systems Market, Year-on-Year Growth, Overview, 2018-2031

Figure 82: South America Terahertz Components and Systems Market Projections by Component, Value (US$ Mn), 2017‒2031

Figure 83: South America Terahertz Components and Systems Market, Incremental Opportunity, by Component, Value (US$ Mn), 2022‒2031

Figure 84: South America Terahertz Components and Systems Market Share Analysis, by Component, 2022 and 2031

Figure 85: South America Terahertz Components and Systems Market Projections by Type, Value (US$ Mn), 2017‒2031

Figure 86: South America Terahertz Components and Systems Market, Incremental Opportunity, by Type, Value (US$ Mn), 2022‒2031

Figure 87: South America Terahertz Components and Systems Market Share Analysis, by Type, 2022 and 2031

Figure 88: South America Terahertz Components and Systems Market Projections by Application, Value (US$ Mn), 2017‒2031

Figure 89: South America Terahertz Components and Systems Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 90: South America Terahertz Components and Systems Market Share Analysis, by Application, 2022 and 2031

Figure 91: South America Terahertz Components and Systems Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 92: South America Terahertz Components and Systems Market, Incremental Opportunity, by End-use Industry, Value (US$ Mn), 2022‒2031

Figure 93: South America Terahertz Components and Systems Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 94: South America Terahertz Components and Systems Market Projections by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 95: South America Terahertz Components and Systems Market, Incremental Opportunity, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 96: South America Terahertz Components and Systems Market Share Analysis, by Country & Sub-region, 2022 and 2031