The telecom sector has played an imperative role in the development of human society and has consistently remained the main driver for global digital transformation. Over the past couple of decades, technological advancements and implementation of new software infrastructure have played a pivotal role in the development of the telecommunication sector around the world. The telecom sector is expected to provide a makeover to enterprise systems and an array of B2C channels and transform them into agile and modern platforms. The tectonic shift toward digital technologies is likely to have a strong impact on the future of the telecom sector. The integration of streamlined messaging and voice is the major factor that is likely to reshape the telecom industry during the forecast period.

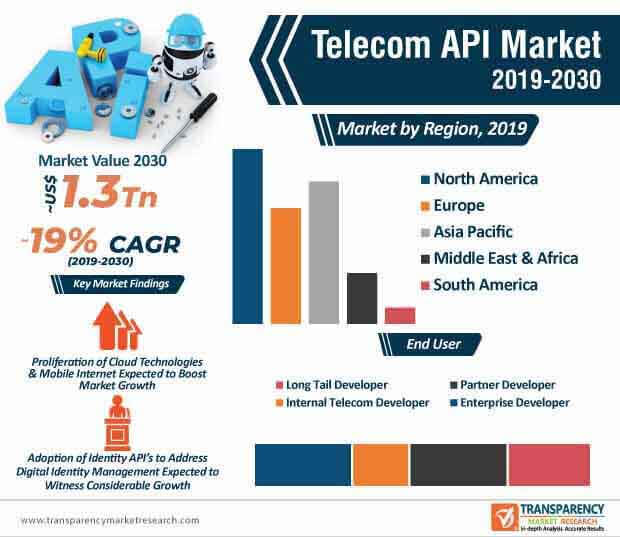

The advent of the application programming interface into the telecom space is expected to set the tone for how developers as well as consumers interact with a system. User-friendly API is set to make a solid impression across the telecom sector and set the wheels rolling for Telecom 2.0. Over the past few years, a large number of telecommunication companies have gradually drifted from being carriers and are increasingly becoming more visible across the value chain. The proliferation of cloud technologies and mobile Internet coupled with increasing access to the 4G LTE network is projected to provide a significant boost to the overall growth of the global telecom API market. At the back of these factors, the global telecom API market is expected to attain a market value of ~US$ 1 Trn by the end of 2030.

Over the past decade, APIs have played an essential role in the development of mobile applications and the modern web due to constant pressure to launch applications into the market. The adoption of third party APIs is primarily driven by C level digital transformation initiatives and growing requirements to find the right expertise, owing to complex requirements of applications. At present, some of the leading companies involved in the telecom API market are utilizing their spare resources to develop some pre-existing and common functionalities from scratch.

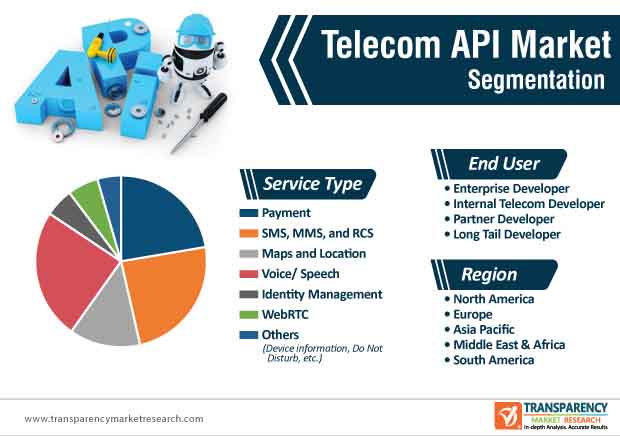

The adoption of API is on the rise across the telecom sector, as it provides access to niche and advanced functionalities to companies of all sizes. In addition, as payment, identity, and communications are core requirements of customer-facing applications, the demand for telecom API is on the rise. At present, data management and protection of the identity data of thousands of customers that engage with the different applications is highly crucial to prevent bad press, data breaches, and GDPR fines. Some of the key areas wherein telecom API developers are currently seeking improvements include multi-factor authentication, single-sign-on (SSO), dynamic utilization of strong identities, usage of social identity, setup and contextual authentication, identity storage data, and mobile identity support, among others.

Over the past few years, the telecom sector has experienced a tectonic shift from the hardware space to the software space primarily driven by API. Cloud communication platforms are at the vanguard of the telecom API providing SMS, video, chat, voice, etc. Recent trends suggest strong demand for mobile top-up API and a range of other telecom APIs– a factor that is expected to propel the growth of the telecom API market during the assessment period. Several companies in the current telecom API market landscape are focusing on the development of API to enable the integration of their services within programs and applications of developers. For instance, Twilio, provides an API in which its own cloud network can be integrated into the developer’s applications. Moreover, another participant involved in the telecom API market, Aepona, provides an API foundation platform, that is largely used to implement, create, and monetize APIs. While identity API is expected to garner considerable popularity, maps and location API is expected to remain the most popular service type.

As the COVID-19 pandemic continues to stall the progress of several industrial sectors across the world, several companies that are active in the current telecom API market are focusing on the development of new concepts of API to provide an impetus to the delivery of COVID-19 tracking technologies. For instance, Apple and Google have announced that tech giants have come together to roll out the initial version of an API to the developers– a step that is likely to pave the way for COVID-19 tracking technologies. The two tech giants announced that the collaboration is aimed toward creating a solution that is expected to enable transmission of data to track COVID-19 cases and contact tracing. While the telecom API market is likely to enter an indefinite period of uncertainty, market players are projected to provide solutions that are likely to assist in the detection and tracking of active COVID-19 cases.

Analysts Viewpoint

The global telecom API market is expected to grow at a staggering CAGR of ~19% during the forecast period. The market growth is primarily driven by a range of factors, including the proliferation of cloud technologies & mobile Internet, high adoption of location & maps API, and growing emphasis on the development of API to enable the integration of services across the programs used by developers. North America will be at the forefront in terms of the development of new telecom API and likely to provide considerable opportunities, owing to rapid adoption of new technologies and high concentration of tier 1 market players.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modelling

3. Executive Summary - Global Telecom API Market

4. Market Overview

4.1. Market Definition

4.2. Macroeconomic Factors

4.2.1. World GDP Indicator – For Top Economies

4.2.2. Global ICT Spending (US$ Bn)

4.3. Market Factor Analysis

4.3.1. Market Dynamics (Growth Influencers)

4.3.1.1. Drivers

4.3.1.2. Restraints

4.3.1.3. Opportunities

4.3.1.4. Impact Analysis of Drivers and Restraints

4.4. Key Trends Analysis

4.5. Impact Analysis of COVID-19 on Telecom API Market

4.6. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.6.1. By Service Type

4.6.2. By End-user

4.7. Market Outlook

5. Global Telecom API Market Analysis and Forecast

5.1.1. Market Revenue Analysis (US$ Bn), 2015-2030

5.1.1.1. Historic Growth Trends, 2015-2019

5.1.1.2. Forecast Trends, 2020-2030

6. Global Telecom API Market Analysis, by Service type

6.1. Overview

6.2. Key Segment Analysis

6.3. Telecom API Market Size (US$ Bn) Forecast, by Service Type, 2018 - 2030

6.3.1. Payment

6.3.2. SMS, MMS, and RCS

6.3.3. Maps and Location

6.3.4. Voice/Speech

6.3.5. Identity Management

6.3.6. WebRTC

6.3.7. Others (Device information, Do Not Disturb, etc.)

7. Global Telecom API Market Analysis, by End-user

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Telecom API Market Size (US$ Bn) Forecast, by End-user, 2018 - 2030

7.3.1. Enterprise Developer

7.3.2. Internal Telecom Developer

7.3.3. Partner Developer

7.3.4. Long Tail Developer

8. Global Telecom API Market Analysis and Forecast, By Region

8.1. Key Findings

8.2. Telecom API Market Size (US$ Bn) Forecast, by Region, 2018 - 2030

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Telecom API Market Analysis

9.1. Regional Outlook

9.2. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

9.2.1. By Service Type

9.2.2. By End-user

9.3. Telecom API Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

9.3.1. U.S.

9.3.2. Canada

9.3.3. Rest of North America

10. U.S. Telecom API Market Analysis and Forecast

10.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

10.1.1. By Service Type

10.1.2. By End-user

11. Canada Telecom API Market Analysis and Forecast

11.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

11.1.1. By Service Type

11.1.2. By End-user

12. Europe Telecom API Market Analysis and Forecast

12.1. Regional Outlook

12.2. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

12.2.1. By Service Type

12.2.2. By End-user

12.3. Telecom API Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

12.3.1. Germany

12.3.2. U.K.

12.3.3. France

12.3.4. Rest of Europe

13. Germany Telecom API Market Analysis and Forecast

13.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

13.1.1. By Service Type

13.1.2. By End-user

14. U.K. Telecom API Market Analysis and Forecast

14.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

14.1.1. By Service Type

14.1.2. By End-user

15. France Telecom API Market Analysis and Forecast

15.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

15.1.1. By Service Type

15.1.2. By End-user

16. APAC Telecom API Market Analysis and Forecast

16.1. Regional Outlook

16.2. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

16.2.1. By Service Type

16.2.2. By End-user

16.3. Telecom API Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

16.3.1. China

16.3.2. India

16.3.3. Japan

16.3.4. Rest of Asia Pacific

17. China Telecom API Market Analysis and Forecast

17.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

17.1.1. By Service Type

17.1.2. By End-user

18. India Telecom API Market Analysis and Forecast

18.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

18.1.1. By Service Type

18.1.2. By End-user

19. Japan Telecom API Market Analysis and Forecast

19.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

19.1.1. By Service Type

19.1.2. By End-user

20. Middle East & Africa (MEA) Telecom API Market Analysis and Forecast

20.1. Regional Outlook

20.2. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

20.2.1. By Service Type

20.2.2. By End-user

20.3. Telecom API Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

20.3.1. GCC

20.3.2. South Africa

20.3.3. Rest of Middle East & Africa (MEA)

21. GCC Telecom API Market Analysis and Forecast

21.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

21.1.1. By Service Type

21.1.2. By End-user

22. South Africa Telecom API Market Analysis and Forecast

22.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

22.1.1. By Service Type

22.1.2. By End-user

23. South America Telecom API Market Analysis and Forecast

23.1. Regional Outlook

23.2. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

23.2.1. By Service Type

23.2.2. By End-user

23.3. Telecom API Market Size (US$ Bn) Forecast, by Country & Sub-region, 2018 - 2030

23.3.1. Brazil

23.3.2. Rest of South America

24. Brazil Telecom API Market Analysis and Forecast

24.1. Telecom API Market Size (US$ Bn) Analysis and Forecast (2018 - 2030)

24.1.1. By Service Type

24.1.2. By End-user

25. Competition Landscape

25.1. Market Competition Matrix, by Leading Players

25.2. Market Revenue Share Analysis (%), by Leading Players (2019)

26. Company Profiles

26.1. AT&T, Inc.

26.1.1. Business Overview

26.1.2. Geographical Footprint

26.1.3. Revenue and Strategy

26.2. Cisco Systems, Inc.

26.2.1. Business Overview

26.2.2. Geographical Footprint

26.2.3. Revenue and Strategy

26.3. Fortumo OU

26.3.1. Business Overview

26.3.2. Geographical Footprint

26.3.3. Revenue and Strategy

26.4. Google, LLC

26.4.1. Business Overview

26.4.2. Geographical Footprint

26.4.3. Revenue and Strategy

26.5. Huawei Technologies Co., Ltd.

26.5.1. Business Overview

26.5.2. Geographical Footprint

26.5.3. Revenue and Strategy

26.6. LocationSmart

26.6.1. Business Overview

26.6.2. Geographical Footprint

26.6.3. Revenue and Strategy

26.7. Nokia Corporation

26.7.1. Business Overview

26.7.2. Geographical Footprint

26.7.3. Revenue and Strategy

26.8. Orange S.A.

26.8.1. Business Overview

26.8.2. Geographical Footprint

26.8.3. Revenue and Strategy

26.9. Twilio, Inc.

26.9.1. Business Overview

26.9.2. Geographical Footprint

26.9.3. Revenue and Strategy

26.10. Verizon Communications Inc.

26.10.1. Business Overview

26.10.2. Geographical Footprint

26.10.3. Revenue and Strategy

27. Key Takeaways

List of Tables

Table 1: Global Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 2: Global Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 3: Global Telecom API Market Value (US$ Bn) Forecast, by Region, 2018 - 2030

Table 4: North America Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 5: North America Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 6: North America Telecom API Market Value (US$ Bn) Forecast, by Country, 2018 - 2030

Table 7: U.S. Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 8: U.S. Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 9: Canada Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 10: Canada Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 11: Europe Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 12: Europe Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 13: Europe Telecom API Market Value (US$ Bn) Forecast, by Country, 2018 - 2030

Table 14: Germany Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 15: Germany Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 16: U.K. Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 17: U.K. Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 18: France Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 19: France Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 20: Asia Pacific Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 21: Asia Pacific Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 22: Asia Pacific Telecom API Market Value (US$ Bn) Forecast, by Country, 2018 - 2030

Table 23: China Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 24: China Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 25: India Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 26: India Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 27: Japan Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 28: Japan Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 29: Middle East & Africa Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 30: Middle East & Africa Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 31: Middle East & Africa Telecom API Market Value (US$ Bn) Forecast, by Country, 2018 - 2030

Table 32: GCC Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 33: GCC Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 34: South Africa Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 35: South Africa Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 36: South America Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 37: South America Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

Table 38: South America Telecom API Market Value (US$ Bn) Forecast, by Country, 2018 - 2030

Table 39: Brazil Telecom API Market Value (US$ Bn) Forecast, by Service Type, 2018 - 2030

Table 40: Brazil Telecom API Market Value (US$ Bn) Forecast, by End-user, 2018 - 2030

List of Figures

Figure 1: Global Telecom API Market Size (US$ Bn) Forecast, 2018 – 2030

Figure 2: Global Telecom API Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2020E

Figure 3: Top Segment Analysis

Figure 4: Global Telecom API Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2030F

Figure 5: GDP (US$ Bn), Top Countries (2014 – 2019)

Figure 6: Top Economies GDP Landscape, 2019

Figure 7: Global ICT Spending (%), by Region, 2019

Figure 8: Global ICT Spending (US$ Bn), Regional Contribution, 2019

Figure 9: Global ICT Spending (US$ Bn), Spending Type Contribution, 2019

Figure 10: Global ICT Spending (%), by Type, 2019

Figure 11: Global Telecom API Market Attractiveness Assessment, by Service Type

Figure 12: Global Telecom API Market Relative Attractiveness Assessment, by Service Type

Figure 13: Global Telecom API Market Attractiveness Assessment, by End-user

Figure 14: Global Telecom API Market Relative Attractiveness Assessment, by End-user

Figure 15: Global Telecom API Market Attractiveness Assessment, by Region

Figure 16: Global Telecom API Market Relative Attractiveness Assessment, by Region

Figure 17: Global Telecom API Market, by Service Type, CAGR (%) (2020 – 2030)

Figure 18: Global Telecom API Market, by End-user, CAGR (%) (2020 – 2030)

Figure 19: Global Telecom API Market, by Region, CAGR (%) (2020 – 2030)

Figure 20: Global Telecom API Market Revenue (US$ Bn) Historic Trends, 2015 - 2019

Figure 21: Global Telecom API Market Revenue Opportunity (US$ Bn) Historic Trends, 2015 - 2019

Figure 22: Global Telecom API Market Revenue (US$ Bn) and Y-o-Y Growth (Revenue %) Forecast, 2020 - 2030

Figure 23: Global Telecom API Market Revenue Opportunity (US$ Bn) Forecast, 2020 - 2030

Figure 24: Global Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 25: Global Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 26: Global Telecom API Market Value Share Analysis, by End-user, 2020

Figure 27: Global Telecom API Market Value Share Analysis, by End-user, 2030

Figure 28: Global Telecom API Market Value Share Analysis, by Region, 2020

Figure 29: Global Telecom API Market Value Share Analysis, by Region, 2030

Figure 30: North America Telecom API Market Opportunity Growth Analysis (US$ Bn) Forecast, 2018 – 2030

Figure 31: North America Telecom API Market Y-o-Y Growth (Value %), 2019 - 2030

Figure 32: North America Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 33: North America Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 34: North America Telecom API Market Value Share Analysis, by End-user, 2020

Figure 35: North America Telecom API Market Value Share Analysis, by End-user, 2030

Figure 36: North America Telecom API Market Value Share Analysis, by Country, 2020

Figure 37: North America Telecom API Market Value Share Analysis, by Country, 2030

Figure 38: U.S. Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 39: U.S. Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 40: U.S. Telecom API Market Value Share Analysis, by End-user, 2020

Figure 41: U.S. Telecom API Market Value Share Analysis, by End-user, 2030

Figure 42: Canada Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 43: Canada Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 44: Canada Telecom API Market Value Share Analysis, by End-user, 2020

Figure 45: Canada Telecom API Market Value Share Analysis, by End-user, 2030

Figure 46: Europe Telecom API Market Opportunity Growth Analysis (US$ Bn) Forecast, 2018 – 2030

Figure 47: Europe Telecom API Market Y-o-Y Growth (Value %), 2019 - 2030

Figure 48: Europe Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 49: Europe Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 50: Europe Telecom API Market Value Share Analysis, by End-user, 2020

Figure 51: Europe Telecom API Market Value Share Analysis, by End-user, 2030

Figure 52: Europe Telecom API Market Value Share Analysis, by Country, 2020

Figure 53: Europe Telecom API Market Value Share Analysis, by Country, 2030

Figure 54: Germany Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 55: Germany Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 56: Germany Telecom API Market Value Share Analysis, by End-user, 2020

Figure 57: Germany Telecom API Market Value Share Analysis, by End-user, 2030

Figure 58: U.K. Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 59: U.K. Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 60: U.K. Telecom API Market Value Share Analysis, by End-user, 2020

Figure 61: U.K. Telecom API Market Value Share Analysis, by End-user, 2030

Figure 62: France Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 63: France Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 64: France Telecom API Market Value Share Analysis, by End-user, 2020

Figure 65: France Telecom API Market Value Share Analysis, by End-user, 2030

Figure 66: Asia Pacific Telecom API Market Opportunity Growth Analysis (US$ Bn) Forecast, 2018 – 2030

Figure 67: Asia Pacific Telecom API Market Y-o-Y Growth (Value %), 2019 - 2030

Figure 68: Asia Pacific Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 69: Asia Pacific Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 70: Asia Pacific Telecom API Market Value Share Analysis, by End-user, 2020

Figure 71: Asia Pacific Telecom API Market Value Share Analysis, by End-user, 2030

Figure 72: Asia Pacific Telecom API Market Value Share Analysis, by Country, 2020

Figure 73: Asia Pacific Telecom API Market Value Share Analysis, by Country, 2030

Figure 74: China Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 75: China Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 76: China Telecom API Market Value Share Analysis, by End-user, 2020

Figure 77: China Telecom API Market Value Share Analysis, by End-user, 2030

Figure 78: India Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 79: India Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 80: India Telecom API Market Value Share Analysis, by End-user, 2020

Figure 81: India Telecom API Market Value Share Analysis, by End-user, 2030

Figure 82: Japan Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 83: Japan Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 84: Japan Telecom API Market Value Share Analysis, by End-user, 2020

Figure 85: Japan Telecom API Market Value Share Analysis, by End-user, 2030

Figure 86: Middle East & Africa Telecom API Market Opportunity Growth Analysis (US$ Bn) Forecast, 2018 – 2030

Figure 87: Middle East & Africa Telecom API Market Y-o-Y Growth (Value %), 2019 - 2030

Figure 88: Middle East & Africa Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 89: Middle East & Africa Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 90: Middle East & Africa Telecom API Market Value Share Analysis, by End-user, 2020

Figure 91: Middle East & Africa Telecom API Market Value Share Analysis, by End-user, 2030

Figure 92: Middle East & Africa Telecom API Market Value Share Analysis, by Country, 2020

Figure 93: Middle East & Africa Telecom API Market Value Share Analysis, by Country, 2030

Figure 94: GCC Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 95: GCC Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 96: GCC Telecom API Market Value Share Analysis, by End-user, 2020

Figure 97: GCC Telecom API Market Value Share Analysis, by End-user, 2030

Figure 98: South Africa Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 99: South Africa Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 100: South Africa Telecom API Market Value Share Analysis, by End-user, 2020

Figure 101: South Africa Telecom API Market Value Share Analysis, by End-user, 2030

Figure 102: South America Telecom API Market Opportunity Growth Analysis (US$ Bn) Forecast, 2018 – 2030

Figure 103: South America Telecom API Market Y-o-Y Growth (Value %), 2019 - 2030

Figure 104: South America Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 105: South America Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 106: South America Telecom API Market Value Share Analysis, by End-user, 2020

Figure 107: South America Telecom API Market Value Share Analysis, by End-user, 2030

Figure 108: South America Telecom API Market Value Share Analysis, by Country, 2020

Figure 109: South America Telecom API Market Value Share Analysis, by Country, 2030

Figure 110: Brazil Telecom API Market Value Share Analysis, by Service Type, 2020

Figure 111: Brazil Telecom API Market Value Share Analysis, by Service Type, 2030

Figure 112: Brazil Telecom API Market Value Share Analysis, by End-user, 2020

Figure 113: Brazil Telecom API Market Value Share Analysis, by End-user, 2030