Analysts’ Viewpoint on Market Scenario

Sulfuric acid is one of the most important chemicals that is used in diverse applications in the manufacturing and industrial sectors. It is extensively utilized to synthesize phosphate-based fertilizers, and as a chemical feedstock to produce various crucial chemicals. The food industry in major developing and developed countries is witnessing substantial growth.

This is anticipated to fuel the need for phosphate-based fertilizers significantly due to rise in production of cereals and oilseeds, such as wheat, rice, cotton, and soya bean owing to surge in global population and increased spending capacity of the population of developing countries. Industrial growth in major developing countries, primarily in Asia Pacific, is driving the demand for various chemicals that are dependent on sulfuric acid for their synthesis, which in turn is augmenting the global sulfuric acid industry.

Sulfuric acid is utilized across various manufacturing industries, as it is one of the major bulk chemicals produced across the globe. It is manufactured through conventional methods such as the wet acid process and contact process by using elemental sulfur with oleum or hydrogen sulfide as raw materials. The sulfuric acid market overview reveals the importance of sulfuric acid in various industrial and domestic applications as an intermediate and raw material.

Several key industries require sulfuric acid for the production of fertilizers, nitric acid, hydrochloric acid, hydrofluoric acid, and titanium dioxide. Furthermore, wastewater treatment, metal & mining, pharmaceutical, and paper processing are other end-use applications of sulfuric acid.

The rise in the usage of phosphate fertilizers is also driving the sulfuric acid business across the globe. Furthermore, demand for sulfuric acid is projected to increase due to a rise in its usage in the synthesis of other commodities and specialty chemicals that are dependent on sulfuric acid. Recovery of raw materials of sulfuric acid, primarily sulfur, from core manufacturing industries is estimated to offer significant market opportunities for sulfuric acid manufacturers during the forecast period.

Sulfuric acid is used in the first step in the production of Diammonium phosphate (DAP), monoammonium phosphate (MAP), and trisodium phosphate (TSP), after which it is mixed with phosphate rock to produce phosphoric acid. These fertilizers are extensively used to increase the yield of crops in order to cater to the rising demand for food.

Market demand for sulfuric acid relies heavily on the growing consumption of fertilizers, especially phosphate fertilizers, which is anticipated to increase significantly due to an increase in demand and production of oilseeds and cereals, such as rice, maize, wheat, soybean, and cotton, from an ever-increasing global population.

Government policies regarding fertilizer subsidies and agricultural development in major agrarian economies, such as China, India, and South Africa, is estimated to boost the demand for phosphate fertilizers and consequently, aid in the market progress.

The phosphate fertilizers segment accounted for around 62% of the global market share in 2021. Sulfuric acid is extensively employed to manufacture phosphate fertilizers.

The sulfuric acid market scope also includes applications such as sulfuric acid batteries or lead-cell batteries that are used in automobiles and other motorized vehicles, acidic drain cleaners, which are used to remove grease, and in the paper and pulp industry, domestic applications, and pharmaceuticals.

One of the key market trends, apart from the extensive usage in fertilizer manufacturing, is the rise in demand from the paper and pulp industry, domestic applications, and the pharmaceutical industry.

Sulfuric acid is extensively used in numerous applications as a raw material or processing agent. Sulfuric acid is commonly used in almost all industries such as water treatment, steel manufacturing, fertilizers, pharmaceuticals, cellulose fibers, and chemical processing.

It is widely employed in the manufacture of copper, zinc, hydrofluoric acid, hydrochloric acid, nitric acid, and caprolactam, which, after converting to polyamide 6 and titanium dioxide, is further used as pigments.

It also finds usage in the production of sulfuric acid solutions and chemicals such as hydrochloric acid, sulfate salts, nitric acid, dyes and pigments, synthetic detergents, drugs, and explosives. It is extensively used in petroleum cleansing to wash out of impurity from petrol and other refinery products.

The sulphuric acid market analysis reveals that the market is greatly driven by growth in demand for sulphuric acid in all the connected industrial chemicals due to its diverse range of applications in industrial and manufacturing sectors. Industrial growth in several developing countries is further aiding in market development due to the importance of sulphuric acid in various industrial applications.

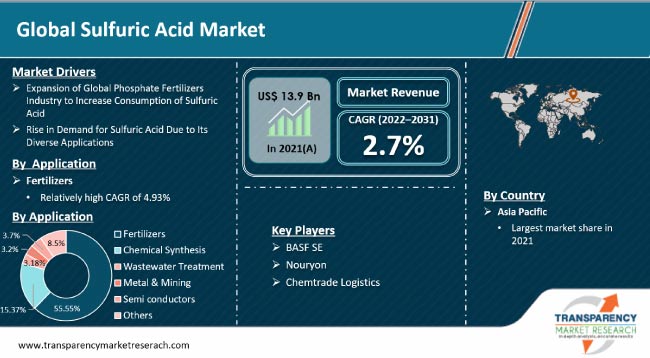

Based on application, the sulfuric acid market segmentation comprises fertilizers, chemical synthesis, wastewater treatment, metal and mining, semiconductors, and others. Sulfuric acid is employed in the production of phosphoric acid, which is used to manufacture fertilizers such as mono and diammonium phosphates and triple superphosphate. The production of fertilizers, especially phosphate fertilizers from wet-process phosphoric acid, is the major end-use of sulfuric acid.

Fertilizers such as superphosphates, ammonium phosphate, and ammonium sulfates are manufactured using sulfuric acid. The fertilizers segment accounted for 62.1% of the total market share in 2021. It is expected to grow at a decent CAGR of 2.9% during the forecast period.

An in-depth look at the sulfuric acid market forecast indicates that Asia Pacific is likely to account for a 47.3% share of the global sulfuric acid business by 2031, due to rapid industrial growth in developing countries in the region.

Worldwide economic growth is expected to increase at a rapid pace as the global economy is expanding rapidly and recovering well post the COVID-19 era. Several developing countries in Asia Pacific have well-established manufacturing base for various industries such as pharmaceutical, automotive, food & beverage, apparel, and semiconductors among others. Growth of fertilizer industry and rise in demand for various other chemicals in the manufacturing sector are also key factors driving market expansion in the region.

The global sulfuric acid industry is highly fragmented. Numerous large-scale as well as medium-scale manufacturers account for a large share of the market. The top seven manufacturers, collectively, held below 10% share of the global sulfuric acid market in 2021. Currently, The Mosaic Company, Nouryon, and BASF SE are the leading market players, while other sulfuric acid manufacturers held more than 90% share in 2021.

Key players focus on technological innovations, business expansion through strategic collaboration, capacity expansion, mergers and acquisitions to boost their presence and consolidate their position in the global sulfuric acid business. BASF SE, Nouryon, INEOS, The Mosaic Company, Ma’aden are some of the prominent entities operating in the market.

Key players in the sulfuric acid market report have been profiled in terms of product portfolio, financial overview, company overview, business strategies, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 13.9 Bn |

|

Market Forecast Value in 2031 |

US$ 18.2 Bn |

|

Growth Rate (CAGR) |

2.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn For Value And Kilo Tons For Volume |

|

Market Analysis |

It includes cross segment analysis at Europe as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 13.9 Bn in 2021

It is expected to grow at a CAGR of 2.7% from 2022 to 2031

Expansion of the global phosphate fertilizers industry to increase consumption of sulfuric acid and rise in demand for sulfuric acid due to its diverse applications

Fertilizers was the largest application segment and held 62.1% share in 2021

Asia Pacific was the most lucrative region and held 46.3% of the global share in 2021

BASF SE, Nouryon, Chemtrade Logistics, The Mosaic Company, INEOS

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Sulfuric Acid Market Analysis and Forecasts, 2020–2031

2.6.1. Global Sulfuric Acid Market Volume (Kilo Tons)

2.6.2. Global Sulfuric Acid Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Sulfuric Acid

3.2. Impact on the Demand of Sulfuric Acid– Pre & Post Crisis

4. Production Output Analysis(Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2020–2031

6.1. Price Trend Analysis by Application

6.2. Price Trend Analysis by Region

7. Sulfuric Acid Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Global Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Fertilizers

7.2.2. Chemical Synthesis

7.2.3. Wastewater Treatment

7.2.4. Metal & Mining

7.2.5. Semi-conductors

7.2.6. Others

7.3. Global Sulfuric Acid Market Attractiveness, by Application

8. Global Sulfuric Acid Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Sulfuric Acid Market Attractiveness, by Region

9. North America Sulfuric Acid Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.3. North America Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

9.3.1. U.S. Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.3.2. Canada Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

9.4. North America Sulfuric Acid Market Attractiveness Analysis

10. Europe Sulfuric Acid Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3. Europe Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

10.3.1. Germany Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.2. France Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.3. U.K. Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.4. Italy Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.5. Russia & CIS Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.3.6. Rest of Europe Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. Europe Sulfuric Acid Market Attractiveness Analysis

11. Asia Pacific Sulfuric Acid Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application

11.3. Asia Pacific Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.3.1. China Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.2. Japan Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.3. India Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.4. ASEAN Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.3.5. Rest of Asia Pacific Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Asia Pacific Sulfuric Acid Market Attractiveness Analysis

12. Latin America Sulfuric Acid Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.3. Latin America Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.3.1. Brazil Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.3.2. Mexico Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.3.3. Rest of Latin America Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Latin America Sulfuric Acid Market Attractiveness Analysis

13. Middle East & Africa Sulfuric Acid Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3. Middle East & Africa Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.3.1. GCC Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.2. South Africa Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.3.3. Rest of Middle East & Africa Sulfuric Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Middle East & Africa Sulfuric Acid Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Sulfuric Acid Company Market Share Analysis, 2021

14.2. Market Footprint Analysis

14.2.1. By Product

14.2.2. By End-use

14.3. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.3.1. BASF SE

14.3.1.1. Company Revenue

14.3.1.2. Business Overview

14.3.1.3. Product Segments

14.3.1.4. Geographic Footprint

14.3.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.2. Nouryon

14.3.2.1. Company Revenue

14.3.2.2. Business Overview

14.3.2.3. Product Segments

14.3.2.4. Geographic Footprint

14.3.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.3. INEOS

14.3.3.1. Company Revenue

14.3.3.2. Business Overview

14.3.3.3. Product Segments

14.3.3.4. Geographic Footprint

14.3.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.4. Chemtrade Logistics

14.3.4.1. Company Revenue

14.3.4.2. Business Overview

14.3.4.3. Product Segments

14.3.4.4. Geographic Footprint

14.3.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.5. The Mosaic Company

14.3.5.1. Company Revenue

14.3.5.2. Business Overview

14.3.5.3. Product Segments

14.3.5.4. Geographic Footprint

14.3.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.6. PQ Corporation

14.3.6.1. Company Revenue

14.3.6.2. Business Overview

14.3.6.3. Product Segments

14.3.6.4. Geographic Footprint

14.3.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.7. Ma’aden

14.3.7.1. Company Revenue

14.3.7.2. Business Overview

14.3.7.3. Product Segments

14.3.7.4. Geographic Footprint

14.3.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.8. Khaitan Chemicals & Fertilizers Limited

14.3.8.1. Company Revenue

14.3.8.2. Business Overview

14.3.8.3. Product Segments

14.3.8.4. Geographic Footprint

14.3.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.9. PVS Chemicals

14.3.9.1. Company Revenue

14.3.9.2. Business Overview

14.3.9.3. Product Segments

14.3.9.4. Geographic Footprint

14.3.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.3.10. Southern States Chemical

14.3.10.1. Company Revenue

14.3.10.2. Business Overview

14.3.10.3. Product Segments

14.3.10.4. Geographic Footprint

14.3.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.3.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 2: Global Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 3: Global Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 4: Global Sulfuric Acid Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 5: North America Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 6: North America Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: North America Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 8: North America Sulfuric Acid Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 9: U.S. Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 10: U.S. Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: Canada Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 12: Canada Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 13: Europe Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 14: Europe Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: Europe Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 16: Europe Sulfuric Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 17: Germany Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 18: Germany Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 19: France Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 20: France Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 21: U.K. Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 22: U.K. Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Italy Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 24: Italy Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 25: Spain Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 26: Spain Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 27: Russia & CIS Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 28: Russia & CIS Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 29: Rest of Europe Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 30: Rest of Europe Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 31: Asia Pacific Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 32: Asia Pacific Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 33: Asia Pacific Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 34: Asia Pacific Sulfuric Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 35: China Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 36: China Sulfuric Acid Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 37: Japan Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 38: Japan Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 39: India Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 40: India Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 41: ASEAN Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 42: ASEAN Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: Rest of Asia Pacific Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 44: Rest of Asia Pacific Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 45: Latin America Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 46: Latin America Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 47: Latin America Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 48: Latin America Sulfuric Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 49: Brazil Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 50: Brazil Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 51: Mexico Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 52: Mexico Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 53: Rest of Latin America Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Latin America Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Middle East & Africa Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 56: Middle East & Africa Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 57: Middle East & Africa Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 58: Middle East & Africa Sulfuric Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 59: GCC Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 60: GCC Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 61: South Africa Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 62: South Africa Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 63: Rest of Middle East & Africa Sulfuric Acid Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 64: Rest of Middle East & Africa Sulfuric Acid Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Sulfuric Acid Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 2: Global Sulfuric Acid Market Attractiveness, by Application

Figure 3: Global Sulfuric Acid Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 4: Global Sulfuric Acid Market Attractiveness, by Region

Figure 5: North America Sulfuric Acid Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 6: North America Sulfuric Acid Market Attractiveness, by Application

Figure 7: North America Sulfuric Acid Market Attractiveness, by Application

Figure 8: North America Sulfuric Acid Market Attractiveness, by Country and Sub-region

Figure 9: Europe Sulfuric Acid Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 10: Europe Sulfuric Acid Market Attractiveness, by Application

Figure 11: Europe Sulfuric Acid Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 12: Europe Sulfuric Acid Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Sulfuric Acid Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 14: Asia Pacific Sulfuric Acid Market Attractiveness, by Application

Figure 15: Asia Pacific Sulfuric Acid Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 16: Asia Pacific Sulfuric Acid Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Sulfuric Acid Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 18: Latin America Sulfuric Acid Market Attractiveness, by Application

Figure 19: Latin America Sulfuric Acid Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 20: Latin America Sulfuric Acid Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Sulfuric Acid Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 22: Middle East & Africa Sulfuric Acid Market Attractiveness, by Application

Figure 23: Middle East & Africa Sulfuric Acid Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Middle East & Africa Sulfuric Acid Market Attractiveness, by Country and Sub-region