Analysts’ Viewpoint on Substation Automation Market Scenario

A substation automation system is a combination of hardware and software elements used for both local and remote monitoring and control of an electrical system. A substation automation system can also automate tasks that are monotonous, time-consuming, and prone to error in order to boost the system's overall productivity and efficiency. Companies operating in the substation automation market are focusing on industry vertical such as energy and utility in order to grow post the COVID-19 pandemic. Consequently, the market is expected to grow considerably during the forecast period, owing to benefits of substation automation system such as detection fault location that is useful in distribution systems, automatic supervision of interlocks, reduces operating and maintenance cost, etc. Most utilities deploy SCADA systems in substation to automate monitoring and control in order to ensure the appropriate operation of substations and related equipment such as line-mounted switches and capacitors. In modern automatic substation control using SCADA, functions are interlinked by means of digital processing devices and power line carrier/radio communication links. Every electric power substation automation has a control room, relay and protection panels, control panels, and man-machine interface (MMI) installed in the control room.

Substation automation is an integral part of electrical system for generation, transmission, and distribution of electricity. Substation control systems are the building blocks of any grid. Electrical power substations are used to receive electricity at high voltage from the transmission system and decrease the voltage to the appropriate level so that it can be used for local distribution. Power substations transport electricity from power plants to homes, businesses, and factories, and are a critical component of the smart grid. The global substation automation market is likely to expand at a decent growth rate during the forecast period, due to a rise in adoption of renewable & non-conventional energy sources and a surge in the demand for smart grids.

Existing substations requires manual management, which can have huge cost impacts and productivity losses especially during breakdowns. North America witnesses an increased focus on transmission and distribution investments in order to address aging and distressed infrastructure.

Adoption of intelligent electronic devices (IED) is increasing, as the device incorporates one or more processors with the capability to receive or send data/control from or to an external source (e.g., digital meters, digital relays, and controllers). Replacing the old substation completely is not possible at once. However, starting with intelligent electronic devices (IED) integration, substation integration with central systems, and subsequently, complete automation is a step-wise activity.

For instance, FirstEnergy subsidiary Penelec announced that it is completing work in Clarion County, Pennsylvania, U.S. to improve reliability for customers. Manually operated switches on the line were replaced with remote-control devices, enabling system operators to rapidly isolate damage and transfer customers to a backup power source in order to reduce the number of customers impacted by service interruptions and shorten their duration.

Electricity has gained significant importance in daily life, similar to air and water. Residential, commercial, and industrial users, each, account for roughly one-third of the nation’s electricity use. On an average, the biggest single uses of electricity in the residential sector are space heating and cooling (air conditioning), lighting, water heating, space heating, home appliances and electronics. Demand for electricity in the residential sector increases on hot summer afternoons due to rise in use of ACs, fans, and coolers.

The commercial sector comprises government organizations, service-providing facilities and equipment, and other public and private entities. Usually, the substantial single uses of electricity in the commercial sector are lighting, heating, ventilation, and air cooling & conditioning. Electricity requirement in the commercial areas rise during operating business hours, and it may reduce substantially on nights and weekends. Electricity use in the industrial sector generally does not fluctuate through the day or year, as in the case of residential and commercial sectors, particularly at manufacturing facilities that operate round-the-clock.

For instance, in 2019, according to IEA, the world’s total electricity final consumption reached 22 848 TWh, up 1.7% from 2018. In 2019, (OECD Organization for Economic Cooperation and Development) the total electricity final consumption stood at 9 672 TWh, 1.1% lower than in 2018, while final electricity consumption in non-OECD countries was 13 176 TWh, an increase of 3.8% from 2018.

These factors are driving the need for electrical substation automation to cater to the surge in demand for electricity across the globe.

In terms of installation, the global substation automation market can be segregated into new installation and retrofit installation. The new installation segment dominated the global substation automation market because the demand for new power stations and smart grid in various cities is increasing rapidly. New installations offer greater reliability and operational safety and require low maintenance, which in turn propels the new installation segment of the substation automation market.

Increase in government initiatives toward modernization of power grids and rise in investments toward power generation through renewable sources are key factors contributing to the substation automation market growth.

Rise in demand for electric power in the last few decades has fueled the need to implement increasingly efficient and reliable automation and protection systems for substations. This, in turn, is boosting the energy and utility segment of the substation automation market.

Moreover, S.A.S. (Substation Automation Systems) are new generation systems that perform the functions of automation, protection, control that are designed based on the functional requirements. These have become a key component of energy transmission systems. This factor is driving the substation automation market share held by the energy and utility segment.

Asia Pacific dominated the global substation automation market because of increasing investment in energy infrastructure by different governments owing increasing urbanization and higher energy demand. Moreover, increasing dependence on electricity, demand from the power system for advanced technology, requirements to reduce maintenance and operating costs, and implementation of government incentives are primarily driving the substation automation market size in Asia Pacific.

Indeed, the European renewable target for 2030 (32% of total energy consumed) means that more than 50% of electricity would be generated from RES, most of which would be connected to the MV and LV grids. Furthermore, policies formulated by the EU have encouraged the development of decentralized electricity generation, electric vehicles, and energy storage to cater to flexible demand. Consequently, the European substation automation market is also estimated to exhibit lucrative growth during the forecast period.

The global substation automation market is consolidated with a small number of large-scale vendors controlling a majority of the market share. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Substation automation companies such as Cisco Systems, Inc., Eaton Corporation plc, General Electric, Hitachi ABB, Ingeteam, Itron Inc, Mitsubishi Electric Corporation, NovaTech, LLC, Schneider Electric SE, Schweitzer Engineering Laboratories, Inc., Siemens AG, and Trilliant Inc. are the prominent entities operating in the market.

Each of these players has been profiled in the substation automation market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

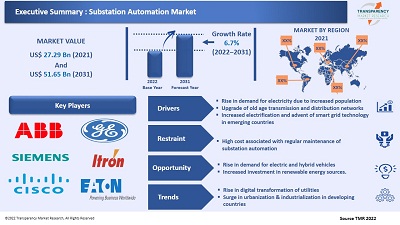

Market Size Value in 2021 |

US$ 27.29 Bn |

|

Market Forecast Value in 2031 |

US$ 51.65 Bn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The substation automation market stood at US$ 27.2 Bn in 2021.

The substation automation market is expected to grow at a CAGR of 6.7% from 2022 to 2031.

Rise in demand for electricity due to increased population and upgrade of old age transmission and distribution networks.

The energy and utility segment accounted for major share of 66.19% of the substation automation market in 2021.

Asia Pacific is a more attractive region for vendors in the substation automation market.

Cisco Systems, Inc, Eaton Corporation plc, General Electric, Hitachi ABB, Ingeteam, Itron Inc, Mitsubishi Electric Corporation, NovaTech, LLC, Schneider Electric SE, Schweitzer Engineering Laboratories, Inc., Siemens AG, and Trilliant Inc.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Substation Automation Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Automation Industry Overview

4.2. Ecosystem Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Substation Automation Market Analysis, by Offering

5.1. Substation Automation Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017–2031

5.1.1. Hardware

5.1.1.1. Intelligent Electronic Devices (IEDs)

5.1.1.2. Meters and Monitoring Devices

5.1.1.3. Microprocessor-Based Relays

5.1.1.4. Remote Terminal Units (RTU)

5.1.1.5. PMUs (Phasor Measurement Units)

5.1.1.6. Communication Devices

5.1.1.7. Programmable Logical Controller

5.1.1.8. Capacitor Bank Controller

5.1.1.9. Others

5.1.2. Software

5.1.2.1. Supervisory Control and Data Acquisition (SCADA)

5.1.2.2. Outage Management System (OMS)

5.1.2.3. Advanced Distribution Management (DCS)

5.1.3. Services

5.1.3.1. Consulting and Training

5.1.3.2. Installation and Integration

5.1.3.3. Maintenance and Repair

5.2. Market Attractiveness Analysis, by Offering

6. Substation Automation Market Analysis, by Type

6.1. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

6.1.1. Transmission Substations

6.1.2. Distribution Substations

6.2. Market Attractiveness Analysis, by Type

7. Substation Automation Market Analysis, by Installation

7.1. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Installation, 2017–2031

7.1.1. New Installations

7.1.2. Retrofit Installations

7.2. Market Attractiveness Analysis, by Installation

8. Substation Automation Market Analysis, by Industry Vertical

8.1. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017–2031

8.1.1. Energy & Utility

8.1.2. Oil and Gas

8.1.3. Others

8.2. Market Attractiveness Analysis, by Industry Vertical

9. Substation Automation Market Analysis and Forecast, by Region

9.1. Substation Automation Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Substation Automation Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Substation Automation Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Offering, 2017–2031

10.3.1. Hardware

10.3.1.1. Intelligent Electronic Devices (IEDs)

10.3.1.2. Meters and Monitoring Devices

10.3.1.3. Microprocessor-Based Relays

10.3.1.4. Remote Terminal Units (RTU)

10.3.1.5. PMUs (Phasor Measurement Units)

10.3.1.6. Communication Devices

10.3.1.7. Programmable Logical Controller

10.3.1.8. Capacitor Bank Controller

10.3.1.9. Others

10.3.2. Software

10.3.2.1. Supervisory Control and Data Acquisition (SCADA)

10.3.2.2. Outage Management System (OMS)

10.3.2.3. Advanced Distribution Management (DCS)

10.3.3. Services

10.3.3.1. Consulting and Training

10.3.3.2. Installation and Integration

10.3.3.3. Maintenance and Repair

10.4. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

10.4.1. Transmission Substations

10.4.2. Distribution Substations

10.5. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Installation, 2017–2031

10.5.1. New Installations

10.5.2. Retrofit Installations

10.6. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017–2031

10.6.1. Energy & Utility

10.6.2. Oil and Gas

10.6.3. Others

10.7. Substation Automation Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Offering

10.8.2. By Type

10.8.3. By Installation

10.8.4. By Industry Vertical

10.8.5. By Country and Sub-region

11. Europe Substation Automation Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Substation Automation Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Offering, 2017–2031

11.3.1. Hardware

11.3.1.1. Intelligent Electronic Devices (IEDs)

11.3.1.2. Meters and Monitoring Devices

11.3.1.3. Microprocessor-Based Relays

11.3.1.4. Remote Terminal Units (RTU)

11.3.1.5. PMUs (Phasor Measurement Units)

11.3.1.6. Communication Devices

11.3.1.7. Programmable Logical Controller

11.3.1.8. Capacitor Bank Controller

11.3.1.9. Others

11.3.2. Software

11.3.2.1. Supervisory Control and Data Acquisition (SCADA)

11.3.2.2. Outage Management System (OMS)

11.3.2.3. Advanced Distribution Management (DCS)

11.3.3. Services

11.3.3.1. Consulting and Training

11.3.3.2. Installation and Integration

11.3.3.3. Maintenance and Repair

11.4. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

11.4.1. Transmission Substations

11.4.2. Distribution Substations

11.5. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Installation, 2017–2031

11.5.1. New Installations

11.5.2. Retrofit Installations

11.6. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017–2031

11.6.1. Energy & Utility

11.6.2. Oil and Gas

11.6.3. Others

11.7. Substation Automation Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Offering

11.8.2. By Type

11.8.3. By Installation

11.8.4. By Industry Vertical

11.8.5. By Country and Sub-region

12. Asia Pacific Substation Automation Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Substation Automation Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Offering, 2017–2031

12.3.1. Hardware

12.3.1.1. Intelligent Electronic Devices (IEDs)

12.3.1.2. Meters and Monitoring Devices

12.3.1.3. Microprocessor-Based Relays

12.3.1.4. Remote Terminal Units (RTU)

12.3.1.5. PMUs (Phasor Measurement Units)

12.3.1.6. Communication Devices

12.3.1.7. Programmable Logical Controller

12.3.1.8. Capacitor Bank Controller

12.3.1.9. Others

12.3.2. Software

12.3.2.1. Supervisory Control and Data Acquisition (SCADA)

12.3.2.2. Outage Management System (OMS)

12.3.2.3. Advanced Distribution Management (DCS)

12.3.3. Services

12.3.3.1. Consulting and Training

12.3.3.2. Installation and Integration

12.3.3.3. Maintenance and Repair

12.4. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

12.4.1. Transmission Substations

12.4.2. Distribution Substations

12.5. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Installation, 2017–2031

12.5.1. New Installations

12.5.2. Retrofit Installations

12.6. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017–2031

12.6.1. Energy & Utility

12.6.2. Oil and Gas

12.6.3. Others

12.7. Substation Automation Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Offering

12.8.2. By Type

12.8.3. By Installation

12.8.4. By Industry Vertical

12.8.5. By Country and Sub-region

13. Middle East & Africa Substation Automation Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Substation Automation Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Offering, 2017–2031

13.3.1. Hardware

13.3.1.1. Intelligent Electronic Devices (IEDs)

13.3.1.2. Meters and Monitoring Devices

13.3.1.3. Microprocessor-Based Relays

13.3.1.4. Remote Terminal Units (RTU)

13.3.1.5. PMUs (Phasor Measurement Units)

13.3.1.6. Communication Devices

13.3.1.7. Programmable Logical Controller

13.3.1.8. Capacitor Bank Controller

13.3.1.9. Others

13.3.2. Software

13.3.2.1. Supervisory Control and Data Acquisition (SCADA)

13.3.2.2. Outage Management System (OMS)

13.3.2.3. Advanced Distribution Management (DCS)

13.3.3. Services

13.3.3.1. Consulting and Training

13.3.3.2. Installation and Integration

13.3.3.3. Maintenance and Repair

13.4. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

13.4.1. Transmission Substations

13.4.2. Distribution Substations

13.5. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Installation, 2017–2031

13.5.1. New Installations

13.5.2. Retrofit Installations

13.6. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017–2031

13.6.1. Energy & Utility

13.6.2. Oil and Gas

13.6.3. Others

13.7. Substation Automation Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of the Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Offering

13.8.2. By Type

13.8.3. By Installation

13.8.4. By Industry Vertical

13.8.5. By Country and Sub-region

14. South America Substation Automation Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Substation Automation Market Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Offering, 2017–2031

14.3.1. Hardware

14.3.1.1. Intelligent Electronic Devices (IEDs)

14.3.1.2. Meters and Monitoring Devices

14.3.1.3. Microprocessor-Based Relays

14.3.1.4. Remote Terminal Units (RTU)

14.3.1.5. PMUs (Phasor Measurement Units)

14.3.1.6. Communication Devices

14.3.1.7. Programmable Logical Controller

14.3.1.8. Capacitor Bank Controller

14.3.1.9. Others

14.3.2. Software

14.3.2.1. Supervisory Control and Data Acquisition (SCADA)

14.3.2.2. Outage Management System (OMS)

14.3.2.3. Advanced Distribution Management (DCS)

14.3.3. Services

14.3.3.1. Consulting and Training

14.3.3.2. Installation and Integration

14.3.3.3. Maintenance and Repair

14.4. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Type, 2017–2031

14.4.1. Transmission Substations

14.4.2. Distribution Substations

14.5. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Installation, 2017–2031

14.5.1. New Installations

14.5.2. Retrofit Installations

14.6. Substation Automation Market Value (US$ Bn) Analysis & Forecast, by Industry Vertical, 2017–2031

14.6.1. Energy & Utility

14.6.2. Oil and Gas

14.6.3. Others

14.7. Substation Automation Value (US$ Bn) and Volume (Thousand Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Offering

14.8.2. By Type

14.8.3. By Installation

14.8.4. By Industry Vertical

14.8.5. By Country and Sub-region

15. Competition Assessment

15.1. Global Substation Automation Market Competition Matrix - a Dashboard View

15.1.1. Global Substation Automation Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Cisco Systems, Inc.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Eaton Corporation plc

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. General Electric

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Hitachi ABB

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Ingeteam

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Itron Inc.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Mitsubishi Electric Corporation

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. NovaTech, LLC.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Schneider Electric SE

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Schweitzer Engineering Laboratories, Inc.

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Siemens AG

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Trilliant Inc.

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Offering

17.1.2. By Type

17.1.3. By Installation

17.1.4. By Industry Vertical

17.1.5. By Region

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 01: Global Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Table 02: Global Substation Automation Market Size & Forecast, by Offering, Volume (Thousand Units), 2017‒2031

Table 03: Global Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 04: Global Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Table 05: Global Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017‒2031

Table 06: Global Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Table 07: Global Substation Automation Market Size & Forecast, by Region, Volume (Thousand Units), 2017‒2031

Table 08: North America Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Table 09: North America Substation Automation Market Size & Forecast, by Offering, Volume (Thousand Units), 2017‒2031

Table 10: North America Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 11: North America Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Table 12: North America Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017‒2031

Table 13: North America Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 14: North America Substation Automation Market Size & Forecast, by Country & Sub-region, Volume (Thousand Units), 2017‒2031

Table 15: Europe Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Table 16: Europe Substation Automation Market Size & Forecast, by Offering, Volume (Thousand Units), 2017‒2031

Table 17: Europe Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 18: Europe Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Table 19: Europe Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017‒2031

Table 20: Europe Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 21: Europe Substation Automation Market Size & Forecast, by Country & Sub-region, Volume (Thousand Units), 2017‒2031

Table 22: Asia Pacific Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Table 23: Asia Pacific Substation Automation Market Size & Forecast, by Offering, Volume (Thousand Units), 2017‒2031

Table 24: Asia Pacific Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 25: Asia Pacific Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Table 26: Asia Pacific Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 27: Asia Pacific Substation Automation Market Size & Forecast, by Country & Sub-region, Volume (Thousand Units), 2017‒2031

Table 28: Middle East & Africa Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Table 29: Middle East & Africa Substation Automation Market Size & Forecast, by Offering, Volume (Thousand Units), 2017‒2031

Table 30: Middle East & Africa Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 31: Middle East & Africa Substation Automation Market Size & Forecast, by Type, Volume (Thousand Units), 2017‒2031

Table 32: Middle East & Africa Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Table 33: Middle East & Africa Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017‒2031

Table 34: Middle East & Africa Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 35: Middle East & Africa Substation Automation Market Size & Forecast, by Country & Sub-region, Volume (Thousand Units), 2017‒2031

Table 36: South America Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Table 37: South America Substation Automation Market Size & Forecast, by Offering, Volume (Thousand Units), 2017‒2031

Table 38: South America Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Table 39: South America Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Table 40: South America Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017‒2031

Table 41: South America Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 42: South America Substation Automation Market Size & Forecast, by Country & Sub-region, Volume (Thousand Units), 2017‒2031

List of Figures

Figure 01: Global Substation Automation Price Trend Analysis (Average Price, US$)

Figure 02: Global Substation Automation Market, Value (US$ Bn), 2017‒2031

Figure 03: Global Substation Automation Market, Value (US$ Bn), 2017‒2031

Figure 04: Global Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 05: Global Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 06: Global Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Figure 07: Global Substation Automation Market Attractiveness, by Offering, Value (US$ Bn), 2022‒2031

Figure 08: Global Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2022‒2031

Figure 09: Global Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 10: Global Substation Automation Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 11: Global Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 12: Global Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 13: Global Substation Automation Market Attractiveness, by Installation, Value (US$ Bn), 2022‒2031

Figure 14: Global Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 15: Global Substation Automation Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 16: Global Substation Automation Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 17: Global Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 18: Global Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 19: Global Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 20: Global Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 21: North America Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 22: North America Substation Automation Market, Value (US$ Bn), 2017‒2031

Figure 23: North America Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 24: North America Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 25: North America Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Figure 26: North America Substation Automation Market Attractiveness, by Offering, Value (US$ Bn), 2022‒2031

Figure 27: North America Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2022‒2031

Figure 28: North America Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 29: North America Substation Automation Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 30: North America Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 31: North America Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 32: North America Substation Automation Market Attractiveness, by Installation, Value (US$ Bn), 2022‒2031

Figure 33: North America Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 34: North America Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017‒2031

Figure 35: North America Substation Automation Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 36: North America Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 37: North America Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 38: North America Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 39: North America Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 40: Europe Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 41: Europe Substation Automation Market, Value (US$ Bn), 2017‒2031

Figure 42: Europe Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 43: Europe Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 44: Europe Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Figure 45: Europe Substation Automation Market Attractiveness, by Offering, Value (US$ Bn), 2022‒2031

Figure 46: Europe Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2022‒2031

Figure 47: Europe Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 48: Europe Substation Automation Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 49: Europe Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 50: Europe Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 51: Europe Substation Automation Market Attractiveness, by Installation, Value (US$ Bn), 2022‒2031

Figure 52: Europe Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2022‒2031

Figure 53: Europe Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2017‒2031

Figure 54: Europe Substation Automation Market Attractiveness, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 55: Europe Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 56: Europe Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 57: Europe Substation Automation Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 58: Europe Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 59: Europe Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 60: Europe Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 61: Asia Pacific Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 62: Asia Pacific Substation Automation Market, Value (US$ Bn), 2017‒2031

Figure 63: Asia Pacific Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 64: Asia Pacific Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 65: Asia Pacific Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Figure 66: Asia Pacific Substation Automation Market Attractiveness, by Offering, Value (US$ Bn), 2022‒2031

Figure 67: Asia Pacific Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2022‒2031

Figure 68: Asia Pacific Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 69: Asia Pacific Substation Automation Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 70: Asia Pacific Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 71: Asia Pacific Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 72: Asia Pacific Substation Automation Market Attractiveness, by Installation, Value (US$ Bn), 2022‒2031

Figure 73: Asia Pacific Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2022‒2031

Figure 74: Asia Pacific Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 75: Asia Pacific Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 76: Asia Pacific Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 77: Asia Pacific Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 78: Asia Pacific Substation Automation Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 79: Asia Pacific Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 80: Middle East & Africa Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 81: Middle East & Africa Substation Automation Market, Value (US$ Bn), 2017‒2031

Figure 82: Middle East & Africa Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 83: Middle East & Africa Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 84: Middle East & Africa Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Figure 85: Middle East & Africa Substation Automation Market Attractiveness, by Offering, Value (US$ Bn), 2022‒2031

Figure 86: Middle East & Africa Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2022‒2031

Figure 87: Middle East & Africa Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 88: Middle East & Africa Substation Automation Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 89: Middle East & Africa Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 90: Middle East & Africa Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 91: Middle East & Africa Substation Automation Market Attractiveness, by Installation, Value (US$ Bn), 2022‒2031

Figure 92: Middle East & Africa Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2022‒2031

Figure 93: Middle East & Africa Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 94: Middle East & Africa Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 95: Middle East & Africa Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 96: Middle East & Africa Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 97: Middle East & Africa Substation Automation Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 98: Middle East & Africa Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 99: South America Substation Automation Market Size & Forecast, by Region, Value (US$ Bn), 2022‒2031

Figure 100: South America Substation Automation Market, Value (US$ Bn), 2017‒2031

Figure 101: South America Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 102: South America Substation Automation Market, Volume (Thousand Units), 2017‒2031

Figure 103: South America Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2017‒2031

Figure 104: South America Substation Automation Market Attractiveness, by Offering, Value (US$ Bn), 2022‒2031

Figure 105: South America Substation Automation Market Size & Forecast, by Offering, Value (US$ Bn), 2022‒2031

Figure 106: South America Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2017‒2031

Figure 107: South America Substation Automation Market Attractiveness, by Type, Value (US$ Bn), 2022‒2031

Figure 108: South America Substation Automation Market Size & Forecast, by Type, Value (US$ Bn), 2022‒2031

Figure 109: South America Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2017‒2031

Figure 110: South America Substation Automation Market Attractiveness, by Installation, Value (US$ Bn), 2022‒2031

Figure 111: South America Substation Automation Market Size & Forecast, by Installation, Value (US$ Bn), 2022‒2031

Figure 112: South America Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 113: South America Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 114: South America Substation Automation Market Size & Forecast, by Industry Vertical, Value (US$ Bn), 2022‒2031

Figure 115: South America Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Figure 116: South America Substation Automation Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 117: South America Substation Automation Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2022‒2031

Figure 118: Global Substation Automation Market Share Analysis, by Company