Analysts’ Viewpoint on Smart Card Market Scenario

Smart cards are widely used in healthcare, transportation, BFSI, and other verticals, as they provide confidentiality and privacy to users. The global market value of the smart card is anticipated to grow rapidly during the forecast period owing to the surge in demand for contactless smart card (tap to pay) payments. Rise in penetration of smart cards for access control and personal identification is significantly impacting the market. Technological advancements and digitalization in various sectors are also contributing to market growth. Expansion in retail and e-commerce industries is expected to boost the demand for smart cards, thereby providing numerous opportunities for players in the global smart card market. Market players are launching high-performance biometric smart card platforms to increase card performance and reduce manufacturing complexities.

Smart card or eSmart card is a physical card that contains a microcontroller. The embedded memory in the card provides secure encryption. Smart cards are usually tamper-proof and are activated in wireless network areas. They are embedded with smart features that are crucial for high-security transactions. Smart cards communicate with a reader through short-range wireless networks or direct physical contacts such as near-field communication (NFC) or radio-frequency identification (RFID). Smart cards can store passwords, private keys, personal information, and account numbers. Various types of smart cards include contact smart cards, contactless smart cards, hybrid smart cards, memory smart cards, microprocessor smart cards, and dual-interface smart cards.

The penetration of smart cards is high in developed and emerging economies. Most stores and businesses accept contactless payments. Many stores restricted physical payments during the peak of the COVID-19 pandemic. Adoption of smart cards is high due to ease of use and convenience. The COVID-19 period proved to be advantageous for the smart card market, with rise in demand for smart cards in healthcare and telecommunication markets. Contactless payment is widely preferred due to hygiene concerns and as a precautionary measure to prevent the spread of the virus.

According to the recent demand analysis of smart cards, increase in adoption of digital payment technologies that focus on improved convenience and security compared to traditional cash-based payments is expected to drive the market during the forecast period. Users pay through smart cards online instead of cash on delivery for convenience purposes. Smart cards ensure privacy and easy management of payment records as smart card-based transactions are highly secure.

Rapid urbanization and rise in industrialization in developing countries such as India, China, Mexico, South Africa, and Brazil are providing lucrative opportunities for players in the global smart card market. Expansion in the prepaid credit card market and contactless smart card market; and rise in adoption of universal smart cards to process banking transactions are also driving the smart card market.

In terms of type, the global smart card market has been segmented into contact smart cards, contactless smart cards, hybrid smart cards, and dual-interface smart cards. The contactless smart cards segment is expected to hold major share of the market during the forecast period. Majority of consumers have shifted to digitalization and automation technologies. This shift has overhauled the functional dynamics of various sectors and industries. Advancements in Internet of Things (IoT) market and automation technology are expected to propel the demand for contactless smart cards. Embedded smart card, secure microcontroller or equivalent intelligence, internal memory, and a small antenna are components of a contactless smart card. COVID-19 has positively impacted the contactless smart cards segment, as companies and government organizations across the globe are increasingly adopting contactless smart cards to ensure social distancing and other COVID related precautions.

Based on verticals, the global smart card market has been classified into BFSI, telecommunication, government & healthcare, education, retail, transportation, and others. The BFSI segment is expected to hold major share of the market during the forecast period. Adoption of smart cards in the BFSI sector has increased significantly, as smart cards are more beneficial than traditional payment methods. Smart cards keep personal data confidential and enable secure transactions. They are utilized as credit cards, debit cards, access control cards, and authentication cards. Smart cards are also used as electronic wallets. They are loaded with funds that can be transferred to a vending machine or an account using cryptographic protocols. Thus, adoption of smart cards has increased in the BFSI sector due to their secure and confidential features.

Asia Pacific is projected to be the fastest-growing market for smart cards during the forecast period, due to rapid urbanization and industrialization in countries such as China, India, and Japan. Rapid growth of the e-commerce market is also fueling the demand for smart cards in the region.

North America and Europe are expected to account for significant share of the global smart card market. The market in South America is also anticipated to grow at a high pace, due to the rise in consumer spending through digital media in the region. The smart card market in Middle East & Africa is estimated to witness substantial progress in the next few years. Rise in adoption of advanced technologies is projected to drive the demand for smart cards in the region.

Players operating in the global smart card market are focusing on investments in research & development activities. Investment in R&D is likely to boost the launch of innovative products, which can better penetrate the existing and untapped markets. In July 2021, Infineon Technologies AG, in collaboration with IDEX Biometrics ASA, announced a reference design for an innovative fingerprint smart card architecture. The design utilizes the TrustedBio solution from IDEX Biometrics and the Infineon SLC38BML800 safety controller with GPIO interface. This allows fingerprint verification with high accuracy, low latency, and power efficiency.

Prominent players operating in the smart card market are Thales, CPI Card Group Inc., Giesecke+Devrient GmbH, IDEMIA, NXP Semiconductors Austria GmbH Styria, CardLogix Corporation, Watchdata Co., Ltd., Eastcompeace Technology Co., Ltd., HID Global Corporation, ABCorp, CardCom, Ingenico., Kona, Identiv, Inc., Valid, VeriFone, Inc., BrilliantTS, Perfect Plastic Printing, Bartronics India Limited, and Infineon Technologies AG.

Each of these players has been profiled in the smart card market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

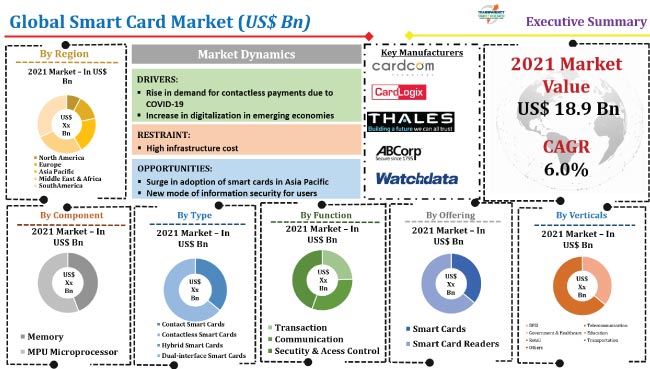

Market Value in 2021 |

US$ 18.9 Bn |

|

Market Forecast Value in 2031 |

US$ 33.5 Bn |

|

Growth Rate (CAGR) |

6.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The smart card market stood at US$ 18.9 Bn in 2021

The smart card market is estimated to grow at a CAGR of 6.0% during 2022-2031.

Rise in demand for contactless payments due to COVID-19 and increase in penetration of smart cards for access control.

The BFSI segment accounted for maximum share of the market in 2021.

Asia Pacific is likely to be one of the lucrative regions of the market during the forecast period.

Thales, CPI Card Group Inc., Giesecke+Devrient GmbH, IDEMIA, NXP Semiconductors Austria GmbH Styria, CardLogix Corporation, Watchdata Co., Ltd., Eastcompeace Technology Co., Ltd., HID Global Corporation, ABCorp, CardCom, Ingenico., Kona, Identiv, Inc., Valid, VeriFone, Inc., BrilliantTS, Perfect Plastic Printing, Bartronics India Limited, and Infineon Technologies AG.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Parent Market Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Roadmap

5.9. Global Smart Card Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Million Units)

6. Global Smart Card Market Analysis and Forecast, By Component

6.1. Global Smart Card Market Size (US$ Mn and Million Units), By Component, 2017 - 2031

6.1.1. Memory

6.1.2. MPU Microprocessor

6.2. Incremental Opportunity, By Component

7. Global Smart Card Market Analysis and Forecast, By Type

7.1. Global Smart Card Market Size (US$ Mn and Million Units), By Type, 2017 - 2031

7.1.1. Contact Smart Cards

7.1.2. Contactless Smart Cards

7.1.3. Hybrid Smart Cards

7.1.4. Dual-interface Smart Cards

7.2. Incremental Opportunity, By Type

8. Global Smart Card Market Analysis and Forecast, By Function

8.1. Global Smart Card Market Size (US$ Mn and Million Units), By Function, 2017 - 2031

8.1.1. Transaction

8.1.2. Communication

8.1.3. Security & Access Control

8.2. Incremental Opportunity, By Function

9. Global Smart Card Market Analysis and Forecast, By Offering

9.1. Global Smart Card Market Size (US$ Mn and Million Units), By Offering, 2017 - 2031

9.1.1. Smart Cards

9.1.2. Smart Card Readers

9.2. Incremental Opportunity, By Offering

10. Global Smart Card Market Analysis and Forecast, By Verticals

10.1. Global Smart Card Market Size (US$ Mn and Million Units), By Verticals, 2017 - 2031

10.1.1. BFSI

10.1.2. Telecommunication

10.1.3. Government & Healthcare

10.1.4. Education

10.1.5. Retail

10.1.6. Transportation

10.1.7. Others

10.2. Incremental Opportunity, By Verticals

11. Global Smart Card Market Analysis and Forecast, Region

11.1. Global Smart Card Market Size (US$ Mn and Million Units), By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Smart Card Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. COVID-19 Impact Analysis

12.5. Smart Card Market Size (US$ Mn and Million Units), By Component, 2017 - 2031

12.5.1. Memory

12.5.2. MPU Microprocessor

12.6. Smart Card Market Size (US$ Mn and Million Units), By Type, 2017 - 2031

12.6.1. Contact Smart Cards

12.6.2. Contactless Smart Cards

12.6.3. Hybrid Smart Cards

12.6.4. Dual-interface Smart Cards

12.7. Smart Card Market Size (US$ Mn and Million Units), By Function, 2017 - 2031

12.7.1. Transaction

12.7.2. Communication

12.7.3. Security & Access Control

12.8. Smart Card Market Size (US$ Mn and Million Units), By Offering, 2017 - 2031

12.8.1. Smart Cards

12.8.2. Smart Card Readers

12.9. Smart Card Market Size (US$ Mn and Million Units), By Verticals, 2017 - 2031

12.9.1. BFSI

12.9.2. Telecommunication

12.9.3. Government & Healthcare

12.9.4. Education

12.9.5. Retail

12.9.6. Transportation

12.9.7. Others

12.10. Smart Card Market Size (US$ Mn and Million Units), By Country/Sub-region, 2017 - 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Smart Card Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. COVID-19 Impact Analysis

13.5. Smart Card Market Size (US$ Mn and Million Units), By Component, 2017 - 2031

13.5.1. Memory

13.5.2. MPU Microprocessor

13.6. Smart Card Market Size (US$ Mn and Million Units), By Type, 2017 - 2031

13.6.1. Contact Smart Cards

13.6.2. Contactless Smart Cards

13.6.3. Hybrid Smart Cards

13.6.4. Dual-interface Smart Cards

13.7. Smart Card Market Size (US$ Mn and Million Units), By Function, 2017 - 2031

13.7.1. Transaction

13.7.2. Communication

13.7.3. Security & Access Control

13.8. Smart Card Market Size (US$ Mn and Million Units), By Offering, 2017 - 2031

13.8.1. Smart Cards

13.8.2. Smart Card Readers

13.9. Smart Card Market Size (US$ Mn and Million Units), By Verticals, 2017 - 2031

13.9.1. BFSI

13.9.2. Telecommunication

13.9.3. Government & Healthcare

13.9.4. Education

13.9.5. Retail

13.9.6. Transportation

13.9.7. Others

13.10. Smart Card Market Size (US$ Mn and Million Units), By Country/Sub-region, 2017 - 2031

13.10.1. U.K.

13.10.2. Germany

13.10.3. France

13.10.4. Rest of Europe

13.11. Incremental Opportunity Analysis

14. Asia Pacific Smart Card Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. COVID-19 Impact Analysis

14.5. Smart Card Market Size (US$ Mn and Million Units), By Component, 2017 - 2031

14.5.1. Memory

14.5.2. MPU Microprocessor

14.6. Smart Card Market Size (US$ Mn and Million Units), By Type, 2017 - 2031

14.6.1. Contact Smart Cards

14.6.2. Contactless Smart Cards

14.6.3. Hybrid Smart Cards

14.6.4. Dual-interface Smart Cards

14.7. Smart Card Market Size (US$ Mn and Million Units), By Function, 2017 - 2031

14.7.1. Transaction

14.7.2. Communication

14.7.3. Security & Access Control

14.8. Smart Card Market Size (US$ Mn and Million Units), By Offering, 2017 - 2031

14.8.1. Smart Cards

14.8.2. Smart Card Readers

14.9. Smart Card Market Size (US$ Mn and Million Units), By Verticals, 2017 - 2031

14.9.1. BFSI

14.9.2. Telecommunication

14.9.3. Government & Healthcare

14.9.4. Education

14.9.5. Retail

14.9.6. Transportation

14.9.7. Others

14.10. Smart Card Market Size (US$ Mn and Million Units), By Country/Sub-region, 2017 - 2031

14.10.1. China

14.10.2. India

14.10.3. Japan

14.10.4. Rest of Asia Pacific

14.11. Incremental Opportunity Analysis

15. Middle East & Africa Smart Card Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. COVID-19 Impact Analysis

15.5. Smart Card Market Size (US$ Mn and Million Units), By Component, 2017 - 2031

15.5.1. Memory

15.5.2. MPU Microprocessor

15.6. Smart Card Market Size (US$ Mn and Million Units), By Type, 2017 - 2031

15.6.1. Contact Smart Cards

15.6.2. Contactless Smart Cards

15.6.3. Hybrid Smart Cards

15.6.4. Dual-interface Smart Cards

15.7. Smart Card Market Size (US$ Mn and Million Units), By Function, 2017 - 2031

15.7.1. Transaction

15.7.2. Communication

15.7.3. Security & Access Control

15.8. Smart Card Market Size (US$ Mn and Million Units), By Offering, 2017 - 2031

15.8.1. Smart Cards

15.8.2. Smart Card Readers

15.9. Smart Card Market Size (US$ Mn and Million Units), By Verticals, 2017 - 2031

15.9.1. BFSI

15.9.2. Telecommunication

15.9.3. Government & Healthcare

15.9.4. Education

15.9.5. Retail

15.9.6. Transportation

15.9.7. Others

15.10. Smart Card Market Size (US$ Mn and Million Units), By Country/Sub-region, 2017 - 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Smart Card Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Type (US$)

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. COVID-19 Impact Analysis

16.5. Smart Card Market Size (US$ Mn and Million Units), By Component, 2017 - 2031

16.5.1. Memory

16.5.2. MPU Microprocessor

16.6. Smart Card Market Size (US$ Mn and Million Units), By Type, 2017 - 2031

16.6.1. Contact Smart Cards

16.6.2. Contactless Smart Cards

16.6.3. Hybrid Smart Cards

16.6.4. Dual-interface Smart Cards

16.7. Smart Card Market Size (US$ Mn and Million Units), By Function, 2017 - 2031

16.7.1. Transaction

16.7.2. Communication

16.7.3. Security & Access Control

16.8. Smart Card Market Size (US$ Mn and Million Units), By Offering, 2017 - 2031

16.8.1. Smart Cards

16.8.2. Smart Card Readers

16.9. Smart Card Market Size (US$ Mn and Million Units), By Verticals, 2017 - 2031

16.9.1. BFSI

16.9.2. Telecommunication

16.9.3. Government & Healthcare

16.9.4. Education

16.9.5. Retail

16.9.6. Transportation

16.9.7. Others

16.10. Smart Card Market Size (US$ Mn and Million Units), By Country/Sub-region, 2017 - 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis (%), 2021

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

17.3.1. Thales (Netherlands)

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Financial/Revenue

17.3.1.4. Strategy & Business Overview

17.3.1.5. Sales Channel Analysis

17.3.1.6. Size Portfolio

17.3.2. CPI Card Group Inc. (US)

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Financial/Revenue

17.3.2.4. Strategy & Business Overview

17.3.2.5. Sales Channel Analysis

17.3.2.6. Size Portfolio

17.3.3. Giesecke+Devrient GmbH (Germany)

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Financial/Revenue

17.3.3.4. Strategy & Business Overview

17.3.3.5. Sales Channel Analysis

17.3.3.6. Size Portfolio

17.3.4. IDEMIA (France)

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Financial/Revenue

17.3.4.4. Strategy & Business Overview

17.3.4.5. Sales Channel Analysis

17.3.4.6. Size Portfolio

17.3.5. NXP Semiconductors Austria GmbH Styria (Venezuela)

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Financial/Revenue

17.3.5.4. Strategy & Business Overview

17.3.5.5. Sales Channel Analysis

17.3.5.6. Size Portfolio

17.3.6. CardLogix Corporation (US)

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Financial/Revenue

17.3.6.4. Strategy & Business Overview

17.3.6.5. Sales Channel Analysis

17.3.6.6. Size Portfolio

17.3.7. Watchdata Co., Ltd. (Singapore)

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Financial/Revenue

17.3.7.4. Strategy & Business Overview

17.3.7.5. Sales Channel Analysis

17.3.7.6. Size Portfolio

17.3.8. Eastcompeace Technology Co., Ltd. (China)

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Financial/Revenue

17.3.8.4. Strategy & Business Overview

17.3.8.5. Sales Channel Analysis

17.3.8.6. Size Portfolio

17.3.9. HID Global Corporation (US)

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Financial/Revenue

17.3.9.4. Strategy & Business Overview

17.3.9.5. Sales Channel Analysis

17.3.9.6. Size Portfolio

17.3.10. ABCorp (US)

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Financial/Revenue

17.3.10.4. Strategy & Business Overview

17.3.10.5. Sales Channel Analysis

17.3.10.6. Size Portfolio

17.3.11. CardCom (US)

17.3.11.1. Company Overview

17.3.11.2. Sales Area/Geographical Presence

17.3.11.3. Financial/Revenue

17.3.11.4. Strategy & Business Overview

17.3.11.5. Sales Channel Analysis

17.3.11.6. Size Portfolio

17.3.12. Ingenico. (France)

17.3.12.1. Company Overview

17.3.12.2. Sales Area/Geographical Presence

17.3.12.3. Financial/Revenue

17.3.12.4. Strategy & Business Overview

17.3.12.5. Sales Channel Analysis

17.3.12.6. Size Portfolio

17.3.13. Kona (South Korea)

17.3.13.1. Company Overview

17.3.13.2. Sales Area/Geographical Presence

17.3.13.3. Financial/Revenue

17.3.13.4. Strategy & Business Overview

17.3.13.5. Sales Channel Analysis

17.3.13.6. Size Portfolio

17.3.14. Identiv, Inc. (US)

17.3.14.1. Company Overview

17.3.14.2. Sales Area/Geographical Presence

17.3.14.3. Financial/Revenue

17.3.14.4. Strategy & Business Overview

17.3.14.5. Sales Channel Analysis

17.3.14.6. Size Portfolio

17.3.15. Valid (Brazil)

17.3.15.1. Company Overview

17.3.15.2. Sales Area/Geographical Presence

17.3.15.3. Financial/Revenue

17.3.15.4. Strategy & Business Overview

17.3.15.5. Sales Channel Analysis

17.3.15.6. Size Portfolio

17.3.16. VeriFone, Inc. (US)

17.3.16.1. Company Overview

17.3.16.2. Sales Area/Geographical Presence

17.3.16.3. Financial/Revenue

17.3.16.4. Strategy & Business Overview

17.3.16.5. Sales Channel Analysis

17.3.16.6. Size Portfolio

17.3.17. BrilliantTS (South Korea)

17.3.17.1. Company Overview

17.3.17.2. Sales Area/Geographical Presence

17.3.17.3. Financial/Revenue

17.3.17.4. Strategy & Business Overview

17.3.17.5. Sales Channel Analysis

17.3.17.6. Size Portfolio

17.3.18. Perfect Plastic Printing (US)

17.3.18.1. Company Overview

17.3.18.2. Sales Area/Geographical Presence

17.3.18.3. Financial/Revenue

17.3.18.4. Strategy & Business Overview

17.3.18.5. Sales Channel Analysis

17.3.18.6. Size Portfolio

17.3.19. Bartronics India Limited (India)

17.3.19.1. Company Overview

17.3.19.2. Sales Area/Geographical Presence

17.3.19.3. Financial/Revenue

17.3.19.4. Strategy & Business Overview

17.3.19.5. Sales Channel Analysis

17.3.19.6. Size Portfolio

17.3.20. Infineon Technologies AG (Germany)

17.3.20.1. Company Overview

17.3.20.2. Sales Area/Geographical Presence

17.3.20.3. Financial/Revenue

17.3.20.4. Strategy & Business Overview

17.3.20.5. Sales Channel Analysis

17.3.20.6. Size Portfolio

18. Key Takeaway

18.1. Identification of Potential Market Spaces

18.1.1. Component

18.1.2. Type

18.1.3. Function

18.1.4. Offering

18.1.5. Verticals

18.1.6. Geography

18.2. Understanding the Buying Process of Customers

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Smart Card Market, by Component, Million Units, 2017-2031

Table 2: Global Smart Card Market, by Component, US$ Mn, 2017-2031

Table 3: Global Smart Card Market, by Type, Million Units, 2017-2031

Table 4: Global Smart Card Market, by Type, US$ Mn, 2017-2031

Table 5: Global Smart Card Market, by Function, Million Units, 2017-2031

Table 6: Global Smart Card Market, by Function, US$ Mn, 2017-2031

Table 7: Global Smart Card Market, by Offering, Million Units, 2017-2031

Table 8: Global Smart Card Market, by Offering, US$ Mn, 2017-2031

Table 9: Global Smart Card Market, by Verticals, Million Units, 2017-2031

Table 10: Global Smart Card Market, by Verticals, US$ Mn, 2017-2031

Table 11: Global Smart Card Market, by Region, Million Units, 2017-2031

Table 12: Global Smart Card Market, by Region, US$ Mn, 2017-2031

Table 13: North America Smart Card Market, by Component, Million Units, 2017-2031

Table 14: North America Smart Card Market, by Component, US$ Mn, 2017-2031

Table 15: North America Smart Card Market, by Type, Million Units, 2017-2031

Table 16: North America Smart Card Market, by Type, US$ Mn, 2017-2031

Table 17: North America Smart Card Market, by Function, Million Units, 2017-2031

Table 18: North America Smart Card Market, by Function, US$ Mn, 2017-2031

Table 19: North America Smart Card Market, by Offering, Million Units, 2017-2031

Table 20: North America Smart Card Market, by Offering, US$ Mn, 2017-2031

Table 21: North America Smart Card Market, by Verticals, Million Units, 2017-2031

Table 22: North America Smart Card Market, by Verticals, US$ Mn, 2017-2031

Table 23: North America Smart Card Market, by Country, Million Units, 2017-2031

Table 24: North America Smart Card Market, by Country, US$ Mn, 2017-2031

Table 25: Europe Smart Card Market, by Component, Million Units, 2017-2031

Table 26: Europe Smart Card Market, by Component, US$ Mn, 2017-2031

Table 27: Europe Smart Card Market, by Type, Million Units, 2017-2031

Table 28: Europe Smart Card Market, by Type, US$ Mn, 2017-2031

Table 29: Europe Smart Card Market, by Function, Million Units, 2017-2031

Table 30: Europe Smart Card Market, by Function, US$ Mn, 2017-2031

Table 31: Europe Smart Card Market, by Offering, Million Units, 2017-2031

Table 32: Europe Smart Card Market, by Offering, US$ Mn, 2017-2031

Table 33: Europe Smart Card Market, by Verticals, Million Units, 2017-2031

Table 34: Europe Smart Card Market, by Verticals, US$ Mn, 2017-2031

Table 35: Europe Smart Card Market, by Country, Million Units, 2017-2031

Table 36: Europe Smart Card Market, by Country, US$ Mn, 2017-2031

Table 37: Asia Pacific Smart Card Market, by Component, Million Units, 2017-2031

Table 38: Asia Pacific Smart Card Market, by Component, US$ Mn, 2017-2031

Table 39: Asia Pacific Smart Card Market, by Type, Million Units, 2017-2031

Table 40: Asia Pacific Smart Card Market, by Type, US$ Mn, 2017-2031

Table 41: Asia Pacific Smart Card Market, by Function, Million Units, 2017-2031

Table 42: Asia Pacific Smart Card Market, by Function, US$ Mn, 2017-2031

Table 43: Asia Pacific Smart Card Market, by Offering, Million Units, 2017-2031

Table 44: Asia Pacific Smart Card Market, by Offering, US$ Mn, 2017-2031

Table 45: Asia Pacific Smart Card Market, by Verticals, Million Units, 2017-2031

Table 46: Asia Pacific Smart Card Market, by Verticals, US$ Mn, 2017-2031

Table 47: Asia Pacific Smart Card Market, by Country, Million Units, 2017-2031

Table 48: Asia Pacific Smart Card Market, by Country, US$ Mn, 2017-2031

Table 49: Middle East & Africa Smart Card Market, by Component, Million Units, 2017-2031

Table 50: Middle East & Africa Smart Card Market, by Component, US$ Mn, 2017-2031

Table 51: Middle East & Africa Smart Card Market, by Type, Million Units, 2017-2031

Table 52: Middle East & Africa Smart Card Market, by Type, US$ Mn, 2017-2031

Table 53: Middle East & Africa Smart Card Market, by Function, Million Units, 2017-2031

Table 54: Middle East & Africa Smart Card Market, by Function, US$ Mn, 2017-2031

Table 55: Middle East & Africa Smart Card Market, by Offering, Million Units, 2017-2031

Table 56: Middle East & Africa Smart Card Market, by Offering, US$ Mn, 2017-2031

Table 57: Middle East & Africa Smart Card Market, by Verticals, Million Units, 2017-2031

Table 58: Middle East & Africa Smart Card Market, by Verticals, US$ Mn, 2017-2031

Table 59: Middle East & Africa Smart Card Market, by Country, Million Units, 2017-2031

Table 60: Middle East & Africa Smart Card Market, by Country, US$ Mn, 2017-2031

Table 61: South America Smart Card Market, by Component, Million Units, 2017-2031

Table 62: South America Smart Card Market, by Component, US$ Mn, 2017-2031

Table 63: South America Smart Card Market, by Type, Million Units, 2017-2031

Table 64: South America Smart Card Market, by Type, US$ Mn, 2017-2031

Table 65: South America Smart Card Market, by Function, Million Units, 2017-2031

Table 66: South America Smart Card Market, by Function, US$ Mn, 2017-2031

Table 67: South America Smart Card Market, by Offering, Million Units, 2017-2031

Table 68: South America Smart Card Market, by Offering, US$ Mn, 2017-2031

Table 69: South America Smart Card Market, by Verticals, Million Units, 2017-2031

Table 70: South America Smart Card Market, by Verticals, US$ Mn, 2017-2031

Table 71: South America Smart Card Market, by Country, Million Units, 2017-2031

Table 72: South America Smart Card Market, by Country, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Smart Card Market, by Component, Million Units, 2017-2031

Figure 2: Global Smart Card Market, by Component, US$ Mn, 2017-2031

Figure 3: Global Smart Card Market Incremental Opportunity, by Component, US$ Mn, 2017-2031

Figure 4: Global Smart Card Market, by Type, Million Units, 2017-2031

Figure 5: Global Smart Card Market, by Type, US$ Mn, 2017-2031

Figure 6: Global Smart Card Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 7: Global Smart Card Market, by Function, Million Units, 2017-2031

Figure 8: Global Smart Card Market, by Function, US$ Mn, 2017-2031

Figure 9: Global Smart Card Market Incremental Opportunity, by Function, US$ Mn, 2017-2031

Figure 10: Global Smart Card Market, by Offering, Million Units, 2017-2031

Figure 11: Global Smart Card Market, by Offering, US$ Mn, 2017-2031

Figure 12: Global Smart Card Market Incremental Opportunity, by Offering, US$ Mn, 2017-2031

Figure 13: Global Smart Card Market, by Verticals, Million Units, 2017-2031

Figure 14: Global Smart Card Market, by Verticals, US$ Mn, 2017-2031

Figure 15: Global Smart Card Market Incremental Opportunity, by Verticals, US$ Mn, 2017-2031

Figure 16: Global Smart Card Market, by Region, Million Units, 2017-2031

Figure 17: Global Smart Card Market, by Region, US$ Mn, 2017-2031

Figure 18: Global Smart Card Market Incremental Opportunity, by Region, US$ Mn, 2017-2031

Figure 19: North America Smart Card Market, by Component, Million Units, 2017-2031

Figure 20: North America Smart Card Market, by Component, US$ Mn, 2017-2031

Figure 21: North America Smart Card Market Incremental Opportunity, by Component, US$ Mn, 2017-2031

Figure 22: North America Smart Card Market, by Type, Million Units, 2017-2031

Figure 23: North America Smart Card Market, by Type, US$ Mn, 2017-2031

Figure 24: North America Smart Card Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 25: North America Smart Card Market, by Function, Million Units, 2017-2031

Figure 26: North America Smart Card Market, by Function, US$ Mn, 2017-2031

Figure 27: North America Smart Card Market Incremental Opportunity, by Function, US$ Mn, 2017-2031

Figure 28: North America Smart Card Market, by Offering, Million Units, 2017-2031

Figure 29: North America Smart Card Market, by Offering, US$ Mn, 2017-2031

Figure 30: North America Smart Card Market Incremental Opportunity, by Offering, US$ Mn, 2017-2031

Figure 31: North America Smart Card Market, by Verticals, Million Units, 2017-2031

Figure 32: North America Smart Card Market, by Verticals, US$ Mn, 2017-2031

Figure 33: North America Smart Card Market Incremental Opportunity, by Verticals, US$ Mn, 2017-2031

Figure 34: North America Smart Card Market, by Country, Million Units, 2017-2031

Figure 35: North America Smart Card Market, by Country, US$ Mn, 2017-2031

Figure 36: North America Smart Card Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 37: Europe Smart Card Market, by Component, Million Units, 2017-2031

Figure 38: Europe Smart Card Market, by Component, US$ Mn, 2017-2031

Figure 39: Europe Smart Card Market Incremental Opportunity, by Component, US$ Mn, 2017-2031

Figure 40: Europe Smart Card Market, by Type, Million Units, 2017-2031

Figure 41: Europe Smart Card Market, by Type, US$ Mn, 2017-2031

Figure 42: Europe Smart Card Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 43: Europe Smart Card Market, by Function, Million Units, 2017-2031

Figure 44: Europe Smart Card Market, by Function, US$ Mn, 2017-2031

Figure 45: Europe Smart Card Market Incremental Opportunity, by Function, US$ Mn, 2017-2031

Figure 46: Europe Smart Card Market, by Offering, Million Units, 2017-2031

Figure 47: Europe Smart Card Market, by Offering, US$ Mn, 2017-2031

Figure 48: Europe Smart Card Market Incremental Opportunity, by Offering, US$ Mn, 2017-2031

Figure 49: Europe Smart Card Market, by Verticals, Million Units, 2017-2031

Figure 50: Europe Smart Card Market, by Verticals, US$ Mn, 2017-2031

Figure 51: Europe Smart Card Market Incremental Opportunity, by Verticals, US$ Mn, 2017-2031

Figure 52: Europe Smart Card Market, by Country, Million Units, 2017-2031

Figure 53: Europe Smart Card Market, by Country, US$ Mn, 2017-2031

Figure 54: Europe Smart Card Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 55: Asia Pacific Smart Card Market, by Component, Million Units, 2017-2031

Figure 56: Asia Pacific Smart Card Market, by Component, US$ Mn, 2017-2031

Figure 57: Asia Pacific Smart Card Market Incremental Opportunity, by Component, US$ Mn, 2017-2031

Figure 58: Asia Pacific Smart Card Market, by Type, Million Units, 2017-2031

Figure 59: Asia Pacific Smart Card Market, by Type, US$ Mn, 2017-2031

Figure 60: Asia Pacific Smart Card Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 61: Asia Pacific Smart Card Market, by Function, Million Units, 2017-2031

Figure 62: Asia Pacific Smart Card Market, by Function, US$ Mn, 2017-2031

Figure 63: Asia Pacific Smart Card Market Incremental Opportunity, by Function, US$ Mn, 2017-2031

Figure 64: Asia Pacific Smart Card Market, by Offering, Million Units, 2017-2031

Figure 65: Asia Pacific Smart Card Market, by Offering, US$ Mn, 2017-2031

Figure 66: Asia Pacific Smart Card Market Incremental Opportunity, by Offering, US$ Mn, 2017-2031

Figure 67: Asia Pacific Smart Card Market, by Verticals, Million Units, 2017-2031

Figure 68: Asia Pacific Smart Card Market, by Verticals, US$ Mn, 2017-2031

Figure 69: Asia Pacific Smart Card Market Incremental Opportunity, by Verticals, US$ Mn, 2017-2031

Figure 70: Asia Pacific Smart Card Market, by Country, Million Units, 2017-2031

Figure 71: Asia Pacific Smart Card Market, by Country, US$ Mn, 2017-2031

Figure 72: Asia Pacific Smart Card Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 73: Middle East & Africa Smart Card Market, by Component, Million Units, 2017-2031

Figure 74: Middle East & Africa Smart Card Market, by Component, US$ Mn, 2017-2031

Figure 75: Middle East & Africa Smart Card Market Incremental Opportunity, by Component, US$ Mn, 2017-2031

Figure 76: Middle East & Africa Smart Card Market, by Type, Million Units, 2017-2031

Figure 77: Middle East & Africa Smart Card Market, by Type, US$ Mn, 2017-2031

Figure 78: Middle East & Africa Smart Card Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 79: Middle East & Africa Smart Card Market, by Function, Million Units, 2017-2031

Figure 80: Middle East & Africa Smart Card Market, by Function, US$ Mn, 2017-2031

Figure 81: Middle East & Africa Smart Card Market Incremental Opportunity, by Function, US$ Mn, 2017-2031

Figure 82: Middle East & Africa Smart Card Market, by Offering, Million Units, 2017-2031

Figure 83: Middle East & Africa Smart Card Market, by Offering, US$ Mn, 2017-2031

Figure 84: Middle East & Africa Smart Card Market Incremental Opportunity, by Offering, US$ Mn, 2017-2031

Figure 85: Middle East & Africa Smart Card Market, by Verticals, Million Units, 2017-2031

Figure 86: Middle East & Africa Smart Card Market, by Verticals, US$ Mn, 2017-2031

Figure 87: Middle East & Africa Smart Card Market Incremental Opportunity, by Verticals, US$ Mn, 2017-2031

Figure 88: Middle East & Africa Smart Card Market, by Country, Million Units, 2017-2031

Figure 89: Middle East & Africa Smart Card Market, by Country, US$ Mn, 2017-2031

Figure 90: Middle East & Africa Smart Card Market Incremental Opportunity, by Country, US$ Mn, 2017-2031

Figure 91: South America Smart Card Market, by Component, Million Units, 2017-2031

Figure 92: South America Smart Card Market, by Component, US$ Mn, 2017-2031

Figure 93: South America Smart Card Market Incremental Opportunity, by Component, US$ Mn, 2017-2031

Figure 94: South America Smart Card Market, by Type, Million Units, 2017-2031

Figure 95: South America Smart Card Market, by Type, US$ Mn, 2017-2031

Figure 96: South America Smart Card Market Incremental Opportunity, by Type, US$ Mn, 2017-2031

Figure 97: South America Smart Card Market, by Function, Million Units, 2017-2031

Figure 98: South America Smart Card Market, by Function, US$ Mn, 2017-2031

Figure 99: South America Smart Card Market Incremental Opportunity, by Function, US$ Mn, 2017-2031

Figure 100: South America Smart Card Market, by Offering, Million Units, 2017-2031

Figure 101: South America Smart Card Market, by Offering, US$ Mn, 2017-2031

Figure 102: South America Smart Card Market Incremental Opportunity, by Offering, US$ Mn, 2017-2031

Figure 103: South America Smart Card Market, by Verticals, Million Units, 2017-2031

Figure 104: South America Smart Card Market, by Verticals, US$ Mn, 2017-2031

Figure 105: South America Smart Card Market Incremental Opportunity, by Verticals, US$ Mn, 2017-2031

Figure 106: South America Smart Card Market, by Country, Million Units, 2017-2031

Figure 107: South America Smart Card Market, by Country, US$ Mn, 2017-2031

Figure 108: South America Smart Card Market Incremental Opportunity, by Country, US$ Mn, 2017-2031