Even as manufacturers in the Europe plastic packaging market in some cases are reaching the limits in terms of capacity, suppliers in the automotive industry are being confronted with a considerable drop in demand during the pandemic. This signals how differently the coronavirus outbreak is affecting the plastic packaging industry. Stakeholders in the food industry are working under high pressure to secure supplies for the European population, while packaging demand in industrial applications and the gastronomy sector is witnessing a decline.

Mass inoculation with COVID-19 vaccines is anticipated to revive growth of the Europe plastic packaging market, as stakeholders in various end-use industries are expected to start working in full capacity and consumers would increase their spending by mid-2021. Although suppliers are increasing efforts to fulfill client orders, corona-related restrictions such as reduced personnel numbers and short-time working hours are affecting business activities.

The Europe plastic packaging market is projected to grow at a modest CAGR of 4.1% during the forecast period. Plastic has been under great scrutiny for increasing the environmental footprint. Stringent regulations on plastic have compelled manufacturers to innovate in bioplastics consisting of plant-based materials including corn, which is broken down into PLA (Polylactic Acid) to produce drinks bottles, food-grade containers, and films.

The growing demand for cruelty-free, paraben-free, and natural ingredients in beauty produced has led to an extensive use of recyclable plastic bottles with outer shell made from high performance strong fiber. Such trends are reducing the use of plastic materials and help companies to adhere to stringent plastic regulations.

Plastic materials are increasing the ecological footprint. However, it is potentially challenging to completely replace plastic in packaging applications and will take several years. Manufacturers in the Europe plastic packaging market are adhering to guidelines laid down by CEFLEX (The Circular Economy for Flexible Packaging), involving SUPRAVIS S.A. and other European countries that are reinventing consumer flexible packaging solutions. They are using various materials and polymers that contribute toward a circular economy.

Companies in the Europe plastic packaging market are anticipated to invest in research for the development of multi-material product profiles and validate their cleaning & processing in chemical recycling.

Pharmaceutical & healthcare is predicted to dominate the second-highest revenue among all end uses in the Europe plastic packaging market. The market is expected to reach US$ 73 Bn by 2030. Manufacturers are gaining proficiency in new product design, engineering services using CAD (Computer-Aided Design), and affordable short prototyping to expand revenue streams in pharmaceutical & healthcare applications.

Extensive experience in blow molding and injection molding is helping companies in the Europe plastic packaging market to unlock growth opportunities in medical, military, optical, and aerospace applications. They are increasing their production capabilities in sealable solid plastic containers that prevent foreign elements from contaminating the medicine within.

The custom cosmetics packaging is helping brands to stand out from other competitive products in supermarkets and increases brand visibility. Companies in the Europe plastic packaging market are innovating in designs that cater to the modern beauty consumer. This is being achieved with excellent graphics and right packaging format that help to accurately reflect the brand’s persona. Custom services in plastic packaging for beauty products incorporate the brand’s preferred color palette, icons, font styles, images, and the likes.

Excellent clean lines and perfect alignment of vivid graphics are being provided by manufacturers in the Europe plastic packaging market. They are increasing the availability of eco-friendly flexible cosmetic packaging solutions. Specialized features including micro-perforations are being incorporated in cosmetic packaging to allow for aeration of special products.

Analysts’ Viewpoint

The consistent demand for hygiene and cleaning products are generating stable revenue streams for stakeholders during the coronavirus outbreak. The Europe plastic packaging market is predicted to mature from an output of ~18,710 tons in 2020 and surpass ~27,054 tons by the end of 2030. However, measures to prevent plastic from ending up in landfills are rather poorly developed, depending on the type of waste, since PET (Polyethylene Teraphthalate) bottles are easy to recycle but plastic films are potentially challenging. Thus, stakeholders are taking cues from the CEFLEX initiative to increase R&D in eco-designing of packaging solutions that help in easy recycling of plastic waste.

1. Executive Summary

1.1. Europe Market Outlook

1.2. Demand Side Trends

1.3. Supply Side Trends

1.4. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage

2.2. Market Definition

3. Europe Plastic Packaging Market Demand Analysis 2015-2019 and Forecast, 2020-2030

3.1. Historical Market Volume (000 Tones) Analysis, 2015-2019

3.2. Current and Future Market Volume (000 Tones) Projections, 2020-2030

3.3. Y-o-Y Growth Trend Analysis

4. Europe Plastic Packaging Market - Pricing Analysis

4.1. Pricing Break-up

4.2. Europe Average Pricing Analysis Benchmark

5. Europe Plastic Packaging Market Demand (Value in US$ Mn) Analysis 2015-2019 and Forecast, 2020-2030

5.1. Historical Market Value (US$ Mn) Analysis, 2015-2019

5.2. Current and Future Market Value (US$ Mn) Projections, 2020-2030

5.2.1. Y-o-Y Growth Trend Analysis

5.2.2. Absolute $ Opportunity Analysis

6. Market Background

6.1. Europe Economic Outlook

6.2. Europe Packaging Industry Overview

6.3. Europe Business Environment Outlook

6.4. Europe GDP Growth Outlook

6.5. Macro-Economic Factors

6.5.1. Europe GDP Growth Outlook

6.5.2. GDP Per Capita

6.5.3. Manufacturing Value Added

6.5.4. Growth of Plastic Packaging Manufacturing Industries, by Region/Country

6.6. Forecast Factors - Relevance & Impact

6.6.1. Europe Plastic Packaging Industry Growth

6.6.2. Europe Food & Beverage Industry Growth

6.6.3. Europe Pharmaceutical Industry Growth

6.6.4. Europe Retail Industry Growth

6.6.5. Segmental Revenue Growth, by each key player

6.6.6. Rise in Disposable Income

6.6.7. Personal Care Industry Market Growth

6.6.8. Urban Population Growth

6.7. Value Chain

6.7.1. Key Participants

6.7.1.1. Raw Material Suppliers

6.7.1.2. Plastic Packaging Manufacturers

6.7.1.3. Distributors

6.7.2. Profitability Margin

6.8. Market Dynamics

6.8.1. Drivers

6.8.2. Restraints

6.8.3. Opportunity Analysis

6.9. Impact of COVID-19

6.9.1. Current Statistics and Probable Future Impact

6.9.2. Impact of COVID-19 on Plastic Packaging Market

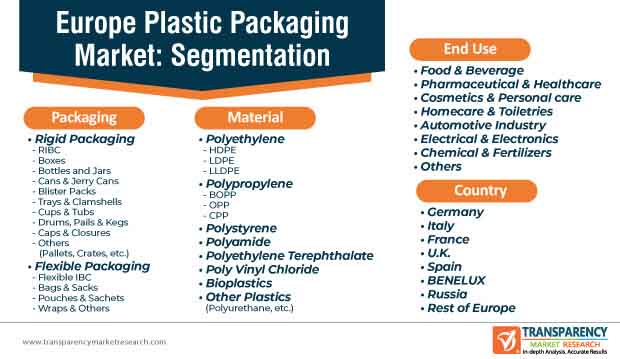

7. Europe Plastic Packaging Market Analysis 2015-2019 and Forecast 2020-2030, by Material

7.1. Introduction

7.2. Historical Market Value (US$ Mn) and Volume (000 Tones) Analysis, by Material, 2015-2019

7.3. Current and Future Market Value (US$ Mn) and Volume (000 Tones) Analysis and Forecast, by Material, 2020-2030

7.3.1. Polyethylene

7.3.1.1. HDPE

7.3.1.2. LDPE

7.3.1.3. LLDPE

7.3.2. Polypropylene

7.3.2.1. BOPP

7.3.2.2. OPP

7.3.2.3. CPP

7.3.3. Polystyrene

7.3.4. Polyamide

7.3.5. Polyethylene Terephthalate

7.3.6. Poly Vinyl Chloride

7.3.7. Bioplastics

7.3.8. Other Plastics (Polyurethane, etc.)

7.4. Market Attractiveness Analysis, by Material

8. Europe Plastic Packaging Market Analysis 2015-2019 and Forecast 2020-2030, by Packaging

8.1. Introduction

8.2. Historical Market Value (US$ Mn) and Volume (000 Tones) Analysis, by Packaging, 2015-2019

8.3. Current and Future Market Value (US$ Mn) and Volume (000 Tones) Analysis and Forecast, by Packaging, 2020-2030

8.3.1. Rigid Packaging

8.3.1.1. RIBC

8.3.1.2. Boxes

8.3.1.3. Bottles and Jars

8.3.1.4. Cans & Jerry Cans

8.3.1.5. Blister Packs

8.3.1.6. Trays & Clamshells

8.3.1.7. Cups & Tubs

8.3.1.8. Drums, pails & Kegs

8.3.1.9. Caps & Closures

8.3.1.10. Others (Pallets, Crates, etc.)

8.3.2. Flexible Packaging

8.3.2.1. Flexible IBC

8.3.2.2. Bags & Sacks

8.3.2.3. Pouches & Sachets

8.3.2.4. Wraps & others

8.4. Market Attractiveness Analysis, by Packaging

9. Europe Plastic Packaging Market Analysis 2015-2019 and Forecast 2020-2030, by End Use

9.1. Introduction

9.2. Historical Market Value (US$ Mn) and Volume (000 Tones) Analysis, by End Use, 2015-2019

9.3. Current Market Value (US$ Mn) and Volume (000 Tones) Analysis and Forecast, by End Use, 2020-2030

9.3.1. Food & Beverage

9.3.2. Pharmaceutical & healthcare

9.3.3. Cosmetics & Personal care

9.3.4. Homecare & Toiletries

9.3.5. Automotive Industry

9.3.6. Electrical& Electronics

9.3.7. Chemical & Fertilizers

9.3.8. Others

9.4. Market Attractiveness Analysis, by End Use

10. Europe Plastic Packaging Market Analysis 2015-2019 and Forecast 2020-2030, Country

10.1. Introduction

10.2. Historical Market Value (US$ Mn) and Volume (000 Tones) Analysis, by Country, 2015-2019

10.3. Current Market Value (US$ Mn) and Volume (000 Tones) Analysis and Forecast, by Country, 2020-2030

10.3.1. By Country

10.3.1.1. Germany

10.3.1.2. Italy

10.3.1.3. France

10.3.1.4. U.K.

10.3.1.5. Spain

10.3.1.6. BENELUX

10.3.1.7. Russia

10.3.1.8. Rest of Europe

10.4. Market Attractiveness Analysis, by Country

11. Market Structure Analysis

11.1. Market Analysis, by Tier of Plastic Packaging Companies

11.2. Market Share Analysis of Top Players

11.3. Market Presence Analysis

12. Competition Analysis

12.1. Competition Dashboard

12.2. Competition Benchmarking

12.3. Competition Deep Dive (Key Players)

12.3.1. Berry Global Group, Inc

12.3.1.1. Overview

12.3.1.2. Packaging Portfolio

12.3.1.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.1.4. Sales Footprint

12.3.1.5. Strategy Overview

12.3.1.5.1. Marketing Strategy

12.3.1.5.2. Packaging Strategy

12.3.1.5.3. Channel Strategy

12.3.2. Amcor Plc

12.3.2.1. Overview

12.3.2.2. Packaging Portfolio

12.3.2.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.2.4. Sales Footprint

12.3.2.5. Strategy Overview

12.3.2.5.1. Marketing Strategy

12.3.2.5.2. Packaging Strategy

12.3.2.5.3. Channel Strategy

12.3.3. Mondi Group Plc

12.3.3.1. Overview

12.3.3.2. Packaging Portfolio

12.3.3.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.3.4. Sales Footprint

12.3.3.5. Strategy Overview

12.3.3.5.1. Marketing Strategy

12.3.3.5.2. Packaging Strategy

12.3.3.5.3. Channel Strategy

12.3.4. Sonoco Products Company

12.3.4.1. Overview

12.3.4.2. Packaging Portfolio

12.3.4.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.4.4. Sales Footprint

12.3.4.5. Strategy Overview

12.3.4.5.1. Marketing Strategy

12.3.4.5.2. Packaging Strategy

12.3.4.5.3. Channel Strategy

12.3.5. Sealed Air Corp

12.3.5.1. Overview

12.3.5.2. Packaging Portfolio

12.3.5.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.5.4. Sales Footprint

12.3.5.5. Strategy Overview

12.3.5.5.1. Marketing Strategy

12.3.5.5.2. Packaging Strategy

12.3.5.5.3. Channel Strategy

12.3.6. Huhtamäki Oyj

12.3.6.1. Overview

12.3.6.2. Packaging Portfolio

12.3.6.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.6.4. Sales Footprint

12.3.6.5. Strategy Overview

12.3.6.5.1. Marketing Strategy

12.3.6.5.2. Packaging Strategy

12.3.6.5.3. Channel Strategy

12.3.7. Constantia Flexibles Group GmbH

12.3.7.1. Overview

12.3.7.2. Packaging Portfolio

12.3.7.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.7.4. Sales Footprint

12.3.7.5. Strategy Overview

12.3.7.5.1. Marketing Strategy

12.3.7.5.2. Packaging Strategy

12.3.7.5.3. Channel Strategy

12.3.8. Greif Inc.

12.3.8.1. Overview

12.3.8.2. Packaging Portfolio

12.3.8.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.8.4. Sales Footprint

12.3.8.5. Strategy Overview

12.3.8.5.1. Marketing Strategy

12.3.8.5.2. Packaging Strategy

12.3.8.5.3. Channel Strategy

12.3.9. Mauser Packaging Solutions

12.3.9.1. Overview

12.3.9.2. Packaging Portfolio

12.3.9.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.9.4. Sales Footprint

12.3.9.5. Strategy Overview

12.3.9.5.1. Marketing Strategy

12.3.9.5.2. Packaging Strategy

12.3.9.5.3. Channel Strategy

12.3.10. SCHÜTZ GmbH & Co. KGaA

12.3.10.1. Overview

12.3.10.2. Packaging Portfolio

12.3.10.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.10.4. Sales Footprint

12.3.10.5. Strategy Overview

12.3.10.5.1. Marketing Strategy

12.3.10.5.2. Packaging Strategy

12.3.10.5.3. Channel Strategy

12.3.11. Coveris Holdings S.A

12.3.11.1. Overview

12.3.11.2. Packaging Portfolio

12.3.11.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.11.4. Sales Footprint

12.3.11.5. Strategy Overview

12.3.11.5.1. Marketing Strategy

12.3.11.5.2. Packaging Strategy

12.3.11.5.3. Channel Strategy

12.3.12. AptarGroup, Inc

12.3.12.1. Overview

12.3.12.2. Packaging Portfolio

12.3.12.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.12.4. Sales Footprint

12.3.12.5. Strategy Overview

12.3.12.5.1. Marketing Strategy

12.3.12.5.2. Packaging Strategy

12.3.12.5.3. Channel Strategy

12.3.13. Schur Flexibles Holding GesmbH

12.3.13.1. Overview

12.3.13.2. Packaging Portfolio

12.3.13.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.13.4. Sales Footprint

12.3.13.5. Strategy Overview

12.3.13.5.1. Marketing Strategy

12.3.13.5.2. Packaging Strategy

12.3.13.5.3. Channel Strategy

12.3.14. BUERGO.FOL GmbH

12.3.14.1. Overview

12.3.14.2. Packaging Portfolio

12.3.14.3. Profitability by Market Segments (Packaging/Channel/Region)

12.3.14.4. Sales Footprint

12.3.14.5. Strategy Overview

12.3.14.5.1. Marketing Strategy

12.3.14.5.2. Packaging Strategy

12.3.14.5.3. Channel Strategy

*The above list is indicative in nature and is subject to change during the course of research

13. Assumptions and Acronyms Used

14. Research Methodology

List of Tables

Table 01: Europe Plastic Packaging Market Value (US$ Mn) by Material, 2015H-2030F

Table 02: Europe Plastic Packaging Market Volume (000' Tones) by Material, 2015H-2030F

Table 03: Europe Plastic Packaging Market Value (US$ Mn) by Packaging, 2015H-2030F

Table 04: Europe Plastic Packaging Market Volume (000' Tones) by Packaging, 2015H-2030F

Table 05: Europe Plastic Packaging Market Value (US$ Mn) by End Use, 2015H-2030F

Table 06: Europe Plastic Packaging Market Volume (000' Tones) by End Use, 2015H-2030F

Table 07: Europe Plastic Packaging Market Value (US$ Mn) by Country, 2015H-2030F

Table 08: Europe Plastic Packaging Market Volume (000' Tones) by Country, 2015H-2030F

List of Figures

Figure 01: Europe Plastic Packaging Market Share Analysis by Material, 2020E & 2030F

Figure 02: Europe Plastic Packaging Market Y-o-Y Analysis by Material, 2019A-2030F

Figure 03: Europe Plastic Packaging Market Attractiveness Analysis by Material, 2020E-2030F

Figure 04: Europe Plastic Packaging Market Share Analysis by Packaging, 2020E & 2030F

Figure 05: Europe Plastic Packaging Market Y-o-Y Analysis by Packaging, 2019A-2030F

Figure 06: Europe Plastic Packaging Market Attractiveness Analysis by Packaging, 2020E-2030F

Figure 07: Europe Plastic Packaging Market Share Analysis by End Use, 2020E & 2030F

Figure 08: Europe Plastic Packaging Market Y-o-Y Analysis by End Use, 2019A-2030F

Figure 09: Europe Plastic Packaging Market Attractiveness Analysis by End Use, 2020E-2030F

Figure 10: Europe Plastic Packaging Market Share Analysis by Country, 2020E & 2030F

Figure 11: Europe Plastic Packaging Market Y-o-Y Analysis by Country, 2019A-2030F

Figure 12: Europe Plastic Packaging Market Attractiveness Analysis by Country, 2020E-2030F