Analysts’ Viewpoint on Market Scenario

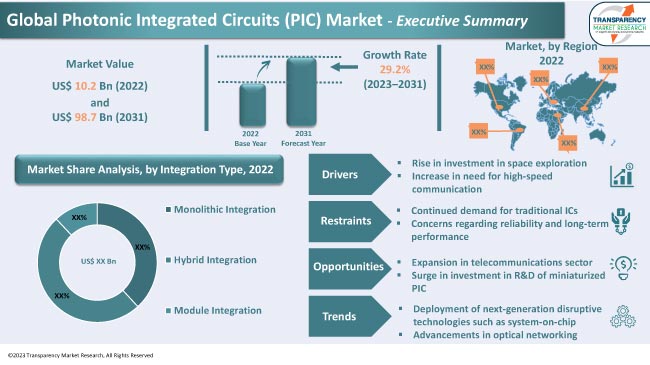

Increase in demand for high-speed communication and rise in adoption of photonic technologies in the space sector are expected to propel the Photonic Integrated Circuits (PIC) market size during the forecast period. Additionally, growth in integration of photonics in high-reliability computing devices is projected to fuel market expansion in the next few years.

Expansion in space and IT & telecommunications sector is likely to offer lucrative opportunities to vendors in the Photonic Integrated Circuits (PIC) industry. Vendors are strategically directing their attention toward high-growth applications, such as data centers, enterprise solutions, and computing devices, to increase their Photonic Integrated Circuits (PIC) market share. They are also launching photonic integrated circuits for high-bandwidth applications.

Photonic Integrated Circuits (PICs) are advanced integrated circuits that combine various photonic components, such as lasers, modulators, detectors, waveguides, and other optical elements, onto a single chip or substrate. Photonic ICs use photons (light) to transmit and process information, in contrast to traditional electronic integrated circuits that use electrons.

Surge in investment in the R&D of miniaturized PICs and deployment of next-generation disruptive technologies, such as system-on-chip, are anticipated to spur the Photonic Integrated Circuits (PIC) market growth in the near future. PICs make it possible to integrate complex optical systems into a compact space. In particular, silicon photonics allows for high-density integration, leading to the realization of innovative and energy-efficient system concepts.

Miniaturization and size reduction, high bandwidth and data rates, radiation tolerance, low power consumption, environmental stability, secure communication, and high precision sensing are some of the major properties of PICs that boost their usage in the space sector. Their ability to provide high-performance data communication, compact form factors, radiation tolerance, and energy efficiency makes them a promising choice for next-generation space applications including satellite communication, earth observation, and interplanetary exploration. Hence, increase in investment in space exploration is augmenting the Photonic Integrated Circuits (PIC) market value.

Space environments expose electronic components to ionizing radiation, which can degrade their performance or cause failure. Photonic integrated circuits, based on optical signals rather than electronic signals, are inherently less susceptible to radiation effects, making them more reliable in space applications.

Surge in need for high-speed data transmission in the IT & telecommunications sector is boosting demand for PICs as they offer superior performance and bandwidth capabilities compared to traditional electronic circuits. Businesses are continuously upgrading their networks to handle high data volumes. PICs provide the means to achieve faster and more robust network infrastructures. Adoption of PICs is expected to grow significantly as technology continues to advance and data-intensive applications become more prevalent. This, in turn, is projected to drive the Photonic Integrated Circuits (PIC) market progress in the next few years.

According to the latest Photonic Integrated Circuits (PIC) market trends, hybrid integration was the largest integration type segment with 53.6% share in 2022. Hybrid integration approach allows for the incorporation of various functionalities that may not be easily achievable with a single material or technology.

Hybrid integration often involves combining different semiconductor materials, waveguide structures, or even non-semiconductor elements, such as polymers or plasmonic materials, to optimize the performance and capabilities of the photonic circuit. Hybrid integration techniques in PICs can lead to improved performance, greater functionality, and enhanced flexibility in designing advanced photonic devices for various applications such as telecommunications, data communications, and sensing.

According to the latest Photonic Integrated Circuits (PIC) market analysis, the silicon raw material segment is projected to dominate the market with a CAGR of 34.1% from 2023 to 2031. Silicon photonics offers several advantages including low cost, scalability, and the potential for large-scale production. It also benefits from the extensive knowledge and infrastructure already established in the silicon semiconductor industry, making it an appealing choice for the development of integrated photonic circuits.

According to the latest Photonic Integrated Circuits (PIC) market forecast, North America is anticipated to hold largest share from 2023 to 2031 High presence of data centers in the U.S. is a major factor fueling the market dynamics of the region. According to Cloudscene, the U.S. is home to around 2,700 data centers, making up almost 33% of the total global count.

Growth in production of computing devices is augmenting market statistics in Asia Pacific. According to The Observatory of Economic Complexity (OEC), China emerged as a major computer exporter in 2020 with a value of US$ 156 Bn, followed by Mexico (US$ 31.5 Bn), the U.S. (US$ 16.6 Bn), the Netherlands (US$ 13.7 Bn), and Germany (US$ 12.2 Bn).

The global industry is fragmented, with the presence of well-established players. Most Photonic Integrated Circuits (PIC) companies are adopting various strategies, such as product expansion, collaboration, and M&A, to broaden their customer base. They are also launching next-generation photonic integrated circuits for advanced applications.

Broadcom Inc., Broadex Technologies Co., Ltd., Ciena Corporation, Cisco Systems, Inc., Coherent Corp., Enablence, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Infinera Corporation, Intel Corporation, Lightwave Logic, Inc., LioniX International, Lumentum Holdings, Inc., MACOM, Nokia Technologies, Q.ANT GmbH, TE Connectivity, Teem Photonics, and VLC Photonics S.L. are key entities operating in this industry.

Each of these players has been profiled in the Photonic Integrated Circuits (PIC) market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 10.2 Bn |

|

Market Forecast Value in 2031 |

US$ 98.7 Bn |

|

Growth Rate (CAGR) |

29.2% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 10.2 Bn in 2022

It is projected to grow at a CAGR of 29.2% from 2023 to 2031

It is estimated to reach US$ 98.7 Bn by the end of 2031

Rise in investment in space exploration and increase in need for high-speed communication

Hybrid integration was the largest integration type segment with 53.6% share in 2022

North America is expected to record the highest demand during the forecast period

The U.S. accounted for 41.6% share in 2022

Broadcom Inc., Broadex Technologies Co., Ltd., Ciena Corporation, Cisco Systems, Inc., Coherent Corp., Enablence, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Infinera Corporation, Intel Corporation, Lightwave Logic, Inc., LioniX International, Lumentum Holdings, Inc., MACOM, Nokia Technologies, Q.ANT GmbH, TE Connectivity, Teem Photonics, and VLC Photonics S.L.

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Photonic Integrated Circuits (PIC) Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Photonics Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

5. Global Photonic Integrated Circuits (PIC) Market Analysis, By Integration Type

5.1. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Integration Type, 2017-2031

5.1.1. Monolithic Integration

5.1.2. Hybrid Integration

5.1.3. Module Integration

5.2. Market Attractiveness Analysis, By Integration Type

6. Global Photonic Integrated Circuits (PIC) Market Analysis, By Raw Material

6.1. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Raw Material, 2017-2031

6.1.1. Indium Phosphide

6.1.2. Gallium Arsenide

6.1.3. Lithium Niobate

6.1.4. Silicon

6.1.5. Silicon-on-Insulator

6.1.6. Others (Silica-on-Silicon, Silicon Dioxide (SiO2), etc.)

6.2. Market Attractiveness Analysis, By Raw Material

7. Global Photonic Integrated Circuits (PIC) Market Analysis, By Component

7.1. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Component, 2017-2031

7.1.1. Lasers

7.1.2. Waveguides

7.1.3. Modulators

7.1.4. Detectors

7.1.5. Attenuators

7.1.6. Multiplexers/De-multiplexers

7.1.7. Optical Amplifiers

7.2. Market Attractiveness Analysis, By Component

8. Global Photonic Integrated Circuits (PIC) Market Analysis, By Application

8.1. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

8.1.1. Optical Communication

8.1.1.1. FTTx and Access Networks

8.1.1.2. Microwave/RF Photonics

8.1.1.3. Long-haul and Transport Networks

8.1.1.4. Optical Datacom

8.1.2. Sensing

8.1.2.1. Structural Engineering

8.1.2.2. Chemical Sensors

8.1.2.3. Transport and Aerospace

8.1.2.4. Energy and Utilities

8.1.3. Optical Signal Processing

8.1.3.1. Optical Metrology

8.1.3.2. Optical Instrumentation

8.1.3.3. Quantum Optics

8.1.3.4. Quantum Computing

8.1.4. Biophotonics

8.1.4.1. Medical Instrumentation

8.1.4.2. Photonic Lab-on-a-Chip

8.1.4.3. Analytics and Diagnostics

8.1.4.4. Optical Biosensors

8.2. Market Attractiveness Analysis, By Application

9. Global Photonic Integrated Circuits (PIC) Market Analysis and Forecast, By Region

9.1. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Region, 2017-2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Photonic Integrated Circuits (PIC) Market Analysis and Forecast

10.1. Market Snapshot

10.2. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Integration Type, 2017-2031

10.2.1. Monolithic Integration

10.2.2. Hybrid Integration

10.2.3. Module Integration

10.3. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Raw Material, 2017-2031

10.3.1. Indium Phosphide

10.3.2. Gallium Arsenide

10.3.3. Lithium Niobate

10.3.4. Silicon

10.3.5. Silicon-on-Insulator

10.3.6. Others (Silica-on-Silicon, Silicon Dioxide (SiO2), etc.)

10.4. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Component, 2017-2031

10.4.1. Lasers

10.4.2. Waveguides

10.4.3. Modulators

10.4.4. Detectors

10.4.5. Attenuators

10.4.6. Multiplexers/De-multiplexers

10.4.7. Optical Amplifiers

10.5. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

10.5.1. Optical Communication

10.5.1.1. FTTx and Access Networks

10.5.1.2. Microwave/RF Photonics

10.5.1.3. Long-haul and Transport Networks

10.5.1.4. Optical Datacom

10.5.2. Sensing

10.5.2.1. Structural Engineering

10.5.2.2. Chemical Sensors

10.5.2.3. Transport and Aerospace

10.5.2.4. Energy and Utilities

10.5.3. Optical Signal Processing

10.5.3.1. Optical Metrology

10.5.3.2. Optical Instrumentation

10.5.3.3. Quantum Optics

10.5.3.4. Quantum Computing

10.5.4. Biophotonics

10.5.4.1. Medical Instrumentation

10.5.4.2. Photonic Lab-on-a-Chip

10.5.4.3. Analytics and Diagnostics

10.5.4.4. Optical Biosensors

10.6. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.6.1. U.S.

10.6.2. Canada

10.6.3. Rest of North America

10.7. Market Attractiveness Analysis

10.7.1. By Integration Type

10.7.2. By Raw Material

10.7.3. By Component

10.7.4. By Application

10.7.5. By Country/Sub-region

11. Europe Photonic Integrated Circuits (PIC) Market Analysis and Forecast

11.1. Market Snapshot

11.2. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Integration Type, 2017-2031

11.2.1. Monolithic Integration

11.2.2. Hybrid Integration

11.2.3. Module Integration

11.3. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Raw Material, 2017-2031

11.3.1. Indium Phosphide

11.3.2. Gallium Arsenide

11.3.3. Lithium Niobate

11.3.4. Silicon

11.3.5. Silicon-on-Insulator

11.3.6. Others (Silica-on-Silicon, Silicon Dioxide (SiO2), etc.)

11.4. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Component, 2017-2031

11.4.1. Lasers

11.4.2. Waveguides

11.4.3. Modulators

11.4.4. Detectors

11.4.5. Attenuators

11.4.6. Multiplexers/De-multiplexers

11.4.7. Optical Amplifiers

11.5. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

11.5.1. Optical Communication

11.5.1.1. FTTx and Access Networks

11.5.1.2. Microwave/RF Photonics

11.5.1.3. Long-haul and Transport Networks

11.5.1.4. Optical Datacom

11.5.2. Sensing

11.5.2.1. Structural Engineering

11.5.2.2. Chemical Sensors

11.5.2.3. Transport and Aerospace

11.5.2.4. Energy and Utilities

11.5.3. Optical Signal Processing

11.5.3.1. Optical Metrology

11.5.3.2. Optical Instrumentation

11.5.3.3. Quantum Optics

11.5.3.4. Quantum Computing

11.5.4. Biophotonics

11.5.4.1. Medical Instrumentation

11.5.4.2. Photonic Lab-on-a-Chip

11.5.4.3. Analytics and Diagnostics

11.5.4.4. Optical Biosensors

11.6. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. U.K.

11.6.2. Germany

11.6.3. France

11.6.4. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Integration Type

11.7.2. By Raw Material

11.7.3. By Component

11.7.4. By Application

11.7.5. By Country/Sub-region

12. Asia Pacific Photonic Integrated Circuits (PIC) Market Analysis and Forecast

12.1. Market Snapshot

12.2. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Integration Type, 2017-2031

12.2.1. Monolithic Integration

12.2.2. Hybrid Integration

12.2.3. Module Integration

12.3. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Raw Material, 2017-2031

12.3.1. Indium Phosphide

12.3.2. Gallium Arsenide

12.3.3. Lithium Niobate

12.3.4. Silicon

12.3.5. Silicon-on-Insulator

12.3.6. Others (Silica-on-Silicon, Silicon Dioxide (SiO2), etc.)

12.4. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Component, 2017-2031

12.4.1. Lasers

12.4.2. Waveguides

12.4.3. Modulators

12.4.4. Detectors

12.4.5. Attenuators

12.4.6. Multiplexers/De-multiplexers

12.4.7. Optical Amplifiers

12.5. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

12.5.1. Optical Communication

12.5.1.1. FTTx and Access Networks

12.5.1.2. Microwave/RF Photonics

12.5.1.3. Long-haul and Transport Networks

12.5.1.4. Optical Datacom

12.5.2. Sensing

12.5.2.1. Structural Engineering

12.5.2.2. Chemical Sensors

12.5.2.3. Transport and Aerospace

12.5.2.4. Energy and Utilities

12.5.3. Optical Signal Processing

12.5.3.1. Optical Metrology

12.5.3.2. Optical Instrumentation

12.5.3.3. Quantum Optics

12.5.3.4. Quantum Computing

12.5.4. Biophotonics

12.5.4.1. Medical Instrumentation

12.5.4.2. Photonic Lab-on-a-Chip

12.5.4.3. Analytics and Diagnostics

12.5.4.4. Optical Biosensors

12.6. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. South Korea

12.6.5. ASEAN

12.6.6. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Integration Type

12.7.2. By Raw Material

12.7.3. By Component

12.7.4. By Application

12.7.5. By Country/Sub-region

13. Middle East & Africa Photonic Integrated Circuits (PIC) Market Analysis and Forecast

13.1. Market Snapshot

13.2. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Integration Type, 2017-2031

13.2.1. Monolithic Integration

13.2.2. Hybrid Integration

13.2.3. Module Integration

13.3. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Raw Material, 2017-2031

13.3.1. Indium Phosphide

13.3.2. Gallium Arsenide

13.3.3. Lithium Niobate

13.3.4. Silicon

13.3.5. Silicon-on-Insulator

13.3.6. Others (Silica-on-Silicon, Silicon Dioxide (SiO2), etc.)

13.4. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Component, 2017-2031

13.4.1. Lasers

13.4.2. Waveguides

13.4.3. Modulators

13.4.4. Detectors

13.4.5. Attenuators

13.4.6. Multiplexers/De-multiplexers

13.4.7. Optical Amplifiers

13.5. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

13.5.1. Optical Communication

13.5.1.1. FTTx and Access Networks

13.5.1.2. Microwave/RF Photonics

13.5.1.3. Long-haul and Transport Networks

13.5.1.4. Optical Datacom

13.5.2. Sensing

13.5.2.1. Structural Engineering

13.5.2.2. Chemical Sensors

13.5.2.3. Transport and Aerospace

13.5.2.4. Energy and Utilities

13.5.3. Optical Signal Processing

13.5.3.1. Optical Metrology

13.5.3.2. Optical Instrumentation

13.5.3.3. Quantum Optics

13.5.3.4. Quantum Computing

13.5.4. Biophotonics

13.5.4.1. Medical Instrumentation

13.5.4.2. Photonic Lab-on-a-Chip

13.5.4.3. Analytics and Diagnostics

13.5.4.4. Optical Biosensors

13.6. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. GCC

13.6.2. South Africa

13.6.3. Rest of Middle East & Africa

13.7. Market Attractiveness Analysis

13.7.1. By Integration Type

13.7.2. By Raw Material

13.7.3. By Component

13.7.4. By Application

13.7.5. By Country/Sub-region

14. South America Photonic Integrated Circuits (PIC) Market Analysis and Forecast

14.1. Market Snapshot

14.2. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Integration Type, 2017-2031

14.2.1. Monolithic Integration

14.2.2. Hybrid Integration

14.2.3. Module Integration

14.3. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Raw Material, 2017-2031

14.3.1. Indium Phosphide

14.3.2. Gallium Arsenide

14.3.3. Lithium Niobate

14.3.4. Silicon

14.3.5. Silicon-on-Insulator

14.3.6. Others (Silica-on-Silicon, Silicon Dioxide (SiO2), etc.)

14.4. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Component, 2017-2031

14.4.1. Lasers

14.4.2. Waveguides

14.4.3. Modulators

14.4.4. Detectors

14.4.5. Attenuators

14.4.6. Multiplexers/De-multiplexers

14.4.7. Optical Amplifiers

14.5. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) Analysis & Forecast, By Application, 2017-2031

14.5.1. Optical Communication

14.5.1.1. FTTx and Access Networks

14.5.1.2. Microwave/RF Photonics

14.5.1.3. Long-haul and Transport Networks

14.5.1.4. Optical Datacom

14.5.2. Sensing

14.5.2.1. Structural Engineering

14.5.2.2. Chemical Sensors

14.5.2.3. Transport and Aerospace

14.5.2.4. Energy and Utilities

14.5.3. Optical Signal Processing

14.5.3.1. Optical Metrology

14.5.3.2. Optical Instrumentation

14.5.3.3. Quantum Optics

14.5.3.4. Quantum Computing

14.5.4. Biophotonics

14.5.4.1. Medical Instrumentation

14.5.4.2. Photonic Lab-on-a-Chip

14.5.4.3. Analytics and Diagnostics

14.5.4.4. Optical Biosensors

14.6. Photonic Integrated Circuits (PIC) Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

14.6.1. Brazil

14.6.2. Rest of South America

14.7. Market Attractiveness Analysis

14.7.1. By Integration Type

14.7.2. By Raw Material

14.7.3. By Component

14.7.4. By Application

14.7.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Photonic Integrated Circuits (PIC) Market Competition Matrix - a Dashboard View

15.1.1. Global Photonic Integrated Circuits (PIC) Market Company Share Analysis, by Value (2022)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Broadcom Inc.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Broadex Technologies Co., Ltd.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Ciena Corporation

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Cisco Systems, Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. Coherent Corp.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Enablence

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Hewlett Packard Enterprise Development LP

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Huawei Technologies Co., Ltd.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Infinera Corporation

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Intel Corporation

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Lightwave Logic, Inc.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. LioniX International

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Lumentum Holdings, Inc.

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. MACOM

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

16.15. Nokia Technologies

16.15.1. Overview

16.15.2. Product Portfolio

16.15.3. Sales Footprint

16.15.4. Key Subsidiaries or Distributors

16.15.5. Strategy and Recent Developments

16.15.6. Key Financials

16.16. Q.ANT GmbH

16.16.1. Overview

16.16.2. Product Portfolio

16.16.3. Sales Footprint

16.16.4. Key Subsidiaries or Distributors

16.16.5. Strategy and Recent Developments

16.16.6. Key Financials

16.17. TE Connectivity

16.17.1. Overview

16.17.2. Product Portfolio

16.17.3. Sales Footprint

16.17.4. Key Subsidiaries or Distributors

16.17.5. Strategy and Recent Developments

16.17.6. Key Financials

16.18. Teem Photonics

16.18.1. Overview

16.18.2. Product Portfolio

16.18.3. Sales Footprint

16.18.4. Key Subsidiaries or Distributors

16.18.5. Strategy and Recent Developments

16.18.6. Key Financials

16.19. VLC Photonics S.L.

16.19.1. Overview

16.19.2. Product Portfolio

16.19.3. Sales Footprint

16.19.4. Key Subsidiaries or Distributors

16.19.5. Strategy and Recent Developments

16.19.6. Key Financials

16.20. Other Key Players

16.20.1. Overview

16.20.2. Product Portfolio

16.20.3. Sales Footprint

16.20.4. Key Subsidiaries or Distributors

16.20.5. Strategy and Recent Developments

16.20.6. Key Financials

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Integration Type, 2017-2031

Table 2: Global Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Integration Type, 2017-2031

Table 3: Global Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Raw Material, 2017-2031

Table 4: Global Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 5: Global Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 6: Global Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 7: Global Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Region, 2017-2031

Table 8: North America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Integration Type, 2017-2031

Table 9: North America Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Integration Type, 2017-2031

Table 10: North America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Raw Material, 2017-2031

Table 11: North America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 12: North America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 13: North America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 14: North America Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 15: Europe Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Integration Type, 2017-2031

Table 16: Europe Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Integration Type, 2017-2031

Table 17: Europe Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Raw Material, 2017-2031

Table 18: Europe Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Raw Material, 2017-2031

Table 19: Europe Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 20: Europe Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Component, 2017-2031

Table 21: Europe Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 22: Europe Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 23: Europe Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 24: Europe Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 25: Asia Pacific Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Integration Type, 2017-2031

Table 26: Asia Pacific Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Integration Type, 2017-2031

Table 27: Asia Pacific Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Raw Material, 2017-2031

Table 28: Asia Pacific Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 29: Asia Pacific Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 30: Asia Pacific Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 31: Asia Pacific Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 32: Middle East & Africa Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Integration Type, 2017-2031

Table 33: Middle East & Africa Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Integration Type, 2017-2031

Table 34: Middle East & Africa Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Raw Material, 2017-2031

Table 35: Middle East & Africa Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 36: Middle East & Africa Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 37: Middle East & Africa Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 38: Middle East & Africa Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

Table 39: South America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Integration Type, 2017-2031

Table 40: South America Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Integration Type, 2017-2031

Table 41: South America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Raw Material, 2017-2031

Table 42: South America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Component, 2017-2031

Table 43: South America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 44: South America Photonic Integrated Circuits (PIC) Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 45: South America Photonic Integrated Circuits (PIC) Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Photonic Integrated Circuits (PIC) Market

Figure 02: Porter Five Forces Analysis - Global Photonic Integrated Circuits (PIC) Market

Figure 03: Integration Type Road Map - Global Photonic Integrated Circuits (PIC) Market

Figure 04: Global Photonic Integrated Circuits (PIC) Market, Value (US$ Bn), 2017-2031

Figure 05: Global Photonic Integrated Circuits (PIC) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 06: Global Photonic Integrated Circuits (PIC) Market Projections by Integration Type, Value (US$ Bn), 2017‒2031

Figure 07: Global Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Integration Type, 2023‒2031

Figure 08: Global Photonic Integrated Circuits (PIC) Market Share Analysis, by Integration Type, 2023 and 2031

Figure 09: Global Photonic Integrated Circuits (PIC) Market Projections by Raw Material, Value (US$ Bn), 2017‒2031

Figure 10: Global Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Raw Material, 2023‒2031

Figure 11: Global Photonic Integrated Circuits (PIC) Market Share Analysis, by Raw Material, 2023 and 2031

Figure 12: Global Photonic Integrated Circuits (PIC) Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 13: Global Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Component, 2023‒2031

Figure 14: Global Photonic Integrated Circuits (PIC) Market Share Analysis, by Component, 2023 and 2031

Figure 15: Global Photonic Integrated Circuits (PIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 16: Global Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 17: Global Photonic Integrated Circuits (PIC) Market Share Analysis, by Application, 2023 and 2031

Figure 18: Global Photonic Integrated Circuits (PIC) Market Projections by Region, Value (US$ Bn), 2017‒2031

Figure 19: Global Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Region, 2023‒2031

Figure 20: Global Photonic Integrated Circuits (PIC) Market Share Analysis, by Region, 2023 and 2031

Figure 21: North America Photonic Integrated Circuits (PIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 22: North America Photonic Integrated Circuits (PIC) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 23: North America Photonic Integrated Circuits (PIC) Market Projections by Integration Type Value (US$ Bn), 2017‒2031

Figure 24: North America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Integration Type, 2023‒2031

Figure 25: North America Photonic Integrated Circuits (PIC) Market Share Analysis, by Integration Type, 2023 and 2031

Figure 26: North America Photonic Integrated Circuits (PIC) Market Projections by Raw Material Value (US$ Bn), 2017‒2031

Figure 27: North America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Raw Material, 2023‒2031

Figure 28: North America Photonic Integrated Circuits (PIC) Market Share Analysis, by Raw Material, 2023 and 2031

Figure 29: North America Photonic Integrated Circuits (PIC) Market Projections by Component (US$ Bn), 2017‒2031

Figure 30: North America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Component, 2023‒2031

Figure 31: North America Photonic Integrated Circuits (PIC) Market Share Analysis, by Component, 2023 and 2031

Figure 32: North America Photonic Integrated Circuits (PIC) Market Projections by Application Value (US$ Bn), 2017‒2031

Figure 33: North America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 34: North America Photonic Integrated Circuits (PIC) Market Share Analysis, by Application, 2023 and 2031

Figure 35: North America Photonic Integrated Circuits (PIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 36: North America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 37: North America Photonic Integrated Circuits (PIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 38: Europe Photonic Integrated Circuits (PIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 39: Europe Photonic Integrated Circuits (PIC) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 40: Europe Photonic Integrated Circuits (PIC) Market Projections by Integration Type Value (US$ Bn), 2017‒2031

Figure 41: Europe Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Integration Type, 2023‒2031

Figure 42: Europe Photonic Integrated Circuits (PIC) Market Share Analysis, by Integration Type, 2023 and 2031

Figure 43: Europe Photonic Integrated Circuits (PIC) Market Projections by Raw Material, Value (US$ Bn), 2017‒2031

Figure 44: Europe Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Raw Material, 2023‒2031

Figure 45: Europe Photonic Integrated Circuits (PIC) Market Share Analysis, by Raw Material, 2023 and 2031

Figure 46: Europe Photonic Integrated Circuits (PIC) Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 47: Europe Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Component, 2023‒2031

Figure 48: Europe Photonic Integrated Circuits (PIC) Market Share Analysis, by Component, 2023 and 2031

Figure 49: Europe Photonic Integrated Circuits (PIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 50: Europe Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 51: Europe Photonic Integrated Circuits (PIC) Market Share Analysis, by Application, 2023 and 2031

Figure 52: Europe Photonic Integrated Circuits (PIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 53: Europe Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 54: Europe Photonic Integrated Circuits (PIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 55: Asia Pacific Photonic Integrated Circuits (PIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 56: Asia Pacific Photonic Integrated Circuits (PIC) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 57: Asia Pacific Photonic Integrated Circuits (PIC) Market Projections by Integration Type Value (US$ Bn), 2017‒2031

Figure 58: Asia Pacific Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Integration Type, 2023‒2031

Figure 59: Asia Pacific Photonic Integrated Circuits (PIC) Market Share Analysis, by Integration Type, 2023 and 2031

Figure 60: Asia Pacific Photonic Integrated Circuits (PIC) Market Projections by Raw Material Value (US$ Bn), 2017‒2031

Figure 61: Asia Pacific Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Raw Material, 2023‒2031

Figure 62: Asia Pacific Photonic Integrated Circuits (PIC) Market Share Analysis, by Raw Material, 2023 and 2031

Figure 63: Asia Pacific Photonic Integrated Circuits (PIC) Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 64: Asia Pacific Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Component, 2023‒2031

Figure 65: Asia Pacific Photonic Integrated Circuits (PIC) Market Share Analysis, by Component, 2023 and 2031

Figure 66: Asia Pacific Photonic Integrated Circuits (PIC) Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 67: Asia Pacific Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 68: Asia Pacific Photonic Integrated Circuits (PIC) Market Share Analysis, by Application, 2023 and 2031

Figure 69: Asia Pacific Photonic Integrated Circuits (PIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 70: Asia Pacific Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 71: Asia Pacific Photonic Integrated Circuits (PIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 72: Middle East & Africa Photonic Integrated Circuits (PIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 73: Middle East & Africa Photonic Integrated Circuits (PIC) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 74: Middle East & Africa Photonic Integrated Circuits (PIC) Market Projections by Integration Type Value (US$ Bn), 2017‒2031

Figure 75: Middle East & Africa Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Integration Type, 2023‒2031

Figure 76: Middle East & Africa Photonic Integrated Circuits (PIC) Market Share Analysis, by Integration Type, 2023 and 2031

Figure 77: Middle East & Africa Photonic Integrated Circuits (PIC) Market Projections by Raw Material Value (US$ Bn), 2017‒2031

Figure 78: Middle East & Africa Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Raw Material, 2023‒2031

Figure 79: Middle East & Africa Photonic Integrated Circuits (PIC) Market Share Analysis, by Raw Material, 2023 and 2031

Figure 80: Middle East & Africa Photonic Integrated Circuits (PIC) Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 81: Middle East & Africa Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Component, 2023‒2031

Figure 82: Middle East & Africa Photonic Integrated Circuits (PIC) Market Share Analysis, by Component, 2023 and 2031

Figure 83: Middle East & Africa Photonic Integrated Circuits (PIC) Market Projections by Application Value (US$ Bn), 2017‒2031

Figure 84: Middle East & Africa Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 85: Middle East & Africa Photonic Integrated Circuits (PIC) Market Share Analysis, by Application, 2023 and 2031

Figure 86: Middle East & Africa Photonic Integrated Circuits (PIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 87: Middle East & Africa Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 88: Middle East & Africa Photonic Integrated Circuits (PIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 89: South America Photonic Integrated Circuits (PIC) Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 90: South America Photonic Integrated Circuits (PIC) Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 91: South America Photonic Integrated Circuits (PIC) Market Projections by Integration Type Value (US$ Bn), 2017‒2031

Figure 92: South America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Integration Type, 2023‒2031

Figure 93: South America Photonic Integrated Circuits (PIC) Market Share Analysis, by Integration Type, 2023 and 2031

Figure 94: South America Photonic Integrated Circuits (PIC) Market Projections by Raw Material Value (US$ Bn), 2017‒2031

Figure 95: South America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Raw Material, 2023‒2031

Figure 96: South America Photonic Integrated Circuits (PIC) Market Share Analysis, by Raw Material, 2023 and 2031

Figure 97: South America Photonic Integrated Circuits (PIC) Market Projections by Component, Value (US$ Bn), 2017‒2031

Figure 98: South America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Component, 2023‒2031

Figure 99: South America Photonic Integrated Circuits (PIC) Market Share Analysis, by Component, 2023 and 2031

Figure 100: South America Photonic Integrated Circuits (PIC) Market Projections by Application Value (US$ Bn), 2017‒2031

Figure 101: South America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Application, 2023‒2031

Figure 102: South America Photonic Integrated Circuits (PIC) Market Share Analysis, by Application, 2023 and 2031

Figure 103: South America Photonic Integrated Circuits (PIC) Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 104: South America Photonic Integrated Circuits (PIC) Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 105: South America Photonic Integrated Circuits (PIC) Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 106: Global Photonic Integrated Circuits (PIC) Market Competition

Figure 107: Global Photonic Integrated Circuits (PIC) Market Company Share Analysis