Analysts’ Viewpoint on Market Scenario

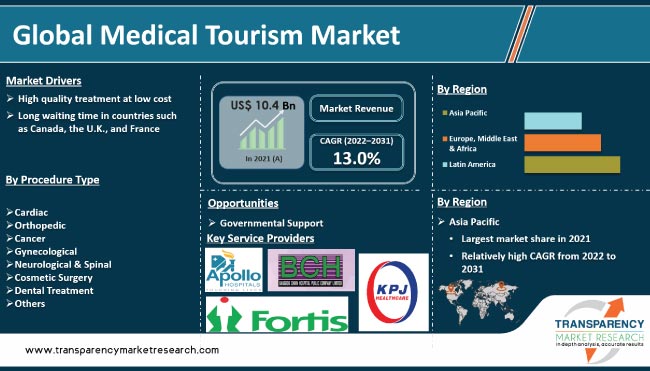

Increase in geriatric population and rise in adoption of sophisticated technologies are driving the global medical tourism business. Population aged 65 years or above is expected to double in the U.S. by 2050. This surge in geriatric population is anticipated to boost the demand for advanced and affordable care. Economic crisis in developed countries has led a decrease in expenditure on healthcare. Therefore, patients, insurers, health insurance agents, and employers seek medical services abroad.

Long waiting time in countries such as Canada, the U.K., and France is one of the key factors that induces patients to visit other healthcare destinations. Furthermore, favorable foreign currency exchange rates and rise in demand for cosmetic surgeries are propelling the outbound medical tourism services market. Companies are introducing new technologies such as medical tourism apps to further attract the global clientele.

Medical tourism is defined as the travel of patients from their home country to different destinations for medical treatment. These services include sophisticated treatments such as cardiac surgery, orthopedics, neurosurgery, and dental care or elective treatments such as cosmetic surgeries or even routine health check-ups. As per medical tourism market research, the rise in healthcare expenditure in developed countries and the availability of cost-effective treatments in developing countries have made medical tourism an emerging industry. Furthermore, the availability of medical tourism insurance is also driving the market. The high cost of treatment in developed countries is a major factor in the migration of patients to other destinations.

High-quality treatment can be availed at a lower cost in developing countries such as Thailand and Malaysia than in developed countries. Despite the low cost of treatment in developing countries, the quality of the procedure is not compromised due to the availability of resources at a relatively lower cost. This results in the influx of people who avail of health services in these countries. For instance, an angioplasty procedure costs around US$ 55,000 to US$ 57,000 for an individual in the U.S. compared to around US$ 2,500 to US$ 3,500 in Malaysia.

People travel from the U.S. to Thailand, Singapore, India, and Malaysia for medical treatments, saving 55% to 70% of their treatment expenses. The cost of dental treatment is lower by 60% to 80% in India than in the U.S. and the U.K. According to DentaVacation, a unit of U.S.-based Medical Tourism Corporation, the cost of dental fillings starts from US$ 150 in the U.S., while it costs only US$ 45 in Thailand, US$ 40 in Turkey, and US$ 20 in India. Thus, dental implant tourism is gaining prominence in developing countries such as India and Thailand.

People often go to other countries for medical operations such as breast augmentation and liposuction. Others choose to have extra skin removed. Several individuals go to seek additional elective treatments, such as LASIK eye surgery or dental operations, which are not covered by insurance policies in the West and can be prohibitively expensive in some countries. Thus, improvement in healthcare infrastructure and access to high-quality healthcare services at affordable prices are likely to drive the global market in the near future.

Long waiting time for appointments with specialists for treatment or consultation is a major concern among patients and is considered a significant driver of outsourcing. Patients are compelled to wait for health services owing to reasons such as lack of medical equipment, shortage of staff, or inefficient management. Furthermore, excessive waiting time could lead to adverse health effects. Patients in developed countries such as the U.K., France, Norway, Sweden, and Canada lack timely access to medical services. Hence, they may opt to travel to other destinations for medical services.

The average waiting period in Canada for patients undergoing cataract surgery, joint replacement surgery, and coronary artery bypass surgery (CABG) is 112 days, 182 days, and 71 days, respectively. If a person has to undergo a routine health examination, then the minimum waiting period is 32 days. Long waiting period presents a significant challenge to patients; hence, they prefer to travel abroad for timely surgery.

In terms of procedure type, the cardiac segment held the largest share of the global market for medical tourism in 2021. This can be ascribed to the increase in the incidence of cardiovascular diseases across the world. According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are the leading cause of death, with an estimated 17.9 billion people across the globe suffering from CVDs. According to data published by the Centers for Disease Control and Prevention (CDC), hypertension accounted for more than half a million deaths in the U.S. in 2019.

The cosmetic surgery segment is projected to grow at a rapid pace during the forecast period. A large percentage of the population opts for cosmetic surgery to improve looks and raise confidence. The rise in the impact of esthetics, influenced by media depictions of unattainable beauty standards, is anticipated to be a primary factor driving the cosmetic surgery segment. Furthermore, technical improvements in the segment have resulted in an increase in demand for esthetic procedures.

Asia Pacific dominated the global market for medical tourism, with more than 75% share in 2021. The market in the region is highly competitive owing to the presence of technologically advanced medical specialties, less stringent government regulations, and attractive locations. Thailand and India are recognized internationally for high-end medical services and receive patients from across the globe. Singapore is renowned for its healthcare infrastructure and receives patients primarily for complex medical procedures.

As per the medical tourism market forecast, the market in Europe, the Middle East, and Africa (EMEA) is anticipated to advance at a CAGR of 12.2% from 2022 to 2031. Economic growth in countries in EMEA and a rise in government expenditure on advanced healthcare facilities are expected to drive the market in EMEA in the near future. Turkey has emerged as a potential medical service provider and is recognized as a competitive healthcare destination. The global healthcare economic crisis has played a key role in bolstering Turkey's health and medical tourism industry. The country's strategic geographic location provides it the added advantage of being able to treat patients from across the globe. Turkey is centrally located between Europe and the U.S.; hence, medical tourists find it convenient to travel to the country. Furthermore, the surge in demand for cosmetic surgery is propelling the global market in Turkey.

Countries in Latin America such as Brazil and Mexico attract a maximum number of patients from the U.S. owing to the geographic proximity and cultural similarities.

Fortis Healthcare, Apollo Hospitals Enterprise Ltd., Bangkok Chain Hospital Public Company Limited, Hamad Medical Corporation, Bumrungrad International Hospital, KPJ Healthcare Berhad, Manipal Health Enterprises Pvt. Ltd., Raffles Medical Group, and Jordan Hospital are the prominent healthcare service providers operating in the global market for medical tourism. Medical tourism companies are leveraging new technologies and providing improved healthcare services through strategic initiatives and collaborations.

Each of these players has been profiled in the medical tourism market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 10.4 Bn |

|

Market Forecast Value in 2031 |

More than US$ 72.8 Bn |

|

Compound Annual Growth Rate (CAGR) |

13.0% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 10.4 Bn in 2021

The global market is projected to reach more than US$ 72.8 Bn by 2031

The global market is anticipated to grow at a CAGR of 13.0% from 2022 to 2031

High quality treatment at low cost

Fortis Healthcare, Apollo Hospitals Enterprise Ltd., Bangkok Chain Hospital Public Company Limited, Hamad Medical Corporation, Bumrungrad International Hospital, KPJ Healthcare Berhad, Manipal Health Enterprises Pvt. Ltd., Raffles Medical Group, and Jordan Hospital

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Tourism Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Tourism Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Global Medical Tourism Market Outlook

5.2. Government Policy & Regulation

5.3. Global Medical Tourism Market Trends

5.4. COVID-19 Impact Analysis

6. Global Medical Tourism Market Analysis and Forecast, by Procedure Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Procedure Type, 2017–2031

6.3.1. Cardiac

6.3.2. Orthopedic

6.3.3. Cancer

6.3.4. Gynecological

6.3.5. Neurological & Spinal

6.3.6. Cosmetic Surgery

6.3.7. Dental Treatment

6.3.8. Others

6.4. Market Attractiveness Analysis, by Procedure Type

7. Global Medical Tourism Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Market Value Forecast, by Region, 2017–2031

7.2.1. Asia Pacific

7.2.2. Latin America

7.2.3. Europe, Middle East & Africa

7.3. Market Attractiveness Analysis, by Region

8. Asia Pacific Medical Tourism Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast, by Procedure Type, 2017–2031

8.2.1. Cardiac

8.2.2. Orthopedic

8.2.3. Cancer

8.2.4. Gynecological

8.2.5. Neurological & Spinal

8.2.6. Cosmetic Surgery

8.2.7. Dental Treatment

8.2.8. Others

8.3. Market Value Forecast, by Country/Sub-region 2017–2031

8.3.1. Thailand

8.3.2. India

8.3.3. Malaysia

8.3.4. Singapore

8.3.5. South Korea

8.3.6. Taiwan

8.3.7. Rest of Asia Pacific

8.4. Market Attractiveness Analysis

8.4.1. By Procedure Type

8.4.2. By Country/Sub-region

9. Latin America Medical Tourism Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Procedure Type, 2017–2031

9.2.1. Cardiac

9.2.2. Orthopedic

9.2.3. Cancer

9.2.4. Gynecological

9.2.5. Neurological & Spinal

9.2.6. Cosmetic Surgery

9.2.7. Dental Treatment

9.2.8. Others

9.3. Market Value Forecast, by Country/Sub-region, 2017–2031

9.3.1. Brazil

9.3.2. Mexico

9.3.3. Rest of Latin America

9.4. Market Attractiveness Analysis

9.4.1. By Procedure Type

9.4.2. By Country/Sub-region

10. Europe, Middle East & Africa Medical Tourism Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Procedure Type, 2017–2031

10.2.1. Cardiac

10.2.2. Orthopedic

10.2.3. Cancer

10.2.4. Gynecological

10.2.5. Neurological & Spinal

10.2.6. Cosmetic Surgery

10.2.7. Dental Treatment

10.2.8. Others

10.3. Market Value Forecast, by Country/Sub-region, 2017–2031

10.3.1. Turkey

10.3.2. Rest of EMEA

10.4. Market Attractiveness Analysis

10.4.1. By Procedure Type

10.4.2. By Country/Sub-region

11. Competition Landscape

11.1. Market Player – Competition Matrix (by tier and size of companies)

11.2. Market Share Analysis/Ranking, by Company, 2021

11.3. Company Profiles

11.3.1. Apollo Hospitals Enterprise Ltd.

11.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.1.2. Financial Analysis

11.3.1.3. Growth Strategies

11.3.1.4. SWOT Analysis

11.3.2. Fortis Healthcare

11.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.2.2. Financial Analysis

11.3.2.3. Growth Strategies

11.3.2.4. SWOT Analysis

11.3.3. Bangkok Chain Hospital Public Company Limited

11.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.3.2. Financial Analysis

11.3.3.3. Growth Strategies

11.3.3.4. SWOT Analysis

11.3.4. Hamad Medical Corporation

11.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.4.2. Financial Analysis

11.3.4.3. Growth Strategies

11.3.4.4. SWOT Analysis

11.3.5. Bumrungrad International Hospital

11.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.5.2. Financial Analysis

11.3.5.3. Growth Strategies

11.3.5.4. SWOT Analysis

11.3.6. KPJ Healthcare Berhad

11.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.6.2. Financial Analysis

11.3.6.3. Growth Strategies

11.3.6.4. SWOT Analysis

11.3.7. Manipal Health Enterprises Pvt. Ltd.

11.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.7.2. Financial Analysis

11.3.7.3. Growth Strategies

11.3.7.4. SWOT Analysis

11.3.8. Raffles Medical Group

11.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.8.2. Financial Analysis

11.3.8.3. Growth Strategies

11.3.8.4. SWOT Analysis

11.3.9. Jordan Hospital

11.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

11.3.9.2. Financial Analysis

11.3.9.3. Growth Strategies

11.3.9.4. SWOT Analysis

List of Tables

Table 01: Global Medical Tourism Market Value Share, by Procedure Type, 2021

Table 02: Global Medical Tourism Market Value (US$ Mn) Forecast, by Procedure Type, 2017–2031

Table 03: Global Medical Tourism Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, by Procedure Type, 2017–2031

Table 05: Asia Pacific Medical Tourism Market Value (US$ Mn) Forecast, by Country/sub-region, 2017–2031

Table 06: Latin America Medical Tourism Market Value (US$ Mn) Forecast, by Procedure Type, 2017–2031

Table 07: Latin America Medical Tourism Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe, Middle East & Africa Medical Tourism Market Value (US$ Mn) Forecast, by Procedure Type, 2017–2031

Table 09: Europe, Middle East & Africa Medical Tourism Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Medical Tourism Market Snapshot

Figure 02: Global Medical Tourism Market Value (US$ Mn) Forecast, 2017‒2031

Figure 03: Global Medical Tourism Market Value Share (%), by Procedure Type (2021)

Figure 04: Global Medical Tourism Market Value Share (%), by Region (2021)

Figure 05: Global Medical Tourism Market Value Share Analysis, by Procedure Type, 2021 and 2031

Figure 06: Global Medical Tourism Market Attractiveness, by Procedure Type, 2022–2031

Figure 07: Global Medical Tourism Market Value Share Analysis, by Region 2021 and 2031

Figure 08: Global Medical Tourism Market Attractiveness, by Region, 2022–2031

Figure 09: Asia Pacific Medical Tourism Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 10: Asia Pacific Medical Tourism Market Value Share (%), by Procedure Type, 2021 and 2031

Figure 11: Asia Pacific Medical Tourism Market Attractiveness, by Procedure Type, 2022–2031

Figure 12: Asia Pacific Medical Tourism Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 13: Asia Pacific Medical Tourism Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 14: Latin America Medical Tourism Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 15: Latin America Medical Tourism Market Value Share (%), by Procedure Type, 2021 and 2031

Figure 16: Latin America Medical Tourism Market Attractiveness, by Procedure Type, 2022–2031

Figure 17: Latin America Medical Tourism Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 18: Latin America Medical Tourism Market Attractiveness, by Country/Sub-region, 2022–2031

Figure 19: Europe, Middle East & Africa Medical Tourism Market Value (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 20: Europe, Middle East & Africa Medical Tourism Market Value Share (%), by Procedure Type, 2021 and 2031

Figure 21: Europe, Middle East & Africa Medical Tourism Market Attractiveness, by Procedure Type, 2022–2031

Figure 22: Europe, Middle East & Africa Medical Tourism Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 23: Europe, Middle East & Africa Medical Tourism Market Attractiveness, by Country/Sub-region, 2022–2031