Vacuum pump provides high ultimate vacuum and high-speed evacuation. Due to its versatility, it is widely adopted in various applications. Latest innovations such as compact design, light weight, low level of vibration and noise, and easy integration capability are enhancing the adoption rate of MEA vacuum pumps in various fields. These innovations are anticipated to fuel growth of the MEA vacuum pump market in coming years.

MEMS technology coupled with vacuum pumps industry has large range of application in consumer electronics (CE), such as video game systems, smart phones, and tablets. MEMS devices consists of silicon wafers and fabrication process tools. Also, vacuum is used by the integrated circuit (IC) industry for MEMS fabrication. This, in turn, fuels demand for mea vacuum pumps.

Further, MEA vacuum pumps market is witnessing tremendous demand for dry vacuum pump. The dry vacuum pump is cost effective when compared to that of oil lubricated pump. Also, dry vacuum pump produces less noise and vibration and is compact in size. Besides, there is no exhaust emission from oil and is highly energy efficient. Chemical and pharmaceutical industries are prominent end users of the segment.

Moreover, demand from energy & power and oil & gas is driving MEA vacuum pumps market. Due to harsh environmental conditions, the end use vertical are susceptible to corrosion. This emphasizes the requirement for vacuum pumps in accordance with several industry regulations.

The vacuum pumps are used for removal of air or gas particles from the container that created vacuum in the vessel.

North America market is likely to hold major share in the vacuum pump landscape. Vacuum pumps are widely used at both residential and industrial sectors.

Also, growing pharmaceutical industry is fuelling MEA vacuum pumps market. The vacuum pumps are used in pharmaceutical industry for production of ingredients, bulk drugs, and intermediate products.

Vacuum technology and processes make it possible to replace processes that impact and harm the environment with others protecting the environment. Vacuum technology includes vacuum pumps and vacuum components such as the measuring devices and leak detectors deployed in many industrial applications. These applications include vacuum packaging of food, evacuation and environment-friendly charging of refrigerators and air conditioners, production of ultrapure high-strength metals, evacuation of lamps and CRT’s, manufacture of flat-panel displays, and coating. Vacuum technology/components are categorized into three main sub segments: vacuum pumps, vacuum instrumentation, and vacuum hardware.

Key factors driving the growth of the vacuum pumps market include growth in the demand for energy and resurgence of large project activity after economic slowdown. Additionally, process industries have increased the popularity of vacuum pumps. With the advancement of technology, vacuum pumps offer a viable cost-effective solution to achieve effective and efficient vacuum-process-based applications in various industrial sectors.

The major exporters of vacuum technology, inclusive of vacuum pumps, are Germany, the U.S., and Italy in the financial year ending 2014. MEA forms one of the major export destinations for the aforementioned exporting countries, where vacuum pumps are exported to GCC countries, Iraq, and Iran for process-industry-based applications. Vacuum pump manufacturers operating out of subsidiaries situated in India, and Japan-based vacuum manufacturers are leaders in vacuum pump exports to countries within GCC, such as the UAE, Kuwait, and Qatar. By 2030, India is expected to become the UAE’s top export destination, surpassing the current export partner, Japan.

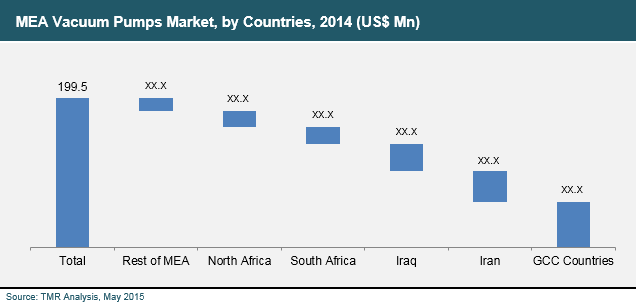

In 2014, GCC countries accounted for 30% of the total MEA vacuum pumps market. The region is characterized by accelerated development in the fields of construction, industrial and agricultural infrastructure apart from petrochemicals, and chemicals industries. The development of non-oil-&-gas-based industries, such as food & beverages, textile, and power are driving the demand for the vacuum pumps market. The growth in the manufacturing sector’s share of the real GDP of the GCC countries has indicated that the region is moving away from primary products export and adopting an export diversification model.

By region, the GCC was one of the largest contributors to the MEA vacuum pumps market in terms of revenue in 2014 on account of large demand from SME manufacturing and industrial enterprises and the presence of leading oil & gas producing companies deploying vacuum pumps in this region. According to a report published by the International Monetary Fund (IMF) in December 2014, Bahrain and Saudi Arabia were leading the composition of manufacturing sector to the real GDP with 13% and 11%, respectively. Meanwhile, Oman, Qatar, the UAE, and Kuwait recorded 6%, 3%, 9.5%, and 2%, respectively. Government-funded capital projects and infrastructure development activities in the utilities and construction sector are also driving the demand for vacuum pumps. The region is also investing in water resource projects, such as the building of desalination stations, recycling of sewage water, the construction of dams for reserving surface water, and increasing the utilization of underground water resources.

Some of the leading players operating in the region are Gardner Denver, Inc., Pfeiffer Vacuum GmbH, ULVAC, Inc., Oerlikon Leybold Vacuum GmbH, Atlas Copco AB, Tuthill Corporation, Graham Corporation, Dekker Vacuum Technologies, Inc., Ebara Corporation, and Sterling SIHI GmbH.

Chapter 1 Preface

1.1 Research Scope

1.2 Market Segmentation

1.3 Research Methodology

Chapter 2 Executive Summary

2.1 MEA Vacuum Pumps Market Snapshot

2.2 MEA Vacuum Pumps Market Revenue, 2012 – 2025 (US$ Mn) and Year-on-Year Growth (%)

2.3 MEA Vacuum Pumps Market, by Application Range, 2014 (US$ Mn)

2.4 MEA Vacuum Pumps Market, by Type, 2014 (US$ Mn)

2.5 MEA Vacuum Pumps Market, by End-use Application, 2014 (US$ Mn)

2.6 MEA Vacuum Pumps Market, by Country, 2014 (US$ Mn)

Chapter 3 MEA Vacuum Pumps Market Analysis, 2008 – 2025 (US$ Mn)

3.1 Overview

3.1.1 MEA Vacuum Pumps Market, 2012 – 2025, Revenue (US$ Mn) and Y-o-Y Growth (%)

3.2 Vacuum Pumps Development Overview

3.2.1 Vacuum Pumps Evolution Overview

3.2.2 Vacuum Pumps Market Development Overview

3.2.3 MEA Vacuum Pumps Import Market Analysis

3.2.4 MEA Vacuum Pumps Export Market Analysis

3.2.5 MEA Vacuum Pumps Main Region Market Analysis

3.3 Vacuum Pumps Application Analysis

3.3.1 Vacuum Pumps Main Application Analysis

3.3.2 Vacuum Pumps Application Share Analysis

3.4 Key Trends Analysis

3.4.1 Urbanization

3.4.2 Power generation

3.4.3 Infrastructure Development

3.4.4 Food Security and production

3.5 Value Chain Analysis

3.6 Market Dynamics

3.6.1 Market Drivers

3.6.1.1 Energy demand growth

3.6.1.2 Resurgence of large project activity after economic slowdown

3.6.2 Market Restraints

3.6.2.1 Instability and regional conflicts in the Middle East hindering growth prospects of industries

3.6.3 Market Opportunities

3.6.3.1 Service Industries and Capital Projects

3.6.3.2 Health Industries

3.7 Vacuum Pumps Up and Down Stream Industry Analysis

3.7.1 Upstream Raw Materials Analysis

3.7.1.1 Upstream Raw Materials Price Analysis

3.7.1.2 Upstream Raw Material Market Analysis

3.7.1.3 Upstream Raw Materials Market Trend

3.7.2 Down Stream Market Analysis

3.7.2.1 Down Stream Market Analysis

3.7.2.2 Down Stream Demand Analysis

3.7.2.3 Down Stream Market Trend Analysis

3.8 Industry Analysis

3.8.1 Distribution Channel Analysis

3.8.2 Cost Price Production Value Gross Margin

3.8.3 PESTLE Analysis

3.8.3.1 Middle East

3.8.3.2 Africa

3.8.4 BCG Matrix

3.8.5 Porter’s Five Forces Analysis

3.8.6 Vacuum Pumps Life Cycle

3.9 Proposal for New Market Entry Strategies

3.10 Recommendations

3.11 MEA Vacuum Pumps Market Analysis, By Application Range, 2008 – 2025 (US$ Mn)

3.11.1 Overview

3.11.2 Low Vacuum Pressure

3.11.3 Medium Vacuum Pressure

3.11.4 High and Ultra-high Vacuum Pressure

3.12 MEA Vacuum Pumps Market Analysis, By Type, 2008 – 2025 (US$ Mn)

3.12.1 Overview

3.12.2 Entrapment Pumps

3.12.2.1 Adsorption Pump

3.12.2.2 Getter Pump

3.12.2.3 Cryopump

3.12.2.4 Condenser Pump

3.12.3 Gas Transfer Vacuum Pumps

3.12.3.1 Positive Displacement Pumps

3.12.3.1.1 Reciprocating positive displacement pumps

3.12.3.1.2 Rotary vacuum pumps

3.12.3.2 Kinetic Vacuum Pumps

3.12.3.2.1 Drag

3.12.3.2.2 Fluid Entrainment

3.12.3.2.3 Ion Transfer

3.13 MEA Vacuum Pumps Market Analysis, By End-use Application, 2008 – 2025 (US$ Mn)

3.13.1 Overview

3.13.2 Oil & Gas

3.13.3 Industrial and Manufacturing

3.13.4 Power

3.13.5 Chemical Processing

3.13.6 Semiconductor & Electronics

3.13.7 Others

3.14 MEA Vacuum Pumps Market Analysis, By Country, 2008 – 2025 (US$ Mn)

3.14.1 Overview

3.14.2 Iran

3.14.3 Iraq

3.14.4 GCC Countries

3.14.5 North Africa

3.14.6 South Africa

3.14.7 Rest of MEA

3.15 Competitive Landscape

3.15.1 Market Positioning of Key Players, 2013

3.15.2 Competitive Strategies Adopted by Leading Players

3.15.3 List of Major Companies Operating at Regional/Country Level

Chapter 4 Company Profiles

4.1 Gardner Denver, Inc.

4.2 Pfeiffer Vacuum GmbH

4.3 ULVAC, Inc.

4.4 Oerlikon Leybold Vacuum GmbH

4.5 Atlas Copco AB

4.6 Tuthill Corporation

4.7 Graham Corporation

4.8 Dekker Vacuum Technologies, Inc.

4.9 Ebara Corporation

4.10 Sterling SIHI GmbH

List of Tables

TABLE 1 Market Snapshot: MEA Vacuum Pumps Market (2008, 2012 and 2025)

TABLE 2 Vacuum Pressure Application Range Order

TABLE 3 MEA Vacuum Pumps Market Segment Share, By Application Range, 2008 – 2025 (%)

TABLE 4 MEA Vacuum Pumps Market Segment Share, By Application Range, 2008 – 2025 (%)

TABLE 5 MEA Getter Entrapment Vacuum Pumps Market, By Types, 2008 – 2025 (US$ Mn)

TABLE 6 MEA Reciprocating positive displacement Vacuum Pumps Market, By Types, 2008 – 2025 (US$ Mn)

TABLE 7 MEA Rotary positive displacement Vacuum Pumps Market, By Types, 2008 –2025 (US$ Mn)

TABLE 8 MEA Drag Kinetic Vacuum Pumps Market, By Types, 2008 – 2025 (US$ Mn)

TABLE 9 MEA Fluid Entrainment Kinetic Vacuum Pumps Market, By Types, 2008 – 2025 (US$ Mn)

TABLE 10 MEA Vacuum Pumps Market Segment Share, By Application Range, 2008 – 2025 (%)

TABLE 11 MEA Vacuum Pumps Market Segment Share, By Country, 2008 – 2025 (%)

List of Figures

FIG. 1 Market Segmentation: MEA Vacuum Pumps Market

FIG. 2 MEA Vacuum Pumps Market, 2012 – 2025, Revenue (US$ Mn) and Y-o-Y Growth (%)

FIG. 3 MEA Vacuum Pumps Market, by Application Range, 2014 (US$ Mn)

FIG. 4 MEA Vacuum Pumps Market, by Type, 2014 (US$ Mn)

FIG. 5 MEA Vacuum Pumps Market, by End-use Application, 2014 (US$ Mn)

FIG. 6 MEA Vacuum Pumps Market, by Country, 2014 (US$ Mn)

FIG. 7 MEA Vacuum Pumps Market, 2012 – 2025, Revenue (US$ Mn) and Y-o-Y Growth (%)

FIG. 8 Vacuum Pumps Evolution

FIG. 9 Vacuum Pumps Market Development Overview

FIG. 10 Global Vacuum Pumps Leading Exporters, By Countries, 2014

FIG. 11 MEA Vacuum Pumps Import Market, 2014

FIG. 12 MEA Vacuum Pumps Export Market, 2014

FIG. 13 MEA Vacuum Pumps Market, By Countries, Revenue, 2014 (US$ Mn)

FIG. 14 MEA Vacuum Pumps Market, By Application, Revenue, 2014 (US$ Mn)

FIG. 15 MEA Vacuum Pumps Application Share Analysis, 2014 – 2025

FIG. 16 Value Chain Analysis

FIG. 17 MEA Ongoing Project Share, By Sector, 2014

FIG. 18 Upstream Raw Materials Price Analysis, 2008 – 2014, (US$ per metric Ton)

FIG. 19 Vacuum Pump Upstream Chain Analysis

FIG. 20 Cost v/s Efficiency: Positioning of Vacuum Pump based on raw material

FIG. 21 Vacuum Pump Downstream Market Analysis

FIG. 22 Distribution Channel Analysis, MEA Vacuum Pumps Market, 2014

FIG. 23 Cost Price Production Value Gross Margin Analysis

FIG. 24 BCG Matrix – MEA Vacuum Pumps Market, 2014

FIG. 25 Porter’s Five Forces Analysis: MEA Vacuum Pump Market

FIG. 26 Vacuum Pumps Life Cycle Analysis, 2014

FIG. 27 MEA Low Vacuum Pressure Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 28 MEA Medium Vacuum Pressure Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 29 MEA High and Ultra – high Vacuum Pressure Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 30 MEA Entrapment Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 31 MEA Adsorption Entrapment Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 32 MEA Cryopump Entrapment Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 33 MEA Condenser Entrapment Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 34 MEA Gas Transfer Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 35 MEA Ion Transfer Kinetic Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 36 MEA Vacuum Pumps Market, By Oil & Gas sector, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 37 MEA Vacuum Pumps Market, By Industrial and Manufacturing sector, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 38 MEA Vacuum Pumps Market, By Power sector, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 39 MEA Vacuum Pumps Market, By Chemical Processing Sector, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 40 MEA Vacuum Pumps Market, By Semiconductor & Electronics sector, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 41 MEA Vacuum Pumps Market, By Others sector, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 42 Iran Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 43 Iraq Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 44 GCC Countries Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 45 North Africa Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 46 South Africa Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 47 Rest of MEA Vacuum Pumps Market, Revenue and Forecast, 2008 – 2025 (US$ Mn)

FIG. 48 Market Positioning of Key Players, 2013