The demand within the global market for magnetic field sensors has been expanding on account of advancements in the field of electronics and semiconductors. Magnetic field sensors are microelectromechanical systems that are used for detection of magnetic fields in a specified region. They have played a pivotal role in overhauling multiple industries and leveraging the production process to the advantage of manufacturers. The use of magnetic field sensors to gauge the intensity of the magnetic field around vehicle disturbances, soft magnets, electric currents, and permanent magnets has played a major role in the boisterous of market growth. Hence, it is safe to estimate that the global magnetic field sensors market would keep attracting commendable revenues over the forthcoming years.

The electronics and semiconductors industry keeps evolving due to the continual invention and manufacture of new electronic devices. This in turn leads to greater deployment of magnetic field sensors in the industry, thus, giving a boost to the demand within the global market. Furthermore, the use of magnetic field sensors in the automobile industry has also created a launch pad for the growth of the global magnetic field sensors market. Several national and regional governments have stipulated rules with regards to the use of energy-efficient technologies. This has also accelerated the growth rate of the global market for magnetic field sensors over the past decade.

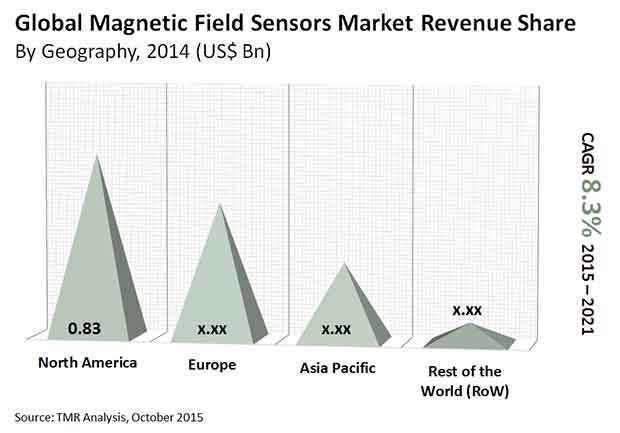

A report by Transparency Market Research (TMR) is estimated to expand at a healthy CAGR of 8.30% over the period between 2015 and 2021. Furthermore, the global market is projected to accumulate revenues worth US$3.5 bn by 2021-end, rising up from a value of US$2.0 bn in 2014.

Automotive Sector to Emerge as Key End-Use Industry

Several key industries such as aerospace, robotics, industrial, healthcare, consumer electronics, defense, and automotive are using magnetic field sensors for multiple applications. Amongst these, the automotive industry has emerged as the key end-use industry due to the advancements in the field of electric vehicles over the past decade. Furthermore, the field of robotics has also undergone vital development in recent times, and this has given a push to the growth rate of the global magnetic field sensors market. On the basis of technology, the global market for magnetic field sensors can be segmented into earth field sensor technology, low field sensor technology, and bias magnetic field sensor technology. Based on the type of magnetic field sensors, the global market is segmented into fluxgate sensors, magneto-resistive sensors, hall-effect sensors, and SQUID sensors amongst others.

North American Market to Expand at a Boisterous Rate

The demand for magnetic field sensors in North America has been escalating at a boisterous rate over the past decade, majorly due to the immaculacy of the electronics industry in the US and Canada. Furthermore, continual research in the field of magnetism across the US has also created commendable demand within the global market for magnetic field sensors. Industrial development in India and China has taken a fresh course in recent times, and this has enhanced the growth prospects of the global magnetic field sensors market in Asia Pacific.

Some of the key vendors in the global market for magnetic field sensors are NXP Semiconductors, Micronas Semiconductors Holdings AG, Honeywell International, ams AG, Melexix NV, and Memsic Inc.

Magnetic Field Sensors Market to Witness Notable Momentum Owing to Booming Electronics Industry

Major advancements in semiconductors and electronics industry is a key factor boosting the growth of the global magnetic field sensors market. Magnetic field sensors are micro-electromechanical frameworks that are utilized for discovery of magnetic fields in a predetermined district. They have assumed a urgent part in upgrading numerous enterprises and utilizing the creation interaction to the benefit of producers. The utilization of magnetic field sensors to measure the force of the magnetic field around vehicle unsettling influences, delicate magnets, electric flows, and perpetual magnets has assumed a significant part in the uproarious of market development. Consequently, it is protected to appraise that the worldwide magnetic field sensors market would continue pulling in honorable incomes throughout the impending years.

The incorporation of gadgets on-chip into these sensors for more knowledge per unit zone based on size, cost, and vigor has powered their interest across the world. Aside from this, the increment in implanted estimation capacities for computerized insightful control is additionally boosting the use of these sensors altogether.

The developing use of these sensors in electric vehicles is the key factor heightening the revenue rate. To take into account the taking off interest for highlights that upgrade the strength, security, execution, dealing with, solace, and accommodation of a vehicle, these sensors are generally used in electronic steadiness control frameworks, stopping automations, and electric force controlling. These sensors likewise discover application as turning speed sensors in auto speedometers, bike wheels, electronic start frameworks, and stuff teeth. Brushless DC engines and half breed electric vehicles are the critical clients of magnetic field sensors in the auto business.

Geographically, the market is dominated by North America on account of the presence of a strong electronics industry in Canada and the United States. In addition to this, major investments on research and development on magnetism especially across the United States is likely to aid in expansion of the regional market in the coming years.

Chapter 1 Preface

1.1 Report description

1.2 Research scope

1.3 Research methodology

Chapter 2 Executive Summary

Chapter 3 Global Magnetic Field Sensors Market: Market Overview

3.1 Introduction

3.2 Key Trends Analysis

3.3 Market Drivers

3.3.1 Increase in demand for consumer electronics and appliances and growing demand for electronic compasses

3.3.2 Increasing application of magnetic field sensors in the automotive industry

3.3.3 Stringent government legislation and policies for energy efficient appliances

3.4 Market Restraints

3.4.1 Poor availability of aftermarket service

3.4.2 Price erosion of magnetic field sensors

3.5 Market Opportunities

3.5.1 Growing popularity of plug-in electric vehicles and battery electric vehicles

3.6 Global Magnetic Field Sensors Market: Market attractiveness analysis

3.6.1 Recommendations

3.7 Global Magnetic Field Sensors Market: Company Market Share Analysis

3.7.1 Competitive strategies adopted by leading players

Chapter 4 Global Magnetic Field Sensors Market Revenue by Technology, 2015 – 2021 (USD Million)

4.1 Overview

4.2 Low Field Sensor Technology

4.2.1 Low Field Sensor Technology Market Revenue and Forecast, 2014 – 2021 (USD Million)

4.3 Earth Field Sensor Technology

4.3.1 Earth Field Sensor Technology Market, Revenue and Forecast, 2014 – 2021 (USD Million)

4.4 Bias Magnetic Field Sensor Technology

4.4.1 Bias Magnetic Field Sensor Technology Market, Revenue and Forecast, 2014 – 2021 (USD Million)

Chapter 5 Global Magnetic Field Sensors Market Revenue by Types, 2015 – 2021 (USD Million)

5.1 Overview

5.2 Hall-effect Sensors

5.2.1 Hall-effect Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

5.3 Magneto-resistive Sensors

5.3.1 Magneto-resistive Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

5.4 SQUID Sensors

5.4.1 SQUID Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

5.5 Fluxgate Sensors

5.5.1 Fluxgate Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

5.6 Other Sensors

5.6.1 Other Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

Chapter 6 Global Magnetic Field Sensors Market Revenue, by Application, 2015 – 2021 (USD Million)

6.1 Introduction

6.2 Automotive

6.2.1 Global Magnetic Field Sensors Market for Automotive Application, Revenue and Forecast, 2014 – 2021 (USD Million)

6.3 Consumer Electronics

6.3.1 Global Magnetic Field Sensors Market for Consumer Electronics Application, Revenue and Forecast, 2014 – 2021 (USD Million)

6.4 Industrial

6.4.1 Global Magnetic Field Sensors Market for Industrial Application, Revenue and Forecast, 2014 – 2021 (USD Million)

6.5 Energy, Power and Utilities

6.5.1 Global Magnetic Field Sensors Market for Energy, Power and Utilities Application, Revenue and Forecast, 2014 – 2021 (USD Million)

6.6 Robotics

6.6.1 Global Magnetic Field Sensors Market for Robotics Application, Revenue and Forecast, 2014 – 2021 (USD Million)

6.7 Healthcare

6.7.1 Global Magnetic Field Sensors Market for Healthcare Application, Revenue and Forecast, 2014 – 2021 (USD Million)

6.8 Aerospace and Defense

6.8.1 Global Magnetic Field Sensors Market for Aerospace and Defense Application, Revenue and Forecast, 2014 – 2021 (USD Million)

Chapter 7 Global Magnetic Field Sensors Market by Geography 2015 – 2021 (Revenue)

7.1 Introduction

7.1.1 Global Magnetic Field Sensors Market Revenue Share, by Geography, 2014 Vs 2021 (%)

7.2 North America

7.2.1 North America Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

7.2.2 North America Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.2.3 North America Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

7.2.4 North America Magnetic Field Sensors Market Revenue and Forecast, by Types, 2014 – 2021 (USD Million)

7.2.5 North America Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million)

7.2.6 U.S. Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.2.7 Canada Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.2.8 Mexico Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.3 Europe

7.3.1 Europe Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

7.3.2 Europe Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.3.3 Europe Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

7.3.4 Europe Magnetic Field Sensors Market Revenue and Forecast, by Types, 2014 – 2021 (USD Million)

7.3.5 Europe Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million)

7.3.6 United Kingdom Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.3.7 Germany Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.3.8 France Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.3.9 Italy Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.3.10 Rest of Europe Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.4 Asia Pacific (APAC)

7.4.1 Asia Pacific Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

7.4.2 Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.4.3 Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

7.4.4 Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, by Types, 2014 – 2021 (USD Million)

7.4.5 Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million)

7.4.6 China Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.4.7 Japan Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.4.8 India Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.4.9 Oceania Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.4.10 Rest of Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.5 Rest of the World (RoW)

7.5.1 RoW Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

7.5.2 RoW Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.5.3 RoW Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

7.5.4 RoW Magnetic Field Sensors Market Revenue and Forecast, by Types, 2014 – 2021 (USD Million)

7.5.5 RoW Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million)

7.5.6 South America Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.5.7 Middle East Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

7.5.8 Africa Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

Chapter 8 Company Profiles

8.1 Infineon Technologies

8.2 Allegro MicroSystems LLC

8.3 ams AG

8.4 Honeywell International

8.5 NXP Semiconductors

8.6 Asahi Kasei Co

8.7 Micronas Semiconductors Holdings AG

8.8 Melexix NV

8.9 Memsic Inc.

List of Tables

TABLE 1 Global Magnetic Field Sensors Market Snapshot (Revenue), 2014 and 2021

TABLE 2 Drivers of the Magnetic Field Sensors Market: Impact Analysis

TABLE 3 North America Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

TABLE 4 North America Magnetic Field Sensors Market Revenue and Forecast, by Types, 2014 – 2021 (USD Million)

TABLE 5 North America Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million)

TABLE 6 Europe Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

TABLE 7 Europe Magnetic Field Sensors Market Revenue and Forecast, by Type, 2014 – 2021 (USD Million)

TABLE 8 Europe Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million)

TABLE 9 Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

TABLE 10 Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, by Types, 2014 – 2021 (USD Million)

TABLE 11 Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million)

TABLE 12 RoW Magnetic Field Sensors Market Revenue and Forecast, by Technology, 2014 – 2021 (USD Million)

TABLE 13 RoW Magnetic Field Sensors Market Revenue and Forecast, by Types, 2014 – 2021 (USD Million)

TABLE 14 RoW Magnetic Field Sensors Market Revenue and Forecast, by Applications, 2014 – 2021 (USD Million

List of Figures

FIG. 1 Market Segmentation: Magnetic Field Sensors Market

FIG. 2 Market attractiveness analysis, by application, 2014

FIG. 3 Company market share analysis, 2014 (%)

FIG. 4 Low Field Sensor Technology Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 5 Earth Field Sensor Technology Market, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 6 Bias Magnetic Field Sensor Technology Market, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 7 Hall-effect Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 8 Magneto-resistive Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 9 SQUID Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 10 Fluxgate Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 11 Other Sensors Market, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 12 Global Magnetic Field Sensors Market Revenue Share (%), By Application, 2014 Vs 2021

FIG. 13 Global Magnetic Field Sensors for Automotive Application, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 14 Global Magnetic Field Sensors Market for Consumer Electronics Application, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 15 Global Magnetic Field Sensors Market for Industrial Application, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 16 Global Magnetic Field Sensors Market for Energy, Power and Utilities Application, Revenue and Forecast, 2014 – 2021(USD Million)

FIG. 17 Global Magnetic Field Sensors Market for Robotics Application, Revenue and Forecast, 2014– 2021 (USD Million)

FIG. 18 Global Magnetic Field Sensors Market for Healthcare Application, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 19 Global Magnetic Field Sensors Market for Aerospace and Defense Application, Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 20 Global Magnetic Field Sensors Market Revenue Share, by Geography, 2014 Vs 2021 (%)

FIG. 21 North America Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

FIG. 22 U.S. Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 23 Canada Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 24 Mexico Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 25 Europe Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

FIG. 26 United Kingdom Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 27 Germany Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 28 France Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 29 Italy Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 30 Rest of Europe Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 31 Asia Pacific Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

FIG. 32 China Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 33 Japan Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 34 India Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 35 Oceania Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 36 Rest of Asia Pacific Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 37 RoW Magnetic Field Sensors Market Revenue, and Forecast, 2014 – 2021 (USD Million)

FIG. 38 South America Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 39 Middle East Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)

FIG. 40 Africa Magnetic Field Sensors Market Revenue and Forecast, 2014 – 2021 (USD Million)