Analysts’ Viewpoint on Life Science Reagents Market Scenario

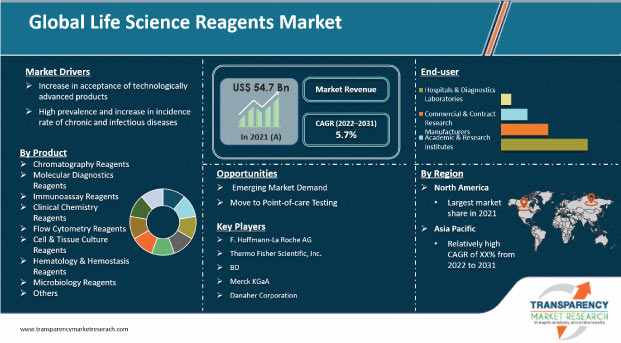

Life science reagents are an integral part of pharmaceutical, biotechnology, life science, and health care industries. The global life science reagents market is expected to witness strong growth during the forecast period due to the increase in application of life science reagents in in vitro diagnostics for the diagnosis of various chronic as well as infectious diseases. Life science reagents are also used to predict disease course, formulate treatment, and monitor the effectiveness of the therapy. Increase in pharmaceutical R&D budgets by governments and private players is likely to support the development of new products and technologies. This is projected to create lucrative revenue opportunities for manufacturers of life science reagents during the forecast period.

Life science reagents are substances or compounds used in a chemical reaction to observe and record changes. Medical researchers analyze this data to determine the cause of a disease. Life science and analytical reagents are used in chemical reactions to measure, detect, or examine other substances. Technological advancements in molecular biology, life sciences, and biotechnology have brought about significant changes in health care diagnostics, drug discovery, personalized medicines, forensic sciences, and clinical research & development. This has increased the demand for biotechnology media, sera and reagents, biotechnology reagents, etc. Growth of the life science industry and increase in incidence rate of chronic and infectious diseases are driving the global life science reagents market.

Advances in the health care industry and life sciences industry, improvement in public health measures, and decrease in life-threatening infectious diseases in developed countries are augmenting the life expectancy of the global geriatric population. According to the United Nations, the elderly population (aged 60+ years) is expected to double by 2050 and triple by 2100. The population is likely to rise from 962 million in 2017 to 2.1 billion in 2050 and 3.1 billion in 2100. Globally, the geriatric population is growing at a faster rate than the young population. The geriatric population in Asia Pacific and South America is estimated to increase by 300% in the next decade. As part of preventive health care, the geriatric population and people with chronic diseases such as diabetes, respiratory disorders, and cancer regularly require medical tests such as blood tests and urine tests. This is projected to augment the life science reagents market during the forecast period.

Development in the areas of enzyme-linked immune assay technology (ELISA), polymerase chain reaction (PCR) such as digital PCR, rtPCR, chromatography, single cell technology, next-generation sequencing (NGS), and flow cytometry techniques; and their application in the health care industry in disease diagnostics and treatment monitoring are propelling the life science reagents market. For instance, the chemiluminescence immunoassay (CLIA) technology provides enhanced sensitivity, specificity, improved precision, and reduced incubation. Together, these increase the efficiency of the technology to diagnose different types of genetic, chronic, acute, and infectious diseases. Technological advancements in point-of-care (POC) instruments for the diagnosis of various chronic and infectious diseases within a short period, development of high throughput automated immunoassay analyzers, and integration of the various diagnostic techniques in a single system are factors fueling the demand for in vitro diagnostics reagents in the health care industry. Advances in genomics and proteomics have led to the development of newer genetic and protein biomarkers for the diagnosis of cancer and several genetic diseases. Genomic studies are also used in pharmacogenetics and targeted therapy to identify infectious diseases by sequencing reagents to diagnose genetic factors that contribute to common diseases and personalized medicines. Increase in application of cell and tissue culture for the production of monoclonal antibodies, drug development, vaccines, enzymes, growth hormones, and stem cell therapy is propelling the demand for life science reagents.

Diagnosis of infectious and chronic diseases is one of the leading applications of in vitro diagnostics. Life science reagents, both biological and laboratory chemical reagents, are integral part of any diagnostic test. Emergence and outbreak of various infectious diseases have created challenges and new opportunities for researchers to develop life science tools and reagents for early diagnosis and prevention of disease. As of June 2022, coronavirus (COVID-19) has caused 539 million confirmed infections and 6.3 million deaths. The pandemic does not show any sign of abatement. The impact and consequences of the COVID-19 pandemic positively impacted the life science reagents market in 2020 and 2021. Growth of the diagnostics segment, led by Covid-19 testing and continuous research & development conducted by various pharmaceutical & biotechnological companies to develop medicines and vaccines, is likely to drive the life science reagents market during the forecast period.

In terms of product, the global life science reagents market has been classified into chromatography reagents, molecular diagnostic reagents, immunoassay reagents, clinical chemistry reagents, flow cytometry reagents, cell & tissue culture reagents, hematology & hemostasis reagents, microbiology reagents, and others. The immunoassay reagents segment dominated the global life science reagents market in 2021. The trend is projected to continue during the forecast period. Immunoassay is a highly preferred diagnostic technique used in hospitals and pathology laboratories. The immunoassay technique is increasingly becoming a popular diagnostic tool owing to specific results, high sensitivity, and ease of use.

Based on end-user, the global life science reagents market has been divided into hospitals & diagnostic laboratories, commercial & contract research manufacturers, academic & research institutes, and others. The hospitals & diagnostic laboratories segment dominated the global life science reagents market in 2021 due to the high usage of life science reagents in hospitals and laboratories for the diagnosis of Covid-19.

North America accounted for the largest share of around 35% of the global life science reagents market in 2021. The market in the region is projected to grow at a CAGR of 5.5% from 2022 to 2031. The life science reagents market in Asia Pacific is anticipated to grow at a higher CAGR during the forecast period due to the large patient pool and rise in investment in health care in countries such as China and India.

The global life science reagents market is fragmented, with the presence of a large number of key players. Most companies are making significant investments in research & development activities. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by the players. Key players operating in the market include F. Hoffmann-La Roche AG, Danaher Corporation, Abbott, Siemens Healthineers, DiaSorin S.p.A, Sysmex Corporation, bioMerieux SA, Thermo Fisher Scientific, Inc., BD, Merck KGaA, Agilent Technologies, Inc., and Waters Corporation.

Each of these players has been profiled in the life science reagents market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 54.7 Bn |

| Market Forecast Value in 2031 | More than US$ 100 Bn |

| Growth Rate | 5.7% |

| Forecast Period | 2022–2031 |

| Historical Data Available for | 2017–2020 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

| Competition Landscape | Market share analysis by company (2021) Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials. |

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global life science reagents market was valued at US$ 54.7 Bn in 2021.

The global life science reagents market is projected to reach more than US$ 100 Bn by 2031.

The global life science reagents market expanded at a CAGR of 11.3% from 2017 to 2021.

The global life science reagents market is anticipated to expand at a CAGR of 5.7% from 2022 to 2031.

Rise in demand for testing & diagnosis due to increase in patient population with infectious and chronic diseases, surge in research & development, and availability of technologically advanced products drive the global market.

The dialysis products segment accounted for more than 30% share of the global life science reagents market in 2021.

North America is expected to account for major share of the global life science reagents market during the forecast period.

Prominent players in the global life science reagents market include F. Hoffmann-La Roche AG, Danaher Corporation, Abbott, Siemens Healthineers, DiaSorin S.p.A, Sysmex Corporation, bioMerieux SA, Thermo Fisher Scientific, Inc., BD, Merck KGaA, Agilent Technologies, Inc., and Waters Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Life Science Reagents Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Life Science Reagents Market Analysis and Forecast,

2017-2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Market Outlook

5.1. Key Mergers & Acquisitions

5.2. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Life Science Reagents Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Chromatography Reagents

6.3.2. Molecular Diagnostic Reagents

6.3.3. Immunoassay Reagents

6.3.4. Clinical Chemistry Reagents

6.3.5. Flow Cytometry Reagents

6.3.6. Cell & Tissue Culture Reagents

6.3.7. Hematology & Hemostasis Reagents

6.3.8. Microbiology Reagents

6.3.9. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Life Science Reagents Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017-2031

7.3.1. Hospitals & Diagnostics Laboratories

7.3.2. Commercial & Contract Research Manufacturers

7.3.3. Academic & Research Institutes

7.3.4. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Life Science Reagents Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Life Science Reagents Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017-2031

9.2.1. Chromatography Reagents

9.2.2. Molecular Diagnostic Reagents

9.2.3. Immunoassay Reagents

9.2.4. Clinical Chemistry Reagents

9.2.5. Flow Cytometry Reagents

9.2.6. Cell & Tissue Culture Reagents

9.2.7. Hematology & Hemostasis Reagents

9.2.8. Microbiology Reagents

9.2.9. Others

9.3. Market Value Forecast, by End-user, 2017-2031

9.3.1. Hospitals & Diagnostics Laboratories

9.3.2. Commercial & Contract Research Manufacturers

9.3.3. Academic & Research Institutes

9.3.4. Others

9.4. Market Value Forecast, by Country, 2017-2031

9.4.1. US

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Life Science Reagents Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Chromatography Reagents

10.2.2. Molecular Diagnostic Reagents

10.2.3. Immunoassay Reagents

10.2.4. Clinical Chemistry Reagents

10.2.5. Flow Cytometry Reagents

10.2.6. Cell & Tissue Culture Reagents

10.2.7. Hematology & Hemostasis Reagents

10.2.8. Microbiology Reagents

10.2.9. Others

10.3. Market Value Forecast, by End-user, 2017-2031

10.3.1. Hospitals & Diagnostics Laboratories

10.3.2. Commercial & Contract Research Manufacturers

10.3.3. Academic & Research Institutes

10.3.4. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017-2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Life Science Reagents Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Chromatography Reagents

11.2.2. Molecular Diagnostic Reagents

11.2.3. Immunoassay Reagents

11.2.4. Clinical Chemistry Reagents

11.2.5. Flow Cytometry Reagents

11.2.6. Cell & Tissue Culture Reagents

11.2.7. Hematology & Hemostasis Reagents

11.2.8. Microbiology Reagents

11.2.9. Others

11.3. Market Value Forecast, by End-user, 2017-2031

11.3.1. Hospitals & Diagnostics Laboratories

11.3.2. Commercial & Contract Research Manufacturers

11.3.3. Academic & Research Institutes

11.3.4. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017-2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user/p>

11.5.3. By Country/Sub-region

12. Latin America Life Science Reagents Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Chromatography Reagents

12.2.2. Molecular Diagnostic Reagents

12.2.3. Immunoassay Reagents

12.2.4. Clinical Chemistry Reagents

12.2.5. Flow Cytometry Reagents

12.2.6. Cell & Tissue Culture Reagents

12.2.7. Hematology & Hemostasis Reagents

12.2.8. Microbiology Reagents

12.2.9. Others

12.3. Market Value Forecast By End-user, 2017-2031

12.3.1. Hospitals & Diagnostics Laboratories

12.3.2. Commercial & Contract Research Manufacturers

12.3.3. Academic & Research Institutes

12.3.4. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017-2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Life Science Reagents Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017-2031

13.2.1. Chromatography Reagents

13.2.2. Molecular Diagnostic Reagents

13.2.3. Immunoassay Reagents

13.2.4. Clinical Chemistry Reagents

13.2.5. Flow Cytometry Reagents

13.2.6. Cell & Tissue Culture Reagents

13.2.7. Hematology & Hemostasis Reagents

13.2.8. Microbiology Reagents

13.2.9. Others

13.3. Market Value Forecast, by End-user, 2017-2031

13.3.1. Hospitals & Diagnostics Laboratories

13.3.2. Commercial & Contract Research Manufacturers

13.3.3. Academic & Research Institutes

13.3.4. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017-2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. F. Hoffmann-La Roche AG

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Danaher Corporation

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Abbott

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Siemens Healthineers

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. DiaSorin S.p.A

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Sysmex Corporation

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. bioMerieux SA

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Ortho Clinical Diagnostics

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Thermo Fisher Scientific, Inc.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. F. Hoffmann-La Roche AG

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Merck KGaA

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

14.3.12. Agilent Technologies, Inc.

14.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.12.2. Product Portfolio

14.3.12.3. Financial Overview

14.3.12.4. SWOT Analysis

14.3.12.5. Strategic Overview

14.3.13. Waters Corporation

14.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.13.2. Product Portfolio

14.3.13.3. Financial Overview

14.3.13.4. SWOT Analysis

14.3.13.5. Strategic Overview

List of Table

Table 01: Global Life Science Reagents Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global Life Science Reagents Market Size (US$ Mn) Forecast, by End-user, 2017-2031

Table 03: Global Life Science Reagents Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 04: North America Life Science Reagents Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 05: North America Life Science Reagents Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 06: North America Life Science Reagents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Europe Life Science Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 08: Europe Life Science Reagents Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 09: Europe Life Science Reagents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 10: Asia Pacific Life Science Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 11: Asia Pacific Life Science Reagents Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 12: Asia Pacific Life Science Reagents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 13: Latin America Life Science Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 14: Latin America Life Science Reagents Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 15: Latin America Life Science Reagents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 16: Middle East & Africa Life Science Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 17: Middle East & Africa Life Science Reagents Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 18: Middle East & Africa Life Science Reagents Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 01: Global Life Science Reagents Market Size (US$ Mn) Forecast, 2017-2031

Figure 02: Global Life Science Reagents Market Value Share, by Product, 2021

Figure 03: Global Life Science Reagents Market Value Share, by End-user, 2021

Figure 04: Global Life Science Reagents Market Value Share, by Region, 2021

Figure 05: Global Life Science Reagents Market Value Share Analysis (US$ Mn), by Product, 2021 and 2031

Figure 06: Global Life Science Reagents Market Attractiveness Analysis, by Product, 2022-2031

Figure 07: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Chromatography Reagents, 2017-2031

Figure 08: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Molecular Diagnostics Reagents, 2017-2031

Figure 09: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Immunoassay Reagents, 2017-2031

Figure 10: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Clinical Chemistry Reagents, 2017-2031

Figure 11: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Flow Cytometry Reagents, 2017-2031

Figure 12: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Cell & Tissue Culture Reagents, 2017-2031

Figure 13: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hematology & Hemostasis Reagents, 2017-2031

Figure 14: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Microbiology Reagents, 2017-2031

Figure 15: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2031

Figure 16: Global Life Science Reagents Market Value Share Analysis (US$ Mn), by End-user, 2021 and 2031

Figure 17: Global Life Science Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 18: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals & Diagnostics Laboratories, 2017-2031

Figure 19: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Commercial & Contract Research Manufacturers, 2017-2031

Figure 20: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Academic & Research Institutes, 2017-2031

Figure 21: Global Life Science Reagents Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2031

Figure 22: Global Life Science Reagents Market Value Share Analysis, by Region, 2021 and 2031

Figure 23: Global Life Science Reagents Market Attractiveness Analysis, by Region, 2022-2031

Figure 24: North America Life Science Reagents Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 25: North America Life Science Reagents Market Value Share Analysis (US$ Mn), by Country, 2021 and 2031

Figure 26: North America Life Science Reagents Market Attractiveness Analysis, by Country, 2022-2031

Figure 27: North America Life Science Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 28: North America Life Science Reagents Market Value Share Analysis, by End-user, 2021and 2031

Figure 29: North America Life Science Reagents Market Attractiveness Analysis, by Product, 2022-2031

Figure 30: North America Life Science Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 31: Europe Life Science Reagents Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 32: Europe Life Science Reagents Market Value Share Analysis (US$ Mn), by Country/Sub-region, 2021 and 2031

Figure 33: Europe Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 34: Europe Life Science Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 35: Europe Life Science Reagents Market Value Share Analysis, by End-user, 2021 and 2031

Figure 36: Europe Life Science Reagents Market Attractiveness Analysis, by Product, 2022-2031

Figure 37: Europe Life Science Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 38: Asia Pacific Life Science Reagents Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 39: Asia Pacific Life Science Reagents Market Value Share Analysis (US$ Mn), by Country/Sub-region, 2021 and 2031

Figure 40: Asia Pacific Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 41: Asia Pacific Life Science Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 42: Asia Pacific Life Science Reagents Market Value Share Analysis, by End-user, 2021 and 2031

Figure 43: Asia Pacific Life Science Reagents Market Attractiveness Analysis, by Product, 2022-2031

Figure 44: Asia Pacific Life Science Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 45: Latin America Life Science Reagents Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 46: Latin America Life Science Reagents Market Value Share Analysis (US$ Mn), by Country/Sub-region, 2021 and 2031

Figure 47: Latin America Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 48: Latin America Life Science Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 49: Latin America Life Science Reagents Market Value Share Analysis, by End-user, 2021 and 2031

Figure 50: Latin America Life Science Reagents Market Attractiveness Analysis, by Product, 2022-2031

Figure 51: Latin America Life Science Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 52: Middle East & Africa Life Science Reagents Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2017-2031

Figure 53: Middle East & Africa Life Science Reagents Market Value Share Analysis (US$ Mn), by Country/Sub-region, 2021 and 2031

Figure 54: Middle East & Africa Life Science Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 55: Middle East & Africa Life Science Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 56: Middle East & Africa Life Science Reagents Market Value Share Analysis, by End-user, 2021 and 2031

Figure 57: Middle East & Africa Life Science Reagents Market Attractiveness Analysis, by Product, 2022-2031

Figure 58: Middle East & Africa Life Science Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 59: Global Life Science Reagents Market Share Analysis, by Company (2021)